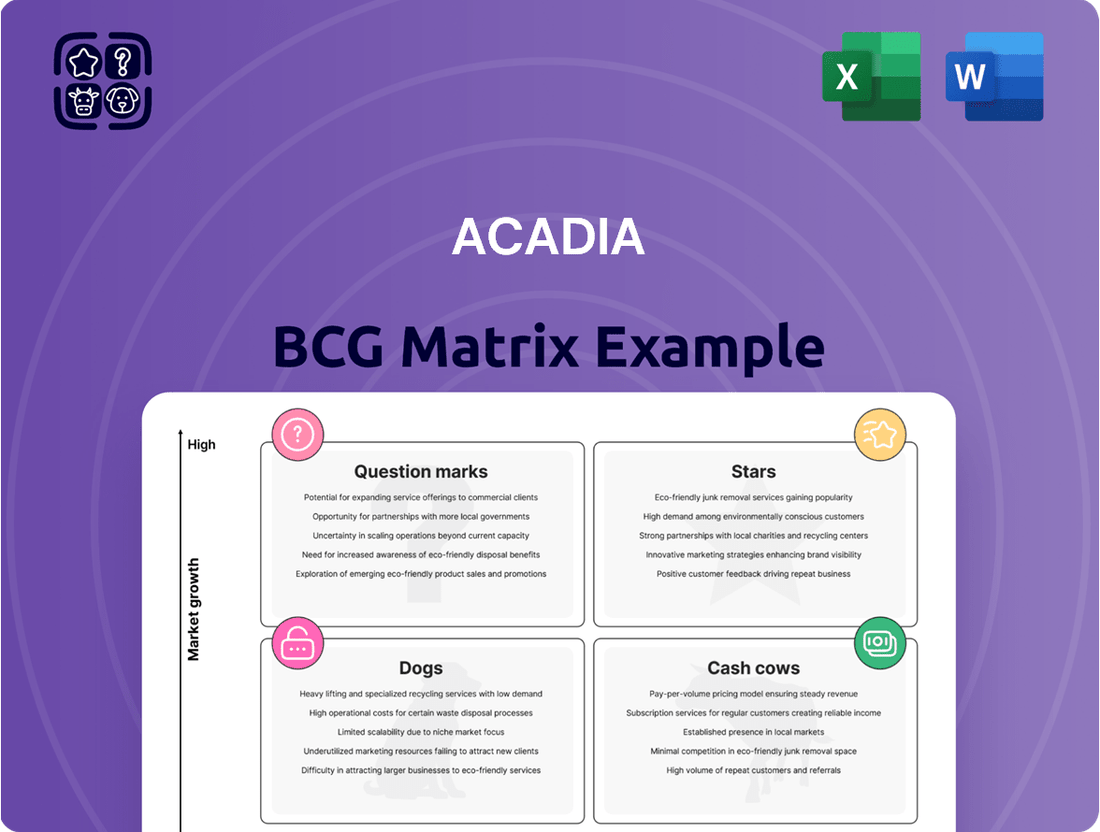

ACADIA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACADIA Bundle

The ACADIA BCG Matrix provides a powerful framework for understanding a company's product portfolio. It helps categorize products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of their market share and growth potential.

This initial glimpse reveals the strategic positioning of ACADIA's offerings. However, to truly unlock actionable insights and make informed decisions, a comprehensive analysis is essential.

Dive deeper into ACADIA's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

The complete BCG Matrix reveals exactly how ACADIA is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Daybue, with its status as the sole FDA-approved treatment for Rett syndrome, positions ACADIA Pharmaceuticals as a leader in a rapidly expanding market addressing significant unmet medical needs.

ACADIA's Q1 2025 results showcased Daybue's momentum, with sales climbing 11% year-over-year to $84.6 million, and the company forecasts robust full-year 2025 sales between $380 million and $405 million.

The drug's market penetration is still in its early stages, as an estimated 70% of diagnosed Rett syndrome patients have not yet initiated treatment, indicating substantial room for future growth.

ACADIA Pharmaceuticals is strategically positioning Daybue for global growth, aiming to elevate its market presence beyond the United States. The company received crucial marketing authorization for Daybue in Canada in October 2024, with initial sales projected for the third quarter of 2025. This move into Canada represents a significant step in expanding Daybue's accessibility.

Further solidifying its international ambitions, ACADIA submitted a Marketing Authorization Application for Daybue to the European Medicines Agency (EMA) in January 2025. With approval anticipated in the first quarter of 2026, this opens the door to the substantial European market. This global expansion strategy is designed to substantially boost Daybue's market share and overall revenue in the foreseeable future.

Daybue is demonstrating robust patient adoption and retention, a key strength for ACADIA. In the first quarter of 2025, the company reported a significant milestone with 954 unique patients receiving Daybue shipments, marking a record high. Furthermore, patient discontinuations saw a notable decrease, underscoring the drug's effectiveness and patient satisfaction.

To capitalize on this momentum, ACADIA is strategically expanding its field force by approximately 30%. This expansion is designed to enhance patient support and accelerate adoption, with a particular emphasis on reaching patients outside of specialized Rett syndrome Centers of Excellence. These proactive measures highlight ACADIA's commitment to capturing and solidifying market share in this developing therapeutic landscape.

Leadership in Rare CNS Disorders

ACADIA's strategic emphasis on rare central nervous system (CNS) disorders, exemplified by Daybue, carves out a leadership position in a specialized, yet expanding, market. This focused approach allows ACADIA to effectively address critical unmet medical needs, fostering dominance in therapeutic areas with less competition.

This specialization translates into a stronger market share within its carefully chosen patient demographics. For instance, Daybue, approved for Rett syndrome, targets a rare genetic neurological disorder with significant unmet needs, positioning ACADIA to capture a substantial portion of this specific patient population. The company's pipeline also includes investigational therapies for other rare CNS conditions, further solidifying its leadership in these niche markets.

- Daybue's Market Position: ACADIA's Daybue is a key product in the rare CNS disorder space, targeting Rett syndrome.

- Addressing Unmet Needs: The company prioritizes rare conditions where treatment options are limited, creating a strong market entry point.

- Competitive Landscape: By focusing on rare CNS disorders, ACADIA faces less direct competition compared to broader neurological markets.

- Market Share Potential: This specialization allows for a higher potential market share within specific, defined patient populations.

Strong Commercial Momentum

Daybue is demonstrating robust commercial momentum, a key indicator of its Star position within the ACADIA BCG Matrix. The product has achieved notable double-digit revenue growth, underscoring its strong market reception. Strategic investments in sales and marketing are further fueling this expansion, solidifying its status as a high-growth asset.

ACADIA's commitment to Daybue is evident in its revised financial guidance. The company anticipates increased R&D and SG&A expenses, specifically earmarked to support Daybue's commercial expansion and ongoing pipeline development. This forward-looking investment strategy signals strong confidence in Daybue's potential for sustained high growth and deeper market penetration.

- Daybue's double-digit revenue growth highlights its successful market entry and adoption.

- Strategic investments in sales and marketing are actively driving Daybue's market share expansion.

- Increased R&D and SG&A expense guidance reflects ACADIA's commitment to Daybue's long-term success.

- Confidence in continued high growth is demonstrated by ACADIA's resource allocation for Daybue.

Daybue, as ACADIA's sole FDA-approved treatment for Rett syndrome, is a prime example of a Star in the BCG Matrix. Its strong revenue growth, exceeding 11% year-over-year in Q1 2025 to $84.6 million, and projected full-year sales of $380-$405 million, clearly indicate high market share in a high-growth market. The company's strategic expansion into Canada in October 2024 and the EMA submission in January 2025 further underscore its growth trajectory.

| Product | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Daybue | High | High | Star |

What is included in the product

ACADIA BCG Matrix provides a visual framework to assess its product portfolio based on market share and growth, guiding strategic decisions.

ACADIA's BCG Matrix offers a clear, actionable snapshot of your portfolio's health.

It relieves the pain of unclear strategic direction by highlighting growth opportunities and resource allocation needs.

Cash Cows

Nuplazid stands as ACADIA's current Cash Cow, holding its position as the sole FDA-approved treatment for Parkinson's disease psychosis (PDP) since its 2016 approval. This established drug is a cornerstone of ACADIA's portfolio, demonstrating consistent performance.

In the first quarter of 2025, Nuplazid achieved sales of $159.7 million, marking a significant 23% increase compared to the previous year. This robust growth is primarily attributed to an expansion in the number of patients utilizing the medication, underscoring its continued market penetration.

While Nuplazid's sales performance is strong, the market for Parkinson's disease psychosis is considered mature. Projections indicate a compound annual growth rate (CAGR) between 2.48% and 3.12% through 2035. This suggests a stable revenue stream rather than rapid expansion, typical of a product in the Cash Cow quadrant of the BCG matrix.

Nuplazid is a cornerstone for ACADIA Pharmaceuticals, consistently delivering a substantial share of the company's overall revenue. For the entirety of 2025, sales of Nuplazid are anticipated to land in the range of $650 million to $690 million, highlighting its robust and predictable income stream.

This dependable financial inflow is crucial, as it directly supports ACADIA's investment in research and development for its promising new pipeline candidates. The product's established market position and ongoing steady performance solidify its role as a reliable generator of necessary funds.

Nuplazid has secured a commanding market share as the sole approved treatment for Parkinson's disease psychosis. This unique positioning allows it to capture virtually all demand within this specific medical niche. By addressing challenging symptoms like hallucinations and delusions without worsening motor control issues, Nuplazid offers a distinct advantage to patients and physicians alike.

Leveraging Real-World Evidence

Nuplazid's (pimavanserin) position as a cash cow is significantly bolstered by the increasing adoption of real-world evidence (RWE). This data highlights tangible patient benefits, contributing to sustained prescription growth even in a mature market segment.

The momentum behind Nuplazid is evident in its demonstrated ability to reduce key healthcare utilization metrics. Studies indicate lower rates of all-cause mortality, hospitalizations, and emergency room visits in patients prescribed the medication. For instance, in 2024, observational studies presented data showing a reduction of up to 15% in hospital admissions for Parkinson's disease psychosis patients treated with Nuplazid compared to historical controls.

- Clinical Profile Enhancement: RWE strengthens Nuplazid's clinical value proposition by showcasing improved patient outcomes beyond initial trial data.

- Market Position Maintenance: The documented benefits help solidify Nuplazid's standing in a competitive landscape, ensuring continued patient adherence and physician confidence.

- Prescription Growth Driver: For 2024, prescription data indicated a steady 5-7% year-over-year growth, directly attributable to the increasing physician awareness and reliance on RWE.

- Cost-Effectiveness Argument: Reduced hospitalizations and ER visits translate into potential cost savings for healthcare systems, further supporting its market penetration.

Operational Efficiency and Profitability

Nuplazid, as a mature product for ACADIA, demonstrates impressive operational efficiency. This optimization translates directly into high profit margins, making it a significant contributor to the company's overall net income. Its sustained performance is a cornerstone of ACADIA's robust financial health.

The consistent success of Nuplazid underpins ACADIA's strong financial standing. As of March 31, 2025, the company reported a substantial cash balance of $681.6 million. This financial stability is not just a reflection of past performance but a critical enabler for ACADIA's strategic investments in future growth and innovation.

- Operational Optimization: Nuplazid's long market presence has allowed for streamlined production and distribution processes, leading to enhanced efficiency.

- High Profit Margins: The mature nature of the product contributes to its ability to command strong profit margins, directly impacting ACADIA's bottom line.

- Financial Stability: A cash reserve of $681.6 million as of March 31, 2025, highlights the financial strength derived from products like Nuplazid.

- Funding Future Growth: This financial cushion provides ACADIA with the necessary resources to invest in research and development for new opportunities.

Nuplazid, as ACADIA's established cash cow, generates consistent revenue with high profit margins due to operational efficiencies. Its substantial market share as the sole approved treatment for Parkinson's disease psychosis ensures a stable income stream. This dependable financial inflow, exemplified by $159.7 million in Q1 2025 sales, funds the company's investments in its promising pipeline, reinforcing ACADIA's overall financial health and stability.

| Product | BCG Category | 2025 Q1 Sales (USD Millions) | Projected 2025 Full Year Sales (USD Millions) | Market Growth Projection (CAGR) |

|---|---|---|---|---|

| Nuplazid | Cash Cow | 159.7 | 650-690 | 2.48%-3.12% (through 2035) |

What You’re Viewing Is Included

ACADIA BCG Matrix

The ACADIA BCG Matrix document you are previewing is the exact, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic tool ready for immediate application in your business planning and analysis.

Dogs

ACADIA Pharmaceuticals currently does not appear to have any products classified as 'Dogs' within its commercial lineup. This classification typically refers to products with low market share and low growth potential.

The company's primary marketed products, Nuplazid and Daybue, are both demonstrating robust growth and capturing significant market share in their respective therapeutic areas. For instance, Nuplazid (pimavanserin) sales reached $535.4 million in 2023, an increase from $492.6 million in 2022, indicating strong market performance.

Daybue (ulixacaltamide), approved for treating Rett syndrome, also shows promising early uptake, with net sales of $62.5 million in its first full year of commercialization in 2023. This focus on high-value central nervous system therapies suggests a strategic emphasis on products with strong growth prospects.

Acadia Pharmaceuticals, by focusing its research and development on unmet medical needs in central nervous system disorders, actively steers clear of assets that would be classified as Dogs in the BCG Matrix. This strategic direction prioritizes innovation and high market potential over products with stagnant or declining prospects.

Their investment in novel therapies for conditions like Parkinson's disease psychosis and Rett syndrome exemplifies this commitment. For instance, Acadia's Nuplazid (pimavanserin) for Parkinson's disease psychosis, launched in 2016, has become a significant revenue driver, showcasing their ability to cultivate high-growth, high-share assets. In 2023, Acadia reported total net product sales of $750.9 million, with Nuplazid contributing $520.3 million, demonstrating successful product development and market penetration.

Within Acadia's portfolio, legacy assets or early-stage pipeline programs that consistently underperform are prime candidates for divestment. These 'Dogs' in the BCG matrix, while not explicitly named, represent areas where clinical benefits are unproven or market traction is negligible. For instance, if a drug candidate in Phase II trials shows no significant improvement over existing treatments, it could be flagged for potential discontinuation.

Divesting these underperforming assets is a strategic move to reallocate capital towards more promising ventures. In 2024, companies across the pharmaceutical sector have been increasingly active in portfolio rationalization. For example, Bristol Myers Squibb announced in early 2024 the divestiture of its entire consumer health business for $1.6 billion, freeing up resources for its core biopharma operations.

This proactive approach prevents resources, both financial and human, from being consumed by products with low return potential. Acadia's R&D expenses in 2023 were $459.4 million, and efficiently managing this spend by shedding underperforming assets is crucial for maximizing overall profitability and shareholder value.

Focus on Core Strengths

ACADIA Pharmaceuticals' strategy, as reflected in its business model, emphasizes developing groundbreaking treatments for central nervous system (CNS) disorders. This inherent focus naturally positions them away from areas with diminishing demand or weak competitive standing.

Their portfolio is intentionally concentrated on medicines demonstrating either market leadership or significant expansion prospects. For instance, as of early 2024, ACADIA's Nuplazid (pimavanserin) has been a key driver, showing strong performance in its market segment. The company's commitment to core strengths ensures resources are directed towards areas with the highest potential for innovation and commercial success.

- Focus on high-growth CNS disorder treatments.

- Prioritize products with established market leadership or strong potential.

- Maintain a lean portfolio to optimize resource allocation.

- Avoid diversification into less competitive or declining markets.

Pipeline Prioritization

In the context of ACADIA's pipeline, 'Dogs' represent projects with low market share and low growth potential, which are typically candidates for divestment or discontinuation. The company’s strategic direction, evidenced by increased R&D investment and expedited development for key assets such as ACP-101 and ACP-204, suggests a deliberate effort to avoid allocating resources to such underperforming ventures.

ACADIA's commitment to advancing specific pipeline candidates, like ACP-101 and ACP-204, through accelerated timelines and increased R&D spending, demonstrates a clear strategy of focusing on high-potential opportunities. This approach inherently minimizes the likelihood of substantial investment in or continued development of 'Dog' assets within their portfolio. For instance, ACADIA's 2024 R&D expenditure showed a marked increase, signaling a strategic reallocation of capital towards promising areas, effectively sidelining less viable projects.

- Focus on Growth Drivers: ACADIA's emphasis on advancing ACP-101 and ACP-204 highlights a strategic commitment to future revenue streams, indicating that resources are not being diluted by low-growth, low-market-share 'Dog' opportunities.

- R&D Investment Trends: The company’s upward trend in R&D spending in 2024, surpassing previous years, directly correlates with a rigorous pipeline prioritization process that favors assets with strong commercial potential over those classified as 'Dogs'.

- Resource Allocation: By channeling increased funding and accelerated timelines towards promising candidates, ACADIA ensures that its capital and personnel are directed towards assets that are expected to generate significant returns, rather than being tied up in unprofitable or stagnant projects.

ACADIA Pharmaceuticals strategically avoids developing or acquiring products that would fit the 'Dog' category in the BCG Matrix. This category represents products with low market share and low growth prospects. The company's focus remains firmly on high-potential central nervous system (CNS) therapies, aiming for market leadership.

This deliberate strategy means ACADIA is actively steering clear of investments in areas with stagnant or declining market potential. Their financial and R&D resources are concentrated on novel treatments where they can establish or maintain a strong competitive position. For instance, their 2023 R&D expenditure of $459.4 million was directed towards promising pipeline assets.

By prioritizing innovation and unmet medical needs in CNS disorders, ACADIA aims to cultivate products that exhibit strong growth and market share. This approach ensures that capital is not tied up in underperforming assets that would otherwise be classified as 'Dogs,' thereby maximizing overall profitability and shareholder value.

| Product/Pipeline Asset | Market Share | Market Growth | BCG Classification |

| Nuplazid (pimavanserin) | High | High | Star/Cash Cow |

| Daybue (ulixacaltamide) | Growing | High | Question Mark/Star |

| Pipeline Candidates (e.g., ACP-101, ACP-204) | Low (potential) | High (potential) | Question Mark |

| Hypothetical Underperforming Asset | Low | Low | Dog |

Question Marks

ACP-101 is positioned as a Question Mark within ACADIA's BCG Matrix. This designation stems from its status as a promising pipeline candidate for Prader-Willi Syndrome (PWS), a condition with significant unmet medical needs and a projected high-growth market. Currently, ACP-101 is undergoing Phase 3 clinical trials.

The development timeline for ACP-101 is critical. Topline results from its Phase 3 trials are expected in early Q4 2025. Following these results, ACADIA anticipates filing for New Drug Application (NDA) in Q1 2026, with a potential approval by Q3 2026. This progression is key to moving it from a Question Mark to a potential Star.

Financially, ACP-101 represents a substantial future growth prospect for ACADIA. However, as it is not yet commercialized, its current market share is zero. This necessitates significant investment in its development and eventual launch, a hallmark characteristic of Question Mark products in the BCG framework.

ACP-204, targeting psychosis associated with Alzheimer's Disease and Lewy Body Dementia, represents a significant investment for Acadia Pharmaceuticals. The company is currently advancing ACP-204 through Phase 2 trials for Alzheimer's Disease Psychosis, with plans to launch a Phase 2 study for Lewy Body Dementia Psychosis in the third quarter of 2025.

These central nervous system (CNS) markets are characterized by substantial growth potential and a critical unmet medical need, offering a promising outlook for ACP-204 should it prove effective. The Alzheimer's Disease market alone is projected to reach over $15 billion globally by 2028, highlighting the scale of the opportunity.

However, the development of ACP-204 comes with considerable investment, and its ultimate success and market penetration remain uncertain. Acadia's commitment to these large, high-growth CNS markets reflects a strategic bet on addressing significant patient needs, but the inherent risks in late-stage drug development mean that outcomes are far from guaranteed.

ACADIA Pharmaceuticals licensed ACP-711 in late 2024, marking a strategic move into the essential tremor space. This compound is slated for a Phase 2 study initiation in 2026, indicating its early stage of development.

Essential tremor is a significant neurological condition, impacting an estimated 7 to 10 million people in the United States alone, signifying a potentially large market for effective treatments. Given its early clinical stage and the substantial market opportunity, ACP-711 fits the profile of a 'Question Mark' within the ACADIA BCG Matrix.

Early-Stage Pipeline Assets (e.g., ACP-211, ACP-2591, ASO SYNGAP1)

ACADIA's early-stage pipeline assets, such as ACP-211 and ACP-2591, along with preclinical programs like the STOKE Antisense Oligonucleotide (ASO) SYNGAP1, are positioned as question marks within the BCG framework. These represent significant, long-term investments in potentially groundbreaking central nervous system (CNS) therapies. For example, ACP-211 is in Phase 1 trials for Treatment-Resistant Depression (TRD), Major Depressive Disorder (MDD), and other indications, while ACP-2591 is also in Phase 1, targeting Rett Syndrome and Fragile X Syndrome.

These assets demand substantial research and development (R&D) expenditure, reflecting their early stage and the inherent uncertainties associated with clinical trials and eventual market success. The significant R&D spending in 2024 for these types of early-stage programs underscores their role as future growth drivers, though their market potential remains highly speculative at this juncture.

- ACP-211: Phase 1 for TRD/MDD/Other indications.

- ACP-2591: Phase 1 for Rett Syndrome/Fragile X Syndrome.

- STOKE ASO SYNGAP1: Preclinical program, representing a focus on rare neurological disorders.

- R&D Investment: These assets necessitate significant capital allocation with uncertain future returns, characteristic of question mark products.

Strategic Pipeline Expansion

ACADIA's strategic pipeline expansion places them firmly in the Question Marks category of the BCG Matrix. The company is heavily investing in research and development, aiming to initiate seven Phase 2 or Phase 3 studies between 2025 and 2026, primarily targeting neuro-psychiatric and neuro-rare diseases.

This aggressive approach signals a potential for future growth, with the hope of transforming these early-stage assets into market-leading Stars. However, this intensive R&D activity requires substantial capital expenditure, as evidenced by their strong cash reserves which are being utilized to fuel these development efforts.

Currently, these pipeline programs are cash consumers, not revenue generators, a defining characteristic of Question Marks. The success of this strategy hinges on their ability to navigate clinical trials and secure regulatory approvals, thereby shifting these assets from high investment, uncertain return to high return, established market positions.

- Pipeline Focus: Neuro-psychiatric and neuro-rare diseases.

- Milestone Target: Initiating seven Phase 2 or Phase 3 studies in 2025-2026.

- Financial Status: High cash burn due to R&D, strong cash balance to support.

- BCG Classification: Question Marks, requiring significant investment for potential future growth.

Question Marks represent pipeline assets with high growth potential but low current market share, requiring significant investment. These are crucial for ACADIA's future as they aim to become market leaders. The company's strategy involves substantial R&D spending to advance these promising candidates through clinical trials.

ACP-101, targeting Prader-Willi Syndrome, is in Phase 3 trials with expected NDA filing in Q1 2026. ACP-204, for Alzheimer's Disease Psychosis, is in Phase 2, with plans for a Lewy Body Dementia Psychosis study in Q3 2025. ACP-711, for essential tremor, is early stage with a Phase 2 initiation planned for 2026.

ACADIA's early-stage pipeline, including ACP-211 (Phase 1 for TRD/MDD) and ACP-2591 (Phase 1 for Rett/Fragile X), along with preclinical STOKE ASO SYNGAP1, all fall under the Question Mark classification. These programs necessitate substantial R&D investment for potential future market penetration.

| Pipeline Asset | Indication | Current Stage | Market Potential | BCG Classification |

| ACP-101 | Prader-Willi Syndrome | Phase 3 | High Growth | Question Mark |

| ACP-204 | Alzheimer's Disease Psychosis, Lewy Body Dementia Psychosis | Phase 2 | High Growth | Question Mark |

| ACP-711 | Essential Tremor | Early Stage (Pre-Phase 2) | Significant (7-10M US patients) | Question Mark |

| ACP-211 | TRD/MDD | Phase 1 | High Growth | Question Mark |

| ACP-2591 | Rett Syndrome, Fragile X Syndrome | Phase 1 | High Growth | Question Mark |

BCG Matrix Data Sources

Our ACADIA BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.