3i Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Group Bundle

3i Group's strategic focus on private equity and infrastructure presents significant growth opportunities, but also exposes them to market volatility and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind 3i Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

3i Group has consistently delivered impressive financial results, showcasing strong shareholder returns. In fiscal year 2025, the company achieved a total return on shareholders' funds of 25%. This performance builds on a solid track record, with an average annual total return of 30% over the preceding five years.

The company's financial strength is further evidenced by a notable increase in Net Asset Value (NAV) per share. Coupled with a progressive dividend policy, 3i Group distributed 73.0 pence per share in FY2025, underscoring its commitment to rewarding investors and generating substantial value.

Action, a discount retailer, represents a significant portion of 3i Group's private equity holdings and has demonstrated remarkable resilience. In the fiscal year ending March 31, 2024, Action reported a 15% increase in sales to €8.9 billion, with EBITDA growing by 17% to €1.3 billion. This consistent outperformance, including strong like-for-like sales growth and successful debt management, solidifies Action as a cornerstone asset, bolstering 3i's financial stability.

3i Group's disciplined investment strategy is a core strength, emphasizing long-term value creation through active management of its private equity and infrastructure portfolios. This hands-on approach involves close collaboration with management teams to foster operational enhancements and strategic growth.

The company's focus on responsible capital deployment and partnering with businesses has consistently led to material value creation. For instance, 3i Group announced a record year in 2024, with its private equity portfolio delivering a 23% return, showcasing the effectiveness of their active management in driving attractive realisations.

Diversified Portfolio with Sectoral and Geographical Reach

3i Group's strength lies in its well-diversified portfolio, which spans multiple sectors such as consumer and private label, healthcare, industrial, and services & software. This broad sectoral exposure, coupled with a significant geographical reach across Europe and North America, effectively reduces the risk associated with concentrating investments in a single area. For instance, as of the first half of 2024, 3i Group reported that its Private Equity portfolio continued to perform strongly, with significant contributions from its European investments, while also demonstrating resilience in its North American holdings.

This strategic diversification not only mitigates potential downturns in specific markets or industries but also opens up numerous avenues for sustained growth. The group’s ability to identify and capitalize on opportunities across different economic landscapes is a key differentiator. For example, in the fiscal year ending March 31, 2024, 3i Group saw robust performance across its diverse portfolio, with its European investments, particularly in the consumer and healthcare sectors, driving much of the value creation.

- Sectoral Diversity: Investments across consumer, healthcare, industrial, and services & software sectors.

- Geographical Reach: Significant presence and investment in both Europe and North America.

- **Risk Mitigation:** Diversification reduces reliance on any single sector or region, enhancing portfolio stability.

- **Growth Opportunities:** Multiple avenues for value creation across varied economic environments.

Robust Balance Sheet and Liquidity

3i Group demonstrates a strong financial foundation, characterized by a robust balance sheet and ample liquidity. As of their latest reporting period, the company maintained significant cash and cash equivalents, bolstered by an undrawn revolving credit facility. This financial strength provides considerable flexibility.

This solid liquidity position is crucial for 3i. It allows the company to actively seek out and capitalize on new investment opportunities, provide necessary support to its existing portfolio of companies, and effectively manage through periods of market volatility or economic uncertainty. The capacity to deploy capital readily is a key competitive advantage.

- Strong Liquidity: Significant cash reserves and access to credit lines ensure operational and investment flexibility.

- Financial Flexibility: Enables proactive pursuit of new investments and support for existing portfolio companies.

- Resilience: The robust balance sheet helps navigate market uncertainties and economic downturns.

3i Group's diversified portfolio across various sectors and geographies significantly mitigates risk. This broad exposure, including strong performance in European consumer and healthcare sectors, alongside resilient North American holdings, provides multiple avenues for sustained growth and value creation.

| Strength | Description | Supporting Data (FY2024/2025) |

|---|---|---|

| Portfolio Diversification | Investments spread across consumer, healthcare, industrial, and services & software sectors, with significant presence in Europe and North America. | Private Equity portfolio delivered 23% return in 2024; Action (discount retailer) reported 15% sales growth to €8.9 billion in FY2024. |

| Financial Performance | Consistent delivery of strong shareholder returns and NAV growth. | Total return on shareholders' funds of 25% in FY2025; average annual total return of 30% over the preceding five years. |

| Active Management | Disciplined strategy focused on long-term value creation through operational enhancements and strategic growth. | Close collaboration with management teams to drive performance across portfolio companies. |

What is included in the product

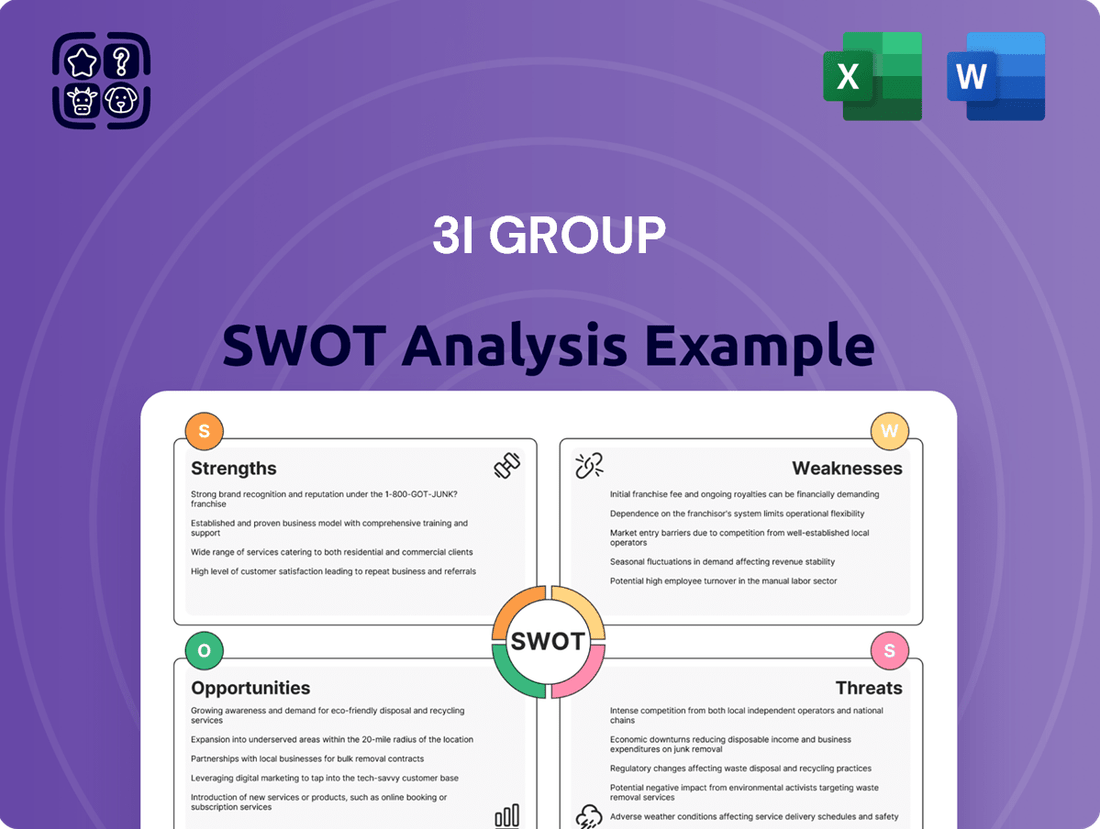

Analyzes 3i Group’s competitive position through key internal and external factors, highlighting its strong investment track record and market opportunities, while also acknowledging potential economic headwinds and competitive pressures.

Offers a clear, actionable SWOT analysis that pinpoints key areas for improvement, alleviating the pain of strategic uncertainty.

Weaknesses

A key weakness for 3i Group is its high concentration risk, particularly with its investment in Action. As of March 2025, Action represented a staggering 76% of 3i's Private Equity portfolio value. This means that the financial health and performance of a single company have an outsized influence on 3i's overall results.

Should Action experience any significant downturns or fail to meet performance expectations, the impact on 3i Group's net asset value (NAV) and earnings could be substantial and disproportionate. This reliance on a single major asset creates a vulnerability that could hinder 3i's stability and growth trajectory.

3i Group's focus on mid-market companies and infrastructure makes it particularly susceptible to shifts in the global economic landscape and geopolitical events. For instance, rising inflation and interest rates in 2024 could dampen consumer spending and business investment across its portfolio. Geopolitical tensions, such as ongoing conflicts or trade disputes, can disrupt supply chains and impact market demand for infrastructure projects, potentially affecting asset valuations and returns.

A significant portion of 3i Group's portfolio is invested in unquoted companies, meaning their value isn't readily available on public stock exchanges. This reliance on private valuations introduces a degree of subjectivity, as fair value is determined by various assumptions and market conditions. For instance, as of March 31, 2024, 3i Group reported that 91% of its portfolio was in unquoted assets, highlighting this inherent valuation challenge.

Challenges in Specific Portfolio Sectors

While 3i Group generally shows portfolio strength, specific sectors are facing headwinds. Notably, assets tied to discretionary consumer spending and the recruitment market have encountered difficulties. This vulnerability suggests that a portion of 3i's investments is more susceptible to economic slowdowns or changes in consumer confidence.

These sector-specific challenges highlight potential risks within the broader portfolio. For instance, in the first half of fiscal year 2025, 3i Group reported that performance in its Private Equity segment was impacted by these softer market conditions in certain areas. This contrasts with the otherwise robust performance across other segments like Private Capital and Infrastructure.

- Discretionary Spending Exposure: Certain portfolio companies rely heavily on consumer spending, which can be volatile and sensitive to economic fluctuations.

- Recruitment Market Sensitivity: Investments in the recruitment sector are directly affected by employment trends and business hiring activity.

- Impact on Overall Performance: While not systemic, these challenged sectors can detract from the overall positive returns generated by the majority of the portfolio.

- Need for Sector-Specific Strategies: Addressing these weaknesses requires tailored strategies for the affected companies rather than a one-size-fits-all approach.

Reliance on Successful Exits and Realisations for Returns

A key vulnerability for 3i Group is its reliance on successfully selling its investments to generate returns and cash. While the firm has a history of good exits, achieving favorable prices depends heavily on market conditions and buyer interest. For instance, in a less robust economic climate, finding buyers willing to pay premium prices for portfolio companies might become more challenging, impacting the timing and value of realisations.

This dependence means that 3i's performance can be significantly affected by external market liquidity and the general appetite for acquisitions. A slowdown in M&A activity or a decrease in investor confidence could directly hinder the group's ability to exit investments at attractive multiples. This was a consideration during periods of market uncertainty, such as the economic adjustments seen in late 2023 and early 2024, where exit multiples for private equity-backed companies faced pressure.

- Dependence on Exit Timing: The ability to realize value is tied to market conditions, potentially delaying or reducing returns.

- Market Liquidity Sensitivity: Performance is vulnerable to fluctuations in M&A activity and overall investor sentiment.

- Risk of Lower Exit Multiples: Unfavorable market conditions can force sales at less attractive valuations.

The significant concentration of 3i Group's portfolio in a single entity, Action, presents a substantial weakness. As of March 2025, Action accounted for 76% of the Private Equity portfolio's value, making 3i highly susceptible to Action's individual performance. This over-reliance on one asset creates considerable risk, as any negative developments with Action could disproportionately impact 3i's overall financial results and net asset value.

Furthermore, 3i Group's investments in unquoted companies, representing 91% of its portfolio as of March 31, 2024, introduce valuation challenges. The absence of public market pricing means valuations are based on assumptions, making them more subjective and potentially volatile. This reliance on private valuations can obscure the true underlying value and create uncertainty in financial reporting.

The group's exposure to sectors sensitive to discretionary consumer spending and the recruitment market poses another weakness. These areas can be significantly impacted by economic downturns, as seen with softer market conditions affecting parts of the Private Equity segment in the first half of fiscal year 2025. This sensitivity means that a portion of 3i's investments is vulnerable to economic slowdowns and shifts in consumer confidence.

Finally, 3i Group's performance is intrinsically linked to its ability to successfully exit investments. The firm's reliance on finding buyers at favorable prices means that market conditions, such as liquidity and M&A appetite, play a critical role. Periods of economic uncertainty, like those experienced in late 2023 and early 2024, can put pressure on exit multiples, potentially impacting the timing and value of realisations.

Full Version Awaits

3i Group SWOT Analysis

This is the actual 3i Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full 3i Group SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights.

This is a real excerpt from the complete 3i Group SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

Action's ambitious growth strategy includes opening approximately 370 net new stores in 2025, significantly expanding its physical presence. This expansion is supported by an upward revision of its total store potential within core European markets, indicating a robust outlook for further penetration.

This ongoing geographical expansion and deepening market penetration are poised to serve as a substantial organic growth driver for Action, which remains 3i Group's largest and most significant asset. The company's commitment to increasing its store footprint directly translates into enhanced market share and revenue potential.

3i Group consistently executes bolt-on acquisitions for its portfolio companies, strengthening their market positions and unlocking new growth avenues. For instance, in the fiscal year ending March 31, 2024, 3i Group deployed significant capital into these strategic additions, demonstrating a commitment to this growth engine.

This approach not only expands the reach and capabilities of existing platform businesses but also provides a reliable method for increasing portfolio value. The successful integration of these smaller companies into larger platforms is a core element of 3i's value creation strategy, as seen in the performance of its key investments throughout 2024.

Consumers are increasingly prioritizing value, and this is a significant opportunity for 3i Group. Their investments in businesses offering good value for money and private label goods are perfectly aligned with this trend. This cautious consumer sentiment, driven by economic uncertainties, means shoppers are actively seeking out more affordable options without compromising on quality.

The success of portfolio company Action, a leading European discount retailer, is a prime example of this opportunity. Action reported a revenue of €8.9 billion in 2023, demonstrating strong growth and consumer appeal in the value segment. This robust performance indicates a favorable market tailwind for a substantial part of 3i's investment portfolio.

Investment in Resilient Infrastructure Businesses

3i Group's infrastructure investments target resilient businesses crucial for essential services, aligning with enduring global trends. This strategic focus offers the potential for stable income streams and long-term capital growth, enhancing portfolio stability and diversification.

The infrastructure sector provides a buffer against economic volatility, making it an attractive area for consistent returns. For instance, investments in sectors like utilities or regulated transportation networks often exhibit predictable cash flows, bolstering investment resilience.

- Stable Income: Infrastructure assets typically generate predictable revenue through long-term contracts or regulated pricing.

- Resilience: Essential services provided by infrastructure remain in demand even during economic downturns.

- Growth Potential: Alignment with megatrends like digitalization and energy transition fuels long-term capital appreciation.

- Diversification: Infrastructure investments can reduce overall portfolio risk due to their low correlation with other asset classes.

Leveraging ESG Integration for Value Creation

3i Group's proactive integration of ESG principles, including its commitment to science-based emissions reduction targets, presents a significant opportunity. This strategic focus is not merely about compliance; it's a pathway to unlocking greater long-term value and bolstering the resilience of its portfolio companies.

The growing demand from investors for sustainable and responsible investments means that 3i Group's ESG-centric approach can attract a broader and more committed capital base. This alignment with market trends can lead to enhanced valuations and more favorable financing conditions.

- Enhanced Investor Appeal: A strong ESG profile can attract capital from a widening pool of ESG-focused funds and institutional investors, potentially leading to higher investment multiples.

- Improved Operational Efficiency: Implementing ESG initiatives, such as energy efficiency measures, can reduce operating costs for portfolio companies, directly boosting profitability.

- Risk Mitigation: Addressing environmental and social risks proactively can prevent costly regulatory fines, reputational damage, and supply chain disruptions.

- Innovation and Growth: Focusing on sustainable solutions can spur innovation within portfolio companies, opening new market opportunities and driving growth.

The increasing consumer focus on value presents a significant tailwind for 3i Group's portfolio companies, particularly those like Action that excel in offering affordable, quality goods. This trend is evidenced by Action's robust performance, with revenues reaching €8.9 billion in 2023, highlighting a strong market appetite for value-driven retail. Furthermore, 3i Group's strategic bolt-on acquisitions continue to bolster its portfolio companies' market positions, creating new avenues for growth and value enhancement.

3i Group's infrastructure investments are strategically aligned with essential services and long-term global trends, promising stable income and capital growth. The group's commitment to ESG principles, including science-based emissions reduction targets, not only enhances investor appeal but also drives operational efficiencies and mitigates risks across its portfolio.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Value-Driven Consumerism | Growing consumer preference for affordable, quality products. | Action's 2023 revenue of €8.9 billion. |

| Strategic Acquisitions | Bolt-on acquisitions strengthen portfolio companies. | Consistent capital deployment in FY24 for strategic additions. |

| Infrastructure Resilience | Investment in essential services with stable demand. | Alignment with megatrends like digitalization and energy transition. |

| ESG Integration | Focus on sustainability attracts capital and improves operations. | Commitment to science-based emissions reduction targets. |

Threats

Ongoing macroeconomic challenges pose a significant threat. Persistent inflation, as seen in the UK's CPI reaching 8.7% in May 2023, coupled with rising interest rates, could dampen consumer spending and increase borrowing costs for 3i Group's portfolio companies.

Potential economic downturns in key markets like Europe could further impact valuations and investment returns. For instance, the IMF projected global growth to slow to 2.7% in 2024, indicating a challenging operating environment.

These pressures necessitate constant monitoring and agile strategic adjustments to mitigate risks and protect asset values. 3i Group must remain vigilant in navigating this uncertain landscape.

The private equity and infrastructure arenas are seeing a surge of new entrants and existing players aggressively pursuing deals. This heightened competition means 3i Group faces greater pressure to secure attractive assets, potentially leading to inflated purchase prices. For instance, in 2024, the global private equity industry saw record fundraising, with dry powder reaching unprecedented levels, intensifying the bidding wars for quality companies and infrastructure projects.

This competitive environment directly impacts 3i Group's ability to generate strong returns. As more capital chases fewer prime opportunities, acquisition multiples are pushed higher, compressing the potential upside for investors. Consequently, finding and closing deals that meet 3i Group's rigorous return criteria becomes a more significant challenge, requiring even sharper due diligence and strategic positioning.

Geopolitical uncertainties continue to pose a significant risk, potentially disrupting supply chains and increasing operational costs for 3i's portfolio companies. For instance, ongoing global conflicts in 2024 have led to volatility in energy prices, impacting sectors like industrials and consumer goods, which are key areas for 3i. This instability can also dampen international trade, affecting companies with substantial export or import dependencies.

Foreign Exchange Rate Volatility

As an international investment manager, 3i Group is inherently exposed to the unpredictable nature of foreign exchange rate fluctuations. These movements can significantly affect its Net Asset Value and the way its financial performance is reported. For instance, in the fiscal year ending March 31, 2024, the group reported a net currency impact of £173 million on its portfolio value, highlighting the tangible effect of currency shifts.

Negative currency translations, as observed in previous reporting periods, have the potential to diminish investment returns, even when the underlying businesses within 3i Group's portfolio are performing robustly. This means that a strong operational performance could be masked or even reversed by unfavorable currency movements.

The group's broad international footprint means it holds assets and generates income in numerous currencies. This diversification, while a strength, also amplifies the risk associated with foreign exchange volatility. For example, significant movements in major currencies like the US Dollar or Euro against Sterling can create substantial headwinds or tailwinds for reported figures.

- Portfolio Impact: Fluctuations in exchange rates directly affect the Sterling value of 3i Group's international investments.

- Reported Earnings: Currency translation differences can distort the reported profitability and growth of the group.

- Risk Mitigation: While hedging strategies are employed, they may not fully eliminate the impact of adverse currency movements.

- 2024 Data: A net currency translation loss of £173 million was recorded on the portfolio value in FY24.

Regulatory Changes and Increased Scrutiny

Regulatory changes, especially concerning private equity and infrastructure investments, pose a significant threat to 3i Group. For instance, evolving environmental, social, and governance (ESG) regulations could necessitate costly adjustments for portfolio companies or limit investment opportunities in certain sectors. As of early 2025, the European Union's ongoing review of alternative investment fund managers directives could introduce stricter capital requirements or operational mandates, impacting 3i's European operations.

Increased scrutiny from financial regulators worldwide, particularly in light of global economic shifts and potential market volatility, could lead to more rigorous compliance demands. This heightened oversight might affect 3i's ability to execute certain investment strategies or require greater transparency, potentially impacting its operational agility and profitability. For example, investigations into the private equity industry's impact on labor practices or tax structures in late 2024 highlighted a trend towards greater accountability.

- New compliance burdens: Stricter regulations could increase operational costs for 3i Group and its portfolio companies.

- Restricted investment strategies: Changes in regulatory frameworks may limit the types of investments 3i can pursue or the way it structures deals.

- Reputational risk: Increased scrutiny on investment practices, particularly concerning ESG or market conduct, could damage 3i's reputation and investor confidence.

- Impact on profitability: Compliance costs and potential restrictions on strategies can directly affect the financial performance of 3i and its investments.

Intensifying competition within the private equity and infrastructure sectors presents a significant hurdle. Record fundraising in 2024 has led to an abundance of dry powder, driving up acquisition multiples and making it more challenging for 3i Group to secure attractive assets at favorable prices.

Geopolitical instability and ongoing global conflicts in 2024 continue to disrupt supply chains and increase operational costs for portfolio companies, particularly impacting sectors like industrials and consumer goods. This volatility also affects international trade, posing risks for companies with significant import or export dependencies.

Foreign exchange rate fluctuations remain a considerable threat, as evidenced by the £173 million net currency translation loss reported on the portfolio value in FY24. This volatility can diminish investment returns and distort reported profitability, despite strong underlying business performance.

Evolving regulatory landscapes, including potential changes to EU directives and increased global scrutiny on investment practices by early 2025, could impose new compliance burdens and restrict investment strategies for 3i Group.

SWOT Analysis Data Sources

This SWOT analysis for 3i Group is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and insightful industry expert commentary, ensuring a well-informed and accurate strategic assessment.