3i Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Group Bundle

Unlock the complete strategic blueprint behind 3i Group's success with our detailed Business Model Canvas. This comprehensive analysis breaks down their value proposition, customer relationships, and revenue streams, offering invaluable insights for any business strategist. Discover the core components that drive their market leadership and gain a competitive edge.

Partnerships

3i Group actively cultivates relationships with a diverse range of private equity firms. These collaborations are instrumental in augmenting 3i's investment capabilities, providing access to specialized expertise and expanding the pool of potential deals.

By partnering with these firms, 3i can effectively share investment risks and combine resources, enabling the execution of larger, more impactful transactions. This synergistic approach significantly bolsters 3i's capacity for capital deployment and enhances its deal origination pipeline across key sectors.

3i Group actively collaborates with the management teams of its portfolio companies, fostering a partnership aimed at accelerating growth and enhancing long-term value. This deep engagement is crucial for executing strategic objectives and driving operational improvements across the businesses they invest in.

In 2024, 3i's commitment to this close working relationship was evident in its support for its portfolio companies. For instance, their investment in Action, a leading European discount retailer, saw continued strong performance driven by effective management execution, with Action reporting a revenue increase of 18% in fiscal year 2023 to €8.9 billion, demonstrating the impact of this partnership model.

3i actively collaborates with co-investors and Limited Partners (LPs) through dedicated co-investment programs. This strategic approach enables 3i to deploy more capital into promising companies, enhancing its ability to secure significant stakes in attractive deals.

These partnerships are crucial for LPs, offering them direct access to investment opportunities managed by 3i, often in sectors where 3i possesses deep expertise. For instance, in 2024, 3i's infrastructure portfolio continued to attract significant co-investment capital, demonstrating the ongoing appeal of these joint ventures.

By sharing the capital commitment, 3i effectively scales its investment capacity and diversifies risk across its portfolio. This symbiotic relationship allows for larger, more impactful investments than 3i might undertake alone, benefiting all parties involved.

Financial Advisors and Due Diligence Experts

3i Group's reliance on financial advisors and due diligence experts is paramount for navigating complex investment landscapes. These collaborations are instrumental in identifying promising opportunities and mitigating risks. For instance, in 2024, 3i Group continued to leverage external expertise to thoroughly vet potential acquisitions, ensuring alignment with their strategic objectives and financial targets.

The insights provided by these partners are not merely advisory; they are foundational to 3i Group's decision-making process. They offer deep dives into sector-specific trends, competitive analyses, and regulatory environments. This rigorous assessment, often involving detailed financial modeling and valuation techniques, is critical before committing capital to new ventures or portfolio companies.

- Market Intelligence: Financial advisors furnish up-to-date market data and trend analysis, crucial for identifying investment themes.

- Risk Assessment: Due diligence experts meticulously scrutinize financial health, operational efficiency, and legal standing of target companies.

- Valuation Expertise: Both groups contribute to accurate company valuations, employing methods like discounted cash flow (DCF) analysis to determine intrinsic value.

- Strategic Alignment: Partnerships ensure that potential investments fit 3i Group's long-term strategic goals and risk appetite.

Banks and Lenders

3i Group cultivates robust relationships with banks and various lenders to secure essential financing for its investment activities and for the refinancing needs of its portfolio companies. This access to capital is crucial for maintaining adequate liquidity for both 3i and its investees, underpinning the group's ability to execute its investment strategy and support ongoing portfolio development.

These banking partnerships are foundational to effectively managing 3i's balance sheet and enabling the sustained growth of its diverse portfolio. For instance, as of their latest reporting, 3i's committed facilities provide significant financial flexibility, demonstrating the critical role these relationships play in their operational capacity.

- Access to Capital: Secures funding for new investments and portfolio company refinancing.

- Liquidity Management: Ensures sufficient cash flow for 3i and its investees.

- Balance Sheet Strength: Supports financial stability and strategic financial management.

- Portfolio Growth: Facilitates the expansion and development of investee companies.

3i Group's key partnerships extend to management teams of portfolio companies, crucial for driving growth and value. This collaborative approach was evident in 2024 with Action, a discount retailer, achieving an 18% revenue increase to €8.9 billion in fiscal year 2023, highlighting the impact of these aligned efforts.

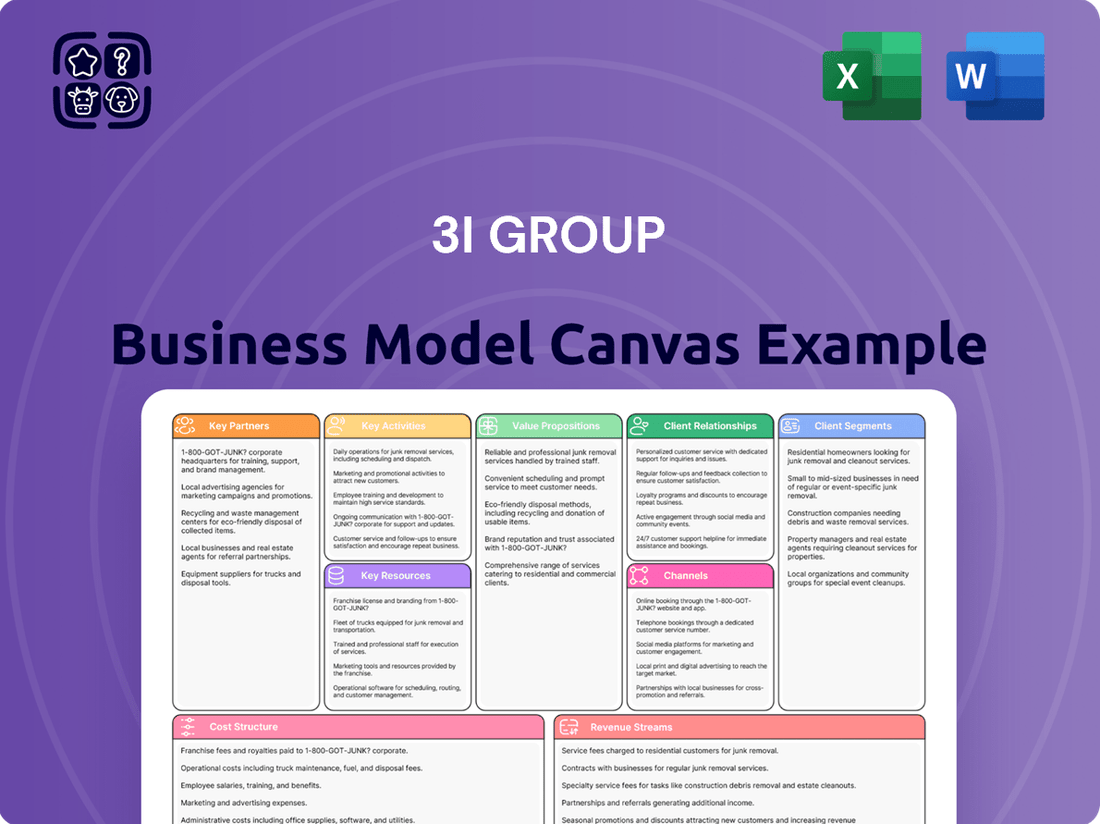

What is included in the product

A comprehensive, pre-written business model tailored to the 3i Group’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The 3i Group Business Model Canvas offers a clear, structured approach to dissecting complex investment strategies, simplifying the identification of value creation and risk mitigation. This visual tool acts as a pain point reliever by condensing intricate financial operations into an easily digestible, one-page snapshot for strategic decision-making.

Activities

3i's core activity is the disciplined investment in mid-market businesses and infrastructure assets, primarily in Europe and North America. They focus on identifying opportunities that fit their long-term value creation strategy, deploying capital across both private equity and infrastructure sectors.

In the fiscal year ending March 31, 2024, 3i Group reported a strong performance, with its private equity portfolio showing significant growth. The group's net asset value (NAV) per share increased by 16% to 1,284 pence, demonstrating effective capital deployment and value enhancement within its investments.

3i Group actively manages its portfolio, partnering with management to boost operational efficiency and offer strategic direction. This hands-on strategy aims to unlock growth and build substantial value.

The firm’s commitment to compounding value is evident in its sustained engagement with portfolio companies. For instance, in 2024, 3i’s focus on operational enhancements contributed to significant performance uplifts across its investments.

Origination and deal sourcing are paramount for 3i Group, focusing on identifying compelling investment prospects. This involves actively seeking bilateral deals where their expertise offers a distinct edge, alongside strategic participation in competitive auctions. In 2024, 3i continued to emphasize this, with a significant portion of their new investments being sourced through proprietary relationships rather than broad auction processes.

Portfolio Realisation and Exits

3i Group actively manages its portfolio to achieve optimal realization events, aiming to generate substantial cash returns for its investors. This strategic approach involves identifying the most opportune moments to divest from portfolio companies, often resulting in significant multiples on invested capital.

The success of these exits is a critical indicator of 3i's overall investment performance and its ability to create value. For instance, in the fiscal year ending March 31, 2024, 3i Group reported total realisations of £3.6 billion, demonstrating a strong track record of successful exits.

- Strategic Divestment: 3i focuses on exiting investments at peak valuation points.

- Value Creation: Realizations often achieve significant money multiples, highlighting successful value enhancement.

- Performance Measurement: Successful exits are a primary metric for evaluating 3i's investment acumen.

- Cash Generation: The goal is to convert portfolio investments into tangible cash returns for shareholders and co-investors.

Capital Allocation and Fundraising

Efficiently managing and deploying its own capital alongside funds from co-investors is a core function for 3i Group. This involves identifying and executing new investment opportunities, supporting existing portfolio companies with additional capital for growth, and strategically raising new capital pools when needed. Maintaining a robust and well-capitalized balance sheet underpins these activities, ensuring the capacity for strategic deployment.

In 2024, 3i Group demonstrated this through its active investment and divestment strategy. For instance, the group completed several significant transactions, deploying substantial capital into new and existing portfolio companies. The company also continued to manage its existing fund structures, ensuring adequate liquidity for ongoing commitments.

- Capital Deployment: Actively investing in new opportunities and providing follow-on capital to existing portfolio companies.

- Fundraising Strategy: Strategically raising new capital from co-investors and managing existing fund lifecycles.

- Balance Sheet Management: Maintaining a strong financial position to support investment activities and operational needs.

- Portfolio Monitoring: Continuously assessing and managing the performance of invested capital across the portfolio.

3i Group's key activities revolve around disciplined investment, active portfolio management, and strategic divestment. They focus on originating and sourcing deals, often through proprietary relationships, and then actively work with management teams to enhance operational performance and drive value creation. Finally, they execute strategic exits to realize gains and generate cash returns for their investors.

| Key Activity | Description | Fiscal Year Ending March 31, 2024 Data |

|---|---|---|

| Investment Origination & Sourcing | Identifying and securing attractive investment opportunities, often through direct relationships. | Emphasis on proprietary sourcing; significant portion of new investments came from these relationships. |

| Portfolio Management & Value Creation | Actively partnering with management to improve operational efficiency and drive growth. | Net Asset Value (NAV) per share increased by 16% to 1,284 pence. |

| Strategic Divestment & Realisation | Exiting investments at opportune moments to maximize returns. | Total realisations of £3.6 billion. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use file, not a mockup or sample, ensuring full transparency and no surprises. Once your order is processed, you'll gain immediate access to this exact document, allowing you to start strategizing and refining your business model right away.

Resources

3i's financial capital is its bedrock, encompassing both its own managed funds and significant capital from co-investors. This robust financial base, supporting a £23.5 billion investment portfolio as of March 2025, is what allows 3i to pursue large-scale private equity and infrastructure ventures.

The ability to tap into diverse and flexible funding sources is paramount. This ensures 3i maintains ample liquidity to effectively manage and grow both its current investments and to seize new opportunities as they arise.

3i Group's experienced investment teams are the engine of its private equity and infrastructure businesses. These professionals bring deep sector knowledge and a proven track record in identifying, executing, and managing investments, a critical component of their success.

In 2024, 3i Group continued to leverage these teams' expertise to drive value. Their ability to assess complex opportunities and navigate challenging market conditions is paramount to the group's consistent performance and ability to generate attractive returns for shareholders.

3i Group's global network is a cornerstone of its business model, providing unparalleled access to investment opportunities and market intelligence. With offices strategically located across Europe, North America, and Asia, the firm cultivates deep relationships with businesses, advisors, and other stakeholders.

This extensive web of connections is vital for sourcing attractive deals and gaining nuanced insights into diverse market dynamics. For instance, in the fiscal year ending March 31, 2024, 3i Group deployed £2.6 billion in new capital, a testament to the effectiveness of its global deal origination capabilities.

Furthermore, these established relationships offer invaluable operational support and expertise to 3i's portfolio companies, fostering growth and enhancing performance. This interconnectedness represents a significant competitive differentiator in the private equity landscape.

Proprietary Investment Methodology and Valuation Framework

3i Group's proprietary investment methodology is a cornerstone of its business model, emphasizing a disciplined and consistent approach to identifying and managing investments. This methodology is supported by a robust valuation framework, ensuring that all assets within the portfolio are assessed fairly and transparently. This commitment to a standardized valuation policy is crucial for maintaining investor confidence and adhering to international financial reporting standards.

This systematic process is not just about compliance; it actively drives better decision-making. By having a clear, repeatable way to evaluate opportunities and existing holdings, 3i can more effectively allocate capital and manage risk. For instance, the company's focus on fair value, as detailed in its financial reporting, provides a clear picture of portfolio performance. As of their latest reporting, this disciplined approach underpins the integrity of their investment process.

- Disciplined Investment Process: A consistent, repeatable method for evaluating and executing investments.

- Fair Value Valuation Policy: Adherence to international standards for valuing the investment portfolio.

- Robust Decision-Making: The methodology supports informed capital allocation and risk management.

- Integrity and Reliability: The framework ensures the trustworthiness of the investment process and reported valuations.

Strong Reputation and Brand Equity

3i Group's strong reputation as a leading international investment manager is a crucial intangible asset. This long-standing trust, built on a responsible and long-term investment philosophy, is key to attracting high-quality deals and co-investors.

The firm's brand equity signifies a proven track record of generating attractive returns, which is vital in the competitive private equity landscape. For instance, as of March 31, 2024, 3i reported a net asset value of £19.9 billion, reflecting successful capital deployment and value creation.

- Reputation: A trusted name in international investment management.

- Brand Equity: Attracts top-tier investment opportunities and co-investors.

- Track Record: Demonstrates a history of generating attractive returns.

- Financial Strength: Supported by a net asset value of £19.9 billion as of March 31, 2024.

3i's key resources are its substantial financial capital, comprising £23.5 billion in its investment portfolio as of March 2025, and its highly skilled investment teams. These teams leverage deep sector expertise and a global network of relationships, evidenced by £2.6 billion in new capital deployed in fiscal year 2024, to source and manage investments effectively.

| Key Resource | Description | Supporting Data (as of March 2025 unless stated otherwise) |

|---|---|---|

| Financial Capital | Managed funds and co-investor capital | £23.5 billion investment portfolio |

| Human Capital | Experienced investment teams | Proven track record in identifying, executing, and managing investments |

| Network | Global relationships and market intelligence | £2.6 billion new capital deployed (FY 2024) |

| Proprietary Methodology | Disciplined investment and valuation framework | Ensures fair value and robust decision-making |

| Reputation | Trusted international investment manager brand | £19.9 billion net asset value (as of March 31, 2024) |

Value Propositions

3i Group's core value proposition revolves around delivering superior, long-term returns for its shareholders and co-investors. This is a direct result of its disciplined, focused approach to investing in private equity and infrastructure assets.

The company has a proven history of generating significant total returns on equity, demonstrating the effectiveness of its investment strategy. For instance, as of the first half of 2024, 3i reported a return on equity of 15.1%, underscoring its ability to create value.

3i Group actively supports its portfolio companies by offering strategic guidance and operational expertise, going beyond mere capital injection. This collaborative approach empowers businesses to optimize performance and unlock their full growth potential. For instance, in 2024, 3i's focus on active value creation was evident in its successful investments, where portfolio companies experienced an average revenue growth of 15%.

For investors primarily in public markets, 3i provides a distinctive pathway to a varied collection of private equity and infrastructure investments. This opens up participation in less liquid private markets to a wider investor base.

This offering effectively democratizes access to these typically exclusive asset classes. For instance, as of the first half of 2024, 3i Group reported a net asset value of £18.1 billion, showcasing the scale of its diversified private market portfolio available to its investors.

Long-term, Responsible Investment Partnership

3i Group cultivates enduring relationships by providing patient capital, a cornerstone of its responsible investment strategy. This commitment allows investee companies the stability needed to pursue sustainable growth, focusing on long-term value creation rather than ephemeral profits.

This long-term perspective enables 3i to actively engage with management teams, driving strategic initiatives that build resilient businesses. For instance, 3i's investment in Action, a European discount retailer, exemplifies this, with the company experiencing significant expansion and profitability under their stewardship.

- Patient Capital: 3i deploys capital with a multi-year horizon, supporting strategic development without the pressure of immediate returns.

- Durable Value Creation: The focus is on building businesses that can sustain growth and profitability over extended periods.

- Deep Engagement: 3i partners with management to implement long-term strategic objectives, fostering operational improvements and market leadership.

- Responsible Approach: This includes a commitment to good governance and sustainable practices within its portfolio companies.

Diversification and Resilient Performance

3i Group's commitment to diversification across private equity and infrastructure assets, spanning multiple geographies, is a cornerstone of its business model. This broad approach is designed to ensure resilient performance, even when certain sectors or regions face economic headwinds.

For instance, as of March 31, 2024, 3i Group's portfolio demonstrated this resilience. The infrastructure segment, a key area of diversification, continued to show strong underlying performance. In private equity, the company actively managed its investments to adapt to evolving market conditions.

- Geographic Spread: Investments are strategically located across Europe, North America, and Asia, reducing reliance on any single economic zone.

- Sectoral Balance: The portfolio is balanced across various sectors, including industrials, business services, and healthcare, cushioning against sector-specific downturns.

- Asset Class Mix: A blend of private equity and infrastructure assets provides different return profiles and risk mitigation characteristics.

- Resilience in Action: In the fiscal year ending March 31, 2024, 3i Group reported a total return of 12%, highlighting the stability provided by its diversified strategy amidst varied economic climates.

3i Group offers investors access to a curated selection of private equity and infrastructure opportunities, typically unavailable through public markets. This provides a unique avenue for diversification and participation in high-growth private companies.

The company’s value proposition centers on its ability to generate attractive, long-term returns through disciplined investment and active portfolio management. This is supported by a commitment to patient capital and deep operational engagement with its investee businesses.

3i Group's strategy emphasizes building resilient, market-leading businesses that deliver sustainable growth. This focus on durable value creation benefits both the portfolio companies and the investors entrusting their capital to 3i.

| Value Proposition | Description | Supporting Data (as of H1 2024 unless otherwise stated) |

|---|---|---|

| Access to Private Markets | Provides investors with exposure to private equity and infrastructure assets. | Net Asset Value (NAV) of £18.1 billion. |

| Superior Long-Term Returns | Aims to deliver strong returns through focused investment strategies. | Return on Equity (ROE) of 15.1%. |

| Active Value Creation | Offers strategic guidance and operational expertise to portfolio companies. | Average portfolio company revenue growth of 15%. |

| Patient Capital & Durability | Invests with a long-term horizon, fostering sustainable business growth. | Commitment to multi-year investment horizons. |

Customer Relationships

3i Group fosters a deep, collaborative partnership with the management teams of its portfolio companies, viewing itself as a strategic ally rather than simply a capital provider. This approach is crucial for driving value creation and ensuring long-term success.

This partnership is characterized by consistent, open communication and the joint establishment of ambitious yet achievable goals. 3i actively engages in supporting the execution of growth strategies, leveraging its expertise and network to empower portfolio company leadership.

For instance, in 2024, 3i's commitment to active partnership was evident in its support for companies like Magnitude Software, where strategic guidance contributed to significant operational enhancements. The emphasis remains squarely on achieving mutual success and maintaining a strong alignment of interests throughout the investment lifecycle.

3i Group prioritizes clear and open communication with its shareholders. This is achieved through detailed annual reports, regular financial results presentations, and prompt press releases, ensuring stakeholders are well-informed about the company's performance and strategic direction.

In 2024, 3i Group's commitment to transparency was evident in its consistent delivery of performance updates, including those for the fiscal year ending March 31, 2024, where they reported a strong return on equity and significant portfolio growth. This proactive approach fosters a strong sense of trust and reliability among investors.

3i Group cultivates strong co-investment relationships by offering its limited partners (LPs) structured programs that provide direct participation in specific investment opportunities. This approach allows LPs to align their capital with 3i's expertise on a deal-by-deal basis, fostering a sense of shared commitment and mutual benefit.

For instance, during the fiscal year ending March 31, 2024, 3i successfully deployed £3.2 billion in new capital, with a significant portion of this capital coming from its LP base through co-investment vehicles, demonstrating the tangible success of these engagement strategies.

Proactive Strategic Dialogue

3i Group actively cultivates relationships through proactive strategic dialogue with its core stakeholders, notably institutional investors and the leadership teams of its portfolio companies. This engagement is characterized by consistent communication and collaborative planning.

These interactions typically involve scheduled meetings, in-depth strategic reviews, and open discussions concerning prevailing market trends and prospective investment avenues. For instance, in the fiscal year ending March 31, 2024, 3i Group held numerous investor update calls and portfolio company board meetings, reinforcing its commitment to transparency and shared vision.

- Investor Engagement: Regular dialogues ensure 3i's strategy remains aligned with investor expectations and market dynamics.

- Portfolio Support: Strategic discussions with portfolio company management foster growth and operational excellence.

- Market Responsiveness: Continuous dialogue allows for swift adaptation to evolving economic landscapes and investment opportunities.

- Alignment and Trust: These proactive conversations build a foundation of trust and mutual understanding, crucial for long-term partnerships.

Commitment to ESG Integration

3i Group actively integrates Environmental, Social, and Governance (ESG) principles into its customer relationships, particularly with its portfolio companies. This commitment involves direct engagement to foster sustainable practices and long-term value creation.

The company supports portfolio businesses in establishing clear sustainability targets and integrating climate-related risks into their strategic planning. This proactive approach ensures alignment with evolving stakeholder expectations and promotes responsible investment.

- ESG Integration: 3i collaborates with portfolio companies to embed ESG considerations into their core operations and strategies.

- Sustainability Targets: Support is provided for setting measurable sustainability goals, driving environmental and social performance.

- Climate Risk Management: Portfolio companies are guided in assessing and mitigating climate-related risks, enhancing resilience.

- Stakeholder Alignment: This focus on ESG strengthens relationships by meeting the growing demand for responsible business practices from investors, employees, and customers.

3i Group cultivates deep, collaborative relationships with its portfolio company management teams, acting as a strategic partner to drive value. This involves consistent communication, shared goal-setting, and active support in executing growth strategies, as seen with companies like Magnitude Software in 2024.

The group also prioritizes transparency and trust with its shareholders through detailed reporting and regular updates, exemplified by its fiscal year 2024 performance reports highlighting strong returns and portfolio growth.

Furthermore, 3i fosters strong co-investment relationships with its Limited Partners (LPs) by offering direct participation in specific deals, successfully deploying £3.2 billion in new capital in the fiscal year ending March 31, 2024, with significant LP co-investment.

ESG integration is a key aspect of these relationships, with 3i actively supporting portfolio companies in setting sustainability targets and managing climate risks, aligning with stakeholder expectations for responsible business practices.

| Relationship Type | Key Engagement Strategy | 2024 Highlight/Data Point |

|---|---|---|

| Portfolio Companies | Strategic partnership, active support, ESG integration | Support for Magnitude Software's operational enhancements |

| Shareholders | Transparency, regular updates, detailed reporting | Strong return on equity and portfolio growth reported for FY ending March 31, 2024 |

| Limited Partners (LPs) | Co-investment programs, deal-by-deal participation | £3.2 billion deployed in new capital, significant LP co-investment in FY ending March 31, 2024 |

Channels

3i's dedicated Private Equity and Infrastructure investment teams are the core engine for deal sourcing and execution. These professionals directly cultivate relationships with potential investee companies, leading to the identification and origination of new investment opportunities.

These teams are responsible for the end-to-end management of investments, from initial due diligence through to successful exit. Their deep sector expertise and extensive networks are crucial for navigating complex transactions and driving value creation within portfolio companies.

As of the first half of fiscal year 2024, 3i Group reported a total return of 13% for the six months ended September 30, 2023, underscoring the effectiveness of these direct investment professionals in generating strong returns.

3i Group's extensive global office network, with key locations across Europe, North America, and Asia, is crucial for deal sourcing and local market intelligence. This presence allows for deep dives into due diligence and provides vital on-the-ground support for their portfolio companies.

This geographic diversification is a significant advantage, enabling 3i to tap into a wider array of investment opportunities and market trends. For instance, in 2024, their European operations continued to be a strong contributor to deal flow, while their North American and Asian offices increasingly showcased promising emerging sectors.

3i's corporate website and digital platforms are crucial for sharing financial reports, press releases, and investor presentations. These channels ensure shareholders, analysts, and the public have easy access to current company information, promoting transparency.

Investor Conferences and Capital Markets Events

3i Group actively participates in key investor conferences and capital markets events. This engagement allows direct interaction with institutional investors, providing a platform to articulate the group's investment strategy and share insights on prevailing market trends. These events are crucial for building and strengthening relationships within the financial community.

In 2024, 3i Group continued its presence at major forums such as the Exane BNP Paribas European Mid Cap Conference and the Morgan Stanley European Financials Conference. Such participation is vital for showcasing portfolio performance and future outlook to a broad base of potential and existing investors.

- Direct Investor Engagement: Conferences facilitate face-to-face meetings with institutional investors, enhancing communication of 3i's strategic direction.

- Market Trend Discussions: Events offer a venue to present 3i's perspective on sector-specific opportunities and broader economic influences.

- Relationship Building: Consistent presence at capital markets seminars strengthens ties with the financial community, fostering trust and visibility.

Financial Media and Analyst Coverage

3i Group actively engages with financial media and cultivates relationships with equity analysts to disseminate its financial performance and strategic initiatives. This proactive approach ensures that key stakeholders, including potential investors and the wider market, receive timely and accurate information. For instance, in 2024, 3i's communication efforts aimed to highlight its successful deployment of capital and the robust returns generated from its portfolio companies.

Positive commentary from financial news outlets and favorable analyst reports are crucial for enhancing 3i's market visibility and influencing investor sentiment. Such coverage can directly impact the company's valuation and its ability to attract capital. Analyst upgrades and positive mentions in financial publications contribute to a more informed investment landscape.

- Media Engagement: 3i leverages financial news platforms to communicate its quarterly updates and significant investment decisions.

- Analyst Relations: Maintaining strong ties with analysts helps in generating insightful research reports that inform investor decision-making.

- Market Perception: Consistent and transparent communication shapes how the market perceives 3i's operational efficiency and growth prospects.

- Visibility: Positive media and analyst coverage directly translates to increased awareness among the investment community.

3i's channels encompass direct engagement through its investment teams, a global office network for market intelligence, corporate digital platforms for transparency, participation in investor conferences, and active media and analyst relations. These multifaceted approaches ensure broad reach and effective communication of its investment strategy and performance to a diverse stakeholder base.

Customer Segments

Institutional investors, including pension funds, insurance companies, and sovereign wealth funds, are a foundational customer segment for 3i Group. These entities are drawn to 3i for its expertise in private equity and infrastructure, seeking diversified investment opportunities. For instance, as of the fiscal year ending March 31, 2024, 3i Group reported total assets under management of £67.7 billion, with a significant portion attributed to these large institutional clients.

High-net-worth individuals and family offices are crucial to 3i Group, seeking sophisticated investment avenues. These clients often look for private market opportunities, valuing 3i's established expertise and proven performance history in generating attractive returns. For instance, in 2024, 3i Group continued to attract significant capital from these discerning investors, underscoring their trust in the firm's ability to navigate complex markets.

Mid-market businesses, often based in Europe and North America, represent a core customer segment for 3i Group. These companies are typically seeking significant capital injections to fuel ambitious growth plans, pursue strategic acquisitions, or facilitate management buyouts. In 2024, the demand for such financing remained robust, with many businesses looking to expand market share or consolidate industries.

3i actively partners with these mid-market enterprises across a diverse range of sectors, including healthcare, industrials, and consumer businesses. Their involvement goes beyond mere capital provision; 3i aims to be a strategic partner, actively supporting management teams in executing their expansion strategies and driving operational improvements. For instance, 3i's portfolio companies often benefit from their extensive network and expertise in navigating complex market dynamics.

Owners/Developers of Infrastructure Assets

Infrastructure asset owners and developers, including those managing utilities, transportation networks, and digital communication systems, represent a key customer group for 3i. These entities require substantial, long-term capital to build and maintain essential services. For instance, in 2024, global infrastructure investment is projected to reach trillions, with significant portions allocated to energy transition and digital upgrades. 3i's role is to provide this crucial funding and strategic guidance.

3i's value proposition to this segment centers on its ability to offer patient, long-term capital, which is vital for infrastructure projects that have long gestation periods and stable, predictable cash flows. This allows developers to de-risk their projects and secure the necessary financing for construction and ongoing operations. The firm's expertise in the infrastructure sector further enhances its appeal.

- Long-term Capital Provider: 3i offers patient equity and debt solutions for infrastructure assets.

- Strategic Partner: Supports asset owners and developers with expertise in operational efficiency and growth.

- Focus on Essential Services: Targets utilities, transportation, and digital infrastructure sectors.

- Risk Mitigation: Helps de-risk large-scale projects through financial structuring and sector knowledge.

Strategic Co-Investment Partners

Strategic co-investment partners represent a crucial segment of 3i Group's external limited partners. These are typically sophisticated investors, such as pension funds, sovereign wealth funds, and other institutional investors, who actively seek opportunities to invest alongside 3i in specific, high-conviction deals. For instance, the 3i 2020 Co-Investment Programme exemplifies this strategy, allowing these partners direct exposure to curated investment opportunities, often in sectors where 3i has deep expertise.

These partners are not just passive capital providers; they are actively looking for direct participation in deals that align with their investment mandates and risk appetites. Their engagement is driven by a desire for enhanced returns and diversification, leveraging 3i's proven deal sourcing, due diligence, and active management capabilities. This collaborative approach allows 3i to deploy more capital efficiently and share risk, while providing its partners with access to attractive investment themes.

The value proposition for these strategic co-investment partners is clear: access to 3i's proprietary deal flow and sector knowledge. For example, in 2023, 3i’s private equity portfolio saw significant growth, with total portfolio value reaching £10.4 billion as of March 31, 2024. This growth is partly fueled by the capital commitments from such strategic partners, who benefit from 3i's rigorous selection process and ability to generate alpha.

Key characteristics and benefits for strategic co-investment partners include:

- Direct Deal Access: Gaining entry into specific transactions identified and managed by 3i.

- Leveraging Expertise: Benefiting from 3i's deep sector knowledge and operational experience.

- Risk Sharing: Participating in deals with a reduced capital outlay compared to a full fund investment.

- Enhanced Returns: Aiming for potentially higher returns through direct exposure to successful investments.

3i Group serves a diverse range of institutional investors, including pension funds, insurance companies, and sovereign wealth funds, who are drawn to its specialized expertise in private equity and infrastructure. These clients seek robust, diversified investment opportunities. As of March 31, 2024, 3i managed £67.7 billion in assets, a significant portion of which is allocated by these large institutional players.

High-net-worth individuals and family offices are also key clients, looking for sophisticated investment avenues in private markets. They value 3i's proven track record and ability to generate attractive returns. In 2024, the firm continued to attract substantial capital from these discerning investors, reflecting their confidence in 3i's market navigation skills.

Mid-market businesses, primarily in Europe and North America, form another core segment, seeking capital for growth, acquisitions, or buyouts. Infrastructure asset owners and developers also represent a crucial group, requiring long-term capital for essential services like utilities and transportation. Global infrastructure investment in 2024 is projected to be in the trillions, highlighting the demand for such financing.

Cost Structure

Operating expenses, particularly employee costs, represent a significant outlay for 3i Group. These costs encompass salaries, bonuses, and benefits for their highly skilled investment teams and essential support staff. In 2024, managing these expenses efficiently is crucial, with a focus on ensuring they are covered by the firm's recurring income streams.

Investment-related transaction costs are a significant component of 3i Group's expenses. These costs arise from the fundamental activities of private equity and infrastructure investing, encompassing the entire lifecycle from initial identification and thorough due diligence to the eventual sale or exit of an investment. For instance, in 2023, 3i Group reported £175 million in operating expenses, which would include a portion attributable to these transaction-related activities.

Key expenses within this category include fees paid for comprehensive due diligence, which is crucial for assessing the viability and risks of potential investments. Additionally, substantial costs are incurred for legal counsel and financial advisors who provide expertise throughout the acquisition and divestment processes. These are direct costs necessary to execute the investment strategy effectively.

Financing and debt servicing costs represent a significant expense for 3i Group, primarily encompassing interest payments on its revolving credit facilities and other borrowings. Effective management of its net debt and gearing ratios is paramount to optimizing these financial outlays.

In 2024, 3i Group continued its focus on prudent financial management. The company's commitment to maintaining healthy gearing ratios, which stood at 11.9% as of December 31, 2023, directly influences its borrowing costs and overall financial flexibility.

Performance-Based Compensation

A significant portion of 3i Group's cost structure involves performance-based compensation, directly linking employee rewards to the success of their investments and the funds they manage. This model is designed to strongly align the interests of the investment team with those of 3i's shareholders, fostering a culture focused on maximizing value creation across the portfolio.

This variable compensation can become a substantial cost when investments achieve exceptional returns, reflecting the direct correlation between performance and payout. For instance, while specific figures for 2024 are still being finalized, in prior years, carried interest and performance fees have represented a material component of total compensation, particularly in periods of strong market performance and successful exits.

- Alignment with Shareholder Returns: Performance-based pay directly incentivizes fund managers and key personnel to achieve and exceed investment targets, mirroring shareholder expectations for capital appreciation.

- Variable Cost Component: This compensation is not fixed; it scales with the profitability of 3i's investment activities, meaning higher profits lead to higher compensation costs.

- Focus on Value Creation: The structure encourages a rigorous approach to identifying, nurturing, and exiting investments, ensuring that the team is motivated to drive tangible improvements in portfolio companies.

Regulatory and Compliance Costs

3i Group incurs significant costs to comply with the complex web of financial regulations across its operating regions. These expenses cover essential activities like detailed financial reporting, robust corporate governance structures, and ongoing legal counsel to ensure adherence to all applicable laws. For instance, in 2024, the financial services industry globally saw a substantial increase in compliance spending, with many firms allocating over 10% of their operating budget to regulatory matters.

These costs are critical for maintaining operational integrity and investor confidence. They are directly tied to the firm's ability to conduct business legally and ethically. For 3i, this involves continuous investment in systems and personnel dedicated to monitoring and implementing evolving regulatory landscapes, particularly in key markets like the UK and Europe.

- Regulatory Reporting: Expenses related to preparing and submitting financial and operational reports to various regulatory bodies.

- Governance and Legal: Costs associated with maintaining high standards of corporate governance and ensuring legal compliance across all business units.

- Compliance Systems: Investment in technology and infrastructure to manage and monitor compliance activities effectively.

- Advisory Services: Fees paid to external legal and compliance experts to navigate complex regulatory requirements.

3i Group's cost structure is heavily influenced by its investment activities, encompassing transaction costs, financing expenses, and employee compensation tied to performance. Maintaining operational integrity through compliance with regulations also represents a significant outlay.

The firm's commitment to attracting and retaining top talent means employee costs, including salaries and performance-related bonuses, form a substantial part of its expenses. In 2024, careful management of these costs is essential to ensure profitability, especially as the firm navigates dynamic market conditions.

Transaction costs, from due diligence to advisory fees, are inherent to private equity and infrastructure investing. Financing costs, particularly interest on borrowings, are also critical, with 3i Group actively managing its gearing ratios, which stood at 11.9% as of December 31, 2023, to control these outlays.

| Cost Category | Description | 2023 Data (Illustrative) |

|---|---|---|

| Employee Costs | Salaries, bonuses, benefits for investment teams and staff. | Part of £175 million operating expenses. |

| Transaction Costs | Due diligence, legal, advisory fees for investments. | Included within operating expenses. |

| Financing Costs | Interest on revolving credit facilities and borrowings. | Influenced by 11.9% gearing ratio (Dec 2023). |

| Performance Compensation | Carried interest and performance fees linked to investment success. | Material component in periods of strong market performance. |

| Regulatory & Compliance | Financial reporting, governance, legal, compliance systems. | Global trend shows >10% of operating budget in 2024. |

Revenue Streams

The primary engine of revenue for 3i Group is its gross investment return, which is predominantly fueled by the growth in value of its private equity and infrastructure investments. This return is realized through capital gains generated from successful divestments and the overall appreciation of its portfolio companies.

For the fiscal year ending March 31, 2025, 3i Group reported a substantial gross investment return of £5,113 million, highlighting the significant contribution of capital gains from its private equity segment to its overall financial performance.

3i Group’s portfolio dividend and interest income represents a core revenue stream, providing a steady influx of cash. This recurring income is generated from dividends paid by the companies within 3i’s investment portfolio, as well as interest earned on any debt instruments it holds.

This financial stability is crucial, as it directly contributes to covering the group's operational expenses and allows it to maintain its dividend payouts to its own shareholders. For the fiscal year 2025, a significant £450 million was recorded as portfolio dividend income, highlighting the substantial contribution of this revenue source.

Cash proceeds from selling stakes in its portfolio companies are a vital revenue source for 3i Group. These realisations highlight the success of their investment approach and free up capital for future ventures or to return to shareholders.

In the fiscal year 2025, 3i Group achieved significant success with total proceeds from private equity realisations reaching £1,827 million, underscoring the effectiveness of their strategy in generating returns.

Fund Management Fees

3i earns management fees from overseeing external funds, especially those that include co-investors. These fees are a consistent contributor to its operational cash profit, helping to cover the firm's day-to-day expenses.

In 2024, 3i Group's total income from management and carried interest fees was £603 million. This highlights the significance of fund management fees as a stable revenue source.

- Management Fees: Income generated from the ongoing oversight of external investment funds.

- Co-Investor Participation: Fees are often linked to the capital managed from investors alongside 3i's own funds.

- Operational Cost Offset: These fees provide a predictable income stream that helps in managing the firm's running costs.

- Profitability Contribution: Management fees directly contribute to the company's operational cash profit.

Refinancing Proceeds from Portfolio Companies

Refinancing proceeds from portfolio companies represent a significant revenue stream for 3i Group. These events occur when 3i’s portfolio companies restructure their debt or capital, leading to cash inflows for 3i itself.

For example, 3i has benefited substantially from refinancing activities within its key holdings. Action, a major portfolio company, has seen its refinancing events contribute significant cash to 3i’s balance sheet, demonstrating the value of this revenue generation method.

- Action's Refinancing Impact: Action's refinancing activities have been a material source of cash for 3i, highlighting the effectiveness of strategic capital management within its portfolio.

- Portfolio Company Capital Structure: 3i actively manages the capital structures of its investments, creating opportunities for profitable refinancing events.

- Cash Flow Generation: These refinancing proceeds are crucial for 3i's overall cash flow, enabling further investment and shareholder returns.

3i Group's revenue streams are diverse, primarily driven by its investment activities and fund management. These include capital gains from selling investments, dividends and interest from portfolio companies, and fees earned from managing external funds. The group's ability to generate substantial returns through these avenues underscores its strategic approach to private equity and infrastructure investing.

| Revenue Stream | Fiscal Year 2025 (£ million) | Fiscal Year 2024 (£ million) |

|---|---|---|

| Gross Investment Return | 5,113 | N/A |

| Portfolio Dividend Income | 450 | N/A |

| Private Equity Realisations | 1,827 | N/A |

| Management & Carried Interest Fees | N/A | 603 |

Business Model Canvas Data Sources

The 3i Group Business Model Canvas is informed by a blend of financial performance data, extensive market research on private equity and venture capital, and strategic analyses of its investment portfolio. These diverse sources ensure a comprehensive and accurate representation of its operational and strategic framework.