3i Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Group Bundle

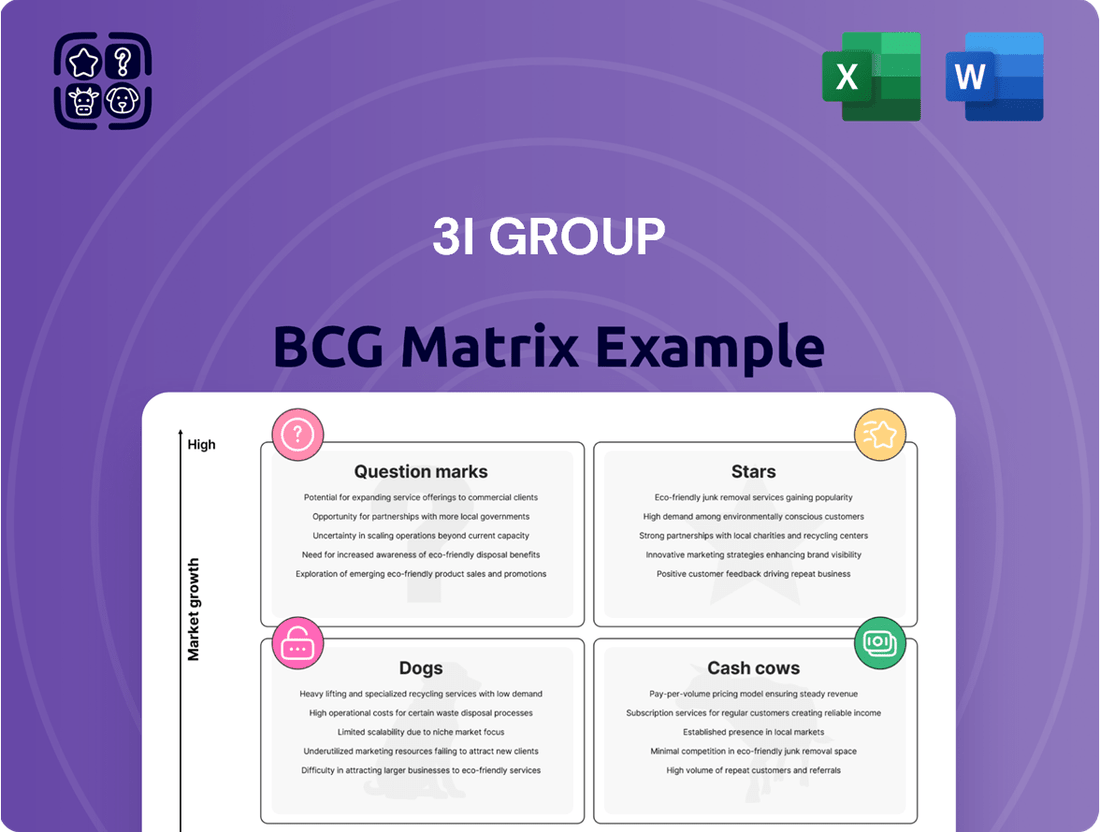

Curious about how 3i Group's portfolio stacks up? Our BCG Matrix preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report to unlock detailed quadrant analysis and actionable insights for optimizing your own investment strategies.

Stars

Action, 3i Group's largest portfolio company, is a true Star in the BCG matrix. In 2024, it demonstrated exceptional performance with significant revenue and EBITDA growth, building on its dominant position in European discount retail. Its aggressive store expansion across the continent further solidifies its market leadership and strong cash generation capabilities, making it a key driver of 3i's overall returns.

Royal Sanders is a prime example of a Star within 3i Group's private equity portfolio. Its impressive trajectory is fueled by both organic expansion and strategic acquisitions, a testament to its well-executed growth strategy.

The company's ability to successfully integrate bolt-on acquisitions has been a significant driver of its performance, allowing it to capture greater market share. This consistent value creation through strategic expansion firmly places Royal Sanders in the Star category, continually compounding returns for 3i.

TCR, classified as a Star within the 3i Group's BCG Matrix, is demonstrating exceptional growth. This infrastructure asset's performance is bolstered by a steady stream of new contract acquisitions and a rapid push into new geographic territories, notably North America. A key driver of this expansion is a substantial contract secured at JFK International Airport, underscoring its position in a specialized and growing market for ground support equipment.

The company's financial stability is further evidenced by successful refinancing initiatives. These activities not only highlight TCR's robust financial health but also its capacity to maintain and strengthen its leadership within the market, solidifying its Star status.

Fibre Links Around the Globe (FLAG)

Fibre Links Around the Globe (FLAG), formerly GCX, is demonstrating impressive financial health. In 2024, the company reported a significant increase in its EBITDA, reflecting its strong market standing in subsea network infrastructure. This consistent EBITDA growth, coupled with margin improvements, clearly marks FLAG as a Star in the 3i Group's BCG Matrix.

FLAG's strategic approach involves substantial capital expenditure, which is crucial for its long-term expansion plans. These investments are designed to bolster its network capabilities and solidify its competitive advantage. By prioritizing future growth through these capital outlays, FLAG is positioning itself for sustained success.

- Consistent EBITDA Growth: FLAG has shown a steady upward trend in its Earnings Before Interest, Taxes, Depreciation, and Amortization, indicating robust operational performance.

- Improved Margins: The company has successfully enhanced its profit margins, signifying greater efficiency and pricing power in the subsea network market.

- Strategic Capital Investments: Significant capital expenditure in 2024 is dedicated to expanding network reach and enhancing technological capabilities, supporting future revenue streams.

DNS:NET

DNS:NET, a significant infrastructure investment, has demonstrated impressive growth, surpassing 100,000 paying customers by early 2024. This milestone highlights its robust market penetration and strong customer acquisition capabilities.

The company's network rollout, supported by continued investment from 3i Infrastructure, is exceeding projected network penetration rates and average revenue per user (ARPU). This financial performance indicates a healthy and expanding market presence for DNS:NET.

- 100,000+ Paying customers as of early 2024.

- Exceeding expectations in network penetration rates.

- Strong ARPU growth, signaling effective monetization.

- High growth potential in the expanding digital infrastructure sector.

Stars in the 3i Group's portfolio represent businesses with high growth and high market share. These companies are typically leaders in their respective industries and are generating significant returns. Their strong performance often necessitates continued investment to maintain their competitive edge and capitalize on market opportunities. Companies like Action, Royal Sanders, TCR, FLAG, and DNS:NET exemplify this category, demonstrating robust financial metrics and strategic expansion.

| Company | Sector | Key Performance Indicator (2024) | Market Position | Growth Driver |

|---|---|---|---|---|

| Action | Discount Retail | Significant Revenue & EBITDA Growth | Dominant in European market | Aggressive store expansion |

| Royal Sanders | Consumer Goods | Successful bolt-on acquisitions | Increasing market share | Organic expansion and M&A |

| TCR | Infrastructure (Ground Support Equipment) | New Contract Acquisitions | Specialized, growing market | Geographic expansion (North America) |

| FLAG (GCX) | Telecommunications (Subsea Networks) | Increased EBITDA & Margin Improvement | Strong market standing | Strategic capital expenditure |

| DNS:NET | Digital Infrastructure | 100,000+ paying customers | Exceeding network penetration | Network rollout and investment |

What is included in the product

The 3i Group BCG Matrix analyzes its portfolio, highlighting which units to invest in, hold, or divest.

The 3i Group BCG Matrix provides a clear visual of business unit performance, alleviating the pain of uncertain resource allocation.

Cash Cows

3i Infrastructure plc, a key component of 3i Group's diversified holdings, reliably generates strong returns and consistent dividend income for its investors. The company has a track record of achieving or surpassing its annual target Net Asset Value (NAV) return of 8-10%.

Its portfolio is built around resilient infrastructure assets, such as essential utilities and transportation networks, which are designed to produce stable, long-term cash flows. These businesses benefit from predictable demand, solidifying their position as reliable income generators.

Given its mature market standing, consistent financial performance, and dependable income stream, 3i Infrastructure plc clearly fits the profile of a Cash Cow within the broader 3i Group structure. For instance, as of its latest reporting, its portfolio continues to demonstrate robust operational performance across its various infrastructure investments.

Scandlines, a key infrastructure asset within the 3i Group's portfolio, continues to exhibit robust cash generation. Despite headwinds in the broader freight sector, the company has maintained resilient freight and leisure volumes, underscoring its stable operational performance.

This consistent cash flow, even amidst a mature market and challenging economic environments, firmly positions Scandlines as a Cash Cow. Its ability to reliably produce income highlights its established market presence and efficient operations.

Before its sale in January 2025, Valorem, a renewable energy firm, operated as a mature Cash Cow for 3i Group. It had successfully transitioned into an integrated owner-operator, generating predictable and substantial cash flows.

The divestment of Valorem yielded a significant gross money multiple and an impressive Internal Rate of Return (IRR). This outcome clearly demonstrates that Valorem was an asset that had been optimally managed to extract maximum value.

Valorem's high profitability and consistent cash generation prior to its sale are hallmarks of a classic Cash Cow. This strategic positioning allowed 3i Group to capitalize on its maturity and strong financial performance.

Nexeye (prior to sale)

Prior to its sale, Nexeye, an optical retailer, demonstrated remarkable growth under 3i Group's ownership. Since its acquisition in 2017, Nexeye successfully doubled both its sales and earnings. This consistent performance highlights its position as a mature business with a strong market presence, consistently generating significant profits.

Nexeye's journey exemplifies a classic Cash Cow scenario within the BCG Matrix. Its ability to achieve substantial profit growth in a mature market, coupled with its eventual successful divestiture after significant value creation, solidifies its status. This indicates a business that required minimal investment to maintain its strong market position and cash flow generation for 3i Group.

- Doubled Sales and Earnings: Nexeye achieved a 100% increase in both sales and earnings from 2017 until its sale.

- Mature Market Dominance: The optical retail sector is generally mature, suggesting Nexeye held a strong, established market share.

- Profit Generation: The substantial profit increase indicates efficient operations and strong pricing power.

- Successful Divestiture: The realization of value through sale confirms its role as a high-performing, cash-generating asset.

Weener Plastics (prior to sale)

Weener Plastics, held by 3i Group from 2015 until its sale in October 2024, exemplified a classic Cash Cow within the portfolio. During its tenure, the company successfully doubled its earnings, demonstrating consistent and robust financial performance. This sustained profitability in a mature industrial segment positioned it as a reliable, high-contributing asset.

The successful exit, marked by a significant profit margin, further solidifies Weener Plastics' classification as a Cash Cow. Its ability to generate substantial and stable returns throughout 3i's ownership highlights its strong market position and operational efficiency.

- Asset Performance: Doubled earnings during 3i Group's ownership period (2015-2024).

- Sector Stability: Operated within a mature industrial sector, indicating predictable revenue streams.

- Financial Health: Demonstrated sustained profitability and strong financial performance.

- Exit Success: Achieved a significant profit margin upon its sale in October 2024, confirming its Cash Cow status.

Cash Cows are mature, low-growth businesses that generate more cash than they consume, providing a stable income stream for the parent company. 3i Group has historically managed such assets effectively, extracting significant value before strategic divestments.

These businesses typically operate in stable or mature markets, requiring minimal investment to maintain their market share and profitability. Their consistent cash generation allows for dividends, debt repayment, or funding for other ventures within the group.

The successful sale of assets like Weener Plastics and Nexeye, both demonstrating doubled earnings and strong profit margins, exemplifies the effective management of Cash Cows. These sales highlight 3i Group's ability to identify, nurture, and monetize mature, cash-generating businesses.

| Asset | Ownership Period | Key Performance Indicator | Sale Outcome |

| Weener Plastics | 2015 - Oct 2024 | Doubled earnings | Significant profit margin |

| Nexeye | 2017 - 2025 (pre-sale) | Doubled sales and earnings | Successful divestiture, value creation |

| 3i Infrastructure plc | Ongoing | 8-10% NAV return target | Consistent dividend income |

What You’re Viewing Is Included

3i Group BCG Matrix

The preview you see is the definitive 3i Group BCG Matrix analysis you'll receive upon purchase, offering a complete and unwatermarked view of strategic insights. This document is meticulously prepared, reflecting the exact same comprehensive data and professional formatting that will be delivered to you, ready for immediate application in your business strategy. You are previewing the actual, fully rendered BCG Matrix report, ensuring no surprises and providing full transparency on the quality and depth of the analysis. Once acquired, this ready-to-use file will be instantly accessible for your strategic planning, empowering you with actionable insights for 3i Group's portfolio. This is the final, polished version, designed for clarity and immediate impact on your decision-making processes.

Dogs

A few of 3i's companies that rely on discretionary consumer spending are facing tough times. These businesses are often in markets that aren't growing much and don't hold a big piece of the market, making it hard for them to earn good profits.

For example, in the first half of fiscal year 2024, 3i Group reported that its portfolio companies in the consumer sector, particularly those sensitive to discretionary spending, showed weaker performance compared to other segments. This is a common trait for 'Dogs' in the BCG matrix, indicating a low market share in a low-growth industry.

Because these companies aren't performing well, 3i might consider selling them off or making significant changes to their strategy. This frees up capital that could be better used in areas with higher growth potential, aligning with the principles of optimizing a portfolio.

Companies in the recruitment market, much like those reliant on discretionary consumer spending, are currently navigating challenging macroeconomic headwinds. This environment often translates into slower growth and increased difficulty in achieving robust profitability or expanding market dominance.

These recruitment sector investments within 3i's portfolio are showing characteristics of the Dog quadrant in the BCG matrix. They are likely demanding significant capital investment to sustain operations or achieve even modest growth, yet are generating minimal returns, indicating a cash-consuming situation without substantial upside potential.

Within 3i Group's portfolio, Ionisos's non-core industrial segment is identified as a potential 'question mark' or even a 'dog' in the BCG matrix. While Ionisos as a whole shows strength, this particular segment is experiencing softness, suggesting low growth and a potentially weak market position.

This segment likely has a low market share in a slow-growing industry. For instance, if this segment’s revenue growth was only 2% in 2024, compared to the overall market growth of 5%, it would highlight its underperformance.

Such a segment requires strategic attention. It might be a candidate for restructuring to improve efficiency, or potentially a divestment if a turnaround is not feasible.

SRL

SRL, as part of the 3i Group's portfolio, is currently positioned as a Dog in the BCG Matrix. This classification stems from reports of its 'softer than expected trading,' suggesting underperformance against initial projections and potentially operating within a market characterized by low growth or intense competition.

Such an asset, lacking substantial market share or robust growth potential, could be considered a 'cash trap.' This means it might require ongoing, albeit minimal, investment to sustain operations, but offers little prospect of significant returns or future value appreciation, making it a candidate for divestment or restructuring.

For instance, if SRL's revenue growth in 2024 was reported at only 1% compared to a market average of 5%, and its profit margins remained stagnant at 3% while competitors saw improvements, this would solidify its Dog status.

- Underperforming Trading: SRL's recent performance indicates it is not meeting market expectations.

- Market Position: Likely operates in a low-growth or highly competitive sector.

- Cash Trap Potential: May require investment without significant future upside.

- Strategic Consideration: Management may need to evaluate exit strategies or turnaround plans.

Underperforming Smaller Assets

Within 3i Group's diverse portfolio, there exist smaller, often less publicized assets that are struggling. These companies typically face specific headwinds within their respective industries or haven't achieved the market penetration needed to thrive. They represent the 'Dogs' in the BCG matrix, characterized by low growth prospects and a small share of their market.

These underperforming smaller assets generally operate at a break-even point or require ongoing capital investment without generating substantial profits. For instance, if 3i Group held a small stake in a niche manufacturing firm experiencing declining demand due to technological obsolescence, this would fit the 'Dog' profile. Such assets drain resources that could be better allocated to more promising ventures.

- Low Growth, Low Share: These assets are stuck in mature or declining markets with limited potential for expansion and a small existing customer base.

- Cash Consumption: Instead of generating returns, these businesses often consume cash through operational costs and necessary, albeit low-return, investments.

- Strategic Review: 3i Group would likely be evaluating these 'Dogs' for potential divestiture, restructuring, or even closure to optimize capital allocation and focus on higher-potential investments.

Dogs within 3i Group's portfolio represent businesses operating in low-growth markets with a small market share. These entities often struggle to generate significant profits and may even consume capital without a clear path to improvement. For example, a company in a mature, non-expanding sector with only a 2% market share in 2024 would fit this description.

These 'Dogs' often require ongoing investment to maintain operations, acting as cash traps rather than profit generators. 3i Group's strategy typically involves assessing these assets for potential divestment or restructuring to reallocate resources to more promising ventures.

The underperformance of certain consumer-facing businesses and recruitment sector investments in 3i's portfolio during the first half of fiscal year 2024 highlights the characteristics of 'Dogs'. These segments faced headwinds that limited growth and profitability, necessitating strategic review.

Considering SRL's softer-than-expected trading and Ionisos's non-core industrial segment, these examples underscore the challenges faced by 'Dogs'. Their low market share in slow-growing industries, potentially yielding only 1-2% revenue growth in 2024 against market averages of 5%, solidifies their position.

| Company/Segment | BCG Category | Market Growth (Est. 2024) | Market Share (Est.) | Profitability Trend |

| Consumer Discretionary (Specific) | Dog | Low | Low | Weak |

| Recruitment Sector (Specific) | Dog | Low | Low | Stagnant/Declining |

| Ionisos (Non-core Industrial) | Potential Dog | Low | Low | Softness |

| SRL | Dog | Low | Low | Softer than expected |

Question Marks

WaterWipes, acquired by 3i Group in December 2024 and finalized in January 2025, fits the profile of a Question Mark within the BCG matrix. This strategic move by 3i Group targets international branded consumer businesses, a sector known for its growth potential, and WaterWipes is positioned within this dynamic market.

The company's recent acquisition signifies a belief in its future prospects, but its current market share and competitive standing require further development. As a relatively new investment for 3i, WaterWipes is likely in a phase of establishing its brand presence and expanding its market penetration.

Significant capital investment will be necessary to fuel WaterWipes' growth, enabling it to scale operations, enhance marketing efforts, and solidify its position against established competitors. This investment strategy is characteristic of Question Marks, which require substantial resources to transition into Stars or Cash Cows.

Constellation, a cybersecurity services group, represents a Question Mark for 3i Group. In 2024-2025, 3i made a significant investment of approximately £98 million in this rapidly evolving sector.

The cybersecurity market is dynamic, offering substantial growth prospects. However, Constellation, as a relatively new venture for 3i, is still building its market position within this competitive arena. Strategic capital allocation is crucial for Constellation to move from its Question Mark status towards becoming a market leader, or a Star, in the future.

OMS Prüfservice, acquired in January 2025, falls into the Question Mark category within 3i Group's BCG Matrix. Operating in the electrical testing services sector, this new investment is positioned in a market with potential for growth.

However, OMS Prüfservice's current market share and its future potential within 3i's portfolio remain unclear. This uncertainty necessitates significant investment and strategic direction to help the company gain traction and establish its long-term success.

New Bolt-on Acquisitions

New bolt-on acquisitions within 3i Group's portfolio often function as Question Marks in a BCG-like analysis. These are typically smaller companies or divisions added to existing, larger platforms. For instance, in 2023, 3i completed several bolt-ons, such as adding to its portfolio company Advanced, which expanded its cybersecurity offerings. These moves aim to enhance market penetration and product breadth, but their ultimate success in becoming Stars is not yet guaranteed.

These bolt-on acquisitions are strategically important but carry inherent risks and require further development to demonstrate significant market share gains. While they operate in generally favorable markets, their integration and the resulting synergy realization are ongoing processes. For example, 3i's investment in the tech sector has seen numerous bolt-ons, but the long-term impact on the overall market position of these enlarged platforms is still being assessed.

- Strategic Expansion: Bolt-on acquisitions are used to broaden market reach and product portfolios within existing 3i investments.

- Growth Potential: These acquisitions are typically placed in growing industries, indicating future potential but with uncertain outcomes.

- Integration Risk: The success of these bolt-ons depends on effective integration and their ability to contribute significantly to the parent company's market share.

- Investment Focus: They represent a strategy where initial capital is deployed to foster future growth and solidify market positions.

Early-Stage Growth Initiatives in Infrastructure

Early-stage growth initiatives within 3i Infrastructure's portfolio, often found in nascent infrastructure sub-sectors or new geographic markets, represent the Question Marks in the BCG Matrix. These ventures, such as investments in emerging renewable energy technologies or the expansion of digital infrastructure in developing regions, demand substantial upfront capital to establish market presence and build operational capacity.

These early-stage projects require significant investment to develop assets and capture market share in rapidly expanding sectors. For example, 3i Infrastructure's commitment to digital infrastructure, a key growth area, necessitates substantial capital deployment to build out networks and services. By the end of 2023, the company had a robust pipeline of potential investments in this space.

- Capital Intensive: These initiatives require significant upfront capital expenditure for asset development and market penetration.

- High Growth Potential: They target rapidly expanding sub-sectors like renewable energy or digital infrastructure.

- Uncertain Future: Their ultimate success as Cash Cows or Stars is not yet guaranteed, hence the Question Mark classification.

- Strategic Importance: They are crucial for future portfolio diversification and long-term revenue generation.

Question Marks in 3i Group's BCG Matrix represent investments with low current market share but operating in high-growth industries. These ventures, like WaterWipes and Constellation, require substantial capital to develop their market position and achieve future success. Their classification highlights the inherent risk and potential reward associated with early-stage or developing businesses within the portfolio.

The strategic allocation of capital to these Question Marks is critical for their transition into Stars or Cash Cows. For instance, 3i Group's investment in Constellation, a cybersecurity firm, was approximately £98 million in 2024-2025, underscoring the significant funding needed for growth in dynamic sectors. Similarly, early-stage infrastructure projects within 3i Infrastructure also fall into this category, demanding upfront investment for asset development in areas like digital infrastructure.

| Investment | Sector | Status | Key Characteristic | Capital Focus |

|---|---|---|---|---|

| WaterWipes | Consumer Goods | Question Mark | High industry growth, low market share | Market penetration, brand building |

| Constellation | Cybersecurity | Question Mark | Rapidly evolving market, developing position | Scaling operations, competitive positioning |

| OMS Prüfservice | Electrical Testing | Question Mark | Growth potential, unclear market share | Strategic development, market traction |

| Bolt-on Acquisitions (e.g., Advanced) | Technology | Question Mark | Enhancing existing platforms, integration risk | Synergy realization, market expansion |

| Early-stage Infrastructure | Renewable Energy, Digital Infrastructure | Question Mark | Nascent sub-sectors, new markets | Asset development, operational capacity |

BCG Matrix Data Sources

Our BCG Matrix is constructed from robust financial statements, comprehensive market research, and expert industry analysis to provide a clear strategic overview.