3i Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Group Bundle

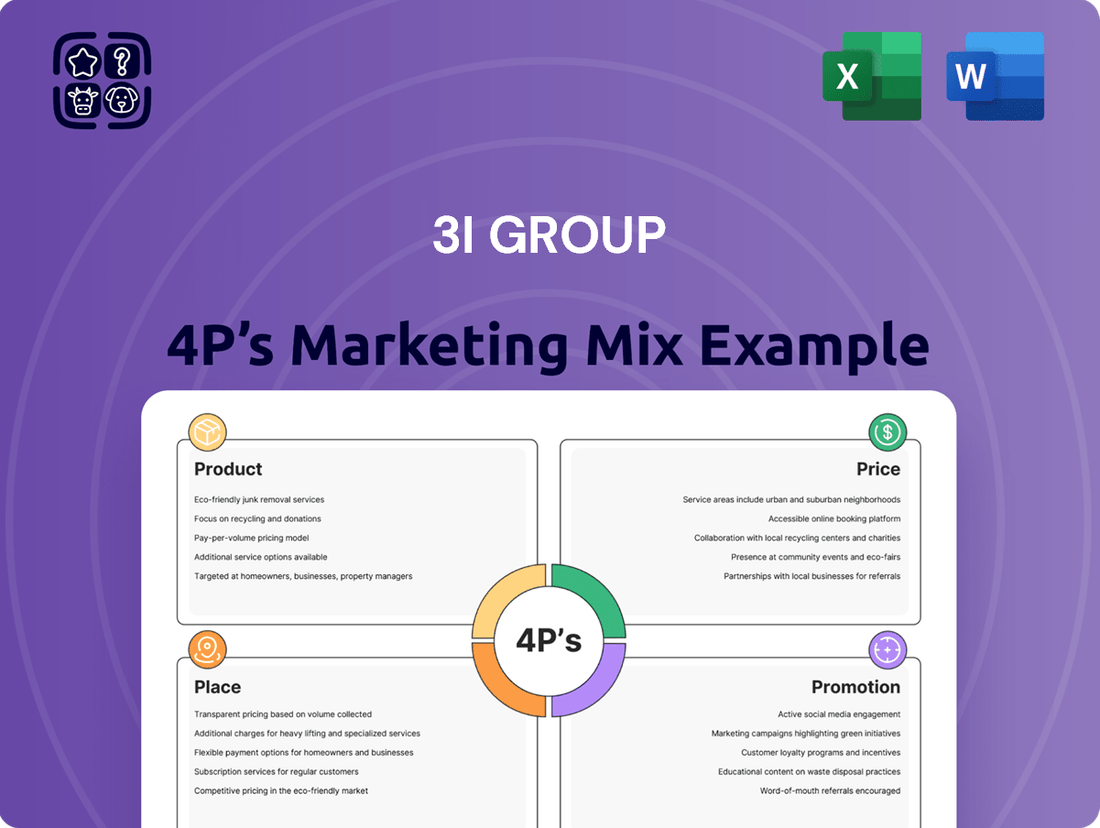

Discover how 3i Group leverages its product portfolio, strategic pricing, global distribution, and targeted promotions to achieve market leadership. This analysis delves into the core elements of their marketing success.

Go beyond the surface—gain access to an in-depth, ready-made 4Ps Marketing Mix Analysis for 3i Group, perfect for business professionals and students seeking strategic insights.

Save hours of research with this pre-written report, offering actionable insights and structured thinking on 3i Group's marketing strategies. Get the full analysis in an editable, presentation-ready format.

Product

3i Group's core offering is private equity investments, primarily targeting mid-market companies. These investments involve acquiring substantial ownership in businesses exhibiting strong growth prospects, often collaborating with existing management to enhance value.

The firm's investment strategy is evident in its diversified portfolio, which spans sectors like consumer, healthcare, industrial, and software. For instance, as of their latest reporting in 2024 and early 2025, their portfolio demonstrates this broad sectoral exposure, aiming to mitigate risk and capture opportunities across different economic landscapes.

Infrastructure investments represent a core offering for 3i Group, complementing their private equity activities. These investments focus on essential, long-term assets like utilities and transportation networks, designed to generate consistent income and grow capital over time due to their inherent resilience.

As of March 31, 2024, 3i Group's infrastructure portfolio held a significant valuation of £3.8 billion. This substantial asset base was comprised of 12 distinct economic infrastructure businesses, underscoring the scale and strategic importance of this segment to the group's overall strategy.

Active asset management is a cornerstone of 3i Group's product strategy, setting it apart from passive investment approaches. This involves more than just deploying capital; it's about deep engagement with portfolio company leadership.

3i actively partners with management, offering strategic direction, operational enhancements, and financial backing. For instance, in the fiscal year ending March 31, 2024, 3i Group reported a record net profit of £1.5 billion, underscoring the success of this hands-on value creation model.

This proactive involvement is instrumental in fostering sustainable growth and optimizing returns for their investors. Their commitment to active management was evident in their portfolio's performance, with key investments like Action and Aura Group showing significant value appreciation during this period.

Long-Term Investment Horizon

3i Group's product offering is fundamentally defined by its long-term investment horizon, setting it apart from more ephemeral speculative plays. This patient capital strategy enables 3i to actively partner with its portfolio companies, providing support for significant growth initiatives such as strategic acquisitions and operational improvements, all geared towards building enduring value over extended periods.

A prime illustration of this commitment is 3i's investment in Action, which commenced in 2011 and has since delivered substantial returns, underscoring the efficacy of their long-term approach. As of their fiscal year ending March 31, 2024, 3i Group reported a record net profit of £1,795 million, a testament to the success of their patient capital deployment.

This long-term perspective allows 3i to:

- Navigate market cycles effectively, weathering short-term volatility to realize long-term gains.

- Foster deep relationships with management teams, encouraging strategic planning and sustainable growth.

- Support significant capital expenditure and R&D within portfolio companies, driving innovation and competitive advantage.

- Achieve compound growth by reinvesting earnings and capital appreciation over multiple years.

Proprietary Capital and Diverse Financing

3i Group’s proprietary capital is a cornerstone of its marketing mix, providing unparalleled flexibility in structuring deals and managing investment timelines. This self-funded approach, as evidenced by their robust balance sheet, allows them to pursue opportunities without the constraints often faced by firms reliant on external fund mandates. For instance, as of their latest reporting, 3i maintained a strong liquidity position, enabling swift decision-making and commitment to investments.

Further enhancing this offering is 3i's in-house banking team, which actively supports portfolio companies in accessing debt financing. This integrated financial capability extends the group's value proposition significantly beyond traditional private equity, acting as a comprehensive financial partner. This allows for the creation of bespoke capital structures designed to optimize growth and operational efficiency for their businesses.

- Proprietary Capital: 3i Group leverages its own capital, offering flexibility in investment terms and duration.

- In-house Banking: An internal team assists portfolio companies in securing debt financing, broadening financial solutions.

- Tailored Financing: This integrated approach enables customized financial strategies to fuel company growth.

- Financial Strength: As of early 2025, 3i's robust capital base underpins its capacity for significant and agile investments.

3i Group's product strategy centers on private equity and infrastructure investments, characterized by active management and a long-term investment horizon. Their offerings are designed to provide strategic, operational, and financial support to portfolio companies, driving sustainable growth and maximizing shareholder value.

The firm's diverse product suite includes substantial stakes in mid-market companies and essential infrastructure assets, such as utilities and transportation networks. This dual focus allows 3i to capitalize on opportunities across different economic cycles and asset classes.

As of March 31, 2024, 3i Group's infrastructure portfolio was valued at £3.8 billion, comprising 12 economic infrastructure businesses. This demonstrates the significant scale and strategic importance of this segment.

Their active asset management approach, including deep engagement with management teams and support for capital expenditure, has proven successful. This is reflected in their record net profit of £1.5 billion for the fiscal year ending March 31, 2024.

| Product Offering | Key Characteristics | Supporting Data (as of FYE March 31, 2024) |

|---|---|---|

| Private Equity Investments | Mid-market focus, active value creation, long-term partnerships | Record net profit: £1,795 million |

| Infrastructure Investments | Essential assets, long-term income generation, capital growth | Portfolio valuation: £3.8 billion (12 businesses) |

| Active Asset Management | Strategic direction, operational enhancements, financial backing | Key investments like Action and Aura Group showing value appreciation |

What is included in the product

This analysis provides a comprehensive breakdown of the 3i Group's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of the 3i Group's market positioning, perfect for benchmarking or informing strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding the 3i Group's market position.

Provides a clear, concise overview of the 3i Group's 4Ps, resolving the challenge of communicating marketing effectiveness to diverse teams.

Place

3i Group maintains a significant global footprint, with offices strategically located in six countries, including its London headquarters. This international presence facilitates deal sourcing and portfolio oversight across diverse markets.

However, their investment strategy exhibits a distinct regional focus, primarily targeting mid-market companies based in Europe and North America, with selective investments extending into Asia. This approach allows 3i to capitalize on localized market knowledge and established regional networks.

3i Group's investment 'place' is deeply rooted in its direct sourcing capabilities and a robust network of advisors and business connections. This strategy enables them to pinpoint and secure investment opportunities, including private deals, and gain a competitive edge in auctions.

By cultivating these direct relationships, 3i effectively bypasses the need for external brokers to generate deal flow. For instance, in the fiscal year ending March 31, 2024, 3i Group completed significant investments such as the acquisition of a majority stake in Aura, a leading European IT services provider, which was sourced directly through their network.

3i Group's strategic office locations are a cornerstone of its distribution and operational strategy. With six international offices, including its London headquarters, the group ensures a global reach. These offices are not just administrative hubs; they are centers where investment professionals leverage both international experience and deep local market understanding to nurture their portfolio companies.

This network of physical presence is vital for 3i Group's approach, enabling closer collaboration with the management teams of its invested businesses. The localized teams provide crucial market intelligence and support, fostering growth and operational improvements. For instance, their presence in key markets allows for quicker identification of opportunities and more agile responses to evolving economic landscapes, a critical factor in their investment success.

Digital Presence and Investor Relations Platforms

3i Group's digital presence is crucial for its investor relations, acting as the primary 'place' for engaging with stakeholders. Their comprehensive website offers a wealth of information, including financial reports and strategic updates, ensuring transparency and accessibility for a global audience of investors and analysts.

The company's commitment to a strong digital platform facilitates informed decision-making by providing easy access to key documents. For instance, their investor relations section typically features:

- Annual Reports and Financial Statements: Detailed breakdowns of performance and financial health.

- Presentations and Webcasts: Insights from management on strategy and market outlook.

- Press Releases and News: Timely updates on significant corporate events and developments.

- Shareholder Information: Data relevant to existing and potential investors.

Targeted Market Segments

3i Group's 'place' in its marketing mix is strategically defined by its focus on specific market segments: mid-market businesses and infrastructure assets. This targeted approach allows 3i to concentrate its considerable resources and deep expertise on a defined universe of investment opportunities. By concentrating on these areas, they can more effectively implement their active management strategy, aiming to generate the most significant positive impact and returns.

The firm actively seeks companies with enterprise values typically falling within the €100 million to €500 million range. This deliberate selection criteria ensures that 3i engages with businesses of a substantial yet manageable size, where its hands-on operational involvement can truly drive value creation. For instance, in the fiscal year ending March 31, 2024, 3i Group reported a return on investment of 18% for its private equity portfolio, underscoring the effectiveness of its segment focus.

- Target Market Focus: Mid-market businesses and infrastructure assets.

- Enterprise Value Range: €100m - €500m.

- Strategic Advantage: Concentrated resources and expertise for active management impact.

- Performance Indicator: 18% return on investment in private equity for FY24.

3i Group's 'place' strategy emphasizes a dual approach: a physical global presence for deal sourcing and portfolio management, coupled with a robust digital platform for investor engagement. Their six international offices, including London, allow for localized market expertise and direct relationship building, bypassing traditional brokers. This physical network is crucial for hands-on portfolio company support.

Digitally, 3i leverages its website as the primary channel for investor relations, offering transparent access to financial reports, presentations, and news. This digital accessibility ensures stakeholders globally can stay informed about the company's performance and strategy. For example, their investor relations portal provides detailed annual reports and timely press releases.

The firm's 'place' also refers to its strategic focus on specific investment segments: mid-market companies and infrastructure assets, typically with enterprise values between €100 million and €500 million. This concentration allows for deeper expertise and more impactful active management, as evidenced by their 18% return on investment in private equity for the fiscal year ending March 31, 2024.

| Key Aspects of 3i Group's 'Place' | Description | Strategic Implication |

|---|---|---|

| Global Office Network | Six international offices, including London HQ. | Facilitates deal sourcing, portfolio oversight, and local market intelligence. |

| Digital Presence | Comprehensive investor relations website. | Ensures transparency and accessibility for global stakeholders. |

| Target Market Segments | Mid-market companies and infrastructure assets. | Concentrates resources and expertise for value creation. |

| Investment Size Focus | Enterprise values of €100m - €500m. | Enables hands-on operational involvement and impact. |

| FY24 Private Equity ROI | 18% | Demonstrates effectiveness of segment and size focus. |

What You See Is What You Get

3i Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the 3i Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

3i Group's promotion heavily relies on robust investor relations and transparent financial reporting. They actively disseminate annual and half-year reports, alongside quarterly performance updates, ensuring stakeholders have a clear view of their financial health and strategic direction.

These communications, including investor presentations and webcasts, are vital for showcasing 3i Group's value creation to both existing shareholders and prospective investors. For instance, their interim results for the six months ended 30 September 2024 reported a net asset value per share of 1,360 pence, demonstrating tangible progress.

A cornerstone of 3i Group's promotional strategy involves spotlighting the achievements of its portfolio companies, with Action serving as a prime example. By showcasing the substantial growth and value enhancement realized through their collaborative efforts, 3i effectively bolsters its reputation and attracts further investment and co-investment prospects. This approach powerfully validates their hands-on asset management methodology.

3i Group leverages strategic communications and news releases as a crucial element of its marketing mix. These releases are vital for announcing significant corporate activities, such as new portfolio investments or successful divestments, keeping stakeholders informed. For instance, in the fiscal year ending March 31, 2024, 3i Group reported total assets under management of £36.7 billion, a figure that would be communicated through such channels.

Disseminating these announcements through financial media and directly to analysts ensures broad reach and cultivates a strong market presence. This proactive approach helps shape investor perception and maintain transparency. The company's commitment to this is evident in the frequent updates to the news section on its official website, providing timely information on its performance and strategic direction.

Industry Recognition and Awards

3i Group's commitment to excellence is frequently highlighted through industry recognition and awards, which act as a powerful promotional tool. These accolades underscore the firm's strong performance and strategic acumen.

The company's impressive total shareholder returns and consistent dividend growth are key indicators of its success. For instance, as of early 2025, 3i Group has demonstrated a sustained upward trend in shareholder value, reflecting its effective investment strategies.

Furthermore, positive increases in net asset value (NAV) per share solidify 3i's reputation as a leading investment manager. This consistent financial growth not only attracts further capital from investors but also draws top talent to the organization.

- Industry Awards: Recognition through prestigious industry awards validates 3i's operational excellence and investment performance.

- Total Shareholder Returns: Consistently strong TSR figures, a key metric for investors, promote confidence in 3i's management.

- Dividend Growth: A history of increasing dividends signals financial health and a commitment to returning value to shareholders.

- NAV per Share Increases: Steady growth in NAV per share demonstrates effective asset management and value creation.

Direct Engagement with Financial Community

3i Group actively cultivates relationships within the financial community through dedicated engagement channels. This includes hosting capital markets seminars and delivering detailed analyst presentations, offering a platform to clearly communicate their strategic direction and investment thesis.

These direct interactions are crucial for fostering transparency and building credibility. By addressing inquiries and articulating their approach, 3i reinforces its expertise and investment philosophy, leading to enhanced trust and understanding among investors and analysts.

For instance, 3i's commitment to open communication was evident in their participation in numerous investor conferences and roadshows throughout 2024, where they highlighted their portfolio performance and future growth prospects.

- Capital Markets Seminars: Platforms for in-depth strategy discussion.

- Analyst Presentations: Opportunities to showcase portfolio value and expertise.

- Relationship Building: Fostering trust with key financial stakeholders.

- Reinforcing Philosophy: Clearly articulating investment strategy and market outlook.

3i Group's promotional efforts are deeply rooted in showcasing tangible financial performance and strategic successes. Their consistent communication of key metrics, such as net asset value growth and total shareholder returns, serves as a primary driver for investor confidence and market perception.

The company actively highlights its portfolio companies' achievements, using them as powerful case studies for its investment strategy. For example, the strong performance of its investment in Action, a European discount retailer, is frequently cited to demonstrate 3i's value creation capabilities.

Furthermore, 3i Group's proactive engagement with the financial community through investor seminars and analyst presentations reinforces its market position. This direct communication strategy, coupled with transparent reporting, is crucial for attracting and retaining capital, as evidenced by their substantial assets under management.

| Metric | Period Ending | Value | Significance |

|---|---|---|---|

| Net Asset Value (NAV) per Share | 30 September 2024 | 1,360 pence | Demonstrates underlying asset growth and value creation. |

| Total Assets Under Management | 31 March 2024 | £36.7 billion | Indicates scale and market trust in 3i's management capabilities. |

| Portfolio Company Performance (e.g., Action) | Ongoing | Significant growth and value enhancement | Provides concrete evidence of successful investment strategy. |

Price

For investors, the 'price' of 3i Group is intrinsically linked to its shareholder returns, measured by net asset value (NAV) per share growth and consistent dividend payments. The company targets a total return of 8% to 10% annually, aiming to grow or at least maintain its dividends each year, provided its financial health and investment prospects remain robust.

Reflecting this commitment, 3i Group recommended a total dividend of 73.0 pence per share for FY2025. This policy underscores their strategy to deliver tangible value to shareholders through both capital appreciation and regular income distributions.

For its unquoted private equity and infrastructure investments, 3i Group utilizes fair value methodologies like Discounted Cash Flow (DCF) and market multiples to establish the enterprise value of its portfolio companies. This detailed valuation approach is crucial for accurately reflecting the intrinsic worth of its assets, directly impacting its reported Net Asset Value (NAV).

The company's valuation policy undergoes a thorough review at least annually, with the most recent update occurring in January 2025. This ensures that the methods used remain relevant and effective in capturing the true economic value of its diverse investment portfolio.

3i Group's investment pricing strategy is centered on achieving strong financial returns, evidenced by their pursuit of attractive money multiples and Internal Rates of Return (IRRs). This disciplined approach ensures they are acquiring assets at valuations that promise significant upside.

The successful divestment of MPM in June 2025 exemplifies this strategy, realizing a 3.2x money multiple and a 29% IRR. Such profitable exits underscore 3i's commitment to generating value for its shareholders through strategic capital allocation and timely asset management.

Debt and Liquidity Management

3i's pricing strategy is intrinsically linked to its robust debt and liquidity management, aiming to fuel investment growth while safeguarding shareholder value. The company actively works to maintain an efficient balance sheet, striking a balance between minimizing return dilution from idle cash and ensuring ample liquidity for opportune investments.

This proactive approach is evident in their financial positioning. As of June 2025, 3i Group reported:

- Gross Cash: £428 million, providing immediate operational flexibility.

- Undrawn Revolving Credit Facility (RCF): £900 million, offering significant additional borrowing capacity for strategic deployment.

- Total Available Liquidity: £1.328 billion, a substantial war chest for new ventures and existing portfolio support.

- Debt Management Focus: The group prioritizes efficient leverage to enhance returns without compromising financial stability, a key component in their long-term value creation strategy.

Market Perception and Share Premium

The market's perception of 3i Group's value, reflected in its share price, often commands a premium over its Net Asset Value (NAV). This premium signals strong investor confidence in the company's strategic direction and its ability to generate future returns through active asset management.

As of July 24, 2025, 3i Group's share price stood at 4,338 pence. This valuation represented a significant 69.98% premium compared to its Net Asset Value. Such a premium suggests that investors anticipate continued growth and value creation beyond the current book value of the company's assets.

- Share Price: 4,338 pence (as of July 24, 2025).

- Premium to NAV: 69.98% (as of July 24, 2025).

- Market Sentiment: The premium indicates high investor confidence in 3i Group's management and future prospects.

3i Group's pricing strategy for its investments is geared towards maximizing financial returns, as demonstrated by their focus on attractive money multiples and Internal Rates of Return (IRRs). The successful divestment of MPM in June 2025, yielding a 3.2x money multiple and a 29% IRR, highlights their disciplined approach to asset acquisition and management.

The market's valuation of 3i Group's shares often reflects a premium over its Net Asset Value (NAV), signaling strong investor confidence in its strategic execution and future earnings potential. As of July 24, 2025, 3i Group's share price was 4,338 pence, trading at a 69.98% premium to its NAV.

| Metric | Value (as of July 24, 2025) |

|---|---|

| Share Price | 4,338 pence |

| Premium to NAV | 69.98% |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for 3i Group is grounded in comprehensive data, including official company reports, investor communications, and detailed market intelligence. We analyze product portfolios, pricing strategies, distribution networks, and promotional activities through a blend of public filings and industry-specific insights.