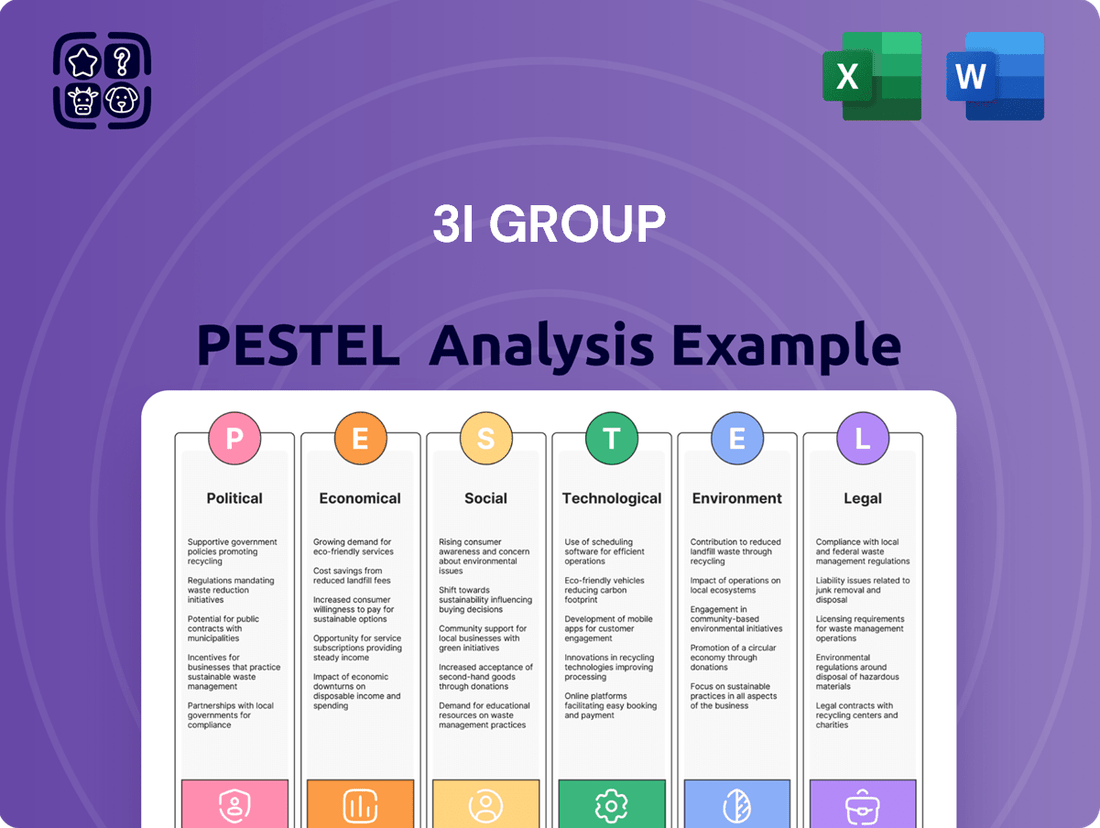

3i Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping 3i Group's trajectory. This PESTLE analysis provides a comprehensive overview of the external landscape, offering vital intelligence for strategic decision-making. Download the full report to gain a competitive edge and navigate the complexities of 3i Group's operating environment.

Political factors

Geopolitical instability, particularly in Europe and globally, significantly shapes investor sentiment and capital flows into private equity and infrastructure. For 3i Group, with its substantial European and North American exposure, navigating this uncertainty is paramount. Heightened geopolitical risk can indeed trigger investor caution, potentially slowing new deal activity and impacting the valuation and performance of its existing portfolio companies.

Government stances on private equity, including potential for heightened regulation or taxation, could impact 3i Group's operational structure and financial performance. For instance, changes in capital gains tax policies in the UK or other key jurisdictions could directly influence the net returns on 3i's investments.

Furthermore, evolving infrastructure investment strategies by governments, such as increased focus on renewable energy projects or changes to public-private partnership frameworks, directly shape the landscape for 3i's infrastructure division. In 2024, the UK government's commitment to net-zero targets, for example, may steer investment towards green infrastructure, presenting both opportunities and challenges for 3i's portfolio.

Evolving international trade agreements and tariffs present a significant factor for 3i Group. For instance, the ongoing adjustments in trade relationships between major economies can directly influence the supply chains and market access of its portfolio companies, such as the retail giant Action, which operates extensively across Europe. Changes in import duties or trade barriers could affect the cost of goods and the competitiveness of these businesses.

Protectionist policies and escalating trade disputes introduce palpable risks for 3i's cross-border investment and divestment strategies. As of early 2024, tensions in global trade, particularly concerning manufacturing hubs, highlight the potential for increased regulatory scrutiny and operational complexities. This can impact the valuation and exit strategies for companies within 3i's diverse portfolio.

Regulatory Environment and Compliance

The political landscape significantly impacts 3i Group through evolving regulatory frameworks. For instance, in late 2023 and early 2024, discussions around enhanced consumer data protection, particularly in the EU with potential updates to GDPR, could influence how 3i's portfolio companies manage and leverage data, potentially increasing compliance burdens.

Furthermore, a heightened political focus on anti-trust and competition in key markets, such as the US and UK, might lead to stricter scrutiny of acquisitions or market dominance by portfolio companies, impacting their growth strategies and potentially requiring divestitures. The ongoing global emphasis on financial stability and investor protection also means that regulatory bodies are likely to maintain or even increase oversight of private equity firms and their investments.

- Increased compliance costs due to potential new data privacy laws in the EU.

- Stricter anti-trust scrutiny affecting portfolio company expansion in major economies.

- Heightened regulatory oversight on private equity operations and investment practices.

Political Stability in Key Markets

Political stability in markets where 3i Group operates is crucial for its investment performance. For instance, the Netherlands, a key market for its portfolio company Action, experienced a stable political environment in 2024, contributing to consistent consumer spending. However, potential policy changes impacting retail or private equity could introduce uncertainty.

3i Group's exposure to various political landscapes means that geopolitical events can significantly influence its asset valuations. A shift towards protectionist policies in any of its major investment regions could affect cross-border trade and, consequently, the profitability of its underlying businesses.

The firm's 2024/2025 outlook is sensitive to election outcomes and governmental stability in countries like Germany and the UK, where it holds substantial investments. For example, changes in corporate tax regulations or investment incentives following elections could alter the attractiveness of these markets for future capital deployment.

- Political Stability: Key markets for 3i Group, including the Netherlands, generally maintained political stability through 2024, supporting stable business environments.

- Policy Impact: Potential shifts in government policies related to taxation, regulation, or foreign investment in 2025 could materially affect 3i's portfolio companies.

- Geopolitical Risk: Broader geopolitical tensions or trade disputes could indirectly impact consumer confidence and economic activity in 3i's operating regions.

- Regulatory Landscape: Evolving regulatory frameworks, particularly concerning environmental, social, and governance (ESG) standards, will require ongoing adaptation by 3i and its investee companies.

Political stability in key markets remains vital for 3i Group's performance. For instance, the Netherlands, a significant market for its portfolio company Action, demonstrated political stability through 2024, fostering a conducive business environment. However, potential policy shifts in 2025 concerning taxation or investment incentives in countries like Germany and the UK, where 3i holds substantial assets, could impact future capital deployment and existing portfolio valuations.

Evolving regulatory frameworks, particularly around ESG standards and data privacy, present ongoing challenges and opportunities. Stricter anti-trust scrutiny in major economies could also influence portfolio company expansion strategies. Increased compliance costs and heightened regulatory oversight on private equity operations are anticipated as governments aim for greater financial stability and investor protection.

| Political Factor | Impact on 3i Group | 2024/2025 Relevance |

|---|---|---|

| Government Stability in Key Markets | Affects business environment and investor confidence. | Netherlands stable in 2024; UK/Germany elections in 2024/2025 could alter policies. |

| Regulatory Changes (ESG, Data Privacy) | Increases compliance burden and operational complexity. | Ongoing adaptation required for portfolio companies, e.g., GDPR updates. |

| Taxation Policies | Directly impacts net returns on investments. | Potential changes in capital gains tax or corporate tax rates in 2025. |

| Trade Policies & Protectionism | Influences supply chains, market access, and valuations. | Global trade tensions could affect companies like Action. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the 3i Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help the 3i Group navigate market dynamics, identify opportunities, and mitigate potential threats.

The 3i Group PESTLE analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into external factors impacting investment decisions.

Economic factors

Rising inflation in 2024 and projected into 2025 directly impacts 3i Group's portfolio companies by increasing their operating expenses, from raw materials to labor. This can squeeze profit margins, making it harder for these businesses to grow and generate returns. For instance, if a portfolio company in the consumer goods sector faces higher input costs due to inflation, its ability to maintain current pricing without losing market share becomes a significant challenge.

Concurrently, central banks' responses to inflation, often involving interest rate hikes, present a dual challenge. Higher interest rates in 2024 and anticipated further adjustments in 2025 increase the cost of borrowing for both 3i Group and its investee companies. This elevated cost of debt can dampen investment appetite, potentially lower company valuations, and reduce the overall attractiveness of future investment opportunities for 3i.

The economic health of Europe and North America is a key factor for 3i Group, as it directly impacts consumer spending, a vital engine for many of its portfolio companies, particularly those in the retail and consumer sectors. For instance, robust economic expansion in these regions typically translates to higher consumer confidence, leading to increased purchasing power and, consequently, greater sales volumes for businesses like Action, a major player in 3i's portfolio.

In 2024, projections for GDP growth in the Eurozone hovered around 0.7%, with North America showing slightly stronger figures. This moderate growth environment suggests a cautious but generally positive outlook for consumer spending, which is crucial for the performance of 3i's investments. A stable or growing economy supports discretionary spending, a key driver for many of the group's consumer-facing businesses.

Currency exchange rate volatility presents a significant challenge for 3i Group, an international investment manager. Fluctuations in foreign exchange markets directly impact the reported value of its overseas assets and income when these are translated back into its primary reporting currency. For instance, a strengthening pound sterling against currencies where 3i holds significant investments would reduce the reported value of those holdings.

In 2024, the pound sterling experienced notable movements against major currencies. For example, the GBP/USD exchange rate saw periods of both appreciation and depreciation, influenced by economic data releases and central bank policy expectations in both the UK and the US. Such shifts can lead to substantial unrealized gains or losses on 3i's portfolio, affecting its reported net asset value and profitability.

Availability and Cost of Capital

The availability and cost of capital are heavily influenced by the broader economic landscape, directly impacting 3i Group's investment strategies. A tightening credit market or rising interest rates can significantly increase the expense of securing funds for new acquisitions or bolstering the expansion of current portfolio companies. For instance, as of mid-2024, the Bank of England's base rate remained elevated, making borrowing more costly for private equity firms.

This environment presents a dual challenge: not only is it more expensive to raise debt, but the equity risk premium investors demand also tends to increase.

Key considerations for 3i Group include:

- Increased borrowing costs: Higher interest rates directly translate to greater financing expenses for deals.

- Investor risk appetite: Economic uncertainty can reduce the willingness of investors to commit capital to private equity.

- Valuation pressures: A higher cost of capital can lead to lower valuations for potential acquisitions.

Market Valuations and Exit Opportunities

Economic conditions directly shape how much private companies and infrastructure assets are worth, which in turn impacts 3i Group's ability to sell these investments profitably. When the economy is robust, 3i typically finds more favorable conditions for divesting its holdings, leading to higher valuations.

For instance, in 2024, global equity markets saw a general upturn, with indices like the S&P 500 reaching new highs, indicating a positive sentiment for asset sales. This environment generally translates into stronger exit opportunities for private equity firms like 3i.

The availability and cost of capital are also crucial. Higher interest rates, as seen in many developed economies throughout 2023 and into 2024, can make financing acquisitions more expensive, potentially dampening buyer appetite and valuations for 3i's portfolio companies.

- Strong Market Valuations: A healthy economic climate typically supports higher multiples for businesses and infrastructure assets, enabling 3i to achieve greater returns on its investments.

- Exit Environment: Favorable economic conditions, characterized by robust investor demand and readily available financing, create more numerous and attractive exit avenues for 3i's portfolio.

- Impact of Interest Rates: Rising interest rates, a trend observed through 2023-2024, can increase the cost of capital for potential buyers, potentially moderating valuations and exit proceeds.

- Investor Confidence: Overall economic stability and growth foster greater investor confidence, which is a key driver for both initial investment and successful divestment by firms like 3i.

Persistent inflation throughout 2024 and into 2025 directly impacts 3i Group's portfolio companies by increasing their operational costs, potentially squeezing profit margins. Higher interest rates, a common response to inflation, also increase borrowing expenses for both 3i and its investees, dampening investment and valuations.

Economic growth in key markets like Europe and North America influences consumer spending, a critical driver for many of 3i's businesses. While Eurozone GDP growth was projected around 0.7% in 2024, with slightly better figures for North America, this moderate growth signals a cautious but generally positive outlook for consumer demand.

Currency fluctuations, particularly the pound sterling's movements against major currencies in 2024, directly affect the reported value of 3i's international assets. A strengthening pound would diminish the reported value of overseas holdings, impacting net asset value and profitability.

The availability and cost of capital remain critical. Elevated interest rates, as seen through 2023-2024, make financing acquisitions more expensive, potentially moderating valuations and exit proceeds for 3i's portfolio companies.

| Economic Factor | 2024 Projection/Observation | Impact on 3i Group |

|---|---|---|

| Inflation | Rising, impacting operating costs | Squeezed profit margins for portfolio companies |

| Interest Rates | Elevated, with potential for further adjustments | Increased borrowing costs, reduced investment appetite |

| GDP Growth (Eurozone) | ~0.7% | Moderate consumer spending, impacting retail/consumer sectors |

| Currency Volatility (GBP) | Notable movements against USD and EUR | Affects reported value of international assets |

Full Version Awaits

3i Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, featuring a comprehensive PESTLE analysis of the 3i Group. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape surrounding 3i Group.

Sociological factors

Consumer preferences are evolving, with a notable trend towards value-for-money offerings. This shift directly impacts 3i's investments in the retail and consumer sectors. For instance, the continued growth of online shopping, projected to account for 23.4% of total retail sales in the UK by 2025, presents both opportunities and challenges for portfolio companies.

Aging populations in key markets, such as the UK and Europe, present a dual challenge for 3i's portfolio companies: a shrinking pool of younger workers and increasing demand for healthcare and elder care services. For instance, the UK's Office for National Statistics projected that by 2050, 26% of the population will be over 65, a significant increase from 18% in 2018. This demographic shift directly impacts labor availability and costs, potentially increasing wages and benefits required to attract and retain talent in sectors where 3i invests.

Evolving workforce dynamics, including the rise of remote work and the gig economy, are also reshaping labor market trends. This can affect the operational models and talent acquisition strategies of 3i's portfolio businesses. For example, companies in professional services or technology may find it easier to access a global talent pool, but also face increased competition for skilled individuals. Conversely, infrastructure projects might require more localized, on-site labor, making them more susceptible to regional demographic pressures.

These labor market trends can influence the demand for specific infrastructure assets. An aging population, for example, could drive greater investment in healthcare facilities and retirement living communities. Conversely, a declining birth rate might temper demand for new schools or childcare facilities. 3i's investment decisions will need to carefully consider how these demographic shifts translate into varying demand for the physical assets and services its portfolio companies provide.

Societal expectations are increasingly pushing businesses towards robust Environmental, Social, and Governance (ESG) practices. This trend directly impacts 3i Group's investment strategy, guiding its selection of portfolio companies and its approach to their active management. For instance, a 2024 report by PwC indicated that 70% of investors consider ESG factors when making investment decisions, highlighting the financial imperative for companies to align with these values.

Companies demonstrating strong ESG performance often enjoy enhanced reputations and greater appeal among both investors and consumers. This can translate into tangible benefits, such as improved access to capital and increased customer loyalty. In 2025, the global sustainable investment market is projected to exceed $50 trillion, underscoring the significant financial opportunities associated with responsible business conduct.

Urbanization and Infrastructure Needs

The ongoing trend of urbanization, particularly in emerging markets, fuels a significant demand for enhanced infrastructure. This directly translates into investment prospects for 3i Group's infrastructure portfolio, spanning critical sectors such as transportation networks, essential utilities, and advanced digital connectivity. For instance, global urbanization is projected to see 68% of the world population living in urban areas by 2050, according to UN data, highlighting the scale of this need.

These evolving urban landscapes require substantial investment in:

- Transportation: Upgrades to roads, public transit systems, and airports to accommodate growing populations and economic activity.

- Utilities: Investments in water, wastewater, and energy infrastructure to ensure reliable service delivery.

- Digital Infrastructure: Expansion of broadband networks and data centers to support digital economies.

Health and Safety Standards

Societal expectations for stringent health and safety are increasingly influencing investment decisions, especially for companies like 3i Group operating in sectors with potential hazards. A strong commitment to safety not only protects employees and the public but also bolsters a company's image, making it more attractive to investors and customers alike. For instance, in 2024, companies with exemplary safety records often saw higher valuations and lower insurance premiums.

The emphasis on health and safety translates into tangible operational requirements. 3i's portfolio companies must implement and maintain rigorous protocols, which can include regular safety audits, comprehensive training programs, and investment in safer equipment. Failure to meet these evolving standards can lead to significant financial penalties and reputational damage, impacting long-term profitability.

- Enhanced Reputation: Companies prioritizing health and safety often gain a competitive edge and attract top talent.

- Reduced Liabilities: Robust safety measures can significantly lower the risk of accidents, lawsuits, and associated costs.

- Investor Confidence: Strong ESG (Environmental, Social, and Governance) performance, including safety, is a key factor for many institutional investors in 2024-2025.

- Operational Efficiency: A safe working environment typically leads to fewer disruptions and increased productivity.

Societal shifts towards valuing work-life balance and flexible working arrangements are reshaping employment expectations. This impacts 3i's portfolio companies by influencing talent attraction and retention strategies. For example, a 2024 survey found that 65% of UK employees would consider leaving a job that did not offer flexible working options, highlighting the need for adaptable employment models.

Consumer demand for ethical and sustainable products is growing, pushing companies to adopt more responsible practices. This trend affects 3i's investments in consumer-facing businesses, requiring them to align with evolving consumer values. By 2025, it's estimated that over 75% of consumers will prioritize sustainability in their purchasing decisions, a significant increase from previous years.

Public perception and trust are increasingly tied to corporate social responsibility and transparency. For 3i Group, this means portfolio companies must actively engage with stakeholders and demonstrate a commitment to positive societal impact. Companies with strong social governance metrics are often viewed more favorably by both consumers and investors, as evidenced by a 2024 study showing a 15% higher valuation for businesses with high social impact scores.

The increasing awareness of mental health and well-being is influencing workplace culture and employee expectations. Portfolio companies need to foster supportive environments to attract and retain talent. In 2025, employee assistance programs and mental health support are becoming standard benefits, with companies investing more in these areas to reduce absenteeism and improve productivity.

Technological factors

The ongoing digital transformation and automation trends are significantly impacting 3i Group's portfolio. Companies are increasingly adopting advanced technologies to streamline operations, boost productivity, and achieve greater scalability. For instance, in 2024, global spending on digital transformation was projected to reach over $2.3 trillion, highlighting the widespread commitment to these initiatives.

These technological advancements offer 3i's portfolio companies substantial opportunities for operational enhancements. By integrating automation and digital solutions, businesses can reduce costs, improve customer experiences, and gain a competitive edge. A McKinsey report in 2024 indicated that widespread automation could boost global productivity growth by 0.8 to 1.4 percent annually.

As businesses increasingly depend on digital systems, the risk of cyberattacks escalates significantly. For 3i Group and its portfolio companies, this means a critical need to bolster cybersecurity defenses to safeguard sensitive information, ensure uninterrupted operations, and uphold stakeholder confidence. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial implications of security breaches.

Technological shifts are profoundly reshaping industries, creating both new avenues for growth and significant challenges for 3i Group's portfolio companies. For instance, the rapid evolution of artificial intelligence (AI) and machine learning is automating processes and enhancing data analysis capabilities across sectors like software and healthcare, where 3i has investments. Companies embracing these technologies are seeing improved efficiency and new product development.

The increasing digitalization of business operations, accelerated by events in 2024 and continuing into 2025, means that staying ahead of technological curves is paramount. 3i's strategy involves identifying and supporting businesses that are either developing groundbreaking technologies or are effectively integrating them to maintain competitive advantages. For example, in the digital infrastructure space, investments in companies providing cloud services or cybersecurity solutions are crucial as data security and remote work trends persist.

Disruptive technologies, such as advancements in renewable energy and sustainable materials, also present substantial opportunities. As global focus intensifies on ESG (Environmental, Social, and Governance) factors, 3i's portfolio companies that are innovating in these areas, like those in clean tech or circular economy models, are well-positioned for future value appreciation. This proactive approach to technological integration and innovation is a cornerstone of 3i's investment philosophy.

Data Analytics and AI Integration

3i Group is increasingly leveraging data analytics and artificial intelligence (AI) to enhance its investment strategies and portfolio company performance. By analyzing vast datasets, 3i can identify emerging market trends and predict shifts in customer behavior more accurately. For instance, in 2023, the firm's portfolio companies saw an average revenue growth of 12%, partly attributed to data-driven customer engagement strategies.

The integration of AI allows for more sophisticated risk assessment and due diligence processes, providing deeper insights into potential investments. This technological edge enables 3i to make more informed decisions, optimizing resource allocation and operational efficiencies across its diverse holdings. The firm anticipates that AI-driven insights will contribute to a further 5% uplift in portfolio company EBITDA by the end of 2025.

- Enhanced Market Insight: AI algorithms can process market data at speeds and scales unattainable by human analysts, identifying subtle patterns and opportunities.

- Customer Behavior Analysis: Predictive analytics helps portfolio companies understand and anticipate customer needs, leading to improved product development and marketing.

- Operational Efficiency: AI can optimize supply chains, predict maintenance needs, and streamline internal processes, reducing costs and boosting productivity.

- Strategic Decision Support: Data analytics provides a robust foundation for strategic planning, enabling more agile and effective responses to market dynamics.

Infrastructure Technology Advancements

Technological progress in infrastructure, like smart grids and advanced transport, opens new investment opportunities for 3i's infrastructure division. These advancements can also boost the performance of their current holdings. For example, the global smart grid market was valued at approximately USD 35 billion in 2023 and is projected to grow significantly, offering substantial avenues for investment.

Improved renewable energy solutions are also a key factor. Investments in solar, wind, and battery storage technologies are becoming increasingly attractive. In 2024, renewable energy sources accounted for over 30% of new power capacity additions globally, highlighting a robust sector for infrastructure investment.

The integration of digital technologies, such as IoT and AI, within infrastructure assets is enhancing operational efficiency and predictive maintenance. This digital transformation is crucial for maximizing returns on investment. For instance, the adoption of AI in grid management can reduce energy losses by up to 10%, directly impacting asset profitability.

- Smart Grid Market Growth: The global smart grid market is anticipated to reach over USD 100 billion by 2030, presenting substantial growth potential for infrastructure investors.

- Renewable Energy Investment: Global investment in renewable energy reached a record USD 500 billion in 2023, underscoring the sector's increasing importance and attractiveness.

- Digitalization in Infrastructure: The use of digital twins and AI in managing infrastructure assets is expected to improve asset lifespan by 15-20% and reduce operational costs.

- Transportation Technology: Advancements in autonomous driving and electric vehicle charging infrastructure are creating new investment opportunities within the transportation sector.

Technological advancements are a major driver for 3i Group, influencing both its portfolio companies and its investment strategies. The rapid adoption of AI and automation is reshaping industries, offering opportunities for efficiency gains and new product development. For example, global spending on digital transformation was projected to exceed $2.3 trillion in 2024.

Cybersecurity is a critical concern, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. 3i Group must ensure its portfolio companies have robust defenses. Furthermore, the firm is leveraging data analytics and AI to enhance investment decisions, anticipating a 5% uplift in portfolio company EBITDA by the end of 2025 through AI-driven insights.

| Technology Area | 2024/2025 Projection/Data | Impact on 3i Group |

|---|---|---|

| Digital Transformation Spending | >$2.3 trillion (2024) | Drives operational efficiency and competitive advantage for portfolio companies. |

| Cybercrime Costs | $10.5 trillion annually by 2025 | Necessitates enhanced cybersecurity measures across the portfolio. |

| AI Impact on Productivity | 0.8-1.4% annual global productivity growth | Potential for significant cost reduction and performance improvement. |

| AI in Investment Strategy | 5% uplift in portfolio company EBITDA by end of 2025 | Enhances decision-making and optimizes resource allocation. |

Legal factors

As an investment manager, 3i Group operates within a dynamic regulatory landscape. Changes in financial services regulations, such as those impacting fund structures or reporting obligations, directly affect its operational framework. For instance, the ongoing implementation of MiFID II in Europe, which came into full effect in 2018, has continued to shape how financial firms like 3i Group conduct business, including transparency and client protection measures.

Anti-trust and competition laws significantly shape 3i Group's operations, particularly concerning its core strategy of mergers and acquisitions. These regulations, enforced by bodies like the European Commission and the UK's Competition and Markets Authority, scrutinize deals for potential impacts on market competition. For instance, a proposed acquisition by a 3i portfolio company might face regulatory hurdles if it's deemed to create a dominant market position, potentially limiting 3i's growth avenues.

Stricter enforcement or new legislation in key markets could directly affect 3i's deal execution. In 2024, competition authorities globally have shown an increased willingness to block or impose conditions on large transactions. This heightened scrutiny means 3i must navigate a more complex regulatory landscape, potentially increasing the time and cost associated with completing acquisitions and impacting the overall profitability of its investments.

Corporate governance regulations, covering aspects like board diversity and executive pay, directly shape how 3i Group and its investments operate. For instance, the UK Corporate Governance Code, which 3i adheres to, mandates specific reporting on remuneration policies and board effectiveness, influencing decisions on executive compensation and strategic oversight within the group's portfolio companies. Failure to comply can erode investor trust and market standing.

Employment and Labor Laws

Employment and labor laws are a critical legal consideration for 3i Group, as its portfolio companies operate in numerous jurisdictions. These laws, covering aspects like minimum wage, working hours, health and safety standards, and employee protections, differ significantly from country to country. For instance, in the UK, the National Living Wage was £11.44 per hour for those 21 and over as of April 2024, a figure that impacts labor costs for 3i's UK-based investments. Similarly, regulations around employee representation and collective bargaining vary widely, affecting how companies manage their workforce and engage with unions.

Ensuring compliance with this complex web of labor legislation is paramount. Non-compliance can lead to substantial fines, legal challenges, and reputational damage, all of which can negatively impact a portfolio company's financial performance and, consequently, 3i's investment returns. For example, a significant labor dispute in one of 3i's portfolio companies, stemming from a breach of employment law, could disrupt operations and require costly settlements. Staying abreast of evolving labor regulations, such as new mandates on flexible working or enhanced parental leave policies, is therefore essential for risk mitigation and fostering a stable operational environment.

The legal landscape also encompasses regulations related to fair employment practices and anti-discrimination. 3i's portfolio companies must adhere to laws that prohibit discrimination based on age, gender, race, religion, or disability. In the EU, for example, the Gender Equality Act sets out principles for equal pay and treatment. Maintaining robust HR policies and training programs is vital to ensure these legal obligations are met across all operations.

- Compliance Burden: Portfolio companies face varying labor law requirements across different operating countries, necessitating tailored compliance strategies.

- Risk of Litigation: Failure to adhere to wage, working condition, and employee rights laws can result in costly legal disputes and penalties.

- Reputational Impact: Legal breaches in employment practices can damage a company's brand, affecting its ability to attract and retain talent.

- Evolving Regulations: Continuous monitoring of changes in labor laws, such as minimum wage adjustments or new worker protections, is crucial for ongoing compliance.

International Investment Treaties and Laws

International investment treaties and laws are crucial for a global investor like 3i Group. These agreements, such as Bilateral Investment Treaties (BITs), offer protections against expropriation and ensure fair treatment, significantly impacting investment security. For instance, as of early 2025, the global landscape features over 3,000 BITs, providing a framework for cross-border capital flows.

Navigating this complex legal terrain is essential for mitigating risks associated with foreign direct investment. These treaties often include provisions for investor-state dispute settlement (ISDS), allowing companies to seek arbitration if their investments are unfairly treated by host governments. The effectiveness and evolution of these legal frameworks continue to shape international investment strategies.

- Bilateral Investment Treaties (BITs): Over 3,000 BITs are in effect globally, establishing legal protections for foreign investors.

- Investor-State Dispute Settlement (ISDS): Many treaties include provisions for arbitration, offering recourse for investors against host state actions.

- Legal Framework Impact: These laws directly influence investment protection, market access, and the resolution of cross-border disputes for entities like 3i Group.

The legal framework surrounding financial services is a constant consideration for 3i Group, impacting everything from fund structuring to reporting. Regulatory changes, such as those stemming from the UK's Financial Services and Markets Act 2023, continue to refine the operating environment. These legal shifts can influence how 3i structures its investments and manages its compliance obligations.

Environmental factors

The intensifying global focus on climate change and ambitious decarbonization goals directly shape 3i Group's investment approach, especially within its substantial infrastructure holdings. Governments worldwide are implementing stricter regulations and incentives aimed at reducing carbon emissions, influencing the long-term viability and attractiveness of various assets.

3i Group has publicly committed to science-based targets for emissions reduction, demonstrating a proactive stance. This commitment extends to actively supporting its portfolio companies in their efforts to lower their environmental footprint. For instance, in 2024, 3i announced its intention to align its portfolio emissions with a 1.5°C pathway, a significant undertaking for a firm with extensive infrastructure investments.

This strategic pivot towards sustainability not only mitigates climate-related risks but also unlocks new avenues for growth. Investments in green technologies, renewable energy projects, and sustainable infrastructure are becoming increasingly crucial, presenting 3i with opportunities to capitalize on the transition to a low-carbon economy.

Growing concerns over resource scarcity, particularly water and key raw materials, present a significant environmental factor for 3i Group. This scarcity can directly impact the operational costs and supply chain stability of its diverse portfolio companies, potentially leading to increased input prices and production disruptions. For instance, the global water stress index indicates that by 2025, two-thirds of the world's population may face water shortages, a critical consideration for companies in sectors like agriculture and manufacturing.

Effective resource management is therefore paramount for the long-term sustainability and profitability of 3i's investments. Companies that proactively implement strategies for water conservation, waste reduction, and the sourcing of sustainable materials will likely demonstrate greater resilience and competitive advantage. This focus on efficient resource utilization is not only an environmental imperative but also a strategic financial one, mitigating risks associated with price volatility and supply chain disruptions.

The global push towards waste reduction and circular economy principles significantly impacts 3i Group's portfolio companies by reshaping production and business models. For instance, the European Union's Circular Economy Action Plan, with its 2024 updates focusing on sustainable products and waste prevention, encourages companies to design for durability and recyclability, potentially altering supply chain costs and material sourcing strategies.

Embracing sustainable practices, such as those promoted by the Ellen MacArthur Foundation's initiatives, can bolster brand reputation and mitigate environmental risks for 3i's investments. Companies that proactively adopt circular models, like those seen in the packaging sector where recycled content targets are rising, may find themselves better positioned to meet evolving consumer demands and regulatory requirements, potentially leading to enhanced market share and reduced operational liabilities.

Biodiversity and Ecosystem Protection

Growing awareness of biodiversity loss and the urgent need for ecosystem protection directly influences how companies operate, particularly concerning land use and resource extraction. For 3i Group's portfolio, this translates into a need to carefully assess and mitigate potential impacts on natural environments. For instance, the UN estimates that around 1 million animal and plant species are now threatened with extinction, many within decades, highlighting the scale of the challenge.

This environmental factor can affect operational practices across various sectors. Companies involved in agriculture, forestry, or infrastructure development might face stricter regulations or increased scrutiny regarding their environmental footprint. 3i needs to ensure its portfolio companies are prepared for evolving compliance requirements and can demonstrate responsible land management.

- Regulatory Pressure: Expect increased regulations on land use and resource management to protect biodiversity hotspots.

- Supply Chain Scrutiny: Investors and consumers are demanding greater transparency and sustainability in supply chains, impacting raw material sourcing.

- Operational Adaptation: Companies may need to invest in more sustainable practices, such as habitat restoration or reduced water usage, to align with conservation goals.

- Reputational Risk: Failure to address biodiversity concerns can lead to negative publicity and damage brand value, a key consideration for 3i's investments.

Environmental Regulations and Reporting

Stricter environmental regulations are increasingly impacting businesses globally, including those within 3i Group's portfolio. These regulations cover areas like pollution control, emissions standards, and, crucially, mandatory sustainability reporting. For 3i's portfolio companies, this translates to a greater compliance burden and potentially higher operational costs as they adapt to new environmental mandates.

3i Group is actively engaged in helping its portfolio companies navigate and meet these evolving reporting requirements. This includes ensuring adherence to frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the EU's Corporate Sustainability Reporting Directive (CSRD). For instance, by 2024, many European companies were already preparing for expanded CSRD reporting, which necessitates detailed disclosures on environmental impacts and risks.

The push for greater environmental accountability is a significant trend. For example, the increasing focus on Scope 1, 2, and 3 emissions means companies must meticulously track and report their carbon footprint. This heightened scrutiny is driven by investor demand for sustainable practices and a growing awareness of climate change's economic implications.

Key aspects of these environmental factors include:

- Increased compliance costs: Adapting operations and reporting systems to meet new environmental standards can be resource-intensive.

- Mandatory sustainability reporting: Frameworks like TCFD and CSRD require detailed disclosures on environmental performance.

- Focus on emissions reduction: Companies are pressured to set and achieve targets for reducing greenhouse gas emissions across their value chains.

- Investor and stakeholder expectations: There's a growing demand for transparency and demonstrable progress on environmental, social, and governance (ESG) issues.

The increasing global emphasis on climate action and decarbonization directly influences 3i Group's investment strategy, particularly within its infrastructure assets. Governments are enacting more stringent environmental regulations and offering incentives to curb carbon emissions, impacting the long-term value and appeal of various investments.

Resource scarcity, especially concerning water and vital raw materials, poses a significant environmental challenge for 3i Group's portfolio companies. This scarcity can escalate operational expenses and disrupt supply chains, leading to higher input costs and potential production interruptions. By 2025, projections indicate that two-thirds of the global population may face water shortages, a critical factor for businesses in sectors like agriculture and manufacturing.

The global drive towards waste reduction and circular economy principles is reshaping production methods and business models for 3i Group's portfolio companies. Updates to the European Union's Circular Economy Action Plan in 2024 focus on sustainable products and waste prevention, pushing companies toward designing for durability and recyclability, which can alter supply chain costs and material sourcing strategies.

Growing awareness of biodiversity loss and the imperative for ecosystem protection are influencing operational practices, particularly regarding land use and resource extraction. For 3i Group's portfolio, this necessitates careful evaluation and mitigation of potential impacts on natural environments. The UN estimates that approximately one million species are currently threatened with extinction, many within decades, underscoring the magnitude of this environmental concern.

| Environmental Factor | Impact on 3i Group | Key Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Decarbonization | Shapes investment in infrastructure; influences asset viability. | 3i committed to aligning portfolio emissions with a 1.5°C pathway in 2024. |

| Resource Scarcity (Water) | Increases operational costs and supply chain risks. | By 2025, two-thirds of the world's population may face water shortages. |

| Circular Economy Principles | Reshapes production and business models; impacts supply chain costs. | EU's Circular Economy Action Plan updates in 2024 focus on sustainable products and waste prevention. |

| Biodiversity Loss | Requires careful assessment and mitigation of environmental impacts. | UN estimates 1 million species threatened with extinction. |

PESTLE Analysis Data Sources

Our PESTLE analysis for 3i Group is grounded in data from reputable financial news outlets, economic forecasting agencies, and official government publications. We meticulously gather information on political stability, economic indicators, technological advancements, and regulatory changes impacting the investment landscape.