3i Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Group Bundle

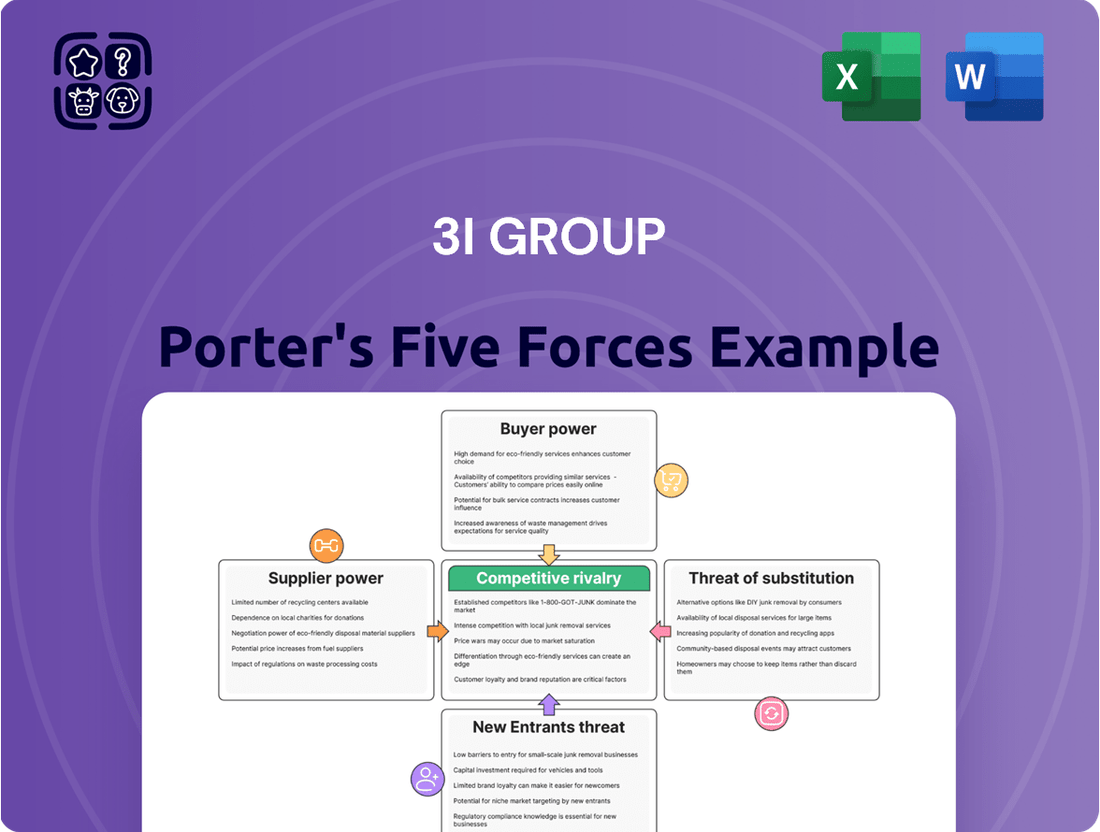

The 3i Group operates within a dynamic investment landscape, facing moderate bargaining power from its suppliers (fund managers and service providers) and significant pressure from intense rivalry among private equity firms. The threat of substitutes is relatively low, but the threat of new entrants demands constant strategic adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 3i Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Limited Partners (LPs) and other capital providers wield considerable influence over 3i Group, as their commitments form the bedrock of the firm's investment capital. The attractiveness of 3i Group's offerings, including its historical fund performance, competitive fee structures, and the unique appeal of its investment strategy compared to other available opportunities, directly shapes their willingness to allocate funds. For instance, in 2023, private equity fundraising saw a notable slowdown, with global capital raised by PE funds declining to approximately $730 billion, down from around $870 billion in 2022, underscoring the importance of a compelling proposition to attract LPs.

The scarcity of highly skilled investment professionals, particularly those with specialized sector knowledge or established deal-sourcing networks, significantly amplifies the bargaining power of these individuals. In 2024, the demand for top-tier talent within the private equity and infrastructure sectors continued to outstrip supply, granting these professionals considerable leverage regarding compensation packages and career progression.

The bargaining power of specialized advisory service providers, such as legal, financial due diligence, and M&A advisors, is a significant factor for 3i Group. These firms possess unique expertise critical to evaluating investment opportunities and executing transactions. Their specialized knowledge and the limited availability of comparable services can grant them considerable leverage, especially in intricate or high-value deals, impacting 3i Group's operational costs and deal success rates.

Proprietary Deal Flow Access

Intermediaries such as investment banks, brokers, and corporate advisors are crucial suppliers of proprietary deal flow for firms like 3i Group. Their exclusive access to unique investment opportunities can significantly enhance a firm's competitive edge. The bargaining power of these intermediaries is directly linked to the exclusivity and quality of the deals they can source.

For instance, in 2024, the global mergers and acquisitions advisory market was valued at approximately $100 billion, highlighting the substantial role and influence of these deal-sourcing intermediaries. Strong relationships and networks with these suppliers are essential for mitigating their power and ensuring a consistent flow of attractive investment prospects.

- Proprietary Deal Flow Access: Investment banks and advisors act as key suppliers, providing exclusive investment opportunities.

- Exclusivity as a Power Lever: The bargaining power of these intermediaries is derived from their unique access to off-market or early-stage deals.

- Mitigation through Networks: Building robust relationships with multiple intermediaries helps diversify deal sourcing and reduce reliance on any single supplier.

- Market Context: The significant valuation of the M&A advisory market in 2024 underscores the financial importance and influence of these deal-making intermediaries.

Data and Technology Providers

The bargaining power of data and technology providers for 3i Group is significant, given the critical role of advanced market data and analytics in making informed investment decisions. These providers can wield considerable influence if their platforms or datasets are proprietary or deeply embedded within 3i's analytical workflows, making switching costly.

For instance, the increasing reliance on AI-driven insights and sophisticated data visualization tools means that specialized providers offering unique capabilities can command higher subscription fees. The exclusivity of certain market intelligence or the proprietary nature of analytical algorithms directly translates into supplier power.

- Data Dependency: 3i Group's ability to identify and capitalize on investment opportunities is heavily reliant on the quality and comprehensiveness of market data.

- Platform Integration: The deeper the integration of a technology provider's platform into 3i's decision-making processes, the higher their bargaining power.

- Cost of Switching: High costs associated with migrating data, retraining staff, or reconfiguring analytical models strengthen the position of existing data and technology suppliers.

Limited Partners (LPs) and other capital providers wield considerable influence over 3i Group, as their commitments form the bedrock of the firm's investment capital. The attractiveness of 3i Group's offerings, including its historical fund performance, competitive fee structures, and the unique appeal of its investment strategy compared to other available opportunities, directly shapes their willingness to allocate funds. For instance, in 2023, private equity fundraising saw a notable slowdown, with global capital raised by PE funds declining to approximately $730 billion, down from around $870 billion in 2022, underscoring the importance of a compelling proposition to attract LPs.

The scarcity of highly skilled investment professionals, particularly those with specialized sector knowledge or established deal-sourcing networks, significantly amplifies the bargaining power of these individuals. In 2024, the demand for top-tier talent within the private equity and infrastructure sectors continued to outstrip supply, granting these professionals considerable leverage regarding compensation packages and career progression.

The bargaining power of specialized advisory service providers, such as legal, financial due diligence, and M&A advisors, is a significant factor for 3i Group. These firms possess unique expertise critical to evaluating investment opportunities and executing transactions. Their specialized knowledge and the limited availability of comparable services can grant them considerable leverage, especially in intricate or high-value deals, impacting 3i Group's operational costs and deal success rates.

Intermediaries such as investment banks, brokers, and corporate advisors are crucial suppliers of proprietary deal flow for firms like 3i Group. Their exclusive access to unique investment opportunities can significantly enhance a firm's competitive edge. The bargaining power of these intermediaries is directly linked to the exclusivity and quality of the deals they can source. For instance, in 2024, the global mergers and acquisitions advisory market was valued at approximately $100 billion, highlighting the substantial role and influence of these deal-sourcing intermediaries. Strong relationships and networks with these suppliers are essential for mitigating their power and ensuring a consistent flow of attractive investment prospects.

| Supplier Type | Bargaining Power Factor | Impact on 3i Group | 2024 Market Data/Context |

|---|---|---|---|

| Limited Partners (LPs) | Capital availability, fund performance, fee structures | Influences capital allocation decisions and fund formation success. | Global PE fundraising slowed in 2023 to ~$730B. |

| Investment Professionals | Specialized skills, networks, demand vs. supply | Affects talent acquisition costs and retention. | High demand for PE/Infrastructure talent in 2024. |

| Advisory Services (Legal, Due Diligence) | Unique expertise, availability of comparable services | Impacts deal execution costs and success rates. | N/A (Specific data not publicly available for this segment). |

| Intermediaries (Investment Banks, Brokers) | Access to proprietary deal flow, exclusivity of deals | Determines the quality and quantity of investment opportunities. | Global M&A advisory market valued at ~$100B in 2024. |

What is included in the product

This analysis unpacks the competitive forces impacting 3i Group, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its investment sectors.

Understand competitive intensity at a glance with a visual breakdown of each force, simplifying complex market dynamics.

Quickly assess the impact of supplier power on margins with pre-formatted calculations, enabling faster strategic adjustments.

Customers Bargaining Power

Mid-market companies seeking growth capital or strategic partners have a robust selection of private equity firms, sovereign wealth funds, and other investment entities to consider. This wide array of choices empowers these businesses, as they can actively select the partner offering the best valuation, strategic alignment, and operational support, thereby enhancing their bargaining leverage.

In 2024, the private equity landscape continued to be competitive, with numerous firms vying for attractive mid-market deals. Many of these firms, including 3i Group, actively highlight their track records in value creation and operational improvement as key differentiators to attract these discerning companies.

Limited Partners (LPs) often spread their investments across various fund managers to mitigate risk and enhance potential returns. This widespread allocation grants LPs significant leverage in negotiating fund terms, demanding greater transparency, and setting reporting standards.

For 3i Group, this means they must consistently deliver top-tier performance to secure and maintain LP capital. In 2023, private equity fundraising saw a notable slowdown, with global funds raised falling to $744 billion, down from $1.2 trillion in 2022, underscoring the competitive landscape for attracting LP commitments.

When 3i Group plans to exit an investment, the bargaining power of customers becomes evident through the potential buyers of their portfolio companies. These buyers, whether strategic acquirers, other financial sponsors, or even the public markets, wield significant influence. The valuation and terms of any sale are directly impacted by the prevailing market conditions and the alternative options available to these buyers.

For instance, in 2024, the appetite for private equity exits varied significantly across sectors. Companies in high-growth technology areas might have seen robust buyer interest, allowing 3i to negotiate more favorable terms. Conversely, businesses in more mature or cyclical industries might have faced a more discerning buyer pool, increasing customer power in the exit negotiation process.

This dynamic underscores the critical importance of 3i Group's ability to actively enhance the value of its investments prior to an exit. Proactive value creation, such as improving operational efficiency or expanding market reach, directly counteracts the bargaining power of potential buyers by making the portfolio company a more attractive and less negotiable acquisition target.

Reputation and Track Record

3i Group's customers, encompassing both its portfolio companies and Limited Partners (LPs), are significantly swayed by the firm's established reputation and its history of successful investments and profitable exits. This robust track record inherently lowers the perceived risk for these stakeholders, making them more inclined to engage with 3i. Consequently, their bargaining power is somewhat diminished because the firm's proven performance reduces their need to negotiate aggressively on terms.

The strength of 3i's brand plays a crucial role in this dynamic. For instance, in 2024, private equity firms with strong brand recognition often command better deal terms and attract more capital from LPs, a testament to the value placed on a consistent history of alpha generation. This brand equity translates directly into a reduced ability for customers to dictate terms, as they are often eager to participate in what is perceived as a reliable and high-performing investment vehicle.

- Reputation as a Shield: 3i's long-standing success in identifying and nurturing businesses, coupled with its ability to execute profitable exits, builds significant trust.

- Reduced Perceived Risk: A strong track record assures LPs and management teams of portfolio companies that 3i can deliver on its promises, lowering their inherent need to exert strong bargaining power.

- Brand Equity Advantage: In 2024, the private equity landscape saw continued emphasis on manager reputation, with top-tier firms like 3i leveraging their brand to secure favorable terms.

- Influence on Partnership Willingness: The firm's consistent performance encourages a more cooperative relationship, as clients are more willing to accept standard terms rather than push for concessions.

Access to Capital Alternatives

The bargaining power of customers, in this context referring to potential portfolio companies seeking investment, is significantly influenced by their access to alternative capital sources. For instance, in 2024, while interest rates remained a consideration, many companies still had viable options beyond private equity.

These alternatives include traditional bank loans, which saw commercial lending activity robust in many sectors, venture capital funding for high-growth potential businesses, and the option of public market listings. Companies can also leverage retained earnings, a testament to their operational success.

The presence and attractiveness of these alternatives directly empower companies, giving them more leverage when negotiating terms with private equity firms like 3i Group. This means 3i must present a value proposition that extends beyond mere capital provision.

- Alternative Funding Channels: Traditional bank loans, venture capital, and public markets offer competitive financing options.

- Company Leverage: Strong performance and retained earnings bolster a company's ability to negotiate favorable terms.

- 3i's Value Proposition: Beyond capital, 3i needs to offer strategic support and operational expertise to stand out.

The bargaining power of customers, specifically portfolio companies seeking investment from 3i Group, is moderated by the availability of alternative financing. In 2024, companies could access traditional bank loans, venture capital, or even public markets, providing leverage in negotiations.

3i Group must therefore offer more than just capital, emphasizing strategic guidance and operational improvements to attract and retain portfolio companies. This competitive landscape means that the value proposition must be compelling enough to outweigh readily available alternatives.

For instance, the robust commercial lending market in 2024 meant that many businesses had viable debt financing options, reducing their reliance on private equity and thus strengthening their negotiating position with firms like 3i.

3i Group's ability to secure attractive portfolio companies in 2024 was influenced by its capacity to offer a comprehensive value-add beyond mere financial backing, directly addressing the bargaining power of these potential clients.

Full Version Awaits

3i Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the 3i Group, providing insights into competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. This professionally written report is ready for your immediate use, offering valuable strategic intelligence on the 3i Group's operating environment.

Rivalry Among Competitors

The global private equity arena is a battleground, teeming with formidable competitors. Think of behemoths like KKR, Blackstone, and Carlyle, alongside specialized funds focusing on specific industries or geographies. 3i Group must vie with all of them for the most attractive investment deals and for the attention of limited partners (LPs) who provide the capital. This crowded field means that winning a good investment often requires paying a premium, which can naturally squeeze potential profits.

Firms in the private equity sector, including 3i Group, differentiate themselves through deep sector expertise, a focused geographic footprint, unique operational value-add capabilities, and a specialization in specific investment stages. 3i's strategic emphasis on mid-market companies and infrastructure, coupled with its established international operations, carves out its competitive position.

However, the landscape is highly competitive, with many rivals asserting similar specializations, thereby amplifying the intensity of rivalry. For instance, in 2024, the private equity industry continued to see a proliferation of funds targeting specific sectors like technology and healthcare, making it challenging for any single firm to maintain a truly unique selling proposition based solely on specialization.

The immense global capital available to private equity and infrastructure funds significantly heightens competition for desirable investments. In 2024, the sheer volume of uncalled capital, often referred to as 'dry powder,' reached record levels, estimated to be over $2.5 trillion globally. This abundance of funds means firms are compelled to deploy capital, leading to more aggressive bidding for target companies, which can drive up valuations and potentially compress future returns for investors.

Performance and Track Record

Past performance is a crucial differentiator for 3i Group, directly influencing its ability to attract both limited partners (LPs) and high-quality investment prospects. Firms demonstrating consistent strong returns naturally secure a competitive advantage.

3i Group's capacity to consistently outperform its industry peers is paramount for sustaining its market standing and securing future capital commitments. For instance, in its fiscal year ending March 31, 2024, 3i Group reported a total shareholder return of 27%, significantly outperforming the MSCI World Index's 18% return over the same period.

- Strong historical returns: 3i Group's track record of generating robust returns is a key factor in its competitive rivalry.

- LP attraction: Consistent outperformance makes the firm more appealing to institutional investors seeking reliable growth.

- Deal sourcing advantage: A strong reputation for performance helps 3i Group secure access to attractive investment opportunities.

- Transparency: Open and clear reporting of performance metrics builds trust and reinforces its competitive position.

Talent Acquisition and Retention

The competition for skilled investment professionals, deal originators, and operational experts is fierce. Firms that cultivate positive work environments, offer competitive pay, and provide clear advancement opportunities gain a significant edge.

This intense 'war for talent' is a defining characteristic of rivalry within the investment management sector. In 2024, reports indicated that the average compensation for a senior investment analyst in private equity could exceed $200,000 annually, excluding bonuses.

- Talent Acquisition Costs: High demand for specialized skills drives up recruitment expenses, with executive search firms charging significant fees.

- Retention Challenges: Top performers are frequently targeted by competitors, necessitating ongoing investment in retention strategies.

- Cultural Impact: A firm's culture is increasingly a differentiator, influencing its ability to attract and keep key personnel.

- Industry Benchmarks: Compensation packages often align with industry benchmarks, requiring continuous evaluation to remain competitive.

The private equity landscape is intensely competitive, with numerous global firms like KKR, Blackstone, and Carlyle vying for attractive deals and investor capital. 3i Group differentiates itself through its focus on mid-market companies and infrastructure, alongside its international presence. However, many rivals offer similar specializations, intensifying the rivalry, especially as the industry saw a continued proliferation of sector-specific funds in 2024.

The sheer volume of available capital, or dry powder, globally surpassed $2.5 trillion in 2024, fueling aggressive bidding for target companies and potentially compressing future returns. This abundant capital means firms must deploy funds, leading to higher valuations and increased competition for prime investment opportunities.

3i Group's strong historical returns, exemplified by a 27% total shareholder return in its fiscal year ending March 31, 2024, significantly outperform the MSCI World Index's 18% return. This consistent outperformance is crucial for attracting limited partners and securing access to high-quality investment prospects, reinforcing its competitive edge.

The competition for top talent in investment management is fierce, with senior investment analysts earning over $200,000 annually in 2024, excluding bonuses. Firms must offer competitive compensation and a positive work environment to attract and retain skilled professionals, making talent acquisition and retention a significant cost and strategic imperative.

SSubstitutes Threaten

Public market liquidity serves as a significant substitute for private equity capital. Companies can access funds and provide liquidity to existing investors by listing on stock exchanges, offering an alternative to private equity firms. For instance, in 2024, the global IPO market saw a notable uptick compared to previous years, with the US market alone witnessing over 150 IPOs by mid-year, raising billions, demonstrating the continued appeal of public markets.

While public markets have distinct advantages like broader investor access and established liquidity mechanisms, they also present challenges such as stringent regulatory compliance and market volatility. Despite these, for larger, established businesses, the ability to tap into public capital pools remains a compelling alternative to private equity funding, especially when economic conditions favor public offerings.

Traditional bank loans and corporate bonds represent significant substitutes for equity financing, particularly for mature companies with stable earnings. In 2024, the cost of debt remained a critical factor, with average interest rates on corporate bonds varying by credit rating, for instance, BBB-rated bonds yielding around 5.5% to 6.5% in early 2024, making them an attractive alternative to diluting ownership through equity issuance.

Companies often opt for debt to maintain complete ownership and control, positioning it as a strong competitor to private equity investments. This preference is amplified when the cost of debt is demonstrably lower than the expected cost of equity, a calculation that heavily influences capital structure decisions.

Companies, instead of pursuing private equity investment, may form strategic alliances, joint ventures, or accept minority investments from larger corporations. These partnerships offer capital, market access, and operational expertise, acting as a substitute for a complete private equity buyout. This trend is particularly noticeable in sectors like technology and pharmaceuticals, where collaboration can accelerate innovation and market penetration.

Venture Capital and Growth Equity

Venture capital and growth equity funds present a potential substitute for companies seeking capital, particularly those in earlier stages or experiencing rapid growth. While 3i Group primarily targets the mid-market, there's an acknowledgment of overlap where businesses might opt for VC or growth equity due to specific funding needs or the desire for more hands-on strategic guidance. The key distinction often boils down to the company's lifecycle stage and the scale of investment required.

For instance, in 2024, the global venture capital market saw significant activity, with deal values fluctuating based on economic conditions and sector performance. Growth equity, a segment often seen as a bridge between venture capital and traditional private equity, also continued to attract substantial investment. Companies that might otherwise consider private equity investment could find VC or growth equity more appealing if they prioritize rapid scaling and market penetration over immediate profitability, a common scenario in technology and innovation sectors.

- Venture Capital (VC): Typically invests in startups and early-stage companies with high growth potential, often in exchange for equity.

- Growth Equity: Focuses on more mature companies that are already profitable but need capital to accelerate growth, such as expanding into new markets or developing new products.

- 3i Group's Focus: Primarily targets mid-market companies, often with established business models and a history of profitability, differentiating it from the earlier-stage focus of many VC funds.

- Substitution Factor: Companies might choose VC or growth equity if they require specialized sector expertise or a more aggressive growth strategy than what 3i Group might offer for their specific stage of development.

Internal Capital Generation

Mature, profitable businesses often possess the ability to fund their growth and expansion using internally generated cash flow, thereby bypassing the need for external investment. This internal capital generation serves as a significant substitute for external financing, effectively shrinking the pool of potential acquisition targets for private equity firms like 3i Group.

Companies frequently evaluate the trade-offs between the costs and benefits associated with internal versus external financing options. For instance, in 2024, many established companies with strong balance sheets prioritized reinvesting profits to fuel organic growth, a strategy that can be more cost-effective than seeking debt or equity financing.

- Internal Capital Generation: Mature, profitable companies can self-fund growth, reducing reliance on external capital.

- Reduced Target Pool: This self-funding capability limits the number of companies available for private equity investment.

- Financing Strategy Evaluation: Businesses weigh the cost-effectiveness of internal cash flow versus external funding options.

The availability of public markets, traditional debt financing, and strategic alliances all represent significant substitutes for private equity capital. Companies can opt for IPOs, issue corporate bonds, or forge partnerships, thereby reducing their reliance on private equity firms like 3i Group. For example, in 2024, the robust performance of the global IPO market, with billions raised, underscored the attractiveness of public listings as an alternative funding source.

| Financing Alternative | Key Benefit | 2024 Relevance |

|---|---|---|

| Public Markets (IPOs) | Broad investor access, established liquidity | Over 150 IPOs in the US by mid-2024, raising billions |

| Debt Financing (Bonds) | Retains ownership, potentially lower cost | BBB-rated corporate bonds yielding 5.5%-6.5% in early 2024 |

| Strategic Alliances/JVs | Capital, market access, operational expertise | Increasingly common in tech and pharma sectors |

Entrants Threaten

Establishing a credible private equity or infrastructure fund, like those managed by 3i Group, demands significant capital. For instance, raising a new fund in the current market often requires commitments in the hundreds of millions, if not billions, of dollars to compete effectively. This necessity for substantial fundraising capacity acts as a formidable barrier, deterring many aspiring entrants who lack the established track record and extensive limited partner (LP) network crucial for securing such large sums.

The need for a proven track record presents a significant barrier for new entrants in the private equity space, like those looking to compete with established firms such as 3i Group. Limited Partners (LPs), who provide the capital, are inherently risk-averse. They strongly favor funds that have demonstrated a history of consistent, strong returns and responsible management over multiple fund cycles. For instance, in 2024, many LPs continued to allocate a disproportionate amount of capital to managers with over a decade of successful fundraising and deployment history.

New firms simply cannot offer this established credibility. Building a reputation for generating alpha and effectively navigating market cycles takes considerable time, often spanning many years and several investment funds. This lengthy gestation period means that new entrants face immense difficulty in attracting the substantial capital required to compete effectively with firms like 3i Group, whose brand equity is a significant asset.

The financial services sector, particularly private equity and infrastructure, is heavily regulated, with rules that are constantly changing across various countries. New companies entering this space must contend with intricate compliance mandates, obtain necessary licenses, and fulfill extensive reporting duties. These demands are not only expensive but also consume considerable time, effectively acting as a barrier to entry.

Specialized Expertise and Network

The private equity and infrastructure investment landscape demands deep, specialized expertise. This includes not only understanding specific industries but also cultivating robust networks for deal sourcing and possessing sophisticated due diligence and operational improvement skills. New entrants face a substantial challenge in replicating the established talent and interconnected relationships that seasoned firms like 3i Group possess.

Building a team with this caliber of specialized knowledge and a strong network is a lengthy and resource-intensive process. For instance, attracting and retaining top-tier investment professionals often involves competitive compensation packages and a proven track record, which new firms lack. This talent acquisition hurdle significantly raises the barrier to entry.

The ability to effectively source, evaluate, and add value to investments is critical. New firms must demonstrate:

- Deep industry-specific knowledge to identify undervalued assets and growth opportunities.

- Extensive deal sourcing networks built over years of active participation in the market.

- Proven due diligence capabilities to uncover risks and validate investment theses.

- Operational expertise to drive value creation post-acquisition, a key differentiator for established players.

Limited Access to Proprietary Deals

Established investment firms like 3i Group benefit significantly from their deep-seated networks and long-standing relationships, granting them exclusive access to proprietary deals that are not publicly marketed. This privileged access to less competitive deal flow is a critical differentiator.

New entrants often find themselves at a disadvantage, as they lack the established trust and rapport necessary to tap into these exclusive networks. Consequently, they are frequently relegated to participating in highly competitive auction processes for investment opportunities, which can lead to inflated acquisition prices and diminished potential returns.

For instance, in 2024, the private equity market continued to see a strong preference for proprietary deal sourcing, with estimates suggesting that a significant portion of deals were initiated through direct relationships rather than open auctions. This trend underscores the substantial barrier to entry for new players lacking established networks.

- Proprietary Deal Access: Established firms leverage existing relationships for exclusive investment opportunities.

- Competitive Auctions: New entrants often face more competitive and less profitable auction-based deal sourcing.

- Network Advantage: The strength of a firm's network directly impacts its ability to secure advantageous deals.

- 2024 Market Trend: Proprietary deal sourcing remained a dominant strategy in private equity throughout 2024.

The threat of new entrants for a firm like 3i Group is generally low due to substantial capital requirements and the need for an established track record. In 2024, raising a new private equity fund often necessitated hundreds of millions, if not billions, in commitments, a hurdle most newcomers cannot clear. LPs consistently favor managers with proven, multi-cycle success, making it difficult for new firms to attract capital without this history.

Regulatory complexity and the demand for specialized expertise further erect barriers. Navigating intricate compliance and building a team with deep industry knowledge and extensive deal sourcing networks takes years. For instance, the talent acquisition process for top-tier investment professionals in 2024 remained highly competitive, requiring firms to offer substantial compensation and demonstrate a strong existing platform.

Established firms like 3i Group also benefit from proprietary deal access through long-standing relationships, a significant advantage over new entrants often confined to competitive auctions. In 2024, proprietary deal sourcing continued to dominate, with a substantial portion of transactions stemming from direct networks rather than open bidding processes, reinforcing the network advantage.

| Barrier | Description | Impact on New Entrants | 2024 Relevance |

|---|---|---|---|

| Capital Requirements | Substantial funds needed to launch and operate effectively. | High barrier; limits ability to compete. | Raising funds in the hundreds of millions to billions remained standard. |

| Track Record & Reputation | Demonstrated history of strong returns and reliable management. | Critical for attracting LP capital; difficult for new firms to establish. | LPs continued to prioritize managers with over a decade of success. |

| Regulatory Compliance | Adherence to complex and evolving financial regulations. | Costly and time-consuming; requires specialized legal and compliance teams. | Ongoing regulatory changes across jurisdictions demand continuous adaptation. |

| Specialized Expertise & Networks | Deep industry knowledge, deal sourcing capabilities, and operational skills. | Requires significant time and resources to build; new firms lack established connections. | Proprietary deal flow, a key differentiator, relies heavily on strong networks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for 3i Group is built upon a foundation of public company filings, including annual reports and investor presentations, complemented by industry-specific market research and financial data from reputable sources like Bloomberg and S&P Capital IQ.