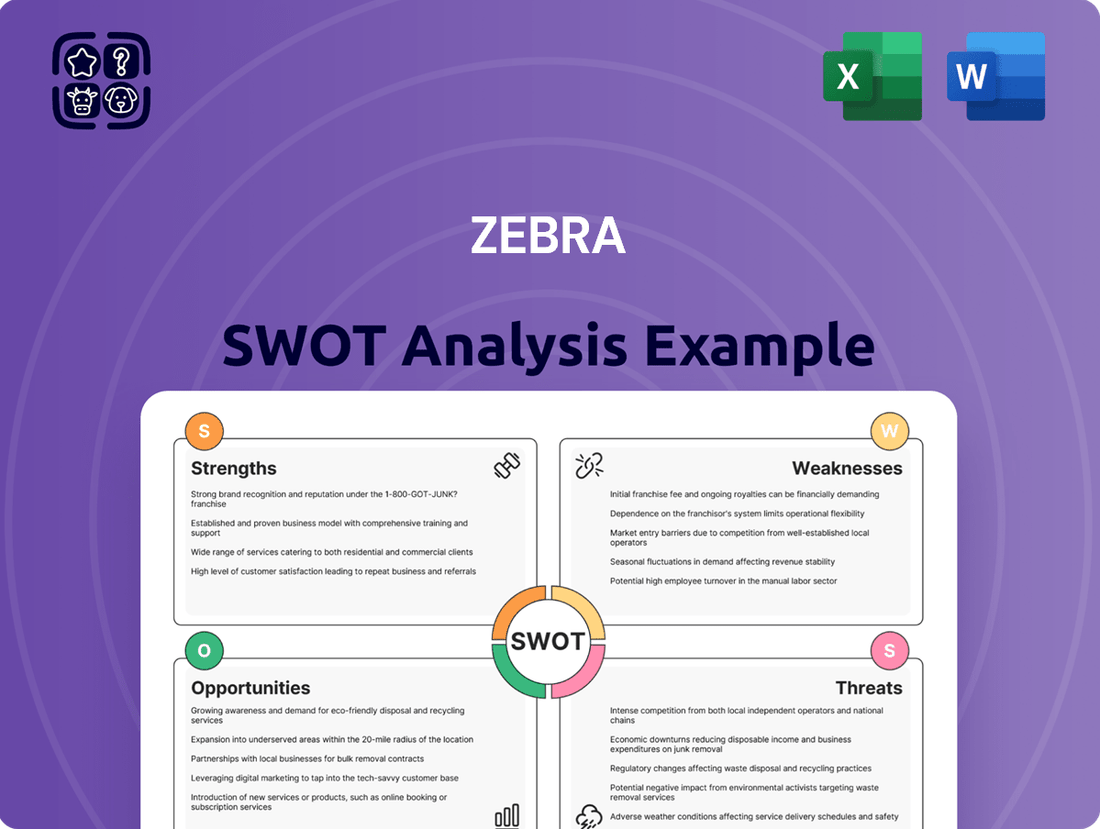

Zebra SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zebra Bundle

The Zebra's unique value proposition and strong brand recognition are significant strengths, allowing it to stand out in a competitive market. However, the company faces challenges in adapting to evolving technological landscapes and potential disruptions from new entrants. Understanding these dynamics is crucial for any strategic investor or business leader.

Want the full story behind Zebra's market position, potential threats, and avenues for growth? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making.

Strengths

Zebra Technologies maintains a dominant position in the enterprise asset intelligence market, built on over 50 years of innovation.

Their solutions are utilized by over 80% of Fortune 500 companies as of 2024, highlighting their strong brand recognition and trusted reputation.

This extensive customer base and substantial brand equity provide a significant competitive advantage and a large installed base for future growth.

Zebra Technologies offers a comprehensive product suite, including mobile computers, barcode scanners, RFID readers, and specialized printers, alongside robust software solutions. This diverse portfolio caters to critical sectors such as retail, healthcare, manufacturing, and transportation and logistics. This breadth of offerings reduces dependence on any single market segment, enhancing stability. For instance, Zebra's Enterprise Asset Intelligence segment, a key revenue driver, leverages these solutions to deliver end-to-end capabilities, supporting strong market positioning as indicated by their Q1 2024 net sales of $1.15 billion.

Zebra Technologies consistently allocates approximately 10% of its sales to research and development, cultivating a strong culture of innovation. This significant investment, reflecting 2024-2025 operational strategies, drives advancements in crucial areas like AI, machine vision, robotics, and cloud-based software solutions. Strategic acquisitions, including Matrox Imaging in 2022 and Photoneo in 2023, significantly enhance Zebra's technological capabilities. These moves expand its portfolio into high-growth sectors, reinforcing its market leadership in enterprise asset intelligence.

Strong Financial Performance

Zebra Technologies exhibits strong financial health, marked by significant revenue and profit growth. In the first quarter of 2025, the company reported an 11.3% year-over-year increase in net sales. This robust performance is supported by a healthy gross profit margin and strong free cash flow generation. A solid balance sheet further provides the flexibility to invest in growth initiatives and navigate economic uncertainties effectively.

- Q1 2025 Net Sales Growth: 11.3% year-over-year increase.

- Healthy Gross Profit Margin: Supports overall profitability.

- Strong Free Cash Flow: Enables strategic investments.

- Solid Balance Sheet: Provides financial flexibility and resilience.

Extensive Global Reach and Partner Ecosystem

Zebra Technologies maintains an extensive global reach, operating in over 100 countries worldwide as of 2024, leveraging a vast network of channel partners. This ecosystem includes thousands of distributors, resellers, and system integrators, crucial for deep market penetration and providing localized support to diverse customers across various industries. The combination of Zebra's direct sales force and its robust partner network ensures comprehensive global market coverage, supporting significant revenue streams. This widespread presence enhances its competitive advantage and facilitates responsiveness to regional market demands, solidifying its position in enterprise asset intelligence.

- Global operations span over 100 countries, ensuring broad market access.

- A vast partner ecosystem, including thousands of channel partners, drives localized sales and support.

- Combined direct and indirect sales channels maximize market penetration and customer engagement as of 2024.

Zebra Technologies commands a dominant market position, leveraging solutions used by over 80% of Fortune 500 companies as of 2024.

Their substantial R&D investments, approximately 10% of 2024-2025 sales, drive continuous innovation across a comprehensive product suite.

Strong financial health, including an 11.3% Q1 2025 net sales growth, supports strategic investments and global operations in over 100 countries.

| Strength Factor | Key Metric | 2024/2025 Data |

|---|---|---|

| Market Dominance | Fortune 500 Usage | >80% (2024) |

| Innovation Investment | R&D as % of Sales | ~10% (2024-2025) |

| Financial Performance | Q1 2025 Net Sales Growth | 11.3% YoY |

| Global Reach | Countries of Operation | >100 (2024) |

What is included in the product

Provides a strategic overview of Zebra's internal capabilities and external market dynamics, including its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic weaknesses and threats, alleviating the pain of uncertainty.

Weaknesses

Zebra Technologies faces significant vulnerability due to its reliance on a limited number of specialized manufacturers for critical components, exposing it to potential supply chain disruptions. Geopolitical tensions, such as those impacting global trade in 2024, and ongoing trade disputes pose substantial risks, potentially increasing component costs and extending lead times. This dependency, evident during the 2023-2024 semiconductor shortages affecting technology sectors, necessitates robust risk management strategies. Diversifying its supply chain remains crucial to mitigate these inherent production and cost risks for 2025 operations.

Zebra Technologies faces significant susceptibility to economic downturns, as its sales are heavily impacted by macroeconomic pressures and fluctuations in enterprise technology spending. During periods of economic contraction, businesses often delay or reduce capital expenditures on essential solutions like those offered by Zebra. This inherent cyclicality directly affects the company’s revenue and overall profitability. Evidence of this was seen with moderated customer demand impacting performance in the latter half of 2024, highlighting the vulnerability to broader market shifts.

Zebra Technologies faces a notable weakness in its significant revenue concentration, with a substantial portion tied to the retail and manufacturing sectors. For instance, recent fiscal reports indicate these segments continue to represent the core of their enterprise solutions business. A downturn or shift in capital expenditure within these key industries, such as a slowdown in retail tech upgrades or manufacturing automation projects in late 2024, could disproportionately affect Zebra's overall financial performance and growth outlook for 2025. This dependency underscores the critical need for continued strategic diversification into other high-growth verticals like healthcare or logistics to mitigate market-specific risks.

Complexity of Product Integration

The complexity involved in integrating Zebra's extensive hardware and software ecosystem can present a significant barrier, particularly for smaller businesses. Implementing these solutions often necessitates specialized IT resources and a substantial integration timeframe, potentially increasing the total cost of ownership for small and medium-sized enterprises (SMEs) by an estimated 15% to 20% in 2024. This complexity may inadvertently favor competitors offering simpler, more accessible solutions, hindering Zebra's market penetration among the 80% of businesses with fewer than 50 employees who often lack dedicated IT teams.

- Integration complexity elevates TCO for SMEs by 15-20% in 2024.

- Specialized IT resources are often required, a challenge for smaller firms.

- Simpler competitor solutions gain traction with the 80% of businesses under 50 employees.

Impact of Tariffs and Trade Policies

Zebra Technologies global operations face significant vulnerability from shifts in international trade policies and tariffs. The company has explicitly noted the potential for a material gross profit impact from U.S. import tariffs, which can directly affect its profitability margins. For instance, ongoing trade tensions could lead to a percentage point reduction in gross margins if unmitigated, as seen in past periods. This uncertainty mandates proactive mitigation strategies like adjusting global production locations or implementing pricing adjustments to offset increased costs, adding a layer of financial risk and operational complexity to its 2024-2025 outlook.

- Potential 2024 gross margin pressure from tariffs.

- Operational shifts may incur additional supply chain costs.

- Pricing adjustments could impact sales volume.

Zebra Technologies faces weaknesses including supply chain reliance on few manufacturers and revenue concentration in retail/manufacturing, impacting 2024 performance. Economic downturns and integration complexity for SMEs, with TCO elevated by 15-20% in 2024, pose further challenges. Shifting international trade policies, like tariffs, also risk 2024-2025 gross margins.

| Weakness | Impact | 2024-2025 Data Point |

|---|---|---|

| Supply Chain Dependency | Disruption Risk | Semiconductor shortages, 2023-2024 |

| Revenue Concentration | Market Downturn Vulnerability | Slowdown in retail tech upgrades, late 2024 |

| Integration Complexity | Higher TCO for SMEs | 15-20% TCO increase for SMEs, 2024 |

| Trade Policy Shifts | Gross Margin Pressure | Potential gross profit impact from tariffs, 2024 |

Preview Before You Purchase

Zebra SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of the Zebra's Strengths, Weaknesses, Opportunities, and Threats. You'll receive the complete, professionally structured analysis, ready for immediate use. No hidden content or missing sections, just the full picture.

Opportunities

Zebra has significant opportunities for growth by expanding into high-growth sectors such as healthcare and transportation. The increasing global need for automation and real-time data visibility in these industries drives strong demand for Zebra's specialized solutions. For instance, the global healthcare IT market is projected to exceed $700 billion by 2025, while logistics automation is set to surpass $80 billion by 2025, areas where Zebra's offerings are critical. Expanding its presence in rapidly developing regions like Asia-Pacific, which continued to show strong sales growth in Q1 2024 for Zebra, can unlock new revenue streams and diversify its customer base.

The growing adoption of AI and machine learning offers a substantial opportunity for Zebra to enhance its offerings. By integrating AI for predictive analytics, demand forecasting, and workflow automation, Zebra can deliver enhanced customer value. The company is actively investing in AI capabilities, including generative AI, to create more intelligent and automated workflows, aligning with the projected 2025 global AI market size exceeding $300 billion. This strategic focus allows Zebra to solidify its leadership in enterprise asset intelligence and empower smarter operations.

The continued expansion of global e-commerce, projected to exceed $6.9 trillion in 2024 and $7.6 trillion in 2025, significantly boosts demand for optimized supply chain and logistics management.

Zebra's mobile computing, barcode scanning, and RFID solutions are essential for streamlining warehouse operations, enhancing inventory accuracy, and improving last-mile delivery efficiency.

This secular trend provides a robust long-term tailwind, with IDC reporting that worldwide spending on supply chain management applications is expected to grow by over 10% annually through 2025, directly benefiting Zebra's core business in automation and visibility.

Strategic Acquisitions to Broaden Portfolio

Zebra Technologies continues to identify strategic acquisitions as a key opportunity to expand its market reach and technological capabilities. This proven strategy, exemplified by the 2022 Photoneo acquisition to enhance 3D machine vision, allows Zebra to enter new high-growth sectors. Future targets could include firms specializing in advanced robotics, sophisticated AI software, or other complementary enterprise solutions. Such moves would further diversify Zebra's portfolio, strengthening its competitive edge in a dynamic market environment.

- Zebra's Q1 2024 net sales were $1.16 billion, indicating a solid financial foundation for potential M&A.

- The company anticipates full-year 2024 net sales to be flat to up 2% from 2023, providing capital for strategic investments.

- Acquisitions could target emerging areas like autonomous mobile robots (AMRs) to complement existing solutions.

Leveraging New Technology Transitions

Zebra is well-positioned to capitalize on significant technological shifts creating new product cycles. The increasing adoption of 5G and Wi-Fi 7, with Wi-Fi 7 device shipments expected to reach 230 million units by 2025, offers substantial opportunities for next-generation enterprise solutions. Furthermore, Android's continued dominance in enterprise mobility, holding over 80% of the rugged device market in 2024, allows Zebra to introduce advanced devices leveraging these standards. The accelerating demand for RFID technology also presents a significant growth avenue, as the global RFID market is projected to exceed $20 billion by 2025.

- 5G and Wi-Fi 7 drive demand for next-gen enterprise devices.

- Android's enterprise market share supports new device cycles.

- RFID market growth provides substantial expansion opportunities.

Zebra can expand into high-growth sectors like healthcare and logistics, capitalizing on increasing automation and real-time data needs. Strategic acquisitions and integrating AI into its solutions offer significant market and technological expansion. The booming e-commerce market and adoption of 5G, Wi-Fi 7, and RFID technology provide robust demand for Zebra's next-generation enterprise solutions.

| Opportunity Area | 2024/2025 Projection | Source |

|---|---|---|

| Healthcare IT Market | >$700 Billion by 2025 | Industry Reports |

| Global E-commerce | $7.6 Trillion by 2025 | eMarketer |

| Global AI Market | >$300 Billion by 2025 | Various Market Reports |

| RFID Market | >$20 Billion by 2025 | IDC |

| Wi-Fi 7 Device Shipments | 230 Million Units by 2025 | IDC |

Threats

Zebra Technologies navigates an intensely competitive market, facing significant pressure from established players such as Honeywell and Datalogic, along with emerging technology providers. Competitors often offer alternative solutions or more aggressive pricing strategies, impacting Zebra's market share and profitability, as seen in its Q1 2024 revenue decline to $1.16 billion. This environment necessitates continuous innovation and a robust value proposition to maintain its competitive edge against rivals like Honeywell, whose Safety and Productivity Solutions segment remains strong. Sustained investment in R&D is crucial for Zebra to differentiate its offerings.

The technology industry's rapid innovation poses a significant threat, potentially rendering Zebra's products obsolete quickly. Zebra Technologies must continually invest heavily in research and development to maintain its competitive edge and meet evolving customer demands, with R&D expenses projected to remain substantial in fiscal year 2024, following a reported $330 million in 2023. Failure to innovate swiftly could result in losing market leadership to more agile competitors who are quicker to adopt emerging technologies like advanced AI in computer vision or next-gen RFID. Sustained investment is crucial for their long-term viability in a dynamic market.

Global economic and geopolitical uncertainties pose a significant threat to Zebra's operations, particularly as real GDP growth projections for 2025 remain modest at around 2.2% globally, impacting enterprise IT spending. Ongoing geopolitical instability and trade disputes, such as those affecting critical component supply chains, can disrupt manufacturing and distribution, increasing operational costs. This dynamic environment creates volatility in financial markets and directly influences customer spending patterns, especially in regions experiencing economic deceleration. Zebra's cautious outlook for 2024 reflects these persistent macroeconomic headwinds and trade complexities.

Cybersecurity Risks

The increasing connectivity of Zebra's products and solutions exposes the company and its customers to significant cybersecurity threats. A security breach could severely damage Zebra's reputation, leading to substantial financial losses and eroding critical customer trust. For instance, the average cost of a data breach globally reached USD 4.45 million in 2023, a figure projected to rise in 2024. Therefore, robust cybersecurity measures are critical to protect its systems and sensitive customer data, especially as cyberattack volumes continue their upward trend, with a notable 38% global increase observed in 2022 compared to the previous year, a trend expected to persist through 2025.

- Average global cost of a data breach: USD 4.45 million in 2023.

- Projected rise in breach costs through 2024 and 2025.

- 38% global increase in cyberattacks observed in 2022.

- Persistent upward trend in cyberattack volumes expected.

Supply Chain Disruptions

Global events present ongoing threats to supply chains, impacting component availability and finished goods delivery for Zebra Technologies. The 2024 Red Sea disruptions, for example, caused notable shipping delays and increased costs, highlighting continued vulnerabilities. Zebra must prioritize building robust supply chain resilience to mitigate these escalating risks. Proactive strategies are crucial to maintain operational continuity and meet customer demand effectively.

- Global shipping costs saw up to a 200% increase in early 2024 for some routes.

- Component lead times for certain electronics remained elevated through Q1 2025.

- Geopolitical tensions continue to pose unpredictable supply chain challenges.

- Zebra's Q4 2024 earnings calls emphasized supply chain stability as a key focus.

Zebra Technologies faces significant threats from intense competition, evidenced by a Q1 2024 revenue decline to $1.16 billion, and rapid technological obsolescence requiring substantial R&D investments projected for 2024. Global economic uncertainties, with modest 2.2% GDP growth projected for 2025, alongside persistent supply chain disruptions like the 2024 Red Sea issues, heighten operational risks. Additionally, cybersecurity threats, with average data breach costs reaching USD 4.45 million in 2023, pose a substantial risk to reputation and financial stability.

| Threat Category | Key Metric/Impact | 2024/2025 Data |

|---|---|---|

| Competition | Q1 Revenue Decline | $1.16 billion (Q1 2024) |

| Economic Uncertainty | Global GDP Growth | 2.2% (projected 2025) |

| Cybersecurity | Average Data Breach Cost | USD 4.45 million (2023) |

| Supply Chain | Shipping Cost Increase | Up to 200% (early 2024) |

SWOT Analysis Data Sources

This Zebra SWOT analysis is built upon a robust foundation of verified data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to ensure accurate strategic insights.