Zebra Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zebra Bundle

Understanding the competitive landscape for Zebra Technologies is crucial for any business operating in or investing in their market. A Porter's Five Forces analysis provides a robust framework to dissect these dynamics, revealing the underlying pressures that shape profitability and strategy.

We've touched upon the core elements, but the true power lies in a comprehensive examination. Imagine a deep dive into buyer bargaining power, supplier leverage, and the ever-present threat of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Zebra’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Zebra Technologies heavily relies on suppliers for critical components, including advanced semiconductors, specialized scanner engines, and precise printheads. The unique nature of these parts and often a concentrated supplier base, particularly for cutting-edge technologies, grant these suppliers significant leverage. This power is evident in pricing and terms, especially during periods of high demand or global supply chain disruptions like those seen affecting semiconductor availability into 2024. Such dependencies can impact Zebra's production costs and profit margins, making supplier relationships crucial.

Zebra Technologies actively mitigates supplier power by diversifying its global sourcing, a critical strategy in 2024. This involves identifying and qualifying alternative suppliers across various geographic regions to reduce reliance on any single source. For instance, ongoing efforts aim to broaden vendor relationships beyond traditional hubs, enhancing supply chain resiliency. This diversification is crucial for Zebra's ability to negotiate favorable terms and maintain cost efficiency, especially given current global economic shifts.

Zebra Technologies actively cultivates long-term alliances with its core suppliers, a strategy vital for its 2024 operational stability. These established partnerships facilitate deep collaboration on technology roadmaps, ensuring consistent supply for products like its Q1 2024 mobile computing releases. This approach typically leads to more stable costs and favorable pricing terms. However, this close interdependence can also reduce Zebra's flexibility when seeking alternative sourcing options.

Input Cost Volatility

The cost of crucial raw materials and electronic components, vital for Zebra's products, is constantly subject to market swings and geopolitical influences like tariffs. These fluctuations directly impact Zebra's manufacturing expenses and overall profitability, granting suppliers periodic leverage to raise prices.

- Global semiconductor market is projected to recover in 2024, potentially stabilizing electronic component costs.

- Ongoing geopolitical tensions, particularly US-China trade relations, continue to pose risks for supply chain disruptions and tariffs.

- Raw material prices, while moderating from 2022 peaks, remain sensitive to global economic shifts and demand.

- Supplier concentration in specialized components can amplify their bargaining power over Zebra.

Acquisitions to Internalize Technology

Zebra's strategic acquisitions, like Matrox Imaging in 2022 and Photoneo in 2021, directly reduce supplier bargaining power by internalizing critical vision technologies.

This vertical integration allows Zebra greater control over product development and cost structures, enhancing its supply chain resilience.

By owning these core capabilities, Zebra lessens its dependence on external suppliers for key components, ensuring more stable production and innovation pathways.

- Matrox Imaging acquisition (2022) strengthened machine vision capabilities.

- Photoneo acquisition (2021) added advanced 3D vision solutions.

- These moves bolster Zebra's competitive edge and reduce supplier leverage.

- The strategy improves control over technology roadmaps for 2024 and beyond.

Zebra Technologies faces significant supplier power due to its reliance on specialized components like advanced semiconductors, which remained critical in 2024. A concentrated supplier base, particularly for cutting-edge technology, grants these suppliers leverage over pricing and terms, impacting Zebra's costs. However, Zebra mitigates this through strategic sourcing diversification and vertical integration via acquisitions like Matrox Imaging (2022).

| Key Factor | 2024 Impact | Zebra's Response |

|---|---|---|

| Semiconductor Supply | Improving stability | Diversified sourcing |

| Specialized Components | Concentrated suppliers | Vertical integration |

| Raw Material Costs | Market volatility | Long-term alliances |

What is included in the product

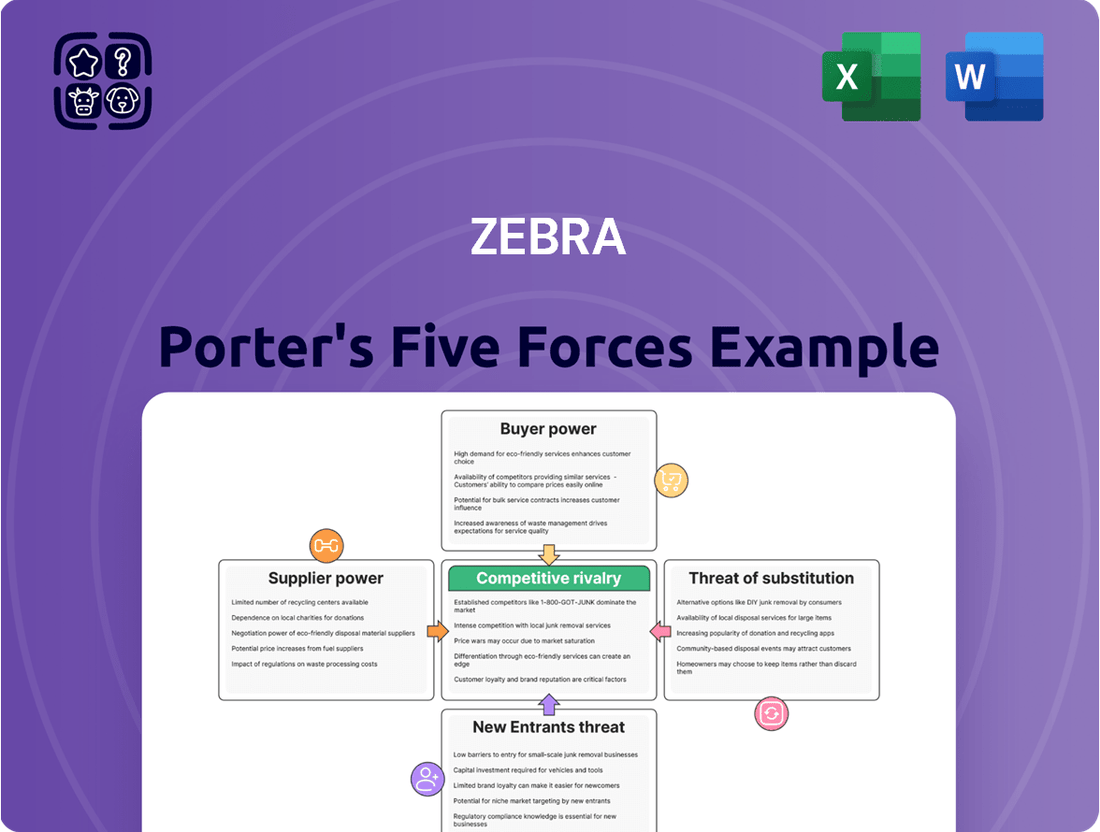

This analysis dissects Zebra's competitive environment by examining the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a clear visualization of each force, simplifying strategic planning.

Customers Bargaining Power

Zebra Technologies serves a broad spectrum of industries, including retail, e-commerce, manufacturing, transportation and logistics, and healthcare. This extensive customer diversification, with over 80% of Fortune 500 companies reportedly utilizing Zebra solutions as of early 2024, significantly reduces its reliance on any singular buyer or sector. Consequently, the individual bargaining power of customers is limited, as no single client represents a substantial portion of Zebra's revenue. This wide-ranging customer base ensures a stable demand for Zebra's enterprise asset intelligence solutions, mitigating risks associated with customer concentration.

Customers integrating Zebra's hardware, software, and services into core workflows face substantial switching costs. These expenses include not only the capital expenditure for new equipment but also significant outlays for software integration. For example, migrating from a Zebra-centric system in 2024 could involve considerable retraining for thousands of employees, impacting operational efficiency. Furthermore, the process re-engineering required for such a shift presents a major barrier, reinforcing customer stickiness.

Even with high switching costs for integrated solutions, customers remain highly price-sensitive, particularly for substantial deployments. The competitive landscape, featuring major players like Honeywell, empowers customers to compare pricing and feature sets rigorously. This allows them significant leverage to negotiate more favorable deals. Large enterprise clients, making high-volume purchases, especially benefit from this dynamic, influencing pricing strategies across the market in 2024.

Demand for Integrated Solutions

Customers increasingly seek comprehensive, end-to-end solutions, moving beyond standalone hardware to demand integrated software, analytics, and ongoing service support from providers like Zebra. This shift empowers customers to negotiate for tailored ecosystems that precisely fit their workflow needs, enhancing their bargaining leverage. For instance, the global supply chain management software market is projected to reach approximately $27.7 billion in 2024, highlighting the strong demand for integrated digital tools.

- Customers prioritize holistic solutions, not just individual components.

- Demand for analytics and software alongside hardware is rising.

- Integrated service and support are critical bargaining points.

- This trend allows customers to demand highly customized offerings.

Extensive Channel Partner Network

Zebra Technologies leverages an extensive network of over 10,000 global channel partners to reach its diverse customer base. While this expansive reach is a significant competitive advantage, it also grants these partners a degree of bargaining power. These partners, having direct relationships with end-customers, can significantly influence purchasing decisions and product preferences. This dynamic means Zebra must continually ensure partner loyalty and competitive offerings to maintain its market position, especially as the demand for integrated solutions continues to grow in 2024.

- Over 10,000 channel partners globally as of 2024.

- Partners directly influence customer purchasing decisions.

- Their strong customer relationships contribute to customer bargaining power.

- Zebra's reliance on this network necessitates strong partner programs.

Zebra's vast customer base, including over 80% of Fortune 500 in early 2024, limits individual buyer power due to diversification. High switching costs, such as retraining thousands of employees for new systems, lock customers in. However, intense competition and demand for end-to-end solutions, like the $27.7 billion global supply chain management software market in 2024, enable large clients to negotiate pricing. Over 10,000 global channel partners also wield influence over purchasing decisions.

| Factor | Impact on Power | 2024 Context | ||

|---|---|---|---|---|

| Customer Diversification | Lowers individual power | 80%+ Fortune 500 clients | ||

| Switching Costs | Increases stickiness | Significant retraining, re-engineering | ||

| Price Sensitivity | Increases negotiation leverage | Competitive market, large deployments | ||

| Integrated Solutions Demand | Empowers tailored negotiations | SCM software market $27.7B | ||

| Channel Partner Influence | Adds indirect leverage | 10,000+ global partners |

What You See Is What You Get

Zebra Porter's Five Forces Analysis

This preview showcases the complete Zebra Porter's Five Forces Analysis, exactly as you'll receive it upon purchase. You're viewing the final, professionally formatted document that will be instantly available for your strategic planning needs. This analysis delves into the competitive landscape of Zebra Technologies, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Rest assured, the document you see here is the definitive version you'll download, providing actionable insights without any hidden surprises or placeholder content.

Rivalry Among Competitors

The enterprise asset intelligence and data capture market remains intensely competitive, with Zebra facing significant rivalry from established players like Honeywell, Datalogic, and Impinj. This competition hinges on factors such as product breadth, technological innovation, and brand reputation. For instance, Honeywell's Safety and Productivity Solutions segment, a direct competitor, reported significant sales in 2024, highlighting the scale of the rivalry. Market dynamics in 2024 show ongoing price pressures and a drive for advanced RFID and vision solutions, pushing companies to continuously innovate their offerings. Zebra's ability to maintain its market share against these formidable competitors depends on its continued investment in cutting-edge solutions and competitive pricing strategies.

Zebra Technologies maintains its market leadership by consistently investing in research and development, a critical differentiator against competitors. For fiscal year 2024, Zebra's R&D expenditure is projected to remain robust, typically hovering around 10% of its net sales, underscoring its commitment to innovation. This significant investment enables the company to pioneer new technologies in high-growth areas like RFID, advanced machine vision, and AI-powered enterprise software solutions. Such continuous technological advancement ensures Zebra delivers cutting-edge products, enhancing its competitive edge and solidifying its position in the competitive landscape.

Zebra actively engages in strategic acquisitions to strengthen its portfolio and expand into adjacent markets, exemplified by its 2022 acquisition of Matrox Imaging and Photoneo. This strategy, aimed at enhancing machine vision and industrial automation capabilities, is also employed by competitors within the industry. Consequently, the market for enterprise asset intelligence and automation solutions is highly dynamic and consolidating. Companies are continually vying for technological superiority and increased market share through these strategic moves, influencing competitive rivalry significantly in 2024.

Broad Product Portfolio and Ecosystem

Zebra's robust competitive position stems from its extensive portfolio, integrating hardware, software, and services into a comprehensive ecosystem. This 'one-stop-shop' approach for enterprise asset intelligence solutions significantly enhances customer loyalty, creating a substantial barrier for competitors offering only point solutions. For instance, Zebra reported net sales of $957 million in Q1 2024, reflecting continued demand for their integrated offerings. This broad reach across various solutions makes it challenging for rivals to dislodge established customer relationships.

- Zebra's extensive portfolio includes mobile computing, data capture, and printing solutions, alongside robust software and services.

- The company's integrated ecosystem fosters high customer loyalty, making switching costly for enterprises.

- Zebra reported Q1 2024 net sales of $957 million, showcasing the financial strength of its comprehensive offerings.

- This 'one-stop-shop' strategy acts as a significant entry barrier against competitors focused on niche products.

Global Distribution and Partner Network

Zebra Technologies leverages a significant competitive advantage through its vast global network, comprising over 10,000 channel partners. This extensive reach, a key differentiator in 2024, allows Zebra to serve a diverse customer base across numerous industries and geographies. Such a widespread distribution and support system is exceptionally difficult for smaller competitors to replicate, solidifying Zebra's market position against rivals.

- Zebra's network extends to over 10,000 partners globally.

- This vast reach supports diverse industries and geographies.

- It creates a high barrier to entry for new competitors.

- The network remains a strong competitive asset in 2024.

Competitive rivalry for Zebra Technologies is intense, with major players like Honeywell and Datalogic vying for market share through innovation and comprehensive solutions. In 2024, the market faces ongoing price pressures and a strong demand for advanced RFID and vision technologies. Zebra counters this by investing heavily in R&D, making strategic acquisitions, and leveraging its integrated portfolio, which achieved $957 million in Q1 2024 net sales. Its global network of over 10,000 partners further solidifies its competitive edge.

| Metric | Value (2024) | Competitor Context |

|---|---|---|

| Zebra Q1 Net Sales | $957 Million | Reflects demand for integrated solutions |

| Zebra R&D Spend (Est.) | ~10% of Net Sales | Commitment to innovation |

| Zebra Partner Network | >10,000 Global Partners | Significant distribution advantage |

SSubstitutes Threaten

Smartphones increasingly serve as viable substitutes for dedicated data capture devices, like those offered by Zebra, due to their ubiquitous presence and advanced camera capabilities.

These devices can perform effective barcode scanning and inventory management, often at a significantly lower initial investment compared to specialized hardware.

The enterprise trend of Bring Your Own Device (BYOD) further amplifies this threat, with a 2024 projection showing continued growth in companies leveraging employee-owned devices for business tasks.

This widespread adoption means businesses can often avoid the capital expenditure on ruggedized scanners.

Software-as-a-Service (SaaS) and cloud-based platforms pose a significant substitute threat to Zebra's hardware-focused offerings. These solutions, like inventory management or asset tracking software, provide flexibility and can be more cost-effective for businesses that prefer subscription models over large upfront hardware investments. For instance, the global public cloud services market is projected to reach $679 billion in 2024, reflecting a strong shift towards such agile alternatives. This trend reduces the need for specialized on-premise hardware, as many functions migrate to the cloud. Businesses often find these software-centric approaches scalable and easier to integrate, diminishing reliance on proprietary hardware systems.

While consumer-grade smartphones and tablets offer a lower initial price point, Zebra's ruggedized enterprise hardware is engineered for the demanding conditions of industrial settings. The total cost of ownership (TCO) becomes a critical factor, as consumer devices often fail prematurely, leading to higher repair and replacement rates. For instance, a 2024 study by VDC Research indicated that rugged devices can have a TCO up to 39% lower over five years compared to non-rugged alternatives due to reduced downtime and breakage. This durability difference significantly mitigates the threat posed by cheaper, less robust substitutes in enterprise applications.

Digital and Mobile Payment Systems

The rise of digital and mobile payment systems presents a significant substitute threat to Zebra Technologies. These technologies, like QR code payments and tap-to-pay, can reduce the reliance on traditional barcode scanning at checkout, impacting Zebra's core retail solutions. As of 2024, global mobile payment transaction values continue to grow, with projections indicating a substantial increase in adoption. This shift could substitute some of Zebra's traditional applications in point-of-sale environments.

- Global mobile payment transaction value is projected to reach $10.5 trillion in 2024, demonstrating widespread adoption.

- The increasing use of embedded payment solutions within apps and devices bypasses the need for physical scanning hardware.

- Retailers are investing more in seamless, self-checkout experiences often powered by non-barcode dependent methods.

- Zebra's revenue from its Enterprise Visibility & Mobility segment, including scanning devices, faces potential long-term pressure from this trend.

Advancements in AI and Machine Vision

Advancements in AI and machine vision present a significant threat of substitution for Zebra, despite their own investments. Sophisticated camera systems, powered by AI software, are increasingly capable of performing identification tasks traditionally reliant on dedicated barcode scanners or RFID readers. For instance, the global machine vision market is projected to reach $18.2 billion by 2024, indicating rapid adoption of these alternative solutions. This trend allows for new forms of inventory tracking and asset management without specialized hardware.

- The global machine vision market is projected to reach $18.2 billion in 2024.

- AI-powered camera systems can now perform tasks like object identification and inventory counting.

- Smartphone-based scanning applications leveraging AI offer a low-cost substitute for traditional devices.

- Companies are increasingly exploring software-centric solutions over hardware-specific deployments.

Smartphones and consumer devices present a low-cost substitute for basic data capture, with the BYOD trend continuing to grow in 2024.

Software-as-a-Service and cloud platforms offer flexible, subscription-based alternatives for inventory and asset management, with the global public cloud market projected at $679 billion in 2024.

The rise of mobile payments, projected to reach $10.5 trillion in 2024, and AI-powered machine vision, a $18.2 billion market in 2024, further diminish the need for traditional scanning hardware.

These pervasive technologies challenge Zebra's hardware-centric solutions by providing versatile and often more cost-effective alternatives.

| Substitute Threat | 2024 Market Data | Impact on Zebra |

|---|---|---|

| Smartphones/BYOD | Continued growth in enterprise adoption | Reduces need for specialized hardware |

| SaaS/Cloud Platforms | $679 Billion (Global Public Cloud Market) | Shifts focus from hardware to software subscriptions |

| Mobile Payments | $10.5 Trillion (Global Transaction Value) | Less reliance on barcode scanning at POS |

| AI/Machine Vision | $18.2 Billion (Global Market) | Automated identification without dedicated scanners |

Entrants Threaten

The enterprise asset intelligence market presents significant barriers to new entrants, making the threat from newcomers relatively low. Developing competitive solutions requires substantial research and development investment, with leading firms dedicating significant capital to innovation; for example, top players in the broader IoT solutions space invested billions in R&D in 2024. Furthermore, specialized manufacturing capabilities for sensors and hardware, alongside extensive software development for analytics platforms, demand considerable upfront capital and expertise. New companies would face a steep learning curve and high initial costs to establish a credible presence, hindering their ability to compete effectively.

Zebra Technologies has cultivated a formidable brand reputation and a deeply loyal customer base over decades, making market entry challenging. As of 2024, over 80% of Fortune 500 companies rely on Zebra's solutions, reflecting significant established trust. New entrants face substantial hurdles overcoming this entrenched loyalty, as customers perceive high switching costs in terms of integration, training, and operational disruption. This strong incumbency acts as a significant barrier to new competition.

Zebra Technologies benefits from substantial economies of scale, making new entry challenging. Its large-scale manufacturing and global distribution network, which included over 10,000 channel partners globally in 2024, provide significant cost advantages. Replicating Zebra's extensive operational footprint and established supply chains, which support an estimated annual revenue of over $4.5 billion, demands immense capital and time. This global reach and cost efficiency create a formidable barrier, as new entrants would struggle to match pricing and delivery capabilities from day one. Any new competitor would face substantial hurdles in building comparable infrastructure and market access.

Intellectual Property and Patents

Zebra Technologies possesses a substantial intellectual property portfolio, including thousands of patents globally. This robust collection, backed by significant investments in research and development, deters new market entrants. Competitors face considerable risk of patent infringement lawsuits, making market entry prohibitively expensive. Zebra's 2023 R&D spending exceeded $300 million, reinforcing its innovation leadership.

- Zebra holds over 6,000 active patents globally as of early 2024.

- R&D investment for 2023 was approximately $309 million, up from $287 million in 2022.

- Patent infringement lawsuits can incur millions in legal fees and damages.

- This intellectual property creates a high barrier to entry for new competitors.

Access to Distribution Channels

Zebra Technologies maintains a significant competitive edge through its extensive distribution network, comprising over 10,000 channel partners and distributors globally as of 2024. This well-established infrastructure presents a formidable barrier to new entrants. A new company would face substantial time and resource investments to build a comparable network from the ground up. Replicating Zebra’s widespread market access and global reach is a capital-intensive and prolonged endeavor, making it exceptionally challenging for newcomers to effectively compete.

- Zebra's network of 10,000+ channel partners in 2024.

- High capital and time investment for new entrants to build similar reach.

- Difficulty in establishing global customer access without an existing network.

Zebra Technologies faces a low threat from new entrants due to substantial barriers to entry. Significant R&D, specialized manufacturing, and an extensive global distribution network (over 10,000 partners in 2024) demand immense capital. Zebra's strong brand, loyal customer base (80%+ Fortune 500), and over 6,000 patents further deter new competition.

| Barrier | 2024 Data | Impact |

|---|---|---|

| Capital Costs | R&D >$300M (2023) | High initial investment |

| Brand & Loyalty | 80%+ Fortune 500 use | Difficult to displace |

| Intellectual Property | >6,000 active patents | Legal deterrents |

Porter's Five Forces Analysis Data Sources

Our Zebra Porter's Five Forces analysis is built on a foundation of comprehensive data, including Zebra's annual reports, investor presentations, and SEC filings. We also incorporate industry research from leading market intelligence firms and analyses of competitor strategies to provide a robust understanding of the competitive landscape.