Zebra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zebra Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Zebra. Discover how external forces are shaping the company’s future, from evolving technological landscapes to shifting consumer behaviors. Use these critical insights to strengthen your own market strategy and anticipate competitive moves. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Global trade disputes, especially between the U.S. and China, directly impact Zebra's financial performance due to increased tariffs on imported components and finished goods. Zebra is actively working to mitigate these risks by diversifying its supply chain and shifting production out of China, a process taking 12-18 months. For fiscal year 2025, the company anticipates a significant gross profit impact from these tariffs. This directly influences Zebra's pricing strategies and overall profitability. These trade policies demand continuous strategic adjustments.

Zebra Technologies secures substantial revenue from government contracts, particularly within the defense and logistics sectors. These contracts are vital, with government sales contributing approximately 10-15% of Zebra's total revenue in fiscal year 2023, highlighting the necessity of maintaining strong relationships with government agencies. Shifts in government spending, defense budgets, and public sector procurement policies directly influence Zebra's sales performance and growth prospects in these key market segments. For instance, a 2024 increase in federal logistics modernization initiatives could lead to new opportunities for Zebra's tracking and visibility solutions.

Geopolitical tensions, particularly in regions like Southeast Asia where Zebra sources critical components, pose significant supply chain risks. Escalating conflicts, such as those impacting global shipping lanes, can lead to increased freight costs and delays, directly affecting Zebra's inventory management and production schedules. For instance, disruptions observed in early 2024 necessitated strategic adjustments to mitigate potential component shortages and maintain operational continuity. This environment requires continuous risk assessment and agile sourcing strategies to ensure supply chain resilience.

Regulatory Environment in Key Markets

Operating globally means Zebra Technologies must navigate a complex and evolving regulatory landscape across over 100 countries. This includes adhering to diverse national and regional standards for its enterprise asset intelligence products, which directly influences product design, market access, and compliance costs. For instance, new EU AI Act regulations coming into effect by 2025 will require significant compliance for Zebra's computer vision solutions. A business-friendly regulatory environment, like those promoting IoT adoption, can foster growth, while restrictive policies, such as data localization laws in certain Asian markets, create operational hurdles.

- Zebra's global presence spans over 100 countries, necessitating adherence to diverse regulatory frameworks.

- New regulations like the EU AI Act (effective 2025) will directly impact Zebra's AI-driven solutions.

- Compliance costs are a significant factor, influencing product development and market entry strategies.

- Data localization laws in certain regions present ongoing operational challenges for global data flows.

International Relations and Market Access

The quality of international relations between the United States and other nations significantly influences Zebra's ability to access and operate in foreign markets. Diplomatic tensions can lead to trade barriers, impacting regions where Zebra has substantial operations. Conversely, positive relationships open new opportunities for expansion and collaboration, supporting growth in key international segments. Zebra’s performance in EMEA and Asia Pacific, which saw sales decreases of 10.3% and 6.2% respectively in Q1 2024, can be sensitive to geopolitical stability. However, strong diplomatic ties can also bolster growth, as seen with Latin America's 13.0% sales increase in Q1 2024.

- Trade policies and tariffs remain critical, with potential shifts impacting supply chains and profitability.

- Geopolitical stability directly affects market entry and operational costs for international subsidiaries.

- Regulatory alignment or divergence between countries can create both challenges and opportunities for global technology providers.

- Access to emerging markets in Asia Pacific and Latin America hinges on favorable bilateral agreements and stable political climates.

Government trade policies, including US-China tariffs, significantly impact Zebra's 2025 gross profit and supply chain. Shifts in government spending and defense budgets, like 2024 logistics initiatives, directly influence Zebra's 10-15% revenue from public sector contracts. Geopolitical tensions and international relations create market access hurdles and supply chain risks, affecting Q1 2024 sales in EMEA and APAC.

| Political Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| Trade Policies | Gross Profit Impact | Significant for FY2025 |

| Government Contracts | Revenue Contribution | 10-15% of FY2023 Revenue |

| Geopolitical Stability | Market Access/Sales | EMEA -10.3%, APAC -6.2% Q1 2024 |

What is included in the product

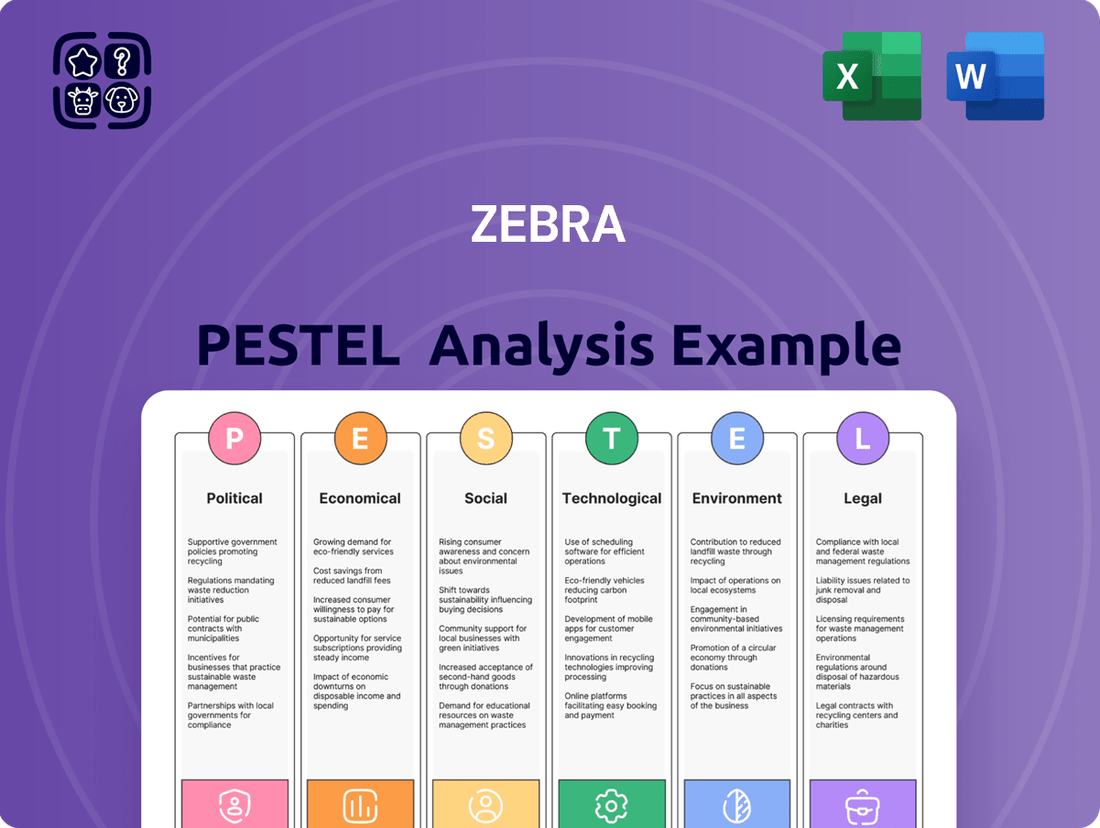

The Zebra PESTLE Analysis provides a comprehensive examination of external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by detailing how these factors create both threats and opportunities within Zebra's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the external landscape without getting bogged down in detail.

Economic factors

The outlook for global enterprise technology spending is a crucial economic factor for Zebra, with a brighter forecast for 2025 following a recent slowdown. Global IT spending is projected to reach $5 trillion in 2024, growing by 8%, and is expected to continue increasing to $5.3 trillion in 2025. This growth is significantly driven by recovery in European and Asian markets, particularly in software and cloud-based services. Increased IT budgets in sectors like retail, manufacturing, and healthcare directly boost demand for Zebra's asset tracking and workflow automation solutions.

Rising inflation, projected around 2.7% for the US in mid-2025, and elevated interest rates create economic uncertainty, directly impacting customer technology investments and Zebra's operational expenditures. While easing monetary policies, with potential Fed rate cuts anticipated in late 2024 or early 2025, could support recovery, continued inflation may cause caution among retail and manufacturing customers regarding capital outlays. Zebra's financial performance and profitability remain sensitive to these macroeconomic pressures, influencing demand for its enterprise asset intelligence solutions. The company's Q1 2024 net sales decreased by 19.5% year-over-year, reflecting this cautious environment.

Fluctuations in manufacturing and logistics costs, influenced by global economic conditions, directly affect Zebra's gross margins; for example, freight costs saw significant volatility through late 2023 and early 2024. The company has undertaken significant efforts to improve supply chain resiliency, including renegotiating vendor agreements aiming for a 5-10% cost optimization by mid-2025, and diversifying sourcing to mitigate risks. These actions are crucial for maintaining profitability in a volatile economic environment, ensuring a stable operational framework despite ongoing global supply chain disruptions.

Foreign Currency Exchange Rates

As a global entity, Zebra Technologies' financial performance is highly susceptible to foreign currency exchange rate volatility. A substantial portion of their revenue, with international sales comprising over 50% of total sales in fiscal year 2023, exposes the company to these fluctuations. Unfavorable movements, such as a stronger US dollar, can negatively impact reported revenues and profits. For 2025, Zebra's financial outlook anticipates an ongoing unfavorable impact from foreign currency translation, potentially impacting sales growth by an estimated 100 basis points.

- Zebra's international sales represent over 50% of total revenue as of fiscal year 2023.

- Q1 2024 saw currency fluctuations negatively impact net sales by approximately 0.5 percentage points.

- The 2025 financial outlook projects an unfavorable foreign currency translation impact.

Economic Growth in Emerging Markets

Zebra Technologies targets underpenetrated markets like Japan and various developing economies, leveraging their robust economic expansion. As of early 2025, emerging and developing Asia is projected to grow by approximately 4.9%, presenting significant opportunities for increased demand. This growth fuels a greater need for automation and efficiency-enhancing technologies across manufacturing, logistics, and retail sectors. Zebra's strategy aligns with the rising disposable incomes and industrial modernization in these regions, bolstering its market presence.

- Emerging Asia's GDP growth is forecast at 4.9% for 2025.

- Developing economies are prioritizing digital transformation in supply chains.

- Increased investment in industrial automation is observed in countries like India and Indonesia.

- Zebra's solutions address labor shortages and efficiency needs in rapidly expanding markets.

Global IT spending is forecast to reach $5.3 trillion in 2025, providing a key tailwind for Zebra despite persistent economic caution from an anticipated 2.7% US inflation in mid-2025. Zebra's Q1 2024 net sales decreased by 19.5% year-over-year, reflecting this challenging environment. The company is actively managing supply chain costs, targeting 5-10% optimization by mid-2025, and navigating unfavorable foreign currency translation, which could impact 2025 sales growth by 100 basis points. Expanding into high-growth emerging Asian markets, projected to grow by 4.9% in 2025, presents significant opportunities.

| Economic Factor | 2024 Data | 2025 Data |

|---|---|---|

| Global IT Spending | $5 trillion (8% growth) | $5.3 trillion (projected) |

| US Inflation Rate | 2.7% (mid-2025 projection) | |

| Emerging Asia GDP Growth | 4.9% (projected) |

Preview Before You Purchase

Zebra PESTLE Analysis

The Zebra PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment.

The file you’re seeing now is the final version—ready to download right after purchase.

Sociological factors

The increasing demand for workforce automation is a significant sociological trend, directly benefiting Zebra Technologies. Businesses are prioritizing efficiency and productivity by empowering frontline workers with advanced technology, driving this trend. This includes mobile devices and real-time data solutions, with global spending on digital transformation projected to reach $3.4 trillion by 2026, indicating sustained investment. Companies are actively seeking ways to streamline operations and gain a competitive edge, making solutions like Zebra's crucial for optimizing labor efficiency.

Modern workforce management trends emphasize employee well-being, flexibility, and overall experience. Zebra's solutions, such as mobile computing and scanning devices, significantly reduce manual, repetitive tasks, making jobs easier and more efficient for frontline workers. This directly contributes to a better work environment, with a 2024 Gallup report indicating that organizations with high employee engagement achieve 23% higher profitability. Companies are increasingly investing in technologies that support their workforce, recognizing that an enhanced employee experience drives operational success and talent retention.

The sustained growth of the on-demand economy and e-commerce has dramatically increased the demand for efficient logistics and order fulfillment. This societal shift in purchasing habits directly fuels the need for Zebra's products, such as barcode scanners, mobile computers, and RFID solutions, which are essential for modern warehousing and retail operations. Global e-commerce sales are projected to exceed $7 trillion in 2025, driving the need for sophisticated inventory and supply chain visibility. This rapid expansion of online retail is a significant catalyst for the Automatic Identification and Data Capture (AIDC) market.

Dynamic Career Paths and Skills Development

Today's workforce navigates dynamic career paths, with continuous upskilling and reskilling becoming essential due to the accelerating integration of AI and automation. Zebra's solutions, such as advanced robotics and intelligent automation, fundamentally change operational roles across industries, demanding employees adapt to new technology-assisted workflows. This shift necessitates the development of new proficiencies, impacting over 85 million jobs globally by 2025 as roles evolve, according to recent projections.

- By 2025, an estimated 50% of all employees will need reskilling due to automation.

- Companies are projected to increase spending on digital transformation by 15-20% through 2024-2025.

- Zebra's enterprise asset intelligence tools require workers to master data analytics and system integration.

- Over 70% of businesses surveyed plan to invest more in AI-driven automation by 2025.

Diversity, Equity, and Inclusion (DEI) in the Workplace

Societal expectations strongly emphasize diverse, equitable, and inclusive workplaces, a trend significantly impacting corporate strategy as of 2024. Zebra Technologies actively champions DEI, reflected in its recognition as a Best Place to Work for Disability Inclusion, achieving a 100% score on the 2023-2024 Disability Equality Index. This commitment bolsters Zebra's brand reputation, attracting a broader talent pool and resonating with customers who prioritize partnering with socially responsible organizations. Embracing diversity can lead to enhanced innovation and a more engaged workforce, directly influencing long-term business performance and market perception.

- Zebra scored 100% on the 2023-2024 Disability Equality Index.

- Companies with high DEI scores often see increased talent attraction and retention rates.

- A strong DEI focus enhances brand reputation among conscious consumers and investors.

Societal shifts towards workforce automation and digital transformation, with global spending projected to reach $3.4 trillion by 2026, directly boost demand for Zebra's efficiency solutions. The growing on-demand economy, projected to push e-commerce sales beyond $7 trillion in 2025, fuels the need for sophisticated logistics and inventory management. Furthermore, the evolving workforce requires significant reskilling, with 50% of employees needing new proficiencies by 2025 due to AI and automation integration. Zebra's commitment to DEI also aligns with societal expectations, enhancing brand reputation and talent attraction.

| Sociological Factor | Impact on Zebra | 2024/2025 Data Point |

|---|---|---|

| Workforce Automation Demand | Increased adoption of AIDC solutions | Digital transformation spending: $3.4T by 2026 |

| E-commerce Growth | Higher demand for logistics tech | Global e-commerce sales: >$7T in 2025 |

| Workforce Reskilling | Need for adaptive tech & training | 50% of employees need reskilling by 2025 |

| DEI Expectations | Enhanced brand and talent appeal | Zebra's 2023-2024 Disability Equality Index Score: 100% |

Technological factors

Zebra Technologies is heavily investing in and benefiting from the rapid advancements in Artificial Intelligence and machine vision. The 2021 acquisition of Photoneo significantly enhanced its capabilities in 3D machine vision, opening new applications in manufacturing and transportation automation. By 2025, Zebra is integrating AI-powered analytics and generative AI agents into its solutions. These tools provide customers with more intelligent forecasting and decision-making capabilities, boosting operational efficiency across various industries.

The expansion of the Internet of Things (IoT) and edge computing is pivotal for Zebra's Enterprise Asset Intelligence vision. These technologies are crucial for connecting and optimizing assets and frontline workers at the operational edge, delivering the real-time data visibility central to Zebra's solutions. The global enterprise IoT market, projected to reach over $600 billion by 2025, represents a substantial growth opportunity for Zebra. This trend empowers businesses to enhance efficiency and decision-making through connected operational insights.

Continuous innovation in Automatic Identification and Data Capture (AIDC) technologies, especially RFID, is a critical technological driver for Zebra. The global RFID market is projected to reach approximately $15.5 billion by 2025, reflecting robust demand. Zebra remains a leader, developing next-generation RFID capabilities in its mobile computers and scanners, significantly improving tracking accuracy and operational efficiency. This advancement addresses the urgent need for real-time data in increasingly complex global supply chains, where enterprises are investing heavily to enhance visibility and reduce losses.

Adoption of 5G and Cloud Computing

The rapid rollout of 5G connectivity and the broad adoption of cloud computing are fundamentally transforming enterprise solutions, directly impacting Zebra's market. These technologies significantly enhance Zebra's mobile devices and software platforms, enabling faster data transmission and real-time processing crucial for dynamic operations in sectors like retail and logistics. For instance, global cloud spending is projected to reach over $678 billion in 2024, shifting customer IT expenditures from capital to operational costs, which influences how Zebra's solutions are purchased and deployed. This shift favors as-a-service models and subscription-based offerings, aligning with modern IT procurement trends.

- 5G networks offer peak speeds up to 10 Gbps, enabling real-time data flows critical for Zebra's mobile devices in warehouses.

- Cloud computing adoption is projected to grow by 20.4% in 2024, emphasizing OpEx over CapEx for IT infrastructure.

- Zebra's intelligent edge solutions benefit from enhanced connectivity, facilitating advanced analytics and AI at the point of activity.

- This technological evolution supports the increasing demand for automation and data-driven decision-making across industries leveraging Zebra's portfolio.

Focus on Cybersecurity

As enterprise solutions become increasingly connected, robust cybersecurity is paramount for Zebra. The company must ensure its products, from mobile computers to RFID systems, feature strong security to protect against cyberattacks and safeguard sensitive customer data.

The rising frequency and cost of cyberattacks, with global average data breach costs projected to exceed 4.5 million USD in 2024, compel businesses to significantly increase security spending. This trend makes advanced security a critical purchasing criterion for enterprise technology, directly impacting Zebra's market competitiveness.

- Global cybersecurity spending is forecast to reach approximately 215 billion USD in 2024.

- Over 80% of organizations plan to increase their cybersecurity budgets in 2025.

- Data breaches involving IoT devices, common in Zebra's ecosystem, rose by 18% in 2023.

- Customer trust in secure enterprise solutions is a key differentiator in the 2024-2025 market.

Zebra's enterprise solutions demand robust cybersecurity, as global average data breach costs are projected to exceed 4.5 million USD in 2024. This makes strong security a critical purchasing criterion for customers protecting sensitive data. Over 80% of organizations plan to increase their cybersecurity budgets by 2025, highlighting the market's emphasis on secure technology.

| Metric | 2024 Data | 2025 Outlook |

|---|---|---|

| Avg. Data Breach Cost | > $4.5M USD | Rising |

| Global Cybersecurity Spending | ~$215B USD | Increased Budgets |

| Organizations Increasing Security Budget | >80% |

Legal factors

Zebra Technologies must navigate a complex web of international data privacy laws, including Europe's GDPR and California's CCPA, which mandate strict controls over personal data collection and storage. These regulations necessitate significant compliance investments, with potential fines reaching up to 4% of global annual revenue for GDPR breaches, such as the €1.2 billion Meta fine in May 2023. Zebra has proactively implemented robust internal policies and advanced security measures to meet these evolving legal requirements, aiming to mitigate substantial financial and reputational risks. Continued adherence is crucial as new privacy legislation emerges globally in 2024 and 2025.

Zebra Technologies' extensive global operations are significantly impacted by evolving import/export laws and trade compliance regulations across various jurisdictions. Fluctuations in trade policies, including customs duties and tariffs, directly influence the company's financial performance. For instance, ongoing trade tensions, particularly between the U.S. and China through early 2025, necessitated adjustments to Zebra's supply chain and pricing strategies to mitigate increased costs and maintain competitive positioning.

Protecting its innovations through patents and other intellectual property rights is crucial for maintaining Zebra's competitive advantage in 2024. The company actively invests in research and development, with R&D expenses reaching approximately $208 million for the nine months ending September 30, 2023, reflecting ongoing efforts to file for new technology patents. Safeguarding unique solutions in areas like RFID, barcode scanning, and printing technologies is paramount. Navigating complex international IP law is essential for protecting these valuable assets across global markets, minimizing infringement risks.

Product and Manufacturing Regulations

Zebra Technologies hardware products face extensive product compliance and safety regulations across global markets. This includes stringent electronics safety standards, such as UL and CE certifications, which are crucial for market entry, alongside strict rules on manufacturing materials like the EU RoHS Directive 3.0, updated for 2024. Adherence to these legal requirements significantly influences product design and development cycles, often adding to compliance costs, which in 2024 are projected to average 0.5% to 1.5% of product revenue for complex electronics.

- UL and CE certifications are mandatory for market access, impacting design significantly.

- EU RoHS Directive 3.0 (2024) dictates material restrictions, requiring supply chain transparency.

- Compliance costs for electronics are estimated at 0.5%-1.5% of product revenue in 2024.

Labor and Employment Laws

As a global technology provider, Zebra Technologies must rigorously adhere to diverse labor and employment laws across its operating jurisdictions, encompassing working conditions, employee rights, and workplace safety standards. Non-compliance can lead to significant financial penalties, with fines for labor law violations potentially reaching millions of dollars annually, impacting a company's profitability. For instance, the average cost of a single employee lawsuit can exceed $100,000, underscoring the necessity for robust compliance frameworks. AI-driven platforms are increasingly vital, helping Zebra navigate complex regulatory landscapes by automating compliance checks and monitoring global labor law changes through 2025.

- Global labor law compliance costs are projected to rise by 5-7% in 2024-2025 due to increased regulatory scrutiny and new legislation.

- Companies leveraging AI for compliance can reduce legal expenditures by up to 30% by 2025, mitigating risk exposure.

- Workplace safety regulations are becoming more stringent, with OSHA fines for serious violations increasing to over $16,000 per violation in 2024.

Zebra Technologies strictly adheres to global anti-corruption and anti-bribery laws, including the FCPA and UK Bribery Act. Increased enforcement in 2024-2025 necessitates robust compliance programs and training. Violations can lead to significant fines, potentially exceeding $1 billion for major corporations, and severe reputational damage. Maintaining ethical business practices is critical for global market access.

| Legal Area | 2024-2025 Trend | Impact on Zebra |

|---|---|---|

| Anti-Corruption/Bribery | Increased global enforcement | Higher compliance costs, reputation risk |

| Data Privacy | New global regulations (e.g., US state laws) | Compliance investments, potential fines |

| Trade Compliance | Evolving tariffs/sanctions | Supply chain adjustments, cost volatility |

Environmental factors

Governments, particularly within the EU, are implementing stricter regulations like the Packaging and Packaging Waste Regulation (PPWR), which became effective in 2024 and aims for all packaging to be recyclable by 2030. These rules mandate increased use of recyclable materials, enhanced product durability, and easier disassembly to foster a circular economy. Such shifts compel Zebra to innovate its product design and manufacturing processes, considering the entire lifecycle of its enterprise devices. Compliance costs and design changes are significant, with the global e-waste volume projected to reach 74.7 million metric tons by 2030, emphasizing the urgency for sustainable practices.

Regulations like the EU RoHS Directive 2011/65/EU and REACH Regulation (EC) No 1907/2006 significantly restrict hazardous substances in electronics. Zebra Technologies must ensure its products and extensive supply chain comply with these evolving material restrictions, including growing rules around PFAS chemicals. Rigorous tracking and documentation are essential for Zebra to maintain market access across key regions, particularly as the global market for electronic components is projected to exceed $500 billion by 2025. Non-compliance could result in substantial fines, potentially reaching millions of euros, and product recalls, impacting Zebra's revenue and reputation.

Increasing governmental and stakeholder pressure demands reduced greenhouse gas emissions and enhanced energy efficiency in manufacturing and operations by 2025. Zebra Technologies aims to cut its Scope 1 and 2 emissions by 25% by 2030 from a 2017 baseline, reporting progress annually in its Corporate Social Responsibility reports. This focus on decarbonization is driven by evolving regulatory requirements, such as potential EU Green Deal mandates, and a strong commitment to corporate social responsibility, influencing supply chain partnerships. Zebra's efforts include optimizing logistics and adopting more sustainable materials.

Sustainable Manufacturing and Resource Conservation

The global push for sustainable manufacturing is a significant environmental factor, emphasizing reduced water and energy consumption. The semiconductor and electronics sectors, where Zebra operates, are inherently resource-intensive, consuming substantial raw materials and energy. Zebra Technologies is actively addressing this by focusing on resource conservation within its operations and supply chain to minimize its environmental footprint. Their initiatives aim to improve energy efficiency and reduce waste across their global facilities by 2025.

- Zebra aims for 15% absolute reduction in Scope 1 and 2 GHG emissions by 2025 from a 2019 baseline.

- The company targets a 15% reduction in absolute water withdrawal by 2025.

- Over 90% of Zebra's manufacturing partners are ISO 14001 certified for environmental management.

- Zebra's 2024 product designs prioritize energy efficiency, aligning with ENERGY STAR standards where applicable.

Extended Producer Responsibility (EPR)

Extended Producer Responsibility (EPR) laws are expanding globally, making manufacturers like Zebra increasingly accountable for the end-of-life management of their products. These regulations, prominent in regions such as the EU and parts of North America, require companies to plan for and often finance product take-back systems and recycling programs. This legal trend directly impacts Zebra's product design, encouraging the integration of more sustainable and recyclable materials to comply with evolving 2024/2025 environmental standards. Compliance costs and resource allocation for these programs are growing considerations for Zebra's operational strategy.

- Zebra's 2024 sustainability efforts likely include enhanced material traceability for EPR compliance.

- Increased investment in circular economy initiatives is anticipated due to expanding EPR frameworks.

- EPR costs may influence product pricing and supply chain decisions in 2025.

- Designing products for easier disassembly and recycling becomes critical for future compliance.

Environmental factors significantly impact Zebra, driven by escalating global regulations like the EU's PPWR and RoHS, mandating sustainable product design and material restrictions by 2025. The company faces pressure to cut Scope 1 and 2 emissions by 25% by 2030 and reduce water withdrawal by 15% by 2025, alongside growing Extended Producer Responsibility laws. This necessitates substantial investment in resource conservation, supply chain compliance, and circular economy initiatives to manage rising e-waste volumes projected to reach 74.7 million metric tons by 2030, ensuring market access and avoiding millions in non-compliance fines.

| Metric | 2024/2025 Target/Status | Impact on Zebra |

|---|---|---|

| GHG Emissions Reduction (Scope 1 & 2) | 15% absolute reduction by 2025 (from 2019 baseline) | Requires energy efficiency and operational changes. |

| Water Withdrawal Reduction | 15% absolute reduction by 2025 | Focus on water conservation in manufacturing. |

| E-waste Volume Projection | 74.7 million metric tons globally by 2030 | Drives EPR compliance and product recyclability efforts. |

| Manufacturing Partner Certifications | Over 90% ISO 14001 certified | Ensures environmental management across supply chain. |

| Electronic Components Market Value | Exceeds $500 billion by 2025 | Influences sustainable material sourcing and compliance costs. |

PESTLE Analysis Data Sources

Our Zebra PESTLE Analysis draws on a diverse range of data, including official government reports, economic indicators from institutions like the World Bank, and up-to-date market research from industry-specific firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Zebra Technologies.