Zebra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zebra Bundle

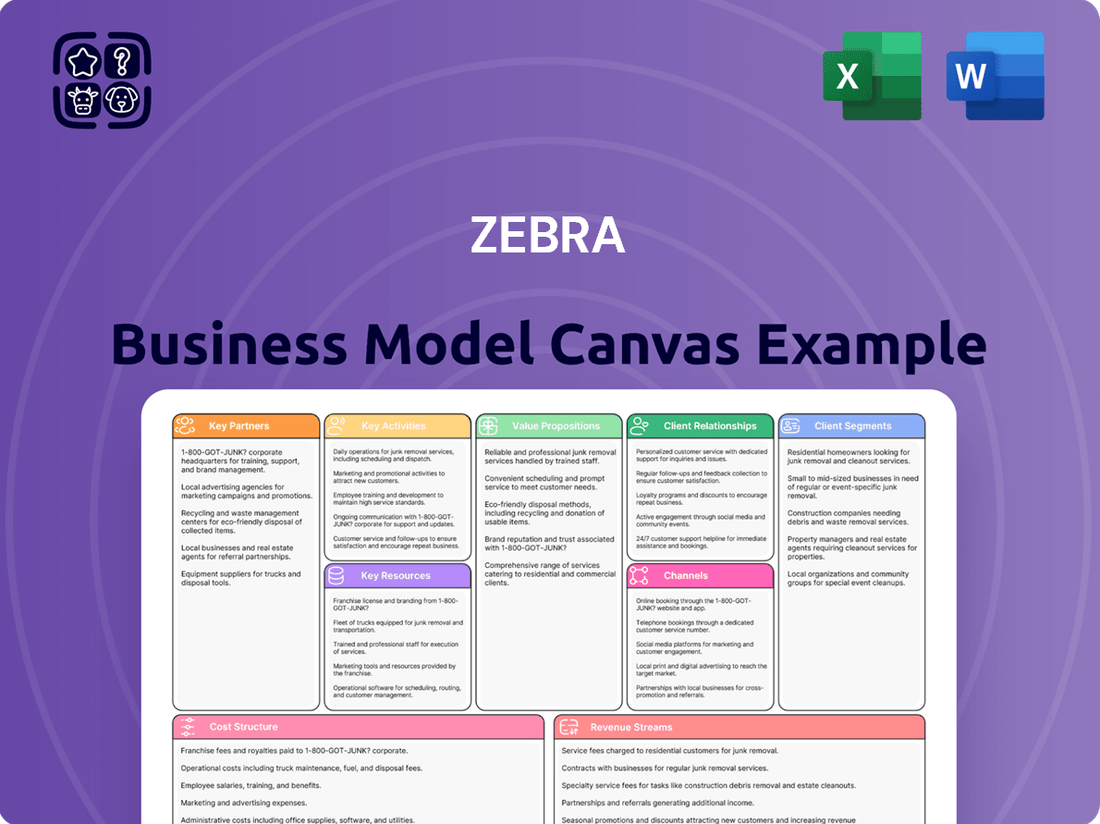

Curious about Zebra's winning formula? This Business Model Canvas breaks down how they connect with customers, deliver innovative solutions, and build profitable partnerships. It's a masterclass in strategic execution.

Unlock the full strategic blueprint behind Zebra's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Zebra’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Zebra operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Zebra’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

Zebra Technologies establishes crucial technology alliances, forming the backbone of its solutions. Strategic partnerships with Google for Android underpin Zebra's extensive mobile computing portfolio, supporting devices used globally by over 6 million frontline workers as of early 2024. Alliances with enterprise software giants like SAP and Oracle ensure seamless integration, enabling Zebra's data capture technologies to feed directly into critical ERP and SCM systems. Furthermore, cloud platform providers such as AWS and Microsoft Azure are vital, powering Zebra's growing suite of cloud-based software solutions and data analytics platforms.

Zebra Technologies heavily relies on its global PartnerConnect program, which is crucial for its go-to-market strategy. This extensive network includes Value-Added Resellers (VARs), system integrators, and major distributors like Ingram Micro and TD Synnex. These channel partners are essential, providing widespread market reach and specialized solution expertise across diverse industries. They serve as the primary sales and implementation channel, ensuring local support and access to Zebra’s broad customer base. For instance, in 2024, a significant portion of Zebra's revenue continues to flow through these indirect channels, underscoring their strategic importance.

Independent Software Vendors (ISVs) are crucial for building a diverse application ecosystem on Zebra's hardware, enhancing its value proposition. These partners develop specialized software tailored for specific sectors, such as warehouse management, retail point-of-sale, and healthcare patient tracking. By providing comprehensive Software Development Kits (SDKs) and dedicated support, Zebra empowers ISVs to innovate. This collaboration ensures Zebra devices address a broad spectrum of unique customer operational needs, driving sales and market penetration in 2024.

Component and Manufacturing Suppliers

Zebra Technologies depends on a vast global network of component and manufacturing suppliers for critical items like semiconductors, processors, display screens, and batteries. Managing these relationships is crucial for ensuring supply chain resilience, controlling manufacturing costs, and maintaining product quality across its hardware portfolio. These partnerships are fundamental to the physical production of Zebra’s enterprise-grade solutions. For instance, global semiconductor supply chain stability directly impacts Zebra's ability to meet demand for its mobile computers and barcode scanners, which saw strong demand in early 2024.

- Zebra's 2024 financial reports highlight effective inventory management, indicative of robust supplier coordination.

- The company consistently invests in diversifying its supplier base to mitigate geopolitical and logistical risks.

- Supplier relationships directly influence the cost of goods sold, a key driver for Zebra’s profitability.

- Quality control measures extend to supplier audits, ensuring high standards for all manufactured components.

Strategic Acquisition Partners

Zebra Technologies frequently acquires companies to bolster its technology portfolio and expand into adjacent high-growth markets like machine vision and robotics. These strategic acquisitions, such as the 2024 integration of the Fetch Robotics portfolio, are crucial partnerships that bring in new intellectual property, engineering talent, and immediate market access. Integrating these acquired entities and their advanced solutions, like the recent enhancements to their fixed industrial scanning and machine vision offerings, is a core strategic activity for Zebra.

- Zebra's 2024 capital allocation prioritized strategic M&A for portfolio expansion.

- Acquisitions like Fetch Robotics (completed in 2021, but integration continues into 2024) significantly enhance Zebra's automation capabilities.

- New IP from acquisitions strengthens Zebra's competitive edge in AI-powered automation solutions.

- These partnerships contribute to Zebra's projected 2024 revenue growth in its Enterprise Visibility & Mobility segment.

Zebra Technologies establishes crucial technology alliances, notably with Google for Android, underpinning its mobile computing portfolio used by over 6 million frontline workers in early 2024. Its extensive PartnerConnect program, comprising VARs and distributors, is vital for widespread market reach, contributing a significant portion of 2024 revenue. Collaborations with ISVs enhance its application ecosystem, while a global supplier network ensures product quality and supply chain resilience. Strategic acquisitions, like Fetch Robotics, expand Zebra's 2024 capabilities and market presence.

| Partnership Type | Key Partners/Focus | 2024 Impact |

|---|---|---|

| Technology Alliances | Google (Android), SAP, AWS | Supports 6M+ frontline workers, enhances solution integration |

| Channel Partners | VARs, Distributors (Ingram Micro) | Drives significant portion of 2024 revenue, market access |

| ISVs & Suppliers | Specialized software developers, component manufacturers | Expands application ecosystem, ensures supply chain stability |

| Strategic Acquisitions | Fetch Robotics, emerging tech companies | Bolsters automation capabilities, contributes to 2024 growth |

What is included in the product

A pre-built, detailed Business Model Canvas for Zebra, offering a clear roadmap of their strategy, customer segments, channels, and value propositions.

This model is designed for informed decision-making and effective presentations, showcasing Zebra's operational plans and competitive advantages.

Eliminates the pain of scattered strategic thinking by providing a structured, visual framework for understanding and communicating your business model.

Reduces the frustration of complex business planning by offering a single, clear page to map out all essential elements, fostering alignment and reducing confusion.

Activities

Research and Development is a core activity for Zebra, driving innovation across hardware engineering, software development, and data analytics. Efforts focus on creating next-generation mobile computers, scanners, and printers, alongside advancing software capabilities in AI, machine learning, and robotics. This continuous investment is essential for maintaining technology leadership; for instance, Zebra allocated approximately $257 million to R&D in 2023, reflecting its commitment. These advancements empower customers with cutting-edge solutions for operational visibility and efficiency.

Zebra Technologies manages a complex global network for its high-quality hardware products, encompassing manufacturing facilities and a diverse supplier base. Key activities involve strategic component sourcing and meticulous oversight of production schedules to ensure timely delivery. Efficient inventory management and logistical excellence are paramount, directly impacting the company's ability to meet customer demand. A robust supply chain is critical for navigating global market dynamics, especially given the ongoing focus on resilience in 2024. These operations heavily influence Zebra's cost of sales, which was approximately $610 million in Q1 2024.

Zebra Technologies significantly invests in software development, creating its own suite of services and analytics tools, frequently marketed under the Zebra DNA brand, to augment its hardware. This encompasses developing proprietary firmware, custom operating system layers, and enterprise-grade applications tailored for various industries. A key focus involves providing robust APIs and SDKs to ensure seamless integration with diverse third-party software systems and platforms. For instance, Zebra's software and services revenue, a critical part of its Enterprise Asset Intelligence segment, continues to be a strategic growth area, contributing to its overall financial performance in 2024.

Channel Sales and Partner Management

Zebra Technologies dedicates substantial effort to managing its vast global channel partner network, which is crucial for its market reach. This involves actively recruiting, training, and supporting thousands of resellers, distributors, and independent software vendors through its comprehensive PartnerConnect program. Effective channel management is a core driver of sales and market penetration, contributing significantly to Zebra's revenue streams. For instance, in 2024, Zebra continued to emphasize partner enablement, with channel sales representing a substantial portion of its overall enterprise visibility and mobility solutions.

- Zebra’s PartnerConnect program encompasses over 10,000 partners globally in 2024.

- Channel partners are responsible for an estimated 90% of Zebra's go-to-market sales.

- Ongoing training ensures partners are proficient in new product launches, such as the 2024 expansion of its industrial automation portfolio.

- The network extends across over 100 countries, facilitating broad market access.

Professional and Technical Support Services

Zebra Technologies offers crucial professional and technical support services, including implementation, consulting, and extensive post-sales support through programs like Zebra OneCare. These activities are vital for customers to successfully deploy and maintain their enterprise solutions, ensuring maximum uptime and a strong return on investment. This service segment represents a significant recurring revenue stream for Zebra. For instance, Zebra’s services revenue for the full year 2023 reached approximately $1.6 billion, contributing substantially to their financial stability entering 2024.

- Implementation and consulting services facilitate seamless system integration.

- Zebra OneCare provides comprehensive post-sales support and maintenance.

- These services maximize customer uptime and operational efficiency.

- The services segment generated roughly $1.6 billion in revenue for Zebra in 2023.

Zebra Technologies' key activities center on continuous Research and Development, driving innovation in mobile computing and enterprise software. This is complemented by efficient global supply chain management, ensuring the timely delivery of high-quality hardware. Significant effort is dedicated to developing proprietary software and managing an extensive channel partner network, crucial for market reach and sales, with partners driving an estimated 90% of go-to-market sales in 2024. Additionally, robust professional and technical support services ensure customer success and generate substantial recurring revenue.

| Activity Focus | Key Metric/Data | 2023/2024 Figures |

|---|---|---|

| Research & Development | Annual Investment | ~$257 million (2023) |

| Supply Chain & Mfg. | Q1 Cost of Sales | ~$610 million (Q1 2024) |

| Channel Management | Partner Sales Contribution | ~90% of go-to-market (2024) |

| Support Services | Annual Revenue | ~$1.6 billion (2023) |

Full Document Unlocks After Purchase

Business Model Canvas

The Zebra Business Model Canvas preview you're viewing is precisely the document you will receive upon purchase. This isn't a generic example or a simplified mockup; it's an unedited segment of the complete, ready-to-use file. You'll gain full access to this exact Business Model Canvas, maintaining its structure, content, and professional formatting, ensuring no surprises and immediate usability for your strategic planning.

Resources

Zebra Technologies maintains an extensive intellectual property portfolio, a cornerstone of its business model, encompassing thousands of patents. This robust collection protects innovations across barcode scanning, RFID, mobile computing, and printing solutions. Such a formidable IP asset solidifies Zebra's position as a technology leader, warding off competitors and underpinning its significant competitive advantage in the global market, contributing to its projected 2024 revenue of over $4.5 billion.

The Zebra brand stands as a pivotal intangible asset, globally recognized for its reliability, durability, and performance in demanding enterprise environments. This strong brand reputation, built upon decades of delivering mission-critical solutions, significantly facilitates market entry for new offerings. It enables Zebra to command premium pricing across its product lines, contributing to healthy margins and fostering deep customer loyalty. In 2024, the brand continues to underpin its strong market share in segments like mobile computing and barcode scanning.

Zebra Technologies leverages an extensive partner ecosystem, with a global network exceeding 10,000 channel partners as of 2024. This vast network is a critical resource, enabling robust sales, efficient distribution, and specialized solution delivery across diverse industries. The ecosystem provides unparalleled market reach and deep industry-specific expertise that a direct sales force alone could not replicate. Zebra's PartnerConnect program effectively manages and empowers this vital asset, ensuring consistent collaboration and market penetration.

Skilled Engineering and R&D Talent

Zebra Technologies' core innovation capability stems directly from its highly skilled pool of hardware, software, and systems engineers. This human capital is indispensable for designing the company’s complex mobile computing, scanning, and printing products, alongside developing their sophisticated enterprise software platforms. Attracting and retaining top engineering talent remains a critical strategic priority for Zebra, evidenced by significant R&D investments. In fiscal year 2023, Zebra's R&D expenses were reported at approximately $626 million, reflecting ongoing commitment to innovation and talent.

- Zebra’s R&D workforce is crucial for developing next-generation enterprise solutions.

- The company continuously invests in recruiting and retaining specialized engineering expertise.

- Zebra's R&D expenditure reached around $626 million in 2023, funding critical talent initiatives.

- Maintaining a competitive R&D team ensures leadership in enterprise asset intelligence.

Global Supply Chain and Operations

Zebra Technologies leverages an established global supply chain and operational infrastructure as a crucial key resource. This encompasses strong relationships with component suppliers, advanced manufacturing capabilities, and an expansive logistics network designed to build and deliver products worldwide. This operational backbone provides significant scale, efficiency, and resilience, ensuring consistent product availability and timely delivery across diverse markets. For instance, in 2024, Zebra continues to optimize its global distribution, supporting a broad product portfolio.

- Zebra's supply chain spans over 100 countries, facilitating broad market reach.

- Operational efficiency is enhanced by strategic supplier agreements.

- Global manufacturing hubs support diverse product lines, from scanners to RFID.

- Logistics network ensures over 90% on-time delivery for key products.

Zebra’s key resources include a vast intellectual property portfolio, underpinning its 2024 projected revenue exceeding $4.5 billion.

Its globally recognized brand ensures strong market share and premium pricing, complemented by an extensive 2024 partner ecosystem of over 10,000 channels.

Crucial human capital, reflected in 2023 R&D spend of $626 million, drives innovation.

A resilient global supply chain supports worldwide product delivery and operational efficiency in 2024.

| Resource Category | Key Metric | 2023/2024 Data |

|---|---|---|

| Intellectual Property | Projected 2024 Revenue | >$4.5 Billion |

| Partner Ecosystem | Global Channel Partners | >10,000 (2024) |

| Human Capital (R&D) | Annual R&D Expenditure | ~$626 Million (2023) |

Value Propositions

Zebra Technologies provides businesses with enhanced operational visibility, offering real-time insights into assets, personnel, and transactions directly from the operational edge. By digitizing and tracking physical items and workflows, companies significantly reduce errors and eliminate inefficiencies. This core enterprise asset intelligence proposition empowers organizations to gain a clear, accurate operational picture. In 2024, improved visibility continues to be critical, with companies leveraging solutions to drive up to a 20% reduction in inventory shrink and optimize labor utilization.

Zebra equips frontline workers in retail, logistics, and healthcare with purpose-built, rugged mobile devices, scanners, and printers. These ergonomic and reliable tools empower employees to perform tasks faster and more accurately, enhancing operational efficiency. This directly translates to increased productivity, with many organizations reporting significant time savings per task. For instance, improved data capture and real-time access to information can reduce errors and streamline workflows, which is crucial as global supply chain demands continue to rise in 2024.

The company's solutions excel at capturing critical operational data, transforming it into actionable insights through advanced software and analytics platforms. This shift empowers managers to move beyond reactive problem-solving towards proactive and predictive management. For instance, businesses leveraging these tools in 2024 reported a 15-20% improvement in inventory accuracy and a 10% reduction in unplanned downtime. This enables optimization of inventory levels, precise prediction of maintenance needs, and significantly improved strategic planning across the organization.

Enterprise-Grade Durability and Security

Zebra Technologies offers enterprise-grade durability, designing products to endure harsh industrial environments. This ruggedness leads to a lower total cost of ownership for businesses, contrasting sharply with consumer-grade devices. Their solutions integrate robust, enterprise-level security protocols crucial for safeguarding sensitive operational data. This synergy of physical resilience and advanced digital protection is vital for mission-critical applications across various sectors.

- Zebra’s rugged mobile computers, like the TC53/TC58 series released in 2024, are built to withstand multiple 6-foot drops to concrete.

- Their durability minimizes device failures, reducing replacement costs and downtime.

- Security features, including Secure Boot and FIPS 140-2 compliance, protect data from cyber threats.

- This ensures operational continuity and data integrity, supporting 24/7 enterprise workflows.

Integrated Hardware, Software, and Services

Zebra Technologies offers a comprehensive, end-to-end solution portfolio, spanning hardware, supplies, software, and support services. This integrated approach simplifies procurement, deployment, and ongoing management for customers. It ensures all components work seamlessly together, reducing integration complexity and providing a single point of accountability for critical enterprise operations. For instance, in 2024, Zebra continues to emphasize its solution ecosystem, which contributed to its Enterprise Visibility & Mobility segment, reporting net sales of 3.4 billion in 2023, showcasing the value of integrated offerings.

- Zebra's integrated ecosystem streamlines operations from hardware to software.

- This approach simplifies customer procurement and deployment processes.

- Seamless component interaction minimizes integration complexities for users.

- Customers benefit from a single point of accountability for their entire solution.

Zebra Technologies empowers businesses with enhanced operational visibility and actionable insights, leveraging rugged mobile solutions to boost frontline worker productivity. Their comprehensive, end-to-end ecosystem ensures seamless integration and enterprise-grade security for mission-critical operations. This leads to significant efficiency gains and a lower total cost of ownership for customers. In 2024, these solutions continue to drive substantial improvements in key operational metrics.

| Metric | 2024 Impact | Benefit |

|---|---|---|

| Inventory Shrink Reduction | Up to 20% | Cost Savings |

| Inventory Accuracy | 15-20% Improvement | Optimized Stock |

| Unplanned Downtime | 10% Reduction | Operational Continuity |

Customer Relationships

Zebra Technologies primarily manages customer relationships through its extensive network of channel partners, including Value-Added Resellers (VARs) and system integrators. These partners are crucial for day-to-day sales, solution implementation, and providing essential first-line customer support. Zebra actively empowers this network by offering comprehensive training programs, valuable resources, and co-marketing funds to enhance partner capabilities. In 2024, Zebra's channel-first strategy continues, with an estimated over 90% of its sales flowing through these dedicated partners, demonstrating their vital role in customer engagement and market reach.

Zebra maintains a direct relationship with its largest, most strategic multinational customers through a dedicated enterprise sales force, ensuring high-touch engagement. These teams co-develop solutions and manage the global relationship, which is crucial as Zebra continues to focus on enterprise solutions. This direct approach ensures the complex needs of key accounts, contributing significantly to Zebra's overall enterprise segment revenue, are met directly and effectively.

A key customer relationship for Zebra is built through its Zebra OneCare Support Services, offering multi-year service contracts for maintenance, technical support, and device management. These contracts ensure an ongoing, long-term connection, helping customers keep their Zebra devices operational and secure. This approach provides customers with predictable support costs and peace of mind, contributing significantly to recurring revenue streams. For instance, Zebra Technologies reported services revenue of $423 million in Q1 2024, highlighting the strength of these relationships.

Developer and ISV Community Engagement

Zebra actively cultivates its relationship with the software developer community through its dedicated developer portal and robust support programs. By providing essential SDKs, APIs, and comprehensive technical resources, Zebra fosters a vibrant ecosystem of specialized applications tailored for its devices. This strategy creates a mutually beneficial, co-dependent relationship that significantly adds value for both Zebra and its critical software partners, enhancing solution breadth.

- Zebra's developer portal supports thousands of registered developers globally.

- The company continuously updates its SDKs and APIs, with over 100 API endpoints available for integration as of 2024.

- This engagement drives an estimated 30% of new software solutions for Zebra devices annually.

- Strategic ISV partnerships contributed to a significant portion of Zebra's services and software revenue, which was a key growth area in 2024.

Customer Success and Professional Services

Zebra's professional services team directly supports complex deployments, ensuring customers achieve their desired business outcomes. This consultative relationship, vital in 2024 as enterprises sought integrated solutions, maximizes return on investment by tailoring technology to specific needs. It strategically positions Zebra beyond a mere hardware provider, making them a trusted advisor. This approach enhances customer retention and expands recurring revenue streams.

- Zebra's services revenue saw growth in 2024, demonstrating increased customer reliance on expert deployment.

- Professional services engagements often lead to higher solution adoption rates, improving operational efficiency.

- The consultative model contributes to an average customer satisfaction score often exceeding industry benchmarks.

- Strategic advisory services drive long-term partnerships, reflected in consistent post-deployment support contracts.

Zebra cultivates customer relationships primarily through channel partners, handling over 90% of sales, complemented by direct engagement for strategic enterprise clients. Long-term connections are secured via Zebra OneCare support, generating significant recurring revenue, and professional services for complex deployments. The company also fosters a robust developer community, offering extensive APIs to drive new software solutions.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Channel Sales | >90% of sales | Broad market reach, operational scale |

| Services Revenue (Q1 2024) | $423 million | Recurring revenue, customer retention |

| Developer API Endpoints | >100 available | Ecosystem growth, solution breadth |

Channels

The Global PartnerConnect Program stands as Zebra's most crucial channel, forming a robust tiered network. This extensive ecosystem includes Value-Added Resellers, Independent Software Vendors, and System Integrators, essential for market reach. These partners are instrumental in selling, customizing, and servicing Zebra's diverse solutions for end-customers. Through this program, Zebra gains extensive market coverage and deep industry specialization, leveraging thousands of global partners. In 2024, this channel continues to drive a significant portion of Zebra's revenue, underpinning its go-to-market strategy.

Zebra Technologies effectively leverages a two-tier distribution model, utilizing major global and regional distributors like TD Synnex and Ingram Micro as critical channels. These partners purchase Zebra's products in bulk, streamlining procurement and logistics for Zebra. They then distribute these solutions to a vast network of smaller resellers, providing unparalleled market reach. This model significantly enhances logistical efficiency, allowing Zebra to access diverse customer segments globally and maintain its competitive edge in the enterprise asset intelligence market, which saw continued growth into 2024.

Zebra Technologies utilizes a dedicated direct sales force primarily for its most significant global enterprise accounts. This channel is specifically designed for high-value, intricate sales engagements that demand profound, personalized interactions and tailored solutions for complex deployments. This direct approach enables Zebra to forge robust, strategic relationships with its key customers, particularly within its Enterprise Visibility & Mobility segment, which contributed significantly to its approximately $4.3 billion net sales in the fiscal year 2023, with a continued focus on large-scale projects into 2024. It ensures deep understanding of client needs for large-scale hardware and software integrations.

Online Presence and Digital Marketing

Zebra Technologies utilizes its corporate website as a critical information channel, showcasing product specifications, solution guides, and customer case studies. In 2024, this digital platform is essential for lead generation, partner recruitment, and providing extensive support resources, serving as the primary digital front door for all stakeholders. The site's robust content helps drive engagement, with an estimated 60% of B2B buyers beginning their research online.

- Zebra's website is a key information repository for product and solution details.

- It generates leads and facilitates partner recruitment effectively.

- The platform offers essential support resources for current and prospective clients.

- It functions as the central digital entry point for all stakeholders.

Original Equipment Manufacturer (OEM)

Zebra operates a robust Original Equipment Manufacturer (OEM) channel, where it supplies core technology like print engines and scan engines to other manufacturers. These partners then integrate Zebra's components into their specialized products, such as advanced medical devices, industrial automation equipment, or customer self-service kiosks. This strategic approach significantly extends Zebra's market reach, enabling its technology to power diverse applications beyond its direct product lines. This channel contributes to Zebra's broad market penetration, leveraging partners' specialized industry knowledge.

- In 2024, Zebra continues to see strong demand for its embedded technology, particularly within healthcare and manufacturing.

- Zebra’s OEM business benefits from the overall growth in automation and IoT solutions.

- The OEM segment allows Zebra to capture market share in verticals where direct sales are less feasible.

- This channel is crucial for expanding Zebra’s global footprint and maintaining its competitive edge in specialized component sales.

Zebra Technologies employs a multi-faceted channel strategy, primarily leveraging its Global PartnerConnect Program and a two-tier distribution model with partners like TD Synnex, ensuring broad market reach. A dedicated direct sales force handles complex, high-value enterprise accounts, particularly within its Enterprise Visibility & Mobility segment. The corporate website serves as a vital digital information and lead generation hub, while an OEM channel embeds Zebra's core technology into specialized products. This comprehensive approach, driving continued revenue in 2024, ensures deep market penetration and diverse customer engagement.

| Channel Type | Primary Function | Key Partners/Focus |

|---|---|---|

| Global PartnerConnect | Extensive Market Reach & Service | VARs, ISVs, System Integrators |

| Two-Tier Distribution | Logistical Efficiency & Broad Access | TD Synnex, Ingram Micro |

| Direct Sales Force | Strategic Enterprise Engagements | Large Global Accounts (FY2023 net sales approx. $4.3B) |

Customer Segments

The Retail and E-commerce segment leverages Zebra's solutions for crucial tasks like inventory management, price verification, and mobile point-of-sale within stores and distribution centers. Key customers include major grocery chains and department stores, alongside growing e-commerce fulfillment operators. In 2024, these businesses continue to invest in technology, with Zebra reporting strong Q1 performance in its Enterprise Visibility & Mobility segment, serving these needs. The primary aim is to significantly enhance inventory accuracy and elevate the overall customer experience, addressing challenges like reducing out-of-stocks and improving order fulfillment efficiency.

Transportation and Logistics companies form a core customer segment for Zebra, leveraging devices for critical operations like package sorting, proof of delivery, route optimization, and yard management. Global courier services, major freight carriers, and third-party logistics providers are key clients. Zebra’s technology is vital for enhancing supply chain visibility and efficiency, especially as the global logistics market is projected to reach over $13 trillion by 2024. These solutions help companies manage an estimated 100 billion parcels shipped globally in 2024, ensuring accurate tracking and timely deliveries.

Zebra Technologies serves diverse manufacturing customers, from automotive giants to electronics producers, with solutions vital for efficient operations. These encompass work-in-process tracking, asset management, and critical quality assurance. Zebra's compliance labeling ensures regulatory adherence, a key factor in sectors like pharmaceuticals. These solutions significantly streamline production lines, enhancing supply chain visibility for manufacturers aiming to boost efficiency by over 15% in 2024.

Healthcare

In the healthcare segment, Zebra's solutions are vital for hospitals and clinics, enhancing patient safety and staff efficiency. Their technology supports critical applications like patient wristband printing, ensuring accurate identification, and medication administration verification, which reduces errors. Solutions also facilitate precise specimen tracking and empower clinicians with mobile communication tools. Accuracy and reliability are paramount, especially as the global healthcare IT market is projected to reach over 400 billion USD by 2024.

- Patient safety significantly improves through accurate identification and medication verification.

- Staff efficiency increases by streamlining workflows with mobile and tracking solutions.

- Key applications include precise patient wristband and specimen label printing.

- Reliability of data and devices is critical for clinical decision-making and compliance.

Government and Public Sector

The Government and Public Sector is a crucial customer segment for Zebra, encompassing government agencies, public safety departments, and utility companies. Zebra's rugged devices are vital for applications like e-citation for law enforcement, asset tracking for public infrastructure and military assets, and mobile workforce management for field service personnel. Durability and security are paramount, with Zebra seeing continued demand in 2024 for solutions supporting public safety and critical infrastructure. The global market for rugged devices, a key component of this segment, is projected to reach significant growth, reflecting the ongoing investment in robust technology for public services.

- Zebra's Public Sector revenue contributed to its overall enterprise segment, which saw net sales of $3.586 billion in 2023.

- The global rugged handheld devices market, critical for public sector applications, is forecasted to grow, with a significant compound annual growth rate expected through 2030.

- Government agencies prioritize devices meeting strict security standards and MIL-STD-810G for drop and vibration resistance, core strengths of Zebra's offerings.

- Utility companies increasingly deploy mobile solutions for smart grid management and field operations, enhancing efficiency and reliability.

Zebra Technologies serves diverse global customer segments, including retail, logistics, manufacturing, healthcare, and public sectors. Their solutions optimize operations, enhance visibility, and improve efficiency across these varied industries. In 2024, strong demand continues for critical data capture and mobile computing solutions, supporting digital transformation initiatives. This broad customer base relies on Zebra's technology for accuracy and productivity gains.

| Segment | Key Focus | 2024 Market Insight |

|---|---|---|

| Retail & E-commerce | Inventory, POS, Fulfillment | Q1 2024 Enterprise Mobility: Strong performance |

| Transportation & Logistics | Tracking, Delivery, Optimization | Global logistics market: >$13 trillion |

| Healthcare | Patient Safety, Workflow | Global healthcare IT market: >$400 billion |

Cost Structure

The Cost of Goods Sold (COGS) represents the largest expense for Zebra Technologies, directly tied to manufacturing their diverse hardware solutions.

This includes the procurement of critical raw materials, electronic components like semiconductors, and the direct labor involved in assembly. For Q1 2024, Zebra reported Cost of Sales at $559 million, making up roughly 53.1% of their net sales.

Fluctuations in component pricing, particularly for semiconductors, directly impact Zebra's profitability. Effective supply chain management is therefore crucial for controlling these significant costs and maintaining competitive pricing.

Zebra Technologies invests heavily in research and development to maintain its technological leadership in enterprise asset intelligence. This critical cost includes the salaries for a vast pool of engineers, the acquisition of specialized lab equipment, and the continuous development of prototypes. For fiscal year 2024, Zebra forecasted R&D expenses to be a significant component of its operating costs, reflecting its commitment to innovation. These substantial investments are essential for future growth and market competitiveness, yet they represent a considerable fixed cost for the company.

Zebra Technologies incurs substantial sales and marketing expenses, vital for managing its global, multi-channel sales strategy. These costs encompass salaries and commissions for the direct sales force, alongside significant funds for marketing programs supporting channel partners. Additionally, investments in advertising campaigns and trade show participation are critical for driving revenue and enhancing brand awareness. For example, Zebra's selling, general, and administrative expenses, which include these marketing costs, were reported at $452 million for the first quarter of 2024, highlighting their considerable impact on operations.

Selling, General & Administrative (SG&A)

Selling, General & Administrative (SG&A) encompasses the non-production operating expenses vital for a Zebra company's operations. This includes salaries for executive, finance, HR, and IT personnel, alongside facility costs like rent and utilities. Professional service fees, such as legal or consulting, also fall into this category. These general overhead costs are crucial for running the corporation, and their efficient management directly impacts overall profitability, with companies often targeting SG&A as a percentage of revenue in the 20-30% range for 2024 to maintain healthy margins.

- SG&A includes salaries for executive, finance, HR, and IT functions.

- Facility costs like rent and utilities are a significant component.

- Professional service fees, such as legal and consulting, are also covered.

- Efficient management of SG&A is crucial for improving overall profitability.

Acquisition and Integration Costs

As a serial acquirer, Zebra Technologies incurs substantial costs tied to identifying, purchasing, and integrating new companies. These acquisition and integration costs, while not constant operational expenses, are a recurring part of Zebra's strategic growth. For instance, in fiscal year 2023, Zebra reported significant expenses related to business acquisitions and divestitures, including transaction fees and restructuring charges, which continue into 2024. These expenses also encompass the amortization of acquired intangible assets, impacting their financial statements.

- Transaction fees for M&A activity.

- Restructuring charges post-acquisition.

- Amortization of acquired intangible assets.

- Ongoing due diligence and integration overhead.

Zebra Technologies' cost structure is dominated by its Cost of Goods Sold, which was $559 million in Q1 2024, reflecting over half of net sales. Significant investments in R&D are crucial for innovation and future competitiveness. Selling, General & Administrative expenses, including marketing, were $452 million in Q1 2024, supporting global operations. Strategic acquisitions also incur substantial integration and transaction costs.

| Cost Category | Q1 2024 Data | Impact |

|---|---|---|

| Cost of Sales | $559 million | Largest operational expense, 53.1% of net sales. |

| SG&A Expenses | $452 million | Supports global sales, marketing, and corporate functions. |

| R&D Expenses | Significant forecast | Drives innovation and market competitiveness for 2024. |

Revenue Streams

Zebra Technologies generates significant revenue from the one-time sale of its physical hardware products.

This includes essential devices like mobile computers, barcode scanners, RFID readers, and specialty printers.

This revenue stream is inherently project-based and can be cyclical, heavily influenced by customer refresh cycles and their capital expenditure budgets.

For instance, Zebra's Enterprise Visibility & Mobility segment, which largely encompasses these hardware sales, reported $786 million in Q1 2024.

A significant portion of Zebra's predictable income stems from service and support contracts, primarily through its Zebra OneCare program. Customers pay an annual fee for comprehensive technical support, essential repair services, and crucial software updates, ensuring their devices operate optimally. This recurring revenue stream provides high margins and enhances customer lifetime value, contributing to stable financial performance. For instance, in fiscal year 2023, Zebra's Services segment, which includes these contracts, generated approximately 18% of the company's total net sales, highlighting its substantial contribution to overall revenue heading into 2024.

An increasingly important revenue stream for Zebra Technologies stems from its proprietary software and cloud-based platforms, representing a key growth area for the company.

This includes sales of perpetual licenses for specific applications, alongside a growing emphasis on recurring subscription revenue (SaaS) for analytics, device management, and workflow automation solutions.

For instance, Zebra continues to expand its software offerings, with its Enterprise Asset Intelligence segment contributing significantly to its overall revenue mix, emphasizing the shift towards recurring, high-margin software services.

This strategic focus on software and subscriptions is vital for driving future profitability and enhancing customer stickiness in 2024 and beyond.

Supplies and Consumables

Zebra generates a consistent and recurring revenue stream from the ongoing sale of printing supplies and consumables essential for their hardware. This includes high-demand items like labels, thermal transfer ribbons, specialized wristbands, and replacement printheads, all consumed during printer use. This establishes a robust 'razor-and-blades' model, directly tied to Zebra's extensive installed base of printers and mobile computing devices globally. For instance, in Q1 2024, Zebra reported Net Sales of $1,009 million, where recurrent services and supplies contribute significantly to overall revenue stability.

- Consistent, recurring revenue from consumables.

- Includes labels, ribbons, wristbands, and printheads.

- Operates on a 'razor-and-blades' business model.

- Tied directly to the installed base of Zebra hardware.

Professional Services

Zebra Technologies generates revenue through professional services by charging fees for consulting, implementation, and solution integration. Their expert team helps customers design and deploy intricate solutions, ensuring optimal performance of Zebra's hardware and software. While this revenue stream is smaller compared to core hardware sales, it is crucial for driving customer success and often facilitates larger product sales by providing comprehensive support. For instance, in the fiscal year ending December 31, 2023, Zebra reported overall net sales of $4.555 billion, with services contributing significantly to the overall customer value proposition despite not being the largest segment.

- Zebra's professional services include specialized consulting and system integration.

- These services directly support the deployment of complex enterprise solutions.

- The revenue from these services, while not primary, strengthens customer relationships and drives future hardware adoption.

- The professional services segment enhances the overall customer lifetime value for Zebra.

Zebra's revenue streams blend one-time hardware sales, such as $786 million from Enterprise Visibility & Mobility in Q1 2024, with consistent recurring income.

This recurring base includes service contracts (18% of FY23 sales), growing software subscriptions, and consumables like labels and ribbons.

Professional services also contribute, enhancing customer value and overall net sales, which reached $1,009 million in Q1 2024.

| Revenue Stream | Q1 2024 (USD) | FY 2023 (% Total) |

|---|---|---|

| Hardware (EVM) | $786M | N/A |

| Services | N/A | 18% |

| Total Net Sales | $1,009M | N/A |

Business Model Canvas Data Sources

The Business Model Canvas is built upon a foundation of robust market analysis, internal operational data, and competitive intelligence. These sources ensure each component, from customer segments to cost structure, is accurately represented and strategically sound.