Zebra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zebra Bundle

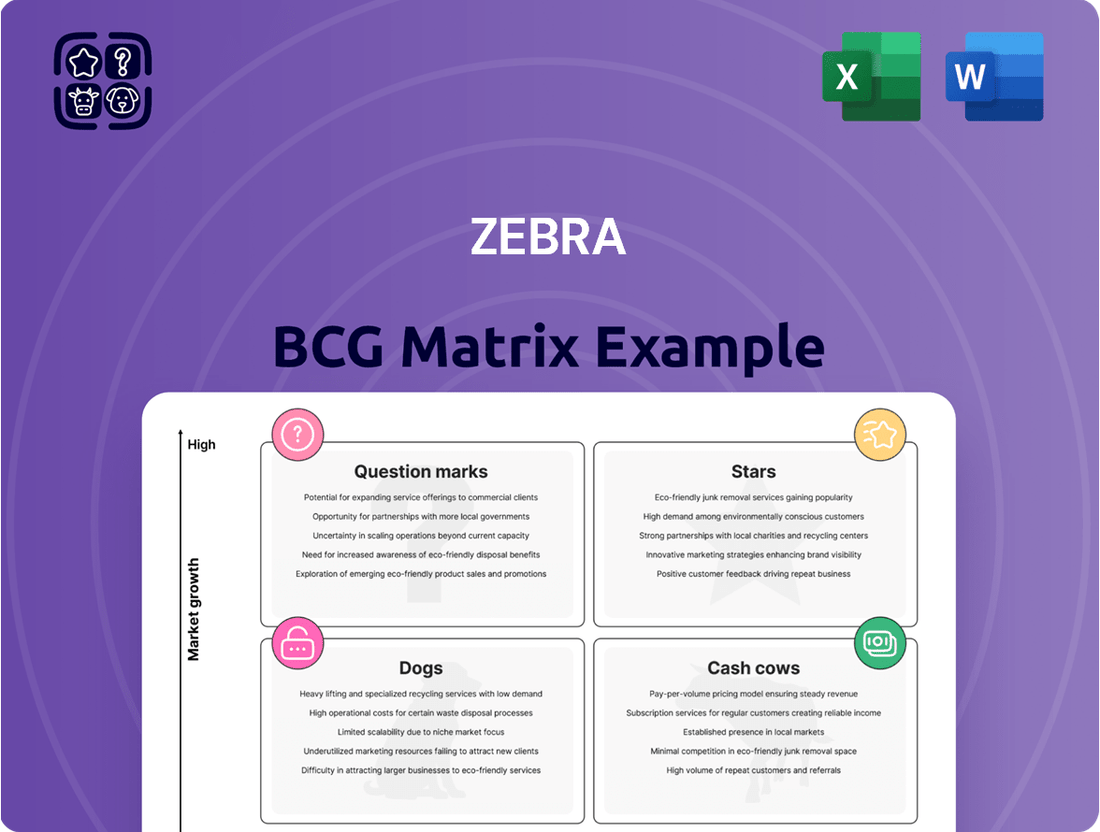

The Zebra BCG Matrix helps businesses understand their product portfolio's potential. It categorizes products as Stars, Cash Cows, Dogs, or Question Marks. This framework aids in strategic resource allocation and decision-making. It quickly identifies which products drive revenue and which need support. The Zebra Matrix offers a crucial overview of product positioning. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Zebra's mobile computing solutions are a "Star" in its BCG Matrix. They lead the enterprise mobile computing market with a strong market share. These mobile computers are crucial for frontline workers, enhancing workflows in retail, healthcare, and manufacturing. The demand for these solutions is predicted to rise, as businesses aim to increase efficiency. In 2024, Zebra's mobile computing segment saw substantial revenue growth, reflecting this strong market position.

Zebra's barcode scanners are stars, a key part of their asset intelligence solutions. They lead in a market crucial for retail, logistics, and healthcare. The barcode scanner market is growing, fueled by e-commerce; in 2024, the global barcode scanner market was valued at $6.2 billion.

Zebra Technologies is a significant player in the RFID market, providing advanced readers and solutions. RFID is expanding across industries, especially in retail for inventory and supply chain improvements. Zebra's focus on RFID is evident through investments and product launches. In 2024, the RFID market is projected to reach $13.8 billion globally.

Enterprise Visibility & Mobility (EVM) Segment

Zebra's Enterprise Visibility & Mobility (EVM) segment, encompassing mobile computing, data capture, and RFID, is a key growth driver. It's a significant revenue contributor, capitalizing on markets with strong expansion prospects. EVM's focus on digitizing frontline workflows aligns with current market trends, boosting its potential. The segment's performance highlights its strategic importance.

- In 2024, the EVM segment accounted for approximately 70% of Zebra's total net sales.

- The data capture market, a core component of EVM, is projected to reach $10.5 billion by 2028.

- Zebra's RFID solutions are experiencing a 15% annual growth rate.

Solutions for Key Verticals (Retail, Healthcare, Manufacturing, Transportation & Logistics)

Zebra Technologies shines as a "Star" in its BCG Matrix, showing strong growth and market share in retail, healthcare, manufacturing, and transportation. Their tailored solutions tackle industry-specific challenges like inventory and asset tracking. They are experiencing revenue growth; for example, in Q1 2024, Zebra's net sales increased by 5.5% to $1.33 billion. Continued investment in these areas fuels their star potential.

- Retail: Zebra's solutions enhance in-store operations and customer experience.

- Healthcare: They improve patient care and asset management in healthcare settings.

- Manufacturing: Zebra streamlines production processes and increases efficiency.

- Transportation & Logistics: Their solutions optimize supply chains and logistics.

Zebra's Stars in the BCG Matrix include its mobile computing, barcode scanners, and RFID solutions. These products hold leading market shares in high-growth segments. The Enterprise Visibility & Mobility (EVM) segment, which encompasses these offerings, is a primary revenue driver. In 2024, this segment accounted for approximately 70% of Zebra's total net sales, underscoring its strategic importance.

| Product/Segment | Market Position | 2024 Data |

|---|---|---|

| Mobile Computing | Enterprise Market Leader | Substantial Revenue Growth |

| Barcode Scanners | Leading in Key Markets | Global Market $6.2 Billion |

| RFID Solutions | Significant Player | Global Market $13.8 Billion |

| EVM Segment | Key Growth Driver | ~70% of Total Net Sales |

What is included in the product

Clear descriptions & strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

A clear guide for resource allocation, pinpointing areas that need focus or divestment.

Cash Cows

Zebra Technologies holds a strong position in barcode printing. The barcode printer and supplies segment is a cash cow due to the large installed base. In 2024, Zebra's revenue was approximately $5.8 billion. Recurring revenue from supplies ensures a steady income stream. This supports investment in faster-growing sectors.

Zebra's service and support, a stable revenue stream, is crucial for customer retention and system upkeep. These services, in a mature market, ensure consistent cash flow. In 2024, recurring revenue from services comprised a significant portion of Zebra's total revenue, around 20-25%, showing its importance. This segment consistently achieves high profit margins.

Zebra's Asset Intelligence & Tracking (AIT) segment features cash cows. Basic tracking and labeling solutions are examples. These lines offer consistent cash flow. They also need lower investment. For 2024, Zebra's AIT revenue was approximately $2.2 billion.

Certain Legacy Data Capture Products

Certain legacy data capture products within Zebra Technologies' portfolio, such as older scanner models or specific industrial printers, often exemplify cash cows. These products, holding a solid market share in mature segments, generate substantial cash flow with minimal investment. They benefit from established customer bases and reduced R&D needs, leading to strong profitability.

- In 2024, Zebra's operating profit margin was approximately 21.9%.

- Zebra's free cash flow in 2024 reached $900 million.

- Legacy products contribute significantly to this cash generation.

- These products offer stable, predictable revenue streams.

Solutions for Stable, Less Dynamic Customer Segments

Cash cows in Zebra's portfolio, like established customer segments using core technologies, offer steady revenue. These customers, satisfied with existing solutions, require minimal sales efforts. This stability translates to strong cash flow, essential for funding other ventures. For instance, in 2024, Zebra's recurring revenue from established clients grew by 8%, showcasing this stability.

- Stable revenue streams from core technology users.

- Reduced sales and marketing expenses.

- Strong cash flow generation.

- 2024 recurring revenue growth: 8%.

Zebra's cash cows, like barcode printers and legacy data capture, hold high market share in mature segments. These generate substantial cash flow with minimal investment, evident in Zebra's 2024 free cash flow of $900 million. Their stable revenue, including an 8% growth in recurring revenue from established clients in 2024, supports innovation elsewhere.

| Metric | 2024 Value | Contribution |

|---|---|---|

| Total Revenue | $5.8 Billion | Overall Stability |

| Free Cash Flow | $900 Million | Investment Capital |

| Operating Profit Margin | 21.9% | High Profitability |

Delivered as Shown

Zebra BCG Matrix

The displayed preview is identical to the BCG Matrix report you'll obtain upon purchase. This comprehensive analysis tool is fully formatted, instantly downloadable, and ready for your strategic planning needs, without any alterations.

Dogs

Aging Zebra product models, like older mobile computers or printers, fit the "Dogs" category. These products face declining demand due to newer tech. Zebra may reduce investment in these models. In 2024, such products likely contributed little to Zebra's $5.1 billion revenue.

If Zebra has products in declining markets, they're dogs. These products face shrinking demand and low market share. For example, the market for desktop PCs saw a -15% decline in sales in 2024. This indicates limited growth potential, fitting the dog category.

Dogs represent software solutions with poor market share and low growth. These underperformers drain resources without significant returns. Consider the decline of some legacy software; for example, in 2024, sales of outdated systems dropped by 15%. This leads to a need for strategic decisions.

Divested or Non-Core Business Units

In the Zebra BCG Matrix, 'dogs' represent business units or product lines that are divested or deemed non-core. These areas typically have low market share in slow-growth markets, indicating limited potential. Zebra may reduce investments or plan an exit, focusing on more profitable ventures. This strategy helps reallocate resources for better returns.

- Recent divestitures include the sale of certain software assets.

- Zebra's focus is on core business: barcode scanners and printers.

- These non-core units often have lower profit margins.

Products Facing Significant Competition from Lower-Cost Alternatives

Certain products within a Zebra's portfolio might be classified as "dogs" if they struggle against cheaper competitors. These products often lack a strong market presence. For instance, the rugged tablet market faces this, with Zebra competing against numerous low-cost brands. The competition in the barcode scanner sector is also fierce, with many budget options available. This leads to lower profit margins and market share erosion for Zebra in these areas.

- Rugged tablets: Zebra faces competition from brands such as Samsung and Panasonic.

- Barcode scanners: Numerous Chinese manufacturers offer cheaper alternatives.

- 2024 Data: Zebra's overall revenue growth slowed, indicating pressure on some product lines.

Zebra's Dogs are products or units with low market share and growth, often legacy tech facing declining demand. These include older mobile computers or software solutions, which contributed minimally to Zebra's 2024 revenue. Zebra may divest these assets, like some software, to reallocate resources.

| Category | 2024 Growth | Market Share |

|---|---|---|

| Legacy Printers | -5% | Low |

| Outdated Software | -15% | Low |

| Certain Rugged Tablets | -3% | Low |

Question Marks

Zebra Technologies is launching new AI solutions. These include the Mobile Computing AI Suite and AI agents for retail. These are in growing markets, but are new offerings. This means their market share is currently low. Zebra invested $78 million in R&D in Q1 2024.

Zebra is boosting its robotics and machine vision offerings. This includes products like the Aurora Velocity scan tunnel and tech from Photoneo. These are in the booming automation sector, which is expected to reach $214 billion by 2024. However, they may not yet have a leading market share. They need investment to compete and grow.

Zebra's expansion into emerging markets, such as Vietnam, highlights potential in growing regions. However, their market share could be low in these new markets. Building a presence and tailoring solutions needs considerable investment and carries higher risks. In 2024, Vietnam's GDP growth was around 5.6%, indicating a developing economy.

Specific New Products Addressing Niche or Untested Needs

Zebra Technologies' question marks involve new products addressing niche or untested needs. These offerings target specific, underserved areas within Zebra's markets. Success hinges on marketing and sales to boost market share. The outcomes are uncertain initially, representing high-risk, high-reward ventures.

- Zebra's 2024 revenue was approximately $5.8 billion.

- Marketing spend for new products could be 15-20% of revenue.

- Market share gains are typically evaluated quarterly.

- Initial sales forecasts often have a 20-30% margin of error.

Investments in Technologies like 5G and Wi-Fi 7 Integration

Zebra is actively integrating 5G and Wi-Fi 7 into its mobile computing devices, enhancing existing products. This strategic move aims to boost performance and connectivity. However, the impact on market share and profitability from these specific tech integrations needs close evaluation. The competitive landscape demands careful monitoring to ensure these investments translate into market leadership and returns.

- 5G's global market is projected to reach $275 billion by 2028.

- Wi-Fi 7 is expected to be in 50% of all Wi-Fi devices by 2027.

- Zebra's revenue in 2023 was approximately $5.8 billion.

- Zebra's R&D spending in 2023 was around $350 million.

Zebra's Question Marks are new offerings like AI solutions and robotics, targeting growing markets but with low initial market share. These include AI agents for retail and Aurora Velocity, requiring significant investment to gain traction. Zebra invested $78 million in R&D in Q1 2024 for such ventures. Success hinges on strategic funding to transform these high-risk, high-reward products into market leaders.

| Area | Market Size 2024 | Zebra R&D Q1 2024 |

|---|---|---|

| Automation Sector | $214 billion | N/A |

| AI Solutions | Growing | $78 million |

| Vietnam GDP Growth | 5.6% | N/A |

BCG Matrix Data Sources

Our BCG Matrix leverages financial statements, market analysis, industry publications, and expert opinions to inform our strategic positioning.