White & Case SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White & Case Bundle

White & Case, a titan in the global legal landscape, boasts significant strengths in its international reach and strong client relationships. However, understanding the nuances of its competitive environment and potential operational challenges requires a deeper dive.

Our comprehensive SWOT analysis reveals the strategic advantages White & Case leverages, alongside potential threats that could impact its market dominance. It’s a critical tool for anyone looking to understand the firm's future trajectory.

Want the full story behind White & Case's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

White & Case boasts an impressive global footprint, operating from 44 offices in 30 countries. This extensive network allows them to expertly navigate the complexities of international law and provide seamless advice on cross-border transactions and disputes. Their deep-rooted experience as a global firm is a significant asset in tackling multifaceted legal challenges worldwide.

The firm's commitment to international business is evident, with a substantial 52% of their 2024 revenue generated from cross-border matters. This statistic underscores their proven ability to serve clients effectively on a global scale, demonstrating a robust understanding of diverse legal systems and market nuances.

White & Case showcased impressive financial strength in 2024. The firm saw its revenue climb by a notable 12.5%, reaching $3.3 billion. This growth indicates a successful strategy in capturing market opportunities.

Profitability also saw a substantial uplift, with profit per equity partner (PEP) surging by 27% to $4 million. This acceleration in PEP is a clear indicator of the firm's enhanced operational efficiency and its ability to translate revenue gains into partner profits, outperforming earlier periods.

White & Case excels in high-value practice areas like Mergers & Acquisitions (M&A), private equity, and capital markets. They consistently achieve top rankings in these competitive sectors, demonstrating deep expertise and market leadership.

Their involvement in major transactions, such as advising on a significant $26.6 billion acquisition in 2024, underscores their capacity to handle complex, high-stakes deals. This specialization attracts top-tier clients and commands premium fees, contributing significantly to revenue generation.

Commitment to Innovation and Technology Adoption

White & Case demonstrates a strong commitment to innovation and technology, actively incorporating advancements like AI to refine client service and streamline internal operations. This dedication is evident in their strategic investment in specialized teams, including data technologists, project managers, and legal professionals focused on these emerging areas.

The firm's forward-thinking approach was underscored by its recognition for Generative AI Strategy in 2024, highlighting their proactive engagement with cutting-edge legal technology solutions. This strategic adoption positions White & Case to offer more efficient and technologically advanced legal services.

- Innovation Focus: Actively integrates AI and other technologies for service enhancement.

- Specialized Teams: Employs data technologists, project managers, and lawyers for tech initiatives.

- Industry Recognition: Awarded for Generative AI Strategy in 2024.

- Operational Efficiency: Leverages technology to improve service delivery and internal processes.

Strong Talent Development and Retention Strategy

White & Case demonstrates a robust approach to talent development and retention. The firm's investment in its people is underscored by the promotion of 37 lawyers to partner, effective January 1, 2025. This internal growth is complemented by strategic lateral hires, aimed at bolstering key practice areas and bringing in specialized expertise.

Furthermore, the firm's dedication to diversity and inclusion plays a crucial role in attracting and keeping top-tier talent. This commitment is validated by a strong performance on the 2024-2025 Corporate Equality Index, signaling an inclusive and supportive work environment. Such initiatives create a compelling proposition for legal professionals.

- Internal Growth: 37 lawyers promoted to partner as of January 1, 2025.

- Strategic Hiring: Significant lateral hires to enhance practice group capabilities.

- Inclusivity Focus: High score in the 2024-2025 Corporate Equality Index.

- Talent Attraction: Diversity and inclusion efforts are key to drawing and retaining professionals.

White & Case's expansive global presence, with 44 offices across 30 countries, provides a significant advantage in handling international matters. Their 2024 revenue demonstrates this strength, with 52% derived from cross-border activities, totaling $1.716 billion. This deep experience in diverse legal landscapes and markets allows them to excel in complex, multi-jurisdictional cases.

The firm's financial performance in 2024 was robust, with revenue reaching $3.3 billion, a 12.5% increase. Profit per equity partner (PEP) saw a substantial 27% jump to $4 million, indicating strong operational efficiency and profitability in their global operations.

White & Case's strategic focus on high-value practice areas, such as M&A and capital markets, is a key strength. Their involvement in a $26.6 billion acquisition in 2024 highlights their capacity to manage major, complex transactions, attracting premium clients and driving revenue growth.

The firm's commitment to innovation, including AI integration and specialized tech teams, positions them for future growth. Recognition for their Generative AI Strategy in 2024 underscores their forward-thinking approach to service delivery and operational efficiency.

White & Case's investment in talent, evidenced by 37 partner promotions effective January 1, 2025, and a strong showing on the 2024-2025 Corporate Equality Index, reinforces their ability to attract and retain top legal professionals. This focus on talent development is crucial for maintaining their competitive edge.

| Metric | 2024 Data | Significance |

|---|---|---|

| Global Offices | 44 (in 30 countries) | Extensive international reach for cross-border expertise. |

| Cross-Border Revenue | 52% of $3.3B ($1.716B) | Demonstrates proven success in global markets. |

| Total Revenue Growth | 12.5% | Indicates strong market performance and client acquisition. |

| Profit Per Equity Partner (PEP) Growth | 27% | Highlights enhanced profitability and operational efficiency. |

| Key Transaction Involvement | Advising on $26.6B acquisition | Shows capacity for high-value, complex deal execution. |

| Partner Promotions (Jan 1, 2025) | 37 | Reflects strong internal talent development and retention. |

What is included in the product

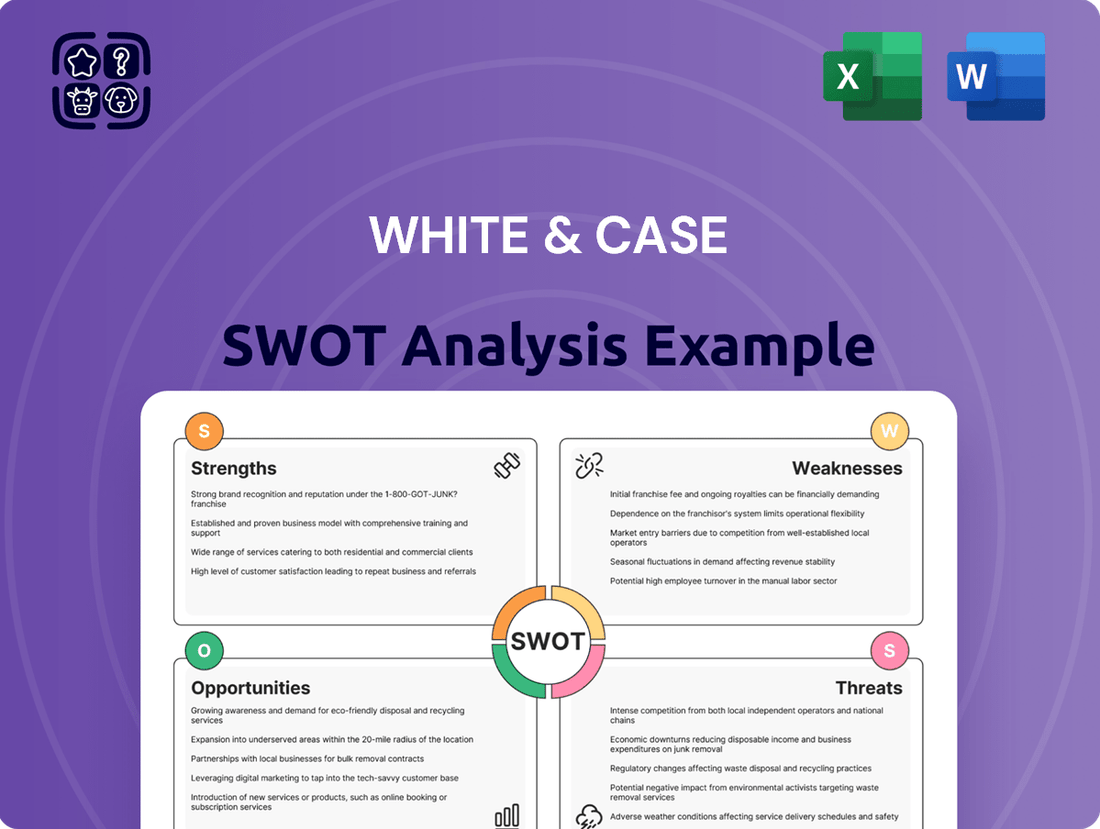

Analyzes White & Case’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address key market challenges and opportunities.

Weaknesses

While White & Case's deep expertise in M&A and capital markets is a significant advantage, the firm's substantial revenue reliance on these areas presents a notable weakness. This specialization, though powerful during active deal periods, can lead to vulnerability when global economic conditions cause a slowdown in transaction volumes.

For instance, in 2023, the global M&A market experienced a significant decline, with deal values dropping considerably compared to the record highs of previous years. This contraction directly impacts firms like White & Case, whose financial performance is closely correlated with the health of these capital-intensive sectors.

A prolonged downturn in M&A and capital markets, potentially driven by interest rate hikes or geopolitical instability in 2024-2025, could disproportionately affect White & Case's overall revenue and profitability. This makes the firm susceptible to the cyclical nature of these markets.

As a prominent global law firm, White & Case undoubtedly operates with a high cost structure. This is largely driven by the need to offer competitive compensation to attract and retain the caliber of legal talent required for its international operations. The intense competition for top-tier lawyers in major legal markets means significant investment in salaries, bonuses, and benefits.

These substantial compensation pressures, a common challenge for BigLaw firms, can directly impact profitability. For instance, in 2023, average partner compensation at major US law firms hovered around $2 million, a figure that influences the entire compensation scale. White & Case, to maintain its standing, must navigate these costs effectively to ensure its financial health remains robust.

White & Case's global reach, with over 40 offices worldwide, presents a significant hurdle in fostering a unified firm culture. This extensive geographical distribution can dilute shared values and practices, impacting cross-border collaboration and knowledge transfer. For instance, differences in local customs and work ethics might create friction in integrating new talent or ensuring uniform client service standards across diverse markets.

Risk of Talent Burnout and Disengagement

The intense, high-stakes nature of global legal practice at a firm like White & Case can unfortunately lead to attorney burnout and a rise in quiet quitting. This constant pressure, coupled with demanding client expectations, creates an environment where employees may feel drained and disengaged, impacting overall firm performance. The challenge of retaining top legal talent is amplified when even competitive compensation can't fully offset the personal toll of such demanding work. This ongoing struggle with burnout significantly impacts productivity and firm morale.

This trend poses a significant risk to White & Case's ability to maintain its competitive edge and deliver consistent, high-quality service.

- Attorney burnout is a growing concern across the legal industry, with reports indicating high stress levels among associates.

- Quiet quitting, defined as employees doing the bare minimum, can subtly erode productivity and team cohesion.

- Talent retention remains a critical challenge, as a disengaged workforce is more prone to seeking opportunities elsewhere.

- The firm's global reach, while a strength, also means navigating diverse cultural expectations around work-life balance, potentially exacerbating burnout risks.

Adaptation to Evolving Client Expectations and Billing Models

Clients are increasingly demanding greater efficiency and value, often leaning towards alternative fee arrangements over the traditional billable hour. This shift, amplified by legal tech advancements, puts pressure on firms like White & Case to innovate their pricing and service delivery models. For instance, a 2024 survey by ALM Intelligence indicated that over 60% of corporate legal departments were actively exploring or implementing alternative fee structures.

Adapting to these evolving expectations presents a potential weakness if not managed proactively. White & Case's established reliance on the billable hour, while historically successful, could face challenges in attracting clients prioritizing predictable costs and demonstrable value. A failure to strategically adjust billing models might lead to a competitive disadvantage against firms more agile in offering blended rates or fixed fees.

- Client Demand for Value: Over 60% of corporate legal departments are exploring alternative fee arrangements, signaling a market shift away from pure hourly billing.

- Efficiency Expectations: Advancements in legal technology are raising client expectations for faster turnaround times and more streamlined legal processes.

- Revenue Structure Impact: A slow adaptation to new billing models could disrupt revenue streams accustomed to the billable hour.

- Competitive Pressure: Firms offering greater pricing transparency and flexibility may gain market share if White & Case's adaptation lags.

White & Case's heavy reliance on M&A and capital markets, while a strength, makes it vulnerable to economic downturns. The global M&A market saw significant declines in deal values in 2023, a trend that could continue into 2024-2025 due to interest rate hikes and geopolitical instability, directly impacting the firm's revenue.

The firm's extensive global footprint, with over 40 offices, presents a challenge in maintaining a unified culture and fostering seamless cross-border collaboration. This can lead to inconsistencies in service delivery and integration issues with new talent across diverse markets.

High operating costs, driven by competitive compensation for top legal talent, put pressure on profitability. In 2023, average partner compensation at major US law firms was around $2 million, a benchmark White & Case must meet to retain its talent.

Attorney burnout and quiet quitting are significant concerns due to the high-stakes nature of global legal practice. This can negatively impact productivity and talent retention, even with competitive pay. The firm's global nature may also exacerbate burnout risks by requiring navigation of diverse work-life balance expectations.

Client demand for efficiency and alternative fee arrangements is growing, with over 60% of corporate legal departments exploring these models in 2024. White & Case's traditional reliance on the billable hour may hinder its ability to attract clients seeking predictable costs and greater value, potentially creating a competitive disadvantage against more agile firms.

| Weakness Area | Description | Impact | Supporting Data/Trend (2023-2025) |

|---|---|---|---|

| Revenue Concentration | High reliance on M&A and capital markets. | Vulnerability to market slowdowns. | Global M&A deal values declined significantly in 2023; continued economic uncertainty projected for 2024-2025. |

| Global Cultural Integration | Extensive office network (40+ locations). | Challenges in unified culture and cross-border collaboration. | Diverse local customs and work ethics can hinder integration and uniform service standards. |

| Cost Structure | High compensation for top legal talent. | Pressure on profitability. | Average partner compensation in major US firms around $2 million in 2023; intense competition for talent. |

| Talent Engagement | Attorney burnout and quiet quitting. | Reduced productivity, impact on morale, talent retention risk. | High stress levels reported across the legal industry; disengaged workforce prone to seeking other opportunities. |

| Billing Model Adaptation | Reliance on billable hour vs. client demand for value/AFAs. | Potential loss of clients to more flexible firms. | Over 60% of corporate legal departments exploring alternative fee arrangements (2024). |

Same Document Delivered

White & Case SWOT Analysis

This is a real excerpt from the complete White & Case SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of the firm's strategic positioning.

You’re viewing a live preview of the actual SWOT analysis file for White & Case. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

The file shown below is not a sample—it’s the real White & Case SWOT analysis you'll download post-purchase, in full detail, allowing for in-depth strategic planning.

This preview reflects the real White & Case SWOT analysis document you'll receive—professional, structured, and ready to use for your strategic insights.

Opportunities

White & Case has a substantial opportunity to grow by expanding into emerging markets and secondary cities. This strategy not only taps into new client bases but also offers a way to lower operational costs compared to established major hubs. By strategically increasing its footprint in these developing regions, the firm can capture a larger share of legal work driven by their economic expansion.

The firm's existing global network is a key asset for this expansion. Leveraging this international presence allows White & Case to more effectively penetrate emerging markets and capitalize on their rapid economic growth trajectories. For instance, many African economies are projected to see robust GDP growth in the coming years, with countries like Nigeria and Ethiopia showing significant potential for increased foreign investment and associated legal needs.

Growth sectors, such as renewable energy and technology, present further avenues for expansion. These industries are booming globally, and emerging markets are increasingly investing in them. White & Case can position itself as a leader by offering specialized legal services to companies operating in these dynamic fields within these developing economies, further solidifying its market position.

The legal industry's embrace of generative AI offers White & Case a significant avenue for growth. By automating tasks like document review and legal research, the firm can substantially increase lawyer efficiency. This not only reduces operational costs but also frees up legal professionals to focus on higher-value strategic work and client advisory, improving overall service delivery.

White & Case's proactive investments in AI technology position it to capitalize on this trend. Early adoption allows the firm to pioneer the development and implementation of bespoke AI solutions. This strategic advantage can translate into a distinct competitive edge, enabling the creation of innovative client services and enhancing the firm's reputation as a technology leader in the legal space.

The global legal tech market is projected to reach $39.2 billion by 2027, indicating a robust demand for such innovations. For instance, a 2024 survey found that 70% of law firms are exploring or actively using AI for tasks like contract analysis, demonstrating a clear industry shift.

The increasing complexity of global regulations and the heightened emphasis on Environmental, Social, and Governance (ESG) factors present a significant growth avenue for specialized legal advisory services. White & Case is well-positioned to capitalize on this trend by expanding its expertise in these critical areas.

By offering comprehensive advice to corporations and governments on navigating evolving compliance landscapes and implementing sustainable business practices, the firm can attract new clients and deepen relationships with existing ones. The global ESG market is projected to reach $50 trillion by 2025, indicating substantial revenue potential.

Strategic Lateral Hires and Partner Promotions

White & Case can fortify its core practice areas and expand its reach geographically by strategically bringing in experienced partners from other firms and promoting high-performing internal talent. This dual strategy helps the firm gain specialized knowledge and broaden its client appeal in areas poised for growth.

For instance, in 2023, law firms globally saw a significant trend in lateral partner hiring, particularly in high-demand sectors like technology, finance, and energy. White & Case’s ability to attract top-tier lateral talent directly translates to enhanced service offerings and competitive advantage.

Internal promotions also play a crucial role in maintaining firm culture and leveraging existing expertise. By nurturing and advancing its own lawyers, White & Case ensures a pipeline of skilled professionals deeply familiar with the firm’s values and client relationships.

This approach to talent acquisition and development is critical for staying ahead in the competitive legal market, allowing the firm to adapt to evolving client needs and market dynamics. The firm's focus on these opportunities can lead to increased market share and revenue growth in key practice areas.

Diversification of Service Offerings and Client Base

White & Case can unlock new revenue streams by broadening its service portfolio beyond its established strengths in M&A and capital markets. Exploring areas like technology law, cybersecurity consulting, or specialized regulatory advisory could tap into growing market demands. This strategic expansion would also mitigate risks associated with the inherent cyclicality of traditional deal-making sectors.

Growing the firm's client roster to encompass a wider array of industries and organizational types, from emerging tech startups to established energy firms, would significantly bolster its resilience. A diverse client base reduces dependency on any single sector's performance, offering greater stability. For example, in 2023, while M&A activity saw fluctuations, demand for ESG advisory services surged, presenting a clear opportunity for diversification.

- Expand into emerging legal tech services to capture new client needs.

- Develop specialized practices in high-growth sectors like renewable energy and digital transformation.

- Target a broader range of clients including private equity firms with diverse portfolio companies and mid-market businesses.

- Increase cross-selling opportunities by integrating new service lines with existing client relationships.

White & Case has a significant opportunity to tap into the growing demand for specialized legal services in emerging markets and secondary cities, thereby lowering operational costs and capturing new client bases. The firm's existing global network is a considerable advantage in penetrating these regions, which are showing strong economic growth projections, such as in many African economies expected to see robust GDP increases.

Furthermore, the firm can capitalize on growth sectors like renewable energy and technology, which are experiencing global booms and increasing investment in developing economies. By offering expert legal advice in these dynamic fields, White & Case can solidify its market leadership.

The integration of generative AI presents another key opportunity, allowing for increased lawyer efficiency through task automation, reduced costs, and a focus on high-value strategic work. White & Case's early investments in AI position it to lead in developing innovative client services.

The escalating complexity of global regulations and the growing importance of Environmental, Social, and Governance (ESG) factors create a substantial avenue for specialized legal advisory services. White & Case is well-positioned to offer comprehensive guidance on compliance and sustainable practices, tapping into a market projected to reach $50 trillion by 2025.

Strategic talent acquisition, including lateral partner hires in high-demand sectors like technology and finance, alongside internal promotions, will fortify core practice areas and expand geographic reach. This approach enhances service offerings and maintains a strong firm culture.

Broadening its service portfolio beyond traditional strengths into areas like technology law and cybersecurity consulting can unlock new revenue streams and mitigate risks associated with market cyclicality.

Diversifying its client base across various industries, from tech startups to energy firms, will enhance resilience and reduce sector-specific dependencies. For instance, while M&A saw fluctuations in 2023, ESG advisory demand surged.

| Opportunity Area | Market Projection/Growth Factor | Strategic Action |

|---|---|---|

| Emerging Markets & Secondary Cities | Projected robust GDP growth in African economies (e.g., Nigeria, Ethiopia) | Leverage global network for expansion, lower operational costs. |

| Growth Sectors (Renewable Energy, Tech) | Increasing global investment in these sectors | Develop specialized legal services for companies in these fields. |

| Legal Tech (AI) | Global legal tech market projected at $39.2 billion by 2027; 70% of firms exploring AI (2024) | Automate tasks, increase efficiency, focus on strategic client advisory. |

| ESG & Regulatory Complexity | Global ESG market projected at $50 trillion by 2025 | Expand expertise in ESG and regulatory compliance advisory. |

| Talent Acquisition & Development | Trend in lateral partner hiring (2023) in tech, finance, energy | Attract top-tier talent and promote internal high-performers. |

| Service Portfolio Diversification | 2023 saw surge in ESG advisory demand amidst M&A fluctuations | Explore tech law, cybersecurity, regulatory consulting. |

Threats

The legal landscape in 2024 and 2025 is marked by fierce rivalry. White & Case faces significant pressure from both expansive global law firms, which often boast larger resources and broader service offerings, and highly specialized boutique firms that excel in niche practice areas. This dual threat means that winning high-value mandates and attracting top legal talent requires constant innovation and a clear demonstration of unique value proposition.

This intense competition directly impacts pricing strategies and client acquisition costs, forcing firms like White & Case to be more strategic in their business development efforts. The ability to retain skilled professionals is also a critical challenge, as top performers are highly sought after across the industry. For instance, the global legal services market is projected to reach over $900 billion by 2025, underscoring the sheer scale of the competition and the need for differentiation.

Global economic headwinds, marked by persistent inflation and rising interest rates throughout 2024 and into early 2025, present a significant threat. This environment often correlates with a slowdown in mergers and acquisitions and other transactional work, directly impacting the demand for legal services.

White & Case, with its strong presence in corporate finance and M&A, is particularly exposed. A downturn in these sectors could lead to reduced legal spending by corporations and financial institutions, directly affecting the firm's revenue streams. For example, a 10% drop in global M&A deal volume, a plausible scenario given current economic forecasts for 2024, could translate to a material impact on firms heavily reliant on such transactions.

The swift evolution of legal technology and artificial intelligence presents a significant threat to traditional law firm operations. While these advancements offer efficiency gains, they also carry the potential to automate tasks historically handled by legal professionals, directly challenging the long-standing billable hour model that many firms rely upon.

Firms that are slow to embrace and integrate these technologies into their service delivery risk falling behind competitors. For instance, in 2024, many law firms are actively exploring AI-powered contract review and legal research tools, which can reduce the hours required for these tasks, potentially impacting revenue if not offset by new service models.

Failure to adapt business models and invest strategically in technology integration could lead to a gradual erosion of market share and profitability. Reports from late 2023 and early 2024 indicate a growing trend of clients seeking more cost-effective legal solutions, often facilitated by technology, putting pressure on firms that maintain purely traditional approaches.

Talent Poaching and Retention Challenges

The legal sector, particularly at the BigLaw level, faces significant hurdles in attracting and keeping top-tier talent. Fierce competition from other prominent firms drives up compensation expectations, increasing the risk that skilled lawyers will be poached. This dynamic means firms like White & Case must continually assess and potentially increase their remuneration packages to remain competitive.

Burnout and disengagement are also critical threats to talent retention. Reports consistently highlight the demanding nature of BigLaw, contributing to high turnover rates. For instance, a 2023 survey indicated that over 60% of associates experienced burnout in the past year, underscoring the need for proactive strategies.

Addressing these challenges requires ongoing investment in associate well-being and the implementation of flexible work arrangements. Firms that can foster a supportive environment and offer adaptable working conditions are better positioned to retain their most valuable legal professionals. Failing to do so can lead to a constant cycle of recruitment and loss, impacting service delivery and profitability.

Key considerations for talent retention include:

- Competitive Compensation: Ensuring salary and bonus structures remain at or above market rates.

- Work-Life Balance Initiatives: Implementing programs to mitigate burnout and promote well-being.

- Career Development Opportunities: Providing clear pathways for advancement and skill enhancement.

- Flexible Work Policies: Offering options for remote or hybrid work arrangements.

Regulatory and Geopolitical Risks

Changes in international trade policies and escalating geopolitical tensions, particularly concerning trade relations between major economies, present significant challenges for global law firms. For instance, the ongoing trade disputes and sanctions regimes impacting various regions create complex compliance hurdles and can disrupt cross-border deal flow. White & Case, with its extensive international presence, must continually adapt its strategies to navigate these volatile conditions.

The evolving regulatory environments across different jurisdictions add another layer of complexity. As governments implement new data privacy laws, antitrust regulations, or environmental standards, firms like White & Case must ensure their clients remain compliant, often requiring specialized expertise in multiple legal systems. This dynamic landscape necessitates constant monitoring and strategic adjustments to service offerings.

These interconnected risks can create significant uncertainties, directly impacting the volume and nature of cross-border transactions that law firms advise on. For example, the imposition of tariffs or restrictions on investment can lead to a slowdown in M&A activity and international project finance, areas crucial to a firm like White & Case's revenue streams.

- Increased Compliance Costs: Adapting to diverse and changing regulations globally leads to higher operational expenses for legal service providers.

- Disruption of Cross-Border Deals: Geopolitical instability and trade wars can halt or significantly alter international mergers, acquisitions, and investments.

- Demand for Specialized Expertise: Clients require legal counsel with deep knowledge of specific regional regulations and international political dynamics.

- Reputational Risk: Missteps in navigating complex geopolitical or regulatory landscapes can damage a firm's standing with clients and in the market.

The intense competition from both global behemoths and specialized boutiques pressures White & Case to constantly innovate and clearly articulate its unique value. This rivalry directly impacts pricing and client acquisition, making talent retention a critical battleground, especially as the global legal services market approaches $900 billion by 2025.

Economic headwinds, including persistent inflation and rising interest rates into early 2025, pose a threat by potentially slowing M&A and transactional work, areas where White & Case holds a strong position. A projected 10% dip in global M&A volume for 2024, for instance, could significantly affect the firm's revenue.

Rapid advancements in legal technology and AI present a challenge to traditional billing models by automating tasks. Firms slow to adopt these tools, such as AI-powered contract review, risk losing market share to more tech-savvy competitors, as clients increasingly seek cost-effective solutions.

The legal sector faces a talent drain due to fierce competition and burnout, with over 60% of associates reporting burnout in 2023. White & Case must invest in competitive compensation, work-life balance, career development, and flexible policies to retain its skilled professionals.

Geopolitical tensions and evolving international trade policies create complex compliance challenges and can disrupt cross-border deal flow, demanding constant strategic adaptation from firms like White & Case. Navigating diverse and changing global regulations also increases compliance costs and the need for specialized expertise.

| Threat Category | Specific Challenges | Impact on White & Case | Data/Trend (2024-2025) |

|---|---|---|---|

| Market Competition | Rivalry from global and boutique firms | Pressure on pricing, client acquisition, talent retention | Global legal services market to exceed $900B by 2025 |

| Economic Conditions | Inflation, rising interest rates | Reduced M&A and transactional work | Potential 10% drop in global M&A volume |

| Technological Disruption | AI and automation impacting billable hours | Risk of market share loss if slow to adopt | Growing adoption of AI in legal research/contract review |

| Talent Management | Burnout, high competition for talent | Increased compensation demands, high turnover | >60% of associates reported burnout in 2023 |

| Geopolitical & Regulatory Shifts | Trade disputes, evolving global regulations | Increased compliance costs, deal disruption | Complex compliance hurdles from sanctions and new data privacy laws |

SWOT Analysis Data Sources

This White & Case SWOT analysis is built upon a robust foundation of publicly available financial filings, comprehensive market intelligence reports, and insights from leading legal industry publications. These sources provide the necessary data to assess the firm's current standing and future potential.