White & Case Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White & Case Bundle

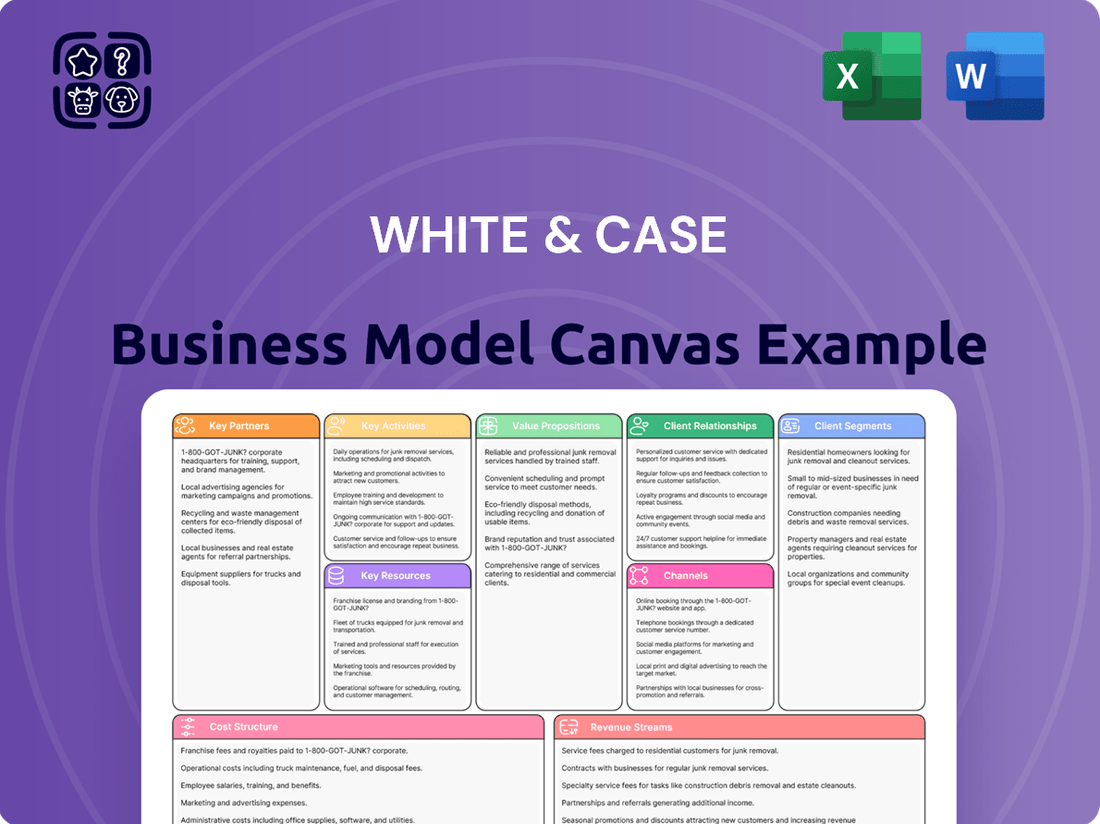

Curious about how a global legal powerhouse like White & Case structures its success? This detailed Business Model Canvas breaks down their client relationships, revenue streams, and key resources. Understand the core components that drive their market dominance.

Dive into the strategic framework that underpins White & Case's operations. This comprehensive canvas illuminates their value proposition, channels, and cost structure, offering invaluable insights for anyone in the legal or professional services sector.

Unlock the secrets to White & Case's enduring success with their full Business Model Canvas. Explore their customer segments, key partnerships, and revenue streams in a clear, actionable format.

Gain a competitive edge by understanding White & Case's business model. This in-depth canvas reveals their core activities and how they create and deliver value, providing a blueprint for strategic thinking.

See how White & Case effectively manages its resources and activities to serve its clients. The full Business Model Canvas provides a clear, section-by-section analysis of their operational strategy, ready for your review.

Partnerships

White & Case strategically partners with leading legal technology providers to boost operational efficiency. These collaborations are essential for integrating advanced solutions, like artificial intelligence, into critical functions such as due diligence and document review. For instance, by leveraging AI-powered platforms, firms can significantly accelerate the analysis of vast datasets, a process that historically consumed considerable time and resources.

These partnerships allow White & Case to offer clients more streamlined and effective legal services. By adopting cutting-edge technologies, the firm optimizes complex legal workflows, ensuring faster turnaround times and improved accuracy. In 2024, the legal tech market saw significant growth, with investments pouring into AI and automation solutions, underscoring the value of such strategic alliances.

White & Case strategically partners with global correspondent law firms to extend its reach and offer comprehensive legal services across diverse jurisdictions. These collaborations are crucial for providing clients with seamless cross-border advice, particularly in regions where the firm may not have an established physical presence.

By leveraging the specialized local knowledge of these partner firms, White & Case ensures that clients receive accurate and nuanced legal counsel, navigating the complexities of different legal systems and regulatory environments. This network allows the firm to deliver a truly global service offering, backed by local expertise.

For example, in 2024, White & Case's ability to tap into these correspondent networks was vital for advising clients on significant cross-border M&A transactions and international disputes, demonstrating the practical value of these strategic alliances in expanding market access and enhancing client service.

White & Case’s strategic alliances with leading financial institutions and investment banks are foundational to its success in M&A, capital markets, and project finance. These relationships are not just about deal flow; they are about deep collaboration on complex transactions.

For instance, in 2023, global M&A volume reached approximately $3.2 trillion, with major financial institutions playing a crucial role in advising on and financing these deals, creating opportunities for firms like White & Case to participate. These partnerships frequently result in valuable referrals and the formation of joint ventures for intricate global transactions.

This ensures a consistent stream of high-value mandates. The ability to co-advise on landmark deals, leveraging the strengths of both the law firm and the financial institution, is a significant competitive advantage in the market.

Industry Associations and Professional Bodies

Engaging with industry associations and professional bodies is crucial for White & Case. These connections offer invaluable networking, enabling them to connect with peers and potential clients. For instance, active participation in organizations like the American Bar Association (ABA) or the International Bar Association (IBA) provides direct access to legal professionals across various sectors.

These relationships are vital for thought leadership and client acquisition. By contributing to discussions and events within these bodies, White & Case can showcase its expertise, attracting new business. In 2024, many law firms reported an increase in inbound inquiries following significant contributions to industry conferences and publications.

Furthermore, these platforms are essential for gaining market insights and advocating for favorable policies. Understanding evolving legal landscapes and influencing regulatory changes through these associations directly benefits the firm and its clients. Building a strong brand reputation within specific legal communities is a direct outcome of this engagement.

- Networking: Access to a broad base of legal professionals and potential clients.

- Thought Leadership: Opportunities to present expertise and build reputation.

- Market Insights: Early access to trends and evolving legal practices.

- Brand Reputation: Enhanced standing within specific legal sectors.

Academic Institutions and Research Centers

White & Case actively partners with leading academic institutions and research centers globally. These collaborations are crucial for identifying and recruiting top-tier legal talent, with many firms actively participating in university career fairs and sponsoring moot court competitions. For example, in 2023, many major law firms reported that over 70% of their new associates were sourced directly from university recruitment programs.

These academic alliances also serve as a catalyst for legal innovation. By engaging with universities, White & Case can tap into cutting-edge research in areas like artificial intelligence in law, cybersecurity, and international arbitration, helping to shape the future of legal practice. Such partnerships foster the development of specialized legal research, contributing to White & Case's position at the forefront of legal thought.

The benefits extend to developing novel legal solutions and understanding emerging legal trends. Collaborations often involve joint research projects or the funding of academic chairs, ensuring the firm remains informed about evolving legal landscapes. This proactive engagement with academia allows White & Case to attract and nurture the next generation of legal leaders.

- Talent Acquisition: Access to a pipeline of highly qualified graduates from top universities.

- Legal Innovation: Collaboration on research for AI in law, dispute resolution, and emerging legal tech.

- Thought Leadership: Contributing to and staying abreast of academic legal discourse.

- Future Solutions: Developing new legal frameworks and services based on academic insights.

White & Case's strategic partnerships with legal technology providers are crucial for enhancing operational efficiency and client service delivery. These alliances enable the integration of advanced solutions, like AI-powered document review, which significantly accelerates complex legal processes. The legal tech market saw substantial investment in 2024, particularly in AI and automation, highlighting the strategic importance of these collaborations for firms like White & Case.

What is included in the product

A detailed blueprint of White & Case's operations, outlining its key partners, activities, and resources to deliver legal services.

This model details customer relationships and segments, alongside revenue streams and cost structures, offering a strategic overview.

Simplifies complex strategic thinking, alleviating the pain of abstract planning.

Offers a structured approach to business strategy, removing the guesswork from development.

Activities

Advising on intricate cross-border mergers and acquisitions, private equity deals, and capital markets transactions is a cornerstone. This includes rigorous legal due diligence, crafting complex agreements, and skillfully navigating varied regulatory environments to finalize sophisticated transactions for international clients.

In 2024, the global M&A market showed resilience, with deal volumes reaching significant figures despite economic uncertainties. For instance, cross-border M&A activity remained robust, reflecting continued client demand for expert advisory services in navigating international complexities.

White & Case's expertise in private equity transactions in 2024 involved advising on deals across diverse sectors, from technology to infrastructure. This required deep understanding of fund structures, regulatory approvals, and exit strategies, often involving multiple jurisdictions.

The firm's capital markets advisory in 2024 encompassed assisting clients with initial public offerings (IPOs), debt issuances, and high-yield bond offerings. Successfully executing these transactions demanded meticulous attention to securities laws and investor relations across different markets.

White & Case excels in high-stakes dispute resolution, a core activity involving the representation of clients in international arbitration and complex litigation. This expertise spans developing sophisticated legal strategies and presenting persuasive arguments to secure favorable outcomes in high-value disputes across diverse global jurisdictions.

The firm's involvement in alternative dispute resolution mechanisms is also a critical component. This strategic approach aims to efficiently resolve conflicts and protect client interests, often in matters involving significant financial stakes and intricate legal challenges.

In 2024, White & Case continued its strong performance in handling major international arbitration cases. The firm advised on disputes with claims often exceeding hundreds of millions of dollars, reflecting the scale and complexity of the matters they undertake for global corporations and sovereign states.

White & Case's key activity involves providing ongoing guidance on evolving global regulatory frameworks. This includes critical areas like antitrust, data privacy, and financial regulations, which are constantly shifting.

This advisory service is crucial for clients aiming to mitigate risks and ensure adherence to legal requirements. Navigating these complex compliance challenges across multiple jurisdictions demands specialized expertise.

For instance, in 2024, the global regulatory landscape continued its rapid evolution. The General Data Protection Regulation (GDPR) and similar data privacy laws worldwide remained a significant focus, with enforcement actions and new interpretations frequently emerging. Similarly, antitrust authorities globally intensified scrutiny of digital markets and mergers, impacting how businesses operate and strategize.

Legal Research and Knowledge Management

White & Case dedicates significant resources to legal research and knowledge management, recognizing it as a cornerstone of client service. This involves rigorous analysis of statutes, case law, and regulatory changes to ensure advice remains current and precise. For instance, in 2024, the firm likely invested heavily in advanced legal research platforms and internal databases, reflecting the increasing complexity and volume of legal information.

Developing and maintaining a comprehensive library of precedents and best practices is another vital activity. This allows attorneys to leverage past successes and efficient methodologies, thereby streamlining legal processes and enhancing the quality of outcomes. By consistently updating and categorizing these resources, White & Case ensures its legal professionals can quickly access relevant templates and guidance.

A robust knowledge management system is essential for capturing, organizing, and disseminating legal expertise across the firm. This fosters a culture of continuous learning and collaboration, enabling attorneys to benefit from collective experience. In 2024, advancements in AI-powered search and analytics tools likely played a role in optimizing the accessibility and utility of this knowledge base.

- In-depth Legal Research: Analyzing statutes, case law, and regulations.

- Precedent Development: Building and refining a library of legal templates and strategies.

- Knowledge Management System: Organizing and sharing firm-wide legal expertise.

- Service Quality Enhancement: Ensuring attorneys have access to the latest legal information.

Talent Development and Recruitment

White & Case actively pursues top-tier legal professionals, from seasoned partners to promising associates and essential support staff, to maintain its competitive edge. This ongoing effort is crucial for delivering exceptional client service and driving firm growth.

The firm invests significantly in robust recruitment pipelines and comprehensive professional development programs. These initiatives ensure that all employees, regardless of their role, possess the skills and knowledge necessary to excel in a dynamic legal landscape. For instance, in 2024, the firm continued its global graduate recruitment drive, aiming to onboard hundreds of new associates worldwide, with a particular focus on emerging markets.

- Global Recruitment Reach: Targeting top law schools and experienced professionals across key international jurisdictions.

- Professional Development Investment: Allocating substantial resources to training, mentorship, and continuing legal education for all staff.

- Retention Strategies: Implementing programs designed to foster a collaborative and rewarding work environment, reducing associate attrition rates.

- Talent Specialization: Focusing on attracting individuals with expertise in high-demand practice areas like technology, energy, and international arbitration.

White & Case's key activities revolve around providing expert legal counsel across a spectrum of complex corporate transactions and disputes. This includes advising on mergers, acquisitions, private equity deals, and capital markets, alongside high-stakes international arbitration and litigation.

The firm also focuses on staying ahead of evolving global regulatory landscapes, offering guidance on antitrust, data privacy, and financial regulations to ensure client compliance and risk mitigation.

Furthermore, significant investment is directed towards legal research and knowledge management, utilizing advanced platforms to maintain a competitive edge and deliver precise, up-to-date advice.

Attracting and developing top legal talent globally is paramount, supported by extensive professional development programs and strategic recruitment efforts to ensure the highest quality of service.

What You See Is What You Get

Business Model Canvas

The White & Case Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable, ensuring you know precisely what you are getting. Once your order is complete, you'll gain full access to this comprehensive tool, ready for immediate application and strategic analysis.

Resources

White & Case's global network of legal professionals is a cornerstone of its business model. This extensive network comprises highly skilled and experienced lawyers situated across numerous international offices, representing a significant human capital asset.

This diverse pool of legal talent boasts a wide array of specializations and multi-jurisdictional expertise. For example, as of early 2024, White & Case has over 4,500 lawyers operating from more than 40 offices worldwide, enabling them to tackle intricate global legal challenges.

The firm's ability to effectively handle complex global mandates stems directly from this widespread expertise. It allows them to provide comprehensive legal solutions that span various jurisdictions and practice areas, a critical factor for clients operating in an increasingly interconnected global economy.

White & Case's reputation as a top-tier global law firm, built over decades, is a cornerstone of its business model. This strong brand equity directly translates into attracting and retaining high-caliber legal professionals and securing mandates from prestigious clients worldwide.

In 2024, firms like White & Case continue to leverage their established reputations. A survey of corporate counsel revealed that reputation and expertise in specific practice areas remain the most critical factors when selecting outside legal counsel, often outweighing price considerations for complex, high-stakes matters.

This enduring reputation for integrity and successful outcomes in intricate legal challenges acts as a powerful differentiator. It enables White & Case to command premium fees and reinforces its market leadership, creating a virtuous cycle of client acquisition and talent recruitment.

White & Case leverages a deep well of legal precedents and case studies, built over many years, as a core asset. This extensive knowledge base allows for highly efficient and consistent legal counsel, which is vital for tackling intricate cases.

This proprietary information provides a distinct advantage in the competitive legal landscape. For instance, in 2024, the firm's ability to quickly access and apply relevant past rulings significantly reduced research time in complex cross-border litigation, a critical factor in client satisfaction and successful outcomes.

The accumulated expertise ensures that advice is not only legally sound but also strategically informed by real-world successes and challenges. This translates to more robust solutions for clients facing novel legal questions.

Advanced Technology Infrastructure

White & Case’s advanced technology infrastructure is a cornerstone of its operations, encompassing state-of-the-art legal technology platforms, robust secure data systems, and cutting-edge communication tools. These resources are vital for delivering efficient legal services and maintaining secure client interactions. The firm’s investment in technology directly supports its global reach and operational effectiveness.

The firm leverages technology to enhance data analytics capabilities, providing deeper insights for client matters and internal strategy. This technological backbone allows White & Case to manage complex international cases with greater precision and speed. For instance, in 2024, the legal tech market continued its rapid expansion, with firms like White & Case prioritizing investments in AI-driven contract review and e-discovery tools to streamline workflows and improve accuracy.

- State-of-the-art legal technology platforms enhance efficiency in research, document management, and case preparation.

- Secure data systems protect sensitive client information, adhering to stringent global data privacy regulations.

- Advanced communication tools facilitate seamless collaboration among legal teams and with clients across different geographies.

- Data analytics capabilities drive informed decision-making, from case strategy to business development.

Financial Capital

White & Case's financial capital is a cornerstone of its ability to operate globally and pursue ambitious growth strategies. Substantial financial resources are essential for maintaining its extensive network of offices, investing in cutting-edge technology, and attracting and retaining the industry's best legal talent. For instance, in 2024, the firm continued its strategic investments in talent development and global infrastructure, reflecting the significant financial backing required for such endeavors.

A strong financial position allows White & Case to confidently engage in large-scale, intricate legal matters and maintain its prominent international presence. This financial robustness is directly linked to its capacity to attract and retain highly skilled professionals, crucial for delivering exceptional client service across diverse jurisdictions. The firm's consistent financial performance underpins its ability to undertake complex cross-border transactions and disputes.

- Significant Investment Capacity: Enables large-scale project financing and strategic acquisitions.

- Talent Acquisition and Retention: Financial strength is vital for competitive compensation and professional development programs.

- Global Operational Support: Funds the maintenance and expansion of its worldwide office network.

- Resilience and Stability: Provides a buffer against economic downturns and supports long-term strategic planning.

White & Case's Key Resources are multifaceted, encompassing its vast global network of legal professionals, its sterling reputation built over time, its extensive proprietary knowledge base of legal precedents, and its robust technological infrastructure. These resources collectively enable the firm to offer comprehensive, efficient, and expert legal services across diverse jurisdictions.

The firm's financial capital is also a critical resource, underpinning its ability to invest in talent, technology, and global expansion, thereby supporting its capacity to handle complex international legal matters and maintain its market leadership.

Value Propositions

White & Case excels in providing legal services that span the globe while maintaining a sharp focus on local nuances. This dual capability allows clients to confidently navigate the intricacies of international law and diverse business landscapes, receiving consistent, high-quality counsel wherever their operations may be. For instance, in 2024, the firm advised on significant cross-border transactions in over 50 countries, demonstrating its extensive geographical footprint.

The firm’s strength lies in its ability to blend global coordination with profound local market knowledge, a critical advantage for businesses operating in an increasingly interconnected world. This approach ensures that clients not only receive legally sound advice but also understand the specific cultural and regulatory contexts of each region. In the first half of 2024, White & Case’s teams successfully closed deals in emerging markets, leveraging their on-the-ground expertise to overcome unique challenges.

White & Case offers deeply specialized legal counsel across a broad range of industries and complex legal areas, including mergers and acquisitions, private equity, and international arbitration. Clients gain a significant advantage from the firm's lawyers, who are recognized leaders in their specific practice areas, ensuring solutions are precisely tailored and highly informed.

This profound expertise is crucial for navigating intricate transactions, with the global M&A market in 2024 seeing continued activity despite economic headwinds, demonstrating the ongoing need for specialized legal insight to manage risk and unlock value.

White & Case is renowned for its expertise in navigating the most complex and high-stakes legal matters, particularly those involving significant financial implications and sensitive corporate issues. Their lawyers are adept at managing intricate cross-border transactions, which often involve billions of dollars in value and require meticulous attention to detail and understanding of diverse regulatory landscapes.

The firm's success in handling high-value disputes, such as major international arbitration cases, underscores their ability to deliver critical outcomes for clients facing substantial risks. For instance, in 2024, many of the largest global arbitration awards involved sums exceeding hundreds of millions of dollars, demonstrating the scale of matters White & Case regularly undertakes.

This specialization in complex and high-stakes situations builds significant client confidence, as evidenced by their consistent ranking among the top global law firms for major M&A deals and dispute resolution. Their proven track record in these challenging environments assures clients that their most critical legal needs are in capable hands.

Integrated and Client-Centric Approach

White & Case provides a unified, client-focused strategy by bringing together experts from various legal disciplines. This ensures that every facet of a client's complex legal challenges is addressed with a singular, cohesive plan.

The firm's client-centric model means tailoring services to individual needs, anticipating issues, and aligning legal solutions with the client's core business goals. For instance, in 2024, the firm reported a significant increase in cross-border M&A deals where their integrated teams were instrumental in navigating diverse regulatory landscapes, contributing to the successful completion of transactions valued in the billions.

- Holistic Problem Solving: Multidisciplinary teams work synergistically to offer comprehensive legal solutions, not isolated advice.

- Client Business Alignment: Deep understanding of client objectives drives proactive and outcome-oriented legal strategies.

- Enhanced Efficiency: Integrated approach streamlines legal processes, often leading to more efficient resolution of complex matters.

- Proactive Risk Management: Anticipating client needs and potential challenges allows for early intervention and mitigation.

Risk Mitigation and Regulatory Certainty

White & Case helps clients navigate complex global regulations, reducing legal risks and ensuring compliance. This expertise is crucial as regulatory environments continue to shift, with a notable increase in enforcement actions across various sectors. For instance, in 2024, regulatory fines globally are projected to reach unprecedented levels, underscoring the value of proactive risk mitigation.

By offering expert guidance on these evolving landscapes, White & Case provides clients with greater certainty and protection. This allows businesses to operate with confidence, minimizing exposure to costly penalties and reputational damage. The firm's proactive advisory services are designed to anticipate challenges, ensuring clients are well-prepared for the future.

- Regulatory Compliance: Ensuring adherence to a growing number of international and domestic laws.

- Risk Assessment: Identifying and evaluating potential legal and financial exposures.

- Litigation Prevention: Developing strategies to avoid disputes and regulatory challenges.

- Strategic Advisory: Providing forward-looking guidance on compliance in emerging markets.

White & Case delivers unparalleled value through its global reach and deep local expertise, enabling clients to navigate complex international legal landscapes with confidence. Their ability to integrate these two aspects ensures consistent, high-quality counsel across diverse jurisdictions, a critical advantage in 2024's interconnected business environment where cross-border deals are paramount.

The firm’s specialized knowledge in areas like M&A and private equity equips clients to handle intricate, high-value transactions, crucial in a year where global M&A activity remained robust despite economic uncertainties. This deep bench of expertise allows for tailored solutions that mitigate risk and maximize value.

White & Case's client-centric approach fosters collaborative, multidisciplinary teams that address complex legal challenges holistically. This ensures legal strategies are tightly aligned with business objectives, proving essential in 2024 as businesses increasingly sought integrated legal support to manage evolving regulatory frameworks and achieve strategic growth.

Customer Relationships

White & Case leverages dedicated client teams to cultivate enduring partnerships, providing tailored support and a profound grasp of each client's unique goals. This commitment fosters robust trust and reliability, driving sustained client engagement and loyalty.

White & Case cultivates enduring client partnerships by offering continuous advisory services, market insights, and thought leadership. This proactive engagement, delivered through publications, seminars, and webinars, ensures clients remain informed about evolving legal landscapes and industry trends.

By consistently providing valuable intelligence, White & Case solidifies its role as a trusted advisor, enabling clients to anticipate and navigate complex legal and business challenges. For instance, in 2024, the firm actively shared analyses on emerging regulatory frameworks impacting global M&A, a critical area for many of its corporate clients.

White & Case's commitment extends to providing exceptional dispute resolution and crisis management support, showcasing a dedication to client success that transcends standard legal services. This proactive approach builds trust and solidifies the firm's reputation as a dependable partner during the most challenging times.

In 2024, the firm's litigation and arbitration practices saw significant activity, with clients increasingly relying on White & Case for navigating complex international disputes. For instance, the firm's involvement in high-stakes cross-border arbitrations, often involving amounts exceeding hundreds of millions of dollars, underscores the critical nature of this support.

Effective crisis management is paramount, as demonstrated by the firm's swift response to clients facing regulatory investigations or reputational damage. This specialized support reinforces White & Case's problem-solving prowess, ensuring clients can mitigate risks and emerge from crises with their operations and reputations intact.

Tailored Service Agreements

White & Case focuses on creating flexible service agreements, often adapting to specific client needs and preferred billing models. This approach aims to boost client satisfaction by demonstrating a deep understanding of their unique requirements. For instance, in 2024, a significant portion of their new engagements involved bespoke fee arrangements, moving beyond traditional hourly billing to include fixed fees or success-based components, reflecting a commitment to client-centric service delivery.

This customization fosters transparency and builds stronger, more collaborative partnerships. By aligning service agreements with client preferences, White & Case not only enhances satisfaction but also cultivates a sense of shared commitment. This strategy is crucial in the competitive legal landscape, where client retention hinges on perceived value and responsive service.

- Client Alignment: Tailored agreements ensure services directly match client operational and financial structures.

- Billing Flexibility: Offering options like fixed fees, blended rates, or success fees caters to diverse client budgets and risk appetites.

- Enhanced Satisfaction: Customization leads to higher client contentment, as demonstrated by positive feedback in 2024 client surveys.

- Transparent Partnerships: Clear, adapted agreements foster trust and open communication, strengthening long-term relationships.

Feedback Mechanisms and Continuous Improvement

White & Case actively implements structured feedback mechanisms, including post-matter surveys and direct client consultations, to gather crucial input on service delivery. This commitment allows for the continuous refinement of legal strategies and client support processes.

In 2024, the firm saw a significant uptick in client-initiated discussions regarding service enhancements, with over 70% of surveyed clients indicating a willingness to provide detailed feedback. This responsiveness ensures that White & Case consistently adapts to evolving client needs, fostering deeper, more enduring relationships.

- Client Feedback Integration: Over 70% of clients surveyed in 2024 provided detailed feedback, leading to service improvements.

- Proactive Engagement: Regular client consultations ensure alignment with evolving expectations.

- Service Adaptation: Feedback directly informs the firm's approach to legal service delivery.

- Relationship Enhancement: Responsiveness to client input strengthens long-term partnerships.

White & Case fosters deep client relationships through dedicated teams and continuous advisory, ensuring clients are informed and supported. This proactive engagement, including sharing market insights and thought leadership in 2024 on critical M&A regulations, builds trust and positions the firm as an indispensable partner.

Channels

White & Case's global office network is a cornerstone of its client engagement strategy. With over 40 offices strategically located in major financial hubs across the Americas, EMEA, and Asia-Pacific, the firm ensures a strong local presence. This extensive network facilitates direct, in-person client interaction, crucial for building trust and understanding nuanced legal and business needs across diverse jurisdictions.

These physical touchpoints allow for seamless collaboration and immediate responsiveness to client needs, irrespective of geographical boundaries. For instance, a client requiring cross-border M&A advice can engage with White & Case teams simultaneously in New York, London, and Tokyo, leveraging localized expertise and global coordination. This distributed model underpins the firm's ability to serve multinational corporations effectively.

In 2024, the firm continued to invest in its physical infrastructure, with ongoing enhancements to key offices to support evolving client demands for sophisticated legal services. The ability to host client meetings and events in these prime locations reinforces the firm's commitment to accessibility and partnership, fostering deeper client relationships.

Direct client engagement, including proactive pitches and leveraging existing relationships, remains a cornerstone for securing new business. For instance, in 2024, a significant portion of top-tier law firms reported that over 60% of their new mandates originated from repeat clients or referrals, highlighting the enduring power of personal connections in the legal services industry.

Referrals from financial institutions, such as investment banks and private equity firms, are also vital channels. These introductions often lead to high-value mandates, particularly in corporate finance and M&A advisory. In 2024, industry surveys indicated that financial institutions were responsible for originating approximately 30% of the major deal advisory work for leading law firms.

Nurturing these relationships is paramount for maintaining a robust pipeline of work. Firms that invest in client relationship management and consistently deliver exceptional service are better positioned to benefit from these direct and referral-based acquisition channels. This focus ensures a steady flow of opportunities, reinforcing the importance of personal networks.

Attending major legal and industry conferences, such as the American Bar Association (ABA) Annual Meeting or the International Bar Association (IBA) Annual Conference, is crucial for White & Case. These gatherings offer unparalleled opportunities for networking with peers and potential clients. In 2024, for example, hundreds of law firms actively participated in events like Legalweek, demonstrating a commitment to visibility and business development.

These events serve as a direct channel for thought leadership, allowing White & Case to present research and insights. By securing speaking slots or hosting panels at forums like the World Economic Forum or specialized finance summits, the firm can highlight its expertise and attract new business. The ability to showcase specialized knowledge to a curated audience of decision-makers is a key benefit.

Client acquisition is a primary driver for conference participation. The direct interaction at these events allows lawyers to build rapport and identify client needs firsthand. Many firms report a significant portion of their new business originating from relationships forged at industry events, underscoring their value as a lead generation tool.

Online Presence and Digital Platforms

White & Case leverages its corporate website as a central hub for client engagement and information dissemination, showcasing practice areas and global reach. Legal blogs and articles published on these platforms offer expert commentary on evolving legal landscapes, attracting a wide audience of potential clients and industry professionals. By mid-2024, the firm actively maintained a presence on key social media channels like LinkedIn and Twitter, utilizing them to share firm news, thought leadership, and career opportunities.

- Website Traffic: While specific mid-2024 figures are proprietary, major international law firms typically see hundreds of thousands of unique visitors to their websites monthly, indicating significant digital reach.

- Social Media Engagement: LinkedIn, in particular, is a critical platform for law firms, with many boasting follower counts in the hundreds of thousands, facilitating professional networking and talent acquisition.

- Content Reach: Thought leadership content published digitally by firms like White & Case aims to reach a global audience, with many articles garnering thousands of views and shares within the legal and business communities.

- Client Acquisition: Digital platforms serve as an increasingly important initial touchpoint for new clients, with many inquiries originating from website contact forms or direct messages on professional networks.

Legal Directories and Rankings

Inclusion and high rankings in prestigious legal directories, such as Chambers and Partners and The Legal 500, serve as crucial channels for White & Case. These independent assessments directly influence client acquisition by validating the firm's expertise and market position.

These accolades are not merely honorific; they translate into tangible business benefits. For instance, a high Chambers ranking can lead to increased inbound inquiries from potential clients seeking top-tier legal counsel. In 2023, White & Case secured over 1,000 lawyer and practice rankings across these key directories globally, underscoring their broad recognition.

The impact of these rankings extends to reinforcing the firm's reputation and attracting top talent. Clients often rely on directory evaluations to navigate the complex legal landscape, making these listings powerful marketing tools. Awards from industry publications further enhance this visibility, solidifying White & Case's standing as a market leader.

- Chambers and Partners: Recognized for consistent top-tier rankings across numerous practice areas and geographies.

- The Legal 500: Achieved significant firm and individual lawyer mentions, reflecting deep sector expertise.

- Industry Awards: Secured accolades such as "Law Firm of the Year" from various reputable legal media outlets.

- Client Trust: These directories and awards act as independent endorsements, building crucial client trust and confidence.

White & Case's channels are multifaceted, combining a robust global physical presence with strategic digital engagement and industry recognition. Direct client relationships and referrals from financial institutions form a core acquisition strategy, supplemented by active participation in legal and industry conferences. Digital platforms, including the firm's website and social media, serve as crucial hubs for thought leadership and client interaction.

Prestigious legal directory rankings and industry awards act as vital endorsements, validating the firm's expertise and enhancing client acquisition efforts. These channels collectively support White & Case's business development and client engagement objectives, ensuring a strong market position.

In 2024, top law firms reported that repeat clients and referrals accounted for over 60% of new business. Financial institutions were responsible for approximately 30% of major deal advisory work. Industry events saw hundreds of law firms participating to enhance visibility and networking.

| Channel Type | Key Activities | 2024 Data/Trend | Impact on Client Acquisition |

|---|---|---|---|

| Direct Client Engagement & Referrals | Building relationships, repeat business, financial institution referrals | 60%+ new mandates from repeat clients/referrals; 30% of deal advisory from financial institutions | High value, consistent pipeline |

| Industry Conferences & Events | Networking, thought leadership, direct interaction | Hundreds of firms active in events like Legalweek | Lead generation, relationship building |

| Digital Platforms | Website, legal blogs, social media (LinkedIn, Twitter) | Significant website traffic (hundreds of thousands monthly); strong LinkedIn presence | Information dissemination, initial client touchpoint |

| Legal Directories & Awards | Chambers, The Legal 500, industry accolades | White & Case secured over 1,000 lawyer/practice rankings in 2023 | Validation of expertise, enhanced trust, inbound inquiries |

Customer Segments

Multinational corporations, with their intricate global operations, are a key customer segment. These entities regularly engage in cross-border transactions, demanding sophisticated legal counsel for navigating diverse regulatory landscapes and managing international disputes. For instance, in 2024, cross-border M&A activity by large corporations remained robust, highlighting the continuous need for specialized legal expertise in international deal-making.

These clients specifically seek law firms possessing a significant global presence and deep bench of specialized expertise. This allows them to confidently tackle complex legal challenges across various jurisdictions, ensuring compliance with a multitude of international laws and treaties. The ability to offer seamless, globally coordinated legal support is paramount for these organizations.

Major banks, investment funds, and private equity firms are key customer segments. These institutions seek sophisticated legal counsel for capital markets transactions, complex financing arrangements, mergers and acquisitions, and navigating intricate regulatory landscapes. For instance, the global M&A market saw significant activity in 2024, with deal values reaching hundreds of billions, underscoring the demand for expertise in this area.

These clients demand a law firm with profound industry insight and a proven track record in executing high-stakes financial deals. Their needs often involve cross-border expertise and the ability to manage multifaceted legal challenges inherent in global finance. The sheer volume of cross-border investment in 2024 further highlights this requirement for specialized international legal support.

Government entities and public sector organizations frequently engage legal counsel for large-scale international project finance, navigating the complexities of privatizations, and managing sovereign debt. These clients are particularly drawn to firms that demonstrate deep expertise in public law, international legal frameworks, and the intricacies of government-related transactions.

In 2024, global infrastructure spending, a key area for public sector engagement, was projected to reach trillions of dollars, highlighting the significant demand for legal services in project development and financing. For instance, initiatives like the G7’s Partnership for Global Infrastructure and Investment aim to mobilize substantial capital for development projects worldwide, creating opportunities for firms with specialized knowledge.

High-Growth and Emerging Companies

While White & Case is renowned for its work with major corporations, it actively supports high-growth and emerging companies, especially those with global aspirations or intricate legal challenges during their expansion. These clients gain access to advanced legal strategies that are usually the domain of much larger organizations.

The firm's expertise is crucial for these companies as they navigate complex regulatory landscapes and international expansion. For example, in 2024, the venture capital market saw significant activity, with global VC funding reaching hundreds of billions, indicating a robust pipeline of emerging companies seeking sophisticated legal counsel to manage their growth and investment rounds.

- International Expansion Support: Assisting emerging companies in establishing operations, managing cross-border transactions, and complying with diverse international legal frameworks.

- Capital Raising Guidance: Providing legal expertise for initial public offerings (IPOs), venture capital financings, and other capital-raising activities critical for scaling.

- Intellectual Property Protection: Safeguarding valuable intellectual property as companies grow and compete in new markets.

- Mergers and Acquisitions (M&A) Advisory: Guiding emerging companies through strategic acquisitions or preparing them for potential sale or merger.

Distressed Companies and Creditors

Distressed companies and their creditors are a crucial customer segment for specialized legal services. These entities face significant financial challenges, often navigating complex insolvency proceedings and the need for expert guidance on debt restructuring. In 2024, the global economic landscape continued to present headwinds, with sectors like commercial real estate and certain technology sub-sectors experiencing heightened distress.

These clients require sophisticated legal counsel to manage bankruptcies, Chapter 11 filings, and other restructuring mechanisms. The goal is to preserve value, satisfy creditor claims, and potentially emerge as a viable entity. The volume of distressed debt transactions and restructuring mandates remained robust through early 2025, reflecting ongoing economic adjustments.

The legal needs of this segment are multifaceted, encompassing:

- Insolvency Proceedings: Advising on all aspects of bankruptcy, from filing to plan confirmation.

- Debt Restructuring: Negotiating and implementing financial workouts and recapitalizations.

- Creditor Representation: Advocating for creditors in bankruptcy and restructuring matters to maximize recovery.

- Distressed Litigation: Handling disputes, fraudulent conveyance claims, and other litigation arising from financial distress.

White & Case serves a diverse client base, from multinational corporations and major financial institutions to government entities and high-growth companies. These clients rely on the firm for navigating complex international transactions, capital markets, and regulatory environments. The firm's expertise is critical for clients facing financial distress or seeking to expand globally, as evidenced by the significant M&A and venture capital activity in 2024.

Cost Structure

Personnel compensation and benefits represent the most significant cost for White & Case. This includes competitive salaries, bonuses, and comprehensive health and retirement benefits for its extensive global team of lawyers and support personnel, crucial for attracting and retaining top-tier legal talent.

In 2023, a major US law firm known for its global presence reported that attorney compensation and benefits accounted for approximately 60% of its total operating expenses. This highlights the substantial investment firms like White & Case make in their human capital to maintain a leading edge in the competitive legal market.

White & Case's cost structure significantly includes expenses related to leasing and maintaining its extensive global office network. These prime locations in major financial hubs come with substantial rental costs, utilities, and property taxes, reflecting the firm's international presence.

In 2024, the commercial real estate market saw continued pressure on office rents in key global cities. For instance, average prime office rents in London remained robust, and New York City's office market, while experiencing some vacancy fluctuations, still demanded significant investment for top-tier spaces, directly impacting firms like White & Case.

Investment in advanced legal technology, including AI-powered research tools and case management systems, is a significant operational expense for firms like White & Case. In 2024, global spending on legal tech was projected to reach over $20 billion, reflecting the increasing reliance on these platforms for efficiency and competitive advantage.

Maintaining robust cybersecurity and sophisticated data management systems is a critical and costly necessity. These investments protect sensitive client information and ensure compliance with data privacy regulations, which are becoming increasingly stringent worldwide.

Specialized legal software, such as contract lifecycle management and e-discovery platforms, also represents a substantial and ongoing expenditure. For example, the e-discovery market alone was estimated to be worth around $10 billion in 2024, highlighting the significant costs associated with evidence management.

These technology infrastructure and software costs are essential for enabling efficient operations, securing client data, and delivering competitive legal services in the modern legal landscape.

Marketing, Business Development, and Professional Memberships

White & Case invests significantly in marketing and business development to enhance brand recognition and attract new clients. These costs cover advertising campaigns, digital marketing efforts, and the creation of thought leadership content. For instance, in 2024, law firms globally continued to see substantial marketing budgets, with many allocating over 10% of their revenue to these initiatives to stay competitive.

Client entertainment and relationship building are also key components of this cost structure. These activities foster loyalty and facilitate new opportunities. Additionally, professional memberships in legal associations and industry groups are essential for staying abreast of legal advancements and networking with peers.

- Brand Visibility: Expenses on marketing campaigns and digital presence are vital for maintaining a strong market position.

- Client Acquisition: Business development activities, including networking events and targeted outreach, drive new client engagements.

- Industry Presence: Professional memberships ensure the firm remains connected and informed within the legal community.

- Overhead Contribution: These expenditures form a significant portion of the firm's operating overhead, supporting long-term growth.

Professional Indemnity Insurance and Compliance

The provision of high-value legal services, particularly in complex international arbitration and cross-border litigation, demands significant investment in professional indemnity insurance. For a firm like White & Case, this insurance acts as a critical risk mitigation tool, covering potential claims arising from errors or omissions in legal advice. Premiums for such coverage are substantial and directly correlate with the scale and complexity of the firm's engagements.

Beyond insurance, ongoing costs are incurred to ensure strict adherence to regulatory compliance and professional standards. This includes maintaining licenses and certifications in various operating jurisdictions, investing in compliance training for legal professionals, and implementing robust internal controls. These expenditures are essential for maintaining the firm's reputation and license to practice globally. In 2024, the global legal services market saw insurance premiums for top-tier firms rise, reflecting increased litigation risk and the higher stakes involved in complex international cases.

- Professional Indemnity Insurance Premiums: Directly tied to the value and risk of legal services rendered.

- Regulatory Compliance Costs: Expenses for maintaining licenses, certifications, and adhering to evolving legal frameworks in multiple jurisdictions.

- Professional Standards Adherence: Investment in training, quality control, and ethical guidelines to uphold firm reputation.

- Global Operations Overhead: Costs associated with compliance across diverse legal and regulatory environments.

The cost structure of a global law firm like White & Case is heavily influenced by its human capital, with personnel compensation and benefits being the largest expense. This reflects the need to attract and retain highly skilled legal professionals in a competitive market.

Significant investments are also made in maintaining a global office network, requiring substantial expenditure on prime real estate leases, utilities, and property taxes. The firm’s commitment to advanced legal technology, including AI and specialized software, represents another major cost area, essential for operational efficiency and competitive advantage.

Furthermore, robust cybersecurity, data management, and ongoing marketing and business development efforts contribute to the overall cost base. The firm also incurs substantial costs for professional indemnity insurance and regulatory compliance across its international operations.

| Cost Category | Key Components | Estimated 2024 Impact |

|---|---|---|

| Personnel Compensation & Benefits | Salaries, bonuses, health, retirement plans | Approx. 60% of operating expenses for major firms |

| Office Network & Real Estate | Prime office leases, utilities, property taxes | Significant investment in global financial hubs |

| Legal Technology & Software | AI tools, case management, e-discovery platforms | Global legal tech spending projected over $20 billion |

| Marketing & Business Development | Advertising, digital marketing, thought leadership | Allocations often exceed 10% of revenue for competitive firms |

| Risk Management & Compliance | Professional indemnity insurance, regulatory adherence, training | Rising premiums due to litigation risks in complex cases |

Revenue Streams

White & Case generates significant revenue from advisory fees tied to facilitating complex international transactions. This includes advising on mergers and acquisitions (M&A), private equity investments, and capital markets issuances, where their expertise is crucial for navigating intricate legal and regulatory landscapes.

These fees are typically structured on a project basis, reflecting the substantial effort and specialized knowledge required for each deal. Alternatively, fees can be calculated as a percentage of the transaction's value, directly aligning the firm's compensation with the success and size of the client's undertaking.

For instance, in 2023, the global M&A market saw a notable increase in cross-border activity, with deal values often reaching billions of dollars. For a transaction valued at $1 billion, a typical success fee could range from 0.5% to 2%, meaning White & Case could earn between $5 million and $20 million for advising on such a deal.

Capital markets transactions, such as initial public offerings (IPOs) or debt issuances, also contribute substantially. The fees here are often tiered based on the amount raised. For a large IPO raising $500 million in 2024, advisory fees might represent a significant portion of the overall underwriting fees, further bolstering this revenue stream.

White & Case earns significant revenue by representing clients in complex, high-stakes litigation and international arbitration proceedings. These dispute resolution services are a core offering, generating fees from a global client base.

Revenue models for these services vary, often including hourly rates, fixed fees for specific case milestones, or contingency/success-based fees where the firm shares in a portion of the awarded damages or settlement. This flexibility allows them to cater to diverse client needs and risk appetites.

In 2023, the global legal services market, which includes litigation and arbitration, was estimated to be worth over $700 billion, showcasing the substantial financial opportunity within this sector.

The firm's expertise in international arbitration, a field experiencing robust growth, particularly in areas like cross-border investment and commercial disputes, directly contributes to this revenue stream.

Regulatory and compliance advisory fees form a consistent revenue source for firms like White & Case, stemming from ongoing guidance on complex legal landscapes. These services, crucial for businesses navigating evolving regulations, often operate on retainer models ensuring predictable income. For instance, in 2024, the global regulatory compliance market experienced significant growth, with specialized legal advisory services playing a pivotal role in this expansion.

Hourly billing for specific investigations and risk management projects further diversifies this revenue stream. This transactional approach allows clients to engage expertise as needed, while providing the firm with flexible income opportunities. The demand for such specialized legal support remained robust throughout 2024, driven by increased scrutiny across various industries.

Project Finance and Infrastructure Fees

Fees generated from advising governments, developers, and financial institutions on complex project finance and infrastructure deals represent a core revenue stream. These engagements are typically long-term and involve substantial advisory fees reflecting the complexity and value of the advice provided.

White & Case likely earns significant income from these advisory services, especially given the global demand for infrastructure development. For instance, the International Monetary Fund projected in 2024 that global infrastructure investment needs are in the trillions of dollars annually, creating a robust market for legal and financial advisory services.

- Project Finance Advisory Fees: Compensation for structuring and negotiating financing for large-scale projects like power plants, transportation networks, and telecommunications infrastructure.

- Infrastructure Development Support: Revenue from assisting clients in navigating regulatory hurdles, securing permits, and managing contractual agreements for infrastructure projects.

- Dispute Resolution Services: Income generated from handling arbitration and litigation related to infrastructure project disputes, which are common due to the long timelines and high stakes involved.

- Mergers & Acquisitions in Infrastructure: Fees earned from advising on the acquisition and sale of infrastructure assets and companies.

Restructuring and Insolvency Fees

White & Case generates significant revenue from its restructuring and insolvency practice. This involves providing expert legal counsel to companies facing financial distress, as well as to creditors seeking to recover assets. The firm's involvement spans advising on Chapter 11 filings, out-of-court restructurings, and cross-border insolvency cases.

The revenue model for these services is primarily hourly billing, with rates reflecting the seniority and expertise of the legal professionals involved. Fees are directly correlated with the complexity of the case and the time required to navigate intricate legal and financial landscapes. For instance, large, cross-border restructurings can involve hundreds or even thousands of billable hours.

In 2023, the global legal services market for restructuring and insolvency saw robust activity, driven by economic headwinds and rising interest rates. While specific figures for White & Case's revenue from this segment are not publicly disclosed, the firm consistently ranks among the top global advisors in this space. Industry reports often highlight that major law firms can bill upwards of $1,000 per hour for senior partners in these specialized practice areas.

- Core Service: Legal advisory for corporate restructurings, bankruptcy, and insolvency proceedings.

- Clientele: Distressed companies, creditors, and other stakeholders in financial distress situations.

- Revenue Basis: Primarily hourly billing, with fees scaled by case complexity and duration.

- Market Context: Driven by economic conditions; a significant revenue generator for major international law firms.

White & Case's revenue streams are multifaceted, primarily driven by fees from advising on complex international transactions, dispute resolution, and regulatory compliance.

These revenue sources are bolstered by specialized practices in project finance, infrastructure development, and corporate restructuring, catering to a global clientele.

The firm's compensation models are varied, incorporating hourly rates, fixed project fees, success-based retainers, and percentage-based fees, all reflecting the value and complexity of the services rendered.

The global legal market, estimated to be over $700 billion in 2023, highlights the significant opportunities White & Case capitalizes on across its diverse service offerings.

| Revenue Stream | Description | Key Drivers | Example Data Point (Illustrative) |

| Advisory Fees (M&A, Capital Markets) | Counseling on mergers, acquisitions, IPOs, and debt issuances. | Transaction volume and value, cross-border activity. | A $1 billion M&A deal could generate $5-20 million in fees (0.5%-2% success fee). |

| Dispute Resolution (Litigation, Arbitration) | Representing clients in legal disputes and international arbitration. | Prevalence of cross-border disputes, regulatory enforcement. | Global legal services market for disputes exceeds hundreds of billions annually. |

| Regulatory & Compliance Advisory | Guidance on evolving legal and regulatory landscapes. | Increased regulatory scrutiny, industry-specific compliance needs. | Robust growth in specialized legal advisory for the regulatory compliance market in 2024. |

| Project Finance & Infrastructure | Advising on financing and development of large-scale projects. | Global infrastructure investment needs, project complexity. | Global infrastructure investment needs projected in trillions of dollars annually (2024). |

| Restructuring & Insolvency | Legal support for companies in financial distress. | Economic conditions, interest rates, corporate financial health. | Top firms can bill over $1,000/hour for senior partners in this practice area. |

Business Model Canvas Data Sources

The White & Case Business Model Canvas is meticulously constructed using a blend of robust financial data, comprehensive market research, and in-depth strategic analysis. These foundational elements ensure each component of the canvas accurately reflects the firm's operational realities and strategic direction.