White & Case Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White & Case Bundle

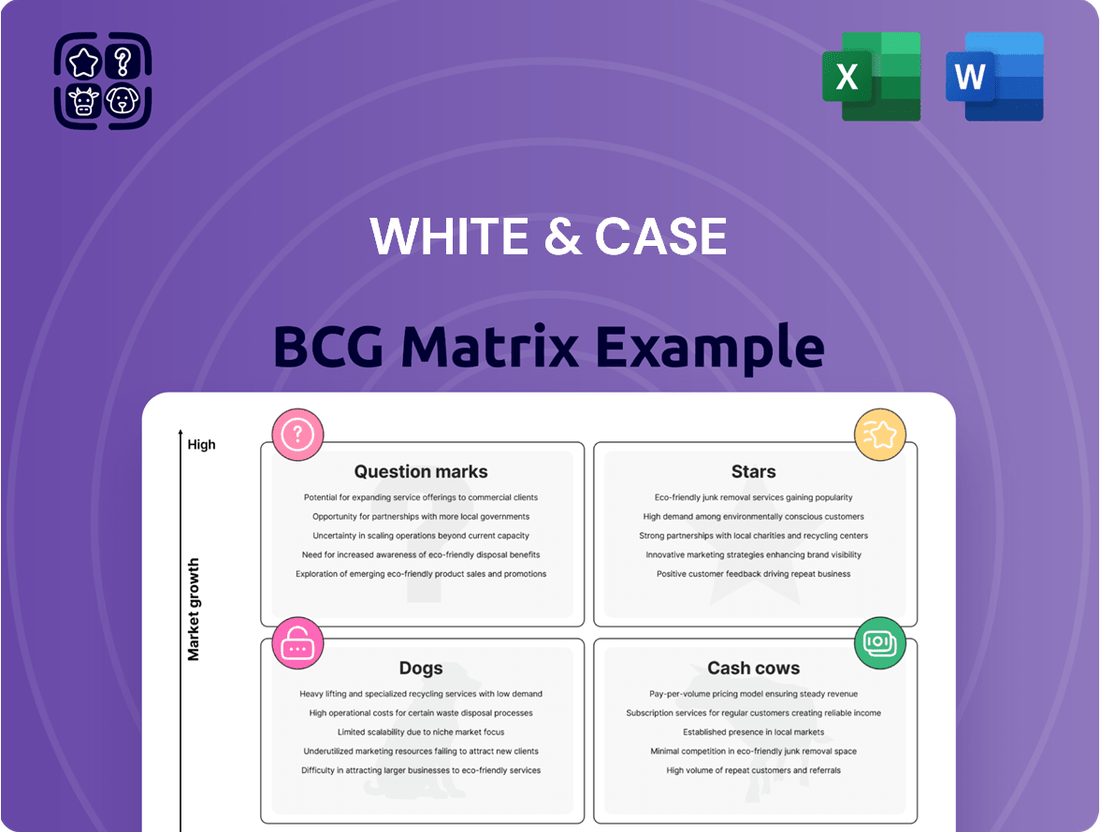

This glimpse into the White & Case BCG Matrix reveals how their diverse portfolio is strategically categorized. By understanding which products are Stars, Cash Cows, Dogs, or Question Marks, you can begin to grasp their market dynamics. However, this is just the surface-level view.

To truly unlock the strategic potential and make informed decisions, dive deeper into the full BCG Matrix report. It provides a comprehensive breakdown of each product's position, offering actionable insights for resource allocation and future growth.

Don't miss out on the opportunity to gain a competitive edge. Purchase the complete BCG Matrix to receive detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing White & Case's product strategy.

Stars

White & Case is a powerhouse in cross-border M&A and private equity, a sector that saw robust activity in 2024. Their extensive global reach and deep industry knowledge are key to securing a significant share of these intricate, high-value deals.

The firm’s strategic focus on this segment is evident, as they continue to invest in capabilities that support this vital area for revenue expansion. This commitment positions them well to capitalize on the ongoing revival and strong growth trends observed in the international deal market.

White & Case stands out with a premier international arbitration practice, excelling in both investment treaty and commercial disputes, especially those connected to emerging markets. This sector is experiencing robust growth, fueled by global geopolitical realignments and a rise in cross-border conflicts, where the firm's strong reputation and deep experience consistently place it at the forefront. Their ability to achieve favorable outcomes in challenging and evolving arbitration landscapes is a key strength.

White & Case commands a dominant position in global capital markets, securing the #1 spot in Bloomberg's H1 2025 Capital Markets League Tables. This leadership underscores their extensive deal volume and influence across various financial products.

Their advisory work in sustainable finance, particularly on green bond issuances, highlights a strategic focus on a rapidly growing sector. With increasing ESG mandates and investor appetite, this area is poised for significant expansion, and White & Case is well-positioned to capture a substantial market share.

Legal Technology & AI Integration for Service Delivery

White & Case is at the forefront of integrating advanced legal technology, particularly generative AI, to redefine how legal services are delivered. This commitment extends to boosting internal operations and fostering deeper client engagement through innovative digital solutions.

The legal technology sector is witnessing significant expansion, with a growing number of law firms prioritizing the adoption of AI-powered tools to gain a competitive edge. This surge reflects a broader industry shift towards embracing digital transformation.

White & Case's forward-thinking approach is underscored by their recognition with the 'Innovation in Generative AI Strategy' award in 2024. This accolade highlights their leadership in adopting and implementing cutting-edge AI technologies within the legal domain.

The firm's strategic investments are designed to enhance efficiency and provide superior value to clients. Key areas of focus include:

- Automating routine tasks: Utilizing AI to streamline document review, contract analysis, and legal research, freeing up legal professionals for more complex strategic work.

- Improving client collaboration: Implementing secure platforms that facilitate seamless communication and document sharing with clients, enhancing transparency and responsiveness.

- Driving operational efficiency: Leveraging AI for workflow optimization, predictive analytics in case management, and resource allocation to reduce costs and improve turnaround times.

- Developing novel service offerings: Exploring AI-driven insights and solutions to address emerging client needs and create new avenues for legal service delivery.

Global Debt Finance

White & Case's Global Debt Finance practice experienced a remarkable year in 2024, advising on numerous multi-billion dollar financings. This robust activity underscores their strong market standing in a sector characterized by sustained high demand. The firm's extensive expertise in both US and English law, coupled with a seamlessly integrated global network, positions them as a preferred advisor for intricate cross-border debt finance transactions. This practice area consistently contributes significant revenue and maintains exceptional client interest.

Key highlights from 2024 for the Global Debt Finance practice include:

- Advising on financings exceeding $50 billion in aggregate value across diverse industries.

- Leading roles in landmark syndicated loan facilities and high-yield bond issuances.

- Successfully navigating complex regulatory environments for international clients.

- Maintaining a top-tier reputation for handling sophisticated, multi-jurisdictional debt restructurings.

Stars represent high-growth, high-market-share businesses within the BCG matrix. White & Case’s dominant position in global capital markets, securing the #1 spot in Bloomberg's H1 2025 Capital Markets League Tables, exemplifies a Star. Their extensive deal volume and influence across various financial products indicate strong growth and a leading market share, making this a key area for continued investment and focus.

What is included in the product

This BCG Matrix overview provides tailored analysis for a company's product portfolio, detailing strategic insights for each quadrant.

The White & Case BCG Matrix offers a clear, visual way to understand portfolio health, relieving the pain of strategic uncertainty.

Cash Cows

White & Case's core commercial litigation practice consistently generates substantial revenue, acting as a reliable cash cow for the firm. This group excels in securing significant settlements in high-stakes disputes, particularly those involving complex cross-border and regulatory issues. The mature nature of this market, coupled with White & Case's deep-seated reputation and proven expertise, ensures a steady flow of client demand and robust profitability.

White & Case's expertise in general corporate and regulatory compliance serves as a bedrock for their diverse clientele, including multinational corporations, governments, and financial institutions. This area represents a stable, high-margin segment of their business, driven by the intricate and global nature of compliance demands.

While not a rapidly expanding market, the consistent need for guidance on corporate governance and regulatory adherence ensures a steady revenue stream. For instance, in 2024, the global legal services market experienced continued growth, with compliance and regulatory advisory remaining a significant contributor, particularly for firms with international reach like White & Case.

The complexity inherent in navigating diverse legal frameworks and international regulations allows White & Case to command premium fees for these services. This predictability makes it a dependable component of their overall business strategy, akin to a cash cow that reliably generates substantial income.

White & Case's Project Development and Finance practice in traditional infrastructure and energy is a clear Cash Cow. Their deep, decades-long expertise in these mature but perpetually active global markets, from oil and gas to power generation, consistently attracts high-value mandates. This established strength translates into a reliable revenue stream, underscored by their involvement in numerous landmark projects, such as advising on the financing of the largest renewable energy projects. For instance, in 2023, global infrastructure investment reached an estimated $3.4 trillion, with traditional energy and renewables forming a significant portion.

Antitrust and Competition

White & Case's antitrust practice operates as a prominent cash cow, reflecting its deep expertise in advising multinational corporations on complex competition law matters. This practice area consistently delivers substantial revenue streams through its involvement in high-stakes global merger reviews, significant cartel enforcement actions, and critical abuse of dominance investigations. The firm's extensive international network and profound understanding of diverse regulatory environments underpin its success in this mature and vital sector.

The firm’s antitrust team is renowned for handling some of the most challenging merger control filings worldwide. For instance, in 2023, White & Case advised on numerous significant global transactions requiring approval from multiple antitrust authorities, contributing to the firm's robust revenue generation. Their advisory work often involves intricate remedies and extensive engagement with regulators, solidifying their position as a leader.

Key revenue drivers for White & Case's antitrust practice include:

- Merger Control: Advising on complex cross-border transactions requiring clearance from international antitrust agencies.

- Cartel Defense: Representing clients facing investigations and litigation related to alleged anti-competitive agreements.

- Abuse of Dominance: Counseling companies on preventing and responding to allegations of monopolistic practices.

- Regulatory Counseling: Providing ongoing advice to businesses on compliance with evolving competition laws globally.

Financial Restructuring and Insolvency

White & Case's financial restructuring and insolvency practice operates in a mature market that, while generally stable, experiences cyclical upticks. This practice area is a significant cash cow for the firm, consistently advising on complex business reorganizations and intricate cross-border insolvency cases. Their established reputation and deep expertise make them a preferred choice for high-stakes restructuring mandates.

The demand for these services naturally ebbs and flows with broader economic conditions. However, White & Case's strong market position and specialized knowledge allow them to maintain robust revenue streams even during slower periods. For instance, in 2024, the firm was notably active in several large-scale restructurings across diverse industries, reflecting ongoing client needs for sophisticated insolvency advice.

The practice consistently generates strong cash flow due to the high-value nature of the transactions it handles. This includes advising creditors, debtors, and other stakeholders on navigating distressed situations. The firm's ability to secure significant fees from these critical engagements solidifies its status as a reliable cash-generating business unit.

- Market Position: High market share in a mature, cyclical industry.

- Service Offering: Advises on complex business reorganizations and cross-border insolvency.

- Revenue Generation: Generates strong cash flow from high-value, critical restructuring work.

- 2024 Activity: Engaged in numerous significant restructurings, demonstrating consistent demand.

White & Case's expertise in financial restructuring and insolvency represents a stable, high-margin business, acting as a dependable cash cow. This practice consistently attracts complex, high-value mandates, even during economic downturns, due to the firm's established reputation and deep knowledge in navigating distressed situations.

The firm's ability to secure significant fees from these critical engagements, advising debtors, creditors, and other stakeholders, solidifies its status as a reliable cash generator. For instance, in 2024, White & Case was actively involved in several large-scale restructurings across various industries, underscoring sustained client demand for their specialized insolvency advice.

This practice benefits from a high market share in a mature, though cyclical, industry. The consistent revenue stream is driven by the firm’s advisory work on complex business reorganizations and intricate cross-border insolvency cases, making it a core contributor to profitability.

| Practice Area | Cash Cow Characteristics | Key Activities | 2024 Relevance | Market Dynamics |

| Financial Restructuring & Insolvency | Mature market, high-value mandates, stable revenue | Complex business reorganizations, cross-border insolvencies, distressed situation advice | Active in multiple large-scale restructurings | Cyclical upticks, but sustained demand for expertise |

Full Transparency, Always

White & Case BCG Matrix

The White & Case BCG Matrix preview you are currently viewing is the complete, unwatermarked document you will receive immediately after your purchase. This ensures you are seeing the exact strategic tool designed for rigorous business analysis and decision-making. The professional formatting and comprehensive insights are preserved, offering you a ready-to-use resource for evaluating your portfolio's strategic positioning. Rest assured, there are no alterations or demo content; you are getting the final, professional output.

Dogs

The commoditized local property conveyancing market, often characterized by high transaction volumes and consequently lower profit margins per deal, has seen a noticeable downturn. This slowdown is largely attributed to the persistent impact of elevated interest rates and broader cost of living pressures, which tend to dampen real estate activity. For instance, in many developed economies, residential property transactions in 2023 and early 2024 were down significantly compared to pre-pandemic levels, affecting all participants in the conveyancing chain.

White & Case, as a premier global law firm, strategically positions itself in the realm of complex, high-value cross-border transactions and mergers and acquisitions. Consequently, the firm does not actively participate in the commoditized local property conveyancing segment. This deliberate focus means that this particular area represents a low-growth, low-market-share aspect of White & Case's overall business portfolio, aligning with its strategy to concentrate on more intricate and lucrative legal services.

Routine local family law, encompassing straightforward divorces and child custody matters, is typically the domain of smaller, neighborhood law practices. This segment of the legal market is characterized by low growth prospects.

White & Case's strategic focus and operational scale are not designed for the high-volume, lower-value transactions characteristic of these localized family law services. Their business model is geared towards more complex, international, and higher-fee engagements.

In 2024, the demand for some routine family law services may be influenced by demographic shifts, including potential depopulation trends in certain regions, which could further limit market expansion.

Basic wills and estate planning are generally considered low-growth, high-volume services. These offerings are more suited for individual clients rather than the large corporations and financial institutions that typically engage White & Case for complex legal matters. The firm’s strategic focus remains on high-value, intricate legal challenges, making this segment less of a priority.

Small-Scale, Domestic-Only Litigation

Small-scale, domestic-only litigation that lacks significant financial or strategic implications for major corporations would likely be considered a Dog in the White & Case BCG Matrix.

These types of cases do not efficiently utilize the firm's extensive global network or its highly specialized expertise in complex, cross-border disputes. The overhead associated with a top-tier international firm managing such matters would likely result in low returns compared to the resources invested.

For example, a purely domestic contract dispute involving a mid-sized company, with damages under $1 million, would not align with White & Case’s typical client profile or the nature of its most profitable engagements. In 2024, the average cost of commercial litigation in the US can range from $30,000 to $100,000 for simpler cases, and much higher for complex ones, making smaller domestic disputes less appealing for firms focused on high-value international work.

- Low Strategic Importance: These cases typically do not involve precedent-setting issues or major reputational risks for large enterprises.

- Inefficient Resource Allocation: The firm's global infrastructure and specialized talent are not optimally deployed on such matters.

- Limited Profitability: The revenue generated from small domestic cases may not justify the firm's operational costs and required partner involvement.

- Opportunity Cost: Resources spent on these cases could be better utilized on more lucrative, complex international litigation.

General Consumer Protection Litigation (non-class action)

General Consumer Protection Litigation (non-class action) represents a segment where White & Case's focus is not on handling numerous individual consumer complaints. Instead, their expertise is channeled towards defending or advising clients on broader, more significant consumer protection matters that impact businesses. This area, while not a primary growth driver, is crucial for addressing the systemic issues that affect their corporate clientele.

In 2024, the landscape of consumer protection litigation continued to evolve, with a notable increase in individual claims arising from data privacy breaches and deceptive marketing practices. While White & Case's engagement in these smaller, individual cases is limited, their involvement in larger, systemic consumer protection issues remains a key strength.

- Low Market Share in Individual Cases: White & Case primarily engages in high-stakes litigation and advisory work, meaning individual consumer protection claims, which often involve smaller financial stakes and less complex legal arguments, do not represent a significant portion of their practice volume.

- Focus on Systemic Issues: The firm's strength lies in defending corporations against allegations of widespread deceptive practices, unfair advertising, or breaches of consumer rights that have a broad impact, rather than managing numerous isolated disputes.

- Strategic Advisory Role: White & Case provides strategic counsel to businesses navigating complex consumer protection regulations and potential liabilities, helping them mitigate risks associated with product marketing, sales, and customer service operations.

- High-Profile Client Defense: Their involvement in this space is typically characterized by representing major corporations facing significant regulatory scrutiny or high-profile litigation concerning consumer protection, where their global reach and deep industry knowledge are paramount.

Dogs in the BCG framework represent business units or products with low market share in low-growth industries. For White & Case, these are legal services that do not align with their core strengths in complex, cross-border, high-value transactions.

Examples include small-scale domestic litigation or routine conveyancing, which, while potentially generating revenue, are not strategic growth areas and may offer limited profitability relative to the firm's resources. In 2024, the legal market continues to see specialization, pushing firms like White & Case further into niche, high-demand areas, leaving less profitable segments as potential Dogs.

Question Marks

The cybersecurity and data privacy legal market is booming, driven by widespread digital adoption and evolving regulations. For instance, the global cybersecurity market was projected to reach $300 billion in 2024, highlighting significant client demand.

While White & Case has expertise in technology and regulatory issues, its position in highly specialized, emerging areas within cybersecurity and data privacy, such as novel digital asset protection or cutting-edge privacy tech compliance, might be considered a Question Mark.

This classification reflects an area where the firm is actively developing its practice and market share, potentially facing strong competition from firms with deeply entrenched, specialized reputations in these nascent fields.

The firm's investment in building capabilities here could lead to substantial future growth, mirroring the increasing regulatory scrutiny, with GDPR fines alone exceeding €2 billion by early 2024.

The rapid evolution of AI necessitates specialized advisory services, covering its complex regulatory and ethical dimensions. This burgeoning field presents a significant opportunity for firms like White & Case, as the legal and compliance frameworks for AI are still very much under construction.

White & Case's strategic focus on developing a dominant external advisory practice for cutting-edge AI regulatory and ethical issues is a forward-thinking move. This area, particularly concerning novel AI applications, represents a nascent market with substantial growth potential, where establishing an early lead is crucial.

By 2024, the global AI market was projected to reach hundreds of billions of dollars, with significant investment flowing into AI development and deployment. This growth underscores the increasing demand for expert guidance on navigating the intricate web of AI regulations and ethical considerations that accompany these advancements.

The firm's internal investment in AI for operational efficiency complements its external advisory ambitions. This dual approach allows them to build deep, practical understanding of AI technologies, which can then be leveraged to provide more informed and impactful advice to clients grappling with AI's unique legal and ethical challenges.

Expanding into niche emerging markets, like specialized digital economy regulations in frontier economies, presents a classic 'Question Mark' scenario for a firm like White & Case. These nascent legal areas offer substantial growth prospects, mirroring the global trend of digital transformation. For instance, the compound annual growth rate for legal tech in emerging markets was projected to be around 15% between 2022 and 2027, highlighting the potential.

Such ventures demand considerable upfront investment in talent acquisition and local market penetration. Building the necessary expertise in areas like data privacy laws in Southeast Asian nations or fintech regulations in African startups requires dedicated resources and time. The global legal services market, valued at approximately $1 trillion in 2023, continues to see emerging markets contribute a growing share, with some regions expected to grow at over 10% annually.

Alternative Fee Arrangements (AFAs) and Value-Based Billing Models

The legal sector's move towards Alternative Fee Arrangements (AFAs) and value-based billing is a powerful current, reshaping how clients engage law firms and how firms operate. This shift signifies a substantial growth area driven by evolving client demands for predictability and cost efficiency. For a firm of White & Case's caliber, navigating and expanding service delivery within these newer models, while ensuring continued profitability, presents a strategic 'Question Mark'.

The key uncertainty lies in the ultimate market share AFAs will capture and their potential impact on established revenue streams. While data from 2024 indicates a growing adoption, the precise long-term penetration and the optimal balance between traditional and alternative billing remain subjects of ongoing evaluation.

- Market Share Uncertainty: While AFAs are growing, their exact future market share relative to hourly billing for large-scale international matters is still developing.

- Profitability Optimization: Determining how to maintain and enhance profitability across diverse AFA structures, such as fixed fees, success fees, and blended rates, is a critical challenge.

- Client Value Perception: Successfully aligning AFA structures with demonstrable client value, beyond mere cost reduction, is crucial for sustainable adoption.

- Operational Adaptation: The internal processes and technological investments required to efficiently manage and deliver services under AFAs represent an ongoing strategic question.

Climate Change Litigation and Adaptation Advisory

The burgeoning field of climate change litigation and adaptation advisory represents a significant growth opportunity, moving beyond broader ESG concerns. White & Case's involvement in sustainable finance positions them well, but establishing a leading presence in this specialized, fast-paced litigation and advisory area could be considered a 'Question Mark'.

This domain, focusing on climate liability lawsuits and corporate adaptation strategies, is experiencing rapid expansion. For instance, the number of climate litigation cases globally has seen a substantial increase, with reports indicating hundreds of new cases filed annually in recent years. Companies are increasingly seeking expert guidance on navigating these legal challenges and developing robust adaptation plans to mitigate physical and transitional climate risks.

- Climate Litigation Growth: Global climate litigation has surged, with hundreds of new cases filed annually, demonstrating a clear trend.

- Adaptation Advisory Demand: Corporations are actively seeking specialized advice on adapting to climate change impacts and associated legal liabilities.

- Market Specialization: White & Case is building capabilities in this niche, aiming to capture a growing market share in a highly specialized legal service.

- Strategic Expansion: This area represents a strategic investment for the firm, potentially becoming a dominant practice as climate-related legal and advisory needs evolve.

Areas like novel digital asset protection or cutting-edge privacy tech compliance are nascent fields where White & Case is developing its practice. This presents a classic Question Mark, as the firm builds market share against established specialists in these emerging cybersecurity and data privacy niches.

The firm's focus on AI regulatory and ethical advisory is a strategic move into a rapidly growing market. While AI's market value was projected to reach hundreds of billions in 2024, the legal frameworks are still evolving, making this a Question Mark for market leadership.

Expansion into specialized digital economy regulations in frontier economies also falls into the Question Mark category. These areas offer high growth potential, as seen in the projected 15% CAGR for legal tech in emerging markets, but require significant investment.

The shift towards Alternative Fee Arrangements (AFAs) is a significant growth area, but White & Case's optimal profitability and market share within these structures remain a key question. While AFA adoption grew in 2024, their long-term impact is still being assessed.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.