White & Case PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White & Case Bundle

Gain a competitive edge with our meticulously crafted PESTLE Analysis for White & Case. Uncover the intricate political, economic, social, technological, legal, and environmental factors that are currently shaping the global legal landscape and impacting White & Case's strategic direction. Equip yourself with the essential intelligence needed to anticipate challenges and seize emerging opportunities. Purchase the full, actionable report now to unlock critical insights and refine your own market approach.

Political factors

Geopolitical stability is a cornerstone for White & Case's business, directly impacting cross-border transactions. When global political climates are calm, companies feel more confident pursuing international mergers, acquisitions, and capital markets deals, which are key revenue generators for the firm. For instance, in 2024, despite ongoing regional conflicts, there was a noticeable uptick in cross-border M&A activity in sectors like technology and renewable energy, reaching an estimated $2.5 trillion globally by mid-year, benefiting firms like White & Case.

Conversely, heightened geopolitical tensions, such as trade wars or new sanctions regimes, can significantly dampen international deal-making. This can result in a slowdown in the volume and complexity of transactions White & Case handles, directly affecting their deal flow. For example, the ongoing trade friction between major economic blocs in late 2024 led to a cautious approach by many corporations, with a reported 15% decrease in cross-border investment announcements in the latter half of the year compared to the first half.

Periods of enhanced stability, however, create a fertile ground for global business expansion, which in turn drives demand for White & Case's specialized legal expertise. As countries forge new trade agreements and foster investment-friendly policies, companies increasingly require sophisticated legal counsel for navigating international regulations and structuring complex deals. The stabilization of supply chains and a more predictable regulatory environment observed in early 2025 is expected to boost global FDI by an estimated 5-7% for the full year.

Governments globally are sharpening their focus on antitrust investigations, data privacy mandates, and the oversight of financial services. For a firm like White & Case, which provides counsel on navigating these complex regulatory landscapes and resolving significant disputes, these shifts directly influence their operations and client needs. For instance, the European Union's Digital Markets Act, implemented in 2023 and carrying significant fines for non-compliance, exemplifies the intensified regulatory environment that demands specialized legal expertise.

Shifting global trade policies and evolving diplomatic ties directly impact White & Case's clients, especially those with international supply chains or cross-border business dealings. For instance, the World Trade Organization (WTO) reported a 1.3% increase in global trade volumes in 2024, a modest but positive sign, yet geopolitical tensions continue to create volatility. The firm's proficiency in international arbitration and complex cross-border transactions is thus increasingly vital as clients confront intricate tariffs, sanctions, and trade barriers, such as those seen in ongoing disputes impacting semiconductor supply chains.

Government Spending and Infrastructure Projects

Government spending on infrastructure, particularly in areas like renewable energy and digital networks, directly fuels demand for legal services. White & Case's advisory role in major project finance deals, such as those in the burgeoning offshore wind sector, highlights this. For instance, the US Infrastructure Investment and Jobs Act of 2021 allocated over $1 trillion towards improving roads, bridges, and clean energy, creating a wave of transactional and regulatory work.

Public-private partnerships (PPPs) are a key mechanism for delivering these large-scale projects. These collaborations, often involving complex contractual frameworks and financing structures, are areas where firms like White & Case excel. The UK's continued investment in its rail network through PPPs, for example, represents ongoing legal opportunities in procurement and dispute resolution.

Government initiatives supporting the energy transition are particularly impactful. Investments in green hydrogen, battery storage, and grid modernization are leading to significant M&A activity and project development. In 2024, global investment in energy transition technologies was projected to reach new highs, directly translating into legal advisory needs for White & Case and similar firms.

- Government spending on infrastructure projects, such as the US’s $1 trillion Infrastructure Investment and Jobs Act, creates substantial legal opportunities.

- Public-private partnerships in sectors like UK rail modernization offer complex legal work in contracting and finance.

- The global energy transition, with significant 2024 investment forecasts, drives M&A and project finance legal advisory.

- White & Case’s involvement in advising on large-scale energy sector acquisitions demonstrates the direct link between government spending and legal services demand.

Political Elections and Policy Uncertainty

Major global elections in 2024, including the United States presidential election and the European Parliament elections, have created a degree of policy uncertainty, which can lead to a temporary slowdown in dealmaking and investment. This hesitation is often driven by businesses waiting to understand the implications of new administrations and potential shifts in regulatory or fiscal policies.

However, the stabilization of political landscapes, which is expected in many key economies during 2025, often acts as a catalyst for renewed economic activity and increased mergers and acquisitions (M&A). For firms like White & Case, this post-election stabilization can unlock pent-up demand for legal and advisory services related to corporate transactions.

The anticipation of clearer policy directions following these electoral cycles can significantly boost investor confidence. For instance, a clearer stance on trade agreements or industry-specific regulations can encourage cross-border investments and domestic expansion, directly impacting the M&A market.

- 2024 witnessed over 60 elections worldwide, impacting a significant portion of the global population and economic activity.

- The US presidential election alone can influence global FDI flows, with historical data suggesting shifts in investment patterns based on administration policies.

- Post-election periods often see a rebound in M&A activity; for example, after the 2020 US election, global M&A volume surged significantly in the following year.

- The projected stability in major economies by 2025 is expected to fuel a recovery in deal volumes, potentially exceeding pre-election levels.

Political stability is crucial for White & Case, influencing cross-border deals and international investment. Geopolitical tensions can hinder M&A, as seen with a 15% drop in cross-border investment announcements in late 2024 due to trade friction. Conversely, stable political environments, with predictable regulations and new trade agreements, foster global expansion, driving demand for legal services, with global FDI projected to increase by 5-7% in 2025.

What is included in the product

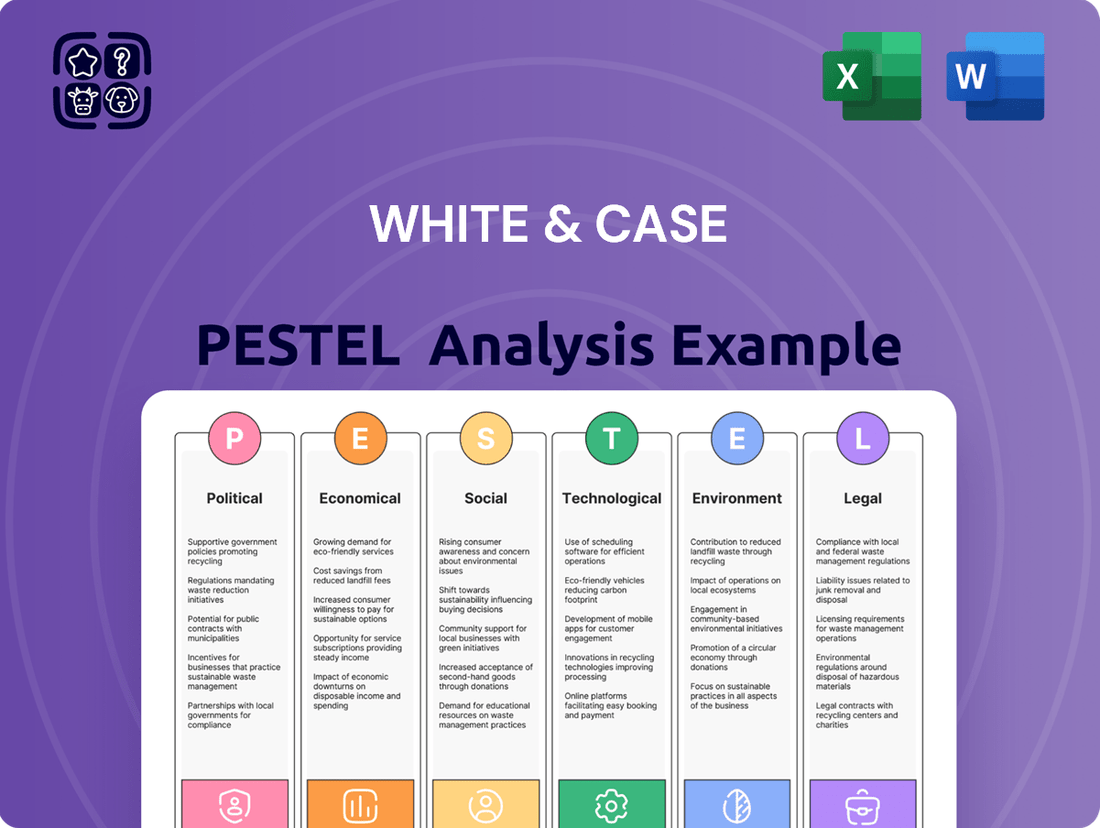

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting White & Case, providing actionable insights for strategic decision-making.

A clear, actionable framework that helps identify and mitigate external threats and opportunities, fostering more informed strategic decision-making.

Economic factors

White & Case's financial health is intrinsically linked to the global economic landscape, especially the M&A and capital markets. When the global economy is strong, with solid GDP growth and positive sentiment, we typically see more deals happening, boosting demand for White & Case's corporate and transactional services. This was evident in 2024, where the firm reported substantial revenue increases, mirroring a noticeable upturn in global deal-making activity.

Interest rates and inflation are critical economic levers. In late 2024 and projected into 2025, many central banks are aiming for a 'soft landing', suggesting a gradual decrease in interest rates and a return to inflation targets, potentially around 2-3% in major economies like the US and Eurozone. This environment is generally positive for M&A and project financing.

Fluctuations here directly affect the cost of borrowing, making it more or less expensive for companies and investors to fund acquisitions or new ventures. For instance, if interest rates fall, as anticipated in some forecasts for 2025, the cost of capital decreases, potentially leading to higher company valuations.

This scenario is particularly beneficial for firms like White & Case, which advise on mergers, acquisitions, and large-scale project financing. Lower borrowing costs and stable inflation can embolden CEOs and private equity firms, increasing deal volumes and, consequently, demand for legal and advisory services.

The financial health of White & Case's clients, encompassing corporations, governments, and financial institutions, is a critical driver for the demand for legal services. When these entities are financially stable, they are more likely to engage in complex transactions and strategic initiatives that require expert legal counsel.

Investment trends are particularly illuminating. For instance, the leveraged finance market, a key area for White & Case, saw significant activity. In 2024, global leveraged loan issuance was projected to reach over $1 trillion, indicating robust client investment and a corresponding need for legal support in structuring and executing these deals.

Growth in specific sectors where White & Case has a strong presence further signals opportunity. The healthcare and life sciences sector, for example, continued its upward trajectory with substantial M&A activity; by mid-2024, healthcare M&A volume globally was on track to surpass previous years, suggesting sustained client investment and a high likelihood of increased legal engagement.

Similarly, the energy sector, particularly in areas like renewable energy finance and infrastructure development, experienced considerable investment throughout 2024. This sustained client capital deployment in areas aligned with White & Case's expertise directly translates into demand for the firm's services in navigating complex regulatory environments and transaction structures.

Currency Fluctuations and International Operations

Currency fluctuations significantly impact global law firms like White & Case, affecting reported revenues and expenses across its international offices. For instance, a strengthening US dollar in 2024 could make revenue earned in euros or yen appear lower when converted back to dollars, impacting the firm's overall financial performance. Navigating these shifts is crucial for maintaining profitability.

Managing a worldwide network involves understanding how foreign exchange rates influence operational costs and the value of cross-border transactions. White & Case's ability to advise clients on international deals means it must also manage its own exposure to these same currency risks. This requires sophisticated treasury management and a keen awareness of global economic trends.

- Global Economic Outlook (2024-2025): The International Monetary Fund (IMF) projects global growth to moderate in 2024 and slightly improve in 2025, with significant variations across regions, impacting the relative strength of major currencies.

- Major Currency Performance (Late 2024 - Early 2025): Analysts anticipate continued volatility in major currency pairs like EUR/USD and USD/JPY, influenced by differing monetary policies and geopolitical events, directly affecting the translation of foreign earnings for firms like White & Case.

- Impact on Legal Services: Fluctuations can alter the cost-effectiveness of legal services in different markets and influence the pricing strategies for cross-border advisory work.

- Risk Mitigation Strategies: Firms often employ hedging techniques and local currency invoicing to mitigate the adverse effects of currency volatility on their financial statements and operational planning.

Competition and Pricing Pressures in Legal Market

The legal market is seeing increased competition, not just from rival law firms but also from Alternative Legal Service Providers (ALSPs). These ALSPs often offer specialized services at lower costs, forcing traditional firms to re-evaluate their pricing. For instance, ALSPs accounted for an estimated 10% of legal spend in 2023, a figure projected to grow. This competitive pressure is pushing firms like White & Case towards more predictable billing, such as fixed fees or value-based billing, rather than relying solely on hourly rates.

This shift in client expectations towards cost certainty means that law firms must clearly articulate their value proposition. Simply offering expertise is no longer enough; firms need to demonstrate efficiency and a client-centric approach to service delivery. The ability to manage costs effectively and deliver measurable outcomes will be crucial for maintaining profitability and market share in the coming years.

- Increased ALSP Market Share: ALSPs captured approximately 10% of the legal services market in 2023, with projections indicating continued growth.

- Client Demand for Predictable Billing: A significant majority of corporate legal departments expressed a preference for fixed fees or alternative fee arrangements over traditional hourly billing in recent surveys.

- Value-Based Service Delivery: Law firms are increasingly focusing on demonstrating tangible value and ROI to clients, moving beyond just legal expertise.

- Adapting Service Models: White & Case, like its peers, must innovate its service delivery to incorporate technology and more efficient processes to counter pricing pressures.

The global economic climate significantly influences White & Case's business, particularly M&A and capital markets activity. A robust economy with healthy GDP growth and positive market sentiment typically fuels more transactions, directly increasing demand for the firm's transactional legal services. For example, 2024 saw substantial revenue growth for the firm, mirroring a notable uptick in global deal-making.

Interest rates and inflation are key economic indicators. Projections for late 2024 and 2025 suggest central banks are targeting a soft landing, with gradual interest rate decreases and inflation returning to around 2-3% in major economies. This environment is generally favorable for M&A and project finance, as lower borrowing costs can boost company valuations and encourage investment.

Client financial health is paramount; financially stable corporations, governments, and financial institutions are more likely to engage in complex, high-value transactions requiring expert legal counsel. Investment trends, such as the over $1 trillion projected for global leveraged loan issuance in 2024, highlight robust client investment and the corresponding need for legal support in structuring these deals.

Currency fluctuations directly impact firms with a global presence like White & Case, affecting reported revenues and expenses. A strengthening US dollar in 2024, for instance, could reduce the dollar value of earnings from European or Japanese offices. Managing these currency risks through sophisticated treasury management and hedging strategies is crucial for maintaining profitability.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on White & Case |

|---|---|---|---|

| Global GDP Growth | Moderating growth (IMF) | Slight improvement | Influences overall deal volume and client activity. |

| Interest Rates | Potential for gradual decrease in major economies | Continued gradual decrease | Lower cost of capital encourages M&A and project finance. |

| Inflation | Targeting 2-3% in major economies | Targeting 2-3% | Stable inflation supports predictable client investment. |

| Leveraged Loan Issuance (Global) | Projected over $1 trillion | Expected continued strength | Indicates robust client investment and demand for deal structuring. |

| Healthcare M&A Volume | On track to surpass previous years (mid-2024) | Continued growth expected | High client investment in a key sector for the firm. |

Same Document Delivered

White & Case PESTLE Analysis

The preview shown here is the exact White & Case PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of political, economic, social, technological, legal, and environmental factors impacting White & Case.

Everything displayed here is part of the final product; what you see is what you’ll be working with, offering actionable insights for strategic planning.

Sociological factors

Attracting and retaining top legal professionals is a significant hurdle for global firms like White & Case, especially in today's competitive legal landscape. Factors like flexible work arrangements, robust compensation packages, and clear career progression pathways are paramount. For instance, a 2024 survey indicated that over 60% of associates prioritize work-life balance when choosing an employer.

White & Case addresses this by investing heavily in its people, utilizing both strategic lateral hiring to bring in specialized expertise and fostering internal growth through promotions. This approach ensures a pipeline of skilled lawyers ready to meet client demands. In 2023, the firm reported a 15% increase in internal promotions to senior associate and partner levels.

The legal sector, like many industries, is experiencing a significant shift towards greater workforce diversity, equity, and inclusion (DEI). This isn't just a matter of social responsibility; it's increasingly becoming a business imperative. Clients, especially large corporations, are scrutinizing their outside counsel for alignment with their own DEI goals. In 2023, for instance, a notable percentage of major corporations tied a portion of their legal spend to law firms demonstrating progress in DEI metrics.

White & Case's proactive stance, exemplified by the appointment of its first female firm chair, signals a deep understanding of these evolving client expectations and societal demands. This move not only reflects an internal commitment to fostering a more inclusive environment but also positions the firm favorably in securing business from organizations that prioritize diverse leadership and teams. Such leadership diversity is often linked to improved decision-making and a broader understanding of varied client needs.

The emphasis on DEI directly impacts recruitment strategies, aiming to attract talent from a wider range of backgrounds and experiences. It also shapes firm culture, encouraging environments where all employees feel valued and can contribute their best work. This, in turn, can enhance innovation and client service, as diverse perspectives often lead to more creative problem-solving and a better grasp of complex, global legal issues. By 2024, many leading law firms reported that DEI initiatives were a key factor in attracting top-tier legal talent.

Clients today expect a more integrated and technologically advanced experience from law firms like White & Case. Beyond just legal acumen, there's a strong demand for efficient, prompt service, often delivered through digital platforms. For instance, a 2024 survey indicated that 70% of corporate legal departments prioritize law firms that offer robust online portals for case management and communication.

To meet these evolving client demands, White & Case must adapt its service delivery models. This involves embracing innovation and leveraging technology to enhance client interaction. A hybrid approach, blending traditional in-person meetings with digital tools like secure client portals and video conferencing, is becoming the standard for responsiveness and accessibility.

This shift is driven by a broader societal trend towards digital-first interactions. As clients become more accustomed to seamless digital experiences in other sectors, their expectations for professional services naturally align. Firms that fail to integrate these digital capabilities risk falling behind in client satisfaction and retention.

Corporate Social Responsibility (CSR) Demands

Societal and investor expectations for corporate social responsibility (CSR) and ethical conduct are significantly shaping business landscapes. This heightened awareness directly impacts client acquisition and a firm's overall reputation. For White & Case, demonstrating a robust commitment to Environmental, Social, and Governance (ESG) principles is no longer optional; it's a critical differentiator in attracting and retaining clients who actively seek partners aligned with sustainability and positive social impact.

The demand for responsible business practices is evidenced by growing investment flows into ESG-focused funds. For instance, global sustainable investment assets reached an estimated $37.7 trillion in early 2024, according to reports from The Forum for Sustainable and Responsible Investment (US SIF) and other industry bodies. This trend underscores the financial imperative for firms like White & Case to integrate ESG into their core strategies.

White & Case's proactive engagement in ESG initiatives, such as pro bono work on human rights issues and efforts to reduce its environmental footprint, directly addresses these evolving client priorities. Firms that can credibly showcase their commitment to ethical operations and social contribution are better positioned to win business in a market increasingly driven by values-based decision-making.

- Growing Investor Demand: Global sustainable investment assets are projected to continue their upward trajectory, with significant growth anticipated in 2024 and 2025 as more institutional investors prioritize ESG factors.

- Client Preference for Ethical Partners: Surveys consistently show a rising percentage of corporate clients considering a potential partner's CSR record when making selection decisions, with some studies indicating over 60% of businesses factor this into their vendor choices.

- Reputational Impact: Strong CSR performance enhances brand image, leading to increased client loyalty and a competitive edge, while poor performance can result in reputational damage and loss of business.

- Regulatory Scrutiny: Anticipated new regulations globally regarding climate risk disclosure and supply chain ethics will further compel businesses to adopt and demonstrate robust CSR frameworks.

Generational Shifts in the Workforce

Generational shifts are profoundly reshaping the legal landscape, and firms like White & Case need to adapt. Younger legal professionals, particularly Gen Z and Millennials, often prioritize work-life balance and flexible arrangements over traditional, rigid structures. For instance, a 2024 report indicated that over 60% of associates surveyed expressed a strong preference for hybrid work models.

To attract and retain top talent from these emerging generations, White & Case must actively cultivate a culture that embraces technology and offers transparent career progression. This means investing in modern practice management software and providing clear mentorship programs. In 2025, data suggests that firms with robust technology integration and visible advancement opportunities see significantly higher employee retention rates among junior associates.

Key considerations for White & Case include:

- Adapting to evolving work preferences: Offering flexible hours and remote work options to accommodate the work-life balance demands of younger lawyers.

- Leveraging technology: Implementing advanced legal tech tools that appeal to digitally native professionals and improve efficiency.

- Clear career development: Providing structured mentorship, training, and transparent pathways for advancement to foster long-term commitment.

- Fostering an inclusive culture: Creating an environment that values diverse perspectives and communication styles prevalent among different generations.

Societal expectations are increasingly pushing businesses towards greater diversity, equity, and inclusion (DEI). This translates into client demands for law firms to reflect diverse representation, impacting recruitment and firm culture. A 2024 survey found that 65% of corporate clients consider a law firm's DEI commitment when selecting outside counsel.

Furthermore, there's a growing emphasis on corporate social responsibility (CSR) and ethical conduct, driven by both societal values and investor pressure. Demonstrating a commitment to ESG principles, such as environmental sustainability and fair labor practices, is becoming a critical factor in client acquisition, with global sustainable investment assets reaching an estimated $37.7 trillion by early 2024.

Generational shifts also play a significant role, with younger legal professionals prioritizing work-life balance and flexible work arrangements. Firms that adapt to these evolving preferences, by offering hybrid models and clear career progression, will be better positioned to attract and retain top talent.

The demand for technologically advanced client experiences is also a key societal trend. Clients expect efficient, digital-first interactions, pushing firms to adopt robust online portals and integrated communication tools to meet these expectations.

Technological factors

The legal industry is experiencing a seismic shift with the rapid adoption of Artificial Intelligence, particularly generative AI. This technology is fundamentally reshaping how legal professionals approach their work, promising greater efficiency and precision.

White & Case has embraced this evolution, earning accolades for its forward-thinking generative AI strategy. Their implementation focuses on enhancing critical tasks such as drafting complex legal documents and extracting crucial data, demonstrating a tangible commitment to technological advancement within their client services.

This integration is not just about adopting new tools; it's about achieving measurable improvements. By leveraging AI, firms like White & Case aim to boost accuracy and ensure greater consistency across a wide range of legal processes, from initial client intake to final case preparation.

The increasing digital footprint and the critical nature of client data handled by White & Case necessitate stringent cybersecurity and data privacy measures. The firm must remain vigilant against evolving cyber threats, which saw global cybercrime costs projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures. This requires continuous investment in advanced security protocols to safeguard sensitive information and uphold client trust.

Compliance with a complex web of data privacy regulations, such as GDPR and CCPA, is not merely a legal obligation but a strategic imperative. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover. White & Case must ensure its practices align with these evolving global standards to mitigate risks and maintain its reputation as a secure and reliable legal partner.

The legal sector is undergoing a significant digital transformation, extending well beyond artificial intelligence. Cloud computing is enabling greater collaboration and accessibility to case information, while advanced data analytics are providing deeper insights into legal trends and outcomes. E-discovery tools are becoming more sophisticated, allowing for faster and more efficient review of vast amounts of digital evidence. For example, the global legal tech market was valued at approximately $27.1 billion in 2023 and is projected to grow significantly in the coming years, reflecting substantial investment in these technologies.

White & Case is actively investing in practice technology and innovation to adapt to these changes. These investments are designed to streamline internal operations, enhance the delivery of services to clients, and ultimately maintain a strong competitive position. This proactive approach addresses the increasing demand for technologically advanced legal solutions and ensures the firm remains at the forefront of a rapidly evolving market.

Remote Work Technologies and Collaboration

The shift towards remote and hybrid work models has fundamentally altered operational requirements for global firms like White & Case. This necessitates sophisticated technological solutions to ensure consistent productivity and collaboration across dispersed teams. For instance, by mid-2024, reports indicated that over 70% of professional roles globally were offering some form of flexible work, highlighting the permanence of this trend.

Effective utilization of communication and collaboration platforms is paramount for maintaining team cohesion and operational efficiency. White & Case can leverage tools such as Microsoft Teams, Slack, or Zoom, which saw significant user base growth throughout 2023 and into early 2024, with many reporting a 30-50% increase in daily active users compared to pre-pandemic levels. These platforms are crucial for real-time interaction, document sharing, and project management, bridging geographical divides.

Ensuring secure and reliable access to firm resources is another critical technological imperative. This involves robust VPN capabilities, multi-factor authentication, and cloud-based infrastructure that can handle increased remote access demands. Cybersecurity investments in these areas are projected to increase by an average of 15% annually in the legal sector through 2025, reflecting the heightened importance of data protection in a distributed workforce environment.

- Increased reliance on cloud-based collaboration tools has become standard, with many firms reporting a 40% uplift in cloud service usage for project management and document sharing since 2022.

- Virtual private networks (VPNs) and cybersecurity measures are critical, with spending on legal sector cybersecurity expected to exceed $2.5 billion globally by the end of 2024.

- Video conferencing platforms saw a surge, with platforms like Zoom reporting over 300 million daily meeting participants in early 2024, up from around 10 million in late 2019.

- Investment in digital infrastructure is ongoing, with firms allocating a greater portion of their IT budgets to support remote and hybrid work capabilities.

Automation of Routine Legal Tasks

The increasing automation of routine legal tasks is a significant technological factor. Tools are now adept at handling repetitive work like contract review and legal research, freeing up lawyers for more complex matters.

This shift allows firms like White & Case to enhance efficiency and potentially deliver more cost-effective services. For instance, AI-powered contract analysis platforms can process thousands of documents in a fraction of the time traditional methods take, potentially reducing review time by up to 70% for certain tasks.

The ability to automate these processes means lawyers can dedicate more time to strategic thinking, client counseling, and developing innovative legal solutions, thereby elevating the value proposition offered to clients.

- Increased Efficiency: Automation handles tasks like due diligence and document review much faster than manual processes.

- Cost Reduction: By automating routine tasks, law firms can potentially lower operational costs, translating to more competitive pricing for clients.

- Focus on High-Value Work: Lawyers can now concentrate on complex legal strategy, client advisory, and business development, rather than being bogged down by repetitive administrative duties.

- Improved Accuracy: Automated systems can reduce human error in data extraction and analysis, leading to more reliable outcomes in legal processes.

Technological advancements are fundamentally reshaping the legal landscape, with AI and automation driving significant efficiency gains. The legal tech market is booming, valued at approximately $27.1 billion in 2023, with substantial growth projected. Firms are investing heavily in digital infrastructure to support new ways of working and deliver enhanced client services.

Legal factors

White & Case navigates a dynamic global legal landscape, particularly in areas like antitrust and financial services. For instance, the EU AI Act, expected to significantly impact technology and data usage, is a prime example of evolving regulations that demand constant attention.

Adapting to these changes is crucial for advising clients effectively. This includes staying abreast of shifts in UK competition law, which can affect mergers and market practices. White & Case's ability to interpret and apply these complex international rules ensures client adherence and maintains the firm's advisory edge.

Governments and regulatory bodies globally are intensifying their review of international mergers and acquisitions. This heightened scrutiny often centers on potential impacts on competition and national security. For instance, the US Federal Trade Commission (FTC) and the Department of Justice (DOJ) have been actively reviewing large tech mergers, with several deals facing significant challenges or outright blocking in 2023 and early 2024 due to antitrust concerns.

White & Case's deep understanding of global merger control regulations and antitrust laws is therefore invaluable. Clients undertaking cross-border M&A must navigate a complex web of approvals, and the firm's expertise helps manage these processes, mitigating risks of enforcement actions and ensuring smoother transitions.

The trend of increased regulatory oversight is evident across major economic blocs. The European Commission, for example, has been proactive in investigating deals that could create dominant market positions, with a notable increase in in-depth investigations for non-EU transactions with significant EU revenue in 2023. This global pattern underscores the need for robust legal guidance.

The increasing prevalence of data protection and privacy regulations, like the EU's GDPR and California's CCPA, presents a significant compliance challenge. For White & Case, managing extensive client data necessitates rigorous adherence to these rules, crucial for avoiding substantial fines and preserving client confidence. GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial stakes.

Growth in ESG-Related Litigation and Compliance

The landscape of Environmental, Social, and Governance (ESG) is seeing a significant uptick in legal challenges and stricter regulatory oversight. This surge is largely driven by concerns over greenwashing, where companies make misleading claims about their sustainability efforts, and a greater demand for corporate accountability. For instance, the number of ESG-related lawsuits filed in the US has been steadily climbing, with a notable increase observed in recent years as investors and consumers demand greater transparency and action.

White & Case is strategically positioned to assist clients in navigating these evolving legal complexities. The firm's expertise can guide businesses through the intricate web of new ESG regulations and potential litigation. This includes advising on the development and implementation of comprehensive ESG compliance frameworks designed to proactively mitigate risks and potential liabilities arising from their sustainability initiatives.

- Increased Litigation: Reports indicate a substantial rise in ESG-related litigation globally, with a particular focus on environmental claims and corporate governance.

- Regulatory Scrutiny: Regulators worldwide are intensifying their focus on ESG disclosures and practices, leading to more enforcement actions and fines for non-compliance.

- Greenwashing Concerns: Allegations of greenwashing are a primary driver of legal action, highlighting the need for accurate and substantiated ESG reporting.

- Compliance Frameworks: Businesses are increasingly seeking legal counsel to build robust internal controls and reporting mechanisms to ensure adherence to ESG standards and avoid legal repercussions.

Legal Professional Standards and Ethics in a Digital Age

The rapid integration of artificial intelligence and other digital tools into legal practice presents significant challenges to established professional standards and ethical norms. White & Case, like all major firms, must navigate how these technologies impact core duties such as client confidentiality and attorney-client privilege. For instance, ensuring that AI platforms used for document review or legal research adhere to strict data privacy regulations is paramount, especially with increasing scrutiny over data handling practices.

Maintaining the responsible use of AI is a critical ethical imperative for White & Case. This involves understanding the limitations of AI, ensuring human oversight, and being transparent with clients about the use of such technologies. The potential for algorithmic bias in AI-driven legal analytics also demands careful consideration to uphold principles of fairness and equity in legal services.

- Client Confidentiality: Ensuring that AI tools used for client data processing comply with robust data security protocols and privacy laws, a growing concern as data breaches remain a significant threat, with cybersecurity spending in the legal sector projected to rise.

- Attorney-Client Privilege: Verifying that the deployment of AI in communication or advice generation does not inadvertently waive privilege through improper data handling or sharing.

- Responsible AI Use: Developing internal guidelines and training for legal professionals on the ethical application of AI, focusing on accuracy, bias mitigation, and transparency with clients about AI's role in their matters.

- Regulatory Compliance: Staying abreast of evolving regulations concerning AI in legal practice, such as those emerging from bar associations and data protection authorities globally, to ensure adherence to new legal mandates.

Legal frameworks are increasingly shaping how businesses operate globally, especially concerning antitrust and mergers. For example, in 2023, regulatory bodies like the US FTC and DOJ actively challenged major tech mergers, highlighting intensified scrutiny on competition and national security impacts. This global trend demands sophisticated legal navigation for cross-border transactions.

The proliferation of data protection laws, such as GDPR and CCPA, mandates rigorous compliance, with potential fines reaching substantial percentages of global turnover. White & Case's expertise in these areas is vital for clients to avoid penalties and maintain trust. Furthermore, ESG regulations are expanding, leading to increased litigation over greenwashing claims and a greater demand for transparent sustainability reporting.

The legal profession itself is adapting to AI, raising ethical considerations around client confidentiality and attorney-client privilege. Firms must ensure AI tools meet strict data privacy standards and develop guidelines for responsible use to mitigate bias and maintain transparency with clients. Staying current with evolving AI regulations is crucial for maintaining professional standards.

| Regulatory Area | Key Trend | Impact on Businesses | Example Data (2023-2024) |

|---|---|---|---|

| Antitrust & M&A | Increased scrutiny of mergers, particularly in tech | Longer approval timelines, potential deal blocking | US FTC/DOJ challenged numerous tech mergers; EU saw a rise in in-depth merger investigations |

| Data Protection | Stricter enforcement of privacy laws (GDPR, CCPA) | Significant compliance costs, risk of large fines | GDPR fines can reach up to 4% of global annual turnover |

| ESG | Growing litigation over greenwashing and disclosure | Need for robust ESG reporting and compliance frameworks | Rise in ESG-related lawsuits in the US; increased regulatory focus on ESG practices |

| AI in Legal Practice | Ethical considerations regarding confidentiality and privilege | Need for secure AI tools and clear usage policies | Projected rise in cybersecurity spending in the legal sector to protect client data |

Environmental factors

Global pressure for Environmental, Social, and Governance (ESG) principles is reshaping client needs, pushing White & Case to expand its advisory services in sustainability and climate change law. Clients are actively seeking guidance on ESG compliance, robust disclosure frameworks, and the intricacies of sustainable finance, creating new avenues for legal expertise.

This trend is evident in the market, with sustainable finance deals projected to reach trillions in the coming years, as indicated by various financial institutions. For instance, the sustainable bond market alone saw significant growth in 2023 and is expected to continue its upward trajectory into 2024 and 2025, reflecting a clear client demand for legal support in these evolving areas.

Governments globally are intensifying efforts to combat climate change through stricter regulations and policies aimed at fostering a green transition. This push towards a lower-carbon economy significantly reshapes industries, especially those in energy and infrastructure development.

For instance, the European Union's Green Deal aims for climate neutrality by 2050, backed by substantial investment in sustainable technologies. This regulatory landscape necessitates strategic adaptation for businesses, influencing investment decisions and operational strategies.

White & Case assists clients in navigating these evolving regulatory frameworks, advising on investments in renewable energy ventures, and supporting their journey towards achieving net-zero carbon emissions targets. The firm's expertise is crucial for companies seeking to align their operations with global sustainability objectives.

In 2024, global investment in the energy transition reached an estimated $2 trillion, highlighting the significant financial flows directed towards decarbonization efforts. This trend is projected to accelerate as regulatory pressures and market demand for sustainable solutions continue to grow.

Law firms, including White & Case, are facing growing demands to operate sustainably and minimize their environmental impact. This pressure stems from clients, regulators, and the broader public, pushing for reduced carbon footprints and greater corporate accountability. For instance, many major corporations now include sustainability metrics in their selection criteria for legal service providers.

White & Case's commitment to environmental responsibility is increasingly vital for its brand image and client relationships. By actively pursuing eco-friendly business practices, the firm can attract and retain clients who prioritize sustainability in their own operations. This also resonates with stakeholders who expect ethical and responsible corporate behavior.

In 2023, the legal sector globally saw a significant rise in demand for ESG (Environmental, Social, and Governance) related legal services, with many firms reporting substantial growth in this practice area. This trend highlights the direct link between sustainability and business opportunity for firms like White & Case.

Resource Scarcity and Supply Chain Resilience

Resource scarcity, exacerbated by climate change, is increasingly disrupting global supply chains. This creates significant legal challenges for businesses, particularly concerning contract performance and unforeseen events. For instance, a severe drought in Southeast Asia in early 2025 impacted agricultural output, leading to numerous disputes over delivery obligations for food commodities.

The legal complexities arising from these disruptions often involve force majeure clauses, contract renegotiations, and navigating new trade regulations aimed at securing critical resources. White & Case's deep understanding of international trade law and cross-border litigation positions them to assist clients in resolving these intricate matters, ensuring business continuity and compliance.

The economic impact is substantial; the World Bank estimated in late 2024 that climate-related disasters could cost the global economy trillions of dollars by 2050, with supply chain disruptions being a major component of that figure. This underscores the growing need for robust legal frameworks and expert counsel.

- Increased Contract Disputes: As supply chains falter, businesses face more litigation over unmet contractual obligations.

- Force Majeure Claims: Extreme weather events and other climate-related impacts are triggering more force majeure clauses, leading to legal battles over contract validity.

- Regulatory Compliance: Governments are implementing stricter regulations on resource sourcing and supply chain transparency, requiring expert legal guidance.

- Cross-Border Challenges: Navigating international laws and dispute resolution mechanisms for global supply chain issues demands specialized expertise.

Reputational Risk from Environmental Incidents

Environmental incidents, such as oil spills or chemical leaks, can inflict severe reputational damage on companies, leading to loss of customer trust and market share. In 2023 alone, companies globally faced billions in fines and settlements related to environmental non-compliance, highlighting the substantial financial implications of such failures. White & Case often steps in to guide clients through the complex aftermath of environmental crises, offering expertise in crisis communication, litigation defense, and navigating stringent regulatory investigations.

The increasing global focus on sustainability and corporate social responsibility means that even minor environmental missteps can be amplified by social media and public scrutiny. For example, a 2024 report indicated that 60% of consumers consider a company's environmental record when making purchasing decisions. This heightened awareness places a premium on proactive environmental governance, including robust risk assessment and mitigation strategies, to safeguard a company's public image and long-term viability.

- Reputational Damage: Environmental incidents can erode consumer trust and brand loyalty, impacting sales and market value.

- Legal and Financial Penalties: Non-compliance with environmental regulations can result in substantial fines, litigation costs, and operational disruptions.

- Regulatory Scrutiny: Companies are subject to increasing oversight from environmental agencies, requiring diligent adherence to evolving standards.

- Investor Confidence: Strong environmental, social, and governance (ESG) performance is becoming a key factor for institutional investors, influencing access to capital.

The escalating urgency around climate change and sustainability directly influences corporate strategy and legal advisory needs. Businesses are increasingly seeking legal counsel on navigating environmental regulations and meeting ESG commitments, driven by both regulatory pressures and market expectations.

Global investment in the energy transition surged, with an estimated $2 trillion directed towards decarbonization efforts in 2024, a trend expected to continue. This highlights the immense legal and strategic opportunities in renewable energy and sustainable infrastructure development.

Resource scarcity, amplified by climate events, is causing significant supply chain disruptions, leading to increased contract disputes and force majeure claims. For instance, a drought in Southeast Asia in early 2025 impacted agricultural output, triggering numerous legal challenges over commodity delivery. The World Bank projected in late 2024 that climate-related disasters could cost the global economy trillions by 2050, with supply chain impacts being a key factor.

Environmental incidents carry substantial reputational and financial risks, with companies facing billions in fines for non-compliance in 2023. Furthermore, approximately 60% of consumers in 2024 factored a company's environmental record into purchasing decisions, underscoring the critical need for robust environmental governance.

| Environmental Factor | Impact on Businesses | Legal Implications & Opportunities | Data/Statistics (2023-2025 Projections) |

|---|---|---|---|

| Climate Change & Sustainability Focus | Increased demand for ESG compliance, sustainable finance, and green transition strategies. | Advisory on ESG disclosure, sustainable finance deals, renewable energy investments, net-zero targets. | Sustainable finance deals projected in trillions; global investment in energy transition reached $2 trillion in 2024. |

| Resource Scarcity & Supply Chain Disruptions | Disruption of operations, increased contract disputes, and force majeure claims. | Navigating force majeure clauses, contract renegotiations, international trade regulations, cross-border dispute resolution. | Climate-related disasters could cost trillions by 2050 (World Bank, late 2024); drought in SE Asia (early 2025) impacted agricultural supply chains. |

| Environmental Incidents & Non-Compliance | Reputational damage, loss of customer trust, market share decline. | Crisis communication, litigation defense, regulatory investigations, managing fines and settlements. | Billions in fines/settlements globally for environmental non-compliance (2023); 60% of consumers consider environmental record (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a robust mix of official government publications, reputable market research firms, and leading international organizations. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.