White & Case Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White & Case Bundle

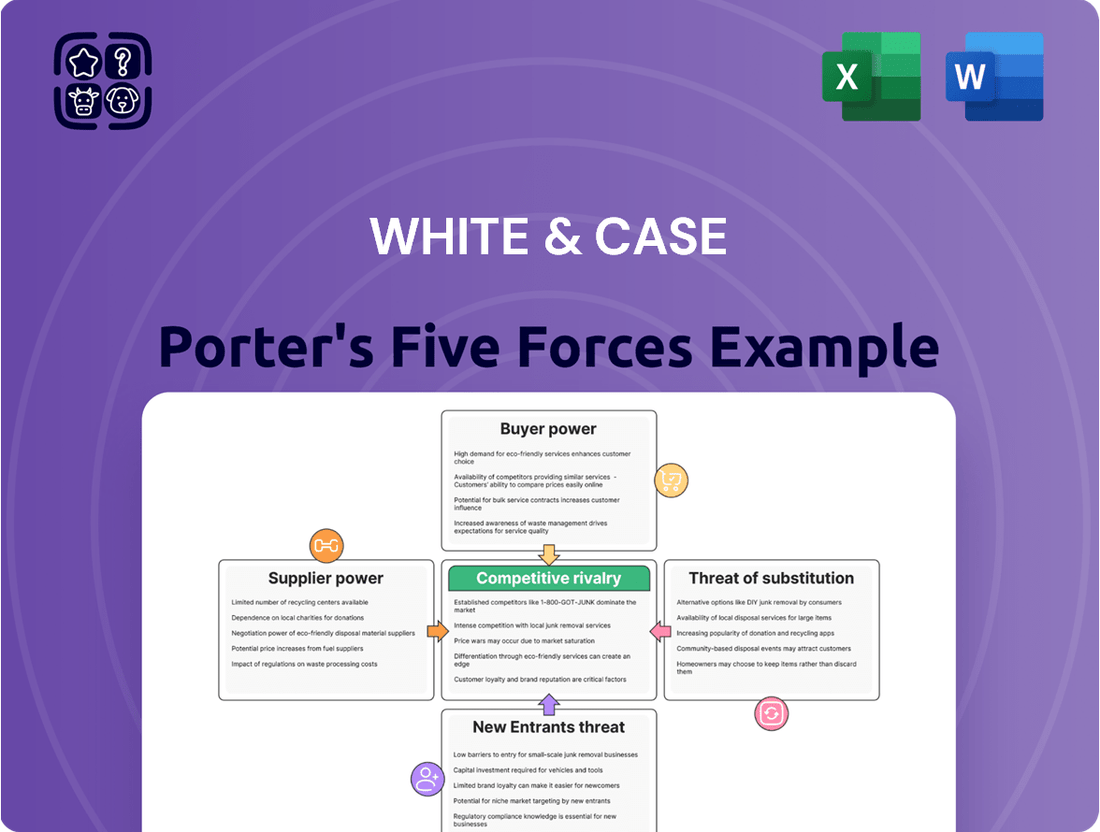

White & Case operates in a highly competitive legal landscape, influenced by several key market forces. Understanding the intensity of rivalry among law firms, the bargaining power of clients, and the threat of new entrants is crucial for strategic planning. Equally important are the pressures from substitute services and the influence of suppliers, such as technology providers.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore White & Case’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The primary suppliers to White & Case are its highly skilled legal professionals, including partners and specialized staff. The intense demand for top-tier legal talent, especially those with expertise in complex cross-border transactions and high-stakes dispute resolution, grants these professionals considerable bargaining power.

This competition for talent directly influences compensation and benefits, a trend reflected in White & Case's impressive performance, with reports indicating record profits per equity partner in 2024. Such financial success is often a direct result of attracting and retaining elite legal minds.

Specialized legal technology providers, particularly those offering AI-powered tools for contract analysis, e-discovery, and legal research, wield significant bargaining power. As law firms like White & Case increasingly depend on these advanced solutions for operational efficiency and to maintain a competitive edge, the specialized nature of these offerings limits readily available alternatives, thereby strengthening the suppliers' leverage.

Global information and data service providers, such as those offering legal databases and regulatory intelligence, wield significant bargaining power. Their services are often indispensable for law firms, making them critical operational components. In 2024, the reliance on these platforms remains high, with firms investing heavily in maintaining access to comprehensive and current data.

The high switching costs associated with migrating from established providers like Westlaw or LexisNexis further solidify their strong position. Transitioning to a new system involves not only financial expenditure but also the time and effort required for data integration and user retraining, often presenting a substantial barrier to change for even the largest global firms.

Prime Real Estate and Infrastructure

The bargaining power of suppliers for prime real estate is significant for a global firm like White & Case. Landlords in major financial hubs such as New York and London, where White & Case maintains a substantial presence, can leverage their desirable locations and high-quality facilities. This is particularly true given the firm's need for premium office spaces to cater to its high-profile clientele and attract top legal talent.

The requirement for strategically positioned offices in cities with high commercial rents means White & Case is susceptible to price increases. For instance, average office rents in Manhattan's prime submarkets often exceed $70 per square foot annually, while London's West End can see figures upwards of £100 per square foot. These costs directly impact the firm's operational expenses.

- High Demand for Prime Locations: Limited availability of premium office space in global financial centers grants landlords leverage.

- Client and Talent Attraction: The firm's need for prestigious addresses to serve elite clients and recruit top lawyers enhances supplier power.

- Rising Rental Costs: Fluctuations in real estate markets, especially in key cities, can lead to increased occupancy costs for White & Case.

- Infrastructure Quality: The essential nature of state-of-the-art facilities for a law firm of White & Case's caliber further strengthens the position of real estate suppliers.

Expert Consultants and Support Services

White & Case’s reliance on specialized consultants like forensic accountants and industry experts for complex international cases grants these suppliers significant bargaining power. The niche expertise required for intricate litigation and cross-border transactions means fewer providers can meet these demands, increasing supplier leverage.

High-level support services, including IT infrastructure, cybersecurity, and sophisticated marketing, also contribute to supplier power. The critical nature of these services for a global law firm, especially in protecting client data and maintaining operational efficiency, allows specialized service providers to command favorable terms.

- Specialized Consultants: Firms often engage forensic accountants for financial investigations and industry specialists for sector-specific knowledge, driving up the cost of specialized expertise.

- IT and Cybersecurity: The increasing threat landscape necessitates advanced IT and cybersecurity solutions, making providers of these services indispensable.

- Global Operations: Supporting international operations requires robust and often proprietary IT systems, further entrenching the power of key technology suppliers.

The bargaining power of suppliers for White & Case is notably high, primarily due to the specialized nature of the services and talent required by a global law firm. Key suppliers include elite legal professionals, advanced legal technology providers, and providers of global information and data services, all of whom can command significant leverage. This power is further amplified by high switching costs and the critical need for premium locations and infrastructure.

| Supplier Category | Key Factors Influencing Bargaining Power | Example Impact on White & Case |

|---|---|---|

| Legal Professionals (Partners & Staff) | High demand for specialized skills, intense competition for talent | Drives up compensation and benefits; contributes to high partner profits (e.g., record profits per equity partner reported in 2024) |

| Legal Technology Providers (AI, E-discovery) | Specialized offerings, limited readily available alternatives, increasing reliance for efficiency | Secures favorable terms for advanced solutions necessary for competitive edge |

| Information & Data Service Providers (Legal Databases) | Indispensable services, high switching costs (e.g., Westlaw, LexisNexis) | Ensures continued reliance and investment in these platforms, solidifying their market position |

| Real Estate Providers (Prime Locations) | High demand in financial hubs, need for prestigious addresses, rising rental costs | Increases operational expenses, with prime Manhattan rents often exceeding $70/sq ft and London West End exceeding £100/sq ft annually |

| Specialized Consultants (Forensic Accountants) | Niche expertise, limited providers for complex cases | Increases costs for specialized litigation and transaction support |

| IT & Cybersecurity Providers | Critical nature of services, increasing threat landscape, global operational needs | Makes providers indispensable, allowing them to set terms for essential infrastructure and data protection |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the specific company, evaluating the power of suppliers and buyers while identifying disruptive threats and substitutes.

Streamline competitive analysis with pre-built frameworks for each force—saving hours of manual setup.

Customers Bargaining Power

White & Case's clientele, comprising major corporations, governments, and financial institutions, are inherently sophisticated purchasers of legal services. These entities typically possess robust in-house legal teams and seasoned negotiation professionals, granting them considerable leverage in fee discussions and service expectations.

Their deep understanding of legal requirements allows these large clients to effectively scrutinize and challenge pricing structures, pushing for greater cost efficiencies. In 2024, many large corporate legal departments reported increased pressure to optimize external legal spend, with some aiming for 5-10% reductions in outside counsel fees through strategic sourcing and alternative fee arrangements.

This sophistication translates into a heightened bargaining power, as these clients can readily compare service offerings and rates across multiple law firms. Their ability to switch providers or insource work further amplifies their influence, compelling firms like White & Case to demonstrate exceptional value and competitive pricing.

The bargaining power of customers for a firm like White & Case is influenced by the availability of alternative top-tier legal service providers. While White & Case is recognized as an elite global law firm, clients, particularly large corporations, have a select but potent group of other ‘Magic Circle’ and ‘AmLaw 100’ firms to consider.

This robust competitive landscape empowers clients. They can exert pressure on pricing and service terms, knowing that if their demands aren't fully met, they have other highly capable firms ready to take their business. For instance, in 2024, major international arbitration cases often saw bids from multiple elite firms, demonstrating this client leverage.

For many routine legal services, clients are becoming much more aware of costs. They want to know upfront what they’ll pay, and they’re looking for pricing that matches the value they receive. This focus on predictability and value is a big reason why alternative fee arrangements, like fixed fees for specific tasks, are becoming more popular. In 2024, many law firms reported a significant increase in client requests for these types of arrangements, with some studies showing over 50% of corporate legal departments prioritizing them for predictable matters.

In-house Legal Department Capabilities

Large corporations are increasingly bolstering their in-house legal teams, allowing them to manage more legal tasks internally. This trend means they depend less on outside law firms for routine or specialized work, which naturally strengthens their negotiating position.

For example, a 2024 survey indicated that 75% of Fortune 500 companies reported an increase in their in-house legal department headcount over the past five years. This growing internal capacity directly translates to reduced spending on external legal services, giving these companies more leverage when negotiating fees with law firms.

- Increased Internal Capacity: Corporations are hiring more lawyers and legal professionals in-house, allowing them to handle a larger volume of legal work.

- Reduced Reliance on External Firms: This internal growth lessens the need for outside counsel, particularly for standardized or high-volume legal matters.

- Cost Savings Drive Bargaining Power: By bringing work in-house, companies achieve cost efficiencies, which they can then leverage in negotiations with external legal providers.

- Strategic Outsourcing: In-house teams focus on core competencies, while external firms are engaged for highly specialized or overflow work, often on more favorable terms.

Volume and Strategic Importance of Work

Clients who represent a substantial portion of a law firm's revenue or engage the firm in critical, high-stakes matters possess significant leverage. For instance, a client entrusting White & Case with a landmark cross-border merger valued in the billions, or a complex, multi-jurisdictional litigation, inherently commands greater influence over pricing and service delivery.

This volume and strategic importance of work directly translate into enhanced bargaining power. White & Case, like other major law firms, is incentivized to cultivate and retain these key relationships. The potential loss of such substantial business, or the reputational damage from mishandling it, can be substantial.

- High-Value Engagements: Clients driving significant revenue through large-scale M&A, major financings, or complex international arbitration cases wield considerable power.

- Strategic Significance: Work deemed 'bet-the-company' by clients, where the outcome could fundamentally impact their business, increases their bargaining leverage.

- Retention Priority: Firms like White & Case often prioritize retaining these strategically important clients, potentially leading to concessions on fees or terms.

- Market Benchmarks: In 2023, major global law firms reported that their top 10 clients accounted for an average of 15-20% of their total revenue, underscoring the importance of these relationships.

The bargaining power of customers for a firm like White & Case is significantly shaped by the availability of other elite legal service providers. Clients, especially large corporations, can choose from a select group of highly reputable firms, which naturally enhances their leverage in negotiations.

This competitive environment allows clients to exert pressure on pricing and service conditions, knowing they have capable alternatives. In 2024, high-stakes international arbitration proceedings frequently saw multiple top-tier firms bidding, a clear indicator of client influence.

Sophisticated clients, often with substantial in-house legal departments, can effectively challenge pricing structures and demand greater cost efficiencies. In 2024, many corporate legal departments aimed to reduce external legal spending by 5-10% through strategic sourcing and alternative fee arrangements.

Same Document Delivered

White & Case Porter's Five Forces Analysis

This preview showcases the complete White & Case Porter's Five Forces Analysis, providing an in-depth examination of competitive dynamics within a specified industry. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase. It's ready for immediate download and application to your strategic planning needs. You're viewing the final deliverable, ensuring no surprises and full readiness for use.

Rivalry Among Competitors

The global legal services market, particularly for intricate, high-stakes work, is a battleground where a select group of elite international law firms vie for dominance. White & Case finds itself in direct competition with these 'Big Law' peers, all chasing the same coveted market share, top-tier legal talent, and prestigious client engagements.

In 2023, major global law firms reported significant revenue growth, with many exceeding $2 billion in annual turnover, underscoring the immense scale and profitability of the high-end legal market. This intense rivalry means firms like White & Case must constantly innovate and differentiate themselves to attract and retain both clients and leading legal professionals.

The fight for talent is particularly fierce, with associate salaries in major markets often exceeding $200,000 annually, a clear indicator of the premium placed on experienced lawyers capable of handling complex cross-border transactions and disputes.

In the legal services sector, competitive rivalry is intensely driven by specialized expertise and a firm's established reputation, particularly for handling intricate, cross-border transactions. Firms like White & Case compete by showcasing their deep knowledge in areas such as mergers and acquisitions, private equity deals, and international arbitration. This focus on niche capabilities and a proven track record in complex cases is paramount.

The global reach and the ability to manage multifaceted international disputes also serve as significant differentiators. A firm's brand strength and its capacity to articulate a unique value proposition are constantly being refined to attract high-profile clients. For instance, in 2024, major law firms continue to invest heavily in building out their capabilities in emerging markets and critical regulatory areas, directly impacting their competitive standing.

Competitive rivalry in this legal segment is intense, primarily because client relationships are the bedrock of success. These relationships are cultivated over years, cemented by trust and a proven track record of achieving favorable results in complex, high-stakes legal battles. For instance, major litigation or M&A deals often involve firms that have long-standing ties with their clients, making it challenging for new entrants to break in.

Firms must consistently invest in nurturing these client connections and proving their mettle through unwavering performance to retain business. This means not only delivering legal expertise but also understanding clients' broader business objectives. The loyalty built through these deep relationships significantly reduces client switching, intensifying the competition among established players for market share and new mandates.

Lateral Hires and Partner Mobility

The legal industry, especially at the partner level, is characterized by intense competition for talent. Firms constantly vie for experienced partners who bring significant client relationships and specialized expertise, driving up recruitment costs and intensifying rivalry. This dynamic is particularly evident in the trend of lateral hiring, where firms strategically recruit partners from competitors to strengthen practice groups or enter new markets.

White & Case, like many major law firms, actively participates in lateral hiring to enhance its capabilities and market position. In 2024, the firm continued this strategy, recognizing that acquiring established talent with portable client books is a crucial method for growth and competitive advantage. This pursuit of top-tier legal talent fuels a high degree of competitive rivalry among law firms, as each seeks to attract and retain the most valuable professionals.

The impact of lateral mobility on competitive rivalry can be seen in several key areas:

- Talent Acquisition Costs: Firms are willing to offer substantial compensation and partnership buyouts to attract key lateral partners, increasing operational expenses.

- Practice Area Expansion: Lateral hires are a primary vehicle for firms to quickly build or expand practice areas, directly challenging established players in those niches.

- Client Base Disruption: When partners move, they often bring their client relationships, leading to potential shifts in market share and client loyalty.

- Market Intelligence: Lateral moves provide firms with valuable insights into competitor strategies, client demands, and evolving market trends.

Mergers and Acquisitions in the Legal Sector

Mergers and acquisitions (M&A) are a significant driver of competitive rivalry in the legal sector. These strategic moves allow law firms to quickly expand their geographic reach, broaden their service portfolios, and gain efficiencies through economies of scale. This ongoing consolidation reflects a strong competitive push for market share and growth among established players.

The legal industry has seen a notable increase in M&A activity. For example, in 2023, the global legal sector experienced a robust M&A market, with deal volumes showing a significant uptick compared to previous years, indicating a clear trend towards consolidation as firms seek to enhance their competitive positioning.

- Geographic Expansion: Firms merge to enter new markets and serve a broader client base.

- Service Diversification: M&A enables firms to add new practice areas, offering clients more comprehensive solutions.

- Economies of Scale: Consolidation can lead to cost savings in operations, technology, and administrative functions.

- Talent Acquisition: Mergers often provide access to specialized legal talent and key client relationships.

Competitive rivalry among elite global law firms, including White & Case, is characterized by an intense pursuit of market share, top-tier talent, and prestigious clients. This competition is fueled by the high profitability of complex legal work, with major international firms reporting revenues well over $2 billion annually as of 2023. The fight for experienced lawyers, evidenced by associate salaries exceeding $200,000 in major markets, highlights the premium placed on specialized expertise and a proven track record.

Firms differentiate themselves through deep knowledge in niche areas like M&A and international arbitration, alongside a global reach for managing complex disputes. Brand strength and a unique value proposition are continuously refined. In 2024, firms are actively investing in emerging markets and critical regulatory sectors to bolster their competitive standing. This intense rivalry means constant innovation and a focus on cultivating long-term client relationships, built on trust and consistent delivery of favorable outcomes in high-stakes matters.

Lateral hiring is a significant competitive tactic, with firms acquiring established partners and their client books to strengthen practice groups and expand into new markets. This drives up recruitment costs and intensifies the competition for talent. Furthermore, mergers and acquisitions are prevalent, with a notable increase in deal volumes observed in 2023, as firms consolidate to gain geographic reach, diversify services, and achieve economies of scale, all aimed at enhancing their competitive positioning.

SSubstitutes Threaten

The growing sophistication of in-house legal teams represents a significant substitute threat to traditional external legal service providers. Companies are increasingly building robust internal departments, equipping them with advanced technology and specialized talent to handle a wider array of legal matters.

This trend is driven by a desire for greater control, cost efficiency, and faster response times. For instance, many Fortune 500 companies have seen their in-house legal spend increase significantly, with some dedicating substantial budgets to technology solutions that automate routine tasks and improve knowledge management.

By bringing legal functions in-house, businesses can reduce their reliance on external law firms for many services, from contract review to compliance. This directly impacts the demand for outside counsel, particularly for commoditized legal work, forcing firms to adapt their service offerings and pricing models.

The rise of Alternative Legal Service Providers (ALSPs) presents a significant threat of substitutes for traditional law firms like White & Case. These ALSPs are increasingly offering cost-effective, technology-driven solutions for tasks like e-discovery, contract review, and legal research, areas that, while not White & Case's core focus, can still be impacted.

While White & Case excels in complex, high-value advisory work, the growing efficiency and lower overhead of ALSPs can exert downward pressure on pricing for more commoditized legal services. This is particularly relevant as ALSPs are projected to capture a larger share of the legal market; for instance, ALSP revenue was estimated to grow by 10-15% annually in recent years leading up to 2024.

Advances in legal technology, particularly generative AI and automation, present a significant threat of substitution for traditional legal services. These tools can now perform tasks previously handled by junior associates or paralegals, such as document review and initial drafting.

The widespread adoption of these technologies, while beneficial for firms like White & Case, also equips clients and alternative legal service providers with the capability to manage more legal work in-house or through more cost-effective channels. For instance, a 2024 report indicated that 70% of large law firms are actively exploring or implementing AI for efficiency gains, a trend that could see clients adopting similar tools.

Consulting Firms Offering Legal Strategy

Management consulting firms are increasingly offering services that touch upon legal strategy, risk management, and regulatory compliance. While they do not offer direct legal advice, their strategic counsel can influence decisions traditionally made by law firms. This presents a competitive threat as businesses may opt for integrated strategic and operational advice from consultants, potentially reducing reliance on traditional legal counsel for certain matters.

The global management consulting market was valued at approximately $300 billion in 2023, with a significant portion dedicated to strategy and operations. This indicates a substantial market where consulting firms are already deeply entrenched. For instance, firms like McKinsey & Company and Boston Consulting Group are known for their work in regulatory strategy and risk assessment, areas that directly intersect with legal services.

- Overlap in Services: Consultants provide strategic advice on compliance, risk mitigation, and operational restructuring, which can indirectly address legal and regulatory challenges.

- Cost-Effectiveness Perception: Some businesses may perceive bundled consulting services as more cost-effective than engaging separate legal and management consulting firms.

- Holistic Approach: The ability of consulting firms to offer a holistic view, integrating legal considerations into broader business strategy, can be appealing.

- Market Growth: The consulting sector's steady growth, projected to continue through 2025, signifies increasing investment in these advisory services.

Specialized Boutique Law Firms

The threat of substitutes for large, full-service law firms like White & Case is particularly relevant when considering specialized boutique firms. For highly niche legal areas or specific types of litigation, clients may find these boutiques offer a compelling alternative. Their deep, focused expertise can be invaluable, and often, they can provide these specialized services at more competitive rates compared to the overhead of a global firm.

These boutique firms can act as potent substitutes because they are inherently agile and laser-focused on their chosen practice areas. This concentration allows them to develop a level of mastery that can be difficult for a larger, more diversified firm to replicate across the board. For instance, a boutique specializing in complex patent litigation or specific regulatory compliance might be the preferred choice for a client facing such a precise legal challenge.

- Specialized Expertise: Boutique firms often possess unparalleled depth in very specific legal domains, attracting clients seeking highly tailored solutions.

- Cost-Effectiveness: For particular matters, boutiques can offer more competitive fee structures than large international firms, appealing to budget-conscious clients.

- Agility and Focus: Their smaller size allows for quicker decision-making and a more concentrated approach to case management, which can be a significant advantage in fast-moving legal situations.

- Niche Market Dominance: By concentrating on a narrow segment of the legal market, boutiques can capture a significant share of that specific client base, posing a direct substitute for broader service providers.

The threat of substitutes for traditional law firms like White & Case is multifaceted, encompassing internal legal departments, alternative legal service providers (ALSPs), management consultants, and specialized boutique firms. Each of these substitutes offers distinct advantages, such as cost savings, specialized expertise, or integrated strategic advice, potentially diverting clients and impacting revenue streams for larger, full-service firms.

The increasing capability of in-house legal teams and the cost-efficiency of ALSPs, which saw estimated annual revenue growth of 10-15% leading up to 2024, directly challenge the market share of traditional firms. Furthermore, the burgeoning legal tech sector, with 70% of large law firms exploring AI by 2024, enables both clients and alternative providers to handle more legal work internally or through more economical channels.

| Substitute Type | Key Advantages | Impact on Traditional Firms |

|---|---|---|

| In-house Legal Teams | Cost control, faster response, greater control | Reduced demand for external counsel on routine matters |

| ALSPs | Cost-effectiveness, technology-driven solutions | Downward pressure on pricing for commoditized services |

| Management Consultants | Holistic strategy, integrated advice | Potential reduction in reliance on legal counsel for strategic/regulatory matters |

| Boutique Law Firms | Deep specialization, competitive rates | Client diversion for niche legal challenges |

Entrants Threaten

The threat of new companies entering the top-tier global law firm sector is quite minimal, largely because the initial capital outlay is so significant. Think about it: setting up a worldwide presence with multiple offices isn't cheap. For instance, a new firm would need to invest heavily in prime real estate in major financial hubs, which can run into tens of millions of dollars just for the initial leases and fit-outs.

Beyond physical locations, the need for advanced technological infrastructure is another major hurdle. This includes sophisticated case management systems, secure data storage, and the latest communication tools, all of which require substantial upfront investment and ongoing maintenance costs. In 2023, the average operating expenses for large international law firms often exceeded $500 million annually, underscoring the scale of financial commitment needed.

Furthermore, attracting and retaining the absolute best legal talent is paramount. This means offering highly competitive salaries, benefits, and partnership opportunities, which adds another layer of considerable expense. The top associates at major firms can earn upwards of $300,000 per year, and partners often see much higher figures, making talent acquisition a significant drain on financial resources from day one.

The sheer scale of investment required to build a global brand and reputation also acts as a powerful deterrent. New entrants must contend with established firms that have decades of client relationships and proven track records. This makes it incredibly difficult for newcomers to gain immediate traction and market share without massive financial backing.

New law firms entering the competitive landscape face a significant hurdle in establishing the kind of reputation and brand loyalty that established players like White & Case have meticulously built over many years. Trustworthiness and a proven track record in complex, high-stakes legal work are not acquired overnight; they are earned through decades of successful client engagements and consistent delivery of excellence.

Firms with a long history, such as White & Case, benefit immensely from deep-seated client relationships and widespread brand recognition, advantages that are virtually impossible for newcomers to replicate quickly. For instance, in 2024, major global law firms continued to leverage their established reputations, winning a disproportionate share of high-value cross-border M&A mandates, often exceeding $1 billion in deal value, where client trust is paramount.

The legal industry's most skilled professionals are in high demand, and established firms like White & Case present robust packages including competitive salaries, engaging case assignments, and clear paths for advancement. New firms entering the market would face significant hurdles in matching these offerings to attract and keep the caliber of lawyers needed for complex, international legal matters.

Regulatory Barriers and Licensing Complexity

The legal profession is inherently protected by robust regulatory frameworks. Obtaining the necessary licenses and adhering to stringent ethical standards, which differ significantly across jurisdictions, creates a formidable hurdle for potential new entrants. For instance, in 2024, the process of establishing a new law firm with international operations can involve navigating dozens of distinct regulatory bodies, each with its own application fees and compliance demands, often running into tens of thousands of dollars per jurisdiction.

This complexity extends to ongoing compliance, requiring continuous investment in legal expertise and oversight. The sheer administrative burden and cost associated with securing and maintaining multiple licenses globally act as a powerful deterrent. This regulatory labyrinth effectively limits the number of new firms that can realistically enter the market, particularly those seeking a global footprint.

- Global Licensing Costs: Establishing a presence in just five major international markets could incur over $100,000 in licensing and initial compliance fees in 2024.

- Ethical Compliance: Adherence to varying professional conduct rules requires substantial ongoing training and internal controls.

- Time to Market: The licensing process alone can add 12-24 months to a new firm's launch timeline.

Extensive Global Network and Client Relationships

White & Case benefits immensely from its vast global network, boasting offices in key financial centers worldwide. This extensive reach allows them to serve clients across diverse jurisdictions seamlessly. Potential new entrants face a formidable challenge in establishing a comparable international presence and operational infrastructure.

The firm's deep-rooted relationships with major multinational corporations and leading financial institutions represent another significant barrier. Cultivating such trust and loyalty takes years, often decades, of consistent high-quality service and proven expertise. For instance, by 2024, White & Case's client roster includes a substantial portion of the Fortune Global 500, a testament to their enduring partnerships.

- Global Footprint: White & Case operates in over 30 locations across the Americas, Europe, the Middle East, and Asia Pacific.

- Client Tenure: Many of White & Case's key client relationships span over 20 years, indicating strong loyalty and trust.

- Market Penetration: The firm has established strong market positions in complex cross-border transactions, a segment demanding established networks.

The threat of new entrants to the top-tier global law firm market, like White & Case, is significantly low due to immense capital requirements for global operations and technology. For instance, establishing a presence in just five major international markets could cost over $100,000 in licensing and compliance fees in 2024, a substantial barrier to entry.

Furthermore, the need to attract and retain top legal talent, with starting associate salaries often exceeding $300,000 annually in 2024, alongside the immense cost of building brand reputation and client relationships that take decades to cultivate, deters many potential newcomers.

Regulatory hurdles are also formidable; navigating diverse licensing and ethical standards across multiple jurisdictions requires significant investment and time, potentially adding 12-24 months to a new firm's launch timeline.

| Factor | Impact on New Entrants | Example Data (2024/2023) |

|---|---|---|

| Capital Investment | Extremely High | Office leases in prime financial hubs can cost tens of millions; annual operating expenses for large firms often exceed $500 million. |

| Talent Acquisition | High Cost | Top associates earn over $300,000 annually; partners earn substantially more. |

| Reputation & Relationships | Very Difficult to Replicate | Established firms win disproportionate share of high-value mandates ($1B+ M&A) due to trust. |

| Regulatory Compliance | Complex & Costly | Licensing in 5 major markets could exceed $100,000; process adds 12-24 months to launch. |

Porter's Five Forces Analysis Data Sources

Our White & Case Porter's Five Forces analysis is meticulously built using a combination of public company filings, proprietary market intelligence reports, and extensive industry-specific research. We also leverage data from leading financial databases and economic trend analyses to provide a comprehensive understanding of the competitive landscape.