US Foods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Foods Bundle

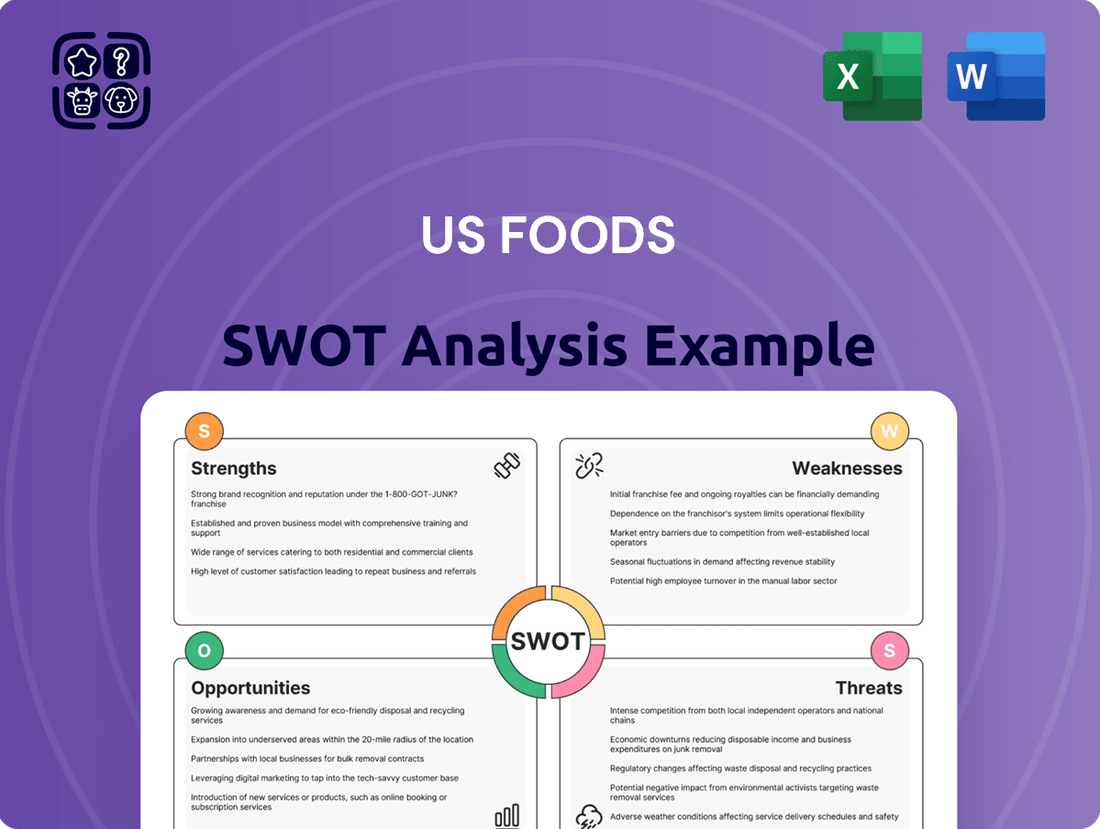

US Foods, a major player in the foodservice distribution industry, boasts significant strengths like its extensive distribution network and broad product portfolio, catering to diverse customer needs. However, it faces challenges such as intense competition and evolving consumer preferences for healthier options.

Opportunities lie in leveraging technology for operational efficiency and expanding into niche markets, while threats include potential supply chain disruptions and changing regulatory landscapes. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind US Foods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

US Foods stands as one of the nation's largest foodservice distributors, a significant strength that translates into an extensive market reach. Serving around 250,000 customers, the company taps into a vast and varied clientele, encompassing everything from small, independent eateries to large institutional operations.

This broad customer base allows US Foods to achieve considerable economies of scale in its operations. The sheer volume of business generated by this widespread network helps to drive down costs and improve efficiency. Furthermore, this extensive reach fosters strong brand recognition across the foodservice industry.

The diverse nature of its customer segments, including restaurants, healthcare facilities, and educational institutions, contributes to a stable and resilient revenue stream. This diversification mitigates risk, as downturns in one sector can be offset by continued demand in others. For instance, in 2023, US Foods reported net sales of $34.4 billion, a testament to its broad market penetration.

US Foods boasts a comprehensive product portfolio, a significant strength. This includes a vast array of national brands alongside its own high-margin private label offerings. In 2023, private brands represented 28.3% of total sales, a testament to their growing importance and contribution to profitability. This broad selection allows the company to cater to a wide spectrum of customer needs, from independent restaurants to large institutional buyers, ensuring a strong market position.

US Foods excels by offering a robust suite of e-commerce and technology solutions. These digital tools go beyond simple ordering, fostering customer loyalty and streamlining operations for their clients.

The company's digital platform provides valuable business insights, transforming the relationship from supplier to strategic partner. This focus on technology integration is key to their customer retention strategy.

In 2023, US Foods reported a significant increase in digital orders, indicating strong adoption of their e-commerce capabilities. This digital push is crucial for maintaining a competitive edge in the evolving food service landscape.

Value-Added Services and Customer Support

US Foods goes beyond just delivering food, offering services that truly help their customers succeed. This includes things like menu planning assistance, operational efficiency advice, and even marketing support. These value-added services foster deeper customer loyalty and significantly reduce the likelihood of customers switching to a competitor. For instance, in fiscal year 2023, US Foods reported that its services segment contributed to increased customer retention rates.

This commitment to customer success is a key differentiator in the competitive foodservice distribution market. By acting as a partner rather than just a supplier, US Foods builds stronger, more resilient relationships. This focus directly translates into a more stable revenue base and a competitive edge. In 2024, the company continued to invest in digital tools and training programs aimed at enhancing these customer support offerings.

- Enhanced Customer Relationships: Value-added services build loyalty and reduce churn.

- Competitive Differentiation: Sets US Foods apart from basic distributors.

- Operational Support: Aids customers in menu planning and efficiency.

- Focus on Customer Success: Drives long-term partnerships and revenue stability.

Diversified Customer Segments

US Foods' strength lies in its deeply diversified customer base, spanning independent restaurants, healthcare facilities, educational institutions, and hospitality venues. This broad reach across various sectors of the foodservice industry significantly reduces the company's vulnerability to economic fluctuations or sector-specific challenges. For instance, while casual dining might face headwinds, demand from healthcare or education can remain more consistent, offering a stabilizing effect on overall revenue.

This diversification is a key resilience factor. In 2023, US Foods reported a net sales increase of 8.7% year-over-year, reaching $34.4 billion. This growth was supported by performance across multiple customer segments, demonstrating the benefit of not being overly dependent on any single market niche. The company's ability to serve such a wide array of operators, from small neighborhood eateries to large institutional clients, showcases its adaptability and broad market penetration.

Key customer segments contributing to this strength include:

- Independent Restaurants: A core focus, providing significant volume and brand loyalty.

- Healthcare and Hospitality: Essential services with consistent demand, offering stability.

- K-12 Schools and Colleges: A substantial segment with predictable ordering patterns.

- Government and Military: Long-term contracts and reliable revenue streams.

US Foods' extensive product portfolio is a major strength, featuring a wide range of national brands alongside its own profitable private label options. In 2023, private brands accounted for a notable 28.3% of total sales, highlighting their significance in driving both volume and margin. This comprehensive offering allows the company to effectively meet the diverse needs of its broad customer base, from small, independent restaurants to large institutional clients, solidifying its market position.

The company's robust technology and e-commerce capabilities are a key differentiator, enabling streamlined operations and fostering customer loyalty. These digital tools provide valuable business insights, positioning US Foods as a strategic partner rather than just a supplier. The strong adoption of these platforms, evidenced by increased digital orders in 2023, is crucial for maintaining a competitive edge in the evolving foodservice landscape.

US Foods’ extensive network and diverse customer base, serving approximately 250,000 clients, provide significant economies of scale. This broad market penetration helps to reduce operational costs and enhances brand recognition. The company’s ability to cater to various segments, from independent eateries to large institutions, ensures a stable revenue stream, as demonstrated by its $34.4 billion in net sales for 2023.

US Foods' commitment to offering value-added services beyond simple distribution is a core strength. These services, including menu planning and operational efficiency advice, deepen customer relationships and reduce churn. By acting as a partner focused on customer success, US Foods cultivates loyalty and a stable revenue base, a strategy that continued to be a focus for investment in 2024.

| Strength Category | Key Aspect | Impact | Supporting Data (2023/2024) |

| Market Reach & Diversification | Extensive Customer Base (~250,000) | Economies of Scale, Revenue Stability | Net Sales: $34.4 billion |

| Product Offering | Diverse National & Private Brands | Caters to Broad Needs, Profitability | Private Brands: 28.3% of Sales |

| Technology & E-commerce | Digital Platforms & Insights | Customer Loyalty, Operational Efficiency | Increased Digital Orders |

| Customer Value-Added Services | Support Beyond Distribution | Customer Retention, Differentiation | Continued Investment in Services |

What is included in the product

Delivers a strategic overview of US Foods’s internal and external business factors, highlighting its strengths in distribution, weaknesses in market share, opportunities in private label growth, and threats from competition and economic shifts.

Offers a clear, actionable framework to identify and address US Foods' strategic challenges and opportunities, boosting operational efficiency.

Weaknesses

US Foods faces considerable operational and logistics costs due to its expansive national distribution network. The company's extensive warehousing and transportation infrastructure, crucial for serving a diverse customer base, represent a significant expenditure. For instance, in fiscal year 2023, US Foods reported selling, general, and administrative expenses of $3.5 billion, a portion of which directly reflects these logistical outlays. Managing such a complex supply chain demands continuous investment in efficiency to mitigate these inherent costs.

US Foods faces a significant weakness in its exposure to commodity price volatility. The company's profitability is directly tied to the prices of key food ingredients, and unexpected surges in these costs can severely impact its bottom line. For instance, a sharp increase in the cost of beef or chicken, which are staple products for many restaurants, can squeeze US Foods' margins if they are unable to pass these higher expenses onto their diverse customer base. This makes financial performance less predictable and harder to manage.

The foodservice distribution landscape is incredibly crowded, featuring a mix of large national distributors, nimble regional players, and local specialists. This fierce competition naturally translates into significant pricing pressures. US Foods, like its peers, often finds itself needing to adjust pricing strategies to stay competitive, which can put a strain on profit margins, particularly when dealing with price-sensitive customers. For instance, in early 2024, industry reports highlighted ongoing price wars in certain segments of the market, directly impacting distributor profitability.

Reliance on External Labor Markets

US Foods' reliance on external labor markets presents a significant weakness. The company's vast distribution and service operations necessitate a substantial workforce, encompassing drivers, warehouse associates, and sales teams. As of Q1 2024, the company employed over 50,000 associates, highlighting the scale of its labor dependency.

This dependence makes US Foods vulnerable to labor market fluctuations. Labor shortages, escalating wage expectations, and a rise in unionization efforts directly impact operational costs. For instance, the national shortage of truck drivers, a critical role for US Foods, has been well-documented throughout 2024, driving up recruitment and retention expenses.

These challenges can lead to increased labor costs, potentially squeezing profit margins. Furthermore, operational disruptions stemming from labor disputes or an inability to fill essential roles can negatively affect service delivery to customers and, consequently, impact overall profitability.

Key labor market challenges include:

- Persistent driver shortages impacting delivery reliability and costs.

- Rising wage demands across warehouse and operational roles, escalating payroll expenses.

- Increased union activity potentially leading to higher labor costs and more complex negotiations.

- The ongoing need to invest in training and development to maintain a skilled workforce amidst market competition.

Sensitivity to Restaurant Industry Health

While US Foods serves a variety of customers, its business remains closely linked to the vitality of the restaurant sector. In 2024, as the restaurant industry navigated persistent inflation and evolving consumer spending, this presented a direct challenge. A dip in restaurant traffic or a shift away from dining out, which was observed in certain segments throughout early 2024, can translate into lower sales volumes for US Foods.

This dependence means that economic slowdowns or changes in how people choose to eat can significantly affect demand for US Foods' offerings. For instance, if consumers cut back on discretionary spending like dining out due to rising living costs, it directly impacts the orders placed by restaurants. This sensitivity was a key factor for food service distributors in 2024.

Consider these points regarding the sensitivity:

- Revenue Concentration: A substantial percentage of US Foods' revenue stream is still derived from restaurant clients.

- Economic Sensitivity: Downturns impacting consumer discretionary spending directly reduce restaurant patronage and, consequently, US Foods' sales.

- Dining Trend Impact: Shifts in consumer preferences, such as increased home cooking or a move towards different dining formats, can negatively affect demand.

- 2024 Economic Headwinds: The economic climate of 2024, marked by inflation and interest rate concerns, put pressure on the restaurant industry, creating a ripple effect for distributors like US Foods.

The company's substantial operational and logistics costs, stemming from its extensive national distribution network, represent a significant weakness. In fiscal year 2023, US Foods reported selling, general, and administrative expenses of $3.5 billion, a figure that reflects the considerable outlays required to manage its complex supply chain and serve a diverse customer base.

US Foods is also susceptible to commodity price volatility, as its profitability is closely tied to the fluctuating costs of key food ingredients. For example, increases in the price of staples like beef or chicken can directly impact margins if these higher expenses cannot be fully passed on to customers, leading to less predictable financial performance.

The highly competitive foodservice distribution market creates intense pricing pressures for US Foods. The presence of large national distributors, regional players, and local specialists forces the company to continually adjust its pricing strategies to remain competitive, potentially straining profit margins, especially with price-sensitive clients.

A notable weakness for US Foods is its reliance on external labor markets, given its workforce of over 50,000 associates as of Q1 2024. This dependence makes the company vulnerable to labor shortages, rising wage expectations, and increased unionization efforts, all of which can escalate operational costs and potentially impact service delivery, as seen with the documented national shortage of truck drivers in 2024.

What You See Is What You Get

US Foods SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing an actual excerpt from the complete US Foods SWOT analysis. Upon purchase, you'll gain access to the full, in-depth report, providing comprehensive insights into their strategic positioning.

Opportunities

US Foods has a prime opportunity to grow by expanding its private label offerings. These own-brand products, like Chef's Line and Metro Deli, generally boast better profit margins compared to national brands. In 2023, private label penetration in the food industry continued to rise, with consumers seeking value and quality, a trend US Foods can capitalize on.

By further developing and marketing its private label portfolio, US Foods can enhance customer loyalty and create a more distinct product offering. This strategy not only allows for greater control over product quality and sourcing but also provides a competitive edge against rivals by offering unique, value-driven options. The company can leverage its existing distribution network to efficiently bring these expanded lines to market.

US Foods has a prime opportunity to significantly boost its operational efficiency by investing more in advanced analytics, automation, and artificial intelligence across its supply chain and customer platforms. For instance, in 2024, the company continued to expand its use of AI in warehouse operations, aiming to reduce order fulfillment times by an estimated 15%.

This technological push also opens doors to providing customers with more sophisticated, data-driven insights to help them improve their own businesses. Imagine offering restaurant clients real-time inventory management suggestions based on predictive analytics, a service that could differentiate US Foods in a competitive market.

By enhancing its digital capabilities, US Foods can deliver more personalized services, thereby strengthening customer loyalty and potentially increasing average order values. This focus on leveraging technology for efficiency and customer insight is a key strategic avenue for growth in the coming years.

The highly fragmented foodservice distribution industry presents a significant avenue for growth through strategic acquisitions. US Foods can target smaller regional distributors or those with specialized product lines to bolster its market presence. For instance, in 2023, the foodservice distribution market in the US was valued at approximately $250 billion, with many smaller, independent operators still holding a notable share.

Acquiring these entities allows US Foods to quickly expand its geographic reach into underserved markets and integrate new product categories, such as ethnic foods or organic produce, that might be more efficiently handled by specialized distributors. This consolidation strategy not only strengthens US Foods' competitive position by increasing its overall market share but also enhances its operational efficiencies through economies of scale.

Growth in Untapped or Niche Foodservice Segments

US Foods can capitalize on growth by targeting underserved or niche foodservice sectors. The rise of ghost kitchens, for instance, presents a significant opportunity. In 2024, the global ghost kitchen market was valued at approximately $50 billion and is projected to reach over $200 billion by 2030, indicating substantial untapped potential for suppliers like US Foods.

Expanding into specialized meal kit providers and unique institutional markets, such as corporate cafeterias with evolving dietary needs or correctional facilities, offers further avenues for revenue growth. By tailoring product assortments and logistics to these specific demands, US Foods can secure new market share and diversify its customer base.

- Ghost Kitchens: A rapidly expanding segment with increasing demand for efficient supply chain solutions.

- Meal Kit Providers: Growing consumer interest in convenient, at-home dining experiences creates opportunities.

- Niche Institutional Markets: Catering to specialized dietary requirements and operational needs within sectors like corporate dining or healthcare.

- Data-Driven Expansion: Leveraging market intelligence to identify and prioritize the most promising niche segments for focused growth strategies.

Focus on Sustainability and Health Trends

The increasing consumer and institutional preference for sustainable, ethically sourced, and healthier food options presents a significant growth avenue for US Foods. By aligning its product portfolio and supply chain with these evolving demands, the company can attract a wider array of customers and bolster its brand reputation. For instance, the global sustainable food market was valued at approximately $610 billion in 2023 and is projected to reach over $1.2 trillion by 2030, indicating substantial market potential.

US Foods can capitalize on this by expanding its offerings of plant-based alternatives, locally sourced produce, and products with reduced environmental footprints.

- Expand plant-based and alternative protein offerings.

- Increase sourcing of locally and ethically produced ingredients.

- Invest in supply chain transparency and sustainability initiatives.

- Highlight health and wellness attributes of its product catalog.

US Foods can leverage the growing demand for private label brands, which offer higher profit margins and foster customer loyalty. By expanding its own-brand portfolio, the company can differentiate itself in the market. For instance, private label penetration in the food industry saw continued growth in 2023, driven by consumers seeking value.

Investing in technology like AI for warehouse operations and data analytics for customer insights offers a significant efficiency and service enhancement opportunity. US Foods aims to reduce order fulfillment times by an estimated 15% through AI in 2024.

The fragmented nature of the foodservice distribution industry presents a prime opportunity for growth through strategic acquisitions of smaller, specialized distributors. This allows US Foods to expand its geographic reach and product offerings efficiently.

Targeting underserved niche markets, such as the rapidly expanding ghost kitchen sector, provides substantial revenue growth potential. The global ghost kitchen market is expected to reach over $200 billion by 2030.

Capitalizing on the increasing consumer preference for sustainable and healthy food options by expanding plant-based and locally sourced offerings can attract new customers and enhance brand reputation. The global sustainable food market is projected to exceed $1.2 trillion by 2030.

Threats

Economic downturns pose a significant threat to US Foods. A recession or sustained high inflation can drastically shrink consumer disposable income, leading people to cut back on dining out. This directly translates to fewer customers for restaurants, thereby reducing their orders from distributors like US Foods. For instance, during periods of economic contraction, restaurant sales can see notable declines, impacting the entire supply chain.

Intensified competition is a significant threat for US Foods. The foodservice distribution industry is highly fragmented, and further consolidation among major players, such as Sysco's ongoing efforts to expand its reach, could intensify rivalry. This means US Foods might face more aggressive pricing strategies from competitors, potentially squeezing profit margins. For instance, in fiscal year 2023, the foodservice distribution market saw continued M&A activity, indicating a trend toward fewer, larger players.

US Foods faces significant threats from ongoing supply chain disruptions and price inflation. Global events, including the lingering effects of the pandemic and geopolitical tensions in 2024, continue to impact the availability and cost of food products, directly affecting sourcing expenses. For instance, the Producer Price Index for food and beverages saw a notable increase throughout 2023 and into early 2024, putting pressure on input costs for distributors like US Foods.

Persistent food inflation erodes profitability if not managed proactively. The company must navigate rising costs for raw materials, transportation, and labor. In 2024, the agricultural sector continued to experience volatile commodity prices, driven by weather patterns and international trade dynamics, which directly translate to higher product costs for US Foods and its customers.

Changing Consumer Dining Habits

Shifts in how people eat present a significant threat. A continued trend towards home cooking, fueled by convenience and cost savings, directly impacts the demand for restaurant meals. For instance, a significant portion of consumers, around 50% according to some 2024 surveys, reported cooking at home more frequently than before the pandemic. This ongoing behavioral change means US Foods, which primarily serves commercial foodservice establishments, faces a reduced overall market for its products.

The rise of direct-to-consumer (DTC) food delivery services is another challenge. Meal kit companies and grocery delivery platforms offer consumers convenient alternatives to traditional dining out, bypassing the need for restaurant patronage. This trend, which saw substantial growth in 2023 and is projected to continue its upward trajectory through 2025, erodes the traditional customer base for restaurants, consequently affecting US Foods' sales volume.

Furthermore, a broader move away from traditional restaurant dining, perhaps towards more casual or alternative eating formats, requires US Foods to adapt its business model. If consumers increasingly opt for food trucks, ghost kitchens, or even specialized catering services over sit-down establishments, the company must be agile in its product offerings and distribution strategies to remain relevant. The ability to pivot and cater to these evolving dining habits will be crucial for sustained success.

- Increased Home Cooking: Consumer surveys in 2024 indicated that over half of households maintained an increased frequency of home cooking compared to pre-pandemic levels.

- Growth of DTC Food Delivery: The meal kit and grocery delivery market, valued at tens of billions of dollars in 2023, continues to expand, offering direct competition for restaurant food purchases.

- Adaptation Imperative: US Foods must actively explore new channels and product lines to align with evolving consumer preferences and mitigate the threat of declining traditional foodservice demand.

Regulatory Changes and Compliance Costs

New food safety regulations, environmental mandates, or labor laws are a significant threat, potentially adding to US Foods' compliance costs and operational complexities. For instance, evolving legal landscapes in food handling, distribution, and employment, such as those related to allergens or sustainable sourcing, could directly impact profitability. These changes might necessitate substantial investments in new technologies or process overhauls to ensure adherence.

Adapting to these evolving legal frameworks can be costly. For example, stricter environmental regulations, like those concerning greenhouse gas emissions from transportation fleets, could drive up fuel and maintenance expenses. Similarly, changes in labor laws, such as minimum wage increases or new worker classification rules, could directly affect the company's operating expenses. In 2023, the food industry saw increased scrutiny around supply chain transparency and labor practices, indicating a trend that is likely to continue through 2024 and 2025, requiring ongoing vigilance and adaptation from large distributors like US Foods.

- Increased compliance burden: New food safety standards or environmental regulations can lead to higher operational costs.

- Investment in adaptation: Companies may need to invest in new technology or training to meet evolving legal requirements.

- Impact on profitability: Unexpected regulatory shifts can strain profit margins if not managed proactively.

- Labor law implications: Changes in minimum wage or worker protections can significantly affect payroll expenses.

The specter of economic downturns presents a substantial threat, as recessions and sustained inflation diminish consumer spending power, leading to reduced dining out and, consequently, fewer orders for food distributors like US Foods. Intensified competition within the fragmented foodservice distribution sector, marked by ongoing consolidation, also poses a risk, potentially forcing more aggressive pricing and impacting profit margins.

Supply chain vulnerabilities and persistent food inflation are critical threats. Global events in 2024 continue to disrupt product availability and inflate sourcing costs, as evidenced by producer price index increases for food and beverages throughout 2023 and into early 2024. Furthermore, evolving consumer preferences, such as increased home cooking and the rise of direct-to-consumer food delivery services, challenge traditional restaurant models and reduce demand for US Foods' core offerings.

The company also faces threats from new or revised food safety regulations, environmental mandates, and labor laws. These can increase compliance costs and necessitate significant investments in technology or operational overhauls. For instance, stricter environmental regulations related to transportation could raise operating expenses, and changes in labor laws could impact payroll, as seen with increased scrutiny on supply chain transparency and labor practices in 2023.

| Threat Category | Specific Threat | Impact on US Foods | 2023/2024 Data Point |

|---|---|---|---|

| Economic Conditions | Recessionary Pressures | Reduced consumer disposable income, lower restaurant sales | Consumer confidence indices showed fluctuations in 2023, indicating potential spending caution. |

| Competition | Industry Consolidation | Increased rivalry, potential price wars | Sysco continued its market expansion efforts throughout 2023. |

| Supply Chain & Inflation | Product Cost Increases | Higher sourcing and operational expenses | Producer Price Index for Food & Beverages rose significantly in 2023. |

| Consumer Behavior | Shift to Home Cooking | Decreased demand from foodservice establishments | Over 50% of households reported cooking at home more in 2024 surveys. |

| Regulatory Environment | Compliance Costs | Increased operational complexity and potential investment needs | Increased scrutiny on supply chain transparency and labor practices in 2023. |

SWOT Analysis Data Sources

This US Foods SWOT analysis is built upon a robust foundation of data, including detailed financial statements, comprehensive market research reports, and insights from industry experts and analysts. We also incorporate information from official company disclosures and relevant trade publications to ensure a well-rounded and accurate assessment.