US Foods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Foods Bundle

Discover the strategic engine powering US Foods with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and key partnerships, offering a clear view of how they dominate the foodservice distribution landscape. Understand their revenue streams and cost structure to grasp their competitive advantage.

Unlock the full strategic blueprint behind US Foods's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

US Foods cultivates strong relationships with a wide array of strategic food suppliers, including farms, manufacturers, and processors. These partnerships are fundamental to securing a consistent and high-quality inventory. In 2024, the company continued to emphasize sourcing from local and regional producers, aiming to fulfill the growing demand for diverse and specialty food items across its customer base.

These collaborations are vital for maintaining supply chain resilience and adapting to evolving consumer preferences. By working closely with suppliers, US Foods can ensure the availability of everything from everyday staples to niche ingredients, supporting its broad customer segments like restaurants and institutional kitchens. This network allows them to offer a comprehensive product catalog that meets specific dietary needs and quality standards.

US Foods actively partners with technology and software providers to bolster its digital offerings and operational backbone. These collaborations are crucial for developing and maintaining robust e-commerce platforms that streamline ordering and customer engagement.

Key partnerships extend to providers of point-of-sale (POS) systems, labor management, and inventory solutions, which are often integrated into the services offered to their diverse customer base. For instance, in 2024, US Foods continued to invest in upgrading its digital tools, aiming to provide customers with seamless access to product information and order tracking.

These technology alliances enable US Foods to offer advanced data analytics capabilities to its clients, helping them optimize their own businesses. By integrating sophisticated software, the company enhances its supply chain visibility and delivery logistics, ensuring greater efficiency and reliability throughout its operations.

US Foods leverages a network of external logistics and transportation partners to enhance its delivery infrastructure. These collaborations are crucial for augmenting their own considerable fleet, particularly when facing surges in demand or requiring specialized transport solutions. For instance, in 2023, US Foods reported utilizing third-party logistics providers for a significant portion of its last-mile deliveries, a strategy that allows for greater flexibility and reach across its diverse customer base.

Industry Associations and Culinary Experts

US Foods actively collaborates with industry associations and culinary experts to drive innovation and maintain market relevance. These partnerships are crucial for staying ahead of evolving consumer tastes and operational demands within the foodservice sector.

Engaging with renowned chefs and participating in industry forums allows US Foods to tap into cutting-edge culinary insights. This direct access to expertise helps in the development of new product lines and value-added services that cater to current market trends. For instance, in 2024, US Foods continued to highlight its commitment to culinary excellence through various chef-driven initiatives and product showcases at major industry events.

These collaborations also serve to bolster US Foods' brand reputation and expand its reach. By associating with respected culinary figures and influential industry bodies, the company reinforces its image as a knowledgeable and trend-setting supplier. This strategic engagement is vital for building trust and demonstrating value to its diverse customer base.

- Culinary Trend Identification: Partnerships with chefs and associations provide early signals on emerging food trends, influencing product development.

- Product Innovation: Collaborations lead to the creation of new, market-responsive menu items and solutions for foodservice operators.

- Brand Credibility: Association with recognized culinary experts and industry groups enhances US Foods' reputation.

- Market Presence: Active participation in industry events and expert dialogues strengthens the company's visibility and influence.

Community and Sustainability Initiatives

US Foods actively partners with numerous non-profit organizations and community programs. These collaborations, particularly in areas like hunger relief and culinary education, directly support the company's broader sustainability objectives and bolster its corporate social responsibility efforts. For instance, in 2024, US Foods continued its commitment to fighting food insecurity, donating millions of pounds of food through its partnerships with organizations like Feeding America, which operates a vast network of food banks across the country.

These strategic alliances are instrumental in fostering a positive brand image and deepening community engagement. By investing in local initiatives, US Foods not only addresses critical societal needs but also builds goodwill and strengthens its connection with the communities it serves. This approach has been a cornerstone of their strategy, reinforcing their role as a responsible corporate citizen.

- Partnerships for Hunger Relief: Collaborations with national and local food banks in 2024 resulted in significant food donations, addressing critical needs within communities.

- Culinary Education Support: US Foods supports culinary arts programs in schools and community centers, investing in the next generation of food industry professionals.

- Sustainability Alignment: These initiatives are directly tied to US Foods' sustainability goals, aiming to reduce food waste and improve community well-being.

- Enhanced Brand Perception: Active community involvement positively influences brand perception, demonstrating a commitment beyond core business operations.

Key partnerships for US Foods are anchored by its extensive network of food suppliers, encompassing farms, manufacturers, and processors. These relationships are critical for maintaining a robust and diverse inventory, with a continued focus in 2024 on sourcing from local and regional producers to meet growing consumer demand for specialty items.

Technology providers are also crucial partners, enabling the development of advanced e-commerce platforms and digital tools that simplify the ordering process and enhance customer engagement. This includes integrations with point-of-sale systems and inventory management solutions, reflecting ongoing investments in 2024 to improve user experience and data accessibility.

Furthermore, US Foods collaborates with logistics and transportation firms to optimize its delivery infrastructure, particularly for last-mile services, ensuring flexibility and expanded reach. Strategic alliances with industry associations and culinary experts drive innovation and help identify emerging food trends, as seen in 2024's chef-driven initiatives, which bolster product development and brand credibility.

What is included in the product

A comprehensive overview of US Foods' business model, detailing its customer segments (restaurants, healthcare facilities), value propositions (diverse product selection, supply chain efficiency), and channels (direct sales, online platform).

This model highlights key resources like its extensive distribution network and partnerships, and revenue streams from food and beverage sales, reflecting its B2B focus in the foodservice industry.

US Foods' Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework to address challenges in food distribution, from sourcing to delivery.

It streamlines complex operations, offering a visual roadmap to overcome inefficiencies and improve customer satisfaction.

Activities

US Foods' procurement and sourcing is a massive undertaking, focusing on acquiring a vast array of food and non-food items from an extensive network of thousands of suppliers. This isn't just about buying; it's a strategic process involving meticulous supplier selection.

The company places a strong emphasis on ensuring the quality, safety, and sustainability of its product offerings, whether they are from third-party brands or US Foods' own private labels. This commitment to standards is crucial for maintaining customer trust and meeting evolving market demands.

In 2024, US Foods continued to navigate complex supply chains, with an estimated 70% of its product assortment sourced from third-party manufacturers and distributors, underscoring the importance of robust supplier relationships and rigorous vetting processes.

US Foods' key activity in warehousing and inventory management focuses on operating a vast network of distribution centers. These facilities are essential for storing a wide variety of food products, from perishables to dry goods, ensuring they are kept in optimal conditions.

This involves meticulous planning to efficiently utilize space, reduce spoilage, and maintain product integrity. The company must constantly balance stock levels to meet diverse customer orders, from small restaurants to large institutions, without overstocking or running out of critical items.

In 2023, US Foods operated over 70 distribution facilities across the United States, a testament to the scale of their warehousing operations. Efficient inventory control is paramount; for instance, managing fresh produce requires rapid turnover and precise temperature control, contributing to a significant portion of their operational complexity and cost.

US Foods' core activities revolve around efficiently moving food and supplies to a vast customer base. This involves operating a substantial fleet of trucks, meticulously planning complex delivery routes to reach around 250,000 foodservice operators across the United States. Think of it as a massive, intricate dance of trucks and schedules ensuring restaurants and other food businesses get what they need, when they need it.

The company offers specialized delivery solutions to meet diverse customer needs. Pronto, for instance, handles smaller, more frequent orders, providing flexibility for businesses with fluctuating demand. Meanwhile, US Foods Direct caters to the demand for specialty products, broadening the company's reach into niche markets and ensuring a comprehensive product offering.

Private Brand Development and Marketing

US Foods focuses heavily on developing and marketing its exclusive private brand portfolio. This is a core activity that helps the company stand out from rivals and cater to specific customer demands. They invest in creating unique products that align with current market trends and customer preferences.

This strategic approach to private brands involves rigorous product innovation and stringent quality control measures. By doing so, US Foods ensures that its exclusive offerings meet high standards, building trust and loyalty among its diverse customer base. For example, in fiscal year 2023, their private brands continued to be a significant driver of growth and margin improvement.

- Product Innovation: Continuously introducing new and improved private label items.

- Quality Assurance: Implementing strict quality checks throughout the supply chain.

- Strategic Branding: Building strong brand identities for their exclusive product lines.

- Customer Focus: Aligning product development with evolving customer needs and market trends.

Customer Relationship Management and Solutions Provision

US Foods actively manages customer relationships through a dedicated sales force. These associates work to understand individual customer needs and offer tailored solutions. This proactive approach is crucial for building loyalty and ensuring customer satisfaction.

Providing comprehensive business solutions is a core activity. This includes offering advanced e-commerce platforms and proprietary technology tools designed to streamline operations for their clients. The goal is to empower customers to enhance efficiency and drive growth within their own businesses.

In 2024, US Foods continued to invest in its digital infrastructure, with its e-commerce platform serving a significant portion of its customer base. For instance, a notable percentage of orders were placed online, demonstrating the effectiveness of these digital tools in facilitating business. This digital engagement directly supports the objective of helping customers grow.

- Dedicated Sales Associates: US Foods employs a large team of sales professionals focused on building and maintaining strong customer relationships.

- E-commerce Platform: The company's online ordering system provides customers with 24/7 access to products and account management.

- Technology Solutions: This includes tools for inventory management, menu planning, and operational efficiency, all aimed at supporting customer business growth.

- Focus on Customer Growth: A key outcome of these activities is enabling customers to expand their operations and improve their bottom line.

US Foods' procurement and sourcing involves strategic supplier selection to acquire a vast array of food and non-food items, prioritizing quality, safety, and sustainability. In 2024, approximately 70% of their product assortment came from third-party manufacturers, highlighting the critical nature of these supplier relationships.

Warehousing and inventory management are key activities, centered around operating over 70 distribution centers to store diverse food products under optimal conditions. Efficient space utilization and minimizing spoilage are paramount, especially for perishables like fresh produce which require rapid turnover and precise temperature control.

US Foods' distribution network is extensive, utilizing a large fleet of trucks to deliver to around 250,000 foodservice operators nationwide. Specialized delivery solutions like Pronto for smaller, frequent orders and US Foods Direct for specialty items cater to varied customer needs.

Developing and marketing exclusive private brands is a core focus, with these brands driving significant growth and margin improvement. This involves continuous product innovation, rigorous quality assurance, and strategic branding to meet evolving customer preferences and market trends.

Customer relationship management is driven by a dedicated sales force and robust digital platforms, including an advanced e-commerce system. In 2024, a substantial portion of orders were placed online, underscoring the importance of these digital tools in facilitating business and directly supporting customer growth objectives.

| Key Activity | Description | 2024/2023 Data |

| Procurement & Sourcing | Strategic acquisition of goods from thousands of suppliers, emphasizing quality and safety. | ~70% of assortment sourced from third parties (2024). |

| Warehousing & Inventory | Operating distribution centers to store and manage diverse product inventory. | Operated over 70 distribution facilities (2023). |

| Distribution & Delivery | Efficiently delivering products to foodservice operators via a large truck fleet and specialized services. | Serves ~250,000 foodservice operators. |

| Private Brand Development | Creating and marketing exclusive product lines to drive growth and differentiation. | Significant driver of growth and margin improvement (FY2023). |

| Customer Relationship Management | Utilizing sales force and digital platforms to support customer needs and growth. | Significant order volume via e-commerce platform (2024). |

Preview Before You Purchase

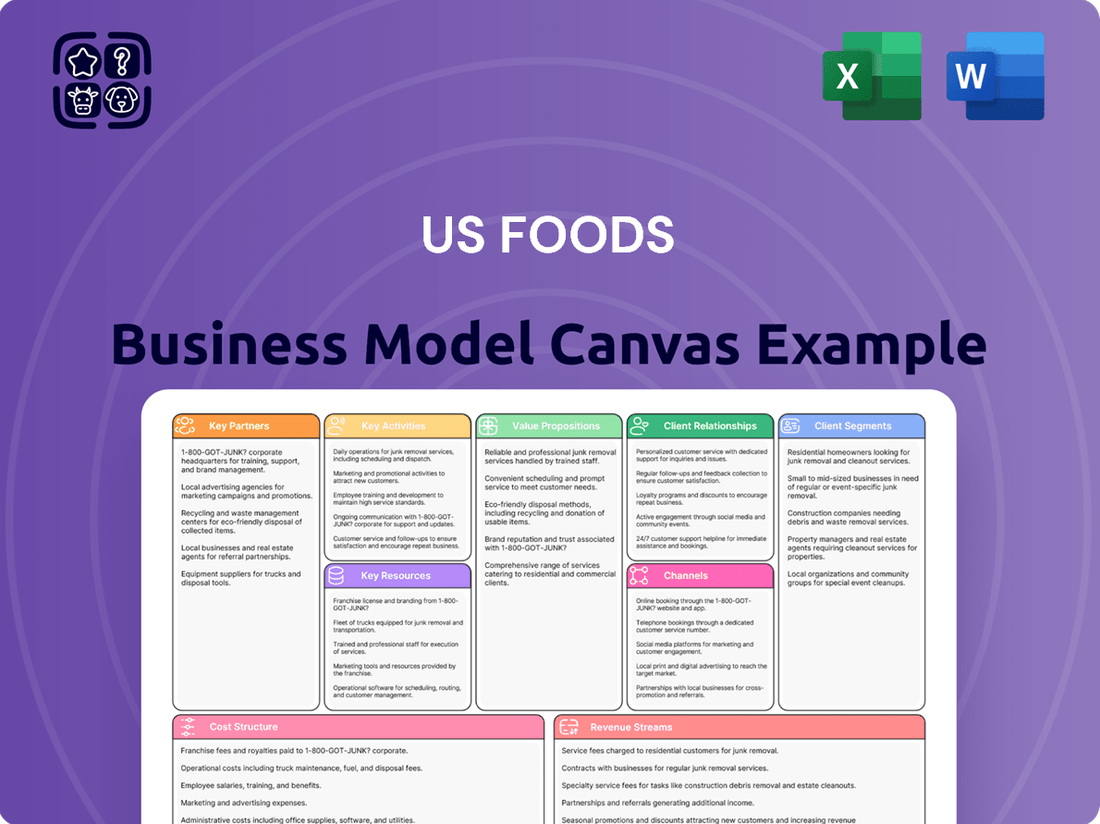

Business Model Canvas

The US Foods Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, professionally designed Business Model Canvas ready for your use. Upon completing your order, you will gain full access to this same file, allowing you to immediately begin analyzing and strategizing for US Foods.

Resources

US Foods operates an extensive physical infrastructure, boasting over 70 broadline distribution facilities strategically located across the nation. This robust network is a cornerstone of their business, facilitating the efficient storage and handling of a vast array of food products.

Complementing its distribution centers, US Foods manages a substantial fleet of over 6,500 trucks. This dedicated fleet is crucial for ensuring timely and reliable delivery of goods to a diverse customer base, from independent restaurants to large institutional clients.

The sheer scale of this distribution network and fleet is a significant competitive advantage for US Foods. It allows them to reach a wide geographical area, meet diverse customer needs, and maintain the freshness and quality of perishable items throughout the supply chain.

In 2024, the company continued to invest in optimizing this logistical backbone, aiming for enhanced efficiency and reduced delivery times. This ongoing commitment to its distribution capabilities underscores its importance in US Foods’ overall business model.

US Foods' expansive product catalog, featuring thousands of food and non-food items, is a critical resource. This broad offering caters to diverse customer needs across the foodservice industry.

A cornerstone of this portfolio is its robust selection of exclusive private brand products. These brands, like Serve Good, are not just differentiators but significant revenue drivers.

In 2024, private brands continue to be a strategic focus for US Foods, contributing to both sales volume and enhanced customer loyalty. For instance, their commitment to sustainability through brands like Serve Good resonates with an increasing number of environmentally conscious businesses.

US Foods leverages proprietary digital platforms such as MOXē and CHECK Business Tools as critical resources. These platforms are central to their e-commerce strategy, enabling seamless online ordering and efficient inventory management for their diverse customer base.

These technologies are not just for transactions; they offer value-added business solutions, empowering customers with data and tools to manage their operations more effectively. This digital infrastructure drives customer engagement and boosts operational efficiency across the board.

As of 2024, US Foods continues to invest heavily in these platforms. For instance, MOXē provides over 100,000 product choices and personalized recommendations, significantly enhancing the customer experience and streamlining procurement processes for restaurants and food service businesses.

Skilled Workforce and Sales Force

US Foods' operational success hinges on its substantial human capital. The company employs around 30,000 associates, a considerable portion of whom are dedicated to customer interaction and service delivery. This extensive workforce is fundamental to maintaining the company's market presence and operational efficiency.

- Workforce Size: Approximately 30,000 associates.

- Sales Force: Roughly 4,000 dedicated sales professionals.

- Key Roles: Managing customer relationships, offering expert product advice, and executing complex distribution logistics.

- Strategic Importance: This skilled workforce is a critical asset for driving sales, ensuring customer satisfaction, and facilitating the intricate supply chain operations.

Supplier Relationships and Supply Chain Expertise

US Foods leverages its established relationships with thousands of suppliers as a critical resource. This extensive network allows for consistent product availability and competitive pricing, directly impacting cost management. In 2023, US Foods worked with over 4,000 suppliers, ensuring a diverse and reliable product offering for its customers.

The company's deep expertise in supply chain management is another key resource. This proficiency enables efficient logistics, inventory control, and responsiveness to market changes. For instance, their sophisticated distribution network, comprising over 60 distribution centers, facilitates timely deliveries across their service areas.

These supplier relationships and supply chain capabilities are vital for maintaining product availability, a cornerstone of their value proposition. They also empower US Foods to effectively manage costs and adapt to evolving market demands, such as shifts in consumer preferences or economic conditions. This resilience is crucial in the dynamic food service industry.

- Supplier Network: Thousands of established relationships provide access to a wide variety of food products and supplies.

- Supply Chain Expertise: Advanced logistics and inventory management ensure efficient operations and product delivery.

- Cost Management: Strong supplier partnerships enable competitive sourcing and cost control, benefiting both US Foods and its customers.

- Market Adaptability: The ability to source diverse products and manage a complex supply chain allows for quick responses to market fluctuations and customer needs.

US Foods' key resources include its vast physical infrastructure, a substantial fleet of over 6,500 trucks, and a diverse product catalog with thousands of items, notably its private brands. Proprietary digital platforms like MOXē and CHECK Business Tools are central to their e-commerce and customer engagement strategies. The company also relies on its approximately 30,000 associates, including around 4,000 sales professionals, and established relationships with thousands of suppliers to ensure product availability and manage costs.

| Resource Category | Key Components | 2024/Recent Data Point |

| Physical Infrastructure | Distribution Facilities | Over 70 |

| Logistics | Delivery Fleet | Over 6,500 trucks |

| Product Offering | Total SKUs | Tens of thousands |

| Digital Platforms | E-commerce & Business Tools | MOXē, CHECK Business Tools |

| Human Capital | Total Workforce | Approximately 30,000 associates |

| Human Capital | Sales Force | Roughly 4,000 |

| Supplier Network | Number of Suppliers | Thousands (over 4,000 in 2023) |

Value Propositions

US Foods offers a vast selection of over 100,000 products, encompassing everything from fresh produce and meats to frozen foods, dairy, and specialty ethnic ingredients. This extensive catalog also includes essential non-food supplies like cleaning products and equipment, positioning US Foods as a convenient single-source solution for foodservice businesses.

This comprehensive product range simplifies procurement for customers, allowing them to consolidate their purchasing and reduce the time spent managing multiple vendors. For instance, a restaurant can source all its ingredients, from organic vegetables to unique spices, plus janitorial supplies, through a single, reliable distributor.

In 2024, US Foods continued to expand its private label offerings, which often provide a more cost-effective alternative for operators seeking to manage their expenses. These private label brands are developed to meet specific quality and performance standards, giving customers access to value without compromising on their menu needs.

The ability to access such a diverse product portfolio directly supports business strategy by enabling operators to create varied menus, cater to specific dietary needs, and maintain consistent quality. This broad access is a key differentiator in a competitive foodservice landscape.

US Foods goes beyond just delivering food, offering a robust suite of e-commerce and technology solutions to support its customers. These digital tools are designed to streamline operations, reduce costs, and provide valuable data for business growth.

Key platforms like MOXē, their e-commerce platform, and CHECK Business Tools offer features such as online ordering, inventory management, and sales analytics. For instance, MOXē allows for easy menu planning and price optimization, directly impacting a restaurant's bottom line.

In 2023, US Foods reported that its digital engagement continued to grow, with a significant portion of orders placed through their e-commerce channels. This adoption highlights how these technology solutions are becoming integral to how their customers manage their businesses day-to-day.

These value-added solutions differentiate US Foods by providing tangible benefits, helping independent restaurants and foodservice operators not only source products but also improve efficiency and gain a competitive edge in a challenging market.

US Foods leverages its private brands to deliver distinct value to its customers. These exclusive products are meticulously developed with a focus on both high quality and forward-thinking innovation, often featuring attributes like simpler ingredient lists or appealing to the growing plant-forward consumer trend.

This strategy of creating and distributing proprietary brands provides US Foods with a significant competitive edge in the marketplace. By offering items not available through other distributors, they create unique selling propositions that attract and retain their customer base.

For instance, in 2023, private brands represented a substantial portion of US Foods' sales, demonstrating their importance in the company's revenue streams. These brands are not just about offering variety; they are a core element of the value proposition, directly impacting customer loyalty and purchasing decisions.

Operational Efficiency and Reliability

US Foods is dedicated to enhancing the operational efficiency of its customers. They achieve this through dependable delivery networks, streamlined order management systems, and innovative solutions designed to cut down on both labor costs and food waste. This commitment to operational excellence directly supports customer profitability and smoother business operations.

For instance, in 2024, US Foods continued to invest in its logistics infrastructure, aiming for even greater delivery reliability. Their technology platforms, like their mobile ordering app, processed millions of orders, simplifying the procurement process for thousands of restaurants. These efficiencies contribute to tangible savings for their clients, allowing them to focus more on their core business.

- Reliable Delivery: Consistent on-time deliveries minimize disruptions for food service businesses.

- Efficient Order Processing: User-friendly technology reduces administrative burden and ordering errors.

- Waste Reduction Solutions: Programs and products help customers manage inventory and minimize spoilage, directly impacting their bottom line.

- Labor Savings: Tools and services designed to optimize kitchen and back-office tasks free up valuable staff time.

Tailored Support and Industry Expertise

US Foods leverages its deep understanding of the foodservice industry, a critical value proposition for its diverse customer base. Their dedicated sales associates offer personalized support, acting as consultants rather than just order-takers. This expertise helps customers navigate specific industry challenges and identify growth opportunities.

This tailored approach is crucial in a dynamic market. For instance, in 2024, US Foods continued to emphasize its role in helping independent restaurants adapt to changing consumer preferences, such as the demand for plant-based options and healthier choices. Their sales teams are trained to provide insights on menu development and operational efficiency specific to different restaurant types, from fine dining to quick-service establishments.

- Industry-Specific Knowledge: Sales associates possess in-depth understanding of various foodservice sectors.

- Consultative Selling: Focus on providing advice and solutions, not just products.

- Personalized Support: Dedicated associates build relationships and understand individual customer needs.

- Navigating Challenges: Assisting customers with industry trends, regulations, and operational hurdles.

US Foods offers a comprehensive product selection of over 100,000 items, serving as a single-source solution for foodservice businesses. This vast catalog simplifies procurement by allowing customers to consolidate their purchasing from a single, reliable distributor, saving them time and administrative effort.

Their private label brands provide cost-effective options without compromising quality, offering a competitive edge and appealing to evolving consumer trends. In 2023, these private brands significantly contributed to US Foods' revenue, underscoring their importance in customer purchasing decisions.

US Foods enhances operational efficiency through dependable delivery, streamlined ordering via platforms like MOXē, and waste reduction solutions. In 2024, continued investment in logistics aimed for greater delivery reliability, while digital tools processed millions of orders, offering tangible savings to clients.

Their deep industry knowledge, delivered through consultative sales associates, helps customers navigate trends and operational challenges. In 2024, this expertise was crucial in assisting independent restaurants adapt to demands for plant-based and healthier options.

Customer Relationships

US Foods leverages a substantial dedicated sales force to cultivate robust, direct customer relationships. These sales professionals are crucial for understanding the unique needs of each client, offering personalized service and expert advice.

In 2024, US Foods continued to invest in its sales team, recognizing their role in driving customer loyalty and growth. This direct engagement allows them to provide tailored recommendations for products and solutions, going beyond simple order-taking.

The company's sales associates act as key partners, helping businesses navigate the complexities of food service operations. Their deep product knowledge and understanding of market trends enable them to offer valuable insights and support.

This emphasis on personal connection is a cornerstone of US Foods' customer relationship strategy, differentiating them in a competitive market. It ensures that clients receive not just food supplies, but comprehensive solutions designed to enhance their success.

US Foods leverages digital tools like its proprietary platform, MOXē, to cultivate strong customer relationships. This platform acts as a central hub, allowing customers to easily place orders, track deliveries, and manage their accounts, significantly enhancing convenience and efficiency.

MOXē also provides access to valuable business solutions, further solidifying the partnership between US Foods and its clients. For instance, in 2024, US Foods reported that a substantial portion of its orders were placed through digital channels, highlighting the platform's integral role in customer engagement and operational streamlining.

US Foods goes beyond simply supplying food by offering robust business consulting and support programs. These initiatives, like the CHECK Business Tools and VITALS platform, are designed to equip customers with actionable data and operational efficiencies, fostering growth and profitability. For instance, in 2023, US Foods reported that its digital tools helped customers improve inventory management by an average of 10%, directly impacting cost savings.

This focus on customer success transforms the supplier-client dynamic into a genuine partnership. By providing these business and technology solutions, US Foods positions itself as an indispensable ally in their customers' journey toward enhanced operational performance and revenue generation. This strategy is crucial for building long-term loyalty and differentiating from competitors.

Customer Service and Support Centers

US Foods offers robust customer service through dedicated support centers. These centers are vital for helping foodservice operators with everything from placing orders and managing deliveries to answering product questions and resolving any issues that arise. This commitment ensures a smooth and efficient experience for their clients.

The company's support infrastructure is designed for prompt and effective communication. For instance, in 2023, US Foods reported that over 90% of customer inquiries were resolved on the first contact through their various support channels, highlighting their focus on efficient problem-solving.

- Dedicated Support Centers: Provide assistance for orders, deliveries, and product information.

- Issue Resolution: Focus on prompt and effective problem-solving for foodservice operators.

- Customer Satisfaction: Aim to ensure a positive and seamless experience for all clients.

- Efficiency Metrics: In 2023, a significant portion of customer inquiries were resolved on the first contact.

Industry Events and Educational Initiatives

US Foods actively cultivates customer relationships through engaging industry events and educational initiatives. A prime example is their Food Fanatics Live! events, which are designed to inspire culinary creativity, offer practical educational sessions, and facilitate valuable networking among chefs, restaurateurs, and food service professionals. These gatherings are instrumental in building a strong community and delivering actionable insights that directly benefit their customers' businesses.

These events are more than just trade shows; they are platforms for knowledge sharing and professional development. For instance, during their 2024 events, US Foods highlighted emerging food trends and provided hands-on training in areas like menu optimization and operational efficiency. Such initiatives demonstrate a commitment to customer success beyond mere product supply, fostering loyalty and a deeper partnership.

- Food Fanatics Live!: Offers culinary inspiration, educational sessions, and networking opportunities.

- Community Building: Strengthens ties within the food service industry.

- Customer Empowerment: Provides valuable insights and practical skills to customers.

- 2024 Focus: Highlighted emerging trends and operational efficiency.

US Foods prioritizes personalized customer engagement through a dedicated sales force. This team acts as a direct link, understanding individual client needs and offering tailored solutions. In 2024, the company continued to emphasize training for these professionals, recognizing their pivotal role in fostering loyalty and driving growth by providing expert advice and product recommendations.

Digital platforms like MOXē are central to cultivating strong relationships, offering convenience for ordering and account management. In 2024, a significant portion of US Foods' orders were processed through these digital channels, underscoring their importance in streamlining operations and enhancing customer experience.

Beyond product supply, US Foods offers valuable business support tools, such as CHECK Business Tools and VITALS. These resources provide actionable data and operational insights, aiming to boost customer profitability and efficiency. For instance, in 2023, these digital tools assisted customers in improving inventory management, leading to an average of 10% cost savings.

Customer service centers are also key, handling inquiries from order placement to issue resolution, ensuring a smooth client experience. In 2023, US Foods reported resolving over 90% of customer queries on the first contact, highlighting their commitment to efficient support.

| Customer Relationship Strategy | Key Initiatives | Impact/Focus | Data Point |

|---|---|---|---|

| Personalized Engagement | Dedicated Sales Force | Understanding client needs, tailored solutions | Continued investment in sales team training in 2024 |

| Digital Convenience | MOXē Platform | Streamlined ordering, account management | Majority of orders placed via digital channels in 2024 |

| Business Support | CHECK Business Tools, VITALS | Operational efficiency, profitability enhancement | 10% average inventory management improvement for customers in 2023 |

| Customer Service | Dedicated Support Centers | Prompt inquiry resolution, issue management | 90%+ first-contact resolution rate in 2023 |

Channels

US Foods' direct sales force is the backbone of its customer engagement strategy, directly reaching out to businesses like restaurants and institutions. This hands-on approach allows their sales teams to truly understand the unique needs of each client, from menu planning to inventory management. This personal connection is key to building lasting relationships and ensuring customer satisfaction. In 2024, US Foods continued to emphasize this channel as a primary driver for growth and retention.

US Foods leverages its proprietary e-commerce platform, MOXē, as a primary digital channel for customer interaction. This platform is crucial for enabling clients to efficiently browse the extensive product catalog, place orders, and manage their accounts, streamlining the procurement process.

MOXē offers significant convenience and efficiency, particularly for repeat business, allowing customers to reorder frequently purchased items with ease. This digital interface also provides access to valuable business tools, such as menu planning and financial management resources, enhancing the overall customer experience and fostering loyalty.

In 2024, US Foods reported that a substantial portion of its sales volume is transacted through digital channels, highlighting the critical role MOXē plays in driving revenue and operational efficiency. The platform's user-friendly design and comprehensive features continue to be a key differentiator in the competitive foodservice distribution market.

US Foods leverages an extensive network of over 70 distribution centers across the United States. This robust infrastructure is the backbone of its physical channels, ensuring products are strategically positioned for efficient customer access.

Complementing these centers is a substantial delivery fleet, comprising thousands of trucks. This fleet is critical for providing reliable and timely delivery of a vast array of food products directly to customer locations, from restaurants to healthcare facilities.

The combined strength of its distribution centers and delivery fleet grants US Foods significant geographic reach. This allows them to serve a broad customer base across diverse regions, a key element in their market penetration strategy.

In 2023, US Foods reported that its supply chain and distribution network supported over 200,000 customer locations. This highlights the scale and effectiveness of their channel operations in meeting market demand.

Cash & Carry Stores (CHEF'STORE)

US Foods utilizes cash and carry locations, like CHEF'STORE, as a direct-to-customer sales channel. This offers customers immediate access to a wide range of food products, bypassing traditional delivery models.

While the company is exploring strategic options for this segment, CHEF'STORE currently serves as a crucial touchpoint for immediate needs. In 2024, US Foods reported that its CHEF'STORE segment continued to see growth, contributing to the overall revenue stream.

CHEF'STORE's business model is built around providing convenience and accessibility for foodservice professionals and other businesses. This allows for quick procurement of ingredients and supplies without the need for pre-ordering or delivery scheduling.

- Direct Customer Access: CHEF'STORE allows immediate product purchase for businesses needing supplies on short notice.

- Strategic Exploration: US Foods is actively reviewing the future strategy for its cash and carry operations.

- 2024 Performance: The CHEF'STORE segment demonstrated positive performance and revenue contribution in the 2024 fiscal year.

- Convenience Factor: It caters to customers who prioritize immediate product availability and self-service.

Specialized Delivery Programs (Pronto, US Foods Direct)

US Foods leverages specialized delivery programs like Pronto and US Foods Direct to cater to diverse customer needs. Pronto is designed for smaller, more frequent orders, offering agility for businesses with fluctuating inventory requirements. This program aims to reduce waste and ensure freshness for customers ordering less frequently.

US Foods Direct, on the other hand, connects customers directly with specialty item suppliers, expanding the available product catalog beyond traditional distribution. This allows access to unique ingredients and niche products that might otherwise be inaccessible. In 2023, US Foods reported continued growth in its diverse customer segments, highlighting the importance of such tailored solutions.

- Pronto: Facilitates smaller, more frequent deliveries, enhancing flexibility for businesses.

- US Foods Direct: Provides direct access to specialty items from suppliers, broadening product selection.

- Customer Focus: These programs are built to meet specific operational and culinary demands.

- Market Responsiveness: Demonstrates US Foods' commitment to adapting to evolving market trends and customer preferences.

US Foods' channel strategy encompasses a multi-faceted approach, blending direct sales, robust e-commerce capabilities, extensive physical distribution networks, and convenient cash-and-carry options. These channels are designed to meet the diverse needs of foodservice operators, ensuring accessibility and efficiency in product procurement.

The digital channel, primarily through its MOXē platform, saw significant adoption, with a substantial portion of sales volume transacted online in 2024. This underscores the platform's critical role in driving revenue and operational efficiency for US Foods.

The physical distribution network, supported by over 70 distribution centers and a large fleet, enabled US Foods to serve more than 200,000 customer locations in 2023. Complementing this, the CHEF'STORE segment, a cash-and-carry option, experienced growth in 2024, providing immediate access to products.

Specialized programs like Pronto and US Foods Direct further enhance customer service by offering tailored delivery solutions for varied order sizes and direct access to specialty items, reflecting the company's adaptive market approach.

| Channel | Description | Key Features | 2024 Data/Trend |

|---|---|---|---|

| Direct Sales Force | Personalized outreach to restaurants and institutions. | Understanding unique client needs, relationship building. | Primary driver for growth and retention. |

| E-commerce (MOXē) | Proprietary online platform for browsing, ordering, and account management. | Convenience, efficiency, business tools (menu planning, financials). | Substantial sales volume transacted; key revenue driver. |

| Distribution Centers & Fleet | Extensive network of over 70 distribution centers and a large delivery fleet. | Strategic positioning, reliable and timely delivery nationwide. | Supported over 200,000 customer locations in 2023. |

| Cash & Carry (CHEF'STORE) | Direct-to-customer sales at physical locations. | Immediate product access, self-service for urgent needs. | Segment saw growth in 2024. |

| Specialized Delivery Programs | Pronto and US Foods Direct. | Pronto: smaller, frequent orders; US Foods Direct: access to specialty items. | Meeting specific operational and culinary demands. |

Customer Segments

Independent restaurants, encompassing everything from casual diners and bustling cafes to upscale fine dining establishments, form a cornerstone of the US Foods customer base. These businesses often operate with distinct identities and specific operational needs, setting them apart from larger chains.

US Foods actively cultivates relationships with these independent operators by offering a diverse product selection designed to meet their unique culinary visions. This includes a wide array of fresh produce, specialty meats, and artisanal ingredients essential for creating signature dishes.

Beyond just product supply, US Foods provides competitive pricing structures and flexible solutions tailored to the independent restaurant's budget and operational scale. For instance, in 2024, US Foods continued to emphasize its commitment to helping these businesses manage costs effectively through various programs and purchasing options.

Furthermore, US Foods offers valuable business support services, recognizing that independent restaurants often require assistance beyond food procurement. These services can include marketing advice, operational efficiency tools, and even culinary expertise to help them thrive in a competitive market.

US Foods is a key supplier for multi-unit restaurant chains, offering a consistent supply of goods across their various locations. These businesses typically need standardized products and rely on efficient logistics to manage their operations effectively.

In 2024, the restaurant industry, particularly chains, continued to navigate supply chain complexities. US Foods’ ability to provide centralized purchasing and distribution solutions is crucial for these clients, ensuring uniformity and cost control from coast to coast.

The demand for specific, often proprietary, product formulations is common among larger chains. US Foods' capacity to meet these specialized needs, alongside their broad product catalog, positions them as a valuable partner for businesses operating multiple outlets.

US Foods serves a crucial role in the healthcare sector, supplying hospitals, nursing homes, and long-term care facilities. These institutions have highly specific dietary and nutritional needs, often driven by patient health conditions and regulatory requirements. For example, the Centers for Medicare & Medicaid Services (CMS) sets standards for food and nutrition services in skilled nursing facilities, emphasizing the importance of tailored meal programs.

To address these specialized demands, US Foods offers tailored product lines and solutions. Their VITALS program, for instance, is designed to meet the unique operational challenges faced by healthcare providers, ensuring compliance with dietary guidelines and supporting patient well-being. This commitment reflects the growing importance of nutritional support in patient recovery and overall health outcomes.

Education Institutions

Educational institutions, including K-12 schools, colleges, and universities, represent a significant customer segment for US Foods. These organizations have unique demands centered on providing nutritious meals to students, managing tight budgets, and requiring bulk purchasing capabilities. US Foods caters to these specific needs through tailored product selections and specialized service offerings designed for the educational sector.

In 2024, the foodservice industry serving educational institutions continued to be a vital market. For instance, the National School Lunch Program (NSLP) alone served over 30 million children daily in 2023, highlighting the sheer volume and consistent demand from schools. US Foods addresses this by providing a wide array of fresh produce, dairy, proteins, and pantry staples that meet USDA nutritional guidelines, ensuring compliance and appeal for young consumers.

US Foods’ strategy for this segment involves understanding the critical balance between cost-effectiveness and quality. They offer a range of private label brands, which often provide a more budget-friendly option without compromising on nutritional value or taste. Furthermore, their supply chain efficiency and ability to manage large-scale deliveries are crucial for institutions that operate on strict schedules and require reliable replenishment.

- Nutritional Compliance: US Foods provides products that align with federal and state nutritional standards for school meals, ensuring compliance with regulations like the Healthy, Hunger-Free Kids Act.

- Budget-Conscious Solutions: Offering a variety of value-priced products and private label brands helps educational institutions manage their food budgets effectively.

- Volume and Reliability: The company's robust distribution network ensures timely and consistent delivery of large orders, critical for feeding thousands of students daily.

- Menu Variety and Support: US Foods assists with menu planning and provides diverse product options to cater to different dietary needs and preferences within student populations.

Hospitality Businesses

US Foods serves a wide array of hospitality businesses, including hotels, resorts, country clubs, and casinos. These establishments rely on a broad spectrum of food and non-food items to cater to their guests' experiences. The emphasis for these customers is often on high-quality ingredients and visually appealing presentations to enhance guest satisfaction and brand reputation.

For instance, the U.S. hotel industry alone generated an estimated $236 billion in revenue in 2024, highlighting the significant purchasing power of this segment. These businesses require everything from premium cuts of meat and fresh produce to specialized beverages and essential cleaning supplies. US Foods' ability to supply a diverse product catalog, coupled with reliable delivery, makes it a key partner in meeting these varied operational needs.

- Hotels and Resorts: These venues require a comprehensive selection of ingredients for dining rooms, room service, and banquets, often prioritizing fresh, seasonal, and locally sourced options.

- Country Clubs: Offering upscale dining experiences, country clubs demand high-quality meats, seafood, artisanal cheeses, and premium wines to satisfy discerning members.

- Casinos and Entertainment Venues: These businesses need a consistent supply of diverse food items for restaurants, buffets, and concessions, often looking for cost-effective solutions without compromising on taste or variety.

- Specialty Needs: Many hospitality clients also require non-food items such as disposables, table linens, cleaning chemicals, and guest amenities, all of which US Foods can provide.

US Foods also serves a vital role in the government and institutional sector, supplying agencies like military bases, correctional facilities, and government offices. These clients often have strict procurement processes, volume requirements, and specialized dietary needs dictated by regulations and the populations they serve.

In 2024, government foodservice operations continued to focus on efficiency and cost control. For example, military dining facilities require consistent, high-volume delivery of a wide range of food items to support service members. US Foods' established distribution network and ability to meet bulk order demands are critical for these entities.

The company's offerings to this segment include standard commodity items as well as products that meet specific nutritional and safety standards, ensuring compliance with government mandates. Their ability to provide reliable supply chain management is paramount for institutions operating with significant logistical challenges.

Cost Structure

The cost of procuring food and non-food items from a vast network of suppliers represents the most significant portion of US Foods' cost structure. This involves substantial expenditure on everything from fresh produce and meats to janitorial supplies and restaurant equipment.

Effective management of these supplier relationships, including rigorous price negotiations and strategic sourcing, is paramount to controlling this major expense. US Foods' ability to secure favorable terms with its numerous suppliers directly impacts its overall profitability.

For instance, in their fiscal year 2023, US Foods reported a Cost of Goods Sold of $31.1 billion, highlighting the immense scale of their procurement operations. Optimizing inventory levels to minimize waste and storage costs while ensuring product availability is another critical element in managing this cost component.

US Foods faces substantial logistics and transportation costs, a critical component of its business model. These expenses stem from maintaining a vast fleet of over 7,000 trucks and managing an intricate distribution network that serves thousands of customers across the United States.

Key cost drivers include fuel, vehicle maintenance, and driver wages, which are directly impacted by fluctuating energy prices and labor market dynamics. For instance, a significant portion of their operating expenses is allocated to these areas, as efficient delivery is paramount to their service offering.

The company also invests heavily in optimizing its supply chain, including warehousing operations and route planning technology. These investments aim to reduce delivery times and fuel consumption, thereby mitigating some of the inherent costs of large-scale food distribution.

Labor and personnel costs represent a significant portion of US Foods' operating expenses, given its workforce of roughly 30,000 associates. This includes substantial investments in salaries, comprehensive benefits packages, and ongoing training programs to maintain a skilled workforce across all operational levels.

The company’s large sales force, crucial for client relationships and revenue generation, contributes significantly to these labor expenditures. Beyond sales, costs are also allocated to warehouse staff managing inventory and logistics, as well as administrative personnel supporting the company's vast operations.

For context, in their fiscal year 2023, US Foods reported total operating expenses of $30.6 billion. While specific breakdowns for labor are not always itemized separately in all public reports, it's understood to be one of the largest individual cost categories within that sum, directly impacting profitability and operational efficiency.

Marketing and Sales Expenses

US Foods’ marketing and sales expenses are a significant component of its cost structure. These costs encompass a broad range of activities aimed at acquiring and retaining customers, driving sales volume, and building brand awareness. This includes substantial investments in digital marketing, such as search engine optimization and targeted online advertising, alongside traditional promotional activities and trade shows.

The company also incurs costs related to its extensive sales force, including salaries, commissions, and training. Maintaining strong customer relationships is paramount, and this involves costs associated with customer service, loyalty programs, and managing account relationships. For instance, in fiscal year 2023, US Foods reported selling, general, and administrative expenses (which include marketing and sales) of $4.3 billion, reflecting the scale of these operations.

- Costs include digital marketing initiatives and customer engagement programs.

- Sales force commissions and relationship management are key expense drivers.

- In fiscal year 2023, SG&A expenses were $4.3 billion.

- These investments are crucial for market penetration and customer retention.

Technology and Infrastructure Investment

US Foods significantly invests in its technological backbone, a crucial element for its business model. This includes ongoing upgrades and maintenance for their e-commerce platforms, ensuring a seamless online ordering experience for customers. In 2023, the company reported capital expenditures of $1.1 billion, a portion of which is allocated to these technology and infrastructure enhancements.

The company's cost structure is heavily influenced by the development, upkeep, and security of its IT infrastructure. This encompasses everything from proprietary software solutions that manage logistics and inventory to robust cybersecurity measures protecting sensitive customer data. These investments are critical for supporting digital operations and the continuous improvement of customer-facing tools.

- E-commerce Platform Enhancement: Continuous investment in user experience and functionality for their online ordering system.

- IT Infrastructure Maintenance: Costs associated with servers, networks, data centers, and cloud services.

- Software Development: Expenses for creating and refining internal business applications and customer-facing digital tools.

- Cybersecurity: Significant spending on protecting systems and data from evolving cyber threats.

Other operational costs for US Foods encompass a range of necessary business expenditures. These include expenses related to maintaining its extensive network of distribution centers, ensuring compliance with food safety regulations, and investing in sustainability initiatives. The company also allocates resources to general administrative functions, such as finance, human resources, and legal services, which are essential for smooth business operations.

These overheads, while less direct than procurement or logistics, are critical for the overall efficiency and compliance of the business. For example, in fiscal year 2023, US Foods reported depreciation and amortization expenses of $1.1 billion, which reflects the ongoing investment and wear-and-tear on its physical assets, including its facilities and equipment.

The company's commitment to corporate social responsibility and environmental, social, and governance (ESG) standards also contributes to its cost structure through various programs and compliance measures.

| Cost Category | FY 2023 (USD Billions) | Notes |

|---|---|---|

| Cost of Goods Sold | 31.1 | Primary cost, reflecting procurement of food and non-food items. |

| Selling, General & Administrative (SG&A) | 4.3 | Includes marketing, sales force, and general overhead. |

| Depreciation & Amortization | 1.1 | Related to the wear and tear of physical assets like trucks and facilities. |

Revenue Streams

US Foods primarily generates revenue by selling a vast selection of food and non-food items to around 250,000 foodservice customers across the United States. This broadline distribution model encompasses everything from fresh produce and frozen meats to dry goods and essential kitchen supplies.

In 2023, US Foods reported net sales of $34.1 billion, highlighting the sheer volume and diversity of their product offerings that contribute to this significant revenue stream. This extensive product catalog allows them to serve a wide range of clients, from independent restaurants to large institutional kitchens.

US Foods generates substantial revenue through its exclusive private label product sales. These brands, such as Chef's Line and Metro Deli, are key drivers of profitability, often offering higher margins compared to national brands. In 2023, private label sales represented a significant portion of the company's overall revenue, demonstrating their importance in the business model.

US Foods generates revenue from value-added services beyond just food distribution. These include technology solutions, like CHECK Business Tools subscriptions, which help restaurants manage operations. For fiscal year 2023, the company reported that its Select Service segment, which encompasses these types of offerings, contributed significantly to overall performance, though specific figures for the value-added services alone are not separately itemized, they are embedded within the broader segment results.

E-commerce and Digital Solution Subscriptions

US Foods leverages its e-commerce platform, MOXē, as a significant revenue driver. This digital solution offers subscription-based access and usage-based charges, providing customers with tools to streamline their operations, order management, and inventory control. This digital ecosystem is designed to enhance customer efficiency and loyalty.

The company generates income from these digital subscriptions and services by offering varying tiers of access and functionality. These offerings are tailored to meet the diverse needs of their broad customer base, from independent restaurants to larger foodservice operators. The aim is to provide value beyond just product delivery.

- Subscription Fees: Recurring revenue generated from customers subscribing to MOXē and other digital tools.

- Usage-Based Charges: Revenue tied to the utilization of specific features or services within the digital platforms.

- Enhanced Efficiency Tools: Digital solutions that help customers manage inventory, track orders, and optimize their business, justifying subscription costs.

- Customer Retention: The digital platform aims to foster stronger customer relationships, leading to increased order frequency and value.

Acquisition-driven Growth

US Foods utilizes strategic acquisitions as a key driver for revenue expansion, though these are not typically recurring revenue streams. These tuck-in acquisitions are carefully selected to broaden their market reach and onboard new customer segments, directly impacting top-line growth. For instance, the company's acquisition of Jake's Finer Foods in 2025 was a significant move that bolstered its financial performance by integrating a complementary customer base and product portfolio, particularly in specialty foods.

This approach to growth allows US Foods to enter new geographic areas or strengthen its position in existing markets more rapidly than through organic expansion alone. By acquiring businesses that align with their strategic objectives, they can quickly gain market share and diversify their revenue base. The integration of acquired entities often brings efficiencies and cross-selling opportunities, further enhancing the overall revenue contribution.

- Strategic Acquisitions: Tuck-in acquisitions contribute to revenue by expanding market presence and customer base.

- Example: The acquisition of Jake's Finer Foods in 2025 positively impacted US Foods' financial performance.

- Growth Driver: Acquisitions offer a faster route to market penetration and customer acquisition compared to organic growth.

- Synergies: Acquired businesses often provide opportunities for cross-selling and operational efficiencies, boosting revenue.

US Foods' revenue streams are built on a foundation of broadline food and non-food product sales to a vast customer base of approximately 250,000 foodservice operators. In 2023, this core business generated net sales of $34.1 billion, showcasing the immense scale of their distribution operations.

A significant contributor to their revenue is the sale of private label products, such as Chef's Line and Metro Deli, which often provide higher profit margins. These exclusive brands are crucial for profitability, with their sales forming a substantial part of the company's overall income in 2023.

Beyond product sales, US Foods also earns revenue from value-added services and digital solutions, including subscriptions to their MOXē e-commerce platform. These offerings help customers streamline operations, and in fiscal year 2023, the Select Service segment, which includes these digital tools, played a notable role in the company's financial results.

| Revenue Stream | Description | 2023 Impact |

| Broadline Distribution | Sales of diverse food and non-food items | $34.1 billion net sales |

| Private Label Sales | Revenue from exclusive brands (e.g., Chef's Line) | Significant portion of overall revenue, higher margins |

| Value-Added Services & Digital Platforms | Subscription fees and usage charges for tools like MOXē | Contributes to Select Service segment performance |

Business Model Canvas Data Sources

The US Foods Business Model Canvas is built upon comprehensive market research, internal operational data, and financial disclosures. These diverse data sources ensure accurate representation of customer segments, value propositions, and revenue streams.