US Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Foods Bundle

US Foods operates within a highly competitive food service distribution landscape, where bargaining power of buyers, particularly large restaurant chains, significantly influences pricing and terms. The threat of new entrants, while somewhat mitigated by high capital requirements, remains a constant consideration.

The intensity of rivalry among existing players is fierce, driving innovation and efficiency as companies vie for market share. Furthermore, the availability of substitutes, such as direct purchasing from manufacturers or alternative distribution channels, exerts pressure on US Foods’s business model.

Supplier power is also a critical factor, as the consolidation of food producers can lead to increased input costs. Understanding these dynamic forces is crucial for navigating the complexities of the food distribution industry.

The complete report reveals the real forces shaping US Foods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key suppliers for essential food categories significantly impacts their bargaining power with US Foods. If a small number of large suppliers dominate segments like fresh produce or specific proteins, they can dictate terms and pricing more effectively. While US Foods' substantial purchasing volume offers some leverage, reliance on a few specialized suppliers for high-demand or niche ingredients can still create significant negotiation challenges.

Commodity price volatility significantly impacts US Foods' supplier bargaining power. Fluctuations in global food prices, such as grains or proteins, directly increase or decrease the input costs for US Foods' suppliers. For instance, a sharp rise in the price of beef in early 2024 could force suppliers to demand higher prices from US Foods, squeezing profit margins.

When commodity prices surge, suppliers often have more leverage to pass these increased costs onto their customers, including US Foods. This is because their own cost structure is directly affected, and they may have limited ability to absorb these hikes. This external pressure on costs can amplify the bargaining power of even smaller suppliers within the broader market.

The bargaining power of suppliers to US Foods is significantly influenced by switching costs. If US Foods can easily move from one supplier to another with minimal disruption or expense, supplier power is diminished. For instance, if many suppliers offer similar commodity food items, US Foods can readily switch, keeping supplier leverage low.

However, switching costs can escalate when dealing with specialized or proprietary products. Imagine a scenario where a supplier provides a unique seasoning blend or a specific type of processed ingredient crucial to US Foods' private label brands. In such cases, finding an alternative supplier with the same quality and specifications, or re-engineering products to accommodate a new ingredient, can be costly and time-consuming, thereby increasing the supplier's bargaining power.

In 2023, the food distribution industry experienced ongoing supply chain challenges, including ingredient scarcity and increased transportation costs, which can naturally drive up the importance of existing supplier relationships. For US Foods, the ability to maintain stable relationships with suppliers of unique or critical components, even at a higher cost, might be preferable to the uncertainty and expense of switching, thus granting those suppliers greater leverage.

Supplier's Product Differentiation

US Foods faces significant supplier power when those suppliers offer highly differentiated or unique products, or if they boast strong brand recognition. When a supplier provides a product that is critical to US Foods' overall offerings and lacks readily available direct alternatives, that supplier gains leverage to dictate better terms and pricing. This dynamic is especially pronounced for suppliers of premium, specialty, or proprietary food items that US Foods needs to maintain its competitive edge and customer appeal.

For instance, in 2024, the demand for ethically sourced and organic produce continued to rise, with consumers increasingly willing to pay a premium. Suppliers specializing in these niche markets, who have invested in certifications and sustainable practices, can command higher prices from distributors like US Foods. This differentiation reduces the substitutability of their products, thereby increasing their bargaining power.

- Differentiated Products: Suppliers offering unique or proprietary food items, such as specialty cheeses or imported delicacies, have greater pricing power.

- Strong Brands: Well-established food brands, recognized and sought after by end consumers, can negotiate more favorable terms with distributors.

- Critical Inputs: If a particular ingredient or product is essential for a popular product line offered by US Foods and has few substitutes, its supplier holds considerable bargaining influence.

- Limited Alternatives: The fewer direct competitors a supplier has for a specific product, the stronger their position in price negotiations with US Foods.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into distribution or directly serving foodservice operators significantly bolsters their bargaining power. While large-scale food distribution isn't typically a primary focus for many producers, the possibility of certain manufacturers exploring direct sales channels to bypass intermediaries like US Foods gives them an edge. This potential direct access allows suppliers to capture more of the value chain, thereby increasing their leverage in negotiations with distributors.

For example, a specialty cheese producer might decide to sell directly to high-end restaurants, cutting out the need for a distributor. This move, if credible, forces US Foods to consider the implications for its own business and potentially offer better terms to retain the supplier's business. The ability of suppliers to credibly threaten forward integration means they can dictate terms more effectively, influencing pricing and product availability for US Foods.

- Increased Supplier Leverage: Suppliers capable of forward integration can command better pricing and contract terms by threatening to bypass distributors.

- Direct Channel Exploration: While less common for broadline distributors, niche producers may explore direct sales to foodservice operators, increasing their negotiation power.

- Value Chain Capture: Forward integration allows suppliers to capture a larger portion of the profit margin, giving them a stronger bargaining position.

- Strategic Implications for US Foods: US Foods must factor in this threat, potentially adjusting its own strategies and service offerings to maintain supplier relationships.

The bargaining power of suppliers to US Foods is amplified by the concentration of key players in essential food categories. For instance, in 2024, a few dominant suppliers in categories like dairy or red meat can exert significant influence over pricing and terms due to their market share.

Commodity price volatility, such as the projected increases in grain prices impacting feed costs for livestock in late 2023 and into 2024, directly strengthens supplier leverage. Suppliers facing higher input costs are better positioned to pass these onto distributors like US Foods, squeezing margins if US Foods cannot secure favorable long-term contracts.

Switching costs also play a crucial role; if US Foods relies on specialized ingredients or custom-processed items from a single supplier, the cost and disruption of finding an alternative can be substantial, thereby empowering that supplier. For example, a supplier of a unique private-label sauce base with proprietary ingredients would hold considerable sway.

Suppliers who offer highly differentiated products, like premium organic produce or specialty imported goods, command greater bargaining power. In 2024, the continued consumer demand for such items means suppliers with unique offerings can negotiate higher prices, as US Foods needs these to cater to specific market segments.

| Factor | Impact on Supplier Bargaining Power | Example (2024 Context) |

| Supplier Concentration | High | Dominant suppliers in beef or poultry markets dictating terms. |

| Commodity Price Volatility | High | Rising grain prices increasing supplier costs and negotiation leverage. |

| Switching Costs | Variable (High for specialized products) | Supplier of unique private-label ingredients. |

| Product Differentiation | High | Producers of premium organic produce or specialty imported goods. |

What is included in the product

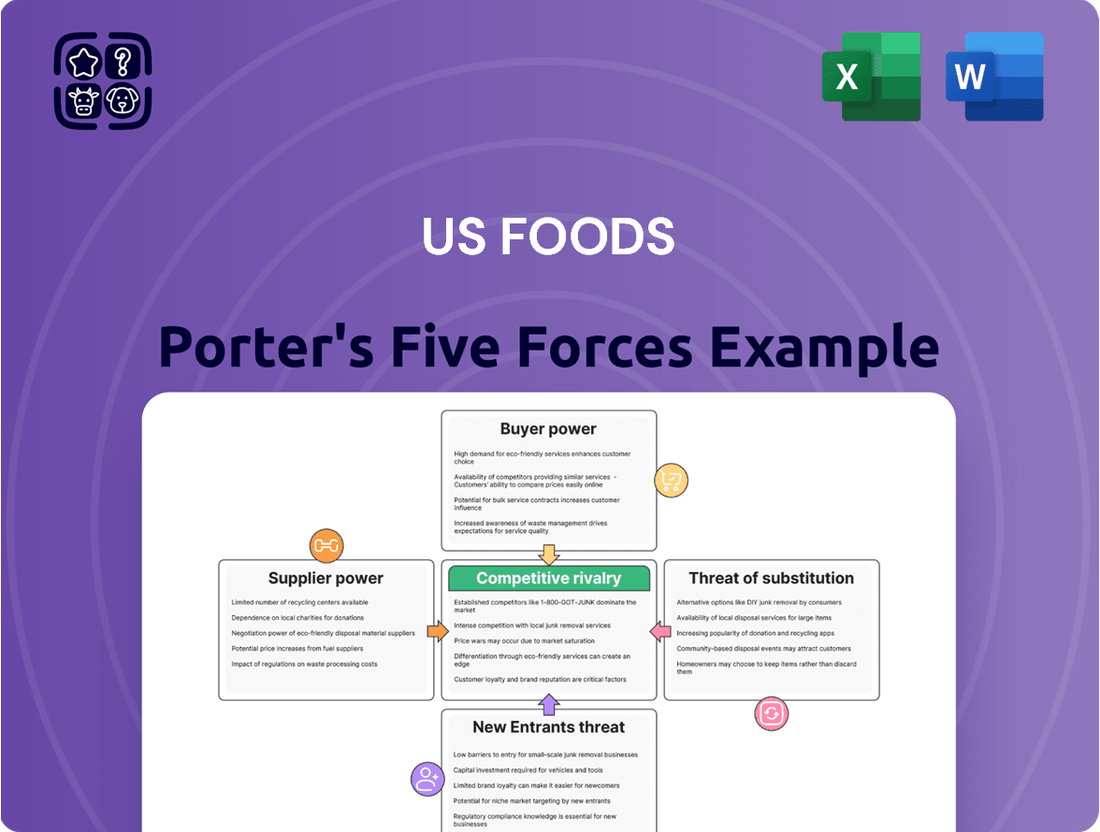

Uncovers key drivers of competition, customer influence, and market entry risks tailored to US Foods' position in the foodservice distribution industry.

Instantly understand competitive pressures within the food service industry with a visually intuitive Porter's Five Forces analysis for US Foods.

No more manual data crunching; this analysis provides a clear, actionable framework to navigate the complexities of supplier power, buyer bargaining, and competitive rivalry.

Customers Bargaining Power

US Foods serves a wide array of clients, from small, independent restaurants to large institutions like schools and hospitals. Many of these customers operate with very thin profit margins, making price a critical factor in their purchasing decisions. This inherent price sensitivity means they actively search for the best deals on their food supplies, which directly impacts US Foods' pricing strategies and overall profitability.

For example, in 2023, the restaurant industry, a significant customer segment for US Foods, continued to grapple with rising operational costs, including food inflation. Reports indicated that many independent restaurants saw their food costs increase by as much as 10-15% year-over-year, forcing them to scrutinize every supplier's invoice to maintain their own pricing viability.

Consequently, customers' ability to switch suppliers if prices are not competitive is a powerful lever. US Foods must therefore maintain a delicate balance, offering attractive pricing to retain its diverse customer base while simultaneously ensuring its own financial health and ability to invest in its business.

The availability of alternative distributors significantly bolsters customer bargaining power. Customers, particularly larger restaurant chains and institutional buyers, can readily switch to competitors such as Sysco or Performance Food Group, both major national players, or opt for a multitude of regional and local suppliers. This ease of switching means US Foods faces constant pressure to offer competitive pricing and superior service, as customers are not locked into a single provider. For instance, in 2023, the foodservice distribution market saw continued consolidation but also robust competition, with these large players vying for market share, directly impacting pricing leverage for buyers.

US Foods, like many distributors, faces significant bargaining power from its larger clientele. Customers with high purchase volumes, such as major restaurant chains or institutional buyers, can leverage their substantial spending to negotiate more favorable pricing, delivery schedules, and even customized product offerings. This is a constant dynamic in the food distribution sector.

In 2023, US Foods reported that its top 25 customers accounted for approximately 10% of its net sales, highlighting the concentrated purchasing power of its largest clients. These key accounts often have the leverage to demand better terms, directly impacting US Foods' profit margins and operational flexibility.

Furthermore, the frequency of purchases plays a crucial role. While consistent orders foster loyalty, they also create recurring opportunities for these high-volume customers to revisit contract terms and seek ongoing concessions. This can transform a stable relationship into one where the customer continuously exerts pressure for better deals.

Low Customer Switching Costs

For many foodservice operators, the effort and expense associated with changing food distributors are often minimal, particularly for standard, widely available products. This ease of switching grants customers significant leverage, allowing them to readily explore alternative suppliers for more favorable pricing or improved service. Consequently, US Foods must continuously demonstrate competitive value and superior service to retain its customer base and mitigate customer defection.

The low switching costs mean that US Foods faces constant pressure to perform. If a competitor offers a slightly better price on staple items, an operator might switch without significant disruption. This dynamic directly impacts US Foods' ability to command premium pricing and necessitates a sharp focus on operational efficiency and customer retention strategies.

Consider the impact on pricing power. With low switching costs, customers can easily shop around. For example, a restaurant needing bulk produce might get quotes from several distributors. If US Foods' pricing isn't competitive, they risk losing that business entirely. This is a common scenario across the industry, affecting margins.

Here's a breakdown of factors contributing to low switching costs in the foodservice distribution sector:

- Standardized Products: Many food items, like produce, dairy, and dry goods, are largely commoditized, making product differentiation difficult and price the primary decision factor.

- Ease of Order Integration: Many distributors offer similar ordering platforms, reducing the technical hurdle for new customers.

- Contractual Flexibility: While some contracts exist, many in the industry allow for relatively easy exit clauses, especially for smaller operators.

- Logistical Simplicity: For many operators, the core delivery process is similar across distributors, minimizing operational changes required to switch.

Customers' Threat of Backward Integration

While backward integration is typically not feasible for the majority of US Foods customers, particularly smaller independent restaurants, very large entities like major restaurant chains or large institutional food service providers could explore this option. For instance, a national fast-food chain might negotiate direct purchasing agreements with food manufacturers, bypassing intermediaries like US Foods for certain high-volume items.

The potential for even a small segment of US Foods' customer base to engage in direct sourcing or establish rudimentary distribution networks, however unlikely for most, can serve as a subtle bargaining chip. This possibility, even if not fully realized, gives these larger customers a degree of leverage when negotiating prices and terms with US Foods.

- Customer Leverage: Very large customers may wield influence by threatening to source directly from manufacturers.

- Impracticality for Most: The significant capital and operational requirements make backward integration impractical for the vast majority of US Foods' customer base.

- Subtle Influence: The mere theoretical possibility of integration can empower larger buyers in price negotiations.

Customers wield significant bargaining power due to the sheer number of foodservice distributors available, including large national competitors and numerous regional players. This competitive landscape allows customers, especially large chains and institutions, to easily switch suppliers if US Foods' pricing or service falters, creating constant pressure on US Foods to offer competitive terms.

For instance, in 2023, the foodservice distribution market remained highly competitive, with major players like Sysco and Performance Food Group actively vying for market share, directly enhancing buyer leverage through readily available alternatives.

The ease with which customers can switch is a primary driver of their bargaining power. With minimal effort and cost, operators can move to a different distributor, particularly for standardized food products, forcing US Foods to maintain competitive pricing and superior service to retain business.

The bargaining power of US Foods' customers is substantial, driven by their ability to switch suppliers easily and the availability of numerous alternatives. Large clients can leverage their purchasing volume to negotiate better prices, and even the threat of direct sourcing by major chains can influence terms, impacting US Foods' profit margins.

Preview Before You Purchase

US Foods Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive US Foods Porter's Five Forces Analysis delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the food distribution industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, offering strategic insights into US Foods' market position.

Rivalry Among Competitors

The US foodservice distribution landscape is dominated by a few giants, including US Foods, Sysco, and Performance Food Group. This high industry concentration means these major players are locked in a constant battle for dominance, which significantly shapes competitive dynamics.

This intense rivalry is often played out through aggressive pricing strategies, as companies strive to win over customers by offering the best deals. For instance, Sysco, the largest player, reported over $37 billion in revenue for fiscal year 2023, demonstrating the scale of operations and the financial muscle these companies wield in their competitive pursuits.

Beyond pricing, companies like US Foods differentiate themselves by expanding their product portfolios and enhancing their service offerings. This constant push for innovation and customer satisfaction is a direct result of the concentrated market structure, where any move by one competitor is met with a swift reaction from others.

The concentration also fosters a cycle of competitive actions and reactions, making it challenging for smaller, less capitalized firms to gain a foothold. This environment necessitates strategic maneuvering and a deep understanding of competitor strategies for any player in the US foodservice distribution sector.

Competitors in the food service distribution sector, including US Foods, are actively differentiating beyond simple pricing. They are investing in broader product selections, often featuring robust private label offerings that provide better margins and unique customer appeal. For instance, in 2024, many distributors expanded their lines of specialty and ethnic foods to cater to evolving consumer tastes.

The digital landscape is also a major battleground. Companies are enhancing their e-commerce platforms and offering advanced technology solutions, such as sophisticated inventory management or data analytics tools, to streamline operations for their clients. This technological edge can significantly improve customer loyalty and operational efficiency.

Furthermore, value-added services are becoming critical differentiators. This includes offering comprehensive support like menu planning, recipe development, and even business consulting to help restaurants optimize their operations and profitability. These services move beyond mere product delivery to become strategic partnerships.

In a market where the core products can often feel commoditized, the ability to provide unique or superior services is a powerful way to stand out. This focus on service excellence is a key element in the competitive rivalry among major players in the food service distribution industry.

The foodservice distribution industry, including players like US Foods, is characterized by substantial fixed costs. These costs stem from investments in large warehouses, extensive trucking fleets, and sophisticated logistics systems. For instance, building and maintaining a nationwide distribution network requires billions of dollars in capital expenditure.

These high fixed costs create a strong incentive for companies to operate at maximum capacity. US Foods, and its competitors, must achieve high sales volumes to spread these overheads across a larger base, which naturally fuels intense competition. Any underutilization of this capacity directly impacts profitability, as the fixed costs remain regardless of sales levels.

In 2023, US Foods reported a gross profit margin of approximately 14.7%, highlighting the razor-thin margins common in the industry. This means even small inefficiencies or drops in volume can significantly erode profits, further intensifying the pressure to maintain high operational throughput and compete aggressively on price and service to fill their extensive networks.

Market Growth Rate

The foodservice industry's growth rate significantly shapes competitive rivalry. When the market expands robustly, companies have more opportunities to grow without directly clashing for existing customers. This environment can temper the intensity of competition.

Conversely, during periods of slower growth, competition intensifies. Companies are compelled to fight harder for market share, often leading to price wars or aggressive promotional activities. For instance, the National Restaurant Association reported that while foodservice sales are projected to reach $1.1 trillion in 2024, this growth follows a period where economic headwinds could have tightened margins and increased competitive pressure.

- Slow growth periods often lead to increased price competition as firms vie for limited customer spending.

- A growing market allows for easier expansion and market entry, potentially reducing direct rivalry over existing share.

- The overall economic climate, affecting consumer discretionary spending, directly impacts industry growth and, consequently, competitive intensity.

- In 2024, the foodservice sector expects sales growth, which may offer some relief from the most aggressive competitive tactics seen in flatter growth environments.

Strategic Acquisitions and Mergers

The food distribution industry, including players like US Foods, has a documented history of consolidation through mergers and acquisitions. This trend intensifies competitive rivalry as dominant firms leverage these strategic moves to bolster their market positions. For instance, the acquisition of smaller, regional distributors by larger national ones can create significant economies of scale and expand geographic coverage, putting pressure on remaining independent entities to either consolidate themselves or face heightened competition.

These strategic acquisitions can reshape the competitive landscape by increasing market power and influencing pricing strategies. Competitors are often compelled to respond with their own growth initiatives, whether through organic expansion or further M&A activity, to avoid being left behind. This ongoing cycle of consolidation and competitive response is a defining characteristic of the sector, directly impacting the intensity of rivalry faced by all participants.

- Industry Consolidation: The food distribution sector has experienced significant consolidation, with major players acquiring smaller competitors to gain market share and operational efficiencies.

- Economies of Scale: Mergers and acquisitions enable companies to achieve greater economies of scale, reducing per-unit costs and enhancing their ability to compete on price.

- Geographic Expansion: Strategic acquisitions allow distributors to rapidly expand their geographic reach, serving new markets and increasing their customer base.

- Market Power: Larger, consolidated entities often wield greater market power, influencing supplier negotiations and customer terms, thereby intensifying rivalry for less integrated competitors.

The competitive rivalry within the US foodservice distribution sector, where US Foods operates, is fierce. Dominated by a few large players like Sysco and Performance Food Group, the market sees intense competition primarily through aggressive pricing and expanded service offerings. Companies are investing heavily in e-commerce platforms and value-added services like menu planning to differentiate themselves beyond basic product delivery, aiming to build customer loyalty in a market where margins are tight.

High fixed costs associated with extensive logistics networks incentivize companies to maximize sales volume, further fueling competition. In 2023, US Foods' gross profit margin of approximately 14.7% illustrates the thin margins that necessitate efficient operations and aggressive strategies to maintain profitability. The industry also sees ongoing consolidation, with larger firms acquiring smaller ones to achieve economies of scale and expand market reach, intensifying pressure on remaining competitors.

Market growth also plays a crucial role; slower growth periods escalate competition as firms fight harder for market share. While the foodservice sector projected sales growth to around $1.1 trillion in 2024, economic factors can still lead to heightened competitive tactics. The constant cycle of strategic moves, acquisitions, and service innovations defines the intense rivalry among major foodservice distributors.

| Key Competitor | FY2023 Revenue (Approx.) | Key Competitive Strategy Example |

|---|---|---|

| Sysco | $37 billion+ | Aggressive pricing, broad product portfolio |

| US Foods | N/A (Private Company) | Private label offerings, technology solutions |

| Performance Food Group | $30 billion+ | Value-added services, strategic acquisitions |

SSubstitutes Threaten

Some foodservice operators, especially larger chains or those focused on farm-to-table, may choose to source directly from farms or specialized producers, bypassing distributors like US Foods. This direct approach can offer benefits like enhanced freshness, access to unique ingredients, or potential cost efficiencies, substituting for a part of the distributor's role. For instance, a significant trend in the restaurant industry in 2024 has been the increasing demand for locally sourced ingredients, with many independent restaurants prioritizing direct relationships with growers.

However, this direct sourcing model presents significant challenges for broad-line distribution needs, as it typically doesn't cover the vast array of products a distributor like US Foods provides. While a restaurant might source its produce directly, it still requires a distributor for dry goods, beverages, and other essential inventory. The logistical complexity of managing numerous direct supplier relationships can also be a deterrent for many businesses, limiting the overall threat to broad-line distributors.

Cash-and-carry wholesalers like Restaurant Depot and Costco Business Centers pose a significant threat to US Foods by offering foodservice operators a direct bulk purchasing alternative. These establishments allow businesses to bypass traditional distribution channels, potentially leading to cost savings. For instance, independent restaurants, often operating on tighter margins, might find these options attractive for specific product needs or smaller volume orders where delivery fees from larger distributors are less economical.

Major restaurant chains and large institutional food service operators possess the significant scale and established infrastructure to develop their own in-house distribution capabilities. This strategic move, known as backward integration, grants them greater command over their supply chain operations and can lead to considerable cost savings. For instance, a hypothetical large chain might leverage its purchasing power and logistical expertise to bypass third-party distributors, directly impacting companies like US Foods. This capability to self-distribute directly challenges the value proposition of external providers, presenting a potent substitute threat.

Specialty Food Distributors

The threat of substitutes for specialty food distributors serving the foodservice industry, including customers who might otherwise source from broad-line providers like US Foods, is moderate. While broad-line distributors offer extensive product ranges, highly specialized distributors can cater to niche demands for unique or high-end ingredients.

These specialized distributors often possess deeper product knowledge and exclusive sourcing relationships, making them a viable alternative for foodservice operators seeking specific, less common items. For instance, a restaurant focusing on authentic regional Italian cuisine might seek out a distributor specializing in imported Italian cheeses and charcuterie rather than relying solely on a general food service provider. This specialization allows them to offer a curated selection that broad-line distributors may not carry or have the same level of expertise in.

- Specialty distributors provide niche product access: Operators requiring specific ingredients, like rare spices or artisanal cheeses, may opt for specialized suppliers over broad-line distributors.

- Deep expertise as a differentiator: These niche players often boast in-depth knowledge of their product categories, offering value beyond mere product availability.

- Exclusive sourcing relationships: Some specialty distributors secure exclusive rights to import or distribute particular high-quality or unique food items.

- Market penetration of specialty channels: While specific 2024 data for specialty food distributor market share versus broad-line distributors is still emerging, the growth in demand for unique culinary experiences suggests a persistent role for these niche suppliers. For example, the fine dining segment, a key customer for specialty items, continued to show resilience in its recovery post-pandemic, indicating sustained demand for specialized ingredients.

Changes in Consumer Dining Habits

Changes in consumer dining habits present a notable threat of substitutes for foodservice distributors like US Foods. A significant trend involves consumers opting for more home cooking, which bypasses the need for restaurant meals and, consequently, reduces demand for foodservice suppliers. For instance, the National Restaurant Association reported that in 2023, a considerable percentage of consumers indicated they were cooking at home more often than they did prior to the pandemic, a habit that persisted.

The burgeoning popularity of meal kit services, such as those offered by HelloFresh or Blue Apron, also acts as an indirect substitute. These services provide pre-portioned ingredients and recipes, catering to consumers who desire convenient, home-cooked meals without the extensive preparation typically associated with grocery shopping and menu planning. This directly competes with the restaurant sector that US Foods serves.

Furthermore, a general reduction in dining out, whether due to economic pressures, health concerns, or evolving lifestyle preferences, shrinks the overall addressable market for foodservice distributors. This contraction can intensify competition among existing players and indirectly elevate the threat posed by these behavioral shifts, as distributors vie for a smaller pool of restaurant clients. In 2024, the foodservice industry continued to navigate these evolving consumer preferences, with many establishments adapting their offerings to capture a share of at-home dining trends.

- Increased home cooking directly reduces restaurant traffic and thus demand for foodservice distributors.

- Meal kit services offer a convenient alternative to dining out, diverting consumer spending.

- A smaller overall dining-out market intensifies competition for US Foods and its clients.

- Consumer preference shifts can lead to a decline in the volume of goods distributed by companies like US Foods.

The threat of substitutes for US Foods is multifaceted, encompassing direct sourcing, alternative wholesale channels, backward integration by large clients, and shifts in consumer dining habits. While broad-line distributors like US Foods offer convenience and a wide product range, these substitutes chip away at their market share by providing cost savings or specialized offerings.

Direct sourcing by larger operators, while logistically complex for a full product range, allows for better control over ingredient quality and can reduce costs for specific items. For example, the 2024 trend of restaurants prioritizing local produce means some operators bypass distributors for fresh goods.

Cash-and-carry wholesalers and the potential for large chains to develop their own distribution networks represent significant threats, offering lower prices or greater supply chain control, respectively. These direct alternatives to traditional distribution channels can impact US Foods' business model.

Consumer shifts towards home cooking and meal kit services also act as indirect substitutes, reducing overall demand for restaurant dining and, by extension, the need for foodservice distributors. This evolving consumer behavior is a persistent challenge for the entire foodservice supply chain.

Entrants Threaten

Entering the broad-line foodservice distribution market, where companies like US Foods operate, demands a significant capital outlay. This includes building and maintaining a vast network of warehouses, often with specialized refrigerated and freezer storage capabilities. For instance, a single distribution center can cost tens of millions of dollars to construct and equip.

A substantial portion of this investment goes into establishing a robust logistics infrastructure. This involves acquiring and maintaining a large fleet of delivery vehicles, many of which require refrigeration to ensure food safety and quality. The cost of a single refrigerated truck can range from $100,000 to over $200,000, and companies need hundreds, if not thousands, of these assets.

Furthermore, maintaining extensive inventory levels is crucial for meeting diverse customer needs, tying up considerable working capital. The sheer scale of operations required to compete effectively means that new entrants face immediate, high fixed costs. In 2024, the average operating lease expense for a fleet of 500 refrigerated trucks could easily exceed $20 million annually, presenting a formidable financial hurdle.

Existing players like US Foods leverage substantial economies of scale in their purchasing power, warehousing operations, and extensive logistics networks. This scale allows them to secure more favorable pricing from suppliers and optimize their distribution, a key advantage.

For instance, in 2023, US Foods reported net sales of approximately $34.1 billion, underscoring the sheer volume of their operations and the associated cost efficiencies.

New entrants would find it incredibly difficult to match these cost advantages, as they would need to build out similar infrastructure and achieve comparable purchasing volumes from the outset.

This significant barrier makes it challenging for new companies to compete on price and efficiency against established giants like US Foods, effectively deterring many potential entrants.

US Foods has cultivated deeply entrenched distribution networks and customer relationships over many years, serving around 250,000 diverse customers. Replicating this extensive infrastructure and the trust built with clients presents a significant hurdle for potential new competitors. The sheer scale and efficiency of US Foods' logistics, honed over decades, make it exceedingly difficult and costly for newcomers to establish a comparable presence. These established channels act as a formidable barrier to entry, protecting US Foods' market share.

Brand Recognition and Private Label Products

US Foods benefits significantly from its strong brand recognition, a key factor that deters new entrants. This established reputation allows them to command customer loyalty and provides a solid foundation for introducing new offerings.

Furthermore, US Foods boasts a comprehensive portfolio of private brand products. These proprietary items offer distinct value propositions and serve as unique selling points, something new competitors struggle to replicate.

New entrants face a considerable hurdle in building comparable brand awareness and developing their own private label lines. This lack of immediate product differentiation makes it challenging to attract and retain customers away from established players like US Foods.

- Brand Equity: US Foods' established brand name acts as a significant barrier, requiring substantial marketing investment for newcomers to overcome.

- Private Label Advantage: The company's private label products, which accounted for a notable portion of their sales in recent years, offer unique value and margin opportunities unavailable to new entrants without a similar product pipeline.

- Customer Loyalty: Existing customer relationships and loyalty programs fostered by US Foods create a stickier customer base, making it difficult for new entrants to gain market share.

Regulatory Hurdles and Food Safety Standards

The foodservice industry, including companies like US Foods, faces substantial regulatory hurdles that act as a significant barrier to new entrants. These regulations cover health, safety, and transportation, demanding intricate compliance from anyone looking to enter the market.

New businesses must secure various licenses and certifications, a process that can be time-consuming and costly. Adherence to stringent food safety standards, such as those outlined by the Food and Drug Administration (FDA), is non-negotiable, requiring robust quality control systems and traceability throughout the supply chain.

For instance, the FDA's Food Safety Modernization Act (FSMA) places a heavy emphasis on preventative controls, which can be particularly challenging for smaller, less established operations to implement effectively. The logistical complexities of managing perishable goods, ensuring proper temperature control during transport and storage, also add to the operational burden.

- Compliance Costs: New entrants must invest in understanding and implementing complex regulations, potentially costing tens of thousands of dollars in legal fees and system upgrades.

- Licensing and Permits: Obtaining federal, state, and local licenses for food handling, storage, and distribution is a prerequisite, often involving lengthy application processes.

- Food Safety Protocols: Implementing HACCP (Hazard Analysis and Critical Control Points) plans and maintaining rigorous sanitation standards are essential, requiring dedicated resources and ongoing training.

- Supply Chain Integrity: Ensuring the safety and quality of food products from farm to fork necessitates sophisticated tracking and monitoring systems, which can be a significant upfront investment.

The threat of new entrants for US Foods is significantly low due to the immense capital requirements and established infrastructure. Building a nationwide distribution network, complete with refrigerated warehouses and a large fleet of delivery vehicles, demands hundreds of millions of dollars in investment. For example, a single distribution center can cost tens of millions, and a fleet of 500 refrigerated trucks could incur annual operating lease expenses exceeding $20 million in 2024.

Economies of scale achieved by incumbents like US Foods, which reported $34.1 billion in net sales in 2023, create a substantial cost advantage that is nearly impossible for new players to match from the outset. This scale impacts purchasing power, operational efficiency, and logistics optimization, making it difficult for newcomers to compete on price.

Deeply entrenched distribution networks, strong brand recognition, and established customer loyalty, serving around 250,000 diverse customers, further fortify US Foods' market position. Replicating these decades-old relationships and the trust they represent requires considerable time and investment, acting as a significant deterrent.

Additionally, stringent regulatory compliance related to food safety, licensing, and transportation adds another layer of complexity and cost for potential entrants. Navigating these requirements and implementing robust food safety protocols, like HACCP, can be a substantial barrier, demanding significant upfront investment in systems and training.

Porter's Five Forces Analysis Data Sources

Our US Foods Porter's Five Forces analysis is built upon a foundation of publicly available data, including SEC filings, annual reports, and investor presentations, to gauge competitive intensity and strategic positioning.