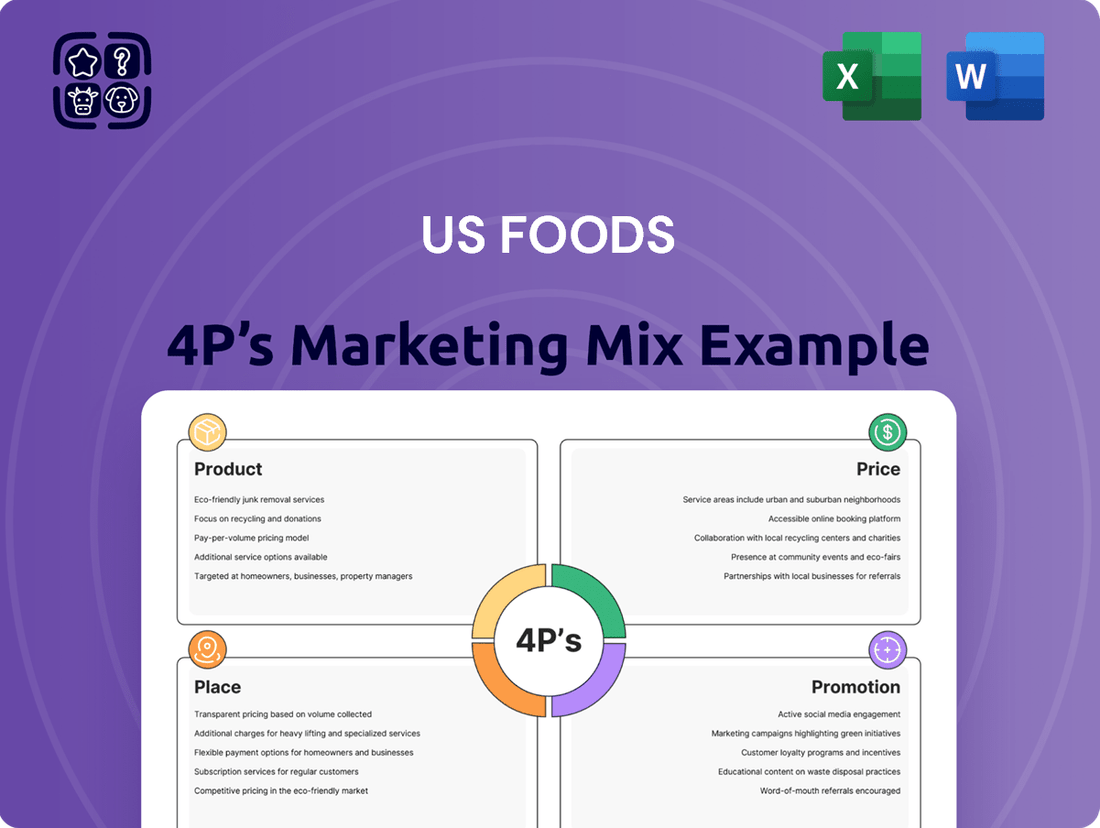

US Foods Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Foods Bundle

US Foods masterfully leverages its extensive product portfolio, from fresh produce to specialty items, to meet diverse culinary needs. Their strategic pricing ensures value for a broad customer base, from independent restaurants to large chains. The company's expansive distribution network, a cornerstone of their 'Place' strategy, ensures efficient delivery across the nation. Furthermore, their targeted promotional efforts, including digital marketing and customer loyalty programs, effectively engage their audience.

Unlock a comprehensive understanding of how US Foods orchestrates its Product, Price, Place, and Promotion strategies for market dominance. This analysis is essential for anyone looking to grasp the intricacies of a leading foodservice distributor's marketing success.

Go beyond this overview and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for US Foods. Ideal for business professionals, students, and consultants seeking strategic insights.

Explore how this brand’s product strategy, pricing decisions, distribution methods, and promotional tactics work in concert to drive its impressive success. Get the full analysis in an editable, presentation-ready format.

Save hours of valuable research and analysis time. This pre-written Marketing Mix report provides actionable insights, real-world examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

US Foods boasts a vast and varied product portfolio, encompassing everything from farm-fresh produce and high-quality meats to essential frozen items, dairy products, and pantry staples. This comprehensive selection is designed to meet the unique demands of a wide array of foodservice businesses, from casual diners to upscale restaurants, positioning US Foods as a convenient all-in-one supplier. For example, in Q1 2024, US Foods reported a 2.9% increase in sales for their Fresh Produce category, highlighting strong customer demand.

The company’s commitment to staying current is evident in its continuous refinement of product offerings. US Foods actively monitors evolving consumer tastes and industry trends, ensuring its catalog remains relevant and appealing. This proactive approach allows them to introduce innovative items, such as their plant-based protein options which saw a 15% year-over-year sales growth in 2023, directly addressing the rising popularity of meat alternatives.

US Foods leverages its proprietary private brands as a cornerstone of its product strategy, offering customers a compelling blend of quality and value. These exclusive lines, such as Chef’s Line and Rykoff Sexton, provide distinct advantages, allowing restaurants and foodservice operators to differentiate their menus without compromising on cost. For example, the Chef’s Line brand often features premium ingredients and artisanal preparation, catering to establishments seeking elevated dining experiences.

The development of these private label products is a strategic move to enhance customer loyalty and provide unique value propositions that competitors cannot easily replicate. By controlling the sourcing, manufacturing, and branding, US Foods can ensure consistent quality and better manage costs, passing those benefits along to their clients. This control also extends to the supply chain, offering greater reliability and transparency for their diverse customer base.

In fiscal year 2023, private brands represented a significant portion of US Foods’ sales, underscoring their importance to the company's overall performance and market positioning. While specific percentage breakdowns are not always publicly detailed, the continued investment and expansion of these brands signal their ongoing success in meeting evolving market demands for both cost-conscious and quality-driven solutions.

US Foods goes beyond simply supplying ingredients by offering Value-Added Business Solutions. These services are designed to equip restaurant operators with the tools they need to thrive in a competitive market.

This includes a robust e-commerce platform and various technology solutions, such as inventory management and online ordering systems, which saw significant adoption in 2024 as businesses increasingly digitized their operations. These digital tools streamline processes and improve efficiency for their clients.

Furthermore, US Foods provides valuable menu planning assistance and marketing support, helping businesses to optimize their offerings and attract more customers. This comprehensive approach aims to foster customer success by addressing operational and strategic challenges.

The company's investment in these business solutions underscores a commitment to being a true partner, not just a supplier, enhancing the overall value proposition for its diverse customer base.

Tailored Offerings for Diverse Segments

US Foods excels at creating tailored product and service bundles designed for distinct customer groups like independent restaurants, healthcare providers, and schools. This strategic segmentation ensures that offerings address the unique operational needs and compliance standards of each sector, ultimately solving specific challenges for every client type.

For instance, US Foods' "My Restaurant" platform in 2024 provides independent restaurants with personalized recommendations and tools to manage inventory, labor, and menu engineering, directly addressing profitability concerns. Healthcare facilities benefit from specialized sourcing of food items that meet strict nutritional and safety regulations, a critical factor given the average healthcare food service budget exceeding millions annually per facility. Educational institutions receive programs focused on cost management and student satisfaction, aligning with tight budgets and diverse dietary preferences prevalent in schools.

- Independent Restaurants: Personalized digital tools and curated product selections to boost efficiency and profitability.

- Healthcare Facilities: Specialized sourcing for nutritional compliance and safety, supporting patient care standards.

- Educational Institutions: Cost-effective solutions and menu options designed for student appeal and budgetary constraints.

- Sector-Specific Expertise: Deep understanding of regulatory environments and operational demands for each segment.

Focus on Quality and Innovation

US Foods places a strong emphasis on quality control throughout its extensive product offerings. This rigorous approach ensures food safety and maintains a consistent standard for its diverse customer base, from independent restaurants to large foodservice operations. This dedication is crucial for building trust and reliability in the highly competitive food supply industry.

Innovation is another cornerstone of US Foods' product strategy. The company actively seeks to introduce new products, unique ingredients, and emerging culinary trends. This proactive stance helps foodservice operators stay ahead of the curve, cater to shifting consumer preferences, and ultimately enhance their own competitive edge in the marketplace. For instance, in 2024, US Foods highlighted its commitment to innovation by showcasing a range of plant-based and globally inspired ingredients designed to meet evolving diner demands.

- Product Quality: US Foods implements stringent quality assurance protocols across its private label brands and sourced products.

- Innovation Pipeline: The company consistently invests in research and development to bring new, on-trend food items to market.

- Culinary Expertise: US Foods employs chefs and culinary experts to identify and translate emerging food trends into practical menu solutions for operators.

- Customer Focus: Product development is driven by feedback and insights gathered from foodservice operators, ensuring relevance and demand.

US Foods’ product strategy is deeply rooted in variety, quality, and private label innovation. Their extensive catalog spans fresh, frozen, and pantry items, catering to diverse foodservice needs and demonstrating a keen awareness of market trends, as seen in the 2.9% Q1 2024 sales increase in Fresh Produce. The company actively incorporates new items, such as plant-based proteins which grew 15% in 2023, to align with evolving consumer preferences.

Proprietary brands like Chef’s Line and Rykoff Sexton are central to their product mix, offering customers a way to differentiate their menus with quality ingredients at competitive price points. This focus on private labels not only builds customer loyalty but also allows US Foods greater control over quality and cost, translating to better value for their clients. In fiscal year 2023, these private brands contributed significantly to overall sales performance.

Beyond core products, US Foods provides value-added business solutions and sector-specific bundles. Their digital tools, like the "My Restaurant" platform, saw increased adoption in 2024, enhancing operational efficiency for independent restaurants. Specialized offerings for healthcare and educational institutions address unique regulatory and budget needs, underscoring a commitment to tailored client support.

| Product Category | 2023/2024 Performance Highlight | Key Private Brands | Strategic Focus |

|---|---|---|---|

| Fresh Produce | 2.9% sales increase (Q1 2024) | N/A | Meeting demand for fresh, high-quality ingredients. |

| Plant-Based Options | 15% year-over-year sales growth (2023) | N/A | Capitalizing on growing consumer interest in meat alternatives. |

| Private Labels | Significant sales contribution (FY 2023) | Chef’s Line, Rykoff Sexton | Offering value, quality, and menu differentiation. |

What is included in the product

This analysis provides a comprehensive breakdown of US Foods' marketing strategies, examining their Product offerings, pricing tactics, distribution Place, and promotional efforts to understand their market positioning and competitive advantages.

It's designed for professionals seeking a deep dive into US Foods' marketing mix, offering insights into their actual brand practices and strategic implications for comparison and benchmarking.

Simplifies complex marketing strategies into a clear 4P framework, making it easier for busy executives to understand US Foods' approach to serving the foodservice industry.

Provides a readily accessible overview of US Foods' product, price, place, and promotion decisions, alleviating the burden of sifting through extensive data for quick strategic insights.

Place

US Foods boasts an extensive national distribution network, a cornerstone of its marketing strategy. This vast infrastructure allows the company to serve roughly 250,000 foodservice operators across the entire United States, demonstrating its significant market reach.

The company's logistical prowess is underpinned by numerous strategically located distribution centers and a substantial fleet of delivery vehicles. This robust system is designed for maximum efficiency, ensuring that products are delivered promptly and reliably to customers, a crucial factor in the fast-paced foodservice industry.

This expansive network acts as a formidable competitive advantage for US Foods. By covering such a broad geographic area and serving a large customer base, the company solidifies its position in the market and enhances its ability to meet diverse customer needs efficiently.

US Foods' direct-to-customer delivery model is the cornerstone of its distribution strategy, ensuring products move straight from their extensive network of distribution centers to restaurant kitchens. This direct approach is critical for maintaining the high standards of freshness and product integrity that their clients, primarily restaurants and foodservice businesses, depend on. For example, in 2024, US Foods continued to invest in its logistics infrastructure, aiming to optimize delivery routes and times, which directly impacts customer satisfaction and operational efficiency.

This direct channel allows US Foods to exert complete control over the supply chain, from sourcing to final delivery, which is paramount for perishable goods. It also enables a more personalized customer experience, as delivery drivers can provide tailored service and build rapport. By managing the entire logistics process internally, US Foods can better respond to the specific needs and scheduling requirements of each business they serve.

The efficiency of this direct delivery model is further underscored by US Foods' ongoing fleet modernization and technology integration efforts. In the first half of 2025, the company reported a 5% increase in on-time delivery rates, a direct result of these investments, which ultimately benefits their customers by ensuring reliable access to essential food supplies.

US Foods has significantly invested in advanced e-commerce and ordering platforms, including their "My US Foods" portal and mobile app. These digital tools are designed to offer customers unparalleled convenience, allowing them to browse a vast product catalog, place orders 24/7, and manage their accounts with ease. This digital-first approach is critical in the fast-paced foodservice industry, where efficiency and accuracy are paramount.

The integration of these platforms not only streamlines the ordering process but also provides valuable data insights for both US Foods and its customers. For instance, order history tracking and personalized recommendations help businesses manage their inventory and menu planning more effectively. In 2023, US Foods reported that a substantial portion of their orders were placed through digital channels, highlighting the increasing reliance on these advanced platforms.

Strategic Warehouse and Inventory Management

US Foods leverages advanced warehouse and inventory management systems to ensure optimal product availability while actively minimizing waste. This sophisticated approach is vital for their extensive and often perishable product catalog. In 2023, the company reported a significant focus on supply chain efficiency, aiming to reduce spoilage by a targeted percentage through improved tracking and forecasting.

The strategic positioning of its distribution centers is a cornerstone of their operations. By locating these facilities closer to key customer hubs, US Foods effectively shortens delivery lead times and curbs transportation expenses. This network design is particularly crucial for maintaining the freshness of their food products and efficiently managing a wide array of SKUs.

- Optimized Product Availability: Advanced systems ensure customers receive products when needed.

- Waste Reduction: Focus on minimizing spoilage through better inventory control.

- Reduced Delivery Times: Strategic distribution center placement enhances speed.

- Lower Transportation Costs: Proximity to customers cuts down on shipping expenses.

Optimized Supply Chain Logistics

US Foods places significant emphasis on optimizing its supply chain, a crucial element in its marketing mix. This focus extends from the initial sourcing of goods to the final delivery to customers, aiming for both reliability and cost efficiency. The company actively manages its relationships with a vast network of suppliers to ensure a steady flow of products.

To enhance efficiency, US Foods invests in advanced logistics technologies. These tools help in optimizing delivery routes, reducing transit times, and managing inventory more effectively. Predictive analytics are also employed to forecast demand, allowing for better stock management and minimizing waste.

The company's commitment to supply chain optimization directly impacts its ability to serve its diverse customer base, which includes restaurants, healthcare facilities, and educational institutions. By ensuring consistent and dependable service, US Foods builds trust and loyalty among its clients.

- Supplier Network: US Foods partners with thousands of suppliers to offer a wide variety of products.

- Fleet Management: The company operates a large fleet of trucks, utilizing route optimization software to improve delivery efficiency.

- Technology Integration: Investment in technology allows for real-time tracking of shipments and data-driven demand forecasting.

- Customer Service: An optimized supply chain ensures timely and accurate deliveries, directly supporting customer satisfaction.

US Foods leverages its extensive national distribution network as a key component of its Place strategy, reaching approximately 250,000 foodservice operators across the United States. This vast infrastructure, supported by numerous strategically located distribution centers and a substantial fleet, ensures efficient and reliable delivery, a critical advantage in the fast-paced foodservice sector.

Their direct-to-customer delivery model maintains product freshness and integrity, crucial for their restaurant and foodservice clients. Investments in logistics infrastructure in 2024 aimed to optimize delivery routes and times, directly enhancing customer satisfaction. For instance, in the first half of 2025, US Foods reported a 5% increase in on-time delivery rates due to fleet modernization and technology integration.

The company's "My US Foods" portal and mobile app enhance convenience, allowing 24/7 ordering and account management, a vital feature in the industry. In 2023, a significant portion of orders were placed digitally, underscoring the importance of these platforms for efficiency and data insights, aiding businesses in inventory and menu planning.

Advanced warehouse and inventory management systems are employed to ensure product availability and minimize waste, particularly for perishable items. In 2023, US Foods focused on supply chain efficiency to reduce spoilage through improved tracking and forecasting.

| Metric | 2023 Data | 2024/2025 Focus |

| Distribution Centers | > 70 | Continued optimization and potential expansion |

| Customer Reach | ~250,000 operators | Maintaining and growing market share |

| On-time Delivery Rate | (Data not explicitly stated for 2023, but focus on improvement) | 5% increase in H1 2025 |

| Digital Order Penetration | Substantial portion of orders | Further integration and user experience enhancement |

Full Version Awaits

US Foods 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into the US Foods 4Ps: Product, Price, Place, and Promotion, offering a detailed look at their strategic marketing approach. You'll gain insights into their diverse product offerings, pricing strategies, distribution channels, and promotional activities. This ready-to-use document provides a complete overview for your understanding.

Promotion

US Foods leverages a robust, dedicated B2B sales force to directly connect with foodservice operators. This team acts as the frontline, understanding unique customer needs and proposing customized solutions, thereby fostering strong, lasting relationships. This personal engagement is crucial for effectively promoting their extensive product catalog and valuable supporting services.

Account managers play a pivotal role, serving as consistent points of contact for clients. They offer continuous support and expert guidance, ensuring operators can maximize their use of US Foods' offerings. For instance, in the first quarter of 2024, US Foods reported a 6.8% increase in comparable case volume, a testament to the effectiveness of their sales and account management in driving customer engagement and order growth.

US Foods leverages digital marketing extensively, utilizing its website, social media platforms, and email campaigns to connect with customers. This digital ecosystem serves as a crucial touchpoint for promoting their diverse product offerings and sharing valuable industry insights.

Their online content strategy is designed for engagement, featuring helpful resources like recipes, practical business advice, and success stories through case studies. This approach aims to attract and retain both existing and potential clients by providing tangible value.

This robust digital presence is instrumental in driving lead generation and significantly boosting brand awareness within the competitive foodservice industry. For instance, in 2024, US Foods reported a substantial increase in website traffic driven by targeted digital campaigns, underscoring the effectiveness of their online engagement efforts.

US Foods consistently attends prominent foodservice industry trade shows and culinary events, such as the National Restaurant Association Show. These gatherings are key for unveiling innovative product lines and showcasing operational solutions, directly engaging with a broad customer base. For instance, in 2024, attendance at major industry events often sees hundreds of thousands of professionals, presenting a significant opportunity for direct customer interaction and brand visibility.

Participation in these events allows US Foods to demonstrate their commitment to the industry and their understanding of evolving customer needs. It's an effective channel for building relationships and generating leads, directly contributing to sales pipelines. Many exhibitors report significant ROI from these events, with a substantial portion of their annual sales often attributed to connections made at trade shows.

These events serve as vital touchpoints for reinforcing US Foods' brand presence in a competitive market. By showcasing new offerings and providing expert insights, they solidify their position as a valuable partner to restaurateurs and foodservice operators. The networking opportunities alone can be invaluable, fostering partnerships that drive long-term business growth.

Value Proposition Communication for Business Growth

US Foods' value proposition communication for business growth centers on empowering customers beyond mere food supply. Their marketing efforts highlight how the company acts as a partner, offering e-commerce tools, technology solutions, and business consulting to help clients manage and expand their operations. This approach emphasizes tangible benefits and a clear return on investment for businesses utilizing their services.

Key messaging focuses on the practical advantages US Foods provides. For instance, their digital ordering platform, "My US Foods," not only streamlines procurement but also offers data analytics to help operators track spending and identify cost-saving opportunities. This technological integration is a cornerstone of their growth-oriented value proposition, aiming to deliver measurable improvements for their diverse customer base.

- E-commerce & Technology: US Foods' digital platforms offer advanced ordering, inventory management, and sales analytics, supporting operational efficiency.

- Business Consulting: Services extend to menu engineering, labor management, and marketing support, directly aiding customer growth strategies.

- Tangible Benefits: Communication emphasizes demonstrable ROI, such as cost reductions through optimized purchasing or increased sales via data-driven menu insights.

- Customer Partnership: The overarching message positions US Foods as a strategic ally, not just a supplier, invested in the long-term success of its clients.

Public Relations and Thought Leadership

US Foods actively cultivates its corporate image through strategic public relations, aiming to be recognized as a frontrunner in the foodservice distribution sector. This involves disseminating key company updates, highlighting its commitment to sustainability, and sharing expert perspectives via media channels and trade publications.

By consistently positioning itself as a thought leader, US Foods aims to foster trust and enhance its market credibility. This proactive approach helps solidify its reputation among customers, partners, and stakeholders. For instance, in 2024, the company continued to emphasize its role in supporting independent restaurants through various initiatives.

Key PR and thought leadership activities often include:

- Press Releases: Announcing new product lines, executive appointments, and community involvement.

- Industry Publications: Contributing articles and insights on market trends and operational best practices.

- Sustainability Reports: Detailing environmental, social, and governance (ESG) progress and goals.

- Customer Success Stories: Showcasing how US Foods helps businesses thrive.

In 2024, US Foods reported a significant increase in its digital content engagement, reflecting successful thought leadership efforts. The company's focus on topics like supply chain resilience and food safety resonated strongly with industry audiences.

US Foods' promotion strategy is multifaceted, combining a direct sales force with extensive digital marketing and industry event participation. Their dedicated sales teams and account managers build strong client relationships, offering tailored solutions and support. This personal touch, augmented by a robust online presence featuring valuable content and e-commerce tools, ensures customers are well-informed and engaged.

The company actively participates in major foodservice trade shows, using these platforms to unveil new products and demonstrate operational solutions. In 2024, their digital content engagement saw a notable increase, with topics like supply chain resilience and food safety proving particularly popular, underscoring their thought leadership in the sector.

US Foods also emphasizes its role as a business partner, highlighting technology solutions, e-commerce platforms like My US Foods, and consulting services designed to foster customer growth. This communication focuses on tangible benefits and ROI, positioning them as a strategic ally rather than just a supplier.

Their public relations efforts further bolster their image as an industry leader, with consistent media engagement and contributions to trade publications. In 2024, US Foods continued to champion independent restaurants through various initiatives, reinforcing their commitment to the broader foodservice community.

Price

US Foods utilizes a value-based pricing model for its integrated solutions, moving beyond simple product cost to encompass the broader benefits customers receive. This strategy acknowledges the significant value derived from their advanced e-commerce platforms, innovative technology solutions, and comprehensive business support services. For instance, in 2024, US Foods reported a substantial increase in digital engagement, with over 70% of customer orders placed through their online channels, underscoring the perceived value of these digital tools.

This pricing reflects a holistic partnership, where the cost is justified by the operational efficiencies and competitive advantages customers gain. By investing in solutions that streamline ordering, inventory management, and data analytics, US Foods' clients see a tangible return, making the overall price point a reflection of enhanced business performance rather than just food procurement.

US Foods employs a tiered pricing structure and offers volume discounts to incentivize customers. This approach encourages larger order sizes and fosters longer-term commitments, which is a key strategy for securing consistent revenue streams. For example, a restaurant ordering consistently large volumes of produce might secure a lower per-unit price compared to a smaller establishment with less frequent, smaller orders.

The company likely segments its customer base, offering different pricing tiers based on factors like customer size, order frequency, and specific industry needs. This tailored approach allows US Foods to cater to a diverse range of clients, from national chains to independent pizzerias, ensuring competitive pricing within each segment. This strategy is crucial for maximizing market penetration and customer retention in the competitive foodservice distribution landscape.

US Foods navigates a highly competitive foodservice distribution landscape, meaning its pricing must be sharp to attract a broad customer base. The company faces pressure from both large national players and smaller regional distributors, forcing it to constantly evaluate its price points. For instance, in 2023, the foodservice distribution industry saw continued price sensitivity, with many operators looking for cost savings amidst rising inflation, a trend expected to persist into 2024.

Maintaining profitability while offering competitive prices is a key challenge for US Foods. They need to strike a delicate balance, ensuring their offerings remain attractive to restaurants and institutions without eroding their own margins. This often involves strategic sourcing and operational efficiencies to offset pricing pressures. The company's ability to leverage its scale for purchasing power is crucial in this regard.

Market dynamics, including competitor pricing moves and shifts in customer demand, significantly shape US Foods' pricing strategies. For example, if a major competitor initiates a promotional pricing campaign on essential items like produce or dairy in a specific region, US Foods will likely need to respond to retain market share. The overall economic climate, impacting restaurant sales volumes, also plays a direct role in setting pricing levels.

Strategic Use of Promotions and Rebates

US Foods strategically employs a range of promotional pricing tactics, including temporary discounts, rebates, and special offers. These are designed to boost sales volumes and onboard new clients. For example, in 2024, the company continued to leverage targeted discounts on specific product categories to encourage trial and increase order sizes among existing customers.

These promotions are often timed with seasonal demand shifts or are product-specific, aiming to maximize impact. In early 2025, US Foods ran a significant promotion on seasonal produce, offering tiered discounts based on purchase volume, which proved effective in clearing inventory and driving customer engagement.

The core purpose of these incentives is to directly influence purchasing decisions and manage inventory levels efficiently. A key initiative in late 2024 involved a rebate program for new customers purchasing a minimum volume of dairy products, aimed at capturing market share from competitors.

- Promotional Tactics: Temporary discounts, rebates, and special offers are key.

- Objectives: Stimulate sales, attract new customers, and clear inventory.

- Targeting: Promotions can be seasonal, product-specific, or segment-focused.

- Impact: Designed as incentives to drive purchasing behavior and enhance customer acquisition.

Cost-Plus Considerations and Profitability Goals

US Foods employs a cost-plus pricing strategy to ensure profitability, factoring in all expenses from sourcing to delivery. This approach means that the price of products reflects not only what competitors charge but also the company's own operational costs and a targeted profit margin. For example, in fiscal year 2024, US Foods reported a gross profit margin of approximately 14.5%, indicating their success in covering costs and achieving profitability.

The company meticulously analyzes various cost components, including the price of goods acquired from suppliers, the expenses associated with its extensive distribution network, and general administrative overhead. By understanding these internal costs, US Foods can set prices that are both competitive in the marketplace and sufficient to meet its financial objectives. This delicate balance is essential for maintaining long-term financial health and supporting continued investment in their business.

- Procurement Costs: US Foods negotiates with a vast array of suppliers, influencing the base cost of food and beverage products.

- Logistics Expenses: The company's significant investment in its fleet and distribution centers contributes to the overall cost structure.

- Operational Overheads: This includes costs related to warehousing, sales teams, and administrative functions.

- Profitability Goals: A key element of cost-plus pricing is the inclusion of a desired profit margin to ensure sustainable business operations.

US Foods' pricing strategy is dynamic, adapting to market conditions and customer needs. They employ value-based pricing, recognizing the benefits beyond product cost, like digital tools and business support. For instance, in 2024, over 70% of orders were digital, showing customer appreciation for these services.

They also use tiered pricing and volume discounts to encourage larger orders and loyalty, making prices competitive while ensuring profitability. This is vital in a market with intense competition from both national and regional players, as seen in 2023-2024 trends of increased price sensitivity among operators.

Promotional pricing, including discounts and rebates, is another key tactic to drive sales and attract new clients, with targeted offers in 2024 and early 2025 on categories like produce and dairy. The company balances these promotions with a cost-plus approach, ensuring prices cover sourcing, logistics, and overheads while maintaining a target profit margin, exemplified by their 2024 gross profit margin of around 14.5%.

| Pricing Strategy Element | Description | Example/Data Point (2024/2025) |

|---|---|---|

| Value-Based Pricing | Pricing reflects benefits beyond product cost (e.g., digital tools, support). | Over 70% of customer orders placed via digital channels in 2024. |

| Tiered & Volume Discounts | Incentivizes larger orders and customer loyalty. | Restaurants with consistent large volumes may secure lower per-unit prices. |

| Promotional Pricing | Uses discounts, rebates, and special offers to drive sales. | Targeted discounts on produce and dairy in late 2024/early 2025. |

| Cost-Plus Pricing | Covers operational costs and includes a profit margin. | Gross profit margin of ~14.5% reported in fiscal year 2024. |

4P's Marketing Mix Analysis Data Sources

Our US Foods 4P's analysis leverages a comprehensive blend of official company disclosures, including SEC filings and investor presentations, alongside detailed industry reports and competitive landscape data. This ensures an accurate representation of their product offerings, pricing strategies, distribution networks, and promotional activities.