US Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Foods Bundle

Navigate the complex external landscape impacting US Foods with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are redefining the food service industry. Identify technological advancements and environmental regulations that present both challenges and opportunities for the company. Get actionable intelligence to refine your strategy and gain a competitive edge. Download the full version now for a complete breakdown of these critical factors.

Political factors

US Foods operates within a complex web of federal and state food safety regulations, constantly shaped by agencies like the FDA and USDA. These rules are not static; for example, the FDA's Human Foods Program has specific 2025 objectives targeting microbiological safety, chemical contaminants, and nutritional content, alongside complete implementation of the Food Defense rule.

Staying compliant with these evolving mandates, such as the Food Safety Modernization Act (FSMA) rules on traceability and preventative measures, is paramount. Failure to adhere can result in significant penalties and damage public confidence in the brand.

Changes in U.S. trade policies, including the potential for new tariffs on imported goods and ingredients, directly affect US Foods' operational costs. For instance, in 2023, the U.S. maintained tariffs on certain steel and aluminum products, which can impact the cost of equipment and packaging materials used by foodservice operators, indirectly influencing US Foods' supply chain. These shifts necessitate proactive adaptation, such as exploring alternative domestic sourcing options to mitigate rising expenses.

Evolving labor laws, especially minimum wage increases, directly impact US Foods' operational costs. As of 2025, many states and cities are enacting higher minimum wages, directly affecting payroll for distribution centers and customer service teams.

These varying regulations necessitate careful monitoring and compliance to manage labor expenses effectively and prevent legal repercussions for US Foods' substantial workforce.

Healthcare and Employee Benefit Regulations

Government regulations concerning healthcare and employee benefits significantly impact US Foods' operational costs, particularly given its workforce of approximately 30,000 individuals. Fluctuations in federal and state mandates, such as those pertaining to the Affordable Care Act or evolving sick leave policies, can directly translate into higher expenses for providing comprehensive health insurance and other essential benefits. For example, in 2024, ongoing discussions around potential expansions of employer-sponsored health coverage or increased minimum benefit requirements could necessitate adjustments in US Foods' benefit packages, potentially raising overall labor costs.

US Foods' commitment to fostering a safe and supportive work environment, as detailed in its sustainability reporting, is also intrinsically linked to these regulatory landscapes. Adherence to Occupational Safety and Health Administration (OSHA) standards and other labor laws ensures compliance and contributes to employee well-being, which can indirectly affect benefit-related expenditures by promoting a healthier workforce and potentially reducing insurance claims. The company's 2024 sustainability report highlighted investments in safety training and wellness programs, aligning with the broader expectation for employers to prioritize their staff's health and security.

- Employee Benefit Costs: Increased healthcare premiums and expanded benefit mandates directly affect US Foods' cost structure.

- Regulatory Compliance: Adherence to labor laws and health regulations impacts operational expenses and risk management.

- Workplace Safety Investment: Spending on safety and wellness programs, aligning with regulations, can influence long-term benefit costs.

- 2024 Healthcare Landscape: Potential policy shifts in healthcare coverage could necessitate budget adjustments for employee benefits.

Government Support and Industry Restrictions

Government actions, like pandemic-related dining restrictions or subsequent economic aid packages, directly influence US Foods' restaurant and hospitality clients. For instance, government stimulus programs in 2021 helped the foodservice sector recover, but ongoing shifts towards limited-service and off-premise dining, partly driven by economic considerations and evolving regulations, present challenges for broadline distributors like US Foods. The company's focus on growth in resilient sectors such as healthcare, which saw increased demand for food services, helps mitigate the impact of volatility in other areas.

The foodservice industry's recovery trajectory is closely tied to government policy. While the National Restaurant Association reported a projected 4.4% sales growth for the US foodservice industry in 2024, reaching an estimated $1.1 trillion, this growth can be uneven. Government policies that encourage or discourage in-person dining, or that impact labor availability and costs, will continue to shape customer demand for US Foods' products. For example, state-level minimum wage increases, often influenced by political discourse, can affect restaurant operating costs and their purchasing power.

- Government stimulus and relief measures, such as the Restaurant Revitalization Fund, provided crucial support during economic downturns, impacting the financial health of US Foods' customer base.

- Shifts in consumer behavior, potentially influenced by public health policies or economic incentives, can alter the mix of limited-service versus full-service dining, affecting distributor volumes.

- Regulatory environments concerning food safety, labor practices, and environmental standards can impose compliance costs on both US Foods and its clients.

- US Foods' strategic diversification into sectors like healthcare, which often have more stable demand profiles, demonstrates an adaptation to political and economic uncertainties affecting the broader hospitality market.

Government policies significantly influence US Foods' operating environment, from food safety regulations to trade agreements. For instance, the U.S. Department of Agriculture (USDA) continually updates its guidelines impacting food handling and labeling, with a particular focus in 2024-2025 on reducing foodborne illnesses through enhanced traceability and preventative controls, directly affecting how US Foods manages its supply chain and product quality. These regulations, often enacted at both federal and state levels, necessitate continuous adaptation and investment in compliance infrastructure.

Labor laws, including minimum wage adjustments and worker protection standards, are also critical political factors. Many states and municipalities have implemented or are considering higher minimum wages, with projections indicating that by 2025, a significant portion of the U.S. workforce could be earning $15 per hour or more, impacting US Foods' payroll expenses across its distribution and operational teams. Furthermore, evolving healthcare mandates and paid leave policies directly affect employee benefit costs, a substantial component of the company's overall operational expenditure.

Trade policies and tariffs represent another significant political consideration. Changes in import/export regulations, including those related to agricultural products and food ingredients, can directly affect the cost and availability of goods within the US Foods supply chain. For example, ongoing trade negotiations and potential adjustments to tariffs on imported goods in 2024 could necessitate strategic sourcing adjustments to mitigate price volatility and ensure consistent product availability for its diverse customer base.

| Political Factor | Impact on US Foods | Example/Data (2024-2025 Focus) |

| Food Safety Regulations | Compliance costs, supply chain management, product quality | FDA's 2025 objectives for microbiological safety and chemical contaminants. |

| Labor Laws (Minimum Wage, Benefits) | Payroll expenses, employee benefit costs, operational budget | Projected widespread adoption of $15/hour minimum wage by 2025; evolving healthcare mandates. |

| Trade Policies & Tariffs | Cost of goods, supply chain reliability, sourcing strategy | Potential adjustments to tariffs on imported food ingredients and packaging materials. |

What is included in the product

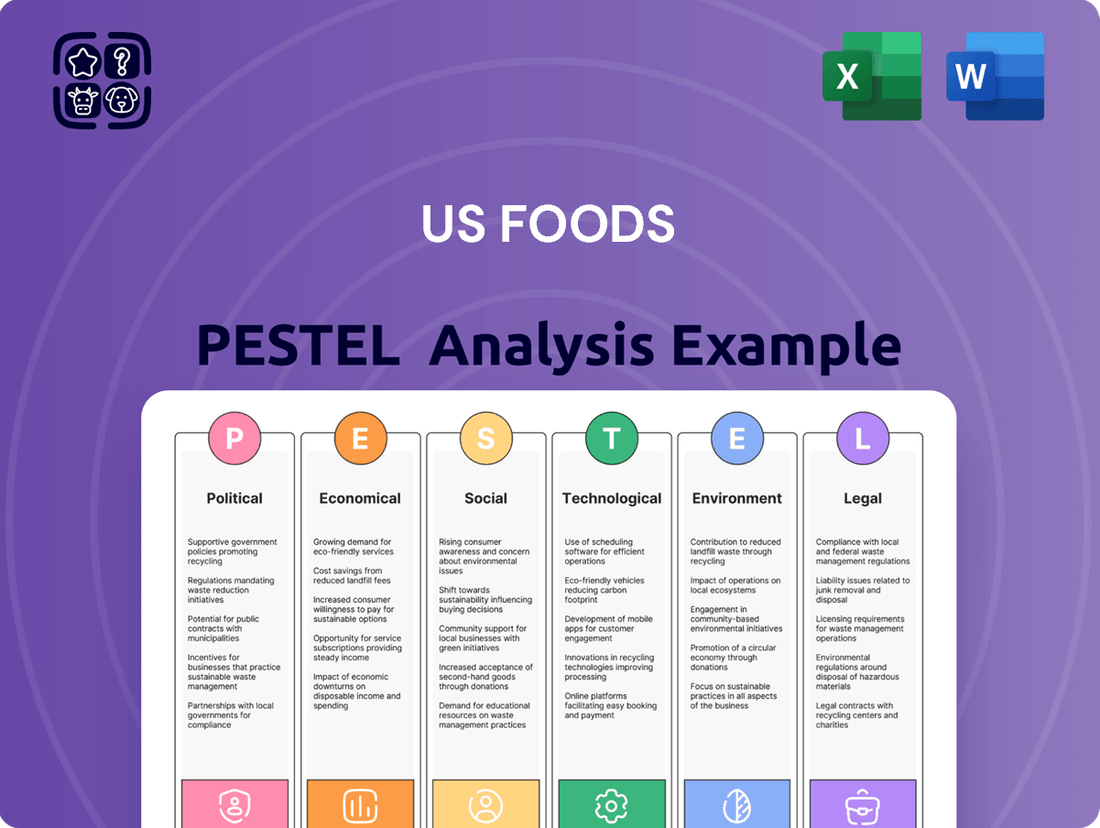

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing US Foods, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It highlights key trends and data points to equip stakeholders with insights for strategic decision-making and identifying market opportunities.

Offers a concise US Foods PESTLE analysis, simplifying complex external factors into easily digestible points for strategic discussions and decision-making.

Economic factors

Persistent food inflation and price volatility present a significant hurdle for US Foods. This dynamic directly impacts the company's procurement expenses and, consequently, the prices it offers to its broad customer base of approximately 250,000 foodservice operators.

The foodservice industry has been contending with substantial food inflation that began in 2020. This ongoing trend has placed considerable pressure on profit margins, necessitating stringent cost management strategies across the board.

For example, the Consumer Price Index for food away from home saw a notable increase, contributing to the challenges. In early 2024, while the rate of increase may have moderated from peak levels, the cumulative effect of years of elevated prices continues to strain budgets.

Navigating these rising costs while simultaneously striving to maintain competitive pricing is a delicate balancing act for US Foods. The company must absorb or pass on these increases judiciously to retain its market share and support its diverse clientele.

Consumer spending and disposable income are crucial drivers for the foodservice industry, directly impacting the demand for US Foods' products. For 2025, while overall consumer spending is projected to remain on an upward trend, a notable shift is anticipated among lower-income households. These consumers are increasingly likely to opt for more budget-friendly, value-oriented dining choices or to prepare meals at home, potentially impacting sales volumes for restaurants that cater to this demographic.

US Foods' financial performance is intrinsically linked to the vitality of the restaurant sector. Early 2025 data indicated mixed traffic trends across various restaurant segments, suggesting that while some establishments are thriving, others may be facing headwinds. This variability underscores the importance of understanding consumer spending patterns and disposable income levels to accurately forecast demand and manage inventory effectively.

Ongoing supply chain challenges, including labor shortages and transportation bottlenecks, continue to affect the availability and cost of food items for US Foods. For instance, the trucking industry faced a shortage of an estimated 78,000 drivers in 2023, driving up freight costs.

Geopolitical events also play a significant role, as seen with the impact of conflicts on global commodity prices, directly influencing the cost of ingredients and finished goods. These persistent disruptions directly impact US Foods' capacity to ensure consistent product stock and control its operational expenditures.

To combat these issues, US Foods is focusing on building supply chain resilience through supplier diversification and investing in advanced visibility tools. These strategies are essential for mitigating the effects of disruptions and the increasing expense of shipping, which saw ocean freight rates fluctuate significantly throughout 2024.

Interest Rates and Investment Capital

Fluctuations in interest rates directly impact US Foods' cost of capital. For instance, if the Federal Reserve raises its benchmark interest rate, the cost of borrowing for new equipment or expansion projects will likely increase. This can make it more expensive for US Foods to finance strategic growth initiatives, such as the continued expansion of its Pronto delivery service or investments in supply chain technology. Managing existing debt and planning future capital allocation becomes critical in a rising rate environment to ensure financial health and support ongoing growth strategies.

The company's approach to capital expenditure is closely tied to interest rate movements. US Foods has been actively investing in its business, aiming to enhance efficiency and customer service. For example, during 2023, capital expenditures were reported to be around $1.1 billion, supporting areas like fleet modernization and technology upgrades. A higher interest rate environment could necessitate a more cautious approach to these investments or a greater reliance on equity financing if debt becomes too costly.

- Interest Rate Impact on Borrowing: Higher interest rates increase the cost of debt for US Foods, affecting its ability to fund capital expenditures and acquisitions.

- Strategic Investments: US Foods continues to invest in growth areas like its Pronto delivery service and technology, which are sensitive to financing costs.

- Debt Management: Navigating a dynamic interest rate landscape requires careful management of the company's debt levels and capital allocation strategies to maintain financial stability.

- 2024 Outlook: Analysts project that the Federal Reserve will maintain a holding pattern on rates through much of 2024, though potential cuts later in the year could offer some relief on borrowing costs for companies like US Foods.

Competition from Unorganized Fast Food Sector

The unorganized fast food sector is a significant factor for US Foods. This segment, often characterized by independent restaurants and food trucks, is experiencing robust growth, particularly with the surge in takeout and delivery services. In 2024, the US foodservice market was valued at approximately $935 billion, with a notable portion attributed to these smaller, agile operators who can quickly adapt to consumer preferences. Their flexibility often translates to competitive pricing and niche offerings, directly impacting US Foods' customer base of independent restaurateurs.

This evolving landscape presents a dual challenge and opportunity for US Foods. While the overall market is expanding, estimated to see a compound annual growth rate of around 4.2% through 2027, US Foods needs to provide compelling value to retain its clients who face direct competition from these nimble players. Success hinges on US Foods' ability to offer differentiated products and crucial business support services that empower independent restaurants to thrive amidst this intense competition.

- Growth in Unorganized Sector: Independent restaurants and food trucks are increasingly capturing market share, driven by lower overhead and flexibility.

- Consumer Preference Shift: A significant portion of the projected 4.2% annual growth in the US foodservice market (through 2027) is fueled by demand for convenient takeout and delivery options, a strength of the unorganized sector.

- Value Proposition: US Foods must continually innovate its product portfolio and business solutions to help its independent restaurant clients compete effectively.

- Market Share Focus: Maintaining market share requires US Foods to understand and address the specific needs of restaurateurs operating within this dynamic competitive environment.

Persistent food inflation remains a key economic challenge for US Foods, impacting procurement costs and pricing strategies for its vast customer base. For instance, the Consumer Price Index for food away from home continued to show elevated levels in early 2024, though the pace of increase may have slowed from its peak.

Consumer spending patterns, particularly among lower-income households, are shifting towards more budget-friendly options in 2025, directly influencing demand for restaurant dining and, consequently, US Foods' product sales. This trend highlights the need for US Foods to adapt its offerings to meet evolving consumer preferences and support its diverse clientele.

Supply chain disruptions, including ongoing labor shortages in sectors like trucking, continue to drive up operational costs for US Foods. An estimated 78,000 truck driver shortage in 2023 significantly impacted freight expenses, a factor that likely persisted into 2024 and 2025.

Interest rate fluctuations directly affect US Foods' cost of capital, influencing its ability to finance strategic investments. Capital expenditures for US Foods were around $1.1 billion in 2023, supporting fleet modernization and technology, projects sensitive to borrowing costs.

Preview the Actual Deliverable

US Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This US Foods PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a comprehensive understanding of the external forces shaping US Foods' strategic landscape. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Consumers are increasingly seeking out healthier, plant-based, and sustainably sourced foods, a major shift influencing the foodservice sector. US Foods has proactively addressed this by broadening its selection of local, sustainable, and health-focused items, now boasting over 5,000 distinct products. This evolving consumer palate necessitates ongoing innovation in both product creation and supply chain management to keep pace with changing tastes and a heightened awareness of well-being among diners.

The American consumer's appetite for convenience is a major driver of change in the food service industry, directly impacting US Foods. In 2024, it's estimated that the food delivery market in the U.S. will generate over $30 billion in revenue, highlighting the significant shift towards off-premise dining. This trend means restaurants, US Foods' primary customers, must adapt their operations to efficiently handle takeout and delivery orders, influencing their purchasing decisions and reliance on distributors for a wider array of pre-prepared or easily customizable ingredients.

This sustained demand for convenience, encompassing everything from grab-and-go options to full meal kits, means restaurants are increasingly looking for suppliers who can provide consistent quality and a diverse product range to meet these evolving consumer needs. US Foods actively supports its restaurant partners by investing in e-commerce platforms and technology solutions. These tools are designed to streamline ordering, manage inventory, and ultimately help customers better navigate the operational complexities of a convenience-driven market, ensuring they can meet the moment for their diners.

The foodservice and distribution industries face significant challenges due to evolving labor force demographics and ongoing availability issues. Persistent staffing shortages, a trend exacerbated in recent years, directly impact US Foods' ability to serve its customers efficiently. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported ongoing tightness in the leisure and hospitality sector, which heavily influences the availability of workers for food preparation and service roles.

Higher labor costs, often driven by minimum wage increases and competitive pressures to attract and retain staff, present a continuous hurdle for foodservice operators who are US Foods' primary clientele. This financial strain on customers can indirectly affect US Foods' sales volumes and the demand for its services. The average hourly earnings in the food services and drinking places sector saw an increase, reflecting these cost pressures.

To counteract these trends, US Foods places a strong emphasis on associate development and engagement programs. Initiatives focused on training, career progression, and fostering a positive work environment are crucial for maintaining a stable and productive workforce within US Foods' own distribution network. This focus aims to mitigate the impact of broader labor market challenges.

Awareness of Food Waste and Sustainability

Societal awareness regarding food waste and sustainability is a significant driver of change within the foodservice industry. Consumers are increasingly demanding that businesses, including major distributors like US Foods, demonstrate a commitment to reducing their environmental footprint. This growing consciousness directly impacts purchasing decisions and brand loyalty.

US Foods acknowledges this trend and actively reports on its initiatives to mitigate environmental impact. Their sustainability reports detail efforts in waste reduction and water management, showcasing a proactive approach to responsible operations. This commitment resonates with a market that prioritizes ethical and sustainable food systems.

The company's focus on sustainability aligns with broader industry shifts. For instance, a 2023 report indicated that 65% of consumers are willing to pay more for sustainably sourced products. Furthermore, food waste is a critical concern; the USDA estimates that between 30-40% of the food supply in the United States is wasted annually, a statistic that underscores the urgency for action.

- Growing Consumer Demand: A majority of consumers now consider sustainability when making purchasing decisions, influencing menu choices and supplier selection.

- US Foods' Sustainability Reporting: The company actively communicates its efforts in waste diversion and water conservation, demonstrating accountability to stakeholders.

- Industry Alignment: US Foods' commitment to reducing its environmental impact is in step with the broader foodservice sector's move towards more responsible sourcing and operational practices.

- Economic Implications: Addressing food waste not only benefits the environment but also presents cost-saving opportunities for businesses through improved efficiency and resource management.

Influence of Social Media on Dining Choices

Social media plays a significant role in shaping where people choose to eat. Younger consumers, in particular, frequently discover new dining spots through visually driven platforms such as Instagram and TikTok. This digital influence means that US Foods' restaurant partners must actively engage online.

US Foods needs to offer solutions that help its customers enhance their digital presence and connect with diners. For instance, by mid-2024, over 70% of consumers reported using social media to find restaurants. This highlights the critical need for restaurants to have a strong, visually appealing online profile.

- Platform Dominance: Instagram and TikTok are key discovery engines for new dining experiences, especially among Gen Z and Millennials.

- Digital Engagement: Restaurants that actively post high-quality food photos and videos see higher customer engagement and foot traffic.

- Influencer Impact: Food bloggers and social media influencers can drive significant traffic to establishments, with some studies showing up to a 25% increase in bookings after a positive review.

- US Foods' Role: Providing digital marketing tools and insights to help restaurants leverage these platforms is crucial for their success.

The growing demand for diverse dietary options, including plant-based and allergen-free choices, directly impacts US Foods' product development and sourcing strategies. By the first half of 2024, sales of plant-based foods in the U.S. continued to show strong growth, indicating a sustained consumer preference. US Foods responded by expanding its portfolio to include over 5,000 items catering to these evolving dietary needs, reflecting a market where customization and health consciousness are paramount.

Technological factors

US Foods is significantly investing in e-commerce platforms and its proprietary mobile app, MOXē, to improve how customers interact and place orders. This digital push is key to reaching more customers and boosting online sales, signaling a major shift towards digital operations in the food distribution sector.

By embracing these digital solutions, US Foods aims to empower its clients, allowing them to manage and grow their businesses more effectively. This strategic move reflects the growing trend of digital transformation across industries, making operations smoother and more accessible for a wider clientele.

US Foods' commitment to technological advancement in its supply chain is a key driver of efficiency. By investing in solutions like AI and IoT, the company enhances its ability to manage a vast network of products and deliveries in real-time. This focus on cutting-edge technology directly translates into better inventory control and more efficient delivery routes.

These technological investments pay off in tangible ways, such as improved real-time tracking and predictive analytics for inventory management. For instance, US Foods has seen significant gains in transportation efficiency, notably achieving record performance through the implementation of advanced routing software like Descartes. This directly impacts operational costs and delivery speed.

US Foods is likely leveraging automation in its operations and warehousing to boost efficiency and cut labor expenses. While the company hasn't detailed specific investments, its emphasis on operational productivity points to a strategic push in this direction. For instance, advancements in automated guided vehicles (AGVs) and robotic picking systems are transforming warehouse logistics across the industry, potentially allowing US Foods to handle more inventory and fulfill orders faster.

Automated warehouse management is becoming crucial for tackling the complexities of the food supply chain, especially given rising consumer demand and the need for rapid, accurate delivery. By implementing more automated processes, US Foods can aim to reduce errors, improve inventory accuracy, and speed up the movement of goods from distribution centers to customers, a vital component in maintaining a competitive edge in the food service sector.

Data Analytics for Business Insights

Data analytics is a cornerstone for US Foods, offering deep insights into customer behavior and operational efficiency. This allows for tailored solutions, from personalized product recommendations to optimized delivery routes, enhancing customer satisfaction. For instance, by analyzing purchasing patterns, US Foods can proactively manage inventory, reducing waste and ensuring product availability for its diverse client base. In 2024, the company continued to invest in advanced analytics platforms to further refine these capabilities.

Leveraging data analytics helps US Foods identify and capitalize on emerging market trends. By understanding customer needs across various sectors, such as the growing demand for healthy options in healthcare or specific service requirements in hospitality, the company can adapt its product portfolio and service offerings. This data-informed strategy is crucial for maintaining a competitive edge and fostering growth in specialized segments.

- Personalized Customer Solutions: Data analytics enables US Foods to offer customized product assortments and service plans based on individual client purchasing history and preferences.

- Inventory Optimization: Predictive analytics help forecast demand more accurately, leading to better inventory management, reduced spoilage, and improved on-shelf availability.

- Strategic Decision-Making: Insights derived from data inform strategic decisions regarding market expansion, new product development, and operational improvements.

- Market Trend Identification: Analyzing sales data and external market information allows US Foods to identify growth opportunities in niche sectors like plant-based foods or specific ethnic cuisines.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical operational pillars for US Foods, especially given its extensive digital footprint and the sensitive nature of the data it manages. The company's reliance on technology to serve its quarter of a million customers means that safeguarding this information against breaches is not just a technical necessity but a fundamental aspect of maintaining stakeholder trust. As of early 2024, the regulatory landscape surrounding data privacy, exemplified by frameworks like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), continues to evolve, demanding constant vigilance and adaptation from businesses like US Foods.

The financial implications of inadequate cybersecurity can be substantial. Beyond direct costs associated with breach remediation, which can run into millions for large enterprises, reputational damage and loss of customer loyalty pose significant long-term threats. US Foods, like many in the food distribution sector, leverages advanced analytics and digital platforms for inventory management, logistics, and customer relationship management, all of which process significant data volumes. Therefore, investing in robust cybersecurity measures is directly linked to their governance and integrity framework, ensuring operational continuity and compliance with increasingly stringent data protection laws.

- 250,000+: The approximate number of customers US Foods serves, highlighting the scale of data management and privacy concerns.

- Evolving Regulations: The continuous updates to data privacy laws globally and within the US necessitate ongoing investment in compliance and security infrastructure.

- Reputational Risk: Data breaches can severely damage customer trust and brand image, impacting long-term business viability.

- Operational Integrity: Strong cybersecurity is essential for maintaining the integrity of US Foods' supply chain and operational systems.

US Foods is heavily investing in digital transformation, evident in its e-commerce platform and the MOXē mobile app, aiming to enhance customer ordering and engagement. This strategic move is designed to broaden their customer reach and significantly boost online sales, reflecting a broader industry shift towards digital solutions.

The company is also focusing on technological advancements within its supply chain to drive efficiency. Investments in areas like AI and IoT enable real-time management of a vast product network and delivery logistics, directly improving inventory control and optimizing delivery routes.

Data analytics plays a crucial role in understanding customer behavior and operational performance, allowing for personalized solutions and optimized deliveries. For example, in 2024, US Foods continued to invest in advanced analytics to refine demand forecasting and inventory management, reducing waste and ensuring product availability.

To maintain operational integrity and customer trust, US Foods prioritizes cybersecurity and data privacy. With over 250,000 customers, safeguarding sensitive data against breaches is paramount, especially with evolving data privacy regulations like the CPRA.

Legal factors

US Foods must adhere to stringent federal and state food safety and hygiene standards, overseen by agencies like the FDA and USDA. Compliance with the Food Safety Modernization Act (FSMA), particularly its Food Traceability Rule and preventive control measures, is paramount for the company's operations. For instance, FSMA requires enhanced record-keeping to quickly identify the source of foodborne illnesses, a significant undertaking for a large distributor like US Foods.

The FDA's ongoing reorganization of its Human Foods Program, expected to continue through 2025, signals a dynamic regulatory environment. This could lead to updated or new standards for food safety and nutrition that US Foods will need to integrate into its supply chain and product offerings. These changes aim to improve public health outcomes by strengthening oversight and enforcement of food safety practices across the industry.

US Foods operates under a comprehensive framework of labor and employment laws, dictating standards for minimum wage, overtime pay, and workplace conditions. These regulations are critical for managing operational expenses and ensuring fair treatment of its workforce.

Recent legal shifts, such as mandated increases in state and local minimum wages, particularly those targeting fast-food industries, directly influence US Foods' labor costs. For instance, California's phased minimum wage hikes for fast-food workers, reaching $20 per hour by April 2024, represent a significant cost factor for companies with a substantial presence in such markets.

Beyond wages, the company must also adhere to stringent rules governing employee benefits, workplace safety protocols, and non-discrimination policies. Compliance with the Fair Labor Standards Act (FLSA) and Occupational Safety and Health Administration (OSHA) standards are ongoing legal imperatives.

Antitrust and competition laws are a significant legal factor for US Foods, given its position as a major foodservice distributor in the United States. These regulations, enforced by bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ), aim to prevent anti-competitive practices and safeguard fair market competition. For instance, the Sherman Act and the Clayton Act are foundational statutes that govern mergers and acquisitions, ensuring that such consolidation does not unduly harm competition.

US Foods' strategic growth, particularly through acquisitions, is directly impacted by these laws. Any proposed mergers or market expansions must undergo scrutiny to ensure they do not create a monopoly or substantially lessen competition. In 2023, the FTC continued its robust enforcement of antitrust laws, reviewing numerous transactions across various industries, setting a precedent that large distributors like US Foods must navigate carefully. Failing to comply can result in significant fines and operational restrictions.

Maintaining a competitive edge while adhering to these stringent regulations is paramount for US Foods' sustained business operations. The company must continually assess its market practices to ensure they align with antitrust guidelines. This includes fair pricing strategies, equitable access for suppliers, and avoiding predatory practices. The ongoing focus on antitrust enforcement in the broader economy, highlighted by increased regulatory activity in 2024 concerning large corporate mergers, underscores the importance of compliance for US Foods.

Data Privacy and Consumer Protection Laws

US Foods' significant e-commerce presence necessitates strict adherence to data privacy and consumer protection laws. Regulations like the California Consumer Privacy Act (CCPA) and similar state-level statutes mandate how companies handle customer data. Failure to comply can result in substantial fines; for instance, CCPA penalties can reach $7,500 per intentional violation.

Maintaining robust cybersecurity is therefore a critical legal and operational requirement for US Foods. This commitment to data protection is essential for building and preserving customer trust, directly impacting brand reputation and long-term business integrity. The company must invest in advanced security measures to safeguard sensitive information against breaches.

- CCPA Penalties: Fines can reach $7,500 per intentional violation, underscoring the financial risk of non-compliance.

- State-Specific Laws: US Foods must navigate a patchwork of consumer protection laws across various states where it operates.

- Cybersecurity Investment: Ongoing investment in cybersecurity is crucial not just for operational efficiency but also for legal defense and consumer confidence.

- Data Governance: Implementing strong data governance policies is integral to demonstrating legal compliance and ethical data handling practices.

Product Labeling and Marketing Compliance

US Foods faces significant legal hurdles in product labeling and marketing. Compliance with federal and state regulations for its extensive private label and distributed product lines is paramount. This includes strict adherence to nutritional facts panels, clear allergen declarations, and any evolving FDA guidelines on terms like 'healthy' or mandatory sodium content reductions, with the FDA actively reviewing updated nutritional guidance in 2024.

Failure to meet these standards can lead to substantial penalties and damage consumer trust. For instance, in 2023, the FDA issued numerous warning letters to food companies for misbranding and unsubstantiated health claims, highlighting the critical need for meticulous oversight. US Foods must ensure all marketing materials and product labels accurately reflect product content and composition to avoid legal repercussions.

- Nutritional Labeling: Adherence to the Nutrition Facts label, including updated serving sizes and calorie information, is mandatory.

- Allergen Information: Clear and conspicuous declaration of major food allergens is legally required.

- Marketing Claims: Claims such as 'healthy', 'low sodium', or 'organic' must be substantiated and comply with FDA regulations.

- State-Specific Laws: US Foods must also navigate varying labeling and marketing laws across different states where its products are sold.

US Foods' legal landscape is shaped by stringent food safety regulations, with agencies like the FDA and USDA enforcing compliance with acts such as the Food Safety Modernization Act (FSMA). The ongoing reorganization of the FDA's Human Foods Program through 2025 suggests a continuously evolving regulatory environment that requires proactive adaptation in food safety and traceability measures.

Environmental factors

US Foods is making significant strides in its sustainability efforts, particularly concerning the reduction of greenhouse gas (GHG) emissions. These initiatives are a core part of their long-term environmental strategy.

The company's commitment is underscored by its 2024 Sustainability Report, which details a notable 16% decrease in absolute Scope 1 and 2 GHG emissions achieved since 2019. This progress is a critical step toward their ambitious 2032 target of a 32.5% reduction.

Key strategies driving these emission reductions include enhancing the efficiency of their extensive fleet operations and improving energy performance across all facilities. Furthermore, US Foods is actively transitioning its fleet to utilize alternative fuel vehicles.

US Foods places a significant emphasis on building an ethical, sustainable, and resilient supply chain through its responsible sourcing initiatives. This commitment is evident in their detailed efforts to mitigate deforestation risks, particularly by mapping palm oil back to the individual mill level, a crucial step in ensuring responsible agricultural practices. Furthermore, the company has updated its seafood sourcing policies to align with recognized sustainability standards, reflecting a dedication to environmental stewardship in its product offerings. These principles are tangible in their Serve Good® and Progress Check® product lines, which highlight products meeting specific sustainability criteria.

US Foods is actively working to reduce its environmental footprint, with a strong focus on waste and water management. The company aims to measure, monitor, and minimize its impact across all operations. A key area of attention is reducing food waste, a considerable challenge within the foodservice sector.

In 2023, US Foods reported progress in its sustainability initiatives, including efforts to divert waste from landfills. The company is exploring and implementing eco-friendly packaging solutions and optimizing its logistics to cut down on emissions and waste. Efficient water usage is also a priority, with ongoing assessments to identify areas for improvement and conservation.

Climate Change Impacts on Food Supply

Climate change presents significant hurdles for US Foods' supply chain, with extreme weather events like droughts and floods directly impacting agricultural yields. This can lead to product shortages and increased costs, as seen in the 2023 agricultural season where extreme weather affected key crop production, resulting in an average 5% increase in certain commodity prices for distributors.

US Foods is actively investing in supply chain resilience to mitigate these climate-related risks. By diversifying sourcing regions and strengthening relationships with suppliers who employ sustainable farming practices, the company aims to ensure a more consistent availability of products, even amidst environmental volatility. Their focus includes building robust inventory management systems and exploring advanced weather forecasting technologies.

Climate risk management is an integral component of US Foods' overall environmental strategy. This involves assessing and quantifying potential impacts on their operations and developing adaptation plans. For instance, the company is evaluating the long-term viability of sourcing from regions increasingly vulnerable to prolonged droughts, as highlighted in a recent industry report indicating a potential 15% reduction in water availability for agriculture in some key growing areas by 2030.

- Increased Volatility: Extreme weather events like heatwaves and heavy rainfall directly affect crop yields, leading to unpredictable product availability and price fluctuations for US Foods.

- Supply Chain Disruptions: Damage to infrastructure, such as transportation routes, caused by severe weather can delay deliveries and increase operational costs.

- Supplier Risk: US Foods must manage the risk associated with suppliers in climate-vulnerable regions, potentially impacting their ability to secure consistent supply.

- Adaptation Investments: The company's strategy includes investing in resilient infrastructure and diversifying sourcing to counter climate change impacts, a move necessitated by the projected rise in global food commodity prices due to climate change, estimated by some analyses to reach 10-20% by 2030.

Regulations on Packaging and Recyclability

US Foods faces increasing pressure from evolving regulations concerning packaging materials and their recyclability, directly impacting its product assortment and how it operates. For instance, states like California have implemented extended producer responsibility (EPR) laws, such as the Plastic Pollution Prevention and Packaging Producer Responsibility Act, which aims to increase recycling rates and reduce plastic waste, influencing the types of packaging materials US Foods can utilize and the associated costs.

There is a significant and growing consumer demand for eco-friendly packaging, pushing companies like US Foods to adopt more sustainable solutions to align with market expectations and comply with these tightening regulatory requirements. This shift necessitates exploring and implementing innovative packaging strategies, such as advancements in stretch hood technology, which can offer enhanced product protection and maintain hygiene standards while potentially utilizing more recyclable or compostable materials.

- Increased Regulatory Scrutiny: Federal and state governments are actively developing and enforcing stricter packaging laws, often focusing on recycled content mandates and single-use plastic restrictions.

- Consumer Preference for Sustainability: Surveys in 2024 consistently show a majority of consumers are willing to pay more for products with sustainable packaging, a trend US Foods must address to maintain market share.

- Supply Chain Adaptations: US Foods is investing in adapting its supply chain to accommodate new packaging materials, which may involve partnerships with packaging suppliers focused on biodegradable or easily recyclable options.

- Operational Cost Implications: The transition to more sustainable packaging can incur higher upfront costs, but also offers potential long-term savings through reduced waste disposal fees and improved brand perception.

US Foods is actively working to reduce its environmental footprint, with a strong focus on waste and water management, aiming to measure, monitor, and minimize its impact across all operations. In 2023, the company reported progress in its sustainability initiatives, including efforts to divert waste from landfills and optimize logistics to cut down on emissions and waste.

Climate change presents significant hurdles for US Foods' supply chain, with extreme weather events directly impacting agricultural yields, leading to product shortages and increased costs. For instance, the 2023 agricultural season saw extreme weather affect key crop production, resulting in an average 5% increase in certain commodity prices for distributors.

US Foods faces increasing pressure from evolving regulations concerning packaging materials and their recyclability. Consumer demand for eco-friendly packaging is growing, pushing companies like US Foods to adopt more sustainable solutions. Surveys in 2024 show a majority of consumers are willing to pay more for products with sustainable packaging.

US Foods' environmental strategy includes significant investments in reducing its greenhouse gas (GHG) emissions, with a 16% decrease in absolute Scope 1 and 2 GHG emissions achieved since 2019, working towards a 2032 target of a 32.5% reduction.

| Environmental Factor | 2023/2024 Initiatives/Data | Impact/Considerations |

|---|---|---|

| GHG Emissions Reduction | 16% reduction in absolute Scope 1 & 2 GHG emissions since 2019. | Fleet efficiency, alternative fuel vehicles, facility energy performance. |

| Supply Chain Resilience | Diversifying sourcing, strengthening supplier relationships. | Mitigating impact of extreme weather events on crop yields and prices. |

| Waste Management | Efforts to divert waste from landfills. | Exploring eco-friendly packaging, optimizing logistics. |

| Packaging Regulations | Adapting to state EPR laws (e.g., California's PPA). | Consumer preference for sustainable packaging, potential cost implications. |

PESTLE Analysis Data Sources

Our US Foods PESTLE analysis is grounded in data from reputable sources including government reports (e.g., USDA, Bureau of Labor Statistics), economic indicators from institutions like the Federal Reserve, and industry-specific market research from firms specializing in the food and beverage sector. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.