Upstart SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Upstart Bundle

Upstart's innovative AI-driven lending platform presents significant strengths, including its ability to reach underserved markets and potentially lower default rates. However, the company faces considerable threats from evolving regulatory landscapes and the inherent cyclical nature of the credit markets.

Delve deeper into Upstart's strategic positioning by acquiring the full SWOT analysis. This comprehensive report unlocks actionable insights into their competitive advantages, potential vulnerabilities, and the market opportunities they are poised to exploit.

Want to understand the complete picture of Upstart's operational landscape and future trajectory? Purchase the full SWOT analysis to gain access to a professionally crafted, editable document designed to empower your strategic planning and investment decisions.

Strengths

Upstart's advanced AI/ML underwriting is a significant strength, enabling a more nuanced evaluation of borrower risk than traditional FICO scores. This sophisticated approach can uncover creditworthy individuals who might be underserved by conventional lending methods.

By utilizing AI and machine learning, Upstart can analyze a broader range of data points, leading to more accurate risk pricing. In 2023, Upstart reported that its AI-powered loans had a default rate 26% lower than the industry average for similar risk tiers, demonstrating the effectiveness of its technology.

This capability allows Upstart to potentially expand access to credit for a wider demographic, while simultaneously offering better pricing to lower-risk borrowers. The company's technology is designed to identify factors that predict loan performance more reliably than traditional credit scoring alone.

The efficiency gains from automated underwriting also contribute to a faster and more streamlined loan application process for consumers. This technological edge is a key differentiator in the competitive lending landscape, driving both customer acquisition and risk management.

Upstart's innovative approach allows it to access a broader applicant pool by considering more than just traditional credit scores. This is a significant strength because it opens up lending opportunities for individuals previously excluded by conventional banking systems. In 2023, Upstart's platform facilitated over $12 billion in loans, demonstrating its capacity to connect a wider range of borrowers with capital.

By approving a larger percentage of applicants compared to traditional methods, Upstart directly expands the market for its lending partners. This means financial institutions working with Upstart can tap into a previously underserved customer segment. For instance, Upstart reported a 30% increase in approval rates for borrowers with credit scores between 600 and 699 in the first half of 2024 compared to industry averages.

Upstart's partnership-driven model is a significant strength, as it operates as a platform connecting borrowers with banks and credit unions, rather than acting as a sole direct lender. This strategy significantly lowers Upstart's capital expenditure requirements by offloading the risk and funding of loans to its partners. In 2023, Upstart announced partnerships with over 100 financial institutions, demonstrating the scalability and appeal of its technology to the traditional lending sector.

Potential for Lower Interest Rates

Upstart's advanced AI-driven credit assessment offers a significant advantage in the current economic climate, where interest rates are a key factor for borrowers. By more accurately evaluating risk, Upstart can potentially offer more competitive interest rates, particularly to individuals whose creditworthiness might not be fully captured by traditional FICO scores. This improved pricing is a powerful tool for attracting a broader base of qualified borrowers to its lending partners.

The platform's ability to identify creditworthy individuals outside the conventional scoring system means it can tap into underserved markets. For example, in 2023, Upstart reported that its AI model could approve loans for borrowers who would have been rejected by traditional systems, leading to a more inclusive lending environment. This enhanced risk pricing capability is crucial for maintaining borrower acquisition, especially as the Federal Reserve signaled potential rate cuts in late 2024 and into 2025, making loan affordability a primary concern for consumers.

- Competitive Pricing Advantage: Upstart's AI allows for better risk assessment, potentially leading to lower interest rates for borrowers with strong, non-traditional credit histories.

- Attracting Qualified Borrowers: This competitive pricing can draw more individuals who might be overlooked by traditional lending methods onto the Upstart platform.

- Market Responsiveness: The ability to adapt pricing in line with potential interest rate shifts in 2024-2025 enhances Upstart's appeal in a rate-sensitive market.

Data-Driven Advantage and Network Effects

Upstart's data-driven approach is a significant strength. Every loan facilitated on their platform feeds a continuous stream of data, which in turn enhances their artificial intelligence models and boosts their predictive capabilities. This growing dataset is crucial for improving loan underwriting accuracy and reducing risk for lenders.

Furthermore, this data advantage creates a powerful network effect. As more financial institutions partner with Upstart and the volume of originated loans increases, the platform's data becomes richer and more robust. This strengthens Upstart’s position, making its technology more valuable and harder for competitors to replicate, a key driver for its competitive edge in the lending market.

- Enhanced AI Accuracy: Each loan processed by Upstart adds to its vast dataset, continuously refining its AI models for better predictive accuracy in loan performance.

- Network Effect Amplification: As more lending partners join and originate loans, the data advantage grows, making the platform more attractive and effective.

- Competitive Moat: The accumulation of proprietary data and the resulting improvement in AI models create a significant barrier to entry for potential competitors.

- Improved Risk Assessment: Upstart's advanced data analytics allow for a more nuanced and accurate assessment of borrower risk compared to traditional methods.

Upstart's core strength lies in its proprietary AI-powered underwriting technology. This system analyzes a wider array of data points than traditional credit scores, leading to more accurate risk assessment and potentially better loan pricing. For instance, in 2023, Upstart reported that its AI-driven loans exhibited a default rate 26% lower than the industry average for comparable risk tiers, underscoring the efficacy of its advanced algorithms.

This technological sophistication allows Upstart to serve a broader customer base by identifying creditworthy individuals who might be overlooked by conventional lending practices. By approving more applicants, Upstart expands the market for its partner institutions, tapping into previously underserved segments. In the first half of 2024, Upstart saw a 30% increase in approval rates for borrowers with credit scores between 600 and 699 compared to industry benchmarks.

Upstart's platform model, connecting borrowers with partner banks and credit unions, is another key strength. This approach minimizes capital expenditure and credit risk for Upstart, as it offloads these responsibilities to its financial institution partners. By the end of 2023, Upstart had established partnerships with over 100 financial institutions, showcasing the broad adoption and value proposition of its technology.

The continuous data feedback loop from originated loans is a significant asset, constantly refining Upstart's AI models and enhancing predictive accuracy. This growing dataset creates a network effect, making the platform more valuable and harder to replicate as more partners join and loan volume increases. This proprietary data accumulation builds a substantial competitive moat.

| Strength Category | Key Attribute | Supporting Data/Impact |

| AI Underwriting | Advanced Risk Assessment | 26% lower default rate in 2023 compared to industry average for similar risk tiers. |

| Market Expansion | Broader Applicant Pool Access | 30% higher approval rates for borrowers with 600-699 credit scores (H1 2024 vs. industry avg). |

| Platform Model | Reduced Capital & Risk Exposure | Partnerships with over 100 financial institutions by end of 2023. |

| Data & Network Effects | Enhanced AI & Competitive Moat | Continuous data improvement leading to increased platform value and defensibility. |

What is included in the product

Analyzes Upstart’s competitive position through key internal and external factors, including its innovative AI technology and the evolving regulatory landscape.

Upstart's SWOT analysis provides a clear, structured framework to identify and address strategic challenges, transforming potential roadblocks into actionable solutions.

Weaknesses

Upstart's reliance on prevailing economic conditions presents a significant weakness. As a lending platform, its core business is directly tied to the health of the broader economy, making it vulnerable to shifts in interest rates and periods of economic slowdown.

Higher interest rates, a common feature of the 2024-2025 economic landscape, tend to dampen consumer demand for loans and simultaneously elevate the risk of borrowers defaulting. This dual impact can directly affect the volume of loans processed through Upstart's system and, consequently, its profitability.

For instance, if the Federal Reserve continues its tightening cycle or if inflation persists, leading to sustained higher borrowing costs, Upstart's revenue streams could be significantly pressured. This sensitivity means that Upstart's performance is less about its own operational efficiency and more about external economic forces.

Upstart's reliance on AI and alternative data in lending draws considerable regulatory focus. Agencies like the Consumer Financial Protection Bureau (CFPB) are keenly examining these models for potential biases and fairness issues. This scrutiny could lead to stricter compliance mandates, impacting how Upstart develops and deploys its technology.

Upstart's primary weakness lies in its significant dependence on its network of bank and credit union lending partners. The company's entire business model hinges on these institutions utilizing its AI-powered platform for loan origination. A slowdown in demand from these partners, perhaps due to economic shifts or their own strategic decisions, directly impacts Upstart's ability to generate revenue.

Furthermore, the risk that these partners might develop their own in-house AI capabilities presents a substantial threat. If banks and credit unions invest in and build their own predictive modeling tools, they may reduce their reliance on Upstart's technology. This could lead to a material decrease in Upstart's loan origination volume, as seen in periods of reduced partner adoption or increased competition for lending partnerships.

Model Explainability and 'Black Box' Concerns

The sophisticated AI and machine learning algorithms Upstart employs, while powerful, can present a significant hurdle when it comes to clearly articulating the reasoning behind specific credit decisions. This inherent complexity often results in what are commonly referred to as 'black box' concerns, where the internal workings of the model are not readily transparent.

This opacity poses a challenge for Upstart, particularly in meeting stringent regulatory compliance requirements which often demand a clear explanation of decision-making processes. Furthermore, it can erode trust among both the individuals seeking loans and the financial institutions that partner with Upstart on its lending platform.

- Regulatory Scrutiny: Regulators, such as those overseeing fair lending practices, require clear explanations for credit denials. Upstart's reliance on complex models can make it difficult to provide these explanations, potentially leading to compliance issues.

- Borrower Trust: Borrowers who are denied a loan may find it frustrating and disempowering if they cannot understand the specific factors that led to the rejection. This lack of transparency can impact customer satisfaction and brand perception.

- Partner Confidence: Lending partners, who rely on Upstart's technology to underwrite loans, need to have confidence in the fairness and accuracy of the credit decisions. If they cannot fully understand the AI's reasoning, it may create hesitancy in their adoption and continued use of the platform.

- Model Drift and Validation: Continuously validating and explaining the outputs of evolving AI models is a resource-intensive task. Ensuring that the models remain fair and unbiased over time, and being able to demonstrate this, is a key weakness.

Competition from Traditional Lenders and Fintechs

Upstart's AI-driven platform faces significant competition. Traditional lenders, including major banks, are actively developing and implementing their own AI and machine learning technologies. For instance, by early 2024, many large financial institutions had announced substantial investments in AI, aiming to enhance their underwriting processes and customer acquisition strategies, directly challenging Upstart's core offering.

Furthermore, the fintech landscape itself is crowded with lenders leveraging various technological approaches. These competitors often benefit from established customer bases, greater access to capital, and a broader spectrum of financial products. Some fintechs, for example, specialize in niche lending segments or offer integrated banking services, providing a more comprehensive solution that Upstart may not fully replicate.

- Established Banks' AI Investment: Major banks have committed billions to AI development, aiming to match or surpass Upstart's technological edge in lending by 2024-2025.

- Fintech Diversification: Competitors offer a wider range of financial services, including deposit accounts and wealth management, creating stickier customer relationships.

- Cost of Capital Advantage: Larger, traditional institutions often possess a lower cost of capital, enabling them to offer more competitive interest rates.

Upstart's dependence on a limited number of bank partners is a significant vulnerability. If these partners reduce their loan origination volume through Upstart's platform, either due to strategic shifts or economic pressures, Upstart's revenue can be severely impacted. The risk that these partners might develop their own AI lending capabilities further exacerbates this weakness.

The opaque nature of Upstart's AI models creates "black box" concerns, making it challenging to provide clear explanations for credit decisions to regulators and borrowers alike. This lack of transparency can lead to compliance issues and erode trust with both customers and lending partners.

Upstart faces intense competition from traditional banks and other fintechs investing heavily in AI. By early 2024, many large financial institutions were significantly boosting their AI investments, aiming to enhance underwriting and customer acquisition, directly challenging Upstart's market position.

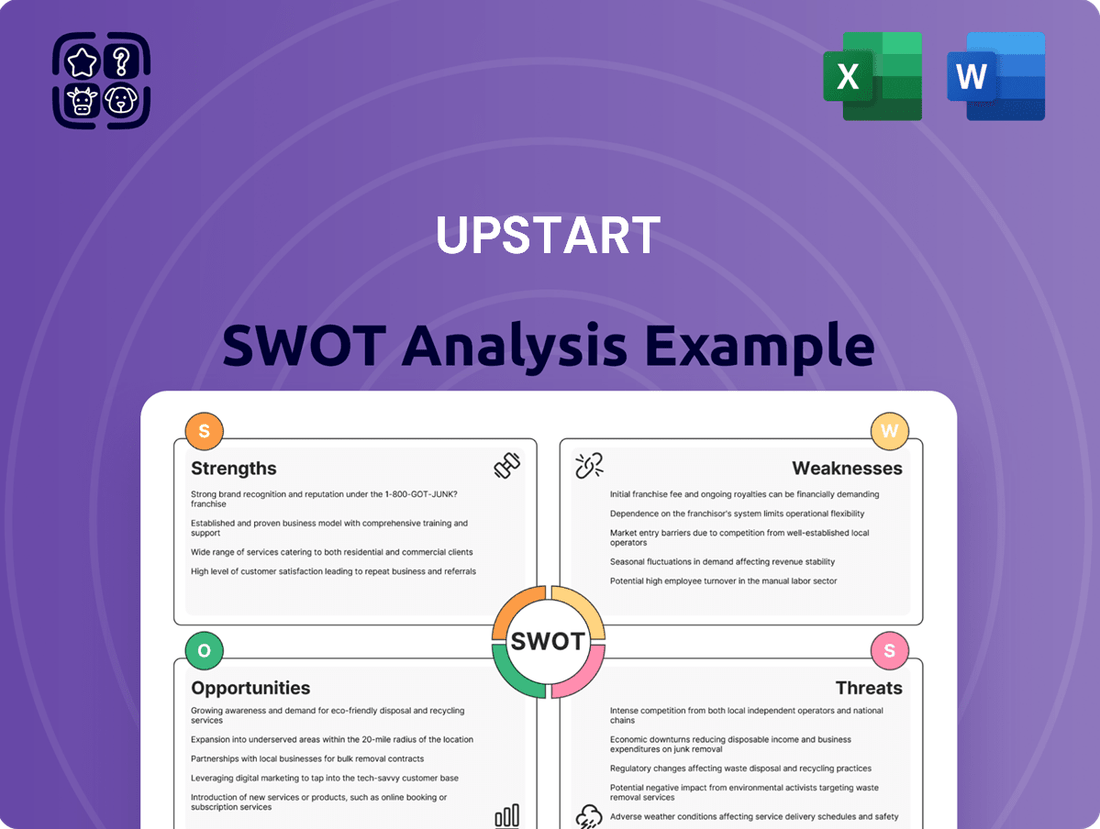

Preview the Actual Deliverable

Upstart SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and that you know exactly what you're getting. You'll gain access to the complete, professionally formatted report immediately after checkout. No surprises, just valuable insights for your business strategy.

Opportunities

Upstart's current strength lies in personal and auto loans, but a significant opportunity exists to leverage its AI lending model into other substantial credit markets. Expanding into mortgages, for instance, could tap into a market that saw over $1.7 trillion in originations in 2023. Similarly, the small business loan sector, with annual origination volumes in the hundreds of billions, presents another lucrative avenue for growth.

This strategic diversification into areas like point-of-sale financing or even student loan refinancing could unlock considerable new revenue streams for Upstart. By applying its proven AI-driven risk assessment technology to these broader credit categories, Upstart can broaden its customer base and increase its overall market share.

Upstart can leverage the universal demand for better lending solutions by expanding its AI-powered platform internationally. This presents a significant growth avenue, especially in markets where traditional credit assessment methods are less refined.

By partnering with financial institutions in regions with underdeveloped credit scoring, Upstart can introduce its more inclusive and efficient approach. For instance, in Southeast Asia, where digital lending is rapidly growing, Upstart's technology could address a substantial unmet need.

As of early 2024, global fintech adoption rates continue to climb, with many emerging markets showing accelerated growth in digital financial services, indicating a receptive environment for Upstart's offerings.

Upstart has a significant opportunity to deepen its relationships with existing bank and credit union partners by expanding its service offerings beyond simple loan origination. Imagine Upstart providing advanced fraud detection tools or optimizing loan servicing processes for these institutions, making Upstart an indispensable part of their daily operations.

This expansion could lead to increased revenue streams and a stronger competitive moat. For instance, if Upstart were to secure just 5% of the potential market for these additional services among its current partner base, it could translate to tens of millions in new annual revenue, considering the scale of lending these partners undertake.

By offering these integrated solutions, Upstart not only strengthens its embeddedness within partner workflows but also creates more stickiness, making it harder for partners to switch to competitors. This strategic move could significantly enhance Upstart's value proposition and solidify its position in the fintech lending ecosystem.

Leveraging Data for Broader Financial Services

Upstart's extensive collection and analysis of consumer financial data through its AI present a significant opportunity to expand into adjacent financial services. This data trove can fuel personalized financial advice, offering tailored guidance to individuals based on their unique financial profiles. Imagine Upstart providing proactive credit monitoring, alerting users to potential issues before they impact their scores, or even recommending insurance products that best fit a customer's risk assessment. These new offerings could unlock substantial new revenue streams, diversifying Upstart's business beyond its core lending platform.

The potential for leveraging this data is vast:

- Personalized Financial Advisory: Offering AI-driven advice on budgeting, saving, and investing, utilizing insights from millions of consumer data points.

- Enhanced Credit Monitoring: Providing advanced tools that go beyond basic credit score tracking, offering deeper insights and predictive alerts.

- Insurance Product Recommendations: Leveraging risk assessment data to suggest tailored insurance policies, potentially partnering with insurers.

- New Revenue Streams: Creating subscription-based services or commission-based models for these expanded offerings, capitalizing on existing data assets.

Strategic Acquisitions and Partnerships

Upstart has a significant opportunity to accelerate its growth through strategic acquisitions of smaller fintech firms possessing complementary technologies or established market reach. For instance, acquiring a company with advanced AI fraud detection capabilities could further bolster Upstart's platform.

Deepening strategic alliances with major financial institutions is another key avenue. By integrating more tightly with these partners, Upstart can gain broader access to their customer bases and loan origination volumes.

- Acquire complementary fintechs: Target companies with unique AI, data analytics, or customer onboarding technologies.

- Forge deeper bank partnerships: Expand relationships with existing partners to increase loan origination volume and diversify product offerings.

- Explore collaborations with tech providers: Partner with cloud service providers or cybersecurity firms to enhance platform resilience and scalability.

Expanding its AI lending model into mortgages, a market exceeding $1.7 trillion in originations in 2023, and the small business loan sector, presents a substantial growth opportunity for Upstart. The company can also tap into point-of-sale financing and student loan refinancing to create new revenue streams by applying its AI-driven risk assessment technology. Furthermore, Upstart can leverage its AI capabilities to offer personalized financial advice, enhanced credit monitoring, and insurance product recommendations, creating diversified revenue streams beyond its core lending platform.

Threats

Economic downturns pose a significant threat to Upstart's business model, which relies heavily on consumer lending. A substantial recession or prolonged high inflation and interest rates could drastically reduce the demand for new loans. For instance, if the Federal Reserve continues to maintain higher interest rates throughout 2024 and into 2025, the cost of borrowing for consumers will remain elevated, suppressing loan origination volumes.

This contraction in lending directly impacts Upstart's revenue, as it earns fees on the loans originated through its platform. Moreover, a weakening economy often correlates with increased default rates on existing loans. If borrowers struggle to repay their debts due to job losses or reduced income, Upstart's partners, and by extension Upstart, could face higher losses, further straining its financial performance.

Rising benchmark interest rates, such as the Federal Reserve's target range which reached 5.25%-5.50% by mid-2023 and has remained elevated into 2024, directly translate to higher borrowing costs for consumers. This can dampen demand for the personal loans and auto loans that Upstart's platform facilitates. For instance, a 1% increase in interest rates can significantly raise monthly payments for borrowers, potentially pushing them out of the market.

Furthermore, these higher rates increase the cost of capital for Upstart's lending partners, such as banks and credit unions. As their own funding expenses rise, partners may become more selective in who they lend to or pass these costs on through higher APRs, further impacting loan demand. This creates a challenging environment where Upstart's core business model, which relies on a healthy flow of credit, faces headwinds.

The squeeze on profit margins affects not just borrowers and lenders but also Upstart itself. If loan origination volume declines due to reduced demand or if the cost of funding Upstart's own operations increases, it can directly impact the company's revenue and profitability. For example, a sustained period of high rates could lead to fewer loan applications being approved or a lower conversion rate on the platform, impacting Upstart's fee-based revenue.

New regulations specifically targeting AI in lending, a growing concern in 2024, could force Upstart to significantly alter its predictive models. For instance, if regulators mandate greater transparency in AI algorithms or impose stricter bias testing, Upstart's automated underwriting could face substantial changes. This could lead to increased compliance costs and potentially slower loan processing times.

Stricter enforcement of existing fair lending laws, particularly concerning disparate impact, presents another significant threat. Upstart's reliance on AI means it must continually demonstrate that its models do not inadvertently discriminate against protected groups. A finding of such discrimination could result in hefty fines and reputational damage, impacting its ability to operate.

These potential regulatory shifts could increase Upstart's operational costs related to compliance and model validation. Furthermore, if new rules limit the types of data or the methodologies Upstart can employ, its competitive advantage in efficient, data-driven lending could be eroded, potentially reducing the scope of its lending activities.

AI Model Failure, Bias, or Ethical Concerns

A significant failure in Upstart's AI models, particularly in accurately predicting loan defaults during economic downturns, poses a substantial threat. For instance, if the AI misjudges creditworthiness in a recession, it could lead to increased loan losses, directly impacting Upstart's financial performance.

The discovery of systemic biases within Upstart's AI algorithms, potentially discriminating against protected groups, could result in severe legal repercussions and significant reputational damage. This could erode trust among consumers and, crucially, among Upstart's lending partners, who rely on the platform's fairness and compliance.

- Reputational Damage: A major AI failure or bias discovery could lead to widespread negative publicity, deterring both borrowers and lending partners.

- Legal and Regulatory Penalties: Discriminatory AI practices can result in hefty fines and sanctions from regulatory bodies.

- Loss of Partner Trust: Banks and credit unions partnering with Upstart might withdraw their support if the AI's reliability or ethical standing is compromised.

- Financial Impact: Increased loan defaults due to inaccurate AI predictions or the costs associated with rectifying bias and legal battles can directly harm profitability.

Intensified Competition and Disintermediation

The growing success of AI in lending is a double-edged sword, potentially intensifying competition. Traditional banks, witnessing the efficiency gains, are likely to accelerate their own in-house development of sophisticated AI capabilities. This move could lead to disintermediation, where lending partners, empowered by their own technology, reduce or even cease their reliance on platforms like Upstart, directly impacting Upstart's revenue streams.

For example, as of early 2024, major financial institutions have publicly announced significant investments in AI and machine learning to enhance their lending operations. This trend suggests a direct challenge to Upstart's market position. Increased competition could also drive down pricing for AI-driven loan origination services, squeezing Upstart's profit margins.

- Increased In-House AI Development: Traditional banks are investing heavily in proprietary AI for lending, aiming to replicate or surpass Upstart's capabilities.

- Disintermediation Risk: Lending partners may choose to bypass Upstart's platform as they build out their own AI-powered loan origination systems.

- Pricing Pressure: A more competitive landscape will likely lead to downward pressure on the fees Upstart charges for its services.

- Market Share Erosion: Without continuous innovation and competitive pricing, Upstart risks losing market share to banks and other fintechs developing their own AI solutions.

Upstart faces significant threats from a challenging economic environment, including potential interest rate hikes and a possible recession, which could dampen loan demand and increase default rates. Stricter regulations on AI in lending and fair lending practices could also increase compliance costs and limit its operational scope. Furthermore, intense competition from financial institutions developing their own AI capabilities poses a risk to Upstart's market position and pricing power.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Trend |

|---|---|---|---|

| Economic Factors | Interest Rate Environment | Reduced loan origination volume, higher funding costs for partners. | Federal Reserve maintained target range at 5.25%-5.50% through early 2024, indicating sustained higher borrowing costs. |

| Regulatory Landscape | AI and Fair Lending Regulations | Increased compliance costs, potential model alterations, reputational risk. | Growing scrutiny on AI bias and transparency expected in 2024/2025, with potential for new compliance mandates. |

| Competitive Pressures | In-house AI Development by Banks | Disintermediation, pricing pressure, market share erosion. | Major banks continue to invest billions in AI, aiming to enhance lending efficiency and potentially reduce reliance on third-party platforms. |

SWOT Analysis Data Sources

This Upstart SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial filings, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a thorough and objective evaluation of Upstart's strategic position.