Upstart PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Upstart Bundle

Want to understand how Upstart is navigating global changes? Our comprehensive PESTEL Analysis gives you the answers—expertly written, instantly downloadable, and easy to customize. Get your copy today.

Political factors

Government bodies worldwide are intensifying their scrutiny of AI's role in financial services, with a particular focus on ensuring fairness and preventing discriminatory outcomes. For Upstart, this means their AI-driven lending models, which rely heavily on diverse data sets, are under a microscope. For instance, the U.S. Consumer Financial Protection Bureau (CFPB) has been actively issuing guidance and conducting investigations into AI use in lending, highlighting concerns about potential bias.

The prospect of new regulations or stricter guidelines could directly impact Upstart's proprietary AI models and how they utilize data. Such changes might necessitate significant adjustments to algorithms, potentially affecting their predictive accuracy and the types of data they can ingest. This regulatory landscape is evolving rapidly, as seen in ongoing discussions around algorithmic accountability in financial decision-making.

Adapting to these evolving regulatory frameworks is not just a matter of compliance but is crucial for Upstart's continued operation and future expansion plans. Failure to do so could lead to penalties or limitations on their business practices. The company's ability to demonstrate transparency and fairness in its AI applications will be paramount in navigating this complex environment.

The financial implications of these regulatory shifts are also considerable. Increased compliance costs, including the need for enhanced auditing, model validation, and potential algorithm redesigns, could directly impact Upstart's profitability. For example, if certain data features previously used are deemed discriminatory, Upstart would need to invest in developing alternative approaches, potentially increasing operational expenses.

Changes in consumer protection laws, especially those concerning lending and debt collection, directly impact Upstart's operations. For instance, evolving regulations around fair lending practices and data privacy could necessitate adjustments to Upstart's AI-driven underwriting model to ensure fairness and transparency.

Stricter rules, such as potential interest rate caps or enhanced disclosure requirements, might constrain the types of loans Upstart can offer or the pricing flexibility it has. In 2023, the Consumer Financial Protection Bureau (CFPB) continued to scrutinize non-bank lenders, signaling a heightened regulatory environment that Upstart must navigate.

Upstart's ability to adapt its platform to new legislative mandates is crucial for avoiding penalties and preserving consumer confidence. The company’s reliance on technology for loan origination means that any regulatory shifts impacting data usage or algorithmic fairness could require significant operational changes.

Central bank decisions on interest rates are a huge factor for companies like Upstart. For instance, the Federal Reserve's actions in 2024, including its pause on rate hikes after a series of increases throughout 2023, directly influenced the cost of borrowing. This pause provided some stability but the anticipation of future cuts or hikes continues to shape the lending landscape.

Higher interest rates, like those seen in late 2023 and early 2024, can make borrowing more expensive for Upstart's partner lenders. This increased cost of capital can lead them to originate fewer loans, as the potential returns on those loans diminish. For example, if the prime rate is high, the cost for a bank to fund its lending operations goes up, making them more selective.

Conversely, if central banks were to lower interest rates, it could boost loan demand as borrowing becomes cheaper. However, this scenario might also squeeze the profit margins for lenders, including those working with Upstart, as the spread between their funding costs and the interest charged on loans narrows.

The Federal Reserve's balance sheet policies, such as quantitative easing or tightening, also play a role. Quantitative easing injects liquidity into the financial system, which can lower longer-term interest rates and encourage lending. Upstart's business model relies on a healthy credit market, which is indirectly supported by these monetary policy tools.

Government Support for Fintech Innovation

Government support plays a crucial role in shaping the fintech landscape, directly impacting companies like Upstart. Initiatives such as grants, tax incentives, and regulatory sandboxes can significantly lower the barriers to entry and encourage the development of new financial technologies. For instance, the U.S. government, through agencies like the Consumer Financial Protection Bureau (CFPB), has explored regulatory sandboxes to allow fintech firms to test innovative products in a controlled environment, potentially fostering growth and competition.

Conversely, a lack of proactive government policies or the imposition of stringent, overly burdensome regulations can stifle innovation. This might manifest as increased compliance costs or delayed market entry for new fintech solutions. As of early 2024, many governments globally are still refining their approaches to fintech regulation, balancing the need for consumer protection with the desire to foster technological advancement.

- Regulatory Sandboxes: Governments in regions like the UK and Singapore have established regulatory sandboxes, allowing fintechs to test new products with real consumers under regulatory supervision, leading to accelerated product development.

- Government Grants and Funding: Programs such as those offered by the National Science Foundation (NSF) in the U.S. can provide seed funding for early-stage fintech research and development, spurring innovation.

- Digital Identity Initiatives: Government efforts to create secure and standardized digital identity frameworks can streamline customer onboarding for fintechs, reducing friction and operational costs.

- Data Privacy Regulations: Evolving data privacy laws (e.g., GDPR, CCPA) necessitate significant investment in compliance for fintechs, but also create opportunities for companies offering privacy-enhancing technologies.

Political Stability and Geopolitical Events

Broader political stability significantly impacts investor confidence, which in turn affects the lending market. Geopolitical events, even those occurring internationally, can ripple through the global financial system, influencing economic sentiment and potentially leading to tighter credit conditions. This heightened caution can translate into reduced consumer borrowing and investment, directly impacting platforms like Upstart that facilitate lending.

For instance, the ongoing geopolitical tensions in Eastern Europe throughout 2024 continued to cast a shadow over global markets, contributing to volatility. While Upstart's operations are primarily domestic, this global financial ecosystem sensitivity means that major international political shifts can indirectly affect its business. Uncertainty often prompts lenders to become more risk-averse, potentially increasing the cost of capital or limiting the availability of funds for borrowers.

- Investor Confidence: Global political instability, such as ongoing trade disputes or regional conflicts, can dampen investor sentiment, making them less willing to allocate capital to financial technology companies like Upstart.

- Credit Conditions: Geopolitical shocks can lead to increased market volatility and a flight to safety, potentially tightening credit conditions and making it more expensive for Upstart to secure funding for its loan portfolio.

- Regulatory Environment: Changes in government policies or international agreements stemming from political shifts can impact the regulatory landscape for lending and financial services, affecting Upstart's operational framework.

- Economic Sentiment: Major geopolitical events can negatively influence overall economic sentiment, leading to reduced consumer spending and borrowing, which directly impacts the demand for loans facilitated by Upstart.

Government scrutiny of AI in finance is intensifying, with a focus on fairness and preventing bias. Upstart's AI-driven models are under particular watch, as seen by the U.S. Consumer Financial Protection Bureau's (CFPB) guidance on AI in lending. Evolving regulations could necessitate costly adjustments to Upstart's algorithms, impacting their operational expenses and predictive accuracy.

What is included in the product

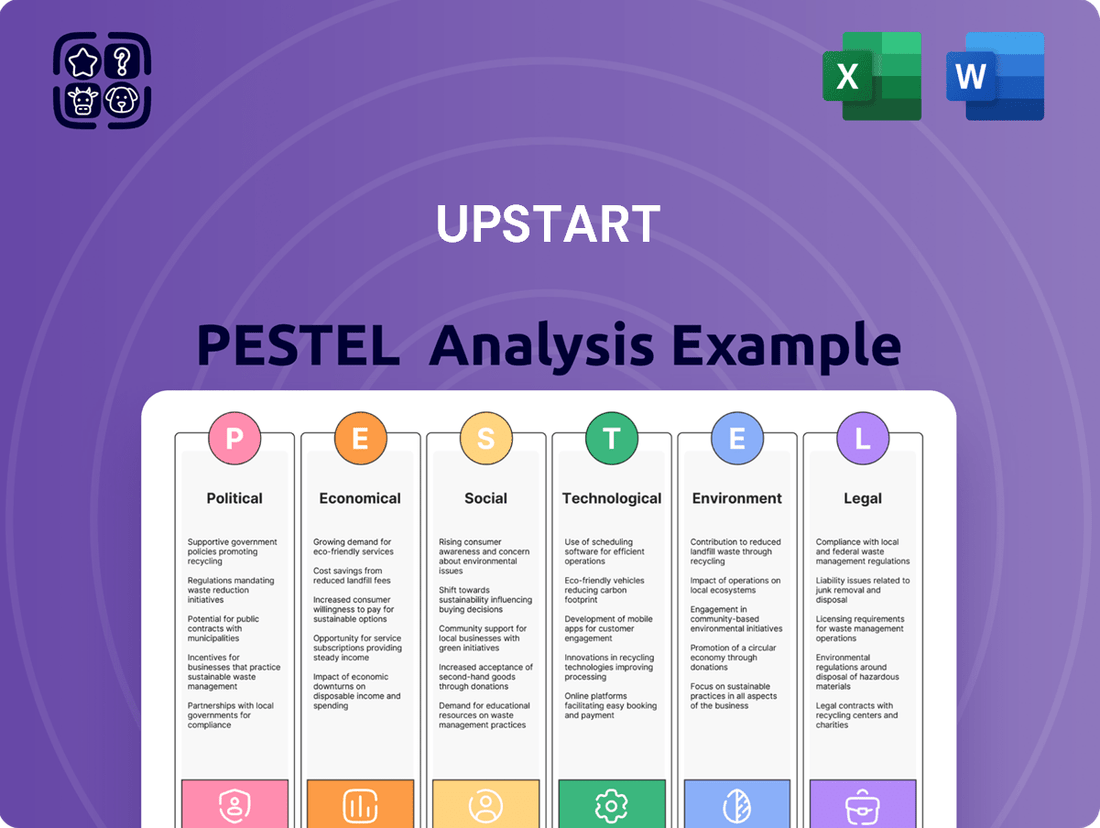

This Upstart PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, spanning Political, Economic, Social, Technological, Environmental, and Legal dimensions, uniquely influence the company's operations and strategic positioning.

Provides a clear overview of external factors influencing Upstart, alleviating the pain of navigating complex market dynamics for better strategic decision-making.

Economic factors

The prevailing interest rate environment significantly impacts Upstart by affecting both loan demand and the profitability of its lending partners. For instance, as of early 2024, the Federal Reserve maintained elevated interest rates to combat inflation, making borrowing more expensive for consumers. This directly influences Upstart's ability to price loans competitively and can lead to a slowdown in loan origination volume.

Higher interest rates also present a dual challenge for Upstart: they can increase the risk of defaults as borrowers struggle with higher monthly payments, and they may compress the net interest margins for banks and credit unions that utilize Upstart's platform, potentially reducing their appetite for originating new loans.

Conversely, a scenario with falling interest rates, as seen in some periods leading up to 2023, could stimulate loan demand and make it easier for Upstart to offer attractive rates. However, this environment might also lead to lower net interest margins for lenders, potentially affecting their willingness to partner with Upstart if the profitability per loan decreases.

Upstart's business model is inherently sensitive to these interest rate shifts, as its success hinges on facilitating efficient and profitable lending for its partners across various economic cycles. The company's revenue is tied to the volume and success of the loans it helps originate, making interest rate stability or predictable changes crucial for its performance.

High inflation, a persistent economic challenge through 2024 and into 2025, directly impacts consumer purchasing power. As the cost of living rises, individuals have less discretionary income, potentially hindering their ability to manage existing debt obligations. This economic pressure can translate into higher default rates within Upstart's loan portfolio, a critical concern for the company's business model.

For instance, if inflation averages 3.5% in 2024, as some forecasts suggest, the real value of a borrower's income effectively decreases. Upstart's sophisticated AI models are therefore tasked with accurately incorporating these macroeconomic risks, such as sustained inflationary trends, into their lending algorithms to maintain loan quality and uphold the confidence of its financial partners.

The current economic climate, with its mix of growth and recessionary signals, directly impacts Upstart's core business. As of late 2024, while some sectors show resilience, others are exhibiting signs of slowing, which can translate to increased unemployment and reduced consumer spending power.

Recessionary pressures, if they intensify, pose a significant risk to Upstart. Higher unemployment rates (which have seen fluctuations, with the U.S. unemployment rate hovering around 3.9% to 4.0% in early to mid-2024) typically lead to more loan defaults. This scenario directly challenges Upstart's reliance on a strong pool of creditworthy borrowers, potentially increasing its risk exposure.

Upstart's AI-driven lending model is particularly sensitive to economic downturns. A weaker economy can mean fewer individuals qualifying for loans, as credit scores may decline and debt-to-income ratios worsen. This reduced demand for credit, coupled with higher default probabilities, could negatively affect Upstart's transaction volumes and profitability.

Unemployment Levels

Unemployment levels directly impact Upstart's business model by influencing consumer creditworthiness and their ability to repay loans. When unemployment rises, individuals have less disposable income, making them more likely to struggle with loan payments. This can lead to an increase in loan defaults, which directly affects the quality of the loans originated through Upstart's platform.

For instance, as of May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months. This figure highlights the sensitivity of Upstart's customer base to economic shifts. A sustained upward trend in unemployment could significantly challenge the accuracy of Upstart's AI in assessing risk, requiring constant adaptation to dynamic employment markets.

- Impact on Creditworthiness: Higher unemployment means fewer people have stable income, reducing their creditworthiness and capacity to manage debt.

- Loan Default Risk: Increased job losses directly correlate with a higher probability of borrowers defaulting on their loan obligations.

- AI Adaptation Necessity: Upstart's artificial intelligence needs to continuously refine its risk assessment algorithms to account for fluctuating employment conditions.

- Disposable Income Reduction: Joblessness shrinks disposable income, limiting consumers' ability to meet financial commitments, including loan repayments.

Consumer Debt Levels and Household Income Trends

The aggregate level of consumer debt and household income trends are critical indicators for the lending market. As of the first quarter of 2024, total U.S. household debt reached a record $17.7 trillion, according to the Federal Reserve Bank of New York. This rise in debt, coupled with more modest growth in household incomes, can indicate increased financial strain for many Americans.

Upstart's platform addresses these concerns by analyzing a wider array of data points beyond traditional credit scores. This allows the AI to better assess an individual's capacity to manage debt, even in a challenging economic environment. The focus is on identifying borrowers with demonstrably stable income streams and manageable debt-to-income ratios, thereby reducing risk for lenders.

- Record Consumer Debt: Total U.S. household debt hit $17.7 trillion in Q1 2024.

- Income vs. Debt: While debt is rising, household income growth has been less robust, potentially increasing risk.

- Upstart's Approach: The company's AI evaluates more than just credit scores to gauge borrower stability.

- Risk Mitigation: The aim is to identify individuals with stable incomes and manageable debt loads for safer lending.

Economic factors like interest rates and inflation significantly shape Upstart's operational landscape. Elevated interest rates, maintained through early 2024 to curb inflation, increase borrowing costs for consumers, potentially slowing loan origination volumes. High inflation, persisting into 2024-2025, erodes consumer purchasing power, raising default risks for borrowers and necessitating robust AI risk assessment.

Recessionary pressures and unemployment figures directly influence Upstart's business. A rising unemployment rate, around 4.0% in mid-2024, signifies a weakening economy that can lead to more loan defaults and reduce the pool of creditworthy borrowers. Upstart's AI must adapt to these dynamic employment markets to accurately assess risk.

The rise in aggregate consumer debt, reaching $17.7 trillion in Q1 2024, against less robust income growth, highlights potential financial strain on households. Upstart's AI model aims to mitigate this by analyzing broader data beyond traditional credit scores to identify stable borrowers.

| Economic Factor | Status (Early/Mid 2024) | Impact on Upstart | Key Data Point |

| Interest Rates | Elevated | Increased borrowing costs, potential slowdown in loan volume, margin pressure for partners | Federal Reserve policy |

| Inflation | Persistent | Reduced consumer purchasing power, increased default risk | Forecasts suggest 3.5% average for 2024 |

| Unemployment Rate | Stable but sensitive | Affects borrower creditworthiness and default probabilities | U.S. rate around 4.0% |

| Consumer Debt | Rising | Potential for increased financial strain on households | $17.7 trillion in Q1 2024 |

Preview the Actual Deliverable

Upstart PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Upstart provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations and strategic decisions. You'll gain valuable insights into market dynamics and potential challenges.

Sociological factors

Societal acceptance of digital finance is surging, especially among younger generations. For instance, a 2024 survey indicated that over 70% of Gen Z and Millennials prefer managing their finances entirely online. This growing comfort with digital platforms directly aligns with Upstart's AI-driven lending model, streamlining the loan application and approval process.

This societal shift means consumers are increasingly at ease with performing sensitive financial transactions remotely. Data from 2024 shows a 25% year-over-year increase in the usage of online-only banking services. This trend significantly reduces friction for Upstart's customers, who can access loans through automated, digital channels.

A significant sociological driver for Upstart is the growing societal emphasis on financial inclusion, particularly for those historically excluded from traditional credit systems. Upstart's artificial intelligence is designed to assess creditworthiness by looking beyond conventional metrics, thereby addressing a critical social need for broader access to financial services. This approach directly supports societal objectives aimed at fostering more equitable distribution of financial opportunities.

The company’s technology actively works to bridge gaps in access to credit for individuals who might be overlooked by traditional lenders. For instance, by analyzing a wider range of data points, Upstart helps to unlock credit for a more diverse applicant pool. This aligns with a societal shift towards recognizing and serving a wider spectrum of financial needs and backgrounds.

Public trust in AI, especially for financial decisions like lending, hinges on perceived fairness and transparency. A significant portion of consumers express concern about AI bias, with some studies indicating over 60% worry about algorithms making unfair decisions. Upstart's success is directly tied to addressing these anxieties and proving its AI operates equitably.

Negative public perception, fueled by worries about algorithmic bias or a lack of clear explanations, can trigger significant backlash. This could manifest as a drop in customer acquisition or, more consequentially, heightened regulatory attention. Upstart's commitment to explainable AI and bias mitigation is therefore paramount.

To maintain public confidence, Upstart must proactively and consistently showcase the fairness and effectiveness of its AI models. Demonstrating a commitment to ethical AI development, perhaps through independent audits or clear communication of its decision-making processes, will be key in navigating the evolving societal expectations around AI.

Demographic Shifts and Generational Preferences

Demographic shifts are significantly reshaping the financial landscape, and Upstart is well-positioned to capitalize on these changes. The growing financial influence of Millennials and Gen Z, who are digital natives, aligns perfectly with Upstart's tech-centric model. These generations typically expect and prefer seamless online interactions and are generally more receptive to cutting-edge financial products and services. For instance, by the end of 2024, it’s projected that Millennials will represent a substantial portion of the adult population in many developed economies, bringing with them distinct digital-first expectations.

Catering to these evolving generational preferences is crucial for Upstart's sustained market penetration and growth. As younger demographics continue to enter their prime earning and borrowing years, their comfort with digital platforms and openness to alternative lending models will be a key differentiator. Data from 2024 indicates that a significant majority of Gen Z and Millennial consumers prefer to manage their finances entirely through digital channels.

Upstart's focus on leveraging artificial intelligence and a digital-first approach directly addresses the expectations of these key demographic groups.

- Digital Natives: Millennials and Gen Z, born into a digital world, are comfortable with online transactions and expect intuitive digital interfaces.

- Preference for Innovation: These generations are often more open to exploring new financial technologies and alternative lending solutions that offer speed and convenience.

- Financial Empowerment: As these cohorts gain greater financial influence, their adoption rates of digital-first financial platforms like Upstart are expected to rise.

- Shifting Market Demands: Traditional financial institutions may struggle to adapt as quickly, creating an opportunity for agile, tech-focused companies like Upstart to capture market share.

Impact of Financial Literacy on Borrowing Behavior

The general level of financial literacy significantly shapes how individuals approach borrowing. A population with higher financial literacy is more likely to understand complex loan terms, interest rates, and the long-term implications of debt. This understanding can lead to more responsible borrowing habits, such as avoiding predatory loans and prioritizing repayment. For instance, a 2024 study by the National Financial Educators Council indicated that states with higher average financial literacy scores also reported lower rates of personal bankruptcy.

Upstart's AI-driven platform is designed to streamline and demystify the lending process. However, societal progress in financial education means borrowers are increasingly seeking clarity and transparency. As financial literacy grows, consumers are better equipped to evaluate loan offers, compare options, and manage their repayment schedules effectively. This trend toward informed decision-making can translate into a more stable borrower base for lenders like Upstart.

The impact of enhanced financial literacy extends to risk reduction for all parties involved in lending. When borrowers comprehend their obligations, the likelihood of defaults and late payments diminishes. This not only benefits the lender by reducing potential losses but also helps borrowers maintain a positive credit history. Data from the U.S. Financial Capability Study consistently shows a correlation between financial knowledge and better debt management outcomes, with financially literate individuals being less likely to carry high-interest credit card debt.

- Informed Borrowers: Higher financial literacy leads to a better understanding of loan terms and conditions, fostering more responsible borrowing.

- Reduced Default Risk: As financial education improves, borrowers are better equipped to manage debt, potentially lowering default rates for lenders.

- Market Demand for Transparency: Societal emphasis on financial education drives demand for clear and accessible lending processes, aligning with Upstart's AI approach.

- Economic Stability: A financially literate populace contributes to greater economic stability by encouraging sound financial decision-making and debt management.

The increasing societal acceptance of digital financial services, particularly among younger demographics, directly benefits Upstart's AI-driven model. A 2024 survey revealed that over 70% of Gen Z and Millennials prefer online finance management, a trend amplified by a 25% year-over-year rise in online-only banking usage in the same year. This comfort with digital interactions streamlines Upstart's automated loan processes.

Societal emphasis on financial inclusion is a key driver for Upstart, as its AI assesses creditworthiness beyond traditional metrics, aiding those historically excluded. This aligns with a growing societal objective for more equitable financial access, with Upstart facilitating this by analyzing diverse data points to broaden credit availability.

Consumer trust in AI for financial decisions is crucial, yet concerns about algorithmic bias persist, with studies in 2024 showing over 60% of consumers worry about unfair AI decisions. Upstart must proactively demonstrate its AI's fairness and transparency to maintain public confidence and mitigate potential backlash or regulatory scrutiny.

Technological factors

Upstart's primary competitive edge is its advanced AI and machine learning, which are key to assessing creditworthiness. These technologies are constantly evolving, with new ways to analyze data and create predictive models. This allows Upstart to continuously improve its credit scoring accuracy and find more individuals who qualify for loans.

For instance, Upstart reported in early 2024 that its AI-powered platform led to a 30% increase in loan approvals compared to traditional methods, while maintaining a similar risk profile. The company's ongoing investment in AI research, including areas like natural language processing for alternative data analysis, is critical for maintaining its leadership position.

The company's commitment to staying ahead in AI innovation is crucial. By integrating cutting-edge machine learning techniques, Upstart aims to further reduce default rates and expand access to credit for a broader segment of the population.

The escalating threat landscape demands significant investment in data privacy and security technologies for Upstart. Protecting sensitive financial data is paramount, requiring advanced encryption, robust cybersecurity protocols, and strong data governance frameworks. Failure to do so could result in severe reputational damage and operational disruptions.

Upstart's commitment to secure data handling is crucial for maintaining borrower trust and ensuring regulatory compliance. For instance, the global cost of data breaches reached an average of $4.35 million in 2022, highlighting the financial implications of security failures, a figure likely to continue rising as threats evolve.

Upstart's operational backbone, particularly its capacity to handle a massive influx of loan applications and seamlessly connect with a wide array of financial institutions, is fundamentally dependent on its robust, scalable cloud computing infrastructure. This technological foundation is not just a convenience; it's a critical enabler of their business model, allowing for the efficient storage and processing of vast datasets, which in turn powers their real-time risk assessment and decision-making capabilities.

By embracing cloud technologies, Upstart gains the agility needed to adapt to fluctuating market demands and support its rapid expansion. For instance, in Q1 2024, Upstart reported a substantial increase in loan originations, a feat directly tied to the underlying scalability of its cloud architecture, which can dynamically allocate resources to meet peak processing needs without compromising performance.

The cost-effectiveness and reliability of these cloud services are paramount to Upstart's profitability and service delivery. Maintaining high availability and ensuring data integrity are constant priorities, directly impacting customer trust and the company's ability to operate efficiently. As of their latest disclosures, Upstart continues to invest in optimizing its cloud spend while ensuring the infrastructure can support projected growth through 2025.

API Integration Capabilities with Banking Systems

Upstart's core business relies heavily on its ability to seamlessly integrate with the existing, often legacy, systems of banks and credit unions. This integration is primarily achieved through Application Programming Interfaces (APIs), which act as the digital bridges connecting Upstart's platform to financial institutions' core banking infrastructure. The ease and security of these API integrations are paramount, directly impacting how quickly and effectively new lending partners can onboard and utilize Upstart's technology. For instance, Upstart reported that in Q1 2024, the number of bank partners utilizing their platform for loan originations continued to grow, underscoring the importance of these technological connections.

The company's commitment to continuously developing and refining these APIs is crucial for maintaining and enhancing its value proposition to financial institutions. Robust and flexible APIs not only streamline the onboarding process but also allow for more dynamic data exchange, improving risk assessment and loan servicing capabilities for partner banks. This technological foundation is a key differentiator, enabling Upstart to offer a more efficient and scalable lending solution compared to traditional methods. Upstart's focus on API development is reflected in its ongoing investment in its technology stack, aiming to reduce integration friction and expand the range of services offered through these digital interfaces.

Key aspects of Upstart's API integration capabilities include:

- Enabling efficient onboarding: Streamlining the technical setup for new bank and credit union partners.

- Ensuring data security: Implementing secure protocols for data transfer between Upstart and financial institutions.

- Facilitating real-time decisioning: Allowing for rapid loan application processing and approval through API connections.

- Supporting diverse product offerings: Adapting APIs to accommodate various loan products and partner-specific requirements.

Emerging Technologies (e.g., Blockchain, Quantum Computing)

While Upstart's current platform doesn't directly leverage blockchain or quantum computing, these technologies represent significant future disruptors and enhancers for the lending industry. Monitoring advancements in blockchain for secure, transparent record-keeping and identity verification could streamline Upstart's processes and build trust. For instance, the global blockchain in financial services market was projected to reach over $13 billion by 2024, highlighting its growing impact.

Quantum computing, though further out, has the potential to revolutionize Upstart's risk assessment and fraud detection capabilities by handling complex datasets and simulations far beyond current capabilities. This could lead to more accurate pricing models and a reduction in default rates. The quantum computing market is expected to grow substantially, with some projections suggesting it could reach tens of billions of dollars by the early 2030s.

- Blockchain Potential: Enhanced security and efficiency in record-keeping and identity verification.

- Quantum Computing Advantage: Advanced analytics for superior risk modeling and fraud detection.

- Competitive Edge: Early exploration and adoption of relevant emerging technologies can secure future market leadership.

- Market Growth: Significant investment and expansion are occurring in both blockchain and quantum computing sectors, indicating their transformative potential.

Upstart's core strength lies in its advanced AI and machine learning, which are continuously refined to enhance creditworthiness assessment and loan approval rates. These sophisticated technologies are crucial for Upstart's competitive edge, allowing for more accurate risk modeling and expanding access to credit.

The company's commitment to innovation in AI, including the exploration of natural language processing for alternative data, is key to its ongoing success. For example, in early 2024, Upstart noted its AI platform increased loan approvals by 30% over traditional methods while maintaining similar risk levels.

Upstart's robust cloud computing infrastructure is fundamental to its operations, enabling the efficient processing of vast datasets for real-time risk assessment and scalable growth. This technological backbone allows Upstart to dynamically manage resources and meet peak demand, as demonstrated by a substantial increase in loan originations in Q1 2024, directly supported by its scalable architecture.

Seamless integration with financial institutions is achieved through robust APIs, which act as critical digital bridges for data exchange and partner onboarding. Upstart's ongoing development of these APIs is vital for streamlining processes and enhancing its value proposition, as evidenced by the growing number of bank partners utilizing its platform in Q1 2024.

| Technology Area | Upstart's Application/Benefit | Industry Trend/Impact |

|---|---|---|

| AI & Machine Learning | Enhanced credit scoring, increased loan approvals, reduced default rates | Growing adoption for personalized financial services and risk management |

| Cloud Computing | Scalability for loan processing, operational efficiency, data management | Essential for agility and handling large data volumes in fintech |

| APIs | Seamless partner integration, efficient onboarding, real-time decisioning | Crucial for interoperability and creating ecosystems in financial services |

| Data Security & Privacy | Protecting sensitive financial data, maintaining borrower trust, regulatory compliance | Increasingly critical due to rising data breach costs (avg. $4.35M in 2022) |

Legal factors

Upstart's operations, which involve processing significant personal and financial data, are heavily influenced by data privacy regulations such as the CCPA and GDPR. Even if Upstart doesn't directly collect data from EU or California residents, its partners' compliance with these laws affects Upstart's ecosystem. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk associated with non-compliance.

Maintaining strict adherence to data privacy laws is paramount for Upstart to prevent substantial financial penalties and safeguard its reputation. The company must ensure its data handling practices are not only compliant but also transparent to build trust with consumers and partners alike. As of early 2024, enforcement of these regulations continues to strengthen, making robust data governance a core operational necessity.

As a lending platform, Upstart must adhere to stringent fair lending laws like the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, which strictly prohibit discrimination in credit decisions based on protected attributes. These regulations are foundational to ensuring equitable access to credit for all consumers.

Upstart's reliance on AI necessitates ongoing audits and rigorous validation of its algorithms to preempt any unintended disparate impacts on individuals belonging to protected classes. For instance, the Consumer Financial Protection Bureau (CFPB) actively monitors lending practices for compliance with these fair lending principles.

Failure to comply with these critical legal frameworks can result in substantial financial penalties, regulatory sanctions, and significant damage to Upstart's reputation and public trust. The legal landscape surrounding AI in finance is evolving, with regulators in 2024 and 2025 likely to increase scrutiny on algorithmic fairness.

Upstart and its lending partners must navigate a complex web of consumer protection laws like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA). TILA ensures borrowers receive clear, upfront information about loan costs and terms, while FCRA regulates how credit information is collected, used, and shared. For example, in 2023, the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices, with enforcement actions often stemming from disclosure violations or improper use of credit data.

Compliance with these regulations is not merely a legal formality; it's crucial for Upstart's operational integrity and building lasting consumer confidence. Failure to adhere to TILA's disclosure requirements or FCRA's data privacy mandates can lead to severe consequences. These can include costly class-action lawsuits, significant regulatory fines, and damage to the company's reputation, as seen in past enforcement actions against other fintechs for similar compliance lapses.

State and Federal Lending Licensing Requirements

Operating as a lending platform, whether directly or through partnerships, requires Upstart to navigate a complex web of state and federal licensing requirements. These regulations are not uniform; they differ significantly across jurisdictions, dictating who can lend, the terms of those loans, and the operational standards that must be upheld. For instance, as of early 2024, the landscape of state lending licenses, such as the Nationwide Multistate Licensing System (NMLS), continues to evolve, with states like California and New York having particularly stringent rules for fintech lenders.

Upstart's business model and its partnerships must be meticulously structured to ensure full compliance with these diverse licensing obligations. Failure to do so can result in significant penalties, operational disruptions, and reputational damage. The sheer number and variability of these licenses represent a substantial barrier to entry for new players and can complicate expansion efforts for established companies like Upstart. For example, a recent trend in 2024 has seen increased scrutiny on rent-a-bank models, which many fintech lenders utilize, potentially impacting partnership structures and licensing needs.

- State-Specific Lending Licenses: Upstart must hold or partner with entities holding licenses in each state where it originates or services loans, a requirement that impacts nearly all 50 states and the District of Columbia.

- Federal Oversight: Federal agencies like the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency (OCC) also play a role, particularly concerning consumer protection and banking partnerships.

- Licensing Costs and Compliance Burden: Obtaining and maintaining these licenses involves significant application fees, ongoing compliance monitoring, and personnel dedicated to regulatory adherence, representing a substantial operational cost.

- Impact on Partnership Models: Changes in regulatory interpretation or new legislation in 2024-2025, such as potential updates to the Madden-Scott decision's impact on bank charters, could necessitate re-evaluation of Upstart's partnership strategies and associated licensing.

Anti-Money Laundering (AML) and KYC Regulations

Financial institutions, including Upstart, operate under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are designed to combat financial crime by ensuring thorough identity verification of all customers and diligent monitoring of transactions. For Upstart, this means robust systems for verifying borrower identities and flagging suspicious activities are not just best practices, but legal mandates. Failure to comply can result in significant penalties, impacting both financial standing and operational legitimacy.

In 2024, the global focus on AML and KYC compliance intensified. For instance, the Financial Crimes Enforcement Network (FinCEN) in the United States continues to emphasize the importance of effective AML programs, with reported fines against financial institutions for compliance failures reaching hundreds of millions of dollars annually. Upstart must therefore invest in and continuously update its technology and processes to meet and exceed these evolving regulatory expectations, ensuring its platform remains a secure and compliant lending environment.

- Regulatory Scrutiny: Financial regulators worldwide are increasing their oversight of lending platforms, demanding rigorous AML and KYC compliance.

- Identity Verification: Upstart must employ advanced solutions to verify borrower identities, often integrating biometric data and government-issued identification checks.

- Transaction Monitoring: Sophisticated systems are required to detect and report suspicious transaction patterns, safeguarding against illicit financial flows.

- Compliance Costs: Adhering to these regulations involves substantial investment in technology, personnel, and ongoing training, which impacts operational expenses.

Upstart's reliance on AI in lending makes compliance with fair lending laws, such as the Equal Credit Opportunity Act (ECOA), critical. These laws prohibit discrimination based on protected characteristics, and regulators like the Consumer Financial Protection Bureau (CFPB) are actively monitoring for disparate impacts. As of 2024, the CFPB has increased its focus on algorithmic fairness in lending decisions.

Data privacy regulations, including GDPR and CCPA, significantly impact Upstart. Non-compliance can lead to hefty fines; for instance, GDPR penalties can reach 4% of global annual revenue. Upstart must ensure its data handling, and that of its partners, is transparent and compliant to maintain consumer trust and avoid substantial financial repercussions, a trend likely to continue in 2024-2025.

Navigating state and federal licensing requirements is a complex legal challenge for Upstart. These regulations vary significantly by jurisdiction, impacting who can lend and under what terms. The ongoing evolution of these rules, particularly concerning fintech lenders and partnership models, demands constant vigilance and adaptation to avoid operational disruptions and penalties, with increased scrutiny on rent-a-bank models in 2024.

Upstart must adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal mandates require robust identity verification and transaction monitoring to combat financial crime. In 2024, financial institutions face intensifying global scrutiny, with significant penalties for non-compliance, underscoring the need for continuous investment in compliance technology and processes.

Environmental factors

The growing emphasis on Environmental, Social, and Governance (ESG) criteria is reshaping investment strategies. In 2024, sustainable investments are projected to exceed $50 trillion globally, creating a significant demand for companies demonstrating strong ESG performance. This trend directly impacts Upstart's ability to attract capital and maintain investor interest.

While Upstart, as a technology platform, has a comparatively low direct environmental impact, its partner institutions are increasingly subject to ESG scrutiny. For instance, banks using Upstart's technology might face pressure from their own investors to ensure their lending portfolios align with environmental sustainability goals, potentially influencing their adoption of Upstart's services.

To capitalize on this evolving landscape, Upstart could proactively integrate ESG considerations into its lending algorithms and operational frameworks. This might involve evaluating the ESG performance of partner lenders or even incorporating ESG metrics into the credit assessment of borrowers, thereby broadening its appeal to a wider, sustainability-conscious investor base.

Climate change poses a significant, albeit indirect, threat to regional economic stability and, consequently, borrower reliability. The increasing frequency and intensity of extreme weather events, like floods in the Midwest or wildfires in the West, can disrupt local industries and supply chains, leading to economic downturns. For instance, the 2023 U.S. experienced a record 28 separate billion-dollar weather and climate disasters, causing over $150 billion in damages, impacting local economies and potentially increasing default risks.

Resource scarcity, another facet of climate change, can also destabilize regional economies. Droughts, for example, severely impact agricultural sectors, a cornerstone of many regional economies, potentially leading to job losses and reduced consumer spending. This ripple effect can weaken the overall financial health of a region, making borrowers more vulnerable to economic shocks.

As these environmental risks evolve, financial institutions like Upstart may need to integrate sophisticated climate modeling into their AI-driven credit assessment. This involves analyzing how specific regional vulnerabilities to climate change, such as rising sea levels or prolonged heatwaves, could affect borrower repayment capacity over the long term, ensuring more robust and forward-looking credit risk management.

Upstart's reliance on extensive data processing means its operational carbon footprint is intrinsically linked to the energy demands of data centers. As of 2024, the digital sector's energy consumption is a growing concern, with data centers accounting for a significant portion of global electricity use. This could drive demand for greener data solutions, potentially influencing Upstart's cloud infrastructure choices.

The push for sustainability may lead to increased scrutiny of Upstart's partnerships with cloud providers. Companies are increasingly prioritizing those with demonstrable commitments to renewable energy sources and carbon neutrality. For instance, major cloud providers are investing heavily in renewable energy projects, aiming to power their operations with 100% renewable energy by various target dates, a trend Upstart will likely need to align with.

Upstart might face pressure to actively offset its digital carbon footprint, particularly as regulatory frameworks around environmental reporting become more stringent. This could involve purchasing carbon credits or investing in carbon removal technologies to mitigate the environmental impact of its data-intensive operations. The growing market for carbon offsets, valued in the billions, highlights the increasing financial relevance of this strategy.

Sustainable Finance Initiatives

The financial industry is increasingly embracing sustainable finance, a trend that could indirectly impact Upstart. This includes the growth of 'green loans' and financing specifically for environmentally conscious projects. While Upstart’s core business remains personal loans, this broader shift towards sustainability could influence its future product development or the criteria used for selecting lending partners.

As of early 2024, the global sustainable finance market is substantial and growing. For instance, assets under management in sustainable funds reached over $37 trillion in 2023, signaling strong investor demand for ESG (Environmental, Social, and Governance) compliant investments. This growing emphasis on sustainability could create opportunities for Upstart to align its platform with environmentally friendly initiatives, potentially enhancing its brand reputation among consumers and investors who prioritize these values.

Upstart could explore several avenues to capitalize on this trend:

- Partnerships with Green Lenders: Collaborating with financial institutions that offer green financing options could allow Upstart to tap into new customer segments and project types.

- ESG Scoring Integration: While not directly applicable to its current loan products, incorporating ESG considerations into its risk assessment models or partner due diligence could be a forward-thinking strategy.

- Brand Alignment: Publicly supporting or participating in sustainability initiatives can bolster Upstart's image as a socially responsible company.

Resource Scarcity and Supply Chain Resilience

While Upstart's core business is software, global resource scarcity and supply chain issues can still create ripple effects. For instance, increased energy costs in 2024, driven by geopolitical tensions, could raise the operational expenses for cloud computing providers that Upstart relies on, potentially impacting its cost structure. Similarly, disruptions in the availability of essential hardware components, though less directly tied to Upstart's software, might indirectly affect the financial institutions that utilize its platform, influencing their overall investment capacity.

The financial sector, a key market for Upstart, is particularly sensitive to the stability of global supply chains, especially concerning energy and critical minerals. For example, fluctuations in semiconductor availability, which underpins much of the digital economy, could indirectly affect the pace of technological adoption by Upstart's partner banks. Upstart's focus on digital lending means its resilience is more about operational dependencies and the economic health of its partners rather than direct physical resource management.

To mitigate these indirect risks, Upstart should continue to monitor broader economic trends impacting its partners. The increasing focus on sustainable finance and the potential for carbon pricing mechanisms in various economies, evident in ongoing policy discussions through 2025, could also influence the cost of capital for financial institutions, a factor that indirectly affects Upstart's market. Ensuring robust cybersecurity and data infrastructure also serves as a form of operational resilience against disruptions.

- Energy Price Volatility: Global energy prices saw significant volatility in 2024, impacting operational costs for tech infrastructure.

- Semiconductor Shortages: While easing, supply chain vulnerabilities for semiconductors remained a concern through early 2025, affecting hardware availability.

- Climate Policy Impact: Evolving climate policies and potential carbon pricing globally could indirectly influence the cost of capital for Upstart's financial partners.

- Digital Infrastructure Reliance: Upstart's dependence on cloud services and data centers makes it indirectly exposed to the energy and hardware supply chains supporting these critical digital assets.

Upstart's environmental impact is primarily indirect, stemming from its reliance on data centers and the energy consumption associated with its AI algorithms. As of 2024, data centers are a significant contributor to global electricity use, a trend that will likely intensify. This necessitates a focus on energy-efficient cloud infrastructure and potentially renewable energy sourcing for its operations.

The increasing global focus on climate change and sustainability means that Upstart's partner institutions face greater scrutiny regarding their own environmental footprints. This pressure can extend to the technologies they adopt, potentially influencing their demand for Upstart's services if not aligned with ESG goals. Proactive integration of ESG considerations into Upstart's platform could therefore be a strategic advantage.

Climate-related risks, such as extreme weather events impacting regional economies, can indirectly affect borrower reliability and thus the performance of loans facilitated by Upstart. For example, the record 28 billion-dollar weather disasters in the U.S. during 2023, causing over $150 billion in damages, highlight the potential for localized economic instability that could affect loan repayment capacity.

The growing sustainable finance market, with assets in sustainable funds exceeding $37 trillion in 2023, presents an opportunity for Upstart to align its brand and potentially its platform with environmentally conscious initiatives. This could involve exploring partnerships with green lenders or integrating ESG metrics into its broader risk assessment framework, thereby appealing to a wider investor base.

PESTLE Analysis Data Sources

Our Upstart PESTLE Analysis draws on a comprehensive blend of data, including official government statistics, reputable financial news outlets, and leading technology industry reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape affecting Upstart.