Upstart Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Upstart Bundle

Curious about Upstart's innovative approach to lending? Our Business Model Canvas breaks down how they connect borrowers with capital and partners. Understand their customer segments, key resources, and revenue streams.

This detailed canvas reveals Upstart's unique value proposition and how they build and maintain customer relationships. It's a crucial tool for anyone analyzing their disruptive strategy.

Unlock the full strategic blueprint behind Upstart's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Upstart’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Upstart's core strategy relies heavily on its relationships with banks and credit unions. These financial institutions act as the primary originators of loans facilitated by Upstart's technology. By partnering with a diverse range of lenders, Upstart can tap into their established customer bases and existing operational frameworks.

As of 2024, Upstart has successfully onboarded more than 100 banks and credit unions onto its platform. This extensive network is vital for scaling its loan origination volume and broadening its market presence. These partnerships are mutually beneficial, allowing lenders to access Upstart's advanced AI-driven underwriting models.

Through these collaborations, partner banks and credit unions can offer more competitive and accessible credit products to their customers. Upstart's cloud-based applications empower these institutions to streamline their lending processes and improve risk assessment, ultimately leading to a better customer experience and potentially higher approval rates for borrowers.

Upstart leverages strategic alliances with premier technology providers to bolster its AI and infrastructure. Key collaborations include Google Cloud Platform, vital for its machine learning infrastructure, and NVIDIA, crucial for its AI computing hardware. These partnerships are foundational for refining Upstart's sophisticated machine learning models and ensuring seamless, efficient operations. In 2024, Upstart continued to deepen its reliance on these cloud and hardware providers to scale its loan origination platform.

Upstart's business model hinges on robust relationships with diverse data providers. These partnerships are crucial for feeding its AI-powered lending platform with the vast array of alternative credit data needed for sophisticated risk assessment.

The company leverages more than 17 distinct data sources. This includes foundational partnerships with major credit bureaus such as TransUnion, Experian, and Equifax, which provide traditional credit history information.

Furthermore, Upstart integrates data from financial technology firms like Plaid and Finicity. These aggregators offer access to a broader spectrum of a borrower's financial behavior, moving beyond just credit scores.

This extensive data ingestion capability enables Upstart to perform more nuanced and accurate credit evaluations, ultimately supporting its goal of expanding access to affordable credit.

Capital Partners and Institutional Investors

Upstart's business model relies heavily on its capital partners and institutional investors. These entities provide the essential funding that allows Upstart to originate and sell loans, effectively transferring the credit risk away from Upstart's own balance sheet. This symbiotic relationship is crucial for scaling operations and maintaining a capital-light structure.

The flow of capital from these partners is a direct enabler of Upstart's loan origination volume. Without these commitments, Upstart would need to hold significantly more capital to back its loans, which would limit its growth potential. This external funding mechanism is a cornerstone of their strategy.

Demonstrating the strength of these relationships, Upstart announced in Q4 2024 that it had secured $1.3 billion in new commitments from its partners. This influx of capital is earmarked for the purchase of loans originated on the Upstart platform, underscoring the continued confidence institutional investors have in Upstart's technology and loan performance.

- Capital Source: Upstart partners with capital providers and institutional investors to fund its loan portfolio.

- Risk Mitigation: This partnership structure allows Upstart to originate loans without retaining significant credit risk.

- Growth Enabler: Access to external capital is fundamental for Upstart's ability to scale loan origination volumes.

- Q4 2024 Funding: Upstart secured $1.3 billion in new partner commitments in the fourth quarter of 2024 for loan purchases.

Strategic Distribution Partners

Upstart is actively building strategic distribution partnerships to significantly expand its customer reach and deepen market penetration. These collaborations serve as crucial channels for acquiring new customers, complementing their existing digital marketing efforts.

A prime example of this strategy is Upstart's partnership with Walmart's OnePay service. This collaboration aims to introduce Upstart's lending products to a much larger and diverse customer base through co-branded marketing initiatives.

- Walmart's OnePay Collaboration: This partnership leverages Walmart's extensive customer network to offer Upstart's lending solutions, potentially reaching millions of unbanked or underbanked individuals.

- Broader Market Access: Strategic distribution partners provide access to customer segments that might be more challenging to reach through direct online channels alone.

- Enhanced Customer Acquisition: By integrating with established platforms and services, Upstart can acquire customers more efficiently and at a potentially lower cost per acquisition.

- Diversified Revenue Streams: These partnerships can open up new avenues for revenue generation beyond traditional direct-to-consumer lending.

Upstart's network of key partners is foundational to its business model, enabling it to scale effectively and offer its services broadly. These partnerships span financial institutions, technology providers, data aggregators, and capital markets participants.

The collaboration with over 100 banks and credit unions in 2024 allows Upstart to originate a significant volume of loans, leveraging their established customer bases and infrastructure. Simultaneously, partnerships with cloud giants like Google Cloud and hardware innovators like NVIDIA are critical for maintaining and advancing its AI and machine learning capabilities.

Upstart’s extensive data partnerships, including those with major credit bureaus and financial technology firms, are essential for enriching its underwriting models. Furthermore, securing capital commitments from institutional investors, such as the $1.3 billion announced in Q4 2024, fuels its loan origination capacity and maintains its capital-light structure.

Distribution partnerships, like the one with Walmart's OnePay, are increasingly important for expanding customer reach and acquiring new users efficiently.

| Partner Type | Key Providers/Examples | 2024 Significance | Impact on Upstart |

|---|---|---|---|

| Lending Institutions | 100+ Banks & Credit Unions | Core loan originators | Scales volume, broadens market reach |

| Technology Infrastructure | Google Cloud, NVIDIA | AI/ML development & operations | Enhances underwriting accuracy, ensures efficiency |

| Data Providers | TransUnion, Experian, Equifax, Plaid, Finicity | Alternative and traditional credit data | Improves risk assessment, expands credit access |

| Capital Markets | Institutional Investors | Loan funding and risk transfer | Enables capital-light growth, fuels origination |

| Distribution Channels | Walmart OnePay | Customer acquisition and market penetration | Expands user base, lowers acquisition cost |

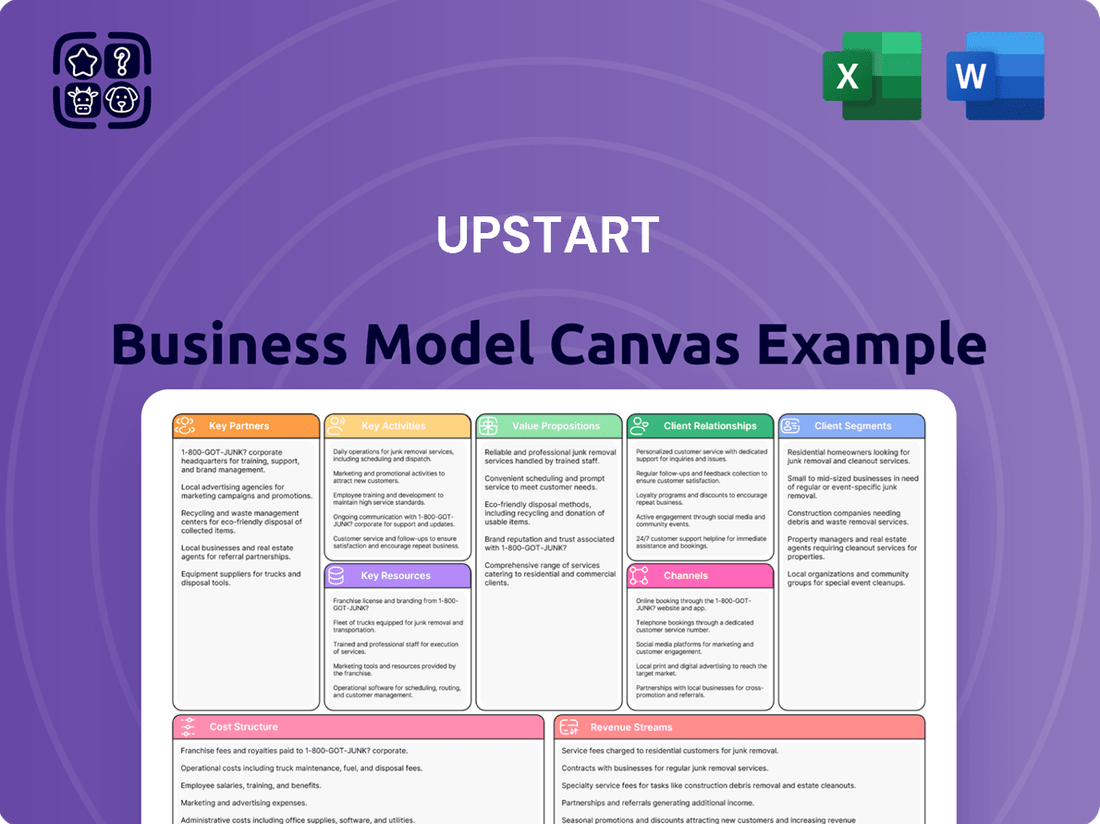

What is included in the product

A visual framework that maps out a company's strategy across key elements like customer segments, value propositions, and revenue streams.

It provides a structured approach to understanding and communicating a business's core logic, facilitating strategic planning and innovation.

The Upstart Business Model Canvas tackles the pain of undefined strategy by providing a structured, visual framework to map out all key business elements.

It alleviates the frustration of scattered ideas by consolidating crucial components into a single, actionable page for clarity and focus.

Activities

Upstart's primary focus is the ongoing development and enhancement of its sophisticated AI and machine learning algorithms for lending. This isn't a static process; it’s a commitment to innovation.

A significant development in this area was the planned introduction of Model 19 in Q4 2024. This new iteration of their AI is designed to significantly improve the accuracy of risk assessments and predict loan performance with greater precision.

The benefit of these continuous algorithm upgrades is twofold for Upstart's lending partners. By refining their predictive capabilities, Upstart aims to facilitate higher loan approval rates for borrowers while simultaneously reducing the potential for defaults.

This iterative improvement cycle is crucial for maintaining a competitive edge and delivering superior risk management capabilities in the lending ecosystem.

A core activity involves managing the entire loan lifecycle, from initial application to final disbursement. This includes gathering applicant information and assessing creditworthiness.

Upstart's artificial intelligence engine is central to this process, automating a substantial portion of loan approvals. In the fourth quarter of 2024, over 90% of the loans processed through their platform were fully automated, highlighting significant operational efficiency.

This automation drastically speeds up the time it takes for borrowers to receive loan decisions and funding. It also significantly lowers the operational expenses for the financial institutions that partner with Upstart.

Upstart's key activity centers on acquiring and nurturing relationships with financial institutions, primarily banks and credit unions. This proactive approach involves showcasing the distinct advantages of their AI-driven lending technology. For instance, as of early 2024, Upstart continued to expand its network, demonstrating a commitment to growth in this crucial area.

The process includes seamless integration of Upstart's platform with partner systems, ensuring smooth operations. This technical integration is vital for facilitating efficient loan origination. Ongoing support is also a cornerstone, guaranteeing that partners maximize the platform's capabilities and address any operational challenges effectively.

Expanding this network of financial partners is not merely about increasing numbers; it directly fuels Upstart's ability to scale loan origination volumes. A larger partner base also diversifies the sources of capital available for lending, creating a more robust and resilient funding ecosystem for the platform.

Marketing and Customer Acquisition

Upstart invests heavily in marketing to draw potential borrowers to its digital lending platform. A significant portion of their customer acquisition originates from digital channels such as Google Ads, Facebook, and LinkedIn, which are crucial for feeding a consistent stream of loan applications to their network of lending partners.

In 2023, Upstart's total revenue was $595.3 million, reflecting the scale of their marketing-driven customer acquisition efforts. The company's focus on digital marketing aims to efficiently reach and convert individuals seeking personal loans, auto loans, and other credit products.

- Digital Channels: Primary reliance on Google Ads, Facebook, and LinkedIn for borrower acquisition.

- Customer Pipeline: Marketing efforts are designed to maintain a robust pipeline of loan applications for lending partners.

- Revenue Generation: Marketing success directly contributes to revenue, with $595.3 million in revenue reported for 2023.

- Efficiency Focus: The strategy prioritizes efficient acquisition of borrowers through targeted online advertising.

Product Diversification and Expansion

Upstart is strategically broadening its financial product suite, moving beyond its initial focus on personal loans. This expansion includes significant growth in auto loans and the introduction of home equity lines of credit (HELOCs) and smaller relief loans. This diversification aims to access more substantial lending markets and create new revenue avenues.

The company's commitment to product expansion is evident in its performance metrics. For example, auto loan originations experienced a substantial five-fold increase in the first quarter of 2025 when compared to the same period in 2024. This rapid growth highlights the market's receptiveness to Upstart's diversified offerings.

- Product Expansion: Upstart is actively developing and launching new loan products, including auto loans, HELOCs, and relief loans.

- Market Penetration: This diversification strategy allows Upstart to tap into larger and more varied lending markets.

- Revenue Growth: The expansion into new loan types is designed to broaden and increase overall revenue streams for the company.

- Performance Indicator: Auto loan originations saw a significant five-fold increase in Q1 2025 versus Q1 2024, underscoring the success of this expansion.

Upstart's key activities revolve around refining its AI lending models, managing the loan lifecycle, building partnerships with financial institutions, acquiring borrowers through digital marketing, and expanding its product offerings.

Continuous algorithm development, like the planned Model 19 for Q4 2024, enhances risk assessment accuracy. Automating over 90% of loan processing in Q4 2024 showcases operational efficiency. Expanding partnerships and digital marketing, which contributed to $595.3 million in 2023 revenue, fuels growth.

The strategic expansion into auto loans, HELOCs, and relief loans, with auto originations rising five-fold in Q1 2025 versus Q1 2024, diversifies revenue and market reach.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| AI Model Development | Enhancing algorithms for risk assessment | Planned Model 19 introduction in Q4 2024 |

| Loan Lifecycle Management | Automating loan processing | Over 90% of loans fully automated in Q4 2024 |

| Partnership Development | Expanding network of banks and credit unions | Continued network expansion in early 2024 |

| Borrower Acquisition | Digital marketing for loan applications | $595.3 million revenue in 2023 |

| Product Expansion | Launching new loan products | Auto loan originations up 5x in Q1 2025 vs Q1 2024 |

Full Version Awaits

Business Model Canvas

The Upstart Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You're not seeing a mock-up; you're getting a direct glimpse of the comprehensive tool that will empower your business planning. Once your purchase is complete, you'll gain full access to this entire, ready-to-edit Business Model Canvas.

Resources

Upstart's proprietary AI and machine learning models are its most crucial resource. These advanced algorithms go beyond traditional credit scores, analyzing a massive amount of data to assess risk more accurately.

By March 2025, these models were trained on over 90 million data points, significantly enhancing their predictive power and providing a distinct competitive advantage that is challenging for rivals to replicate.

Upstart's core strength lies in its extensive and continuously growing data sets. These datasets encompass a vast amount of information from loan applications, detailed repayment histories, and a wide array of alternative data points that traditional lenders often overlook. This accumulation is not just passive; it's actively used to refine their artificial intelligence models.

The company's proprietary data is the bedrock upon which its AI is built and improved. With over 1,500 unique data points collected for each borrower, Upstart has a granular view that fuels its predictive capabilities. This sheer volume and depth of data are crucial for the ongoing training and enhancement of their AI algorithms, directly impacting their effectiveness.

The principle is simple yet powerful: the more data Upstart processes, the more accurate its AI models become. This creates a virtuous cycle where increased data volume leads to improved predictive accuracy, which in turn drives more efficient and effective lending decisions. For instance, by mid-2024, Upstart's AI had been trained on billions of data points, significantly outperforming traditional FICO scoring in predicting default rates.

Upstart's skilled human capital, especially its AI/ML engineers and data scientists, represents a critical key resource. These professionals are the architects behind Upstart's sophisticated AI-driven lending platform, directly influencing its ability to assess risk and provide personalized loan offerings.

The expertise of these engineers and data scientists is fundamental to Upstart's competitive edge. Their continuous work on refining algorithms and developing new machine learning models allows Upstart to adapt to changing market conditions and improve loan approval rates, a key differentiator in the fintech space.

In 2023, Upstart reported that its AI-powered platform originated approximately $11.2 billion in loans. This volume underscores the direct impact of its specialized workforce on the company's operational capacity and market reach.

Financial Capital and Funding Commitments

Upstart's ability to operate and grow hinges on its robust financial capital and funding commitments. This includes its own cash reserves, as well as vital credit facilities and commitments from institutional investors who fund the loans originated on its platform.

As of December 31, 2024, Upstart demonstrated a strong liquidity position with $788.4 million in unrestricted cash. This internal financial strength is complemented by significant access to warehouse credit facilities, which are essential for meeting loan demand and supporting the company's rapid expansion.

- Unrestricted Cash: $788.4 million as of December 31, 2024, providing immediate operational flexibility.

- Warehouse Credit Facilities: Access to substantial credit lines from institutional investors, enabling the funding of originated loans.

- Institutional Investor Commitments: Ongoing partnerships and funding commitments are critical for scaling loan origination.

- Growth Support: These financial resources are fundamental to Upstart's strategy of rapidly increasing loan volume and market share.

Technology Infrastructure and Cloud Computing

Upstart's technological backbone relies heavily on cloud computing, primarily leveraging Google Cloud Platform and Amazon Web Services. This robust infrastructure is critical for handling the immense volume of loan applications and powering their sophisticated AI-driven credit assessment models.

The scalability of these cloud platforms allows Upstart to efficiently process data and execute complex algorithms, which is fundamental to their automated lending operations. This technological infrastructure directly supports their ability to underwrite a high volume of loans quickly and accurately.

- Cloud Infrastructure: Primarily Google Cloud Platform and Amazon Web Services.

- Scalability: Essential for processing millions of loan applications.

- AI Model Support: Underpins the complex algorithms used for risk assessment.

- Operational Efficiency: Enables high-volume, automated lending processes.

Upstart's key resources include its proprietary AI and machine learning models, extensive data sets, skilled human capital, robust financial capital, and a scalable cloud-based technological infrastructure. These elements work in concert to enable efficient, data-driven lending.

The company's AI models, trained on billions of data points by mid-2024, offer superior predictive accuracy compared to traditional FICO scores. This advanced technology, coupled with over 1,500 data points per borrower, forms the core of Upstart's competitive advantage.

Financial strength is demonstrated by $788.4 million in unrestricted cash as of December 31, 2024, and significant access to warehouse credit facilities, crucial for supporting loan origination volumes and growth strategies.

| Key Resource | Description | 2024 Data Point |

|---|---|---|

| AI & ML Models | Proprietary algorithms for risk assessment | Trained on billions of data points by mid-2024 |

| Data Sets | Vast collection of loan and alternative data | Over 1,500 data points per borrower |

| Human Capital | AI/ML engineers and data scientists | Essential for model development and refinement |

| Financial Capital | Cash reserves and credit facilities | $788.4 million unrestricted cash (Dec 31, 2024) |

| Technology Infrastructure | Cloud computing platforms (GCP, AWS) | Supports high-volume loan processing and AI execution |

Value Propositions

Upstart's AI-powered lending platform offers a more inclusive and fair access to credit by utilizing over 1,600 data points, far beyond traditional credit scores. This advanced approach results in a 17% higher approval rate compared to conventional credit assessment models, opening doors for more individuals.

This expanded reach is particularly impactful for those with limited credit histories or no traditional credit scores, effectively democratizing access to financial resources. By identifying creditworthiness through a broader lens, Upstart is making lending more accessible to a wider population.

The fairness of Upstart's model is further demonstrated by its significant impact on minority borrowers, achieving 32% more approvals for this group than traditional lending methods. This data highlights a tangible step towards a more equitable financial system.

Upstart's artificial intelligence platform allows it to assess borrower risk with greater precision than traditional methods. This advanced risk assessment can translate into lower interest rates for individuals who qualify, making borrowing more affordable.

For consumers, this means significant potential savings. Studies suggest that Upstart can offer savings of up to 300 basis points, or 3%, on loan interest rates when compared to conventional lenders. This difference can add up to substantial cost reductions over the life of a loan.

The company's AI-driven models are designed to reduce average Annual Percentage Rates (APRs) by an impressive 36%, all while maintaining comparable approval rates for borrowers. This efficiency benefits both the borrower through lower costs and Upstart by enabling more loans to be originated.

Upstart’s core value proposition is a significantly faster and more efficient loan approval process, driven by its advanced AI-powered technology. As of Q1 2025, the platform boasts impressive automation, with over 80% of borrowers receiving instant approval and a remarkable 92% of loans being fully automated. This digital-first approach drastically cuts down the time from application to funding, offering unparalleled convenience for consumers needing quick access to funds.

This speed is further enhanced by Upstart's commitment to a frictionless experience, aiming for zero documentation uploads for the majority of approved loans. This focus on automation and minimal manual intervention not only accelerates the lending process but also reduces operational costs for financial institutions, creating a win-win scenario.

Reduced Risk and Expanded Customer Base for Lending Partners

Upstart’s AI-driven platform enhances risk assessment for banks and credit unions, leading to more precise creditworthiness evaluations. This precision helps lending partners manage risk more effectively, potentially reducing default rates.

By leveraging Upstart's technology, financial institutions can approve a wider range of borrowers, including those previously underserved, often at more favorable rates. This expansion broadens their customer reach and opens up new market segments.

- Lower Default Rates: Upstart's AI models have historically shown a 30% reduction in the loss rate compared to traditional FICO scoring in certain segments, as reported by the company.

- Broader Customer Access: This technology enables lending partners to approve an additional 10-20% of applicants who might otherwise be declined by conventional methods.

- Improved Portfolio Performance: Expanding the customer base with carefully assessed risk allows for healthier loan portfolios and increased profitability for partner institutions.

- Competitive Advantage: Offering more competitive rates and terms to a wider audience provides a significant edge in the lending market.

Diversified and Automated Loan Products

Upstart provides a broad range of loan options to meet diverse customer needs, including personal loans, auto financing, and home equity solutions. This variety allows financial institutions to serve a wider market. In 2024, the company achieved a significant milestone with 91% of its loans being fully automated, highlighting exceptional operational efficiency.

This high degree of automation is a core value proposition, enabling partners to process applications and disburse funds rapidly and consistently. It translates to a more streamlined experience for both lenders and borrowers, fostering scalability for Upstart’s partner network.

The automated nature of these diversified loan products is key to Upstart's business model. It allows for efficient risk assessment and underwriting, making it possible to offer competitive rates and terms across the product suite.

Key aspects of Upstart's diversified and automated loan products include:

- Product Breadth: Offering personal, auto, HELOCs, and small-dollar loans.

- Automation Excellence: 91% of loans were fully automated in 2024.

- Efficiency Gains: Reduced manual processing and faster turnaround times.

- Scalability: Enabling partners to handle higher loan volumes seamlessly.

Upstart's value proposition centers on its advanced AI platform, which provides fairer and more accessible credit by analyzing over 1,600 data points, leading to a 17% higher approval rate than traditional methods. This democratizes lending, particularly for those with limited credit history, and has shown a 32% higher approval rate for minority borrowers.

The AI also enables more precise risk assessment, potentially lowering interest rates by up to 300 basis points for qualified individuals, with models designed to reduce average APRs by 36% while maintaining approval rates.

Customers benefit from a significantly faster and more efficient loan process, with over 80% of borrowers receiving instant approval and 92% of loans being fully automated as of Q1 2025, often requiring no documentation uploads.

For financial institutions, Upstart's technology enhances risk assessment, leading to potentially lower default rates (historically a 30% reduction in loss rate compared to FICO in certain segments). It also allows them to approve an additional 10-20% of applicants and improve overall portfolio performance.

Upstart offers a diverse range of loan products, including personal, auto, and home equity loans, with 91% of its loans fully automated in 2024, ensuring efficiency, scalability, and competitive rates for its partners.

Customer Relationships

Upstart's customer relationships are built on a foundation of automated digital self-service. Borrowers can initiate loan applications, track their progress, and receive immediate approval decisions entirely through the company's online platform. This streamlined, digital-first approach caters to modern consumers who prioritize speed and ease of use in their financial transactions.

This self-service model is a key driver of Upstart's efficiency and scalability. By automating routine interactions, the platform reduces the need for manual intervention, allowing Upstart to process a high volume of applications quickly. In 2024, Upstart continued to see strong adoption of its digital channels, with a significant majority of loan originations initiated and managed online.

Upstart offers bank and credit union partners dedicated support teams to ensure their AI platform integrates smoothly. This includes vital technical assistance and onboarding, helping institutions effectively utilize Upstart's technology for loan origination and risk assessment.

For instance, in 2024, Upstart continued to expand its network of bank partners, aiming to process billions in new loan volume through these collaborations. This focus on dedicated support fosters strong relationships and drives the adoption of their AI-driven lending solutions.

Ongoing relationship management is a cornerstone, ensuring partners maximize the benefits of Upstart's innovative approach to credit. This proactive engagement helps financial institutions enhance efficiency and improve borrower experiences.

Upstart cultivates strong relationships with its lending partners through consistent, data-driven feedback on loan performance. This transparency showcases the efficacy of Upstart's AI-powered underwriting, building confidence and allowing partners to refine their lending approaches with up-to-the-minute information.

For instance, in the first quarter of 2024, Upstart reported that its AI-driven platform helped originate loans with a 14% lower average APR compared to traditional methods, a key benefit for partners seeking competitive rates and improved customer acquisition.

Community and Educational Resources (Indirect)

Upstart cultivates customer relationships indirectly by offering educational materials that clarify its AI-powered lending model. This transparency helps build trust with individuals seeking financing, particularly those historically overlooked by traditional banks.

By demystifying the technology behind its loan approvals, Upstart empowers potential borrowers with knowledge, fostering a sense of understanding and confidence in their financial decisions. This educational approach acts as a key component in their customer relationship strategy.

- Educational Content: Upstart provides resources explaining its AI algorithms and lending philosophy.

- Trust Building: This transparency helps potential borrowers feel more comfortable with the platform.

- Underserved Markets: The educational aspect is particularly valuable for individuals new to or underserved by digital lending.

- AI Clarity: Explaining how AI influences loan decisions demystifies the process and builds confidence.

Continuous Model Improvement and Adaptation

Upstart's customer relationships are built on a foundation of continuous model improvement and adaptation, particularly concerning its AI-driven lending platform. This means the company actively refines its algorithms based on real-world loan performance data and shifting market dynamics.

This iterative process is key to maintaining Upstart's competitive edge. By integrating feedback, the platform's predictive capabilities become more accurate, leading to better risk assessment and potentially improved loan outcomes for both borrowers and investors.

- AI Model Refinement: Upstart consistently updates its AI models using data from thousands of originated loans, aiming to reduce default rates and increase approval rates for creditworthy individuals.

- Market Responsiveness: The company adapts its underwriting criteria in response to macroeconomic trends, such as changes in interest rates or employment figures, ensuring its models remain relevant.

- Stakeholder Benefits: This ongoing enhancement benefits borrowers through more accessible credit, investors through potentially better risk-adjusted returns, and Upstart through a more robust and efficient platform.

Upstart's customer relationships are deeply rooted in providing a seamless, automated digital experience for borrowers, complemented by dedicated support for its bank and credit union partners. This dual approach ensures both individual users and institutional clients benefit from Upstart's innovative AI lending platform.

In 2024, Upstart continued to emphasize transparency through educational content, helping potential borrowers understand its AI-driven decision-making process, thereby building trust and accessibility.

The company's commitment to continuous AI model improvement, fueled by real-world data and market responsiveness, directly enhances its relationships by delivering increasingly accurate risk assessments and more favorable loan terms.

| Relationship Aspect | Description | 2024 Impact/Data Point |

|---|---|---|

| Borrower Experience | Automated, self-service digital platform for loan applications and management. | Majority of loan originations processed digitally, reflecting strong user adoption. |

| Partner Support | Dedicated technical and onboarding assistance for bank and credit union partners. | Expansion of partner network, processing billions in new loan volume via AI platform. |

| Transparency and Trust | Educational content explaining AI algorithms and lending philosophy. | AI-driven platform offered loans with a 14% lower average APR compared to traditional methods in Q1 2024. |

| Model Improvement | Continuous refinement of AI models based on loan performance and market data. | Ongoing adaptation of underwriting criteria to macroeconomic trends for sustained relevance and accuracy. |

Channels

Upstart.com is the core channel for reaching borrowers, acting as a direct-to-consumer website where individuals can easily check loan rates and submit applications. This user-friendly platform streamlines the entire digital lending process, from initial inquiry to account management.

In 2023, Upstart facilitated over $9 billion in loans through its platform, highlighting the significant volume of transactions handled by Upstart.com. This online presence is critical for their customer acquisition strategy.

Upstart’s lending partner integrations, operating under the 'Powered by Upstart' model, represent a crucial distribution channel. This program embeds Upstart's AI lending platform directly into the operational systems of partner banks and credit unions.

By enabling financial institutions to offer Upstart-powered loans through their own existing channels, this strategy leverages their established customer bases and brand recognition. This direct integration is key to scaling loan origination volume efficiently.

In 2024, Upstart continued to expand its network of bank and credit union partners, facilitating access to its AI-driven lending technology. This expansion directly translates into increased loan originations, as partners utilize the platform to serve their customers.

Upstart leverages digital marketing and advertising extensively to connect with potential borrowers. This strategic focus includes paid search engine campaigns, targeted social media advertising on platforms like Facebook and LinkedIn, and broad display advertising. In 2023, these digital channels were instrumental, driving 65% of Upstart's customer acquisition, underscoring their effectiveness in reaching a wide audience.

Referral Programs

Upstart leverages referral programs as a key channel to acquire new borrowers. These programs are designed to incentivize existing customers to recommend Upstart to friends and family, fostering organic growth and reducing customer acquisition costs. By tapping into trusted networks, Upstart aims to build a more engaged and loyal borrower base.

These initiatives complement Upstart's digital marketing strategies. In 2023, Upstart reported significant growth in loan originations, demonstrating the effectiveness of its multi-channel customer acquisition approach. Referral programs are specifically designed to harness the power of word-of-mouth marketing, which often leads to higher quality leads and improved conversion rates.

- Customer Referrals: Existing satisfied borrowers are encouraged to refer new applicants, often receiving a bonus or credit for successful referrals.

- Partner Referrals: Upstart may also engage strategic partners, such as financial advisors or other fintech companies, to refer potential borrowers.

- Incentivized Sharing: The programs typically involve clear incentives to motivate participation and widespread sharing of referral links or codes.

- Organic Growth Driver: Referral programs contribute to Upstart's efforts to expand its borrower pool in a cost-effective manner, augmenting paid acquisition channels.

Mobile Applications

Mobile applications are a crucial, albeit sometimes implicitly stated, channel for modern fintech platforms like Upstart. These apps offer a highly convenient way for users to manage their financial lives from anywhere.

Through these mobile channels, borrowers can seamlessly apply for loans, track their application progress in real-time, and communicate with the platform. By July 2024, the adoption of mobile banking and financial management apps had reached significant milestones, with global mobile banking users projected to exceed 2.5 billion.

This widespread mobile engagement underscores the importance of a well-designed app for customer acquisition and retention. Upstart's potential mobile offerings would align with this trend, providing:

- On-demand loan access: Users can initiate and manage loan applications directly from their smartphones.

- Real-time status updates: Borrowers can easily check the progress of their applications without needing to call or email.

- Interactive communication: The app can facilitate secure messaging and support interactions.

Upstart's Channels are multifaceted, encompassing direct online engagement, strategic partnerships, and digital outreach. Upstart.com serves as the primary direct-to-consumer portal, facilitating loan applications and account management. In 2023, this platform facilitated over $9 billion in loans, underscoring its central role.

The 'Powered by Upstart' model is a critical distribution channel, embedding Upstart's AI lending technology within partner banks and credit unions, leveraging their existing customer bases. By 2024, Upstart continued to expand this partner network, directly increasing loan origination volume.

Digital marketing and advertising, including paid search and social media, are vital for customer acquisition, driving 65% of customer acquisition in 2023. Referral programs further bolster growth by incentivizing existing customers to bring in new ones, fostering organic acquisition.

Mobile applications represent an increasingly important channel, offering borrowers convenient access for loan applications and management. With global mobile banking users projected to exceed 2.5 billion by July 2024, a strong mobile presence is key to reaching and serving a broad customer base.

Customer Segments

Upstart actively courts borrowers with limited credit histories, often referred to as having 'thin credit files.' These individuals are frequently underserved by traditional lenders because their financial past doesn't provide enough data points for conventional scoring systems.

By leveraging its artificial intelligence and machine learning capabilities, Upstart can analyze a broader set of data points to assess creditworthiness. This approach allows them to approve loans for individuals who might otherwise be denied by conventional methods.

In 2023, borrowers with thin credit files represented a significant portion of Upstart's business, making up 37% of their total loan portfolio. This highlights their commitment to serving this often-excluded segment of the lending market.

Young professionals, generally between 25 and 40 years old, are a crucial customer segment for Upstart. Many in this group possess solid education and stable employment but find their lack of a long credit history a barrier to traditional lending.

This demographic’s importance is underscored by their significant contribution to Upstart’s loan volume. In the fourth quarter of 2023, this vibrant segment accounted for roughly 42% of all loans originated through the Upstart platform.

Upstart actively serves both near-prime and prime credit consumers, offering them personal loans, auto loans, and Home Equity Lines of Credit (HELOCs). This segment represents a significant portion of their business, demonstrating a commitment to providing value across a wider credit spectrum.

In 2023, near-prime and prime borrowers constituted 61% of Upstart's total loan portfolio. This substantial figure highlights Upstart's broad market appeal, extending its reach well beyond solely focusing on traditionally underserved or subprime borrowers.

The company's overarching goal is to achieve the best possible rates for all borrowers, regardless of their credit tier. This strategy aims to make borrowing more accessible and affordable for a diverse range of consumers.

Individuals Seeking Debt Consolidation

Upstart serves a significant segment of individuals looking to consolidate their debts. Many borrowers turn to Upstart to combine multiple high-interest debts, often from credit cards, into a single, more manageable loan with a potentially lower interest rate. This simplifies their financial lives and can lead to substantial savings over time.

The appeal of debt consolidation through Upstart is evident in the platform's performance. For instance, in the first quarter of 2024, Upstart reported that a substantial portion of its personal loan volume was attributed to debt consolidation purposes, indicating a strong demand from consumers seeking financial relief. This strategy allows borrowers to streamline payments and reduce overall interest expenses.

- Debt Consolidation as a Primary Use Case: A large percentage of Upstart's personal loan originations are for customers consolidating existing debts.

- Financial Relief and Simplification: Borrowers benefit from lower monthly payments and a single point of contact for their debt obligations.

- Market Trend: The demand for debt consolidation solutions remains robust, with platforms like Upstart providing a key avenue for consumers to improve their financial standing.

Individuals Seeking Auto Loans and Home Equity Lines of Credit

Upstart's customer base now extends to individuals actively seeking auto loans and home equity lines of credit (HELOCs). This strategic expansion broadens their reach beyond initial unsecured personal loans, addressing more diverse consumer financial requirements. By offering these new product categories, Upstart aims to capture a larger share of the consumer lending market.

For auto loans, Upstart leverages its AI-driven approach to assess creditworthiness, potentially offering competitive rates and faster approvals for car buyers and those looking to refinance existing auto loans. This includes targeting the automotive retail sector, a significant segment of consumer credit. In 2024, the automotive loan market remained robust, with new vehicle sales projected to reach over 15.5 million units in the US.

The inclusion of Home Equity Lines of Credit (HELOCs) allows Upstart to serve homeowners looking to tap into their home's equity for various purposes, such as renovations or debt consolidation. This product line taps into a market where homeowners increasingly seek flexible financing options. The US housing market in 2024 continued to see significant equity growth, with many homeowners having substantial equity built up.

- Auto Loans: Upstart is targeting individuals seeking financing for new and used car purchases, as well as those looking to refinance their current auto loans.

- HELOCs: The company is now offering Home Equity Lines of Credit, enabling homeowners to access their home's equity for various financial needs.

- Market Reach: This diversification significantly expands Upstart's addressable market, moving beyond unsecured personal loans to capture a wider range of consumer credit needs.

Upstart's customer segments are diverse, encompassing individuals with limited credit histories and young professionals seeking accessible lending. The platform also serves near-prime and prime borrowers, along with those looking to consolidate debt.

Furthermore, Upstart has expanded its offerings to include auto loans and Home Equity Lines of Credit (HELOCs), broadening its market reach significantly.

This strategic diversification aims to cater to a wider spectrum of consumer financial needs, leveraging AI to provide competitive rates across these segments.

| Customer Segment | Key Characteristics | 2023/2024 Data Point |

|---|---|---|

| Thin Credit Files | Limited credit history, underserved by traditional lenders | 37% of 2023 loan portfolio |

| Young Professionals | 25-40 years old, educated, stable employment but limited credit history | 42% of Q4 2023 loan volume |

| Near-Prime & Prime Borrowers | Wider credit spectrum, seeking personal, auto loans, HELOCs | 61% of 2023 loan portfolio |

| Debt Consolidation Seekers | Consolidating high-interest debts (e.g., credit cards) | Significant portion of Q1 2024 personal loan volume |

| Auto Loan Seekers | Financing new/used cars, refinancing existing auto loans | US new vehicle sales projected over 15.5 million units in 2024 |

| HELOC Seekers | Homeowners accessing home equity for renovations, debt consolidation | Continued strong US housing equity growth in 2024 |

Cost Structure

A significant portion of Upstart's expenses goes into building and maintaining its technology backbone. This includes the vital cloud services, data storage solutions, robust network security, and the sophisticated machine learning platforms that power their lending decisions.

In the fourth quarter of 2023, Upstart reported technology infrastructure and development costs amounting to $37.1 million. This figure represented a substantial 23.4% of their overall operating expenses, highlighting the critical role technology plays in their business model.

Upstart's cost structure heavily features Research and Development (R&D), a critical component for its AI-driven lending platform. This investment is primarily directed towards refining and expanding its sophisticated AI algorithms and predictive models, which form the core of its business.

In 2022, Upstart reported R&D expenses of $51.1 million, underscoring the significant financial commitment to innovation. This continuous investment is absolutely essential for Upstart to maintain and enhance its competitive advantage in the rapidly evolving fintech landscape and to consistently deliver product improvements.

Upstart's cost structure is heavily influenced by its sales and marketing expenses. These costs are crucial for acquiring both individual borrowers and the financial institutions that act as lending partners on the platform. This includes significant outlays for digital advertising, salaries for the marketing and sales teams, and the resources dedicated to onboarding and supporting lending partners.

In 2024, Upstart's marketing and sales expenses represented a substantial component of its overall operating costs. For instance, the company reported $125 million in sales and marketing expenses for the first quarter of 2024, highlighting the ongoing investment required to fuel platform growth and user acquisition.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at Upstart encompass a range of essential operational costs that keep the business running smoothly. These include salaries for the team managing day-to-day operations, legal and compliance fees to ensure adherence to regulations, and the costs associated with maintaining office spaces and other general overheads. These are distinct from expenses directly linked to building their technology platform or acquiring new customers.

Upstart's approach to managing these fixed costs is a key element in their drive towards profitability. By keeping a close watch on G&A, they aim to optimize operational efficiency. For instance, in the first quarter of 2024, Upstart reported total operating expenses of $172.4 million, with G&A being a significant component of that figure, reflecting ongoing investments in their corporate infrastructure.

- Salaries for administrative and support staff

- Legal, accounting, and other professional services

- Office rent, utilities, and supplies

- Insurance and other general operational overheads

Loan Loss Provisions (for Retained Loans)

Upstart, while largely fee-driven, does set aside funds for potential losses on loans it holds. This is particularly relevant for newer ventures and research.

For instance, in the first quarter of 2024, Upstart reported $12 million in loan loss provisions. This figure reflects the company’s cautious approach to managing risk on its balance sheet, especially as it expands into areas like auto loans and home equity lines of credit (HELOCs). These provisions are crucial for covering potential defaults on the small percentage of loans it chooses to retain.

- Research and Development: Retaining a portion of loans allows Upstart to gather data and refine its AI-powered underwriting models, especially for emerging product categories.

- New Product Categories: Provisions are essential for managing the inherent risks in auto loans and HELOCs, which may have different default characteristics than personal loans.

- Balance Sheet Management: While the primary revenue comes from fees, these provisions are a necessary cost of maintaining a diversified loan portfolio and supporting innovation.

- Q1 2024 Impact: The $12 million in loan loss provisions in early 2024 highlights the direct financial impact of this strategy on Upstart's cost structure.

Upstart's cost structure is dominated by technology development and marketing. The company invested $37.1 million in technology infrastructure and development in Q4 2023, representing 23.4% of operating expenses. R&D expenses reached $51.1 million in 2022 to enhance its AI models. Sales and marketing costs were substantial, with $125 million reported in Q1 2024, reflecting a strong focus on customer and partner acquisition.

| Expense Category | Q4 2023 (Millions) | % of Operating Expenses (Q4 2023) | 2022 (Millions) | Q1 2024 (Millions) |

|---|---|---|---|---|

| Technology Infrastructure & Development | $37.1 | 23.4% | N/A | N/A |

| Research & Development (R&D) | N/A | N/A | $51.1 | N/A |

| Sales & Marketing | N/A | N/A | N/A | $125.0 |

| Loan Loss Provisions | N/A | N/A | N/A | $12.0 |

| Total Operating Expenses (Q1 2024) | N/A | N/A | N/A | $172.4 |

Revenue Streams

Upstart's main way of making money is through fees it gets when its bank and credit union partners use its AI platform to create loans. These fees cover access to the technology and for connecting borrowers with the right lenders.

In the second quarter of 2025, these fees are expected to reach $210 million. This significant amount represents about 93% of Upstart's total expected revenue for that period.

Upstart earns significant revenue from servicing loans, which involves managing the loan lifecycle for its partners. These servicing fees are a crucial component of their overall fee-based income, reflecting the value they provide in operational support.

This servicing typically includes handling payment processing, managing collections for delinquent accounts, and providing ongoing customer support to both borrowers and lenders. For example, in the first quarter of 2024, Upstart's servicing revenue was a substantial contributor to its total revenue, underscoring the importance of this income stream.

By taking on these operational burdens, Upstart allows its lending partners to focus on capital deployment rather than the intricacies of loan administration, creating a valuable service that commands a fee. This model generated over $100 million in servicing revenue for Upstart in 2023, demonstrating its financial significance.

Upstart's model, while primarily a marketplace, includes a crucial revenue stream from net interest income on loans it retains on its own balance sheet. This retention strategy is primarily for product development and testing purposes.

The interest earned on these held loans, after accounting for funding expenses and potential loan defaults, directly contributes to Upstart's overall revenue. For instance, net interest income was projected to reach $15 million in the second quarter of 2025.

Future Product Expansion Revenue

Upstart's strategic expansion into new lending verticals, such as auto loans and home equity lines of credit (HELOCs), is poised to unlock substantial future product expansion revenue. This diversification moves beyond its initial personal loan focus, tapping into larger, more established markets.

The company's performance in Q1 2025 highlights this burgeoning potential. Upstart reported significant growth in auto and home loan originations during this period, indicating strong market adoption and a clear pathway to increased revenue from these new offerings.

This expansion into auto and HELOCs not only broadens Upstart's addressable market but also allows for cross-selling opportunities to its existing customer base. The revenue generated from these new product lines is expected to become a significant contributor to overall growth in the coming years.

- Expansion into Auto Loans: Upstart's platform is increasingly being utilized for auto loan originations, a market with substantial volume.

- HELOC Originations: The introduction of HELOCs provides access to the home equity market, another significant revenue-generating opportunity.

- Q1 2025 Growth: Notable increases in originations for both auto and home loans in the first quarter of 2025 demonstrate early success and market traction.

Data and Model Licensing (Potential)

Upstart's business model includes the potential for significant revenue through data and model licensing. While not currently a primary focus, this avenue represents a scalable, high-margin opportunity. By leveraging its advanced AI and vast datasets, Upstart could license its proprietary underwriting models or anonymized data insights to other financial institutions.

This strategy would allow third parties to enhance their own risk assessment capabilities or gain valuable market intelligence. For instance, financial firms looking to improve loan origination efficiency or gain a deeper understanding of consumer creditworthiness could benefit from Upstart's technology. This B2B approach offers a pathway to diversify revenue beyond its direct-to-consumer lending platform.

- AI Model Licensing: Upstart could license its predictive AI models, which are core to its underwriting process, to banks and credit unions seeking to improve their own loan decisioning.

- Data Insights Licensing: Aggregated and anonymized data insights derived from Upstart's platform could be licensed to various industries for market research, trend analysis, or risk management.

- Partnership Opportunities: Potential exists for deeper partnerships where Upstart's technology is integrated into the platforms of other financial service providers, creating a recurring revenue stream.

- Future Revenue Growth: This licensing segment could become a substantial contributor to Upstart's overall revenue, especially as its AI capabilities continue to mature and demonstrate proven effectiveness in the market.

Upstart's revenue primarily stems from fees charged to its partner banks and credit unions for utilizing its AI-powered loan origination platform. These fees cover technology access and borrower-lender matching.

Additionally, Upstart generates revenue from servicing loans, which includes managing the loan lifecycle for its partners, covering tasks like payment processing and collections. In 2023, servicing revenue alone exceeded $100 million.

The company also earns net interest income from loans it holds on its balance sheet, mainly for product development. This income stream, projected at $15 million for Q2 2025, contributes to overall revenue.

Expansion into auto loans and HELOCs in 2025 is opening new significant revenue avenues, with Q1 2025 showing strong origination growth in these sectors.

| Revenue Stream | Primary Mechanism | 2023 Contribution (Est.) | 2025 Projections (Q2 Est.) |

| Platform Fees | Lender fees for AI platform usage | Majority of total revenue | $210 million |

| Loan Servicing Fees | Fees for managing loan lifecycle | > $100 million | Significant contributor |

| Net Interest Income | Interest on retained loans | Modest | $15 million |

| New Verticals (Auto, HELOC) | Origination and servicing fees | Nascent | Growing rapidly |

Business Model Canvas Data Sources

The Upstart Business Model Canvas is built using comprehensive market research, customer feedback, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects the business's current state and future potential.