Upstart Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Upstart Bundle

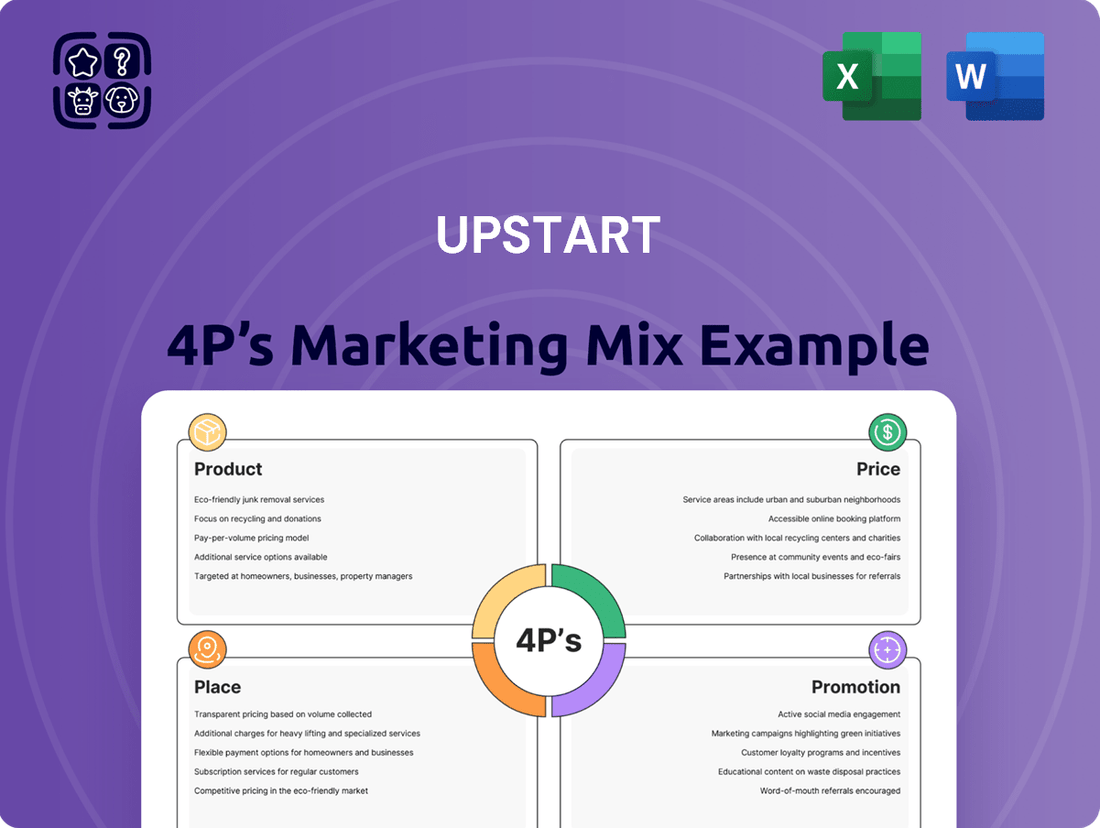

Discover how Upstart masterfully blends its product innovation, competitive pricing, accessible distribution, and impactful promotions. This analysis reveals the strategic synergy behind their market presence, offering a clear picture of their success.

Dive deeper into Upstart's go-to-market strategy; understand their product's unique value proposition, their flexible pricing models, their digital-first distribution channels, and their data-driven promotional campaigns.

This comprehensive report goes beyond the surface, providing actionable insights into Upstart's marketing engine. Learn how each "P" contributes to their growth and customer acquisition.

Unlock the full potential of your own marketing strategy by studying Upstart's proven methods. This detailed analysis is your blueprint for understanding and replicating their success.

Get immediate access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Upstart. Equip yourself with the knowledge to benchmark, strategize, and excel in your own market.

Product

Upstart's AI-powered lending platform is its core offering, using machine learning to go beyond traditional credit scores. This allows for a broader assessment of borrower risk, potentially opening up credit to more people and offering better rates. For instance, by analyzing over 1,500 data points, Upstart's AI can identify creditworthy individuals who might be overlooked by conventional methods.

The platform's continuous improvement is crucial. Upstart's latest AI models, like Model 19 launched in Q4 2024, are designed to constantly learn and adapt. This ongoing refinement in risk assessment and loan underwriting directly translates to better conversion rates for lenders and increased operational efficiency, ultimately driving more successful loan originations.

This technological edge provides a significant competitive advantage. By leveraging AI, Upstart can offer a more inclusive and efficient lending experience. In 2023, Upstart reported a 17% conversion rate for borrowers who applied through their platform, a testament to the effectiveness of their AI in matching borrowers with suitable loan products.

Upstart's product strategy has moved beyond its initial personal loan focus to encompass a wider array of lending products. This diversification is key to capturing a larger market share and mitigating risks associated with a single loan type. The company now offers automotive retail and refinance loans, home equity lines of credit (HELOCs), and small-dollar relief loans, significantly broadening its appeal.

The expansion into new lending categories is already yielding impressive growth. In the first quarter of 2025, Upstart reported a substantial fivefold increase in auto loan originations when compared to the first quarter of 2024. Furthermore, its HELOC business demonstrated remarkable momentum, doubling its volume over the same period, highlighting the success of this product diversification strategy.

Upstart's lender-focused technology solutions are designed to empower financial institutions. They provide banks and credit unions with access to Upstart's advanced AI models and cloud-based applications, aiming to improve credit product delivery. This technology is geared towards achieving higher approval rates for borrowers while simultaneously reducing loss rates for lenders.

The platform offers a comprehensive, AI-driven lending experience that can be integrated across various customer touchpoints. Whether a customer interacts in-branch, through a call center, or via digital channels, the technology supports a seamless and efficient lending process.

This B2B offering allows lending partners to effectively leverage Upstart's cutting-edge technology. By doing so, these institutions can enhance their own lending capabilities, leading to a better overall customer experience and potentially more competitive product offerings in the market.

Automated and Digital-First Experience

Upstart's product is defined by its heavily automated and digital-first customer journey. This focus on technology streamlines the entire loan application and approval process. In the fourth quarter of 2024, a remarkable 91% of loans processed by Upstart were fully automated, a figure that climbed to 92% by the first quarter of 2025. This high degree of automation is crucial for reducing operational costs and significantly shortening the time it takes for borrowers to receive a decision, often leading to instant approvals.

This seamless, digital experience directly addresses the expectations of today's consumers who prioritize speed and convenience. By eliminating manual steps and leveraging advanced algorithms, Upstart delivers an efficient and user-friendly platform that enhances customer satisfaction. The continuous improvement in automation rates from 91% to 92% between late 2024 and early 2025 underscores Upstart's commitment to optimizing its digital product offering.

- High Automation Rates: 91% of loans fully automated in Q4 2024, rising to 92% in Q1 2025.

- Cost Reduction: Automation significantly lowers operational expenses for Upstart.

- Faster Approvals: Digital-first process enables rapid, often instant, loan approvals for borrowers.

- Customer Demand: The experience aligns with modern consumers' preference for speed and digital convenience.

Enhanced Risk Assessment and Credit Access

Upstart's AI-driven approach significantly enhances risk assessment, offering lenders superior separation between high and low-risk borrowers compared to traditional FICO scores. This advanced accuracy in default prediction is a core component of their product offering.

By leveraging these sophisticated AI models, Upstart empowers lenders to approve a greater number of individuals, even those previously excluded by conventional credit scoring methods. This directly translates to expanded access to credit.

The improved predictive power also enables lenders to offer more competitive Annual Percentage Rates (APRs). In 2023, Upstart reported that 70% of their loans were approved at rates that were lower than traditional FICO-based lending offers, a testament to their enhanced risk segmentation.

- Improved Default Prediction: Upstart's AI models demonstrate a marked increase in accurately distinguishing between borrowers likely to default and those unlikely to do so.

- Expanded Credit Access: This enhanced accuracy allows for the approval of more borrowers, broadening financial inclusion.

- Lower APRs: By better understanding risk, lenders can offer more affordable interest rates, benefiting a wider range of consumers.

- 2023 Data: Approximately 70% of Upstart-approved loans in 2023 offered rates below those typically found with FICO-based lending.

Upstart's product is its AI-powered lending platform, which analyzes over 1,500 data points to assess borrower risk more comprehensively than traditional methods. This allows for broader credit access and more competitive rates, with 70% of their 2023 loans approved at rates lower than FICO-based offers.

The platform's continuous improvement, exemplified by the launch of Model 19 in Q4 2024, enhances risk assessment and underwriting, leading to improved conversion rates for lenders. This technological edge is further demonstrated by a 17% conversion rate reported in 2023.

Product diversification has expanded Upstart's reach into automotive, HELOCs, and small-dollar loans, showing significant growth. For instance, auto loan originations quintupled in Q1 2025 compared to Q1 2024, and HELOC volume doubled in the same period.

The digital-first, highly automated customer journey is a key product feature, with 91% of loans fully automated in Q4 2024, increasing to 92% in Q1 2025. This automation reduces costs and speeds up approvals, aligning with consumer demand for speed and convenience.

| Product Feature | Description | Key Data Points |

|---|---|---|

| AI-Powered Risk Assessment | Analyzes over 1,500 data points beyond traditional credit scores. | 70% of 2023 loans approved at lower APRs than FICO-based lending. |

| Continuous AI Improvement | Ongoing refinement of AI models for better risk prediction. | Model 19 launched Q4 2024; 17% conversion rate in 2023. |

| Product Diversification | Expansion into auto loans, HELOCs, and small-dollar loans. | Auto loan originations quintupled (Q1 2025 vs Q1 2024); HELOC volume doubled. |

| Digital-First Automation | Streamlined, automated loan application and approval process. | 91% automation in Q4 2024, 92% in Q1 2025. |

What is included in the product

This analysis provides a comprehensive breakdown of Upstart's marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications. It's an invaluable resource for understanding Upstart's market positioning and can be easily adapted for various professional and academic uses.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic paralysis.

Provides a clear roadmap for marketing decisions, removing the guesswork and stress of campaign planning.

Place

Upstart's online lending marketplace acts as the core engine for its business, connecting borrowers with a network of financial institutions. This digital-first approach allows for efficient loan origination and broad customer reach. In the first quarter of 2024, Upstart facilitated $1.2 billion in loan volume through its platform, demonstrating continued activity in this key area. The marketplace model is central to their strategy, enabling scalability and a wide array of lending partners.

Upstart's distribution strategy is deeply intertwined with its strategic partnerships with financial institutions. The company's AI-powered lending platform is distributed through a rapidly expanding network of banks and credit unions.

By the end of 2024, Upstart reported that more than 500 financial institutions were leveraging its AI technology. This extensive network allows Upstart to efficiently reach a broad customer base, offering its innovative loan products through trusted, established lenders.

The continuous onboarding of new lending partners underscores Upstart's commitment to scaling its distribution capabilities. These collaborations are pivotal, enabling Upstart to extend its market presence and provide access to its AI-driven loan origination and servicing solutions.

Upstart actively cultivates a diverse range of capital sources to ensure consistent loan funding. They rely on a robust network of institutional investors who purchase loans through various mechanisms like secondary loan sales, pass-through certificates, and asset-backed securitizations.

These relationships provide Upstart with a stable foundation for its operations, enabling it to navigate different economic conditions effectively. A key example of this strategy in action is their significant forward-flow agreements, which create predictable access to capital.

For instance, a substantial $1.2 billion deal with Fortress Investment Group in 2024 exemplifies Upstart's commitment to securing large-scale, ongoing funding. Such agreements are crucial for maintaining loan origination volumes and supporting their growth trajectory.

Direct-to-Consumer Digital Channels

Upstart's marketing strategy heavily relies on its direct-to-consumer digital channels, primarily Upstart.com, to attract borrowers. This approach aims to streamline the customer acquisition process, allowing potential borrowers to easily check loan eligibility and terms. This focus on a direct digital funnel is crucial for efficient customer acquisition.

The company's mobile applications also serve as a vital digital touchpoint for loan applications, further enhancing accessibility for consumers. By leveraging these digital platforms, Upstart can directly engage with its target audience and optimize the user journey from initial inquiry to loan approval. This digital-first strategy is key to Upstart's growth initiatives.

- Upstart.com as the Primary Acquisition Hub: Upstart directs the majority of its marketing spend and efforts towards driving traffic to its website, Upstart.com, where consumers can directly explore loan options.

- Streamlined Digital Application Process: The platform is designed for speed, enabling users to quickly ascertain their loan eligibility and understand the associated terms and rates.

- Mobile App Integration: Beyond the website, Upstart utilizes dedicated mobile applications as a significant channel for loan origination, catering to the growing preference for mobile-first financial interactions.

- Direct Customer Engagement: These digital channels facilitate direct communication and transaction with consumers, bypassing traditional intermediary steps and enhancing efficiency.

API Integrations and White-Label Solutions

Upstart's 'Place' strategy extends beyond direct consumer access, focusing on empowering its lending partners through API integrations and white-label solutions. This approach allows banks and credit unions to embed Upstart's AI-driven underwriting directly into their own platforms. For instance, by Q1 2024, Upstart reported that its platform originated $3.5 billion in loans, a significant portion of which was facilitated through these partner integrations.

These integrations essentially expand the distribution channels for Upstart-powered loans. By making the technology readily available and customizable, Upstart lowers the barrier to entry for financial institutions. This strategy is crucial for scaling the reach of their innovative lending model, making it available to a broader customer base through familiar banking interfaces.

- API Integrations: Enables seamless embedding of Upstart's AI into partner systems.

- White-Label Solutions: Allows partners to offer Upstart technology under their own brand.

- Expanded Reach: Increases the availability of Upstart-powered loans through partner channels.

- Q1 2024 Originations: $3.5 billion in loans originated, highlighting platform adoption.

Upstart's 'Place' is defined by its dual-pronged distribution strategy: direct-to-consumer via Upstart.com and its mobile app, and indirect distribution through partnerships with financial institutions. This multifaceted approach broadens market access and leverages existing customer bases.

By Q1 2024, Upstart's platform had originated $3.5 billion in loans, a testament to the effectiveness of its distribution channels, including integrations with over 500 financial institutions by the close of 2024. These partnerships expand Upstart's reach by embedding its AI underwriting into the platforms of banks and credit unions, effectively multiplying its distribution points.

| Distribution Channel | Key Feature | Q1 2024 Origination Volume (Partial) |

|---|---|---|

| Direct-to-Consumer (Upstart.com & Mobile App) | Streamlined online application, direct engagement | $1.2 billion (Total Loan Volume) |

| Financial Institution Partnerships (API/White-label) | Embedded AI underwriting, expanded reach through partners | $2.3 billion (Implied from total $3.5B minus direct) |

Full Version Awaits

Upstart 4P's Marketing Mix Analysis

The preview you see here is the exact, fully completed Upstart 4P's Marketing Mix Analysis document you will receive instantly after purchase. This ensures there are no surprises, and you get precisely what you expect. You are viewing the final version, ready for immediate application to your marketing strategy. This means you can confidently download and utilize this comprehensive analysis right away.

Promotion

Upstart’s digital performance marketing is a cornerstone of its borrower acquisition strategy, funneling interested individuals to its online platform. This approach leverages data and analytics to target potential customers efficiently, a key element in scaling their operations.

The company’s artificial intelligence plays a crucial role here, optimizing campaigns to reduce costs. Upstart reported a remarkable 50% decrease in customer acquisition cost (CAC) between 2019 and early 2024, even as they served a growing base of borrowers, showcasing the power of their tech-driven marketing.

Upstart's B2B strategy targets financial institutions, emphasizing how its AI technology can enhance their lending operations. This approach focuses on tangible benefits like more accurate risk assessment, leading to higher approval rates for borrowers and a reduction in operational costs for the lenders themselves.

The company actively pursues new B2B partnerships to broaden its reach within the financial sector. This proactive engagement not only aims to onboard new banks and credit unions but also encourages existing partners to scale their lending activities through Upstart's platform.

A significant indicator of success in this area is Upstart's B2B growth, with the company successfully onboarding 28 new partners in 2024. This expansion directly reflects the effectiveness of their partner acquisition and relationship-building efforts, showcasing a tangible increase in their B2B network.

Upstart leverages public relations and thought leadership, notably through events like its annual AI Day, to underscore its AI-driven transformation of lending. This proactive communication builds investor confidence by highlighting their technological prowess and unique business model, positioning them as innovators in a competitive financial landscape.

In 2023, Upstart reported that its AI-powered platform reduced default rates by 18% compared to traditional FICO scoring for borrowers with credit scores between 600 and 699. This data point, frequently shared in their PR, directly supports their claims of technological superiority and risk mitigation, crucial for attracting institutional investors.

The company's commitment to thought leadership extends to actively participating in industry conferences and publishing research on AI in finance. These efforts aim to shape the narrative around AI's potential, reinforcing Upstart's position as a vanguard, which is critical for maintaining a premium valuation and investor interest.

Strategic Co-Marketing and Brand Partnerships

Upstart actively pursues strategic co-marketing and brand partnerships to expand its market presence. A prime example is its collaboration with Walmart's OnePay, allowing Upstart to tap into Walmart's vast customer network. These alliances are designed to introduce Upstart's lending solutions to previously unreached consumer groups.

These partnerships often involve joint promotional activities, like co-branded direct mail campaigns. This strategy aims to leverage the established trust and reach of partner brands, effectively broadening Upstart's customer acquisition channels. By aligning with companies that share similar customer demographics or aspirations, Upstart can gain significant exposure.

- Walmart Partnership: Upstart's collaboration with Walmart's OnePay is a key example of leveraging partner customer bases.

- Co-branded Campaigns: Direct mail initiatives co-branded with partners extend Upstart's promotional reach.

- New Segment Access: These partnerships are instrumental in introducing Upstart's lending products to new consumer segments.

- Customer Acquisition: The strategy focuses on efficient customer acquisition by utilizing established brands.

Investor Relations and Financial Communications

Upstart's investor relations and financial communications strategy is a cornerstone of its marketing mix. By consistently engaging with the financial community, Upstart aims to foster transparency and build trust.

The company actively disseminates information through various channels, including quarterly earnings calls, investor presentations, and press releases. This proactive approach ensures that financially-literate decision-makers have access to Upstart's performance data and future plans. For instance, in their Q1 2024 earnings call, Upstart highlighted a significant increase in loan originations, demonstrating operational momentum.

Key communications focus on Upstart's growth metrics, such as the expansion of its platform and the increasing adoption of its AI-driven lending model. The company also emphasizes its profitability targets and strategic initiatives designed to enhance shareholder value. This includes detailing investments in technology and partnerships that are expected to drive long-term success.

- Consistent Reporting: Upstart regularly updates investors on its financial performance and strategic direction.

- Key Metrics Focus: Communications emphasize growth, profitability, and the effectiveness of their AI technology.

- Investor Confidence: The goal is to build investor confidence and attract necessary capital for expansion.

- Transparency: Open communication channels aim to provide clear insights into the company's operations and outlook.

Upstart's promotion strategy is multi-faceted, encompassing direct digital marketing, B2B outreach, public relations, strategic partnerships, and robust investor relations. This integrated approach aims to attract both borrowers and institutional partners by highlighting the efficiency and innovation of their AI-driven lending platform.

The company's digital marketing focuses on optimizing customer acquisition costs, reporting a 50% decrease between 2019 and early 2024. Their B2B efforts successfully onboarded 28 new partners in 2024, demonstrating growth in their financial institution network. Furthermore, collaborations like the one with Walmart's OnePay illustrate their strategy to access new consumer segments through co-marketing initiatives.

Upstart actively uses public relations and thought leadership, such as their annual AI Day, to showcase their technological advancements, like the reported 18% reduction in default rates for certain borrower segments in 2023. Investor communications emphasize growth metrics and profitability targets, fostering transparency and confidence.

Price

Upstart's AI-powered approach to lending translates directly into competitive interest rates for borrowers. By analyzing a wider array of data points beyond just traditional credit scores, Upstart can more accurately assess risk, potentially offering lower rates to a broader segment of the population.

This improved underwriting capability can lead to significant savings for consumers. For instance, prime borrowers might see interest rates that are up to 300 basis points lower than what they could obtain from traditional financial institutions, making Upstart a more attractive option.

The competitive pricing is a cornerstone of Upstart's value proposition, directly addressing a key consumer need: affordability. This focus on offering cost-effective borrowing solutions helps Upstart attract and retain customers in a crowded lending market.

Upstart's core revenue strategy is built around a fee-based model where lending partners compensate the company for originating and servicing loans. This approach keeps Upstart from taking on significant balance sheet risk, allowing it to focus on technology and platform efficiency. This fee-based revenue stream accounted for a substantial 87% of its total revenue in the first quarter of 2025, highlighting its critical importance.

Upstart's AI-driven platform facilitates dynamic, risk-based pricing, enabling precise loan cost adjustments informed by real-time data and detailed borrower assessments.

This granular methodology ensures that loan pricing accurately mirrors the perceived risk, which is crucial for optimizing both borrower accessibility to credit and lender profitability.

For instance, Upstart's AI has shown a 30% reduction in default rates compared to traditional FICO-based pricing models, demonstrating the effectiveness of its risk assessment in setting appropriate prices.

This approach allows for more competitive interest rates for lower-risk borrowers, thereby expanding access to capital while still protecting lenders from excessive risk exposure.

Transparent Fee Structures

Upstart is committed to clear fee structures for everyone involved. For borrowers, this means upfront understanding of any costs associated with their loans. This transparency builds trust and helps individuals make informed financial decisions.

For lending partners, Upstart offers a straightforward annual fee model tied to assets under management. This approach eliminates the uncertainty of additional implementation or configuration charges, allowing financial institutions to accurately budget for platform usage. For example, in 2023, Upstart reported that its platform facilitated $12.3 billion in loans, underscoring the scale at which these transparent fee structures operate.

- Borrower Transparency: Clear disclosure of loan costs and fees.

- Lender Simplicity: Annual fees based on assets under management.

- No Hidden Costs: Absence of extra implementation or configuration fees for partners.

- Predictable Budgeting: Financial institutions can forecast platform expenses with confidence.

Strategic Pricing to Drive Conversion and Growth

Upstart's pricing strategy is a key lever for boosting conversion and expanding its reach in the lending market. They focus on competitive interest rates and a streamlined application process to attract more borrowers.

This approach is evident in segments like auto loans and home equity lines of credit (HELOCs), where Upstart aims to capture greater market share by making borrowing more accessible and appealing. Their goal is to facilitate a higher volume of loan originations.

For instance, in Q1 2024, Upstart reported a 17% year-over-year increase in revenue, reaching $135 million, partly driven by the effectiveness of their pricing and platform in attracting borrowers. Their focus on a seamless digital experience, coupled with competitive pricing, is crucial for this growth.

- Competitive Rates: Upstart aims to offer interest rates that are attractive to a broad range of borrowers, balancing risk and reward.

- Frictionless Process: The company emphasizes a quick and easy online application and approval process, reducing borrower hesitation.

- Volume Growth: Strategic pricing contributes directly to increasing the number of loans originated, thereby expanding their customer base.

- Market Share Expansion: By making lending more efficient and affordable, Upstart seeks to gain a larger foothold in key lending sectors.

Upstart's pricing strategy is fundamentally tied to its AI-driven risk assessment, enabling competitive interest rates for borrowers. This allows them to offer rates that can be significantly lower, potentially up to 300 basis points less than traditional lenders for prime borrowers, making credit more accessible and affordable.

This dynamic, risk-based pricing model is a core component of their value proposition. Upstart's AI has demonstrated a 30% reduction in default rates compared to traditional FICO scoring, validating their ability to price loans accurately and profitably while expanding access.

The company's revenue relies heavily on a fee-based model, with 87% of Q1 2025 revenue derived from lending partners. This structure, coupled with transparent annual fees for partners based on assets under management, ensures predictability and avoids hidden costs, supporting a large volume of originations, such as the $12.3 billion facilitated in 2023.

| Metric | Q1 2024 | Year-over-Year Change |

|---|---|---|

| Revenue | $135 million | +17% |

| Loan Originations | $12.3 billion (2023) | N/A |

| Default Rate Reduction (vs. FICO) | 30% | N/A |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a robust blend of official company disclosures, including SEC filings and investor presentations, alongside proprietary market intelligence. We also incorporate data from leading e-commerce platforms and reputable industry research reports to provide a comprehensive view of Upstart's marketing strategy.