Upstart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Upstart Bundle

Upstart's competitive landscape is shaped by powerful forces, from the bargaining power of its borrowers to the intense rivalry among fintech lenders. Understanding these dynamics is crucial for anyone looking to grasp its market position.

The threat of new entrants and the availability of substitute products present significant challenges that Upstart must navigate. Supplier power, while perhaps less direct, also plays a role in its operational efficiency and cost structure.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Upstart’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Upstart's reliance on data for its AI-driven lending platform means data providers can hold some sway, particularly those offering unique or extensive datasets. For instance, the quality and breadth of alternative data, such as rental payment history or utility bills, are crucial for Upstart's model differentiation. While specific data providers might possess valuable proprietary information, the competitive landscape of data aggregation and the potential for Upstart to source data from multiple channels limits the bargaining power of any single supplier.

The bargaining power of suppliers for AI/ML talent and technology is a critical factor for Upstart. The demand for highly skilled AI/ML engineers and data scientists remains robust, with specialized roles commanding competitive compensation packages. This high demand means these professionals can exert considerable influence over their terms of employment.

Furthermore, Upstart's reliance on cloud infrastructure providers like Amazon Web Services (AWS) and Google Cloud Platform introduces another layer of supplier power. These essential services are fundamental to Upstart's operations, giving these large technology firms leverage in pricing and service agreements. In 2024, the global AI market size was estimated to be over $200 billion, underscoring the intense competition for AI talent and the foundational technologies that power it.

Upstart's reliance on cloud infrastructure providers like AWS, Google Cloud, and Microsoft Azure presents a moderate threat. While the market has dominant players, the significant investment and technical effort required to migrate data and applications create substantial switching costs for Upstart. This integration lock-in, coupled with the essential nature of these services for Upstart's AI platform, grants these providers a degree of bargaining power. For instance, in 2024, major cloud providers continued to see robust revenue growth, with AWS reporting $65.2 billion in revenue for 2023, underscoring their market strength and ability to influence terms.

Capital Providers (for Balance Sheet Lending)

While Upstart is primarily a platform, its direct lending activities mean capital providers act as suppliers. The cost and availability of this capital, especially from institutional investors and debt markets, directly influence Upstart's balance sheet lending operations. For instance, rising interest rates in 2024 could increase the cost of capital for Upstart.

Upstart's strategic goal to minimize loans held on its balance sheet is a direct response to managing this supplier power. By reducing its own capital requirements, Upstart aims to lessen its vulnerability to fluctuations in the cost of funding from external sources. This focus allows Upstart to concentrate on its core platform business.

- Supplier Power Impact: Upstart's reliance on external capital for its balance sheet lending exposes it to the bargaining power of capital providers.

- Cost of Capital: Changes in market interest rates and investor demand directly affect the cost Upstart incurs to fund loans it holds.

- Strategic Mitigation: Upstart's ongoing efforts to reduce its balance sheet footprint are designed to diminish this supplier influence.

- 2024 Context: In 2024, the broader economic environment, including inflation and central bank policies, significantly shaped the cost and availability of capital for financial institutions like Upstart.

Marketing and Customer Acquisition Channels

Upstart's reliance on marketing and customer acquisition channels presents a potential avenue for supplier power. Digital marketing platforms, aggregators, and direct partners, if they consolidate or raise prices, could leverage their position. For instance, a significant increase in advertising costs on major digital platforms could directly impact Upstart's customer acquisition expenses.

Upstart's strategy to counter this involves optimizing its conversion rates and focusing on efficient customer acquisition. By improving the effectiveness of its marketing spend, Upstart can reduce its dependence on any single channel. In 2024, Upstart reported a significant focus on improving its borrower conversion funnel, aiming to maximize the value derived from each acquired lead.

- Digital Marketing Dominance: Increased advertising costs on platforms like Google or Meta could squeeze Upstart's margins if not offset by higher conversion rates.

- Aggregator Dependence: If a few key loan aggregators become dominant, they could dictate terms or increase referral fees.

- Partnership Leverage: Direct lending partners, if they have alternative funding sources, might exert pressure on Upstart's fee structure.

- Mitigation through Efficiency: Upstart's ongoing efforts to enhance its AI-driven underwriting and borrower experience are designed to improve conversion rates, thereby reducing the impact of rising acquisition costs.

Upstart's bargaining power of suppliers is influenced by its need for capital, data, and specialized talent. While some suppliers like major cloud providers and AI talent possess significant leverage due to market concentration and demand, Upstart actively mitigates this. Its strategy focuses on reducing balance sheet lending and optimizing customer acquisition to lessen dependence on any single supplier.

| Supplier Category | Key Suppliers | Bargaining Power Assessment | Impact on Upstart | 2024 Context/Data |

|---|---|---|---|---|

| Capital Providers | Institutional Investors, Debt Markets | Moderate to High (due to market interest rates and investor demand) | Affects cost of funding for balance sheet loans | Rising interest rates in 2024 increased cost of capital. |

| Data Providers | Alternative data aggregators | Low to Moderate (due to multiple sourcing options and competition) | Ensures data quality for AI models | Quality and breadth of alternative data are crucial. |

| Technology Infrastructure | AWS, Google Cloud, Microsoft Azure | Moderate to High (due to switching costs and essential services) | Underpins AI platform operations | Cloud providers saw robust revenue growth in 2024. AWS reported $65.2B revenue for 2023. |

| Talent | AI/ML Engineers, Data Scientists | High (due to strong demand and specialized skills) | Drives AI model development and innovation | Global AI market size exceeded $200 billion in 2024. |

| Marketing Channels | Digital Ad Platforms, Loan Aggregators | Moderate (potential for price increases or consolidation) | Impacts customer acquisition costs | Upstart focused on improving borrower conversion funnel in 2024. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Upstart's unique position in the fintech lending space.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Individual borrowers exert moderate bargaining power. While Upstart's AI-driven platform aims to provide competitive rates and broader credit access, borrowers can readily compare offerings from traditional financial institutions, other fintech competitors, and credit unions. This ease of online research and comparison shopping significantly enhances their ability to secure the most advantageous loan terms, putting pressure on Upstart to maintain attractive pricing.

Upstart's primary customers, the banks and credit unions, wield considerable bargaining power. These institutions are constantly looking to enhance their lending operations, minimize risk, and broaden their customer base, making them discerning partners. As of the first quarter of 2024, Upstart reported that its bank partners originated $1.7 billion in loans through its platform, highlighting the scale of these relationships.

The ability of these financial institutions to explore alternatives amplifies their leverage. They can opt to build their own artificial intelligence underwriting systems, collaborate with competing fintech companies, or revert to established, albeit less efficient, traditional underwriting processes. This array of choices means Upstart must continuously demonstrate superior value and innovation to retain its partners.

The demand for loan products is a key driver of Upstart's business volume. When interest rates climb, like the Federal Reserve's series of hikes throughout 2022 and 2023, consumer borrowing often slows. This reduced demand can give potential borrowers more negotiating power, as lenders compete for their business. Conversely, in a robust economy with low unemployment and stable interest rates, borrower demand typically increases, lessening their leverage.

Access to Alternative Credit Solutions

Borrowers today possess significant bargaining power due to the proliferation of alternative credit solutions. This means individuals seeking loans aren't limited to a single provider like Upstart's network. They can readily compare options from traditional banks, credit unions, and a growing number of fintech competitors such as SoFi and LendingClub.

This increased accessibility to diverse lending channels empowers borrowers. They can leverage competitive interest rates and more favorable terms by shopping around. For instance, in 2024, the personal loan market continued to be highly competitive, with rates for borrowers with good credit often falling between 6% and 15%, allowing them to negotiate or choose the best available offer.

- Increased Lender Competition: The sheer volume of lenders, from established institutions to newer fintech platforms, creates a buyer's market for credit.

- Information Transparency: Online comparison tools and readily available rate information allow borrowers to easily identify the most attractive offers.

- Lower Switching Costs: For borrowers, the effort to switch lenders for a better deal is often minimal, further enhancing their leverage.

- Fintech Innovation: Companies like SoFi and LendingClub have actively courted borrowers with streamlined application processes and competitive pricing, directly challenging traditional models and increasing customer options.

Partner Integration and Switching Costs

The bargaining power of customers, primarily banks and credit unions in Upstart's ecosystem, is influenced by partner integration and the associated switching costs. While these institutions face some investment in time, resources, and training to integrate Upstart's AI platform, these costs are not insurmountable barriers.

If Upstart's predictive models begin to falter in performance or become economically disadvantageous, the calculus for these financial institutions shifts dramatically. The potential benefits derived from migrating to a competing technology provider or developing proprietary in-house AI solutions could then easily eclipse the initial integration expenses, thereby increasing customer leverage.

- Integration Costs: Financial institutions incur upfront costs for integrating Upstart's AI, including IT labor, system modifications, and employee training.

- Switching Costs: Beyond initial integration, ongoing data migration, retraining, and potential disruption to operations represent further switching costs.

- Performance Benchmarks: Banks often have internal benchmarks for loan origination efficiency and default rates, which Upstart must consistently meet or exceed to retain business.

- Competitive Landscape: The availability of alternative AI lending platforms or the feasibility of internal development provides a constant threat, limiting Upstart's pricing power.

Upstart's primary customers, the banks and credit unions, hold significant bargaining power. These institutions can easily switch to alternative AI lending solutions or develop their own, especially if Upstart's platform underperforms. For example, in Q1 2024, Upstart's bank partners originated $1.7 billion in loans, indicating the substantial relationships at play.

| Customer Type | Bargaining Power Factor | Impact on Upstart | Supporting Data (2024) |

|---|---|---|---|

| Financial Institutions (Banks, Credit Unions) | Availability of Alternatives & Integration Costs | High leverage due to ability to switch or build in-house, limiting Upstart's pricing power. Switching costs are manageable if performance dips. | Q1 2024 Loan Originations: $1.7 billion by bank partners. |

| Individual Borrowers | Information Transparency & Lender Competition | Moderate power, can easily compare rates across numerous fintech and traditional lenders, forcing Upstart to offer competitive pricing. | Personal loan rates for good credit often 6%-15%. |

Preview the Actual Deliverable

Upstart Porter's Five Forces Analysis

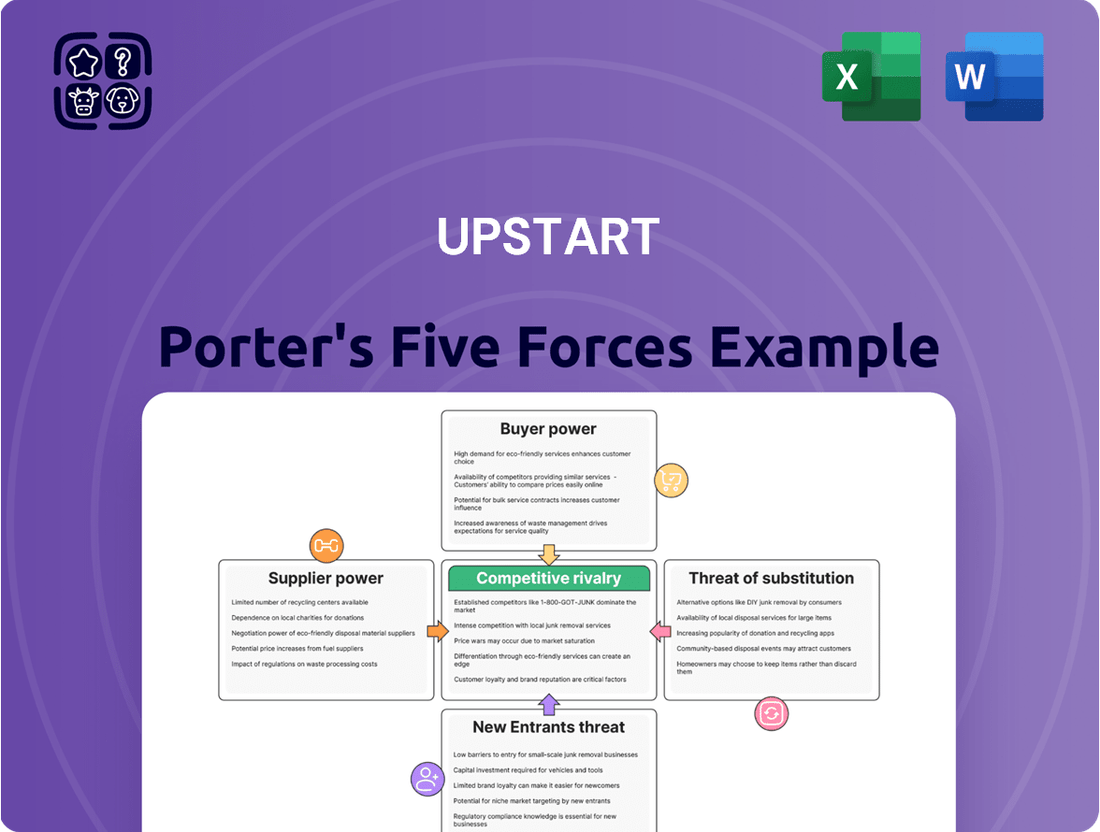

This preview showcases the complete Upstart Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape for the company. You're looking at the actual document, meaning the in-depth insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you'll receive. Once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for immediate use in your strategic planning.

Rivalry Among Competitors

Traditional banks and credit unions are formidable rivals, leveraging decades of customer trust and substantial capital. While historically slower to embrace new tech, many are now actively investing in digital transformation and AI, directly competing with Upstart's AI-driven lending model. For instance, in 2023, the US banking sector saw significant investments in technology, with many larger institutions earmarking billions for digital innovation.

These established players are not just investing in their own AI; they are also increasingly partnering with or acquiring fintech companies, further solidifying their competitive stance. This dual approach allows them to either build their own capabilities or integrate existing solutions, directly challenging Upstart's market position. By the end of 2024, it's projected that over 70% of major banks will have AI strategies in place for customer acquisition and risk management.

The competitive rivalry among other fintech lending platforms is fierce. Companies like SoFi, LendingClub, and Prosper are prominent players, each carving out their niche with distinct business models and customer focuses. This crowded landscape means intense competition for market share.

These rivals often employ AI-driven approaches similar to Upstart, but they differentiate through specialized loan offerings or unique customer engagement strategies. For instance, LendingClub has historically focused on peer-to-peer lending and personal loans, while SoFi initially targeted the refinancing of student loans. Prosper also operates in the personal loan space, often emphasizing community and borrower support.

This intense competition translates directly into price and feature wars. Fintech lenders are constantly innovating to offer more attractive interest rates, lower fees, and faster funding times to attract borrowers. The ability to offer a superior digital experience and a broader range of loan products also becomes a key differentiator in this dynamic market.

In 2023, the personal loan market, a key segment for many fintech lenders, continued to see significant volume. While specific market share data for each fintech platform is proprietary, reports indicate that the overall fintech lending sector processed hundreds of billions of dollars in loans annually, underscoring the scale of the competition.

Niche AI lending startups represent a significant competitive threat. These agile newcomers can quickly develop specialized AI models for specific lending segments, potentially outmaneuvering larger players like Upstart by offering tailored solutions. For instance, a startup focusing solely on AI-driven medical practice financing might build a more refined risk assessment model for that particular niche than a generalist platform.

The rapid pace of AI development means that even established companies can be disrupted. Startups leveraging cutting-edge machine learning techniques, perhaps focusing on alternative data sources or advanced behavioral analytics, could carve out profitable market share. This is particularly true if they can demonstrate superior risk prediction or customer acquisition costs in their chosen segment.

While Upstart reported a revenue of $1.3 billion for 2023, indicating substantial scale, the threat from nimble competitors remains. These smaller entities often have lower overhead and can pivot more rapidly to capitalize on emerging AI advancements or shifts in borrower behavior, potentially chipping away at Upstart's market share in specific lending categories.

Product Diversification and Automation

Upstart's strategic move into auto loans, home equity lines of credit (HELOCs), and small-dollar loans, coupled with its advanced automation capabilities, serves to dampen direct rivalry by expanding its market reach and operational efficiency. This diversification allows Upstart to compete across a wider spectrum of lending products, potentially capturing market share from less diversified players.

Despite Upstart's efforts, the competitive landscape remains intense as rivals also pursue product diversification and automation strategies. For instance, many traditional banks and fintech lenders are enhancing their digital offerings and expanding into new loan segments, ensuring that competitive pressures persist across various credit categories.

- Upstart's Product Expansion: Upstart has strategically broadened its offerings beyond personal loans to include auto loan refinancing, HELOCs, and small-dollar loans, aiming to capture a larger share of the consumer credit market.

- Automation as a Differentiator: The company emphasizes its high automation rates, processing a significant portion of its loans digitally from application to funding, which enhances speed and reduces operational costs.

- Industry Trend of Diversification: Competitors are mirroring this diversification, with many fintechs and established financial institutions actively developing or acquiring capabilities in auto lending and home equity products.

- Persistent Competitive Pressure: While Upstart's diversification and automation are key strengths, the concurrent efforts by competitors to adopt similar strategies mean that competitive intensity remains high across all these lending verticals.

Macroeconomic Sensitivity

The lending sector, including AI-driven lending, faces significant pressure from macroeconomic shifts. Factors like rising interest rates and economic slowdowns directly affect loan demand and borrower creditworthiness. For instance, in early 2024, the Federal Reserve's continued stance on interest rates, with the federal funds rate holding steady in the 5.25%-5.50% range, put a damper on new loan origination volume across the industry, intensifying competition.

These macroeconomic conditions can also erode investor confidence in the lending market, making it harder for companies like Upstart to secure the funding needed for their operations. When the economic outlook darkens, lenders often tighten their standards, leading to a smaller pool of eligible borrowers. This forces companies to compete more fiercely for these limited opportunities, potentially driving down pricing and margins.

- Interest Rate Sensitivity: Higher interest rates increase the cost of capital for lenders and can reduce consumer demand for loans, impacting origination volumes.

- Economic Downturns: Recessions lead to increased default rates, hurting lender profitability and making it harder to attract investment.

- Credit Performance: Macroeconomic factors directly influence the credit quality of borrowers, affecting overall portfolio performance and competitive positioning.

- Funding Availability: During economic uncertainty, the cost and availability of funding for lenders can fluctuate significantly, impacting their ability to compete.

The competitive rivalry in the lending sector, particularly for AI-driven platforms like Upstart, is characterized by a mix of established financial institutions, other fintech companies, and emerging niche startups. Traditional banks, despite their historical slowness to adopt technology, are now heavily investing in digital transformation and AI, directly challenging Upstart's model. For instance, many large US banks allocated billions to technology in 2023, with over 70% expected to have AI strategies by the end of 2024.

Fintech rivals such as SoFi, LendingClub, and Prosper are actively competing by offering specialized loan products and unique customer experiences, often employing similar AI-driven risk assessment. This leads to intense competition on pricing, fees, and speed of funding. The personal loan market, a key area for these platforms, saw hundreds of billions of dollars processed annually by the fintech sector in 2023, highlighting the scale of competition.

Niche AI lending startups pose a threat by developing highly specialized AI models for specific market segments, potentially outperforming generalist platforms. While Upstart reported $1.3 billion in revenue for 2023, these agile competitors can quickly adapt to new AI advancements. Upstart's expansion into auto loans and HELOCs aims to mitigate direct rivalry, but competitors are also diversifying and automating their operations, keeping competitive pressures high across various lending verticals.

| Rival Category | Key Characteristics | Competitive Tactics | Example Players |

| Traditional Banks | Established trust, substantial capital, increasingly digital | Investing in AI, digital transformation, acquiring fintechs | JPMorgan Chase, Bank of America |

| Fintech Lenders | Agile, tech-focused, diverse business models | AI-driven risk assessment, specialized products, competitive pricing | SoFi, LendingClub, Prosper |

| Niche AI Startups | Highly specialized AI models, focus on specific segments | Tailored solutions, advanced machine learning, alternative data | (Specific names often emerge and evolve rapidly) |

SSubstitutes Threaten

For borrowers, traditional credit products offered by established financial institutions like banks and credit unions continue to be strong substitutes. These include well-understood options such as personal loans, credit cards, and lines of credit, often evaluated using traditional FICO scores. Despite Upstart's advancements in AI-driven lending, many consumers still prefer or are accustomed to their existing banking relationships, making these traditional products a persistent alternative.

Alternative lending models present a significant threat of substitutes for Upstart's core business. Beyond traditional banking, platforms offering peer-to-peer loans, buy now, pay later (BNPL) options, and direct online lending outside of Upstart's technology provide borrowers with diverse choices. These substitutes often feature different interest rates, repayment structures, and application processes, potentially attracting segments of the market that Upstart aims to serve.

For instance, the BNPL market has seen explosive growth, with global transaction values projected to reach over $6.1 trillion by 2030, according to Statista. This indicates a strong and expanding alternative for consumers seeking point-of-sale financing, directly competing with personal loans facilitated by Upstart's partners. Similarly, P2P lending platforms continue to evolve, offering tailored credit solutions that can bypass traditional underwriting, thereby siphoning off potential borrowers.

Large financial institutions possess the capital and expertise to build their own AI underwriting platforms, directly competing with Upstart. This internal development bypasses the need for third-party solutions, especially for banks with substantial tech investments. For example, many large banks consistently allocate billions to technology annually; in 2023, major US banks spent tens of billions on IT, a figure expected to grow.

Embedded Finance Solutions

The increasing prevalence of embedded finance solutions poses a significant threat to platforms like Upstart. This trend involves non-financial companies integrating financial services directly into their customer journeys. For instance, a retail platform might offer buy-now-pay-later options at checkout, or a SaaS provider could embed payment processing. This convenience directly competes with traditional lending channels.

These embedded offerings provide a highly streamlined and often more accessible alternative for consumers seeking financial products. By removing the need to navigate separate financial institutions or comparison sites, embedded finance reduces friction and can capture market share. This can lead to a decline in direct customer acquisition for standalone lending platforms.

The market for embedded finance is experiencing rapid growth. By 2028, the global embedded finance market is projected to reach $7.2 trillion, demonstrating a substantial shift in how financial services are accessed. This growth highlights the increasing competitive pressure from these integrated solutions.

- Increased Convenience: Embedded finance offers a frictionless experience, integrating financial products directly into existing user workflows.

- Market Penetration: Non-financial companies can leverage their large customer bases to distribute financial services, bypassing traditional channels.

- Data Advantage: Companies embedding finance often have rich customer data, enabling more personalized and potentially faster loan approvals.

- Competitive Pressure: Platforms like Upstart face direct competition as consumers opt for integrated financial solutions rather than standalone services.

Government Programs and Non-Profit Lending

Government programs and non-profit lending can act as substitutes for Upstart's services, especially for specific borrower segments or loan purposes. These initiatives, though not always directly commercial, provide alternative credit sources that can shrink the market Upstart aims to serve. For instance, the U.S. Small Business Administration (SBA) offers various loan programs that compete with private lenders for small business financing.

These alternative lending avenues can divert potential customers, impacting Upstart's transaction volume. Consider the USDA's Rural Development programs, which provide financing for rural businesses and individuals, offering a substitute for conventional loans in those areas. Such programs can be particularly attractive due to potentially favorable terms or eligibility criteria not always met by private platforms.

- Government-backed loans: Programs like those from the SBA or USDA offer alternative financing, particularly for small businesses and those in specific geographic areas.

- Non-profit lending: Community Development Financial Institutions (CDFIs) and other non-profits provide credit access to underserved populations, acting as substitutes for traditional and online lenders.

- Impact on addressable market: The availability of these alternative options can reduce the number of potential customers seeking loans through platforms like Upstart, especially if they offer more accessible or specialized terms.

The threat of substitutes for Upstart is significant, encompassing traditional banking, alternative lending models, and embedded finance. Consumers have a wide array of choices beyond Upstart's AI-driven platform, including well-established bank loans and credit cards, peer-to-peer lending, and buy now, pay later services. Many of these substitutes offer similar or even more convenient access to credit, directly challenging Upstart's market position.

The burgeoning embedded finance sector, projected to reach $7.2 trillion globally by 2028, exemplifies this threat. Non-financial companies integrating financial services into their customer journeys provide a seamless, often data-driven alternative. This trend means consumers can access credit at the point of need, such as during online purchases, bypassing the need to engage with dedicated lending platforms.

Furthermore, large financial institutions are increasingly developing their own AI underwriting capabilities, reducing their reliance on third-party solutions like Upstart. With billions invested annually in technology, these incumbents can replicate or surpass Upstart's offerings internally. Government and non-profit programs also serve as substitutes, particularly for specific borrower segments, diverting potential customers with tailored or subsidized credit options.

| Substitute Type | Key Characteristics | Market Trend/Size Example | Impact on Upstart |

| Traditional Banking | Established relationships, FICO scores, personal loans, credit cards | Billions in annual IT spending by major US banks (2023) | Persistent preference, familiar processes |

| Alternative Lending | P2P loans, BNPL, direct online lending | BNPL global transaction value > $6.1 trillion by 2030 (Statista) | Diverse borrower options, varied terms |

| Embedded Finance | Integrated financial services in non-financial platforms | Global market projected at $7.2 trillion by 2028 | Frictionless access, data advantage for providers |

| Government/Non-profit | SBA loans, USDA programs, CDFIs | Targeted lending for specific segments (e.g., rural areas, underserved populations) | Reduced addressable market, specialized competition |

Entrants Threaten

New entrants confront a substantial hurdle in amassing and analyzing the immense volume and variety of data essential for training effective AI credit assessment models. This data-intensive nature requires significant upfront investment in infrastructure and data acquisition strategies.

Furthermore, the competition for specialized AI and machine learning talent is fierce, driving up recruitment and retention costs. Companies like Upstart, which have invested heavily in proprietary AI, demonstrate the high cost of building and maintaining this expertise, a barrier for many potential newcomers.

In 2024, the demand for AI specialists continued to outstrip supply, with average salaries for senior machine learning engineers often exceeding $200,000 annually, underscoring the financial commitment required to build a competitive AI capability.

The financial services industry is a minefield of regulations, and AI lending adds even more complexity. Newcomers must contend with strict rules on fair lending, identifying and mitigating bias in algorithms, and safeguarding customer data privacy. For instance, in 2024, regulators like the CFPB continued to emphasize scrutiny over AI-driven credit decisions, signaling a challenging environment for new entrants.

Getting a foothold requires mastering a labyrinth of licensing requirements and compliance frameworks. These processes are not only costly but also incredibly time-consuming, acting as a significant barrier. The evolving nature of regulatory oversight means that even established players must constantly adapt, making it even tougher for new companies to establish themselves without substantial resources and expertise.

Access to capital and a robust funding network presents a significant hurdle for new entrants in the lending space. Establishing trust with traditional financial institutions like banks and credit unions, and securing consistent capital for loan origination, is crucial even for platform-based models. This process demands considerable time and investment, as new players must prove their model's accuracy and reliability to attract and retain these vital partners.

Brand Recognition and Trust

Brand recognition and trust are significant barriers to entry in the financial services sector, particularly for companies like Upstart that utilize innovative AI-driven platforms. Building this trust with both consumers seeking loans and financial institutions partnering for lending takes considerable time and a proven track record of consistent performance. Upstart has actively focused on cultivating its brand identity and showcasing the effectiveness of its AI-powered loan origination system.

New competitors entering this space would face the substantial challenge of replicating Upstart's established brand equity and the deep-seated trust it has cultivated with its user base and partners. This requires not only technological parity but also a sustained effort to demonstrate reliability and superior outcomes. For instance, by the end of 2023, Upstart reported facilitating $27.9 billion in total loan volume, a testament to the growing acceptance and trust in its platform.

- Brand Loyalty: Upstart's investment in brand building aims to foster loyalty among borrowers and lending partners, making it harder for new entrants to attract customers.

- Demonstrated Efficacy: The consistent performance of Upstart's AI models in assessing creditworthiness has built confidence, a hurdle new entrants must overcome.

- Regulatory Landscape: Navigating the complex regulatory environment in financial services requires established trust and compliance frameworks that new players must build from scratch.

- Customer Acquisition Costs: Overcoming brand recognition challenges often translates to higher initial customer acquisition costs for new entrants compared to established players.

Network Effects and Scale Advantages

Upstart’s business model is significantly reinforced by powerful network effects, creating a formidable barrier to entry. As more borrowers utilize Upstart’s platform, it attracts a greater number of lending partners, which in turn allows Upstart to offer more competitive rates and a wider range of loan products to borrowers. This self-reinforcing cycle makes it challenging for new entrants to gain traction. By the end of 2023, Upstart reported facilitating over $30 billion in total loan volume, a testament to the scale it has achieved.

New entrants would struggle to replicate the established relationships Upstart has cultivated with its extensive network of financial institutions. This existing ecosystem of partners is crucial for providing liquidity and competitive pricing, advantages that are difficult and time-consuming to build from scratch. In 2023, Upstart's platform processed applications from millions of consumers, underscoring the breadth of its reach and the depth of its user base, which new competitors would need years to match.

- Network Effect: More borrowers attract more lenders, and more lenders attract more borrowers, creating a positive feedback loop.

- Scale Advantage: Upstart’s established user base and partner network represent a significant hurdle for new entrants aiming to achieve critical mass.

- Relationship Capital: Years of building trust and integration with lending partners are difficult for new players to replicate quickly.

The threat of new entrants for Upstart is significantly mitigated by the immense capital required for data acquisition and AI model development. Furthermore, the intense competition for specialized AI talent, with senior machine learning engineers commanding salaries over $200,000 in 2024, presents a substantial financial barrier. Navigating the complex and evolving regulatory landscape, as emphasized by continued scrutiny from bodies like the CFPB in 2024, adds another layer of difficulty for any newcomer. Building the necessary brand recognition and trust, exemplified by Upstart facilitating $27.9 billion in loan volume by the end of 2023, also demands considerable time and investment, making it hard for new players to compete effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including company annual reports, industry-specific market research, and government economic data. This ensures a comprehensive understanding of the competitive landscape.