Tupy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tupy Bundle

Tupy's robust operational efficiency and strong brand reputation are significant strengths, positioning them well in the competitive manufacturing sector. However, potential reliance on specific markets and evolving global regulations present key challenges that warrant careful consideration.

Discover the complete picture behind Tupy's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to understand their competitive landscape.

Strengths

Tupy stands as a recognized global leader in the metal casting and engine components sector, a position cemented by its deep-seated expertise in metallurgy and advanced casting techniques. The company's enduring reputation for producing high-quality cast iron and ductile iron components makes it a preferred partner across various demanding industries.

This market dominance is a direct result of decades of accumulated knowledge and consistent investment in technological innovation. For instance, Tupy's commitment to advanced manufacturing processes, including its significant investments in automation and digitalization, has allowed it to maintain a competitive edge. In 2023, Tupy reported revenues of approximately R$8.5 billion (around $1.7 billion USD), underscoring its substantial global market presence.

Tupy boasts a highly diversified product portfolio, manufacturing a wide array of cast iron components. These include essential parts like engine blocks and cylinder heads, serving crucial roles in the automotive, commercial vehicle, agricultural, and industrial markets. This broad reach across various sectors significantly mitigates the risk associated with over-reliance on any single industry, offering a robust defense against sector-specific economic fluctuations.

Tupy's financial health is exceptionally strong, underscored by a low net debt-to-EBITDA ratio, which provides significant flexibility for strategic investments and navigating economic shifts.

The company demonstrated remarkable operational prowess in 2024, achieving a record R$1.4 billion in cash generation. This robust cash flow, coupled with an Adjusted EBITDA of R$1.3 billion, highlights Tupy's efficiency even amidst a challenging market environment.

Strategic Focus on Decarbonization and Aftermarket

Tupy's strategic emphasis on decarbonization is a significant strength, evident in its development of new engine technologies and biofuel solutions. This forward-looking approach positions the company to capitalize on the global shift towards sustainable mobility. The company's patent for vermicular cast iron alloys is particularly noteworthy, as this material is essential for creating high-efficiency engine blocks, a critical component in modern, cleaner engines.

The expansion of Tupy's aftermarket segment, bolstered by acquisitions like MWM, provides a crucial counter-cyclical revenue stream. This diversification helps to stabilize earnings, offering resilience even when new vehicle production experiences slowdowns. In 2024, Tupy reported that its aftermarket business continued to demonstrate robust performance, contributing significantly to overall revenue stability.

- Decarbonization Focus: Development of advanced engine technologies and biofuel solutions.

- Material Innovation: Patent for vermicular cast iron alloys for high-efficiency engines.

- Aftermarket Growth: Acquisition of MWM strengthens aftermarket presence.

- Revenue Stability: Aftermarket segment provides an anti-cyclical buffer against new vehicle production volatility.

Advanced R&D and Innovation Capabilities

Tupy's dedication to cutting-edge research and development is a significant advantage. The company actively invests in R&D and fosters innovation through programs like Tupy Tech and the ShiftT accelerator. These initiatives are crucial for Tupy to maintain its technological leadership, pioneer new materials, and proactively address emerging market needs, particularly in sectors like biofuels and hydrogen technologies.

This focus on advanced R&D translates into tangible benefits. For instance, Tupy’s investment in developing hydrogen-compatible components positions it well for the growing green energy transition. In 2023, Tupy reported significant capital expenditures focused on innovation and capacity expansion, underscoring their commitment to staying ahead in technological advancements.

- Commitment to Innovation: Proven through substantial R&D investments and dedicated innovation programs.

- Technological Advancement: Enables development of new materials and solutions for future markets.

- Market Anticipation: Proactively addresses evolving industry needs, especially in green technologies.

- Strategic Investments: Capital expenditures in 2023 highlight a focus on R&D and future growth.

Tupy's strengths lie in its established global leadership in metal casting and engine components, supported by deep metallurgical expertise and advanced casting techniques. Its reputation for high-quality components makes it a preferred partner across demanding industries, a position reinforced by consistent investment in innovation, including automation and digitalization. The company's substantial market presence was evident in its 2023 revenue of approximately R$8.5 billion.

Tupy's diversified product portfolio, serving critical roles in automotive, commercial vehicle, agricultural, and industrial markets, offers robust protection against sector-specific economic downturns. This diversification is further enhanced by a strong financial position, characterized by a low net debt-to-EBITDA ratio. The company's operational efficiency was highlighted in 2024 with a record R$1.4 billion in cash generation and an Adjusted EBITDA of R$1.3 billion.

A significant strategic advantage is Tupy's focus on decarbonization, demonstrated through the development of new engine technologies and biofuel solutions, positioning it for the sustainable mobility transition. Its patent for vermicular cast iron alloys is key for high-efficiency engines. Furthermore, the expansion of its aftermarket segment, notably through the MWM acquisition, provides a vital counter-cyclical revenue stream, stabilizing earnings during periods of reduced new vehicle production. Tupy's aftermarket business showed robust performance in 2024, contributing to revenue stability.

Tupy's commitment to innovation, evidenced by substantial R&D investments and programs like Tupy Tech and ShiftT, enables it to maintain technological leadership and develop solutions for emerging markets, including biofuels and hydrogen technologies. This forward-thinking approach is supported by capital expenditures in 2023 aimed at innovation and capacity expansion, ensuring Tupy remains at the forefront of technological advancements and market anticipation.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Market Leadership & Expertise | Global leadership in metal casting and engine components | Recognized for deep metallurgical expertise and advanced casting techniques. |

| Financial Health & Performance | Strong cash generation and low debt | Record R$1.4 billion cash generation in 2024; low net debt-to-EBITDA ratio. |

| Product Diversification & Aftermarket | Broad product portfolio and growing aftermarket | Serves automotive, agricultural, and industrial sectors; MWM acquisition strengthens aftermarket. Aftermarket showed robust performance in 2024. |

| Innovation & Sustainability | Focus on decarbonization and R&D | Development of biofuel solutions and hydrogen-compatible components; patent for vermicular cast iron alloys. Significant R&D investment in 2023. |

What is included in the product

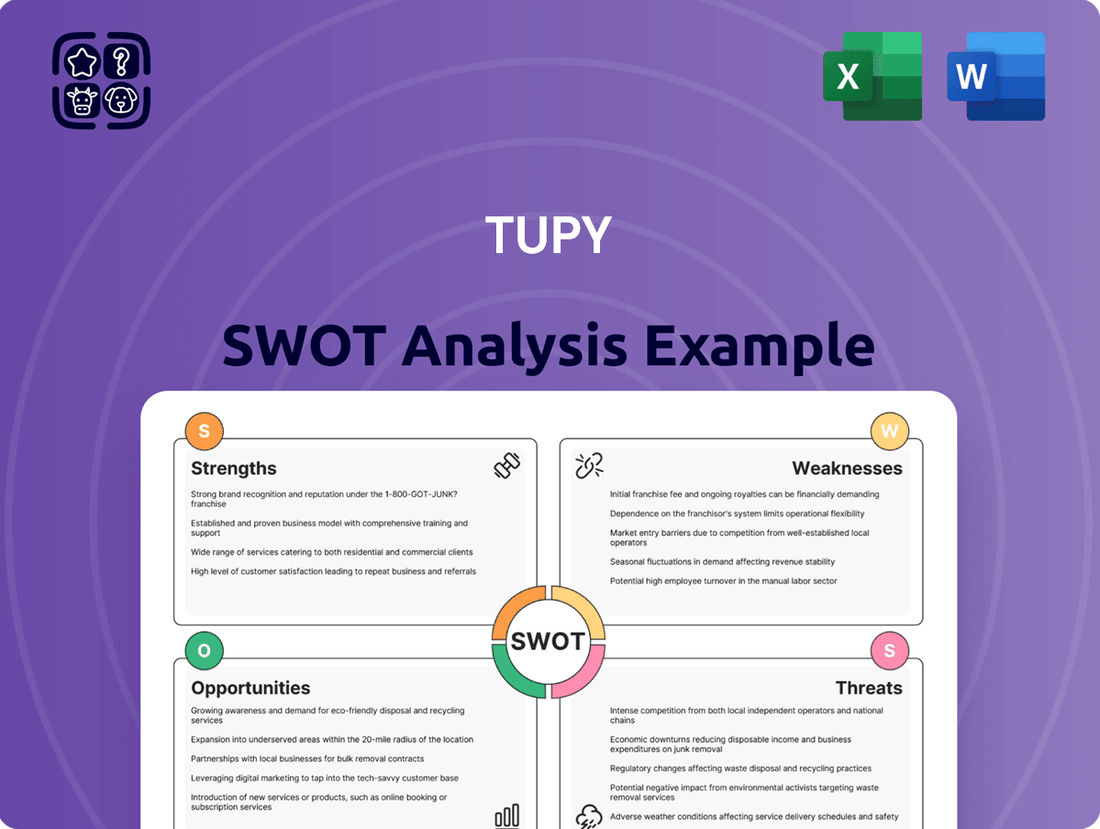

Delivers a strategic overview of Tupy’s internal strengths and weaknesses, alongside external market opportunities and threats.

The Tupy SWOT Analysis offers a structured framework to identify and address operational challenges, transforming potential weaknesses into actionable strategies for growth.

Weaknesses

Tupy has experienced a notable downturn in its financial performance. In the first quarter of 2025, the company reported a net loss of BRL 12.44 million, a stark contrast to the BRL 111.75 million net income achieved in the same period of 2024. This downward trend continued throughout 2024, with net income falling significantly to BRL 79.51 million, a sharp decrease from BRL 508.14 million in 2023. These figures clearly highlight a period of financial contraction and increasing profitability challenges for the company.

Tupy has faced a significant downturn in sales, with a 4% year-on-year decrease in the first quarter of 2025. This brought their sales volume down to BRL 2.48 billion. The primary culprits behind this decline are weaker demand in the commercial vehicles market and reduced activity in off-road applications.

Looking at the full year 2024, Tupy's net revenue also saw a contraction, falling by 6% when compared to 2023. This revenue dip is directly linked to a substantial reduction in physical sales volume, estimated to be around 20% for the year.

Tupy is currently experiencing significant margin pressures, largely driven by inflationary cost increases and the challenge of underutilized capacity, especially within its Mexican manufacturing facilities. This idle capacity, while actively being addressed by management through reallocation efforts, is currently a drag on the company's overall profitability. These operational inefficiencies directly contribute to a noticeable reduction in Tupy's gross margins.

Exposure to Cyclical Industries

Tupy's significant reliance on the automotive and heavy-duty vehicle sectors means it's susceptible to the natural ups and downs of these industries. This can lead to unpredictable swings in demand for its products, affecting its overall performance.

Looking ahead to 2025, market forecasts suggest a notable downturn in the U.S. heavy-duty vehicle market. This projected decline is a direct threat to Tupy's sales volumes and could negatively impact its profitability.

- Cyclical Industry Dependence: Tupy's core business is tied to the automotive and heavy-duty truck sectors, which are inherently cyclical.

- 2025 Market Projections: Anticipated significant declines in the U.S. heavy-duty vehicle market for 2025 pose a direct risk.

- Impact on Sales and Profitability: The industry downturn is expected to reduce Tupy's sales volumes and squeeze profit margins.

Impact of Exchange Rate Fluctuations

Tupy faces significant challenges from fluctuating exchange rates, which can directly impact its profitability. For instance, if the Mexican peso strengthens or the Brazilian real weakens against the U.S. dollar, Tupy's reported revenues in local currencies can decrease. This currency volatility also affects the company's tax liabilities in different operating regions.

These unfavorable currency movements can erode the value of sales made in weaker currencies when translated back into Tupy's reporting currency. For example, if Tupy sells products in Brazil and the real depreciates, the dollar value of those sales shrinks, even if the unit volume remains the same. This directly impacts the top line and subsequent profit margins.

- Currency Volatility: Unfavorable movements, like a stronger Mexican peso or weaker Brazilian real against the U.S. dollar, negatively affect Tupy's financial performance.

- Revenue Reduction: Currency depreciation in key markets can lead to lower reported revenues when translated into the company's primary reporting currency.

- Tax Base Impact: Fluctuations in exchange rates can alter the taxable income calculated in local currencies, potentially leading to unexpected tax liabilities or benefits.

- Operational Costs: While not explicitly stated in the prompt, imported raw materials or components priced in stronger currencies can also increase operational costs for Tupy.

Tupy's profitability is being squeezed by rising costs and underutilized production capacity, particularly in Mexico. This idle capacity acts as a drag on earnings and directly impacts gross margins, highlighting operational inefficiencies that management is working to address.

The company's heavy reliance on the automotive and heavy-duty vehicle sectors makes it vulnerable to industry cycles. Projections for a downturn in the U.S. heavy-duty market in 2025 are a direct threat, potentially reducing sales volumes and further pressuring profitability.

Fluctuating exchange rates present another significant weakness. A stronger Mexican peso or a weaker Brazilian real against the U.S. dollar can reduce reported revenues and impact tax liabilities across its operating regions.

| Financial Metric | 2023 | 2024 | Q1 2025 |

|---|---|---|---|

| Net Revenue (BRL billion) | 12.08* | 11.35 | 2.48 |

| Net Income (BRL million) | 508.14 | 79.51 | -12.44 |

| Sales Volume Change (%) | N/A | -20% | -4% |

What You See Is What You Get

Tupy SWOT Analysis

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

Opportunities

Tupy's strategic expansion into the Energy & Decarbonization sector, offering solutions for biofuels, natural gas, biogas, biomethane, and hydrogen engines, represents a substantial growth avenue. This move directly addresses the escalating global demand for sustainable infrastructure and environmentally friendlier industrial operations, establishing Tupy as a key player in the low-emission technology market.

Tupy's acquisition of the MWM brand significantly bolsters its aftermarket business, evidenced by a 30% year-on-year growth in this division. This segment provides a resilient revenue stream, largely unaffected by the cyclical nature of new vehicle manufacturing.

This strategic move allows Tupy to tap into MWM's established brand recognition, facilitating global expansion of its spare parts distribution for diverse machinery sectors. The focus remains on strengthening distribution channels and leveraging existing brand equity.

Tupy is poised for significant growth through new contract wins. A key opportunity lies in producing engines for a revived U.S. pickup truck model, alongside engine blocks for major heavy truck manufacturers, which are projected to drive sales in the latter half of 2025. These secured orders are a testament to Tupy's manufacturing capabilities and market positioning.

The domestic market also presents compelling recovery prospects. Brazil's heavy-duty production sector is anticipated to rebound, and growth in off-road applications is expected to accelerate. This dual uplift in both new international contracts and domestic market recovery provides a strong foundation for Tupy's sales and profitability in 2024 and 2025.

Leveraging ESG Leadership for Financing and Partnerships

Tupy's robust Environmental, Social, and Governance (ESG) standing, notably its position in the top percentile of its industry and an improved MSCI ESG rating, unlocks significant avenues for green financing and strategic alliances. This dedication to sustainable practices makes Tupy a more appealing prospect for both investors and potential partners who prioritize environmentally conscious enterprises.

This enhanced ESG profile directly translates into tangible financial benefits. For instance, companies with strong ESG ratings often gain access to a wider pool of capital, including dedicated green bonds and sustainability-linked loans, which can offer more favorable interest rates. In 2024, the global sustainable finance market continued its robust growth, with green bond issuance projected to reach new highs, demonstrating a clear investor appetite for companies demonstrating strong ESG credentials.

Furthermore, Tupy's commitment to ESG principles can foster deeper, more resilient partnerships. Businesses increasingly seek to align their supply chains and collaborative efforts with organizations that share their values regarding environmental stewardship and social responsibility. This can lead to more stable long-term agreements and co-investment opportunities in sustainable initiatives.

- Enhanced Access to Capital: Tupy's leading ESG score makes it a prime candidate for green financing instruments, potentially lowering its cost of capital.

- Investor Attraction: A strong ESG profile appeals to a growing segment of investors focused on long-term value creation and risk mitigation.

- Strategic Partnership Advantages: Sustainability-focused companies are more likely to partner with Tupy, creating opportunities for joint innovation and market expansion in eco-friendly sectors.

Geographical Market Diversification

Tupy's presence in key markets like Brazil, Mexico, the United States, and Europe inherently diversifies its revenue streams, mitigating risks associated with economic downturns in any single region. This geographical spread allows the company to navigate varying market conditions effectively. For instance, while some European markets might face slower growth in 2024, Tupy's operations in North America could benefit from increased industrial activity.

Furthermore, Tupy is strategically positioned to leverage emerging opportunities arising from new trade agreements and investments in domestic infrastructure within its export markets. For example, anticipated infrastructure spending in the United States in 2024-2025, potentially boosted by legislative initiatives, could drive demand for Tupy's components in sectors like transportation and energy. This adaptability ensures Tupy can capitalize on shifting global trade dynamics.

- Global Footprint: Tupy operates in Brazil, Mexico, the United States, and Europe, offering significant geographical diversification.

- Market Adaptability: The company can adjust to evolving trade dynamics by leveraging opportunities in different regions.

- Infrastructure Focus: Tupy is poised to benefit from increased infrastructure investments in key export markets, such as the anticipated U.S. infrastructure spending in 2024-2025.

- Risk Mitigation: Diversification across multiple economies helps Tupy reduce its exposure to sector-specific or region-specific economic challenges.

Tupy's expansion into the burgeoning Energy & Decarbonization sector, focusing on components for biofuels, natural gas, and hydrogen engines, presents a significant growth opportunity. This strategic pivot aligns with global trends towards sustainable infrastructure, positioning Tupy to capitalize on the increasing demand for low-emission technologies.

The company's aftermarket business, significantly boosted by the MWM acquisition, achieved a 30% year-on-year growth, demonstrating resilience and providing a stable revenue stream independent of new vehicle production cycles. This expansion into aftermarket services leverages MWM's brand recognition for global reach.

Tupy is set to benefit from new contract wins, including components for a revived U.S. pickup truck model and engine blocks for major heavy truck manufacturers, projected to drive sales in late 2025. Furthermore, the anticipated rebound in Brazil's heavy-duty production and growth in off-road applications further bolster domestic sales prospects for 2024-2025.

Threats

The rapid global shift towards electric vehicles (EVs) presents a considerable challenge for Tupy. As the automotive industry increasingly favors EVs, the demand for traditional iron castings, a core Tupy product, is likely to decline.

This industry evolution is compounded by the growing use of lightweight materials, such as aluminum, in vehicle manufacturing. For example, by 2025, it's projected that the average EV will utilize a higher proportion of aluminum compared to traditional internal combustion engine vehicles, impacting Tupy's established iron casting market.

Failure to adapt by investing in and developing expertise in EV-specific components and lightweight materials could lead to a significant erosion of Tupy's market share in the automotive sector.

The strategic pivot required to embrace EV technologies and alternative materials demands substantial investment, posing a financial risk if not managed effectively.

A projected significant contraction in U.S. heavy-duty vehicle markets for 2025, alongside persistently weak demand for commercial vehicles and off-road applications across North America and Europe, poses a direct threat to Tupy's sales volumes and overall profitability. This downturn in critical sectors directly impacts Tupy's core business, potentially leading to reduced order intake and pressure on margins.

The continuation of U.S. trade tariffs presents a considerable threat to Tupy, potentially inflating costs and diminishing its competitive edge in crucial export destinations. For instance, in 2023, Brazil's total exports to the United States faced headwinds, with some sectors experiencing direct impacts from existing tariff structures.

The possibility of new tariffs being implemented further amplifies this risk, creating uncertainty for Tupy's international sales strategies. Global trade policy shifts can rapidly alter market access and pricing power.

Beyond direct tariffs, broader geopolitical tensions and the resulting supply chain instability contribute to escalating manufacturing expenses for Tupy. These disruptions can lead to production delays and increased operational costs, impacting profitability and delivery timelines.

For example, in early 2024, disruptions in key shipping lanes due to geopolitical events led to significant increases in freight costs for many industries, a challenge Tupy likely navigated as well.

Economic Pressures and Consumer Behavior

Global economic headwinds are a significant threat to Tupy. High vehicle prices, exacerbated by supply chain issues and inflation, are already making consumers hesitant to purchase new vehicles, which directly impacts demand for automotive components. For instance, the average price of a new car in the US hovered around $48,500 in early 2024, a substantial barrier for many buyers.

Rising consumer debt levels further compound these economic pressures. With interest rates remaining elevated, households are likely to prioritize essential spending over discretionary purchases, including big-ticket items. This cautious consumer sentiment translates into reduced demand across Tupy's served industries, potentially leading to slower sales growth and impacting revenue projections for 2024 and 2025.

Potential policy shifts, such as changes in trade tariffs or economic stimulus measures, could also introduce uncertainty and negatively affect Tupy's operational costs and market access. These external economic factors create an environment where demand for Tupy's products could be constrained.

- Constrained Demand: Elevated vehicle prices and consumer debt are likely to limit consumer spending on large purchases.

- Industry-Wide Impact: The broader economic slowdown can dampen demand for Tupy's components across all its key markets.

- Policy Uncertainty: Potential changes in government economic policies can introduce risks to Tupy's operations and market stability.

Increased Competition and Market Dynamics

The automotive sector is seeing a significant surge in competition. Established carmakers are aggressively shifting towards electric vehicle (EV) production, while entirely new companies, especially from China, are entering the market with advanced EV technology. This evolving landscape puts pressure on Tupy to stay ahead by consistently innovating and adapting its offerings to avoid falling behind technology-forward suppliers.

For instance, in 2024, the global automotive market is projected to see continued growth in EV sales, with some analysts predicting they could reach over 20% of total vehicle sales by the end of the year. This rapid adoption rate necessitates that companies like Tupy, which supply critical components, must be agile.

- Intensified EV Competition: Both legacy automakers and new entrants are rapidly expanding their electric lineups.

- Chinese Manufacturers' Rise: Chinese EV brands are increasingly competitive globally, offering advanced technology at attractive price points.

- Technological Disruption: Suppliers not keeping pace with electrification and digital integration risk losing market share.

- Adaptation Imperative: Tupy must continuously invest in R&D to maintain its competitive edge in this dynamic environment.

The global shift towards electric vehicles (EVs) poses a significant threat as demand for Tupy's traditional iron castings may decline, with lightweight materials like aluminum becoming more prevalent in EV manufacturing. For example, by 2025, EVs are expected to use a greater proportion of aluminum than traditional vehicles, directly impacting Tupy's established market. This transition requires substantial investment in new technologies and materials, presenting a financial risk if not managed effectively.

SWOT Analysis Data Sources

This Tupy SWOT analysis is built upon a robust foundation of data, drawing from Tupy's official financial reports, comprehensive market intelligence from leading industry analysts, and insights from expert interviews and publications.