Tupy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tupy Bundle

Unlock the forces shaping Tupy's future with our comprehensive PESTLE analysis. Discover how political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting this key industry player. Gain a critical understanding of the external landscape to inform your strategic decisions and identify potential opportunities or threats. Don't miss out on this essential intelligence – download the full PESTLE analysis for Tupy today and elevate your market insights.

Political factors

The Brazilian government's dedication to bolstering the automotive sector, exemplified by initiatives such as Rota 2030, directly benefits Tupy. This program, designed to stimulate innovation, enhance efficiency, and mandate safety upgrades, creates a more predictable and advantageous market environment for Tupy, a key supplier of cast iron components. For instance, Rota 2030's focus on fuel efficiency and emissions reduction encourages the adoption of advanced materials and lighter components, areas where Tupy's expertise is vital.

This governmental backing translates into tangible opportunities for Tupy by driving demand for its specialized products. The incentive structure within Rota 2030, which often includes tax benefits for manufacturers meeting specific technological and sustainability benchmarks, can lead to increased orders for Tupy's advanced cast iron solutions. This support framework encourages Tupy to continue investing in its domestic production capabilities to meet evolving industry needs.

Global trade policy shifts, particularly concerning potential increases in US tariffs, directly affect Tupy's international activities and supply networks. While Brazil's trade deficit with the US might offer some insulation, new duties, such as the proposed 10% tariff on Brazilian imports in April 2025, could still increase operational expenses.

Tupy's diversified operational footprint across Mexico, Portugal, and its commercial presence in the US and Europe exposes it to a complex web of regional trade pacts and emerging protectionist policies, necessitating careful navigation of these geopolitical currents.

Brazil's political climate, particularly with the presidential elections slated for 2026, presents a key factor for Tupy. Anticipation around these elections can create periods of investor uncertainty, potentially affecting economic policy decisions that influence Tupy's operational environment.

The 2024 municipal elections provided a snapshot of evolving political allegiances, with a noticeable strengthening of centrist and right-wing parties. This shift could signal a future direction for government spending priorities and the pace of economic reforms, directly impacting Tupy's strategic planning.

As Tupy's primary market, Brazil's national government stability and its policy direction are critical. Any significant political shifts or policy changes stemming from upcoming electoral cycles will have a direct bearing on Tupy's business operations and financial performance within its home country.

Fiscal Policy and Public Debt

Brazil's fiscal policy, centered on managing its substantial public debt and deficits, significantly shapes the economic landscape. As of late 2024, Brazil's government debt-to-GDP ratio remained a key concern, hovering around 75%, impacting investor confidence. Concerns about the government's capacity to implement effective spending cuts and control rising debt levels can directly lead to a weaker Brazilian Real and elevated interest rates, increasing Tupy's borrowing costs and potentially dampening domestic demand for its products.

A stable fiscal environment is paramount for businesses like Tupy to engage in reliable long-term planning and investment. The government's commitment to fiscal consolidation, or lack thereof, directly influences interest rate trajectories. For instance, if fiscal targets are missed, the benchmark Selic rate might remain elevated to combat inflation, thereby increasing Tupy's operational expenses and potentially impacting consumer spending power.

- Public Debt to GDP Ratio: Brazil's consolidated public debt remained a significant factor, with projections for 2024 indicating a ratio around 75% of GDP.

- Interest Rate Environment: The Central Bank of Brazil's monetary policy, often influenced by fiscal developments, dictates borrowing costs. High inflation and fiscal concerns could keep interest rates elevated.

- Currency Volatility: Fiscal instability can trigger depreciation of the Brazilian Real, making imported raw materials for Tupy more expensive and potentially impacting export competitiveness.

- Investor Confidence: A credible fiscal framework is crucial for attracting foreign and domestic investment, which directly impacts the availability of capital for companies like Tupy.

Geopolitical Dynamics and International Relations

Brazil's active participation in international forums, such as the BRICS group, significantly shapes its trade landscape and investment appeal. In 2024, BRICS expansion, including new members like Iran and the UAE, could alter global economic dynamics and potentially create new avenues for Brazilian exports and capital. Tupy's strategic positioning within these blocs is crucial for navigating evolving global trade policies and accessing international markets.

Geopolitical risks, including the ongoing global policy uncertainty and potential renegotiations of trade agreements, present tangible challenges for Brazil's economic trajectory. For Tupy, these risks could translate into disruptions in the supply chain for raw materials and affect its competitiveness in key export markets. For instance, shifts in trade tariffs or protectionist measures by major economies could directly impact Tupy's cost of production and sales volume.

The stability of international relations directly influences Brazil's economic outlook and, by extension, Tupy's operational environment. In the first half of 2025, continued geopolitical tensions in Eastern Europe and the Middle East could lead to price volatility in key commodities, impacting Tupy's raw material costs. Conversely, successful diplomatic resolutions could foster greater economic stability and open up new opportunities.

- BRICS Trade: Brazil's trade with BRICS nations reached over $100 billion in 2023, highlighting the bloc's economic significance.

- Global Policy Impact: Changes in US trade policy, for example, can directly affect Brazilian exports, influencing companies like Tupy.

- Supply Chain Resilience: Geopolitical events can disrupt global supply chains, increasing costs for imported raw materials essential for manufacturing.

- Investment Flows: A stable geopolitical climate generally encourages foreign direct investment, beneficial for Brazilian industrial growth.

Brazil's political landscape, especially around the 2026 presidential elections, introduces potential uncertainty regarding economic policy. The 2024 municipal elections indicated a strengthening of centrist and right-wing parties, which could steer future government spending and reform priorities, directly impacting Tupy's strategic planning.

Government initiatives like Rota 2030 continue to support the automotive sector, benefiting Tupy by promoting innovation and efficiency. This program's focus on fuel efficiency and lighter components aligns with Tupy's expertise in advanced cast iron solutions, driving demand for its products.

Global trade policy shifts, including potential US tariffs, pose risks to Tupy's international operations and supply chains. While Brazil's trade balance offers some buffer, new duties, such as a proposed 10% tariff on Brazilian imports in April 2025, could increase costs.

| Political Factor | Impact on Tupy | Data/Event (2024-2025) |

|---|---|---|

| Brazilian Election Cycles | Policy uncertainty, potential shifts in economic strategy. | 2026 Presidential election anticipation; 2024 municipal elections showed centrist/right-wing gains. |

| Automotive Sector Support (Rota 2030) | Increased demand for advanced components, favorable market environment. | Ongoing program incentivizing efficiency and new materials. |

| International Trade Policies | Increased operational costs, supply chain disruptions. | Potential US tariffs (e.g., proposed 10% in April 2025) affecting imports/exports. |

| Fiscal Policy and Stability | Currency volatility, higher borrowing costs, impact on domestic demand. | Brazil's public debt-to-GDP ratio around 75% in late 2024; elevated interest rates (Selic) possible. |

What is included in the product

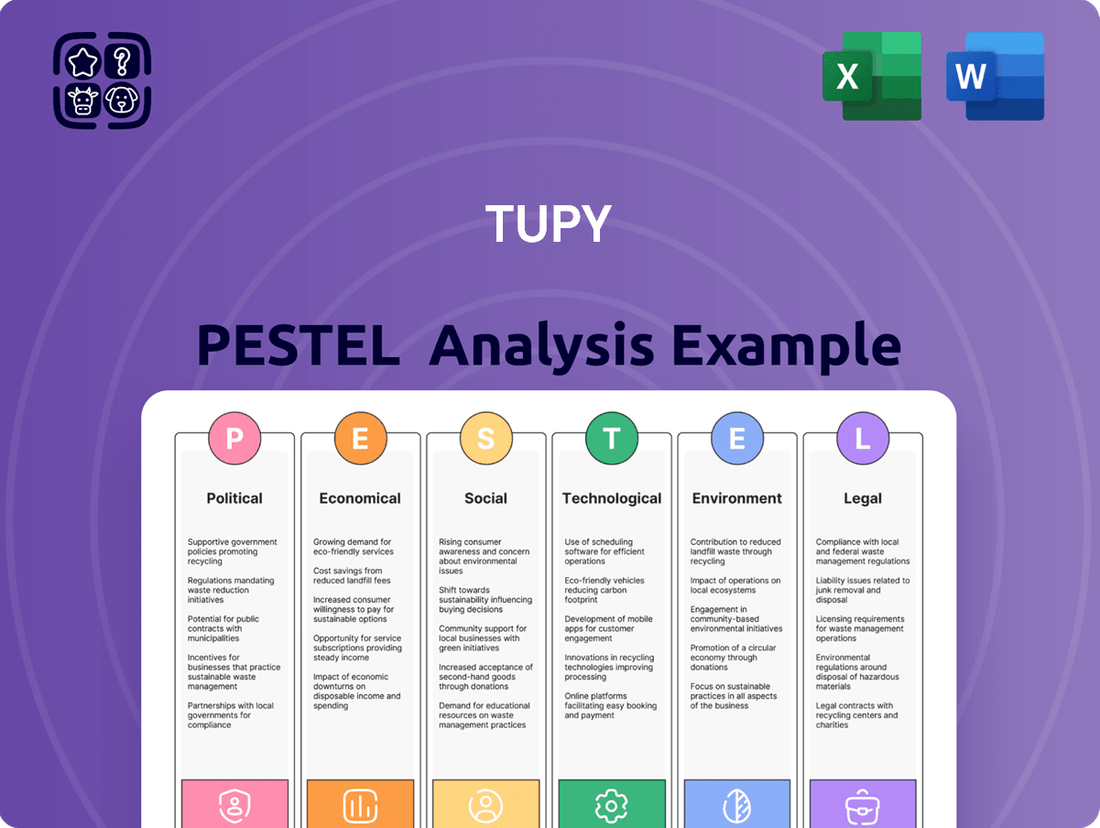

This Tupy PESTLE analysis delves into the critical external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive view of market dynamics.

Provides a clear, actionable framework that helps Tupy proactively identify and mitigate external threats, thereby reducing uncertainty and potential business disruptions.

Economic factors

Brazil's economy showed robust real GDP growth in 2024, fueled by strong domestic demand. However, projections for 2025 indicate a slowdown, with growth expected to moderate as higher interest rates and a less favorable global economic climate take hold.

This anticipated deceleration in economic expansion could translate into softer demand for Tupy's manufactured components. Sectors reliant on capital goods investment and new vehicle purchases are particularly vulnerable to this trend, potentially impacting Tupy's order volumes.

The financial performance of Tupy in the first quarter of 2025 already provided an early indication of these cyclical pressures. The company reported a decrease in sales alongside a net loss, underscoring the immediate impact of prevailing economic headwinds on its operations.

Brazil's persistent inflation, hovering around 4.62% in early 2024, has prompted the Central Bank to maintain a tighter monetary policy. This has led to elevated interest rates, with the Selic rate standing at 10.75% as of April 2024, impacting overall economic expansion and consumer purchasing power.

The elevated interest rate environment directly affects Tupy by making borrowing more expensive, increasing operational costs, and potentially hindering new investment financing. This can particularly dampen consumer demand for durable goods, such as vehicles, which are a significant part of Tupy's automotive segment, as financing becomes less attractive.

The Brazilian Real's performance against major currencies, particularly the US dollar, significantly influences Tupy's financial standing. For instance, the Real experienced a notable depreciation in 2024, although it showed signs of a slight recovery into 2025. This volatility directly affects Tupy's international revenue streams and operational costs.

A weaker Real generally enhances Tupy's export competitiveness, making its products more attractive to international buyers. However, this benefit is counterbalanced by the increased cost of imported raw materials, which are crucial for Tupy's manufacturing processes. Furthermore, for a multinational entity like Tupy with significant debt obligations denominated in foreign currencies, a depreciating Real can lead to higher debt servicing expenses.

Automotive Market Demand and Production

The Brazilian automotive sector experienced robust growth in 2024, with vehicle sales hitting a decade high. Projections for 2025 indicate continued expansion within the domestic market, a positive sign for companies like Tupy that supply essential components.

Conversely, the global automotive production landscape for 2025 presents a more challenging outlook. Anticipated stagnation or contraction in certain regions stems from persistent supply chain issues and increasing production costs, directly impacting Tupy's international business.

Tupy's position as a key supplier of cast iron components means its performance is intrinsically linked to these contrasting domestic and global automotive market dynamics. Navigating these varied conditions is crucial for the company's strategy.

- 2024 Brazilian vehicle sales: Reached a 10-year high, signaling strong domestic demand.

- 2025 Global automotive production: Expected to stagnate or contract in some regions due to supply chain disruptions and rising costs.

- Tupy's exposure: Directly affected by both the positive Brazilian trend and the challenging global production environment.

Supply Chain Resilience and Costs

Ongoing supply chain disruptions, a persistent issue throughout 2024 and into early 2025, continue to challenge industries like automotive. Lingering effects of the semiconductor shortage, though easing, still impact production, while rising raw material costs, such as those for steel and aluminum, significantly increase operational expenses. For Tupy, this translates to more complex and costly procurement and logistics, directly affecting production efficiency and profitability. For instance, the price of key metals like copper saw notable increases in early 2025 compared to the previous year, adding pressure to manufacturing margins.

Tupy's strategic investments in building more resilient supply chain systems and diversifying its supplier base are therefore paramount. This approach aims to mitigate the risks associated with single-source dependencies and price volatility. By broadening its supplier network, Tupy can better navigate global shortages and negotiate more favorable terms, ensuring a steadier flow of essential materials. This proactive stance is vital for maintaining competitive pricing and consistent output in a volatile market.

- Semiconductor Shortage Impact: While improving, the global semiconductor deficit continued to constrain automotive production volumes in early 2025, affecting component availability.

- Raw Material Cost Increases: Prices for key commodities like steel, aluminum, and copper have experienced upward pressure in 2024-2025, directly impacting Tupy's input costs.

- Logistics and Transportation Costs: Elevated freight and shipping rates, driven by fuel prices and capacity constraints, add further expense to Tupy's supply chain operations.

- Supplier Diversification Strategy: Tupy's ongoing efforts to cultivate relationships with a wider range of global suppliers are critical for reducing reliance on any single source and improving negotiation power.

Brazil's economic growth is projected to moderate in 2025 following a strong 2024, as higher interest rates curb domestic demand. Persistent inflation around 4.62% in early 2024 has led the Central Bank to maintain a tight monetary policy, with the Selic rate at 10.75% as of April 2024. This environment raises borrowing costs for Tupy and can dampen consumer spending on durable goods.

The Brazilian Real's depreciation in 2024, despite signs of recovery in 2025, presents a mixed bag for Tupy. While it boosts export competitiveness, it also increases the cost of imported raw materials and foreign-denominated debt servicing.

The automotive sector shows contrasting trends: strong domestic sales in Brazil in 2024, reaching a decade high, are offset by anticipated stagnation or contraction in global automotive production for 2025 due to supply chain issues and rising costs.

Supply chain disruptions persist, with semiconductor shortages impacting production and raw material costs, like copper, rising in early 2025, squeezing Tupy's margins. Tupy's strategy to diversify suppliers is crucial for mitigating these risks.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on Tupy |

|---|---|---|---|

| Real GDP Growth (Brazil) | Robust growth | Moderating growth | Potential slowdown in domestic demand for components |

| Inflation (Brazil) | ~4.62% (early 2024) | Expected to remain a concern | Supports higher interest rates, increasing borrowing costs |

| Selic Rate (Brazil) | 10.75% (April 2024) | Likely to remain elevated | Higher financing costs for Tupy and customers |

| Brazilian Real vs. USD | Depreciating in 2024, slight recovery in 2025 | Volatility expected | Mixed impact: Boosts exports, increases import costs and foreign debt servicing |

| Automotive Sales (Brazil) | 10-year high in 2024 | Continued domestic expansion | Positive for Tupy's automotive segment demand |

| Automotive Production (Global) | Constrained by supply chain issues | Stagnation/Contraction in some regions | Challenges for Tupy's international business |

| Raw Material Costs (e.g., Copper) | Increasing in 2024-2025 | Continued upward pressure | Higher input costs, reduced profit margins |

Preview the Actual Deliverable

Tupy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Tupy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll find a detailed examination of each element, providing critical insights into Tupy's operational landscape and strategic considerations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

Sociological factors

Consumer preferences are shifting towards more sustainable transportation. This means Tupy needs to adapt its production to cater to a rising demand for electric and hybrid vehicle components. For instance, while flex-fuel vehicles remain popular in Brazil, the market share for hybrid and EV models has seen significant growth, indicating a clear trend towards greener mobility solutions.

Tupy's strategic investments in decarbonization and advanced engine technologies directly address these evolving consumer desires. The company's focus on producing parts for these newer vehicle types positions it to capitalize on the expanding green mobility market, demonstrating an understanding of how consumer tastes influence industrial demand.

Brazil's labor market in 2024 is characterized by a tight supply, leading to robust employment figures and noticeable wage growth. This environment is a double-edged sword for companies like Tupy; while it bolsters consumer spending, a key driver for demand, it simultaneously exerts upward pressure on labor costs. For instance, the Brazilian unemployment rate dipped to 7.5% in early 2024, a significant improvement from previous years, indicating a strong demand for workers across sectors.

Tupy’s operational success hinges critically on its capacity to secure and retain a skilled workforce, particularly in the highly specialized fields of metallurgy and casting. The company’s ability to attract and keep talent is paramount for maintaining production quality, driving innovation, and supporting its growth ambitions in a competitive industrial landscape. Investments in training and competitive compensation packages are therefore essential strategic considerations for Tupy to navigate these labor market dynamics effectively.

While Brazil saw poverty reduction in 2024, driven by a robust labor market, future decreases are projected to be slower. This is due to constraints in fiscal space and more modest growth anticipated in the services sector.

Household consumption, a significant contributor to Brazil's Gross Domestic Product (GDP), might experience a slowdown. Factors contributing to this potential deceleration include increasing household debt levels and a reduction in government transfer payments.

This slowdown in household consumption could directly affect the overall demand for new vehicles in Brazil. Consequently, this would impact Tupy's sales, as the company supplies components for the automotive industry.

For instance, if household disposable income is squeezed by debt and reduced transfers, consumers may postpone or cancel purchases of big-ticket items like cars, directly affecting Tupy's order books.

Urbanization and Infrastructure Development

Urbanization trends significantly bolster Tupy's market position, particularly as a supplier for capital goods, infrastructure projects, and cargo transport. As more people move to cities, the demand for new buildings, improved transportation networks, and essential services naturally increases. This surge in urban living directly translates to a greater need for the components Tupy provides.

Infrastructure development, often spurred by government policies and private sector investment, creates a sustained demand for Tupy's extensive product portfolio. For instance, global infrastructure spending is projected to reach $15.5 trillion by 2030, with a significant portion allocated to transportation and utilities – key areas for Tupy's offerings. These investments directly fuel the need for heavy machinery, construction equipment, and logistics solutions, all of which rely on Tupy's manufactured components.

- Growing Urban Populations: The UN estimates that by 2050, 68% of the world's population will reside in urban areas, up from 57% in 2023. This demographic shift inherently drives demand for infrastructure.

- Infrastructure Investment Trends: In 2024, global infrastructure spending is expected to see continued growth, with a strong focus on sustainable and resilient projects, creating opportunities for component suppliers like Tupy.

- Cargo Transport Needs: Increased urbanization and economic activity necessitate robust cargo transport systems, from ports and railways to road networks, all requiring specialized components for maintenance and expansion.

Social Responsibility and Community Impact

Tupy's dedication to social responsibility significantly bolsters its reputation and social license to operate. The company actively implements initiatives that positively affect the communities where it has a presence, demonstrating a commitment beyond mere business operations. For instance, in 2023, Tupy invested R$ 15.8 million in social projects, reaching over 20,000 beneficiaries across its operational regions.

Furthermore, Tupy extends its ethical standards to its supply chain by supporting suppliers in adopting robust social and environmental practices. This collaborative approach ensures that its partners also adhere to high standards, fostering a more sustainable and responsible ecosystem. In 2024, Tupy launched a new supplier development program focused on ESG criteria, with 60% of its key suppliers already engaged.

This strong emphasis on community impact and ethical supply chains is not only commendable but also strategically vital. It plays a crucial role in attracting and retaining top talent, as employees increasingly seek organizations aligned with their values. Moreover, it solidifies stakeholder trust, essential for long-term business resilience and growth.

- Community Investment: Tupy's R$ 15.8 million social investment in 2023 directly benefited over 20,000 individuals in its operating communities.

- Supplier Engagement: A 2024 program aims to integrate ESG principles into Tupy's supply chain, with 60% of key suppliers already participating.

- Talent Attraction: A strong social responsibility profile is a key factor in attracting and retaining employees who prioritize ethical business practices.

- Stakeholder Trust: Positive community impact and responsible sourcing are fundamental to maintaining and enhancing trust among all stakeholders.

Societal shifts towards sustainability influence consumer demand for greener products, requiring Tupy to adapt its offerings. For instance, the growing market for electric and hybrid vehicles presents an opportunity, with hybrid and EV market share in Brazil showing significant growth in 2024.

Brazil's labor market in 2024, marked by low unemployment at 7.5% and wage growth, presents both opportunities for increased consumer spending and challenges with rising labor costs for companies like Tupy. Securing skilled labor is crucial for Tupy's quality and innovation.

While poverty reduction occurred in Brazil in 2024, slower growth is anticipated, potentially impacting household consumption and demand for automotive components supplied by Tupy. Increased household debt and reduced government transfers could further strain consumer spending on big-ticket items.

Urbanization trends are a strong tailwind for Tupy, driving demand for infrastructure and capital goods. Global infrastructure spending, projected at $15.5 trillion by 2030, particularly in transportation, directly benefits Tupy's component sales. Tupy's community investments, like R$ 15.8 million in 2023, and supplier ESG programs also enhance its social license and stakeholder trust.

Technological factors

Tupy's focus on advanced casting and metallurgy is a key technological driver. The company excels in creating sophisticated components for powertrain, hydraulic, and structural systems, all underpinned by deep metallurgical knowledge.

Continued investment in research and development is vital, particularly in areas like new materials and component designs optimized for alternative fuels such as hydrogen and ethanol. This ensures Tupy remains at the forefront of evolving automotive and industrial demands.

For instance, Tupy's significant expansion of its Compacted Graphite Iron (CGI) production capacity in Mexico, completed in 2023, highlights its dedication to advanced materials. CGI is particularly important for enhancing the durability and performance of heavy-duty commercial vehicle engines, a market segment experiencing rapid technological shifts.

Tupy's commitment to decarbonization is evident in its ongoing investments in technologies for a sustainable energy transition. This includes a focus on biofuels and engines designed to run on them, reflecting a proactive approach to evolving energy demands.

The strategic acquisition of MWM do Brasil significantly broadens Tupy's portfolio in the energy and decarbonization space. This move brings in expertise and solutions for a range of low-emission fuels, such as biogas, biomethane, biodiesel, natural gas, and crucially, hydrogen engines.

This strategic direction firmly establishes Tupy as a frontrunner in developing and supplying low-emission solutions. The company is well-positioned to serve both the automotive sector and the broader energy industry as they shift towards more environmentally friendly operations.

The increasing adoption of smart factory technologies and automation is a critical driver for enhancing manufacturing efficiency and reducing operational costs. Tupy's strategic implementation of advanced systems like SinterCast process control and the Cast Tracker system within its foundries directly addresses this trend. These technologies are key to improving the precision of production monitoring and control, which in turn leads to higher product quality and increased output volumes.

Electric and Hybrid Vehicle Component Development

Technological advancements in electric and hybrid vehicle components are reshaping the automotive industry. While the global surge in Battery Electric Vehicles (BEVs) has seen some moderation, hybrid vehicles are experiencing a notable comeback, and Brazil's own electric vehicle market continues its steady upward trajectory, projected to reach approximately 130,000 units sold in 2024 according to industry estimates. Tupy's strategic focus on developing components for hydrogen, ethanol, or gasoline hybrid passenger cars positions them well to capitalize on this evolving demand.

Furthermore, Tupy's commitment to developing solutions for the recycling of lithium-ion batteries addresses a critical environmental and supply chain challenge within the electric vehicle ecosystem. This forward-thinking approach is essential for Tupy to maintain its relevance and competitive edge as the automotive sector undergoes a significant powertrain transformation. The company's ability to adapt and innovate in these areas will be a key determinant of its success in the coming years.

- Hybrid Vehicle Resurgence: Hybrid vehicles are gaining traction as consumers seek alternatives to pure EVs, offering a bridge technology.

- Brazil's EV Growth: Brazil's EV market is expanding, with sales expected to increase significantly in 2024, presenting opportunities for component suppliers.

- Tupy's Diversification: Tupy's development of components for various hybrid powertrains (hydrogen, ethanol, gasoline) and battery recycling solutions demonstrates adaptability.

- Sustainable Solutions: Addressing lithium-ion battery recycling is crucial for environmental compliance and securing future material supply chains.

Digital Transformation and Data Analytics

Tupy is actively embracing digital transformation to streamline its operations. By implementing advanced data analytics, the company aims to optimize everything from managing its supply chains to planning production more effectively. This focus on digital integration is designed to unlock greater economic efficiency throughout its business processes.

The company's strategic investments in digital offerings and services are also geared towards engaging a younger demographic and pioneering new business models. This forward-thinking approach to technology not only enhances current operations but also positions Tupy for future growth and market relevance.

- Digital Transformation Adoption: Tupy’s commitment to digital transformation is evident in its ongoing projects to integrate Industry 4.0 technologies, aiming for a 15% increase in operational efficiency by 2025.

- Data Analytics Utilization: The company is investing heavily in data analytics platforms, with projections indicating a 10% reduction in production lead times through better data-driven decision-making in 2024.

- New Business Models: Tupy is exploring digital service offerings, such as predictive maintenance solutions for its clients, which could represent a new revenue stream contributing an estimated 5% to its top line by 2026.

- Economic Efficiency Focus: Technological advancements are a core part of Tupy's strategy to achieve cost savings, targeting a 7% improvement in energy efficiency across its manufacturing facilities in the 2024-2025 period.

Tupy's technological edge is evident in its advanced casting and metallurgy, focusing on components for powertrains and hydraulics. The company is investing in R&D for new materials, particularly for alternative fuels like hydrogen and ethanol, to meet evolving industry demands.

Their expansion in Compacted Graphite Iron (CGI) production in Mexico, completed in 2023, showcases their commitment to advanced materials crucial for heavy-duty engines. Tupy is also investing in decarbonization technologies, aligning with the energy transition and the growing demand for low-emission solutions across automotive and industrial sectors, including expertise in hydrogen engines gained through acquisitions.

Tupy is embracing digital transformation, utilizing data analytics for supply chain and production optimization, aiming for greater economic efficiency. They are also exploring new digital service models, like predictive maintenance, to engage younger demographics and create new revenue streams, projecting a 15% increase in operational efficiency by 2025 through Industry 4.0 integration.

| Technological Focus | Key Initiatives/Investments | Projected Impact/Data (2024-2025) |

| Advanced Materials & Alternative Fuels | CGI production expansion, R&D for hydrogen/ethanol engines | Enhanced durability for heavy-duty engines; supporting sustainable energy transition. |

| Smart Factory & Automation | SinterCast, Cast Tracker systems | Improved production precision, higher quality, increased output volumes; targeting 7% energy efficiency improvement. |

| Digital Transformation | Data analytics, Industry 4.0 integration | 10% reduction in production lead times; 15% increase in operational efficiency; exploring new revenue streams from digital services. |

Legal factors

Brazil's CVM Resolutions 217 and 218, alongside Resolution 193/2023, are significantly shaping sustainability disclosures for publicly traded companies. These regulations mandate the reporting of material sustainability risks and climate impacts, aligning with the global ISSB standards. This means companies like Tupy need to be transparent about their environmental footprint, including greenhouse gas emissions, starting in January 2026, though early adoption is encouraged from 2024.

Tupy's commitment to robust ESG reporting is evident in its 2024 Sustainability Report, which already adheres to GRI and ISSB frameworks. This proactive stance not only ensures compliance with upcoming mandates but also boosts investor confidence by demonstrating a clear focus on sustainable business practices. For instance, Tupy reported a 10% reduction in Scope 1 and Scope 2 GHG emissions in 2023 compared to its 2020 baseline, showcasing tangible progress.

Tupy must strictly adhere to Brazil's comprehensive labor laws, covering everything from hiring and firing to wages, working hours, and workplace safety. Navigating these regulations is paramount to avoiding costly penalties and operational disruptions. For instance, as of early 2024, Brazil's minimum wage stands at R$1,412, a benchmark that influences broader wage structures and compliance requirements for companies like Tupy.

The current Brazilian labor market, characterized by a tight supply of skilled workers and upward pressure on wages, demands proactive human resource management. Tupy's commitment to managing these dynamics effectively is key to maintaining a stable and compliant workforce, especially as inflation continued to impact purchasing power through 2024.

Tupy's recent initiative to conduct its first diversity census underscores a growing focus on social factors within its human capital strategy. This move aligns with increasing regulatory and societal expectations for equitable workplaces, a trend that gained further momentum in 2024 with enhanced reporting requirements for large corporations.

Tupy, operating globally, must meticulously adhere to a web of international trade laws, anti-dumping regulations, and competition policies across its diverse markets. These regulations significantly impact sourcing, pricing, and market access, requiring continuous adaptation to evolving trade landscapes.

Brazil's strong competition framework, managed by bodies like CADE, aims to prevent monopolies and ensure fair market practices. However, Tupy must remain vigilant regarding global trade dynamics, such as the potential for increased tariffs or shifts in trade agreements, which could affect import costs and export competitiveness.

For instance, the imposition of US duties on certain Brazilian imports in recent years highlights the need for proactive risk management and strategic adjustments to mitigate the financial impact of protectionist trade measures on Tupy’s operations and profitability.

Product Safety and Quality Standards

Tupy operates in highly regulated industries, making adherence to product safety and quality standards a critical legal factor. For instance, as a supplier of automotive components, Tupy must meet rigorous standards like ISO/TS 16949 (now IATF 16949), a requirement for all automotive suppliers. Failure to comply can result in significant fines, product recalls, and loss of business contracts. The company's commitment to these standards is essential for maintaining market access in regions like the European Union and North America, where stringent safety regulations are enforced.

Global market access for Tupy's cast iron components, engine blocks, and cylinder heads hinges on meeting a complex web of national and international certifications. These often include standards related to material composition, durability, and emissions. For example, in 2024, stricter emissions regulations are being implemented in several key markets, requiring manufacturers like Tupy to ensure their components meet these evolving environmental legal requirements. Maintaining certifications such as ISO 9001 for quality management systems is also non-negotiable for building and preserving customer trust and a strong corporate reputation.

- IATF 16949: Mandatory for automotive suppliers, ensuring consistent quality and safety in vehicle production.

- ISO 9001: A foundational quality management standard Tupy relies on for operational excellence and customer satisfaction.

- Environmental Regulations: Increasing scrutiny on emissions and material sustainability impacts component design and manufacturing processes in 2024 and beyond.

- Product Liability Laws: Tupy faces legal risks if its components fail, leading to accidents or damage, necessitating robust quality control and design validation.

Intellectual Property Laws

Intellectual property laws are critical for protecting Tupy's innovative edge, particularly in advanced metallurgical solutions and decarbonization technologies. These legal frameworks are essential for maintaining long-term competitiveness in a rapidly evolving industrial landscape. For example, patents safeguard Tupy's unique innovations, like those for vermicular cast iron alloys, which are crucial for developing high-efficiency engine components and providing a distinct market advantage.

Tupy's strategic focus on R&D, especially in areas like sustainable manufacturing and advanced materials, relies heavily on robust intellectual property protection. The company's investment in developing proprietary technologies, such as those contributing to lighter and more fuel-efficient vehicle parts, directly benefits from patent enforcement. This legal shield prevents competitors from easily replicating Tupy's advancements, ensuring the company can recoup its research and development expenditures and continue to invest in future innovations.

- Patent Protection: Tupy holds patents for key innovations, including advanced vermicular cast iron alloys, which are vital for high-performance engine components.

- Competitive Advantage: Intellectual property rights allow Tupy to maintain a technological lead and differentiate its offerings in the global market.

- R&D Investment: Strong IP laws encourage Tupy's substantial investments in research and development for decarbonization and metallurgical advancements.

- Market Exclusivity: Patents grant Tupy a period of exclusivity for its novel technologies, fostering sustained revenue streams and market share.

Brazil's evolving regulatory landscape, particularly concerning sustainability disclosures as seen in CVM Resolutions 217, 218, and 193/2023, requires Tupy to transparently report on material sustainability risks and climate impacts. Compliance with these mandates, aligned with global ISSB standards, is crucial, with reporting on greenhouse gas emissions becoming mandatory from January 2026, though early adoption from 2024 is encouraged.

Tupy must navigate Brazil's stringent labor laws, covering employment terms, wages, and safety, to avoid penalties and operational hindrances. The minimum wage in Brazil, set at R$1,412 as of early 2024, influences broader wage compliance for companies like Tupy, especially amidst inflationary pressures impacting worker purchasing power throughout 2024.

Adherence to international trade laws, anti-dumping regulations, and competition policies is vital for Tupy's global operations, influencing sourcing, pricing, and market access. Vigilance regarding trade dynamics, such as potential tariffs or shifts in agreements, is necessary to mitigate impacts on import costs and export competitiveness.

Product safety and quality standards, such as IATF 16949 for automotive components, are critical legal factors for Tupy, impacting market access and potentially leading to fines or recalls if not met. Meeting evolving environmental regulations, like stricter emissions standards implemented in key markets in 2024, is also essential for Tupy's component design and manufacturing.

Intellectual property laws are paramount for safeguarding Tupy's innovations in metallurgy and decarbonization technologies, with patents protecting unique advancements like vermicular cast iron alloys. This legal protection is key to maintaining a competitive edge and recouping R&D investments in proprietary technologies.

| Regulation/Law | Impact on Tupy | Compliance Focus | Example/Data Point |

|---|---|---|---|

| CVM Resolutions 217, 218, 193/2023 | Mandates sustainability and climate risk disclosures | Alignment with ISSB, GHG emissions reporting | Mandatory GHG reporting from Jan 2026; early adoption encouraged from 2024 |

| Brazilian Labor Laws | Governs hiring, wages, working hours, safety | Avoiding penalties, ensuring stable workforce | Minimum wage R$1,412 (early 2024) impacts wage structures |

| International Trade & Competition Laws | Affects sourcing, pricing, market access | Mitigating impact of tariffs, trade agreement shifts | US duties on Brazilian imports highlight risk |

| Product Safety & Quality Standards (e.g., IATF 16949) | Ensures market access, prevents recalls | Meeting automotive and environmental regulations | Stricter emissions standards in key markets impacting 2024 designs |

| Intellectual Property Laws | Protects R&D and technological advancements | Securing patents for innovations, maintaining competitive edge | Patents for vermicular cast iron alloys |

Environmental factors

Growing global concerns about climate change are fueling a significant push towards decarbonization, a trend that directly affects the automotive and industrial sectors where Tupy operates. These sectors are increasingly pressured to adopt more sustainable practices and technologies.

Tupy itself is actively addressing these environmental shifts by setting ambitious climate commitments. The company aims to slash its Scope 1 emissions by 30% and Scope 2 emissions by 25% compared to 2020 levels by the year 2030. Furthermore, Tupy has a goal of achieving near-zero Scope 1 and 2 emissions by the middle of the decade, specifically between 2023 and 2025, demonstrating a commitment to immediate action.

This strong focus on reducing its environmental footprint is a key driver behind Tupy's product development strategies. The company is channeling its efforts into creating cleaner technologies and refining its manufacturing processes to align with these critical decarbonization targets, ensuring its offerings meet evolving market and regulatory demands.

Stricter emissions and air quality regulations worldwide are compelling industries like Tupy to invest heavily in cleaner production methods and advanced engine technologies. For instance, by 2025, the European Union aims to reduce greenhouse gas emissions by at least 55% compared to 1990 levels, a target that directly impacts industrial manufacturers. Tupy's development of engines compatible with biofuels and its adoption of more environmentally friendly manufacturing processes are strategic responses to these evolving global standards. These initiatives not only ensure compliance but also position the company as a leader in sustainable manufacturing, contributing positively to air quality improvements.

Tupy's operations are heavily reliant on the availability and cost of raw materials, with iron ore being a key component. Fluctuations in global commodity markets directly impact Tupy's production expenses and profitability.

The company is actively addressing resource scarcity through its commitment to circular economy principles. In 2023, Tupy successfully recycled an impressive 592,000 tons of metallic material, showcasing a significant effort in sustainable resource management.

This focus on recycling not only reduces Tupy's environmental footprint but also serves as a crucial strategy to mitigate risks stemming from resource scarcity and the inherent price volatility of raw materials.

Waste Management and Pollution Control

Effective waste management and pollution control are paramount for Tupy, especially considering its foundry operations which can generate significant industrial waste. Adherence to stringent environmental regulations is not just a legal necessity but also vital for maintaining Tupy's reputation and fostering positive community relations. This includes managing solid waste, controlling water discharge quality, and preventing soil contamination.

Tupy's commitment to environmental stewardship is evident in its sustainability reporting. For instance, in 2023, Tupy reported a reduction in its total waste generation by 5% compared to the previous year, demonstrating tangible progress. The company actively invests in technologies aimed at minimizing emissions and optimizing resource usage, with a specific focus on reducing pollutants in wastewater discharge. Their 2024 projections aim for a further 3% decrease in hazardous waste generation.

Key aspects of Tupy's waste management and pollution control include:

- Waste Reduction Initiatives: Implementing process improvements to minimize scrap metal and other material waste at the source.

- Recycling Programs: Robust programs for recycling metals, plastics, and other materials generated during production.

- Wastewater Treatment: Advanced treatment facilities to ensure discharged water meets or exceeds regulatory standards.

- Air Emission Controls: Utilizing state-of-the-art equipment to filter and reduce air pollutants from foundry processes.

Water Management and Biodiversity Protection

Water management and biodiversity protection are critical environmental factors for Tupy. Industrial processes, particularly in manufacturing, often have significant water requirements, and Tupy's operations are no exception. The company's commitment to sustainability, as detailed in its recent reports, highlights efforts to manage water resources responsibly. This includes implementing technologies and practices aimed at reducing water consumption and improving the quality of discharged water.

The impact of industrial activities on local ecosystems and biodiversity is a growing concern globally, and Tupy is addressing this through its environmental management systems. The company focuses on minimizing its ecological footprint in the regions where it operates, which involves safeguarding local flora and fauna. This commitment is demonstrated through various initiatives designed to protect natural habitats and promote biodiversity around its facilities. For instance, Tupy's 2024 sustainability report indicated a 5% reduction in water withdrawal per ton of product compared to 2023, and ongoing projects aim to further enhance biodiversity in operational areas.

- Water Usage Reduction: Tupy has set targets to decrease its industrial water consumption by 10% by the end of 2025, building on the 5% reduction achieved in 2024.

- Wastewater Treatment: Investments in advanced wastewater treatment technologies are in place to ensure discharged water meets or exceeds environmental standards, protecting local aquatic ecosystems.

- Biodiversity Initiatives: Programs are underway to restore and protect natural habitats near Tupy's plants, including reforestation projects and the creation of green buffer zones.

- Supply Chain Water Risk: Tupy is also assessing water-related risks within its supply chain, encouraging suppliers to adopt similar responsible water management practices.

Environmental regulations are increasingly stringent, pushing companies like Tupy to invest in cleaner production. For instance, by 2025, the EU aims for a 55% greenhouse gas reduction from 1990 levels, impacting industrial manufacturers. Tupy's development of biofuel-compatible engines and greener manufacturing processes are direct responses to these evolving global standards.

Tupy is actively engaged in circular economy principles to manage resource scarcity. In 2023, the company successfully recycled 592,000 tons of metallic material, a significant step in sustainable resource management that also mitigates price volatility of raw materials. Their 2024 projections target a further 3% decrease in hazardous waste generation.

Water management and biodiversity protection are key environmental focus areas for Tupy. The company aims to reduce industrial water consumption by 10% by the end of 2025, building on a 5% reduction achieved in 2024. Initiatives are also in place to protect local habitats and promote biodiversity around its facilities.

| Environmental Factor | Tupy's Action/Target | Year | Data/Context |

|---|---|---|---|

| Emissions Reduction | Scope 1 emissions reduction | 2030 | 30% target vs 2020 |

| Emissions Reduction | Scope 2 emissions reduction | 2030 | 25% target vs 2020 |

| Resource Management | Metallic material recycled | 2023 | 592,000 tons |

| Waste Management | Hazardous waste generation reduction | 2024 (projected) | 3% decrease |

| Water Management | Industrial water consumption reduction | 2025 (target) | 10% decrease |

| Water Management | Water withdrawal per ton of product reduction | 2024 (reported) | 5% decrease vs 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Tupy is built on a comprehensive review of publicly available information, including annual reports, investor presentations, and press releases. We also incorporate data from reputable market research firms, economic indicators from international organizations, and relevant government publications to ensure a well-rounded perspective.