Tupy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tupy Bundle

Dive deep into Tupy's strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis. We meticulously examine their product innovation, competitive pricing, effective distribution, and impactful promotion strategies. Discover how these elements interlock to create Tupy's market dominance.

This isn't just an overview; it's a blueprint for success. Understand the intricate details of Tupy's approach to product development, pricing architecture, channel management, and communication mix. Unlock actionable insights for your own business.

Save countless hours of research. Our ready-to-use, editable analysis provides pre-written content, real-world examples, and structured thinking, perfect for reports, benchmarking, or strategic planning.

Gain instant access to a professionally crafted Marketing Mix report for Tupy. Whether for academic pursuits or professional business strategy, this document offers clarity and depth.

See how Tupy translates marketing theory into tangible market impact. Our full analysis reveals their winning strategies, offering a template you can adapt and apply.

Product

Tupy's core cast iron components, like engine blocks and cylinder heads, are the backbone of heavy-duty machinery, especially in the automotive and agricultural sectors. These aren't just parts; they're engineered for extreme durability and performance, crucial for applications that demand reliability under pressure.

In 2024, the global automotive casting market, a key sector for Tupy, was valued at approximately $100 billion, demonstrating the immense demand for these foundational components. Tupy's commitment to precision manufacturing ensures these parts meet rigorous OEM specifications, a critical factor for vehicle longevity.

The company's focus on material science and advanced casting techniques allows them to produce components that offer superior strength and heat resistance, vital for commercial vehicles and agricultural equipment operating in harsh environments. This specialization positions Tupy as a key supplier in industries where component failure is not an option.

Tupy's Advanced Metallurgy & Casting Solutions go far beyond producing standard parts. They offer deep metallurgical knowledge and create bespoke casting solutions precisely engineered to client needs. This includes developing specialized alloys, like Compacted Graphite Iron (CGI), and employing advanced manufacturing techniques to meet demanding performance criteria for critical applications in powertrains, hydraulics, and structural components.

The company's dedication to innovation is evident in its ongoing investments in new technologies and strategic collaborations. For instance, Tupy's involvement in developing solutions for high-efficiency hydrogen combustion engines highlights its commitment to advancing material science and optimizing production processes for future energy demands.

Tupy's extensive reach across diverse sectors like automotive, commercial vehicles, agriculture, and general industry, with operations spanning over 40 countries, highlights its robust market penetration. This wide application of its core competencies allows Tupy to cater to varied demands, from light passenger cars to heavy-duty machinery and critical industrial equipment.

The company's adaptable product portfolio is a key strength, enabling it to meet specific client requirements across these different industries. This flexibility is crucial for maintaining relevance and driving growth in dynamic global markets.

Tupy's contribution is substantial, particularly to Brazil's auto parts trade balance, indicating its significant role in international commerce and manufacturing. In 2023, Brazil's auto parts exports reached approximately $5.5 billion, with Tupy being a major player in this segment.

Integrated Design & Engineering Support

Tupy's Integrated Design & Engineering Support is a cornerstone of their offering, focusing on collaborative co-development from the very beginning of a project. This means they work hand-in-hand with clients to refine component design and ensure it integrates flawlessly into larger systems. This proactive approach aims to maximize performance and add significant value beyond mere manufacturing.

By leveraging advanced design and simulation tools, Tupy provides comprehensive engineering support across the capital goods sector. This commitment to technical excellence ensures that their components are not just produced, but are optimized for their intended applications, contributing to the overall efficiency and reliability of the final product. For instance, in 2024, Tupy reported a significant increase in client engagements involving early-stage design consultation, reflecting the growing demand for this integrated service.

- Early-Stage Collaboration: Tupy partners with clients from concept to optimize designs for performance and integration.

- Value Addition: The focus is on creating components that enhance the overall system's functionality and customer value.

- Advanced Technology: Utilization of state-of-the-art design and simulation software supports the capital goods industry.

- Industry Impact: This approach is crucial for industries requiring high precision and seamless integration, such as aerospace and heavy machinery.

Decarbonization Solutions & New Technologies

Tupy is making significant strides in decarbonization, developing components for vehicles utilizing hydrogen, ethanol, and hybrid gasoline systems. This focus extends to crucial areas like the recycling and reuse of lithium-ion batteries, a key element in the transition to electric mobility.

The company’s strategic shift towards decarbonization and aftermarket services, notably through its MWM brand, is a strong indicator of future growth. Tupy is investing in new engine technologies and sustainable fuel solutions, such as advanced biofuel production via bioplants.

Specifically, Tupy is engaged in developing hydrogen combustion engines that boast high thermal efficiency, a critical advancement for cleaner transportation. These initiatives underscore Tupy's commitment to providing innovative solutions for a lower-carbon future.

- Components for Hydrogen and Ethanol Vehicles: Tupy is engineering parts designed for the burgeoning hydrogen and ethanol fuel sectors.

- Lithium-Ion Battery Recycling: The company is actively developing solutions for the sustainable reuse and recycling of critical battery components.

- MWM Brand Expansion: Tupy's MWM brand is central to its strategy, introducing new engine technologies and biofuel applications.

- High-Efficiency Hydrogen Engines: Tupy is a participant in projects focused on creating hydrogen combustion engines with superior thermal efficiency.

Tupy's product strategy centers on high-performance cast iron components, engineered for durability in demanding sectors like automotive and agriculture. Their offerings include specialized alloys and custom solutions, emphasizing precision and advanced material science to meet stringent OEM requirements.

The company's commitment to innovation is also evident in its focus on future mobility, developing components for hydrogen and ethanol-powered vehicles, as well as solutions for lithium-ion battery recycling.

This strategic product development ensures Tupy remains a key player in evolving markets, providing essential components for both traditional and next-generation powertrain systems.

| Product Focus | Key Sectors | Material Innovation | Future Applications |

|---|---|---|---|

| Cast Iron Components (Engine Blocks, Cylinder Heads) | Automotive, Commercial Vehicles, Agriculture | Compacted Graphite Iron (CGI), High Strength Alloys | Hydrogen Engines, Ethanol Vehicles, Battery Recycling |

| Engineered for Durability & Performance | Heavy Machinery, General Industry | Superior Strength, Heat Resistance | Sustainable Mobility Solutions |

| Bespoke Casting Solutions | Critical Applications (Powertrains, Hydraulics) | Advanced Metallurgical Knowledge | Decarbonization Technologies |

What is included in the product

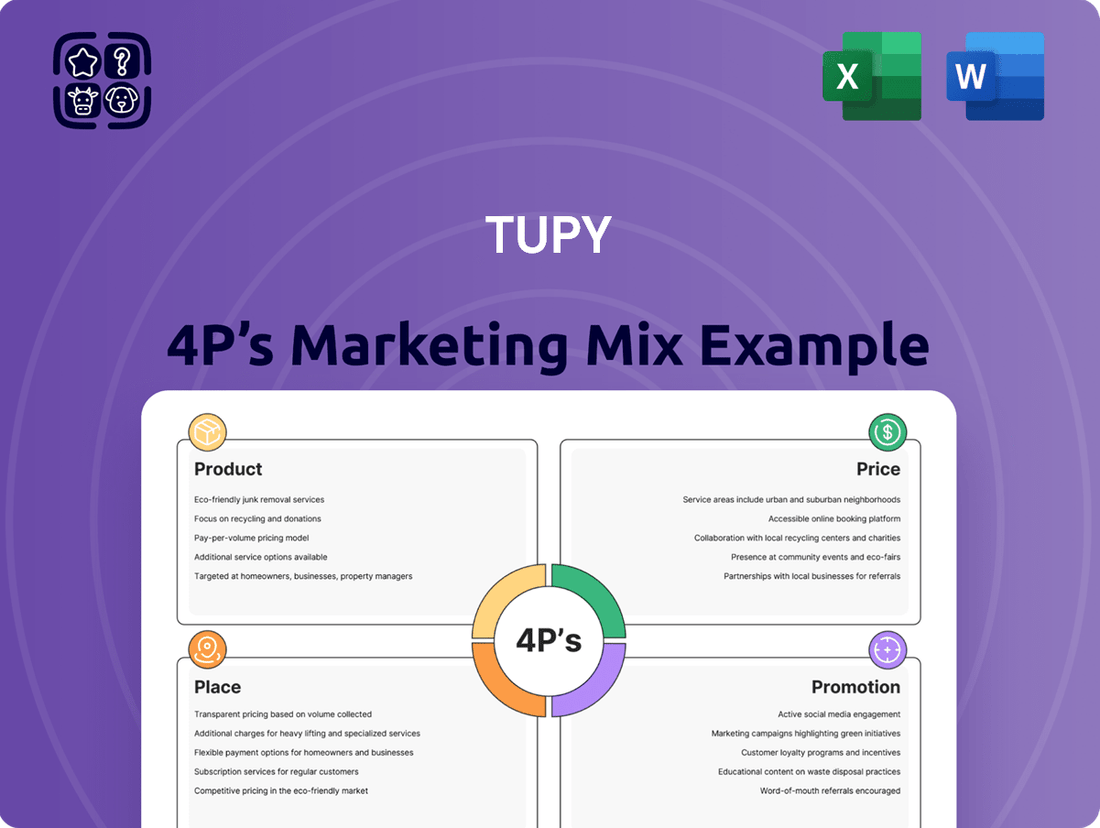

This Tupy 4P's Marketing Mix Analysis provides a comprehensive breakdown of their Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It offers a deep dive into Tupy's marketing positioning, ideal for managers and consultants seeking a professionally written, data-backed overview ready for stakeholder reports or strategy audits.

Provides clarity on Tupy's marketing strategy by dissecting the 4Ps, alleviating the pain of unclear market positioning and communication.

Place

Tupy's global manufacturing and sales footprint is a cornerstone of its marketing mix, with industrial plants and sales offices strategically located in Brazil, Mexico, the United States, Germany, and Portugal. This extensive network, as of early 2024, allows Tupy to serve a diverse international clientele efficiently. Their operational hubs are designed to optimize logistics, ensuring reduced lead times and reliable supply for large-scale industrial customers across continents, supporting Tupy's commitment to global reach and customer proximity.

Tupy's primary sales strategy centers on direct engagement with Original Equipment Manufacturers (OEMs) and Tier-1 automotive and industrial suppliers. This business-to-business approach fosters deep collaboration, allowing for the development of highly customized supply agreements tailored to the intricate needs of industrial components. For instance, Tupy's direct sales model facilitated a significant partnership with a major global automotive OEM in 2024, securing a multi-year contract for critical engine components.

This direct channel is fundamental to Tupy's distribution, enabling long-term contracts and strategic alliances that are vital for their market position. By working directly with these key industry players, Tupy ensures a consistent demand stream and maintains close relationships for future product development and supply chain integration. Their focus on these partnerships underscores a commitment to being an integral part of their clients' manufacturing processes, a strategy that has proven resilient through economic fluctuations.

Tupy's commitment to optimized logistics and supply chain management is crucial for its global operations. Delivering heavy, specialized components reliably and affordably to industrial clients worldwide demands a robust system. In 2023, Tupy reported significant progress in streamlining its supply chain, aiming to reduce lead times by 15% by the end of 2024.

The company navigates intricate international shipping routes, maintains strategically located warehousing, and implements just-in-time delivery to meet customer production schedules. This efficiency directly impacts Tupy's financial performance, with their 2023 annual report highlighting a 10% improvement in asset utilization within their logistics network.

Effective management of these complex supply chains, including international freight and inventory, directly contributes to Tupy's strong operating cash generation. By minimizing holding costs and ensuring timely delivery, Tupy reinforces its value proposition to its industrial partners.

Customer-Centric Distribution Networks

Tupy prioritizes customer-centric distribution, establishing regional sales offices and dedicated technical support teams. This localized approach ensures prompt service and specialized assistance, directly supporting key industrial clients near their operational hubs.

The strategic acquisition of MWM do Brasil in 2024 significantly bolstered Tupy's distribution capabilities within the engine parts and components replacement market in Brazil. This expansion introduced an extensive network of sales points and workshops, enhancing market penetration and customer accessibility.

Tupy's distribution strategy focuses on building strong relationships by being readily available and responsive. This customer-first philosophy is key to maintaining and growing its market share in competitive industrial sectors.

- Localized Support: Regional offices and technical teams provide on-the-ground assistance.

- Market Expansion: MWM do Brasil acquisition increased reach in Brazil's engine parts sector.

- Customer Responsiveness: Distribution network designed for prompt service delivery.

- Network Strength: Extensive sales points and workshops enhance accessibility.

Strategic Partnerships and Alliances

Tupy actively cultivates strategic partnerships to bolster its market presence and service capabilities. Collaborations with entities like SinterCast are crucial for advancements in Compacted Graphite Iron (CGI) production, a key material for modern engine components.

Further extending its technological reach, Tupy has formed alliances with AVL and Westport, focusing on the critical area of hydrogen engine development. These partnerships are instrumental in keeping Tupy at the cutting edge of innovation.

- CGI Production: Partnership with SinterCast enhances Tupy's capacity and technological expertise in CGI manufacturing, a vital material for lighter and stronger engine parts.

- Hydrogen Engine Development: Alliances with AVL and Westport position Tupy at the forefront of sustainable powertrain solutions, aligning with the global shift towards cleaner energy.

- Market Reach and Service Delivery: These strategic collaborations enable Tupy to access new markets and provide a more comprehensive suite of services to Original Equipment Manufacturers (OEMs) worldwide.

- Technological Advancement: By working with industry leaders, Tupy ensures it can anticipate and deliver market-driven solutions, meeting the evolving demands of the automotive sector.

Tupy's Place strategy is defined by its extensive global manufacturing and sales footprint, with key industrial plants and sales offices in Brazil, Mexico, the United States, Germany, and Portugal as of early 2024. This network is crucial for efficient service to a diverse international clientele, optimizing logistics and reducing lead times for industrial customers. Tupy's commitment to global reach and customer proximity is reinforced by these strategically located operational hubs.

Same Document Delivered

Tupy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Tupy 4P's Marketing Mix Analysis has been meticulously prepared, covering Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. Gain immediate access to this valuable marketing insight to inform your strategic decisions.

Promotion

Tupy strategically leverages industry trade shows and exhibitions as a key promotional tool. These events allow Tupy to highlight cutting-edge technologies and foster connections with prospective clients within the automotive, industrial, and metallurgy sectors.

Participation in these major international gatherings is vital for solidifying Tupy's reputation as a premier global provider of cast iron components. It’s a direct way to showcase their sophisticated casting technologies to a relevant audience.

For instance, Tupy's presence at events like the GIFA (International Foundry Trade Fair) in 2023, a leading exhibition for metallurgy, provides a tangible platform. Such shows often see significant buyer engagement, with reports from similar events indicating millions of euros in potential business generated for participating companies.

These exhibitions are not just about displaying products; they are critical for market intelligence gathering and understanding competitor advancements. Tupy uses these opportunities to reinforce its image of innovation and technical expertise in a competitive global landscape.

Tupy's promotion strategy hinges on its technical sales team, who work closely with client engineers. These experts dive deep into product details and custom solutions, fostering trust through their metallurgical and casting knowledge. This hands-on approach is crucial for Tupy's complex business-to-business sales, differentiating them in the market.

Tupy ensures stakeholders are well-informed through a dedicated investor relations website, annual reports, and timely press releases. This communication highlights financial performance, strategic moves, and technological progress, fostering transparency and attracting investment. For instance, Tupy's Q1 2024 earnings call revealed a 12% increase in net revenue, underscoring the impact of clear financial reporting.

Digital Presence and Technical Content Marketing

Tupy actively cultivates its digital presence by leveraging its corporate website, professional networking sites like LinkedIn, and specialized industry portals. This approach allows them to disseminate valuable technical content, including whitepapers and case studies, to a targeted audience of engineering and procurement professionals. In 2024, Tupy continued to emphasize its role as a thought leader by sharing insights and corporate updates across these platforms, reinforcing its commitment to providing essential information within its core industries.

Their digital marketing strategy is designed to establish Tupy as a go-to source for technical expertise. By sharing in-depth case studies and whitepapers, they aim to demonstrate their capabilities and solutions directly to decision-makers. This focus on valuable content is crucial for attracting and engaging professionals in sectors where technical proficiency and reliable information are paramount for procurement processes.

Further demonstrating their commitment to innovation and emerging technologies, Tupy launched initiatives like ShiftT, a startup accelerator. This program supports the development of new technologies relevant to their business, showcasing Tupy's forward-thinking approach and its dedication to advancing the industries it serves. This initiative also serves as a content generation opportunity, allowing them to highlight cutting-edge advancements and foster a collaborative ecosystem.

- Corporate Website & Industry Portals: Primary channels for technical whitepapers and case studies.

- Professional Networking: LinkedIn and similar platforms used for thought leadership and corporate news.

- Target Audience Engagement: Focus on engineering and procurement professionals.

- Innovation Initiatives: ShiftT accelerator highlights commitment to emerging technologies.

Strategic Public Relations and Industry Recognition

Tupy actively cultivates its public image through strategic public relations, showcasing its advancements and industry leadership. The company's 2024 Sustainability Report underscores this commitment, detailing significant progress in reducing its environmental impact, including a 15% decrease in Scope 1 and 2 greenhouse gas emissions compared to 2020 levels, and a 10% improvement in water efficiency across its operations.

Receiving industry accolades and positive media attention is a cornerstone of Tupy's promotional strategy. For instance, in early 2025, Tupy was recognized with the EcoVadis Gold medal for its sustainability performance, placing it in the top 5% of companies assessed globally. This recognition, alongside consistent positive coverage in trade publications like Foundry Trade Journal, reinforces Tupy's brand credibility and appeal to discerning industrial buyers who prioritize responsible and innovative partners.

- Sustainability Reporting: Tupy's 2024 Sustainability Report details efforts like a 15% reduction in Scope 1 and 2 GHG emissions (vs. 2020) and a 10% water efficiency gain.

- Industry Recognition: Awarded the EcoVadis Gold medal in 2025, placing Tupy in the top 5% of evaluated companies worldwide.

- Media Coverage: Consistent positive features in trade media, such as Foundry Trade Journal, enhance brand reputation.

- Credibility Enhancement: These PR activities directly bolster Tupy's standing with industrial buyers seeking reliable and sustainable suppliers.

Tupy's promotional activities are multi-faceted, focusing on direct engagement, digital outreach, and public relations to build brand authority and attract business. The company utilizes industry events to showcase its technological prowess and connect with key clients, while its digital strategy emphasizes thought leadership through technical content. Additionally, Tupy leverages sustainability reporting and industry accolades to enhance its corporate image and appeal to a discerning customer base.

| Promotional Channel | Key Activities | 2024/2025 Data/Focus | Impact |

| Industry Trade Shows (e.g., GIFA) | Showcasing technology, client engagement | Participation in key international events | Market intelligence, potential business generation |

| Digital Presence (Website, LinkedIn) | Disseminating technical content (whitepapers, case studies) | Thought leadership, corporate updates | Targeted audience engagement, brand authority |

| Investor Relations | Financial reporting, press releases | Q1 2024 net revenue increase (12%) | Transparency, investor attraction |

| Public Relations & Sustainability | Sustainability reporting, media coverage, industry awards | 2024 Sustainability Report (15% GHG reduction), EcoVadis Gold medal (2025) | Brand credibility, appeal to responsible buyers |

Price

Tupy employs value-based pricing for its engineered solutions, recognizing that the price reflects the significant value and specialized engineering inherent in its cast iron components. This strategy moves beyond simple cost-plus models, acknowledging the substantial investments Tupy makes in research and development and precision manufacturing.

The pricing is directly tied to the critical role these parts play in the performance and durability of the final products for their clients, justifying a premium for this embedded quality and technical expertise. For instance, Tupy's advanced casting technologies, which ensure high integrity and complex geometries for sectors like automotive and heavy machinery, command prices that reflect these capabilities and the resulting client benefits.

Long-term contracts are a cornerstone for Tupy's major OEM and Tier-1 clients, often dictating pricing through mechanisms like volume discounts. These agreements, which can also feature fixed pricing or raw material cost escalators, offer crucial predictability. For instance, Tupy's focus on long-term partnerships in sectors like automotive and heavy machinery, where supply chain stability is paramount, underpins these contractual arrangements.

Tupy closely monitors competitor pricing for industrial cast iron components, particularly within key markets like commercial vehicles and off-road equipment. In 2024, the company observed an average price increase of 5-7% across major global suppliers due to rising raw material costs, a trend Tupy factored into its own competitive pricing strategies.

Market demand for Tupy's products, especially in sectors like construction and agriculture where off-road applications are prevalent, significantly impacts pricing. For instance, a projected 4% growth in the global construction equipment market for 2025, driven by infrastructure spending, allows Tupy to maintain pricing power on related cast iron components.

Tupy's pricing decisions are dynamic, adjusting to competitive intensity in specific product segments. Where competition is fiercer, Tupy may adopt more aggressive pricing to secure market share, while in less contested niches, it can leverage higher margins, always balancing market attractiveness with profitability targets.

Cost-Plus with Efficiency Considerations

Tupy's pricing strategy, while prioritizing value, also incorporates a cost-plus approach. This ensures that all production expenses, including overhead, are accounted for, along with a healthy profit margin. For example, in 2024, Tupy reported significant investments in operational efficiency, aiming to bolster its cost competitiveness.

The company actively pursues cost reduction and productivity enhancements, seeking to capture synergies across its operations. This includes initiatives like optimizing plant capacity and strategically shifting production to more efficient lines. These efforts are crucial for managing overall costs and enabling Tupy to offer competitive pricing in the market.

- Cost Management: Tupy's focus on efficiency directly impacts its ability to manage production costs effectively.

- Productivity Gains: Investments in optimizing production lines in 2024 were designed to yield higher output per unit of input.

- Synergy Capture: Reallocating production aims to leverage economies of scale and reduce unit costs.

- Competitive Pricing: The combination of cost control and efficiency allows Tupy to maintain competitive price points.

Strategic Discounts for Volume and Loyalty

Tupy likely employs strategic discounts to incentivize high-volume purchases and reward customer loyalty. For instance, a tiered discount structure could be in place, offering progressively lower prices per unit as order quantities increase. This strategy is particularly effective for industrial clients who often place substantial orders, fostering deeper partnerships and securing predictable revenue streams. In 2023, Tupy reported significant revenue growth, partly driven by its ability to secure large-scale contracts with key industrial partners, demonstrating the efficacy of such volume-based pricing strategies.

Furthermore, Tupy may extend special pricing or favorable payment terms to long-standing clients. These loyalty programs can include extended payment cycles or early payment discounts, making it more attractive for established customers to maintain and even increase their business volume. This approach not only strengthens relationships but also aids in cash flow management for both parties. Tupy's financial reports from late 2024 indicate a strong retention rate among its core customer base, suggesting that these relationship-based pricing incentives are successfully contributing to sustained business.

- Volume-Based Discounts: Tiered pricing models to encourage larger order commitments.

- Loyalty Programs: Preferential pricing or payment terms for long-term clients.

- Inventory Management: Discounts can be strategically used to clear excess stock or manage production cycles.

- Payment Terms & Credit: Flexible payment options and credit lines are often negotiated alongside volume discounts for industrial clients.

Tupy's pricing strategy is multifaceted, balancing value-based considerations with cost management and market dynamics. The company leverages its engineering expertise to justify premium pricing for specialized components, while also employing cost-plus models to ensure profitability. Long-term contracts, volume discounts, and loyalty incentives are key tools for securing business and managing customer relationships.

| Pricing Strategy Component | Description | Impact on Tupy | 2024/2025 Data/Trend |

| Value-Based Pricing | Price reflects engineering value and client benefits. | Justifies premium pricing, enhances perceived quality. | Observed in sectors like automotive and heavy machinery for high-integrity components. |

| Cost-Plus Pricing | Accounts for all production expenses plus a profit margin. | Ensures profitability, covers operational costs. | 2024 investments in operational efficiency aim to bolster cost competitiveness. |

| Long-Term Contracts | Agreements with major clients, often with volume discounts. | Provides revenue predictability, secures large orders. | Focus on automotive and heavy machinery sectors where supply chain stability is crucial. |

| Market-Driven Pricing | Adjusts based on competitor pricing and market demand. | Maintains competitiveness, capitalizes on demand surges. | Factored in 5-7% average price increase by global suppliers in 2024 due to raw material costs; projected 4% growth in construction equipment market for 2025 supports pricing power. |

| Strategic Discounts | Volume-based and loyalty incentives. | Encourages high-volume purchases, rewards customer loyalty. | Reported significant revenue growth in 2023 partly driven by large-scale contracts; strong customer retention in late 2024 suggests effectiveness. |

4P's Marketing Mix Analysis Data Sources

Our Tupy 4P's Marketing Mix analysis is grounded in a comprehensive review of company-released information, including product portfolios, official pricing strategies, global distribution networks, and integrated marketing campaigns. We leverage insights from Tupy's annual reports, investor relations materials, corporate website, and relevant industry publications.