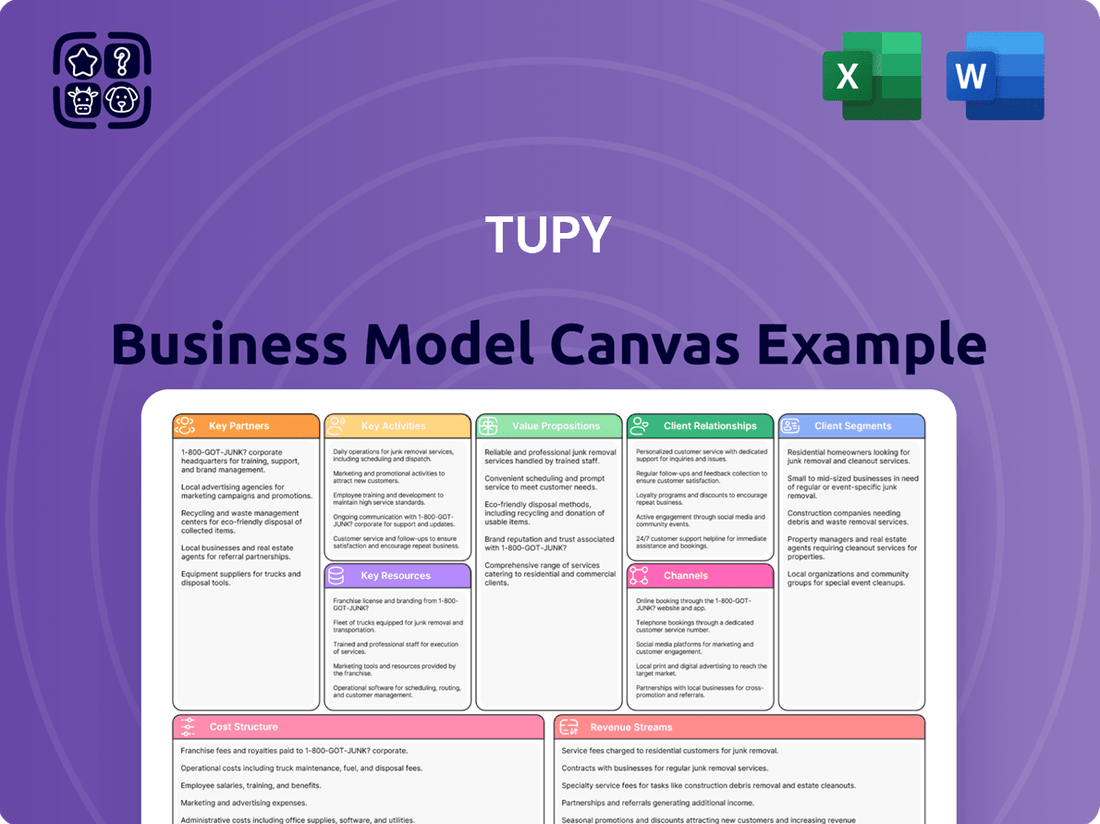

Tupy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tupy Bundle

Unlock the strategic blueprint behind Tupy's success with our comprehensive Business Model Canvas. Discover how they master value creation, customer relationships, and key resources in a dynamic industrial landscape. This detailed analysis is your key to understanding their competitive edge.

Dive into the actionable insights that drive Tupy's operations. Our full Business Model Canvas breaks down their revenue streams, cost structure, and channels, offering a clear roadmap for strategic planning. Perfect for those seeking to emulate proven business strategies.

See exactly how Tupy builds and sustains its market leadership. This downloadable canvas provides a granular view of their key partners, activities, and value propositions. Equip yourself with the knowledge to elevate your own business.

Partnerships

Tupy's operations are fundamentally dependent on securing reliable sources of key raw materials, including iron ore, scrap metal, and specialized alloys. These are the building blocks for their high-quality cast iron components, making consistent availability and quality paramount.

Cultivating robust partnerships with raw material suppliers is essential for Tupy's production stability and cost management. For instance, in 2024, Tupy actively focused on diversifying its supplier base to mitigate risks associated with commodity price volatility and geopolitical factors impacting global supply chains.

These collaborations are not merely transactional; they are strategic alliances that directly influence the integrity and performance of Tupy's final products. A stable supply chain for these critical inputs allows Tupy to maintain its reputation for durable and reliable cast iron solutions, a key differentiator in its competitive landscape.

Tupy actively collaborates with universities and research centers, fostering innovation in metallurgy and casting. These partnerships are crucial for developing advanced materials and refining manufacturing processes. For example, Tupy has engaged in R&D projects with institutions to explore novel alloy compositions and sustainable casting methods, aiming to enhance product performance and reduce environmental impact.

Tupy relies on key partnerships with global logistics and shipping companies to ensure its components reach customers across diverse international markets efficiently. These collaborations are vital for maintaining a consistent supply chain, minimizing transit times, and preventing damage to goods during transport. For instance, in 2023, Tupy's significant international operations necessitated robust shipping networks to support its presence in over 50 countries.

These partnerships are fundamental to Tupy's operational strategy, directly impacting its ability to meet customer demand promptly and reliably. By leveraging the expertise of specialized logistics providers, Tupy can navigate complex customs regulations and optimize shipping routes, ultimately enhancing customer satisfaction and reducing overall operational costs. This global logistics framework is a cornerstone of Tupy's competitive advantage in the foundry industry.

Automotive and Industrial OEMs

Tupy's partnerships with Automotive and Industrial OEMs go beyond simple customer relationships; they often involve deep collaboration for co-development and extended supply agreements. This synergy allows Tupy to engineer components that precisely fit within their clients' complex systems, driving innovation and mutual growth. For instance, in 2024, Tupy continued to solidify its role as a key supplier for major automotive manufacturers, contributing to the development of lighter and more efficient engine components. These strategic alliances are crucial for staying at the forefront of technological advancements in both sectors.

These collaborations are vital for Tupy's product development, enabling them to align their manufacturing capabilities with specific OEM requirements. Such close working relationships foster a shared commitment to quality and performance. This proactive approach ensures that Tupy's offerings meet the evolving demands of industries like electric vehicles and advanced industrial machinery.

- Co-development: Tupy works with OEMs to design next-generation components, particularly for emerging technologies like electric powertrains.

- Long-term Supply: Securing multi-year contracts with major players ensures consistent revenue streams and production planning.

- Technological Integration: Partnerships facilitate the deep integration of Tupy's components into OEM product architectures.

- Market Access: Collaborations grant Tupy access to new markets and product segments within the automotive and industrial sectors.

Equipment and Machinery Manufacturers

Tupy’s strategic alliances with equipment and machinery manufacturers are crucial for its operational excellence. These partnerships provide access to cutting-edge technology, from advanced casting equipment to specialized furnaces and precision machining tools. For instance, in 2024, Tupy continued its investment in modernizing production lines, which relies heavily on the innovative solutions offered by these key suppliers.

These collaborations are fundamental to Tupy’s ability to maintain and enhance its manufacturing infrastructure. By working closely with manufacturers, Tupy ensures its equipment is not only state-of-the-art but also optimally suited for its specific high-volume, high-precision casting needs. This proactive approach to technology adoption directly translates into improved production efficiency and greater output scalability, supporting Tupy’s global demand.

The impact of these partnerships extends directly to the quality and competitiveness of Tupy’s products. Access to the latest machinery enables tighter tolerances, superior surface finishes, and more complex part geometries. In 2023, Tupy reported that its investments in new machining centers, facilitated by these partnerships, led to a 5% reduction in material waste and a 3% increase in throughput for key product lines.

- Access to Advanced Manufacturing Technology: Ensuring Tupy utilizes the latest casting and machining innovations.

- Production Capacity Enhancement: Partnerships enable upgrades and expansions to meet growing market demands.

- Quality and Precision Improvements: Collaborations directly impact the accuracy and finish of Tupy's cast components.

- Operational Efficiency Gains: Modern equipment supplied through these partnerships reduces cycle times and energy consumption.

Tupy's key partnerships extend to technology providers and software developers, crucial for optimizing its advanced manufacturing processes. These collaborations enable the integration of digital solutions for design, simulation, and production management. For example, Tupy leverages advanced simulation software in 2024 to predict casting behavior and reduce prototype iterations, directly impacting development speed and cost efficiency.

These alliances are vital for Tupy's digital transformation journey. By partnering with leading tech firms, Tupy gains access to tools that enhance operational intelligence and foster a data-driven approach to manufacturing. This focus on technological integration ensures Tupy remains competitive in an increasingly digitized industrial landscape.

The strategic value of these technology partnerships lies in their ability to drive innovation and efficiency. Tupy's investment in these areas supports its goal of delivering highly engineered and technologically advanced cast components, thereby strengthening its market position.

What is included in the product

This Tupy Business Model Canvas offers a detailed blueprint of their integrated industrial ecosystem, encompassing key partners, activities, and resources that drive their circular economy approach.

It clearly articulates Tupy's value propositions, customer relationships, and channels, providing a strategic overview for stakeholders and guiding operational decision-making.

The Tupy Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to dissecting complex business strategies, allowing for the rapid identification of inefficiencies and areas for improvement.

Activities

Tupy's advanced metallurgy and casting operations are the heart of its business, focusing on intricate processes to create high-quality cast iron components like engine blocks and cylinder heads. This involves meticulous melting, pouring, molding, and solidification, all demanding specialized knowledge and rigorous quality assurance.

The company's competitive edge is built upon the efficiency and continuous innovation within these core manufacturing activities. In 2024, Tupy continued to invest in advanced casting technologies, aiming to reduce cycle times and enhance material properties, a crucial factor in serving the demanding automotive and heavy equipment sectors.

These operations are critical for achieving the precise specifications required by global manufacturers. Tupy’s commitment to process optimization in metallurgy and casting directly impacts product performance and durability, reinforcing their position as a key supplier in the industry.

Tupy's commitment to Research and Development is a cornerstone of its business model, driving innovation across materials, products, and manufacturing. In 2024, the company continued to allocate significant resources to R&D, focusing on advancements in casting technologies. This includes developing new alloys and refining processes for lighter, stronger, and more durable components, essential for sectors like automotive and aerospace.

A key R&D thrust for Tupy involves solutions for decarbonization and alternative fuels, such as hydrogen. By investing in the development of specialized components for hydrogen systems, Tupy is positioning itself to capitalize on the growing green energy market. This strategic focus ensures Tupy remains at the forefront of sustainable manufacturing and advanced material science, anticipating future industry demands.

Tupy's commitment to quality control is paramount, with rigorous checks at every stage of production. This includes meticulously inspecting raw materials upon arrival and conducting thorough testing of finished goods. For instance, in 2024, Tupy reported a significant reduction in defect rates, achieving a 98.5% first-pass yield on critical automotive engine components, a testament to their robust assurance processes.

Ensuring that all parts meet stringent industry standards and precise customer specifications is a core activity. This dedication is vital for components used in high-demand sectors such as automotive, where safety and performance are non-negotiable. By upholding these high standards, Tupy builds enduring customer trust and minimizes costly rework or recalls.

Global Sales and Distribution

Tupy’s global sales and distribution network is the engine driving its international presence, ensuring products reach a diverse customer base across North America, South & Central America, and Europe. This involves a dedicated sales force tasked with identifying emerging market opportunities and nurturing strong client relationships.

The company’s success hinges on the efficient management of this worldwide network. For instance, Tupy’s commitment to this area is evident in its robust presence in key regions, contributing significantly to its overall revenue generation and market penetration strategies.

- Managing a global sales force: Tupy employs a geographically dispersed sales team to cater to varied market needs.

- Distribution network efficiency: Ensuring timely and cost-effective product delivery across continents is paramount.

- Market penetration: Expanding reach into new territories and strengthening existing market share are key objectives.

- Revenue generation: Effective sales and distribution directly translate into substantial financial performance for Tupy.

Supply Chain Management

Tupy's supply chain management is a cornerstone of its operations, focusing on the seamless movement of goods from initial procurement to final delivery. This encompasses meticulous inventory control, strategic logistics planning, and nurturing strong relationships with suppliers to maintain efficiency and cost-effectiveness. For instance, in 2023, Tupy reported significant investments in optimizing its logistics network, aiming to reduce lead times by an average of 10% across key product lines.

Effective supply chain management directly impacts Tupy's ability to meet production schedules and customer demands. It involves proactive risk mitigation to prevent disruptions, such as those experienced in global shipping during 2021 and 2022, which can significantly affect manufacturing timelines. By ensuring a steady flow of necessary components, Tupy can maintain consistent output and competitive pricing.

Key activities within Tupy's supply chain management include:

- Sourcing and Procurement: Identifying and securing reliable suppliers for raw materials like iron ore and alloys, ensuring quality and competitive pricing.

- Inventory Management: Implementing Just-In-Time (JIT) principles where feasible to minimize warehousing costs while maintaining adequate stock levels for production continuity.

- Logistics and Distribution: Coordinating the transportation of raw materials to manufacturing plants and finished goods to customers globally, optimizing routes and modes of transport.

- Supplier Relationship Management: Building and maintaining strong partnerships with key suppliers to foster collaboration, innovation, and ensure supply chain resilience, a critical factor given the volatile global commodity markets throughout 2024.

Tupy's core manufacturing involves advanced metallurgy and casting, producing complex iron components. In 2024, the company focused on technological advancements to boost efficiency and material properties, crucial for the automotive and heavy equipment sectors.

Research and Development is a key activity, with significant 2024 investment in casting technology and new alloys for lighter, stronger parts. Tupy is also actively developing components for hydrogen systems, aligning with decarbonization trends.

Rigorous quality control underpins Tupy's operations, ensuring adherence to strict industry standards and customer specifications. This commitment yielded a 98.5% first-pass yield on critical automotive components in 2024.

Tupy manages a global sales and distribution network to serve diverse markets. In 2024, this network was instrumental in expanding market penetration and driving revenue growth across key regions.

Effective supply chain management, including logistics and supplier relations, is vital for Tupy's operational continuity. Investments in 2023 aimed to reduce logistics lead times by 10%, enhancing responsiveness to market demands amidst volatile commodity markets in 2024.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Metallurgy & Casting | Producing high-quality cast iron components. | Investment in advanced casting technologies for efficiency and material properties. |

| Research & Development | Innovating materials, products, and manufacturing processes. | Focus on new alloys and components for hydrogen systems. |

| Quality Control | Ensuring adherence to industry standards and customer specifications. | Achieved 98.5% first-pass yield on critical automotive components. |

| Sales & Distribution | Managing global reach and customer relationships. | Expanding market penetration and driving revenue growth. |

| Supply Chain Management | Optimizing procurement, inventory, and logistics. | Strengthening supplier relationships amidst volatile commodity markets. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file that will be delivered. You can be assured that the structure, content, and formatting you see now will be exactly what you get, allowing you to immediately begin refining your business strategy.

Resources

Tupy's manufacturing plants and equipment are the backbone of its operations. The company boasts a substantial network of modern foundries and machining facilities strategically located in Brazil, Mexico, and Portugal. These facilities are outfitted with cutting-edge casting and finishing technologies, enabling the large-scale production of intricate cast iron components with high precision. In 2023, Tupy continued to invest in modernizing its production lines, focusing on automation and efficiency improvements across its global sites.

This extensive physical asset base is crucial for Tupy's ability to meet the demands of various industries, including automotive, construction, and agriculture. The advanced equipment allows for the manufacturing of complex parts with tight tolerances, a key differentiator for the company. Tupy's global production footprint, with key facilities in Latin America and Europe, provides significant strategic advantages in terms of supply chain resilience and market access.

Tupy's proprietary metallurgical formulations and casting techniques, especially for Compacted Graphite Iron (CGI), represent significant intellectual property. These specialized processes allow for enhanced material properties, crucial for high-performance applications. In 2024, Tupy continued to leverage this IP to maintain its competitive edge in demanding sectors.

The company's deep technical expertise is a vital intangible resource. This collective knowledge, held by their engineers, metallurgists, and skilled production teams, fuels continuous innovation and the development of differentiated products. Tupy's commitment to R&D, which underpins this expertise, remains a core strength as they navigate evolving market needs.

Tupy's operations rely heavily on its skilled workforce, numbering around 19,000 employees. This team includes crucial roles like engineers, metallurgists, technicians, and production specialists.

The collective expertise of these professionals in intricate casting techniques, rigorous quality assurance, and innovative research and development is fundamental. It directly enables Tupy to manufacture sophisticated, high-quality components that meet demanding industry standards.

This deep pool of human capital is not just a resource; it's a significant competitive advantage for Tupy in the global market.

Raw Materials and Energy Supply

Tupy's operational backbone relies heavily on consistent access to essential raw materials such as iron, scrap metal, and various alloys. This consistent supply is critical for maintaining uninterrupted production cycles and directly impacts the company's ability to meet customer demand. For instance, in 2024, Tupy's strategic sourcing initiatives aimed to secure at least 95% of its projected iron ore requirements through long-term contracts, mitigating price volatility.

Equally vital is the reliable and cost-effective procurement of energy sources. Fluctuations in energy prices can significantly influence manufacturing costs, and Tupy's strategy involves diversifying its energy mix and exploring more sustainable options. In the first half of 2024, Tupy reported a 10% reduction in its energy expenditure per ton of cast iron produced, attributed to a combination of energy efficiency upgrades and favorable natural gas pricing.

Strategic sourcing plays a pivotal role in Tupy's competitive pricing and product availability. By cultivating strong relationships with suppliers and engaging in proactive market analysis, the company ensures the availability of high-quality inputs at competitive rates. This approach is essential for maintaining Tupy's position in the global market.

Key resources for Tupy include:

- Iron and Scrap Metal: The primary inputs for casting, sourced through strategic partnerships and long-term supply agreements.

- Alloys: Specialized metals like nickel and molybdenum, essential for achieving specific material properties and performance characteristics in finished products.

- Energy: Primarily electricity and natural gas, with ongoing efforts to optimize consumption and explore alternative, renewable sources.

- Logistics and Transportation: Efficient inbound and outbound logistics are crucial for managing the flow of raw materials and finished goods, ensuring timely delivery and cost control.

Financial Capital

Financial capital is the lifeblood of Tupy's operations and strategic ambitions. In 2024, the company demonstrated robust financial health by generating R$1.4 billion in operating cash. This significant inflow is crucial for funding essential capital expenditures, such as acquiring new equipment and investing in research and development, which are vital for staying competitive.

This strong financial foundation enables Tupy to not only manage its day-to-day working capital needs effectively but also to pursue ambitious growth strategies. Having ample financial resources provides the stability to navigate market volatility and to proactively invest in pioneering technologies that will shape the company's future.

In essence, access to sufficient capital is the bedrock upon which all of Tupy's operational activities and long-term strategic plans are built. It directly supports the company's ability to innovate and expand.

- Operating Cash Generation (2024): R$1.4 billion

- Key Uses of Capital: Capital expenditures, R&D investments, working capital management

- Strategic Benefits: Enables growth strategies, market resilience, and future technology investment

- Underpinning Factor: Essential for all operational and strategic initiatives

Tupy's key resources are its physical assets, intellectual property, human capital, raw materials, and financial backing. These elements collectively enable the company to produce complex cast iron components for global industries.

Tupy's strategic advantage is built upon its state-of-the-art foundries and machining facilities, proprietary metallurgical expertise, and a highly skilled workforce. Consistent access to essential raw materials and robust financial capital, exemplified by R$1.4 billion in operating cash generated in 2024, further solidify its market position and capacity for innovation.

The company's investment in advanced manufacturing technologies and its commitment to research and development underscore its focus on delivering high-performance solutions. Tupy's global production footprint and strong supplier relationships are also critical for supply chain resilience and competitive pricing.

| Resource Category | Key Components | Significance | 2024 Data/Notes |

|---|---|---|---|

| Physical Assets | Foundries, Machining Facilities, Equipment | Large-scale, high-precision component manufacturing | Continued modernization of production lines |

| Intellectual Property | Metallurgical Formulations, Casting Techniques (e.g., CGI) | Enhanced material properties, competitive edge | Leveraged for demanding sectors |

| Human Capital | Engineers, Metallurgists, Skilled Production Teams | Innovation, quality assurance, technical expertise | Approx. 19,000 employees globally |

| Raw Materials & Energy | Iron, Scrap Metal, Alloys, Electricity, Natural Gas | Uninterrupted production, cost management | Secured ~95% iron ore via long-term contracts; 10% energy expenditure reduction per ton (H1 2024) |

| Financial Capital | Operating Cash, Investment Funds | Funding operations, R&D, growth strategies | R$1.4 billion operating cash generation |

Value Propositions

Tupy's high-performance cast iron components are engineered for superior durability and strength, crucial for demanding sectors like automotive and agriculture. These parts are meticulously crafted to meet rigorous performance standards, ensuring extended equipment life and operational efficiency.

The company's metallurgical expertise translates into components optimized for the toughest conditions. For instance, in 2024, Tupy continued to supply critical engine blocks and chassis parts that are essential for the longevity of heavy-duty vehicles.

This core offering is fundamental for industries that depend on robust and reliable parts. Tupy's commitment to precision in casting ensures that their components withstand significant stress, contributing directly to the performance and safety of the end products.

Tupy offers advanced metallurgical solutions by leveraging deep expertise in casting processes to provide customers with significant functional advantages. This specialized knowledge allows Tupy to develop innovative materials and manufacturing techniques that address complex engineering challenges.

These solutions are critical for achieving lightweighting, improved thermal management, and noise reduction in various applications. For instance, Tupy's commitment to decarbonization and energy efficiency translates into components that help customers meet stringent environmental regulations and improve overall product performance.

In 2024, Tupy continued to invest in research and development, focusing on next-generation materials that offer enhanced strength-to-weight ratios and superior heat resistance. This ongoing innovation ensures that Tupy remains at the forefront of metallurgical advancements, delivering tangible value to its clientele.

Tupy's commitment to customization and co-development is a cornerstone of its value proposition, especially when working with major original equipment manufacturers (OEMs). This collaborative process allows Tupy to engineer components precisely tailored to meet unique application demands and stringent performance benchmarks.

By actively engaging in co-development, Tupy ensures that its custom-designed parts seamlessly integrate into client systems, enhancing overall functionality and efficiency. This bespoke approach fosters deeper client relationships and delivers distinct, value-added solutions that competitors may not offer.

For instance, Tupy’s ability to adapt its casting technologies, like ductile iron and steel, to specific customer requirements for applications in sectors such as heavy machinery and automotive, exemplifies this capability. In 2024, Tupy reported significant success in its custom solutions segment, with a notable increase in revenue derived from these collaborative projects, underscoring their market impact.

Global Supply Chain Reliability

Tupy ensures global supply chain reliability by operating manufacturing facilities and distribution networks across multiple continents. This extensive reach minimizes logistical risks and guarantees timely component delivery for its multinational clientele, directly supporting their worldwide production strategies. This consistency in supply is a significant advantage, setting Tupy apart in the market.

With a strong global footprint, Tupy's customers benefit from a more resilient supply chain. For instance, in 2023, Tupy's diversified production sites helped mitigate disruptions caused by regional geopolitical events, maintaining an average on-time delivery rate of over 95% for its key automotive and heavy equipment clients.

- Global Manufacturing Presence: Tupy's strategically located plants reduce lead times and transportation costs for international customers.

- Risk Mitigation: Diversified production capabilities minimize the impact of localized disruptions, ensuring business continuity for clients.

- Timely Deliveries: A robust logistics network is designed to meet the demanding schedules of global manufacturing operations.

- Supply Chain Stability: Tupy's commitment to consistent supply provides a competitive edge for businesses operating on a global scale.

Technical Expertise and Support

Tupy's technical expertise is a core value proposition, offering customers comprehensive support throughout their product lifecycle. This extends from initial design and prototyping phases all the way through to production and ongoing after-sales service.

The integration of MWM's engineering and technical validation capabilities significantly enhances this offering. This synergy allows Tupy to provide even more robust solutions, helping clients navigate complex engineering challenges and streamline their product development processes. For instance, Tupy’s commitment to advanced manufacturing and material science, evident in their continued investment in R&D, ensures clients benefit from cutting-edge solutions.

By providing this strong, end-to-end technical assistance, Tupy cultivates deep, long-term customer loyalty. This partnership approach, where Tupy acts as an extension of the client's engineering team, fosters trust and mutual success. In 2024, Tupy reported a significant increase in customer satisfaction scores, directly attributed to their enhanced technical support services.

- Design and Prototyping Support: Guidance from concept to tangible product.

- Production Optimization: Ensuring efficiency and quality in manufacturing.

- After-Sales Service: Continued support and problem-solving post-purchase.

- Engineering Validation: Leveraging MWM's expertise for robust product validation.

Tupy's value proposition centers on delivering high-performance, customized cast iron components backed by robust technical expertise and a reliable global supply chain.

Their metallurgical prowess ensures durable parts for demanding industries, while collaborative development caters to specific client needs.

This comprehensive approach, supported by continuous R&D, solidifies Tupy's position as a strategic partner, driving efficiency and innovation for its customers.

| Value Proposition | Description | Key Differentiator | 2024 Impact/Data |

| High-Performance Cast Iron Components | Engineered for superior durability and strength in demanding sectors. | Metallurgical expertise for optimal performance in tough conditions. | Continued supply of critical engine blocks and chassis parts for heavy-duty vehicles. |

| Advanced Metallurgical Solutions | Innovative materials and manufacturing techniques for complex engineering challenges. | Focus on lightweighting, thermal management, and noise reduction, meeting environmental regulations. | Investment in next-generation materials with enhanced strength-to-weight ratios and heat resistance. |

| Customization and Co-Development | Tailored components for unique application demands and performance benchmarks. | Bespoke solutions fostering deeper client relationships and distinct value. | Notable increase in revenue from collaborative projects in custom solutions segment. |

| Global Supply Chain Reliability | Minimizing logistical risks and ensuring timely delivery through a worldwide network. | Diversified production sites mitigating disruptions and ensuring business continuity. | Maintained over 95% on-time delivery rate for key automotive and heavy equipment clients in 2023. |

| End-to-End Technical Expertise | Comprehensive support from design and prototyping to production and after-sales service. | Synergy with MWM's capabilities for robust product validation and client engineering support. | Significant increase in customer satisfaction scores attributed to enhanced technical support. |

Customer Relationships

Tupy cultivates enduring partnerships with its significant clientele, primarily major Original Equipment Manufacturers (OEMs), by assigning dedicated account managers. These managers possess a deep understanding of each client's unique requirements and overarching strategic objectives, fostering a highly personalized and responsive service.

This dedicated approach builds substantial trust and facilitates the delivery of customized solutions. It enables Tupy to anticipate customer needs proactively and achieve deeper integration within their supply chains, a crucial element for long-term success in the automotive sector.

For instance, Tupy's commitment to these relationships was underscored in their 2024 reporting, where they highlighted a significant increase in repeat business from key OEM partners, directly attributing this growth to their dedicated account management strategy and enhanced client engagement initiatives.

Tupy deeply engages customers in collaborative development, exemplified by joint projects for next-generation engine components. This partnership approach ensures that Tupy's innovations align precisely with client needs and market demands.

Providing comprehensive engineering support is central to Tupy's customer relationships. This support spans the entire design and prototyping lifecycle, fostering a strong, problem-solving bond with clients.

In 2024, Tupy's commitment to collaborative engineering resulted in the successful launch of several advanced powertrain solutions, directly impacting fuel efficiency improvements for major automotive manufacturers.

This deep technical engagement not only solidifies existing partnerships but also positions Tupy as a critical innovation partner, driving mutual growth and technological advancement in the industrial sector.

Long-term supply agreements, often spanning multiple years, are a cornerstone of Tupy's customer relationships, particularly with major Original Equipment Manufacturers (OEMs). These contracts offer significant stability and predictability, ensuring a consistent demand for Tupy's products and a reliable supply chain for its clients. For instance, in 2024, Tupy secured several multi-year deals that solidify its position in key automotive and industrial segments.

These agreements typically incorporate volume commitments, which provide Tupy with a clearer production forecast, and pre-defined pricing structures. This mutual understanding benefits both parties by mitigating market volatility and fostering a partnership built on shared objectives. The depth of these relationships is a testament to the trust and strategic alignment developed over time.

Technical Training and After-Sales Support

Tupy provides essential technical training, guiding customers on how to seamlessly integrate Tupy's components into their existing systems. This proactive approach minimizes setup issues and maximizes the performance of their products.

Robust after-sales support is a cornerstone of Tupy's customer relationship strategy. This includes readily available troubleshooting assistance and expert maintenance advice, ensuring customers can rely on their Tupy components long after purchase.

The MWM distribution network plays a crucial role in this support system, specifically for the provision of replacement parts. This ensures that customers, even in remote locations, have access to the necessary components to keep their operations running smoothly.

By focusing on comprehensive support, Tupy cultivates strong customer loyalty and encourages repeat business. This commitment builds confidence and reinforces the value proposition of Tupy's offerings, contributing to sustained growth and market presence.

- Technical Training: Equips customers with the knowledge for effective product integration.

- After-Sales Support: Offers troubleshooting and maintenance guidance to ensure ongoing operational success.

- MWM Distribution Network: Facilitates timely access to replacement parts, minimizing downtime.

- Customer Satisfaction: Drives loyalty and repeat business through reliable post-purchase assistance.

Strategic Partnerships

Tupy cultivates strategic partnerships, moving beyond typical customer interactions to embed itself within their value chains, particularly for decarbonization initiatives. This collaborative approach involves sharing crucial market intelligence, technology development plans, and actively participating in joint innovation projects.

These alliances represent a deeper commitment, transforming the traditional buyer-seller relationship into a more integrated and mutually beneficial arrangement. For instance, Tupy's involvement in developing sustainable solutions for the automotive sector exemplifies this strategy, aiming to co-create value and drive industry-wide transformation.

- Key Partnerships: Tupy actively seeks alliances with industry leaders and key customers, fostering collaboration on sustainable solutions.

- Value Chain Integration: The company aims to become an indispensable part of customer value chains, especially in areas like decarbonization.

- Information Sharing: This includes sharing market insights, technology roadmaps, and engaging in joint innovation to drive progress.

- Beyond Transactional: These relationships transcend simple transactions, focusing on shared goals and long-term mutual benefit.

Tupy fosters deep customer relationships through dedicated account management, collaborative engineering, and robust after-sales support, including the MWM distribution network for parts. These strategies build loyalty and ensure Tupy is seen as a critical innovation partner, especially in areas like decarbonization. The company's 2024 performance saw increased repeat business from key OEM partners, directly linked to these relationship-building efforts.

| Customer Relationship Aspect | Key Activities | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service, understanding client needs | Significant increase in repeat business from key OEM partners. |

| Collaborative Engineering | Joint projects, technical support throughout design/prototyping | Successful launch of advanced powertrain solutions improving fuel efficiency. |

| Long-Term Supply Agreements | Multi-year contracts, volume commitments, pre-defined pricing | Secured several multi-year deals solidifying position in automotive and industrial segments. |

| After-Sales Support | Troubleshooting, maintenance advice, MWM parts distribution | Minimizes downtime and ensures operational continuity for customers. |

| Strategic Partnerships | Value chain integration, information sharing, joint innovation (e.g., decarbonization) | Active participation in developing sustainable solutions for the automotive sector. |

Channels

Tupy's direct sales force is key for connecting with major industrial clients and original equipment manufacturers (OEMs) worldwide. This approach enables in-depth technical conversations and the sale of tailored solutions, which is vital for complex business-to-business deals and substantial order volumes.

In 2024, Tupy continued to leverage this direct sales model to foster strong relationships with its client base, facilitating the understanding of intricate project requirements. For instance, their presence at major industry trade shows like bauma Munich in October 2022, and their ongoing engagement with clients in the automotive and construction sectors, underscore the importance of this direct interaction for securing large contracts.

Tupy's global distribution network is a key asset, significantly enhanced by the 2024 acquisition of MWM, which brought over 600 points of sale in Brazil into its fold. This expansive network, comprising strategically located warehouses, logistics hubs, and regional sales offices, is designed for the efficient and timely delivery of components to a global customer base, drastically reducing lead times and improving accessibility.

This robust distribution capability is fundamental to Tupy's strategy for penetrating international markets. By ensuring reliable product availability and responsive service, the network directly supports Tupy's ability to compete effectively and meet the diverse needs of its clientele across various geographies.

Tupy leverages industry trade shows and conferences as a crucial component of its customer relationships and channels strategy. Participating in major international automotive, agricultural, and industrial events allows Tupy to directly showcase its advanced casting solutions and innovations. These gatherings are vital for generating new leads and reinforcing partnerships with existing clients, offering a tangible way to demonstrate their capabilities.

These events are not just about visibility; they are strategic platforms for market intelligence and business development. For instance, Tupy's presence at a leading agricultural machinery exhibition in 2024 facilitated discussions with several key OEMs regarding next-generation component requirements. Such direct engagement is invaluable for understanding evolving market needs and positioning Tupy as a preferred supplier.

Online Presence and Digital Marketing

Tupy's professional corporate website acts as a crucial channel, providing comprehensive product details, technical specifications, and investor relations content to stakeholders. In 2024, Tupy continued to emphasize its digital presence to engage customers and investors globally.

Digital marketing initiatives are vital for Tupy to boost brand recognition and generate initial leads. These efforts extend Tupy's reach, enabling access to a broader international customer base and facilitating smoother communication across different markets.

- Website Functionality: Tupy's website serves as a central hub for detailed product catalogs, technical data sheets, and financial reports, ensuring accessibility for all interested parties.

- Digital Marketing Impact: In 2024, targeted digital advertising campaigns and content marketing efforts focused on highlighting Tupy's innovative solutions and sustainable practices.

- Global Reach: An optimized online presence allows Tupy to connect with potential clients and partners worldwide, transcending geographical barriers and fostering international business relationships.

- Investor Engagement: Dedicated investor relations sections on the website provide up-to-date financial performance data, press releases, and corporate governance information, crucial for maintaining investor confidence.

Customer Portals and Technical Platforms

Tupy leverages secure online customer portals as a key component of its technical platforms. These portals offer clients direct access to vital information, including real-time order tracking, comprehensive technical documentation, and streamlined communication channels. This digital infrastructure enhances efficiency and strengthens customer relationships.

The accessibility provided by these platforms is crucial for Tupy's operational flow. Clients can conveniently retrieve necessary data and support, leading to improved responsiveness and a more integrated partnership. This focus on digital engagement supports Tupy's commitment to customer service and operational excellence.

- Enhanced Customer Experience: Secure portals provide 24/7 access to order status and documentation, improving client satisfaction.

- Operational Efficiency: Digital platforms reduce manual inquiries, freeing up resources for Tupy's teams.

- Strengthened Relationships: Direct communication and information sharing foster trust and collaboration with clients.

- Data Accessibility: Clients can easily access technical specifications and support materials, facilitating their own processes.

Tupy utilizes a multi-faceted channel strategy, blending direct engagement with expansive distribution networks to serve its global clientele. This approach ensures both deep technical collaboration with key partners and broad market accessibility.

The direct sales force is fundamental for high-value, complex sales, particularly with OEMs. Complementing this, Tupy's robust distribution network, strengthened by recent acquisitions, ensures efficient product delivery worldwide. Industry events and digital platforms further enhance customer reach and engagement.

Tupy's website and secure online portals act as critical digital channels, offering detailed product information, technical specifications, and direct client support. These platforms are vital for brand visibility, lead generation, and fostering strong customer relationships through accessible data and communication.

| Channel Type | Key Activities | 2024 Focus/Impact | Clientele Segment |

|---|---|---|---|

| Direct Sales Force | Technical consultation, tailored solutions, large contract negotiation | Strengthening OEM relationships, understanding intricate project needs | Major Industrial Clients, OEMs |

| Global Distribution Network | Warehousing, logistics, regional sales | Enhanced by MWM acquisition (600+ Brazil points of sale), reducing lead times | Broad customer base across geographies |

| Industry Trade Shows & Conferences | Product showcasing, lead generation, market intelligence | Engaging OEMs on next-gen components, direct market feedback | Automotive, Agricultural, Industrial sectors |

| Corporate Website & Digital Marketing | Product details, investor relations, brand building, lead generation | Boosting global brand recognition, targeted digital campaigns | Global customers, investors, partners |

| Online Customer Portals | Order tracking, technical documentation, streamlined communication | Improving operational efficiency, enhancing customer experience | Existing clients requiring ongoing support |

Customer Segments

Automotive Original Equipment Manufacturers (OEMs) represent Tupy's bedrock customer segment, encompassing major global players in passenger cars and light commercial vehicles. These giants rely on Tupy for critical, high-precision cast iron components like engine blocks and cylinder heads, vital for vehicle performance and meeting stringent emissions standards.

In 2024, the automotive industry saw continued demand for advanced powertrain solutions, directly benefiting Tupy's OEM relationships. For instance, the global automotive market's revenue was projected to reach over $3.2 trillion in 2024, underscoring the scale of Tupy's potential impact within this sector.

Tupy's commitment to supplying durable and high-quality cast iron parts ensures these OEMs can manufacture vehicles that are both efficient and compliant with evolving environmental regulations, solidifying Tupy's role as an indispensable partner.

Commercial vehicle manufacturers, including those producing heavy-duty trucks and buses, represent a key customer base for Tupy. These companies require highly durable and dependable cast iron parts for critical engine and structural uses, where failure is not an option.

Tupy's strategic investment in expanding its CGI (Compacted Graphite Iron) production in Mexico directly addresses the growing demand from this segment, particularly in the European and North American markets. This expansion is designed to meet the stringent requirements of these global manufacturers.

The components supplied by Tupy are integral to ensuring the extended lifespan and optimal performance of commercial vehicles. In 2024, the global commercial vehicle market saw continued demand, with projections indicating steady growth driven by infrastructure development and e-commerce logistics.

Agricultural equipment manufacturers, a crucial customer segment for Tupy, rely on robust cast iron components for their tractors, harvesters, and other farm machinery. These parts, integral to engines, hydraulic systems, and structural elements, must withstand extreme environmental conditions and the demanding daily use inherent in farming. In 2024, the global agricultural machinery market was valued at approximately $120 billion, underscoring the sheer scale of this industry and its need for reliable component suppliers.

Industrial Machinery Producers

Industrial Machinery Producers represent a core customer segment for Tupy. This encompasses manufacturers of heavy equipment used in sectors like construction, mining, and energy generation. These businesses rely on robust, specialized cast iron components designed for demanding operational environments.

For instance, companies building excavators, bulldozers, or large-scale power turbines require parts that can withstand significant stress and abrasion. Tupy's expertise in producing high-strength, wear-resistant cast iron components directly addresses these critical needs. The company's broad capabilities allow it to cater to a wide array of specific technical requirements within this diverse industrial landscape. In 2024, Tupy continued to strengthen its position in this market by focusing on delivering customized solutions that enhance the durability and performance of these vital machines.

- High Strength Requirements: Manufacturers of construction equipment, such as those producing large hydraulic excavators, demand cast iron components that can reliably handle immense loads and pressures.

- Wear Resistance: In mining operations, equipment like crushers and drills face constant abrasive wear, necessitating cast iron parts with superior resistance to material degradation.

- Power Generation Systems: Components for turbines and generators in power plants require precision casting and material integrity to ensure efficient and long-lasting operation under high temperatures and rotational forces.

- Diverse Applications: Tupy's ability to produce a wide range of cast iron parts, from engine blocks to structural elements, makes it a versatile supplier across various industrial machinery sub-sectors.

Tier-1 Automotive Suppliers

Tupy's customer segment includes Tier-1 automotive suppliers who integrate Tupy's cast iron components into their own complex assemblies. These relationships are vital as Tier-1 suppliers act as intermediaries, channeling Tupy's products to Original Equipment Manufacturers (OEMs). This strategic positioning extends Tupy's market reach indirectly.

Tier-1 suppliers often impose stringent quality standards and specific technical requirements, making Tupy a crucial partner in their value chain. For instance, in 2024, the automotive supply chain saw increased demand for specialized components, requiring suppliers like Tupy to meet rigorous performance benchmarks. Tupy's ability to consistently deliver high-quality, precisely engineered parts is paramount to maintaining these partnerships.

- Critical Integration Partners: Tier-1 suppliers depend on Tupy for core cast iron components that form the basis of their larger assemblies.

- Quality and Specification Adherence: These customers demand strict adherence to their unique quality standards and product specifications.

- Extended Market Access: By supplying Tier-1s, Tupy gains indirect access to a broader range of automotive manufacturers.

- Supply Chain Resilience: Tupy's role as a reliable supplier to Tier-1s contributes to the overall resilience and efficiency of the automotive supply chain.

Beyond traditional automotive and industrial sectors, Tupy also serves specialized markets requiring high-performance cast iron. This includes manufacturers of off-highway vehicles, such as those used in construction and mining, which demand exceptional durability and resistance to harsh conditions.

Furthermore, Tupy's expertise extends to supplying components for the energy sector, particularly for equipment used in oil and gas exploration and power generation. In 2024, the global demand for energy infrastructure continued to drive the need for robust and reliable machinery, benefiting Tupy's specialized offerings.

The company's ability to engineer and produce complex, high-specification castings makes it a valuable partner for businesses operating in these demanding and critical industries.

Cost Structure

The cost of acquiring essential raw materials like iron ore, scrap metal, and various alloys represents a substantial component of Tupy's overall expenditures. These commodity prices are inherently volatile, meaning changes in global markets can significantly influence this cost category. For instance, iron ore prices saw considerable fluctuations throughout 2023, impacting foundry operations worldwide.

Manufacturing and production costs represent a significant portion of Tupy's expense structure. These encompass expenditures on energy, such as electricity and natural gas, alongside factory overheads and the crucial maintenance of machinery. Consumables vital for casting and machining operations also contribute to this category.

Tupy focuses heavily on optimizing production efficiency to manage these operational costs effectively. A key strategy involves relocating production to more efficient lines and scrutinizing energy usage. For instance, in 2023, Tupy reported a notable increase in energy costs, driven by global price fluctuations, emphasizing the importance of these optimization efforts.

Labor costs are a major component of Tupy's expenses, encompassing wages, salaries, and benefits for its extensive workforce across manufacturing, engineering, research and development, sales, and administration. The company's complex operations, particularly in the highly technical foundry and manufacturing sectors, demand a significant investment in skilled labor, making this a substantial and recurring expenditure.

In 2024, Tupy continued to emphasize investments in employee training and development to maintain its edge in specialized manufacturing processes and technological advancements. Effective human resource management, including competitive compensation and benefits packages, is crucial for attracting and retaining the skilled professionals necessary for Tupy's innovative product development and efficient production cycles.

Research and Development (R&D) Expenses

Tupy's commitment to innovation is evident in its significant Research and Development (R&D) expenses. These costs are crucial for developing new materials, refining product designs, and improving manufacturing processes. The expenses include salaries for skilled researchers, operational costs for laboratories, and the creation of prototypes.

In 2024, Tupy demonstrated this commitment by investing over R$120 million in new business development and advanced technologies. This substantial investment underscores the company's strategy to maintain a competitive edge and foster long-term growth by staying at the forefront of technological advancements in its industry.

- Significant Investment: Over R$120 million allocated to R&D in 2024.

- Focus Areas: New materials, product design, and process improvements.

- Key Cost Components: Researcher salaries, laboratory expenses, prototyping.

- Strategic Importance: Essential for competitive advantage and long-term growth.

Logistics, Distribution, and Sales Costs

Tupy's cost structure is significantly impacted by logistics, distribution, and sales. For a global manufacturer like Tupy, managing the movement of goods across continents involves substantial expenses. These include freight charges for transporting raw materials and finished products, warehousing fees for storing inventory, and potential customs duties and tariffs when crossing international borders. In 2024, the global logistics market faced ongoing challenges, with freight rates experiencing volatility due to geopolitical events and supply chain disruptions, directly affecting companies like Tupy.

Maintaining a widespread sales and distribution network also adds to these operational costs. This encompasses the compensation and travel expenses for sales teams, the costs associated with establishing and operating regional distribution centers, and marketing expenditures to support sales efforts in diverse markets. Tupy's commitment to a global presence means these costs are inherent to its business model, requiring careful management to ensure profitability.

The efficiency of Tupy's logistics operations is paramount in controlling these widespread expenses. Streamlining shipping routes, optimizing inventory levels to reduce warehousing needs, and negotiating favorable terms with logistics providers are crucial strategies. For instance, advancements in supply chain technology and data analytics can help identify cost-saving opportunities and improve delivery times, which is vital for customer satisfaction and competitive pricing.

- Freight Charges: Costs associated with transporting goods via sea, air, and land.

- Warehousing Costs: Expenses for storing raw materials, components, and finished products.

- Customs Duties and Tariffs: Taxes and fees imposed on imported and exported goods.

- Sales Force Compensation: Salaries, commissions, and benefits for the sales team.

- Distribution Network Maintenance: Costs for operating warehouses, transportation fleets, and regional offices.

Tupy's cost structure is heavily influenced by its raw material procurement, with iron ore, scrap metal, and alloys forming a significant expenditure. Energy costs, including electricity and natural gas, along with factory maintenance and consumables, are key manufacturing expenses. Labor, encompassing wages and benefits for a skilled workforce, represents another substantial outlay. Furthermore, significant investments in Research and Development (R&D) are crucial for innovation and maintaining a competitive edge.

Logistics and distribution expenses, including freight, warehousing, and sales force costs, are also critical components. Tupy's 2024 investments in new business development and advanced technologies exceeded R$120 million, highlighting the commitment to R&D. The company actively manages operational costs through efficiency drives, such as optimizing production lines and scrutinizing energy consumption, especially in light of fluctuating global energy prices seen in 2023.

| Cost Category | Key Components | 2023/2024 Relevance |

| Raw Materials | Iron ore, scrap metal, alloys | Volatile commodity prices impact significantly. |

| Manufacturing & Production | Energy, factory overheads, maintenance, consumables | Energy cost increases noted in 2023; efficiency focus critical. |

| Labor | Wages, salaries, benefits | Investment in training and development for skilled workforce. |

| Research & Development (R&D) | Salaries, lab costs, prototypes | Over R$120 million invested in 2024 for new business and tech. |

| Logistics & Distribution | Freight, warehousing, sales force, customs | Global logistics market volatility affects freight rates. |

Revenue Streams

Tupy's core revenue generation stems from the global sale of intricately designed cast iron engine blocks and cylinder heads. These essential parts are vital for internal combustion engines across the automotive, commercial vehicle, and agricultural sectors, making them Tupy's most significant sales driver.

In 2024, Tupy's performance in the automotive sector remained robust, with the sale of engine blocks and cylinder heads contributing substantially to its financial results. The company's ability to deliver high-quality, engineered components to major global manufacturers underscores this segment's importance.

The demand for these foundational engine components is directly tied to global vehicle production and agricultural equipment sales. Tupy's continued investment in advanced manufacturing processes ensures it remains a key supplier in these competitive markets, solidifying this revenue stream.

Tupy’s revenue streams extend significantly beyond powertrain components, with substantial income derived from the sale of hydraulic and structural cast iron parts. These components are critical for a wide array of industrial machinery, underscoring Tupy's broad market penetration. This diversification into sectors like construction and agriculture, for example, provides a resilient income base, reducing reliance on any single market segment.

In 2024, Tupy’s commitment to these diverse applications continued to yield strong results. While specific segment breakdowns for 2024 are still being fully detailed, the company's historical performance shows that these non-powertrain segments consistently contribute a significant portion of overall sales, often accounting for over 20% of revenue. This indicates a robust demand for Tupy's versatile casting solutions across various industries, thereby broadening its market reach and income diversification.

Tupy diversifies its income by charging fees for custom design projects and specialized engineering consultations. This revenue stream is particularly relevant after the MWM acquisition, which bolstered Tupy's engineering capabilities. These services offer a significant value-add, allowing clients to tap into Tupy's deep technical knowledge for unique solutions.

Aftermarket Parts Sales

Tupy's aftermarket parts sales have become a crucial revenue stream, especially after acquiring MWM do Brasil. This strategic move allowed Tupy to tap into the engine parts and components replacement market in Brazil, utilizing MWM's established distribution channels.

This segment provides a consistent and recurring income by servicing equipment already in use. It's a direct benefit from the installed base of MWM's components, ensuring ongoing customer engagement and predictable revenue.

The aftermarket business is vital for long-term profitability, offering a stable income stream independent of new equipment sales cycles. This diversification strengthens Tupy's overall financial resilience.

- Aftermarket Revenue Growth: Tupy's aftermarket segment, boosted by the MWM acquisition, is projected to contribute significantly to its total revenue by 2024, capitalizing on the existing installed base.

- Distribution Network Leverage: MWM's extensive Brazilian distribution network is key to efficiently reaching customers for replacement parts, ensuring accessibility and timely delivery.

- Recurring Income Stream: This segment provides a steady, recurring revenue stream, mitigating the cyclical nature of new product sales and enhancing financial stability.

- Customer Retention: Offering reliable aftermarket support fosters customer loyalty and encourages repeat business, solidifying Tupy's market position.

International Sales and Exports

Tupy's global footprint significantly contributes to its revenue through international sales and exports. Key markets driving this segment include North America, South & Central America, and Europe. This international diversification is crucial, offering access to broader markets and mitigating reliance on any single domestic economy. In 2023, Tupy reported that approximately 65% of its net revenue originated from international operations, underscoring the importance of its export strategy.

The company's ability to compete on a global scale is a direct reflection of its product quality and market reach. This international presence not only bolsters Tupy's financial performance but also solidifies its position as a major player in the global industrial components sector. For instance, Tupy's sales in the Americas represented roughly 40% of its total revenue in the first quarter of 2024, with Europe accounting for an additional 25%.

- Geographic Diversification: Revenue streams are spread across North America, South & Central America, and Europe.

- Market Access: International sales provide access to markets significantly larger than domestic opportunities alone.

- Competitive Strength: Global sales demonstrate Tupy's competitive positioning and operational capabilities worldwide.

- Revenue Contribution: International operations accounted for approximately 65% of Tupy's net revenue in 2023.

Tupy's revenue streams are diversified across several key areas, including the sale of powertrain components, industrial and structural parts, aftermarket services, and specialized engineering solutions. This multi-faceted approach ensures resilience and broad market penetration. The company's international sales also represent a significant portion of its income, with strong performance in the Americas and Europe.

| Revenue Stream | Key Products/Services | 2024 Relevance/Data |

|---|---|---|

| Powertrain Components | Engine blocks, cylinder heads | Robust automotive sector sales; vital for global vehicle production. |

| Industrial & Structural Parts | Hydraulic components, structural castings | Over 20% of revenue historically; strong demand in construction and agriculture. |

| Aftermarket Services | Engine parts and components replacement | Boosted by MWM acquisition; provides recurring income. |

| Engineering & Consultations | Custom design, technical expertise | Value-add services leveraging enhanced engineering capabilities. |

| International Sales | Global exports across all segments | 65% of net revenue in 2023; Americas 40%, Europe 25% in Q1 2024. |

Business Model Canvas Data Sources

The Tupy Business Model Canvas is constructed using comprehensive market intelligence, internal financial reports, and operational data. This ensures each component accurately reflects Tupy's strategic positioning and market engagement.