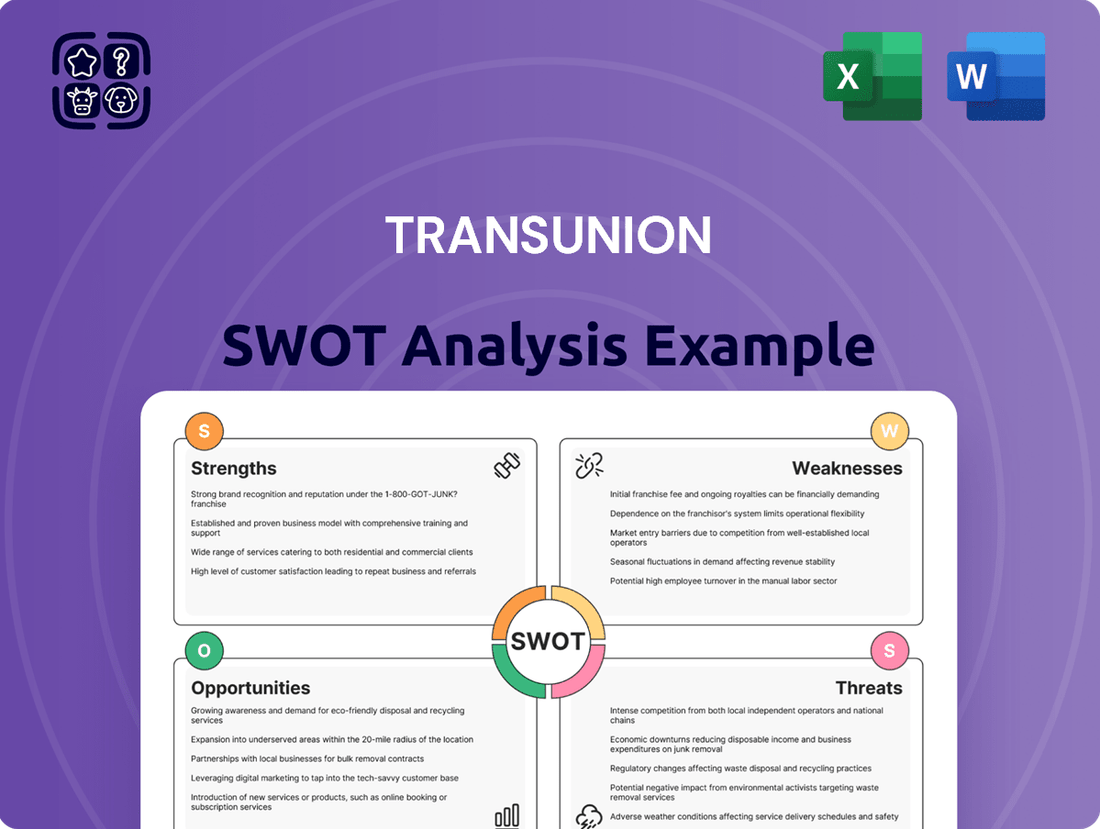

TransUnion SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TransUnion Bundle

TransUnion, a global leader in credit information and information services, possesses significant strengths in its vast data repositories and established brand reputation. However, potential weaknesses include reliance on a few key markets and the ongoing need to adapt to evolving data privacy regulations.

Opportunities abound for TransUnion in emerging markets and the expansion of its digital identity solutions. Yet, the company faces considerable threats from increasing competition, data breaches, and the potential for disruptive technologies that could reshape the credit reporting landscape.

Want the full story behind TransUnion's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TransUnion's extensive data assets are a significant strength. They hold vast amounts of consumer and business information, which is a critical foundation for their services. This data is not just raw information; it's meticulously collected and organized.

Leveraging this data is advanced analytics, including AI and machine learning, powered by platforms like OneTru. In 2023, TransUnion reported revenue growth driven by these capabilities, highlighting how sophisticated analysis of their data translates directly into financial performance. This allows them to offer deep insights into credit risk, fraud prevention, and targeted marketing.

The company excels at integrating diverse data sources, crucially including alternative data. This ability to combine traditional credit information with new, often non-traditional, data points significantly enhances the accuracy and comprehensiveness of the insights they provide. This is vital for clients needing to make informed decisions across various industries, from finance to telecommunications.

TransUnion is a powerhouse in the global information and insights sector, boasting a substantial market share in credit reporting. This strong market position is a testament to its long-standing presence and trusted brand. The company’s ability to maintain such a significant footprint in a competitive landscape highlights its operational efficiency and customer loyalty.

The company's strength is further amplified by its highly diversified portfolio, spanning key U.S. markets like financial services, emerging verticals, and consumer interactive segments. This diversification isn't just about breadth; it actively reduces risk. For instance, in 2024, while some sectors faced headwinds, TransUnion's exposure to resilient areas like essential services and government contracts helped cushion overall performance.

Internationally, TransUnion also maintains a robust presence, serving a wide array of industries from lending and insurance to telecommunications and even gaming. This global reach allows them to tap into growth opportunities worldwide and provides a buffer against regional economic slowdowns. Their international operations contributed approximately 30% to total revenue in the first half of 2025, demonstrating its critical role in the company's financial health.

TransUnion’s commitment to innovation is a significant strength, underscored by its continuous investment in technology. A prime example is the 2024 launch of the OneTru platform, which integrates data, identity, and analytics through AI and machine learning.

This strategic modernization is designed to speed up product creation and boost operational efficiency, ultimately delivering faster insights to clients. This focus on advanced technology directly enhances critical functions like fraud detection, reducing the need for manual interventions and paving the way for new offerings such as freemium credit services.

Consistent Financial Performance and Growth

TransUnion has shown impressive financial consistency, with recent quarters frequently surpassing expectations. This includes robust revenue growth and expanding profit margins.

For instance, in the first quarter of 2025, the company achieved 8% organic revenue growth when currency fluctuations are removed. They also saw improvements in their Adjusted EBITDA and Earnings Per Share (EPS), highlighting effective operational management and a business model that can withstand economic pressures.

Further demonstrating their financial strength, TransUnion has been diligently reducing its debt levels and actively repurchasing its own shares. These actions are clear indicators of a healthy financial standing and a commitment to shareholder value.

- Consistent Revenue Growth: Achieved 8% organic constant currency revenue growth in Q1 2025.

- Margin Expansion: Reported improved Adjusted EBITDA and EPS, signaling operational efficiency.

- Financial Health: Actively deleveraging and engaging in share repurchases.

- Resilient Business Model: Performance often exceeds financial guidance, even in challenging economic environments.

Commitment to Financial Inclusion and Alternative Data

TransUnion’s dedication to financial inclusion is a significant strength, especially as they actively work to bring underserved populations into the formal financial system. By utilizing alternative data sources, they can assess the creditworthiness of individuals who lack traditional credit histories. This is crucial for expanding access to financial products and services globally, particularly in emerging markets where such data is abundant.

This focus on alternative data not only fosters social good but also unlocks new revenue streams and market opportunities for TransUnion. For instance, by enabling credit access for millions of previously excluded individuals, they are expanding their customer base and demonstrating a commitment to responsible growth. Their strategic partnerships in this domain highlight a proactive approach to addressing financial disparities.

- Expanding Access: TransUnion's initiatives aim to provide credit access to millions globally, particularly in developing economies.

- Alternative Data Utilization: They leverage non-traditional data to assess risk for individuals without conventional credit footprints.

- Market Growth: This strategy opens up new customer segments and drives business expansion in underserved markets.

TransUnion's extensive data assets, combined with advanced analytics powered by platforms like OneTru, are a core strength. Their ability to integrate diverse data sources, including alternative data, significantly enhances the accuracy and comprehensiveness of their insights. This robust data foundation and analytical capability directly translate into financial performance, as evidenced by their revenue growth driven by these sophisticated analyses.

The company holds a substantial market share in credit reporting, reflecting a strong, trusted brand and efficient operations. This market leadership is further bolstered by a highly diversified portfolio across key U.S. markets, which helps mitigate risk. Internationally, TransUnion's significant global presence, contributing approximately 30% to total revenue in the first half of 2025, provides resilience against regional economic fluctuations.

TransUnion's commitment to innovation is a key differentiator, demonstrated by continuous investment in technology such as the 2024 OneTru platform. This focus on AI and machine learning accelerates product development and improves operational efficiency, enhancing critical functions like fraud detection. Furthermore, their dedication to financial inclusion, by leveraging alternative data to bring underserved populations into the formal financial system, opens new market opportunities and fosters responsible growth.

Financially, TransUnion exhibits impressive consistency. In Q1 2025, they achieved 8% organic revenue growth (constant currency) and saw improvements in Adjusted EBITDA and EPS. The company is also actively managing its financial health by reducing debt and repurchasing shares, signaling a strong commitment to shareholder value and a resilient business model capable of navigating economic challenges.

What is included in the product

Analyzes TransUnion’s competitive position through key internal and external factors, detailing its strengths in data analytics and market leadership, alongside weaknesses in data privacy concerns and opportunities in emerging markets, while acknowledging threats from regulatory changes and new competitors.

Offers a clear, actionable framework for identifying and addressing TransUnion's strategic challenges and opportunities.

Weaknesses

TransUnion's reliance on the credit ecosystem makes it vulnerable to economic downturns and credit market volatility. For instance, a substantial rise in interest rates or a surge in consumer loan delinquencies, as seen during periods of economic stress, can directly dampen demand for credit information services. In the first quarter of 2024, while TransUnion reported revenue growth, the ongoing uncertainty surrounding inflation and potential economic slowdowns presents a persistent risk. A severe recession could curtail lending activity, thereby impacting the volume of credit data processed and reported by TransUnion.

TransUnion operates within a highly regulated credit reporting industry, facing constant oversight from agencies such as the Consumer Financial Protection Bureau (CFPB). This intense scrutiny necessitates significant resources dedicated to ensuring compliance with evolving data privacy and consumer protection laws.

Recent legal challenges, including settlements for issues with dispute resolution processes and data accuracy, underscore the substantial financial and operational costs associated with regulatory adherence. For instance, TransUnion agreed to a $40 million settlement in 2023 with the CFPB and state regulators over allegations of misleading consumers about the security of their personal information and the accuracy of credit reports.

Failure to meet these stringent requirements can lead to severe consequences, including substantial financial penalties, damage to brand reputation, and costly mandates for overhauling existing systems and processes. The ongoing need to adapt to new regulations and address past compliance failures represents a persistent weakness for the company.

TransUnion's extensive management of sensitive personal and financial data makes it a significant target for cyberattacks. While the number of breaches saw a decrease in 2024, the sophistication and impact of these incidents escalated, with attackers increasingly compromising high-quality credentials, thereby heightening the risk of identity fraud.

The potential fallout from a major data breach for TransUnion is substantial. Such an event could trigger severe financial penalties, erode critical consumer trust, and expose the company to significant legal liabilities, impacting its long-term reputation and operational stability.

Reliance on Traditional Credit Bureau Model

TransUnion's continued reliance on the traditional credit bureau model presents a notable weakness. While the company is investing in alternative data and analytics, a substantial portion of its revenue still originates from this established framework. This makes TransUnion susceptible to disruptions that could alter how creditworthiness is evaluated.

The traditional model's vulnerability stems from potential shifts in credit assessment methodologies and the emergence of new market participants offering innovative solutions. Furthermore, traditional credit scores may become less relevant for certain demographic or economic segments, impacting the core business.

- Revenue Concentration: A significant percentage of TransUnion's income is still tied to traditional credit reporting services, highlighting a dependency on established market dynamics.

- Market Disruption Risk: The company faces threats from fintech companies and other innovators that may offer alternative or more appealing methods of assessing credit risk, potentially bypassing traditional bureaus.

- Evolving Consumer Finance: Changes in consumer behavior and the rise of the gig economy could diminish the predictive power or necessity of traditional credit data for a growing portion of the population.

Competition from Fintech and Niche Data Providers

TransUnion faces intense competition not only from its traditional rivals, Experian and Equifax, but also from a growing wave of fintech disruptors and specialized data providers. These emerging players often bring agility and innovative solutions to market, potentially chipping away at TransUnion's established market share. For instance, by the end of 2024, the fintech sector continued its rapid expansion, with new platforms offering alternative credit scoring models and data analytics, directly challenging incumbent credit bureaus.

These niche providers can focus on specific market segments, offering highly tailored data or analytical tools that TransUnion may not currently prioritize. This specialized approach can be particularly effective in attracting customers seeking customized solutions, thereby pressuring TransUnion's pricing power in those areas. As of early 2025, reports indicate a significant increase in venture capital funding for data analytics startups, highlighting the competitive pressure on established firms to innovate continuously.

- Fintech Competition: A growing number of agile fintech companies are challenging traditional credit reporting with innovative data sources and scoring methods.

- Niche Data Providers: Specialized firms are emerging, offering tailored data solutions for specific industries or customer segments, eroding broad-market dominance.

- Pricing Pressure: Increased competition can lead to pricing pressures as providers vie for market share, potentially impacting TransUnion's revenue margins.

- Technological Disruption: Competitors leveraging newer technologies and alternative data can offer more dynamic and potentially more accurate insights, forcing incumbents to adapt quickly.

TransUnion's significant reliance on the traditional credit reporting model presents a substantial weakness. This model, while historically robust, is susceptible to disruption from evolving credit assessment methodologies and new market entrants. For instance, the traditional credit score's relevance might diminish for certain demographics, impacting TransUnion's core business as of early 2025.

The company faces intense competition from agile fintech companies and specialized data providers offering innovative solutions and alternative credit scoring. By the end of 2024, these disruptors continued their rapid expansion, potentially eroding TransUnion's market share and pricing power.

Operational weaknesses include the substantial resources required for regulatory compliance and the ongoing costs associated with legal challenges and data accuracy issues. TransUnion's vulnerability to cyberattacks also poses a significant risk, with a major data breach potentially leading to severe financial penalties and reputational damage.

Same Document Delivered

TransUnion SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The TransUnion SWOT analysis you see here is exactly what you will download after purchase, offering a comprehensive understanding of the company's strategic position.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, gaining access to all the detailed insights and actionable strategies concerning TransUnion's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

TransUnion can tap into significant growth by expanding into emerging markets, where a substantial portion of the population lacks formal credit histories. By utilizing alternative data sources and tailoring solutions for local needs, TransUnion can onboard millions of new consumers, creating fresh revenue opportunities and promoting financial inclusion. This strategy is exemplified by their acquisition in Mexico, reinforcing their commitment to these underserved regions.

The company's ability to leverage alternative data, such as utility payments or mobile phone usage, is key to unlocking financial access for the 'credit invisible' demographic. This not only benefits consumers by enabling them to build creditworthiness but also provides TransUnion with valuable datasets. For instance, in 2023, TransUnion reported that its international segment accounted for approximately 20% of its total revenue, highlighting the growing importance of global expansion.

The growing need for a comprehensive understanding of consumers creates a significant opportunity for TransUnion to expand its use and profitability of alternative data. This encompasses information from sources like utility payments, rental history, and other non-traditional metrics, which can improve how companies assess risk, spot fraud, and target marketing efforts, particularly for groups that have historically been overlooked. For instance, in 2024, the global alternative data market was projected to reach over $10 billion, demonstrating a clear demand for these insights.

By integrating these diverse data streams, TransUnion can offer richer, more predictive insights to its clients. This allows for more accurate credit scoring for individuals with thin credit files and enables businesses to make more informed decisions regarding customer acquisition and retention. The company's ability to process and analyze this data effectively positions it to capture a larger share of this expanding market, potentially boosting revenue from its analytics solutions.

TransUnion's significant investment in AI and machine learning, exemplified by its OneTru platform, presents a powerful opportunity to create groundbreaking products. This focus allows for the development of solutions that extend far beyond conventional credit reporting, tapping into new revenue streams and market segments.

These advancements can translate into highly sophisticated fraud prevention mechanisms, offering businesses a more robust defense against evolving threats. Furthermore, predictive analytics powered by AI can revolutionize marketing strategies, enabling more targeted and effective customer engagement, thereby boosting ROI.

The enhanced decisioning capabilities derived from AI and machine learning can be applied across a multitude of industries, from financial services to healthcare and beyond. This leads to improved operational efficiency and demonstrably better customer outcomes, solidifying TransUnion's position as a key solutions provider.

For instance, TransUnion's 2024 projections highlight a continued emphasis on leveraging data analytics for enhanced customer insights and risk management. The company's ongoing commitment to these technologies is expected to fuel a pipeline of innovative offerings throughout 2024 and into 2025, directly addressing market demands for smarter, data-driven solutions.

Strategic Partnerships and Acquisitions

TransUnion's strategic partnership and acquisition strategy presents significant growth opportunities. By teaming up with fintech innovators and expanding its data sources through collaborations with other technology firms, TransUnion can unlock new revenue streams and enhance its existing product suite. This approach allows the company to quickly adapt to evolving market demands and offer more comprehensive solutions to its clients.

Inorganic growth through targeted acquisitions is also a key avenue. The company's acquisition of Monevo in 2022, for instance, bolstered its consumer lending solutions. Similarly, securing a controlling interest in Trans Union de Mexico allows for deeper penetration into a crucial Latin American market. These moves not only diversify TransUnion's business but also strengthen its competitive position globally.

- Fintech Partnerships: Access to new data sets and expanded solution offerings.

- Data Provider Collaborations: Enhanced analytics and market insights.

- Acquisition of Monevo: Strengthened consumer lending capabilities.

- Trans Union de Mexico Investment: Deeper market penetration in Latin America.

Enhanced Fraud Prevention and Identity Verification Services

The escalating frequency and sophistication of data breaches, coupled with a surge in fraudulent activities, are creating a significant demand for advanced fraud prevention and identity verification services. TransUnion is exceptionally positioned to leverage its deep expertise in identity data and cutting-edge analytics to meet this growing market need. Their enhanced TruValidate solutions are designed to not only boost fraud detection capabilities but also to minimize the occurrence of legitimate transactions being incorrectly flagged, thereby improving the customer experience for businesses and their clients.

This presents a substantial opportunity for TransUnion to expand its market share by offering solutions that directly address critical business pain points in an era of heightened cybersecurity concerns. For instance, the digital identity verification market is projected to grow substantially, with some reports indicating a compound annual growth rate exceeding 15% through 2027, driven by the need for secure online transactions and regulatory compliance.

- Growing Market Demand: Increased data breaches and fraud attempts amplify the need for reliable identity verification and fraud prevention.

- TransUnion's Strengths: Expertise in identity data and advanced analytics, particularly with TruValidate, allows for superior fraud detection.

- Improved Business Outcomes: Solutions enhance fraud capture rates while reducing false positives, leading to better customer experiences and reduced operational costs.

- Market Growth Projections: The digital identity verification sector is experiencing robust growth, indicating significant revenue potential for TransUnion.

TransUnion's strategic expansion into emerging markets, coupled with its adeptness in leveraging alternative data for financial inclusion, presents a robust growth trajectory. The company's investment in AI and machine learning, particularly through its OneTru platform, is poised to drive innovation in fraud prevention and predictive analytics. Furthermore, a proactive approach to partnerships and acquisitions, such as the integration of Monevo and increased stake in Trans Union de Mexico, solidifies its global presence and diversifies revenue streams.

The increasing demand for advanced fraud prevention and identity verification services, driven by escalating data breaches and fraudulent activities, creates a significant opportunity for TransUnion. Its TruValidate solutions are designed to enhance fraud detection while minimizing false positives, improving customer experiences and operational efficiency for clients. The digital identity verification market's projected substantial growth further underscores TransUnion's potential for market share expansion.

Threats

A significant threat to TransUnion stems from the increasing stringency of data privacy regulations like the GDPR and CCPA, coupled with growing consumer demand for opting out of data sharing. These evolving rules can directly impact TransUnion's ability to collect and utilize data, which is fundamental to its operations.

Stricter compliance requirements will likely increase operational costs for TransUnion. For instance, the ongoing implementation and adaptation to new data privacy laws globally can represent a substantial investment, diverting resources from growth initiatives.

Furthermore, these regulations may restrict the scope and availability of certain data products TransUnion offers, potentially limiting its core business model. A rise in consumer opt-outs directly reduces the data pool available for analysis and product development, a critical concern for a data-centric company.

The credit reporting and data analytics landscape is a crowded space. TransUnion faces constant pressure from both long-standing competitors and nimble new players who are always bringing fresh ideas to the table. This high level of competition directly translates into pricing pressures. Companies like Experian and Equifax are also investing heavily in AI and advanced analytics, forcing TransUnion to keep pace to avoid losing ground.

These competitive forces can squeeze profit margins, as TransUnion might have to lower prices or offer more value to retain customers. For instance, in 2024, the demand for specialized data solutions is driving significant R&D spending across the industry. This means TransUnion needs to continually invest in cutting-edge technology and develop innovative products just to hold onto its market share, which can directly impact its bottom line.

An economic slowdown poses a significant threat to TransUnion. A prolonged downturn with high inflation and rising interest rates, as seen in late 2023 and projected into 2024, directly impacts consumer creditworthiness. This can lead to increased delinquencies and defaults, which in turn dampens demand for credit and the risk management tools TransUnion provides to lenders.

The credit markets themselves are also a concern. Deterioration in these markets, marked by reduced lending activity and greater caution from financial institutions, directly affects TransUnion's core business. For instance, if lenders become more risk-averse due to economic uncertainty, they may scale back their use of credit data and analytics, impacting TransUnion's revenue streams. This trend was observable in early 2024 as many central banks maintained higher interest rate policies.

Reputational Damage from Data Breaches or Misuse

TransUnion, like many in the data-driven industry, grapples with the significant risk of reputational harm stemming from data breaches or perceived misuse of consumer information. Even with robust security measures, the sheer volume of sensitive data TransUnion handles makes it a prime target. A high-profile breach, such as those observed impacting other credit bureaus in recent years, could severely damage consumer trust, a critical asset for the company.

The consequences of such events can be far-reaching. Erosion of trust can lead to customer attrition, impacting revenue streams and future growth prospects. Moreover, negative publicity and legal challenges related to data privacy can tarnish TransUnion's brand image, potentially straining relationships with business partners and regulatory bodies. For instance, in 2023, the company agreed to a settlement over allegations of misleading consumers about credit report accuracy, highlighting the ongoing scrutiny over data handling practices.

- Data Breach Impact: A significant data breach could result in substantial financial penalties and long-term damage to consumer confidence.

- Perception of Misuse: Public perception of how consumer data is utilized, even if compliant with regulations, can negatively affect brand loyalty.

- Competitive Landscape: In an increasingly privacy-conscious market, competitors with stronger data security reputations could gain an advantage.

- Regulatory Scrutiny: Past incidents have increased regulatory focus, making TransUnion vulnerable to stricter oversight and potential fines for non-compliance.

Technological Disruption and Emergence of New Scoring Models

Rapid technological advancements, such as AI and machine learning, are poised to disrupt traditional credit assessment methods. For instance, the increasing use of alternative data sources by fintech companies, which may not be fully integrated into existing credit bureau models, presents a significant challenge. This could impact TransUnion's market position if they are slow to adopt these new approaches.

The emergence of novel scoring models, potentially leveraging unstructured data or advanced behavioral analytics, could fundamentally alter how creditworthiness is evaluated. If TransUnion doesn't proactively integrate or develop capabilities in these areas, its current solutions might become less competitive. This is particularly relevant as players outside the traditional financial sector increasingly offer credit-related services.

Consider these potential threats:

- Emergence of AI-driven credit scoring: Competitors could leverage AI to analyze vast datasets, creating more predictive and nuanced scoring models that surpass existing bureau offerings.

- Rise of alternative data providers: Non-traditional data sources (e.g., social media, transaction history from digital wallets) could become primary inputs for new scoring mechanisms, bypassing established bureaus.

- Disintermediation by fintech platforms: Direct-to-consumer lending platforms might develop proprietary scoring systems, reducing reliance on traditional credit reports for certain segments of the market.

- Regulatory shifts favoring new data sources: Future regulations could mandate or encourage the use of a wider array of data for credit assessment, potentially benefiting innovative new entrants.

Heightened regulatory scrutiny around data privacy, exemplified by the GDPR and CCPA, poses a significant threat by potentially limiting data collection and increasing compliance costs. The competitive landscape is intensifying with both established rivals and agile new entrants investing heavily in advanced analytics, putting pressure on TransUnion's market share and pricing power. Economic downturns and volatility in credit markets can directly reduce demand for TransUnion's services as lending activity contracts.

The risk of data breaches or perceived misuse of information remains a critical vulnerability, capable of eroding consumer trust and leading to substantial financial and reputational damage. Furthermore, rapid technological advancements, particularly in AI-driven credit scoring and the use of alternative data, could disrupt traditional credit assessment models, requiring TransUnion to continuously innovate to maintain its competitive edge.

SWOT Analysis Data Sources

This TransUnion SWOT analysis is built on a robust foundation of data, including their official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a clear view of TransUnion's operational performance and competitive landscape.