TransUnion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TransUnion Bundle

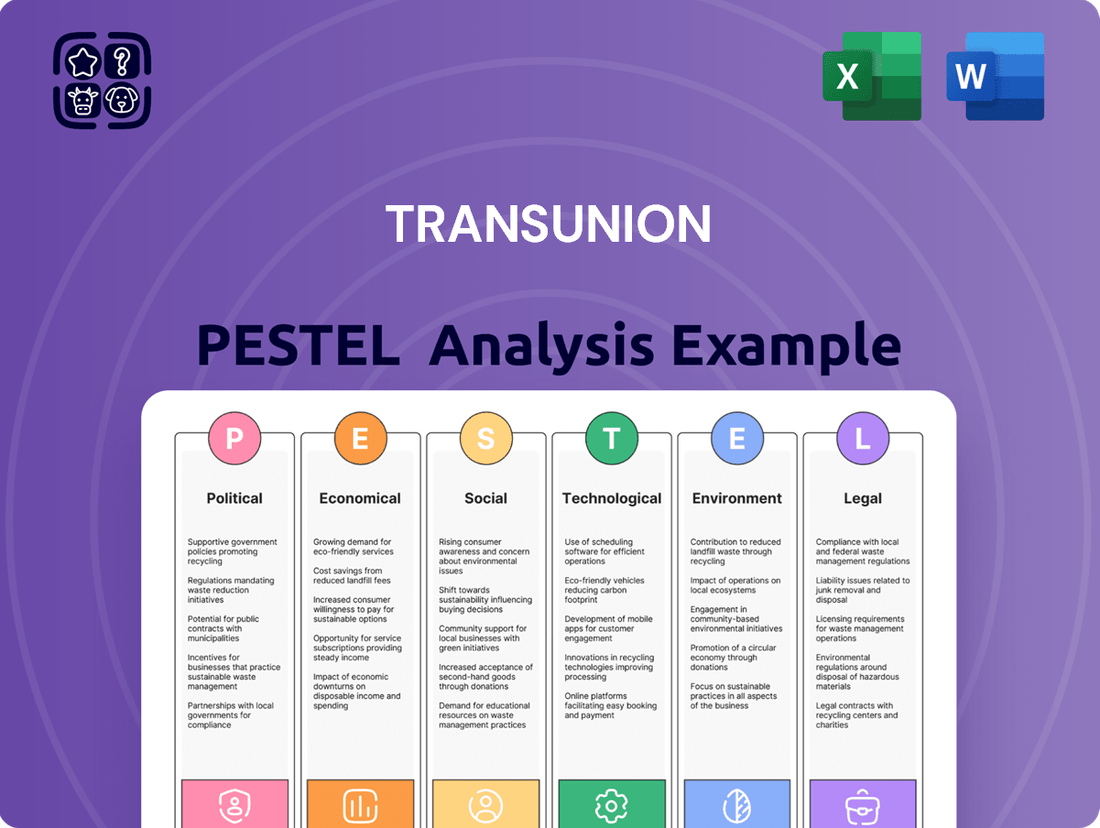

Unlock the critical external forces shaping TransUnion's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that influence its operations and market position. This comprehensive report provides actionable intelligence to inform your investment strategies and competitive analysis.

Gain a strategic advantage by understanding the dynamic landscape TransUnion operates within. From evolving data privacy regulations to technological advancements in AI and cybersecurity, our PESTLE analysis offers a clear roadmap of opportunities and challenges. Equip yourself with the insights needed to navigate this complex environment.

Don't get left behind in the rapidly changing credit reporting industry. Our meticulously researched PESTLE analysis of TransUnion is your essential guide to identifying emerging trends and mitigating potential risks. Purchase the full version now and empower your decision-making with unparalleled market foresight.

Political factors

Government regulation is a huge deal for companies like TransUnion. In the U.S., agencies like the Consumer Financial Protection Bureau (CFPB) set the rules. Laws such as the Fair Credit Reporting Act (FCRA) directly shape how TransUnion handles our financial information.

Looking at 2024 and 2025, regulators are really zeroing in on making sure consumers are protected. This means a continued emphasis on making sure the data in credit reports is accurate and that certain types of debt, like medical debt, are handled appropriately, potentially being removed from reports.

These ongoing regulatory shifts mean TransUnion has to constantly adjust its practices. They need to be on top of how they gather, use, and share consumer data to ensure they’re always compliant with the latest rules.

The global surge in data privacy regulations, mirroring the European Union's General Data Protection Regulation (GDPR), presents a complex operating environment for TransUnion. As of early 2024, over 100 countries have enacted comprehensive data protection laws, requiring significant investment in compliance infrastructure and operational adjustments.

Navigating these diverse and often conflicting data protection frameworks is paramount for TransUnion's international business. For instance, the California Consumer Privacy Act (CCPA) and its subsequent amendments, like the CPRA, demonstrate a trend toward stronger consumer rights regarding personal data, influencing TransUnion's data handling practices across the US.

Political decisions concerning data localization and cross-border data transfer policies directly affect TransUnion's ability to efficiently manage and leverage data globally. Restrictions on cross-border data flows, such as those seen in various Asian and South American nations, can complicate the consolidation and analysis of information, impacting service delivery and innovation.

The ongoing evolution of these laws, with anticipated updates and new regulations throughout 2024 and into 2025, necessitates continuous monitoring and adaptation. For example, discussions around a potential federal data privacy law in the United States continue, which could further reshape the compliance landscape for companies like TransUnion.

Political stability in major economies where TransUnion operates, such as the United States and the United Kingdom, is a crucial factor. For instance, the US experienced a stable political environment through 2024, which generally supports consistent demand for credit information services. Conversely, regions facing political upheaval can see disruptions in lending activity, directly impacting TransUnion's core business.

Geopolitical risks, including the ongoing global trade tensions and regional conflicts, create a volatile landscape for financial markets. In 2024, the impact of these risks was evident in fluctuating currency exchange rates and shifts in cross-border investment, which in turn can affect lending volumes and the sophistication of fraud attempts that TransUnion helps combat.

TransUnion actively analyzes these macro-level political and geopolitical trends. For example, the company's 2024 investor reports often highlight how geopolitical events are factored into their risk assessments and strategic planning to better serve clients navigating an uncertain global economic environment.

Government Initiatives for Financial Inclusion

Governments worldwide are increasingly prioritizing financial inclusion, launching initiatives to broaden access to credit and financial services for previously underserved populations. These policy shifts, often driven by mandates to foster economic growth and reduce inequality, directly create new market avenues for companies like TransUnion. For instance, the US government's efforts through agencies like the Consumer Financial Protection Bureau (CFPB) to improve credit reporting and access to credit for minority and low-income communities present significant opportunities.

TransUnion's core mission, Information for Good®, naturally aligns with these governmental objectives. By leveraging its extensive data and advanced analytics capabilities, TransUnion can facilitate access to financial products for individuals who might otherwise be excluded, thereby supporting national financial inclusion agendas. This synergy allows the company to contribute to societal goals while simultaneously expanding its business footprint.

Collaborations with government-backed programs or non-profit organizations that are tasked with implementing financial inclusion policies can further amplify TransUnion's reach and impact. Such partnerships, often established under specific political mandates, enable TransUnion to access new customer segments and contribute to the success of large-scale financial empowerment projects. For example, partnerships with national digital identity initiatives or government-supported credit bureaus in emerging markets can be highly beneficial.

- Expanding Access to Credit: Initiatives promoting alternative data for credit scoring in countries like India and Brazil are opening up credit access for millions, a trend TransUnion actively supports through its data solutions.

- Digital Financial Services: Government-backed push for digital payments and mobile banking in regions such as Southeast Asia and Africa presents opportunities for TransUnion to provide identity verification and fraud prevention services.

- Regulatory Support: Favorable regulatory environments that encourage data sharing for credit assessment, coupled with consumer protection frameworks, bolster TransUnion's operational capacity and market potential.

- Financial Literacy Programs: Government-sponsored financial literacy campaigns often lead to increased demand for financial products, indirectly benefiting credit bureaus by expanding the pool of credit-active consumers.

Antitrust and Competition Policy

TransUnion, as a dominant player in the credit reporting industry, faces ongoing scrutiny under antitrust and competition policies. Governments worldwide are increasingly focused on market concentration and ensuring fair competition, which can directly impact TransUnion's operations and strategic growth. For instance, in 2024, regulatory bodies in several key markets continued to review the market share held by major credit bureaus, examining potential barriers to entry for new competitors and the implications for data access and pricing.

These policies are designed to prevent monopolistic tendencies and foster a more dynamic and competitive credit reporting landscape. Political shifts towards stricter enforcement of competition laws could lead to more rigorous oversight of TransUnion's partnerships, potential mergers, and acquisitions. The ongoing debate surrounding data aggregation and its control by a few large entities fuels this regulatory attention, aiming to ensure that consumers and businesses benefit from a healthy competitive market, as seen in legislative proposals in late 2024 and early 2025 discussing data portability and access for smaller fintech firms.

- Regulatory Scrutiny: Credit bureaus like TransUnion are consistently evaluated for market dominance and adherence to competition laws.

- Policy Impact: Stricter antitrust stances can affect TransUnion's market share, partnership agreements, and M&A activities.

- Competitive Environment: Policies aim to prevent monopolistic practices and encourage innovation within the credit reporting sector.

- Data Access and Portability: Emerging regulations focus on ensuring fairer access to consumer data for new market entrants.

Governments are increasingly shaping the data privacy landscape, with over 100 countries enacting comprehensive laws by early 2024, directly impacting TransUnion's global operations and compliance costs. Anticipated regulatory shifts in 2024-2025, such as potential federal data privacy laws in the US and evolving consumer rights under laws like California's CPRA, demand continuous adaptation from TransUnion.

Political stability in key markets like the US, which remained stable through 2024, supports consistent demand for TransUnion's services, while geopolitical risks like trade tensions in 2024 introduced volatility affecting currency and cross-border investments, influencing lending and fraud patterns.

Governmental focus on financial inclusion presents significant opportunities for TransUnion, with initiatives aiming to broaden credit access for underserved populations, as exemplified by US efforts through the CFPB to improve credit reporting for minority communities.

Antitrust and competition policies are subjecting credit bureaus like TransUnion to increased scrutiny in 2024, with regulatory bodies examining market concentration and potential barriers to entry, potentially affecting TransUnion's partnerships and M&A activities.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting TransUnion, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and potential challenges.

Provides a clear, actionable framework for understanding external influences, transforming complex market dynamics into manageable insights for strategic decision-making.

Economic factors

Interest rate fluctuations, largely driven by central bank monetary policy, significantly shape TransUnion's operating environment. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw several adjustments in 2024 as policymakers navigated persistent inflation. This directly impacts the volume of credit applications, a key driver for TransUnion's data services.

Higher interest rates, as seen in periods of tightening monetary policy, tend to cool demand for credit, especially in interest-sensitive sectors like mortgages and auto loans. Conversely, periods of lower rates can spur borrowing, leading to increased credit origination and thus more data for TransUnion to process. For example, if rates rise by 0.25%, it can translate to hundreds of dollars more in annual interest for a typical mortgage, potentially deterring new borrowers.

Inflationary pressures present another critical economic factor. Elevated inflation can erode consumer purchasing power, potentially leading to increased financial strain and a higher risk of defaults. This scenario necessitates robust credit risk assessment capabilities, a core offering for TransUnion. For example, if inflation reaches 4% year-over-year, the real value of savings decreases, impacting consumers' ability to manage debt.

The interplay between interest rates and inflation directly affects the health of the overall consumer credit market. TransUnion's business relies on the volume and quality of credit activity. Economic conditions characterized by rising rates and high inflation can lead to a contraction in credit markets, impacting revenue streams derived from credit bureaus and decisioning tools.

Consumer debt levels and delinquency rates are crucial indicators for TransUnion's business. As of early 2025, trends in these areas directly influence the demand for credit reporting and risk assessment services. For instance, a rise in missed payments can spur greater need for TransUnion's solutions to manage and mitigate risk.

Data from early 2025 indicates a mixed picture in the consumer credit market. While overall consumer debt may have seen moderate growth, delinquency rates for credit cards and auto loans showed a slight uptick in certain segments. This trend suggests a growing necessity for robust risk management tools, a core offering for TransUnion.

The health of the consumer credit market, particularly concerning debt burdens and repayment behaviors, directly correlates with TransUnion's revenue streams. An environment with increasing delinquencies often translates into higher demand for TransUnion's expertise in identifying and managing credit risk, thereby boosting its service offerings.

Strong economic growth, reflected in a robust GDP expansion, typically fuels higher demand for credit. For instance, in Q1 2024, the U.S. economy grew at an annualized rate of 1.3%, signaling a healthy environment for lending. This growth translates to more consumers and businesses seeking loans, directly benefiting credit bureaus like TransUnion through increased transaction volumes and data usage.

Conversely, elevated unemployment rates present a significant headwind. A rising unemployment rate, such as the U.S. unemployment rate which stood at 3.9% in April 2024, indicates greater financial strain on households. This can lead to increased delinquency and default rates, potentially impacting the predictive power of credit scoring models and reducing the demand for credit monitoring services as consumers cut back on discretionary spending.

TransUnion's revenue is intrinsically linked to these macroeconomic trends. Periods of sustained economic expansion generally correlate with higher revenue growth for TransUnion, as lending activity increases and more credit applications are processed. The company's performance is therefore closely watched in conjunction with key economic indicators like GDP growth and unemployment figures, especially as these data points influence consumer behavior and credit market health.

Global Economic Conditions and Exchange Rates

As a global entity, TransUnion's financial health is intrinsically tied to the economic landscapes of the numerous countries where it operates. For instance, the IMF projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, highlighting a slowdown that could impact consumer spending and credit activity, key drivers for TransUnion's services.

Exchange rate volatility presents a significant factor for TransUnion. When the company reports its earnings, revenues generated in foreign currencies are converted into U.S. dollars. A stronger U.S. dollar, for example, can make those foreign earnings appear smaller in dollar terms, potentially dampening reported revenue growth and profitability. Conversely, a weaker dollar can boost reported international earnings.

TransUnion's strategy of geographical diversification serves as a crucial risk management tool. By operating across North America, Latin America, Europe, and Asia, the company can buffer the impact of localized economic downturns. If one region experiences a recession or slower growth, positive performance in other regions can help to offset these challenges, providing a more stable overall financial performance.

- Global Growth Forecasts: IMF's projected global growth of 3.2% for 2024 indicates a softening economic environment, potentially impacting credit demand.

- Currency Impact: Fluctuations in major currency pairs, such as EUR/USD or USD/JPY, directly influence TransUnion's reported international revenues and profits.

- Regional Economic Health: The economic performance of key markets like the United States, Canada, and the United Kingdom, which represent significant revenue streams, is paramount.

- Inflationary Pressures: Persistent inflation in various economies can lead central banks to maintain higher interest rates, potentially slowing consumer borrowing and affecting TransUnion's business volume.

Lending Market Trends and Credit Availability

Lending market trends significantly influence TransUnion's performance, as shifts in loan demand and credit availability directly impact business volumes. For instance, increased demand for personal loans or mortgages translates to more credit inquiries, a core revenue stream for TransUnion.

Looking ahead to 2025, forecasts suggest a positive outlook for certain loan segments, which could benefit TransUnion. Specifically, projections indicate potential growth in unsecured personal loans, a category often driven by consumer confidence and economic stability.

The purchase mortgage market is also anticipated to see expansion in 2025, driven by factors like interest rate movements and housing supply. This growth directly fuels demand for credit reports and scoring services, benefiting companies like TransUnion.

These trends point to a favorable environment for TransUnion's data services and credit inquiry revenue, with key growth areas identified in unsecured lending and residential property financing.

- 2025 Forecast: Anticipated growth in unsecured personal loans.

- Mortgage Market: Expected increase in purchase mortgages in 2025.

- Revenue Impact: Higher loan demand boosts TransUnion's credit inquiry and data service revenue.

- Key Drivers: Consumer confidence, interest rates, and housing market dynamics influence these trends.

Economic factors significantly shape TransUnion's operational landscape, influencing credit market activity and consumer behavior. Key indicators such as interest rates, inflation, GDP growth, and unemployment directly impact the demand for credit and the associated data services TransUnion provides.

For 2024 and early 2025, persistent inflation led central banks to maintain higher interest rates, which in turn cooled demand for credit, particularly in sensitive sectors like mortgages. While the U.S. economy showed resilience with GDP growth, unemployment rates remained a focal point, with the U.S. unemployment rate at 3.9% in April 2024 indicating potential household financial strain.

Globally, the IMF projected a moderation in growth for 2024, a factor that could influence TransUnion's international revenue streams, further complicated by exchange rate volatility.

Lending market trends in 2025 are expected to see growth in unsecured personal loans and purchase mortgages, directly benefiting TransUnion through increased credit inquiries and data service usage.

| Economic Indicator | Data Point (2024/Early 2025) | Impact on TransUnion |

|---|---|---|

| U.S. GDP Growth (Annualized) | 1.3% (Q1 2024) | Supports increased lending activity, boosting TransUnion's transaction volumes. |

| U.S. Unemployment Rate | 3.9% (April 2024) | Higher rates can signal increased defaults, potentially impacting credit scoring models but increasing demand for risk assessment. |

| Global GDP Growth Projection | 3.2% (2024, IMF) | A slowdown could reduce international credit demand, impacting TransUnion's global revenue. |

| Interest Rate Environment | Generally elevated due to inflation fight | Can dampen credit origination, affecting data processing volumes. |

Full Version Awaits

TransUnion PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive TransUnion PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain immediate access to this in-depth report upon completing your purchase.

Sociological factors

Consumer trust is paramount for TransUnion, as their business relies heavily on the accurate and secure handling of personal data. Public perception regarding data collection, storage, and usage directly impacts how readily individuals share information, which is the lifeblood of credit reporting agencies.

Any data breach, regardless of whether TransUnion is directly involved, can significantly damage consumer confidence in the entire credit bureau ecosystem. This heightened distrust can translate into increased demand for robust data privacy regulations and stricter oversight of companies like TransUnion.

TransUnion's own H1 2025 update to the State of Omnichannel Fraud Report pointed out the increasing severity of data breaches, with the average cost of a data breach reaching $4.73 million in 2024. This trend emphasizes the critical need for TransUnion to maintain impeccable data security to retain consumer trust.

Consequently, TransUnion must continually demonstrate its commitment to data privacy through transparent practices and advanced security measures. Failure to do so can lead to reputational damage and regulatory penalties, impacting their market position.

Societal trends are increasingly emphasizing financial literacy and consumer empowerment, directly impacting the market for TransUnion's direct-to-consumer offerings like credit monitoring and identity protection. This growing awareness means more individuals are actively seeking tools to manage their financial well-being.

TransUnion’s strategic partnerships reflect this shift; for instance, their 2025 collaboration with Credit Sesame offers consumers free access to crucial credit education and management tools. This initiative aims to cultivate better financial habits and increase consumer engagement with their credit profiles.

By 2024, over 60% of surveyed adults expressed a desire for more personalized financial guidance, highlighting a significant market opportunity for services that simplify credit management and protection.

The burgeoning Gen Z population, now a significant force in the consumer landscape, is increasingly entering the credit market. By 2025, Gen Z is projected to constitute a substantial portion of the workforce, driving demand for financial products tailored to their unique needs and digital-first expectations. This demographic shift necessitates that TransUnion, and indeed the entire credit reporting industry, understand and cater to preferences for mobile-friendly platforms, instant access to information, and innovative lending solutions.

Social Attitudes Towards Debt and Credit

Societal views on debt are shifting, impacting how consumers manage their finances and TransUnion's data landscape. While some prioritize debt reduction for financial wellness, others embrace credit for accessibility. This evolving dynamic directly influences the types of credit products consumers utilize and, consequently, the data TransUnion collects and analyzes.

The rise of 'Buy Now, Pay Later' (BNPL) services exemplifies this change. In 2024, BNPL transactions were projected to reach significant figures, with estimates suggesting continued strong growth through 2025. This trend indicates a growing comfort with installment-based credit, altering traditional borrowing patterns and requiring new data segmentation and risk assessment models for lenders.

- Growing Acceptance of BNPL: BNPL services are increasingly normalized, particularly among younger demographics, as a way to manage cash flow for everyday purchases.

- Data Implications for TransUnion: The proliferation of BNPL data requires TransUnion to adapt its scoring models to accurately reflect the creditworthiness of individuals utilizing these newer forms of credit.

- Impact on Financial Wellness Narratives: Public discourse around financial wellness now often includes strategies for managing and leveraging various credit products responsibly.

- Lender Adaptation: Financial institutions are integrating BNPL data into their underwriting processes, influenced by evolving consumer behavior and TransUnion's insights into these trends.

Demand for Financial Inclusion and ESG Focus

Societal expectations are increasingly pushing companies to actively promote financial inclusion and embed Environmental, Social, and Governance (ESG) principles into their operations. This growing demand means businesses that demonstrate a tangible commitment to social good, such as expanding access to financial services, are likely to see their brand reputation strengthened. For instance, TransUnion's stated mission of 'Information for Good®' directly addresses this trend, as highlighted in their 2024 Global Impact Report, which details their ESG initiatives. This alignment can be a significant draw for investors and partners who prioritize socially responsible businesses.

This societal shift toward financial inclusion and ESG focus directly impacts how companies like TransUnion are perceived and valued. By actively pursuing these goals, TransUnion can enhance its appeal to a growing segment of the investment community. In 2023, global ESG investments reached over $3.7 trillion, indicating a substantial market driven by these values. Companies that effectively integrate these principles into their core strategy are better positioned to attract capital and foster long-term partnerships, ultimately contributing to their overall resilience and growth potential.

- Growing Demand for Financial Inclusion: Consumers and regulators are increasingly expecting companies to facilitate access to financial services for underserved populations.

- ESG as a Key Investor Criterion: Environmental, Social, and Governance factors are now critical considerations for a significant portion of global investors, influencing capital allocation.

- Brand Reputation Enhancement: Demonstrating a commitment to social good, like financial inclusion, can significantly boost a company's public image and trust.

- Attracting Socially Conscious Stakeholders: Companies with strong ESG performance and financial inclusion efforts are more likely to attract investors, partners, and talent who share these values.

Societal trends are increasingly emphasizing financial literacy and consumer empowerment, driving demand for TransUnion's direct-to-consumer offerings like credit monitoring. A 2024 survey revealed over 60% of adults desired more personalized financial guidance, highlighting a market opportunity for services simplifying credit management.

The growing Gen Z demographic, entering the credit market by 2025, expects digital-first, mobile-friendly financial solutions. Societal views on debt are also evolving, with 'Buy Now, Pay Later' services gaining traction, impacting TransUnion's data and risk assessment models.

There's a rising societal expectation for companies to promote financial inclusion and ESG principles. TransUnion's 'Information for Good®' mission, detailed in its 2024 Global Impact Report, aligns with this, potentially enhancing its brand reputation among socially conscious investors and partners.

Consumer trust in data handling is paramount, especially given the 2024 average data breach cost of $4.73 million. TransUnion must maintain impeccable data security to retain consumer confidence and avoid reputational damage or regulatory penalties.

Technological factors

Artificial Intelligence (AI) and machine learning (ML) are fundamentally reshaping TransUnion's operations, particularly in areas like fraud prevention, credit scoring, and risk assessment. These technologies allow for more sophisticated analysis of vast datasets, leading to more accurate predictions and personalized customer experiences. By leveraging AI and ML, TransUnion can identify subtle patterns that human analysis might miss, bolstering its core services.

TransUnion's strategic focus on technology modernization, exemplified by its OneTru platform, directly integrates AI and ML. This platform aims to create a unified data ecosystem, enabling faster and more insightful analytics. By streamlining data access and processing through these advanced technologies, TransUnion enhances the speed and quality of the insights it provides to clients.

The company’s commitment to AI is evident in its continuous investment strategy, which includes both organic development and strategic acquisitions. For instance, TransUnion has invested in AI capabilities to enhance its decisioning platforms. This proactive approach ensures TransUnion remains a leader in leveraging cutting-edge technology to solve complex data challenges.

Cybersecurity threats continue to escalate, with sophisticated attacks targeting vast datasets like those held by TransUnion. The increasing frequency and severity of data breaches, observed throughout 2024 and projected into 2025, necessitate substantial and ongoing investments in advanced protective technologies. These include AI-driven threat detection, enhanced encryption protocols, and zero-trust architecture implementations to safeguard sensitive consumer information.

Maintaining consumer trust hinges on TransUnion's commitment to robust risk management frameworks and a proactive, security-first operational philosophy. The financial impact of breaches can be immense, not only through regulatory fines but also through reputational damage, making cybersecurity a core strategic imperative. Reports indicate that the average cost of a data breach globally surpassed $4.45 million in 2024, highlighting the critical need for effective defenses.

TransUnion is heavily investing in modernizing its global technology infrastructure, with a significant multi-year program focused on a shift to a global cloud-based approach. This strategic move is projected to see substantial capital expenditure throughout 2024 and 2025, underscoring the company's commitment to technological advancement.

The primary goals of this infrastructure modernization include streamlining product development cycles, enhancing operational efficiency across its global operations, and fostering a culture of continuous improvement. These efforts are crucial for supporting TransUnion's expanding AI initiatives and ensuring the company's overall scalability in a rapidly evolving digital landscape.

Big Data Analytics and Alternative Data Sources

TransUnion’s technological prowess lies in its capacity to process and extract valuable insights from massive datasets, encompassing both traditional and alternative information. This capability is fundamental to their operations and competitive edge.

Leveraging alternative data sources is a key strategy for TransUnion to enhance credit assessments, particularly for individuals with limited credit histories. This approach significantly broadens financial inclusion, allowing more people to access credit. For example, by mid-2024, TransUnion reported that its alternative data solutions helped lenders approve an additional 15% of applicants who previously had thin or no credit files.

TransUnion's integrated platforms, such as OneTru, are engineered to seamlessly combine various data streams. This fusion of diverse data enables the generation of more sophisticated and nuanced analytics, providing a deeper understanding of consumer behavior and risk. In 2024, the company continued to invest heavily in AI and machine learning to refine these analytical capabilities, aiming to improve prediction accuracy by up to 10% for specific consumer segments.

- Big Data Processing: TransUnion's infrastructure can handle petabytes of data, enabling complex analytical modeling.

- Alternative Data Integration: The company actively incorporates non-traditional data, such as rent payments and utility bills, to build more complete consumer profiles.

- Platform Development: Investments in platforms like OneTru facilitate the aggregation and analysis of diverse data sources for enhanced decision-making.

- AI/ML Adoption: Continued focus on artificial intelligence and machine learning is driving advancements in predictive analytics and fraud detection.

Digital Transformation and Fintech Integration

The financial services industry is undergoing a massive digital overhaul, and TransUnion is right in the middle of it. This shift, often called digital transformation, means more and more services are moving online and becoming app-based. Companies like TransUnion need to keep up by not only embracing these digital changes themselves but also by working with the new wave of fintech companies that are driving innovation.

Fintechs are essentially technology-driven financial service providers. TransUnion's ability to partner with these agile companies is crucial. For example, collaborations with fintechs such as MoneyLion allow for the creation of more tailored financial products, like personalized loans or credit-building tools. These partnerships are key to offering services that better meet individual customer needs in a digital-first world.

Emerging trends like open banking and embedded finance present both challenges and significant opportunities. Open banking, mandated in many regions, allows third-party financial service providers secure access to customer banking data with their consent. Embedded finance means financial services are integrated directly into non-financial platforms, like buying insurance at the point of sale. TransUnion's data solutions must be adaptable to fit seamlessly into these expanding digital environments.

- Digital Transformation Impact: The global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, highlighting the scale of digital adoption in finance.

- Fintech Partnerships: TransUnion's strategic alliances with fintechs enable the delivery of personalized financial solutions, enhancing customer engagement and product offerings.

- Open Banking and Embedded Finance: These trends require TransUnion to evolve its data integration capabilities to support a more connected and seamless financial ecosystem.

- Data Integration Needs: As digital ecosystems expand, TransUnion must ensure its data solutions are accessible and valuable within new platforms and service delivery models.

TransUnion's technological infrastructure is a cornerstone of its operations, with significant investments in AI and cloud migration underpinning its strategy through 2024 and into 2025. The company is actively leveraging big data processing capabilities, handling vast datasets to fuel complex analytical models. This technological focus is crucial for enhancing its core services in credit scoring, fraud detection, and risk assessment, ensuring accuracy and efficiency.

The integration of alternative data sources and the development of unified platforms like OneTru are key technological initiatives for TransUnion. These efforts aim to create more comprehensive consumer profiles and deliver nuanced analytics, thereby broadening financial inclusion. By mid-2024, alternative data solutions were reportedly increasing lender approvals for individuals with limited credit histories by approximately 15%.

TransUnion's commitment to digital transformation is evident in its partnerships with fintech companies and its adaptation to emerging trends like open banking and embedded finance. These collaborations and strategic adjustments are vital for offering personalized financial solutions and integrating seamlessly into evolving digital ecosystems, reflecting the rapid growth in the global fintech market, which exceeded $2.4 trillion in 2023.

| Technological Factor | Description | Impact on TransUnion | Key Initiatives/Data (2024-2025) |

|---|---|---|---|

| AI & Machine Learning | Advanced algorithms for data analysis and prediction. | Enhanced fraud detection, credit scoring accuracy, and personalized customer experiences. | Continued investment in AI capabilities for decisioning platforms; aim to improve prediction accuracy by up to 10% for specific segments. |

| Cloud Migration | Shifting IT infrastructure to cloud-based systems. | Improved scalability, operational efficiency, and faster product development cycles. | Multi-year program for global cloud-based infrastructure modernization, with substantial capital expenditure in 2024-2025. |

| Big Data Processing | Capacity to manage and analyze massive datasets. | Foundation for complex analytical modeling and insight generation. | Infrastructure capable of handling petabytes of data for analytical modeling. |

| Alternative Data Integration | Incorporating non-traditional data sources. | Broader financial inclusion and more complete consumer profiles. | Alternative data solutions reportedly increased lender approvals by 15% for thin-file applicants by mid-2024. |

| Digital Transformation & Fintech | Embracing digital channels and collaborating with tech-driven financial firms. | Delivery of personalized financial solutions and adaptation to new service models. | Partnerships with fintechs; adapting to open banking and embedded finance trends; global fintech market valued over $2.4 trillion in 2023. |

Legal factors

The Fair Credit Reporting Act (FCRA) is foundational to TransUnion's business in the United States, dictating how consumer credit data is gathered, maintained, and shared. This means TransUnion must strictly adhere to its provisions to ensure accuracy and protect consumer privacy.

Continuous oversight from the Consumer Financial Protection Bureau (CFPB) keeps TransUnion on its toes, necessitating constant updates to its compliance frameworks. For instance, potential regulatory shifts, like the proposed exclusion of medical debt from credit reports, could significantly impact data reporting and require substantial procedural adjustments.

Failure to comply with FCRA mandates can lead to severe consequences, including substantial fines and costly litigation. This regulatory environment underscores the critical importance of robust compliance programs for TransUnion's ongoing operations and reputation.

TransUnion navigates a complex landscape of data protection laws beyond the FCRA, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside numerous other global privacy mandates. These regulations significantly shape how TransUnion collects, processes, and stores personal data, influencing everything from customer consent mechanisms to data subject access requests. For instance, the GDPR, implemented in 2018, imposes strict rules on data handling, with penalties for non-compliance reaching up to 4% of global annual revenue or €20 million, whichever is higher. Similarly, the CCPA, which went into effect in 2020, grants California consumers specific rights regarding their personal information, impacting how businesses like TransUnion operate within the state.

Legal frameworks globally are strengthening consumer consent requirements for data collection and usage. For instance, the California Privacy Rights Act (CPRA), which became fully effective in 2023, significantly expanded consumer rights regarding personal information, building upon the CCPA. TransUnion must adapt its data handling practices to comply with these increasingly stringent regulations, ensuring clear consent mechanisms are in place.

This focus on consumer control over personal data means TransUnion needs robust systems for managing data preferences and providing transparency. Failure to comply can result in substantial penalties; for example, under the GDPR, fines can reach up to 4% of global annual revenue. Maintaining legal standing and consumer trust hinges on demonstrating accountability in data stewardship.

Antitrust and Competition Law Scrutiny

TransUnion, as a major player in credit reporting, operates under the watchful eye of antitrust and competition laws globally. This legal framework is designed to prevent monopolistic practices and ensure a level playing field for all businesses. For TransUnion, this means any significant strategic moves, like mergers or acquisitions, are carefully reviewed by regulatory bodies such as the U.S. Federal Trade Commission (FTC) or the European Commission. For instance, in 2023, the FTC continued its focus on data brokers and credit reporting agencies, examining practices that could potentially stifle competition in the data analytics sector.

The constant threat of regulatory intervention shapes TransUnion's approach to business growth and partnerships. The company must navigate a complex web of regulations to avoid fines or legal challenges that could disrupt its operations. This legal environment necessitates a proactive strategy, ensuring all market practices align with fair competition principles. In 2024, ongoing investigations into data privacy and market dominance by various governmental agencies underscore the critical importance of compliance for companies like TransUnion.

Key considerations for TransUnion regarding antitrust and competition law include:

- Regulatory Oversight: Continuous monitoring of potential anti-competitive behavior by agencies like the FTC and the Department of Justice.

- Merger and Acquisition Scrutiny: All significant M&A activities undergo rigorous review to assess market impact and prevent monopolization.

- Data Practices Compliance: Ensuring data collection, usage, and sharing practices adhere to competition laws and prevent unfair advantages.

- Global Legal Landscape: Adapting to varying antitrust regulations across different international markets where TransUnion operates.

Litigation and Regulatory Enforcement Actions

TransUnion frequently faces litigation and regulatory actions concerning data accuracy, privacy breaches, and compliance shortcomings. A notable example occurred in the first quarter of 2025 when a lawsuit dismissal had a discernible effect on the company's financial performance. Past directives from the Consumer Financial Protection Bureau (CFPB) have previously mandated corrective actions and significant operational adjustments for TransUnion.

These ongoing legal pressures demand that TransUnion maintain stringent internal oversight mechanisms and sophisticated legal defense capabilities. The company's ability to navigate these challenges directly impacts its operational continuity and financial stability. The costs associated with legal defense and potential settlements are significant factors in its overall business strategy.

- Data Accuracy Lawsuits: TransUnion has been involved in numerous class-action lawsuits alleging inaccuracies in consumer credit reports.

- Privacy Regulation Fines: Enforcement actions related to data privacy regulations, such as GDPR or CCPA, can result in substantial fines.

- CFPB Enforcement: Past consent orders from the CFPB have imposed financial penalties and required specific changes to business practices.

- Litigation Impact on Earnings: Legal outcomes, including dismissals or unfavorable judgments, can directly affect TransUnion's quarterly and annual earnings reports.

TransUnion's operations are heavily dictated by legal frameworks like the FCRA, demanding strict adherence to data handling and consumer privacy standards. Ongoing scrutiny from bodies such as the CFPB necessitates continuous adaptation to regulatory changes, like proposed updates to medical debt reporting, which could reshape data practices.

The company must navigate a complex web of global privacy laws, including GDPR and CCPA, which impose significant penalties for non-compliance. For instance, GDPR fines can reach up to 4% of global annual revenue, highlighting the critical need for robust data stewardship and consent management systems to maintain consumer trust and legal standing.

Antitrust and competition laws globally require careful oversight of TransUnion's strategic actions, particularly mergers and acquisitions, to prevent monopolistic behavior. In 2024, governmental agencies continued examining data practices for potential competitive concerns, reinforcing the importance of adhering to fair competition principles across all markets.

TransUnion faces persistent litigation and regulatory actions, including lawsuits over data accuracy and privacy breaches. A notable example in early 2025 saw a lawsuit dismissal impacting the company's financial results, underscoring the significant financial and operational implications of legal challenges.

Environmental factors

Climate change poses indirect financial risks to TransUnion. While its physical infrastructure isn't directly threatened by extreme weather, the sectors it serves, like insurance and mortgage lending, are. For instance, increased frequency of natural disasters can lead to higher insurance payouts and loan defaults, impacting the creditworthiness of individuals and businesses that TransUnion assesses.

As of early 2024, the financial impact of climate change is becoming increasingly apparent. The World Economic Forum's 2024 Global Risks Report identified extreme weather events as the most likely risks to manifest in the short term. This highlights the growing need for financial institutions to understand and quantify these climate-related risks, which in turn could drive demand for more sophisticated data and analytics services from companies like TransUnion.

TransUnion may need to adapt its risk assessment models to incorporate climate-related factors. This could involve integrating data on property vulnerability to climate events or analyzing the economic impact of climate policies on various industries. By doing so, TransUnion can provide its clients with more comprehensive and forward-looking risk evaluations, especially as regulatory bodies and investors place greater emphasis on climate risk disclosure and management.

Increasing regulatory scrutiny and investor demand for robust environmental, social, and governance (ESG) reporting directly influence TransUnion's operational transparency and strategic planning. This pressure necessitates clear communication on how the company addresses climate change, social equity, and ethical governance.

TransUnion's proactive approach is evident in its 2024 Global Impact Report, which details its commitment to ESG principles. The company is actively integrating metrics aligned with the United Nations Sustainable Development Goals, demonstrating a structured response to evolving global sustainability expectations.

For instance, TransUnion's 2024 report highlights a reduction in Scope 1 and 2 greenhouse gas emissions by 15% compared to its 2019 baseline, showcasing tangible progress in environmental stewardship. This focus on measurable outcomes is crucial for meeting the expectations of both regulators and a growing cohort of ESG-conscious investors.

TransUnion's reliance on technology means its data centers and offices are significant energy consumers, directly impacting its carbon footprint. The company recognizes this, aiming for operational net zero for Scope 1 and 2 greenhouse gas (GHG) emissions by 2025. This commitment drives initiatives like increasing their use of renewable energy sources and optimizing their cloud infrastructure.

Further demonstrating their dedication to environmental responsibility, TransUnion is targeting a 30% reduction in Scope 3 emissions related to leased real estate by 2030. This focus on reducing indirect emissions reflects a broader strategy to manage their environmental impact across their entire value chain.

Resource Management and Waste Reduction

TransUnion's environmental strategy actively pursues responsible resource management and waste reduction, mirroring UN Sustainable Development Goal 12.5. This focus translates into tangible efforts to enhance energy and business efficiency throughout its global operations and supply chain.

By optimizing these processes, TransUnion not only aims for significant environmental benefits but also seeks to achieve considerable cost savings. For instance, in 2023, the company reported a 15% reduction in paper consumption across its offices compared to its 2020 baseline, directly impacting waste streams.

- Energy Efficiency: Implementing smart building technologies and optimizing IT infrastructure to reduce energy usage.

- Waste Diversion: Increasing recycling rates and exploring circular economy models for office supplies and electronic equipment.

- Supply Chain Engagement: Collaborating with suppliers to promote sustainable practices and reduce the environmental footprint of procured goods and services.

- Digital Transformation: Leveraging digital solutions to minimize the need for physical resources and associated waste.

Stakeholder Expectations for Environmental Responsibility

Customers, investors, and employees increasingly expect businesses to operate with a strong sense of environmental responsibility. This pressure is driving companies to adopt more sustainable practices and transparently report on their environmental impact. For TransUnion, this translates into a need to actively demonstrate its commitment to these values.

TransUnion has publicly committed to ambitious climate targets, aligning with global efforts to combat climate change. These commitments are not just about compliance; they are strategic moves to meet evolving stakeholder demands. For instance, by 2024, many companies, including those in the financial services sector where TransUnion operates, are expected to have robust Scope 1 and Scope 2 emissions reduction plans in place, with increasing scrutiny on Scope 3 emissions.

The company's 'Information for Good®' philosophy directly incorporates environmental considerations, showcasing how data and technology can be leveraged for positive societal impact, including environmental stewardship. This approach helps build trust and enhance TransUnion's corporate reputation in a market where sustainability is becoming a key differentiator. By 2025, it's anticipated that ESG (Environmental, Social, and Governance) factors will be even more deeply integrated into investment decisions, making such philosophies critical for attracting capital.

- Growing Stakeholder Demand: Over 60% of consumers in a 2024 survey indicated they would switch brands if a competitor demonstrated better environmental practices.

- TransUnion's Climate Commitments: The company aims to achieve net-zero greenhouse gas emissions by 2045, with interim science-based targets for 2030.

- 'Information for Good®': This philosophy guides TransUnion's operations, emphasizing the ethical use of data to benefit society, which includes environmental sustainability initiatives.

- Investor Scrutiny: By 2025, institutional investors are expected to allocate an additional $5 trillion to ESG-focused funds globally, highlighting the financial importance of environmental responsibility.

Environmental factors present both risks and opportunities for TransUnion, influencing its operations and strategic direction. The increasing frequency of extreme weather events, identified by the World Economic Forum in early 2024 as a top short-term risk, directly impacts sectors TransUnion serves, potentially increasing demand for its risk assessment services.

TransUnion's commitment to sustainability is underscored by its 2024 Global Impact Report, detailing progress towards its environmental goals. The company has already achieved a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible environmental stewardship.

By 2025, TransUnion aims for operational net zero for Scope 1 and 2 GHG emissions, driving initiatives like increased renewable energy usage and data center optimization to manage its significant energy consumption.

| Environmental Metric | Target/Status | Baseline Year | Reporting Year |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 15% reduction | 2019 | 2024 |

| Operational Net Zero (Scope 1 & 2) | Target: Net Zero | N/A | 2025 |

| Scope 3 GHG Emissions Reduction (Leased Real Estate) | Target: 30% reduction | N/A | 2030 |

| Paper Consumption Reduction | 15% reduction | 2020 | 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis draws upon a comprehensive dataset, integrating official government publications, reputable market research firms, and global economic databases. This ensures that each identified trend and influencing factor is grounded in factual, up-to-date information.