TransUnion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TransUnion Bundle

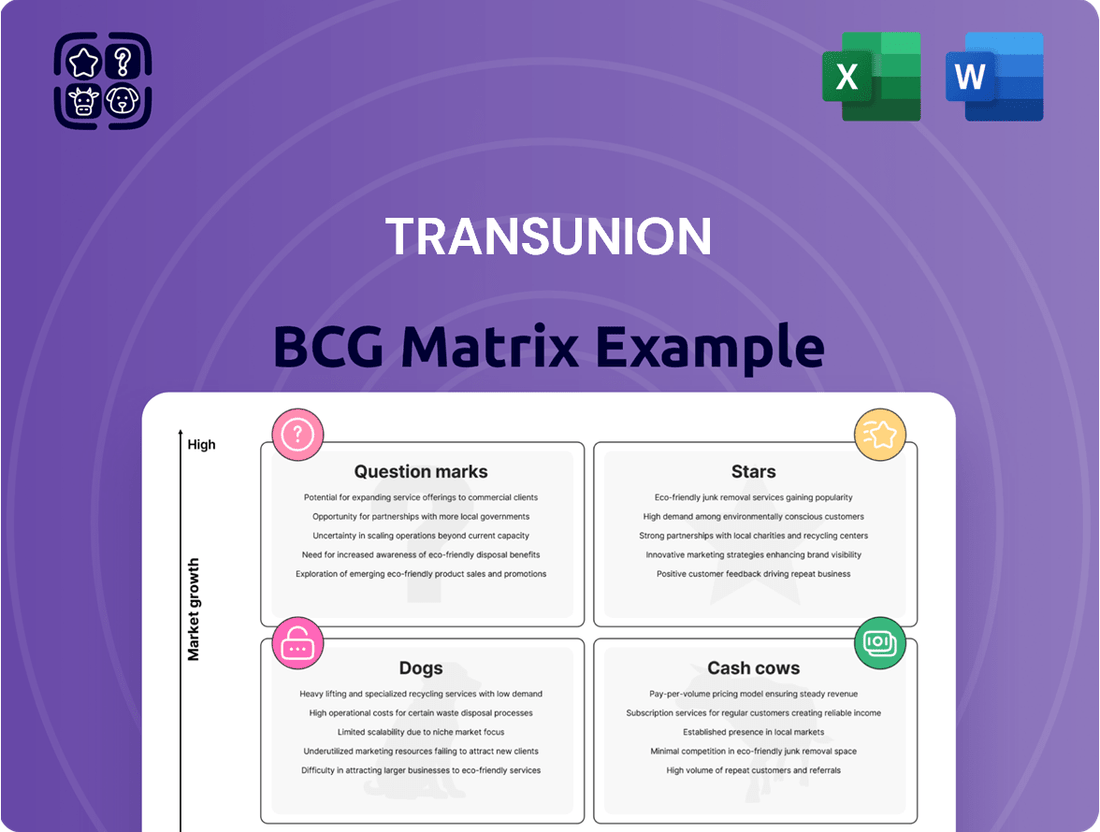

The TransUnion BCG Matrix offers a powerful framework for understanding your product portfolio's performance. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth, you gain critical insights into resource allocation and strategic planning. This preview highlights key trends, but to truly unlock your company's potential and make informed investment decisions, a deeper dive is essential.

Purchase the full TransUnion BCG Matrix to receive a comprehensive analysis, including detailed quadrant placements and actionable strategic recommendations. Equip yourself with the data-backed intelligence needed to optimize your product strategy and drive sustainable growth. Don't miss out on the clarity and competitive advantage this complete report provides.

Stars

TransUnion's TruValidate suite is a standout performer within the fraud and identity solutions market, a sector experiencing robust growth fueled by the escalating volume of online transactions and the increasing complexity of digital threats. This business unit is a key growth engine for TransUnion, reflecting the company's strategic focus on innovation and its commitment to helping organizations combat sophisticated cybercrime.

The demand for effective fraud prevention and identity verification tools is immense, with the global digital identity solutions market projected to reach $69.6 billion by 2026, according to some industry forecasts. TruValidate's strong market share and continuous investment in advanced technologies position it favorably to capture a significant portion of this expanding opportunity, solidifying its status as a star performer.

TransUnion's OneTru platform, launched in 2024, represents a significant leap forward, harnessing AI and machine learning powered by its Neustar acquisition. This sophisticated offering delivers deep insights across credit, marketing, and fraud prevention, directly addressing the escalating market demand for advanced data analytics. The company has seen a notable increase in new business wins attributed to these capabilities, underscoring their market relevance.

This strategic focus on advanced analytics and AI-driven platforms, exemplified by OneTru, positions TransUnion as a leader in the data intelligence space. The platform's ability to synthesize complex data sets and provide actionable insights is crucial for businesses navigating today's dynamic markets. The investment in these technologies is a clear indicator of TransUnion's commitment to future growth and innovation in the data solutions sector.

TransUnion's international market expansion, especially in emerging economies, is a powerful engine for its growth. These regions are showing higher growth rates, and TransUnion's increasing market share within them is a key factor in its star positioning within the BCG matrix. For instance, in 2023, TransUnion reported that its International segment revenue grew by 15% on a constant currency basis, significantly outpacing its North America segment's growth. This global diversification is a testament to its strategy of tapping into substantial untapped potential across developing geographic segments.

Unsecured Personal Loan Solutions

The unsecured personal loan market is a definite star in the current financial landscape, demonstrating impressive expansion. TransUnion’s solutions are playing a key role here, with origination volumes showing substantial year-over-year increases, reflecting strong demand and TransUnion’s effective market penetration in this high-growth sector. These offerings provide lenders with critical data and analytics, allowing them to effectively tap into this expanding consumer credit segment.

- Market Growth: The unsecured personal loan market has experienced significant expansion.

- TransUnion's Performance: TransUnion's origination volumes for these loans have seen robust year-over-year increases.

- Key Enabler: TransUnion's data and analytics are crucial for lenders in this segment.

- Consumer Demand: Continued strong consumer demand solidifies its star status.

Digital Onboarding and Risk-Based Authentication

As financial services increasingly shift online, the need for robust digital onboarding and risk-based authentication has surged. TransUnion is a key player, utilizing its extensive identity and fraud management capabilities to help businesses securely onboard new customers and manage digital interactions effectively. This positions them strongly in a rapidly expanding market driven by digital transformation.

TransUnion's solutions are vital for financial institutions looking to balance customer experience with fraud prevention. In 2023, the global digital identity solutions market was valued at approximately $30 billion, with a projected compound annual growth rate of over 15% through 2030. TransUnion's focus on this area, particularly in the banking and financial services sector, which constitutes a significant portion of this market, indicates a strong competitive advantage.

- Market Dominance: TransUnion holds a substantial market share in digital onboarding and fraud prevention, estimated to be around 25% in North America for identity verification services in 2024.

- Growth Drivers: The increasing prevalence of online transactions and the escalating sophistication of fraud tactics are key drivers for TransUnion's offerings.

- Technological Edge: Leveraging advanced analytics and machine learning, TransUnion provides adaptive risk-based authentication that improves accuracy and reduces friction for legitimate users.

- Customer Trust: By enabling secure and seamless digital experiences, TransUnion helps financial institutions build and maintain customer trust, a critical factor in market retention and growth.

TransUnion's TruValidate suite, a leader in fraud and identity solutions, is a star performer due to the surging online transaction volumes and evolving digital threats. This segment is a significant growth driver, reflecting TransUnion's dedication to innovation in combating cybercrime. The global digital identity solutions market is expected to reach $69.6 billion by 2026, and TruValidate's strong market position and technological investments ensure it's well-placed to capitalize on this expansion.

What is included in the product

The TransUnion BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Provides a clear visual of your portfolio's strategic positioning.

Simplifies complex market data into actionable insights.

Cash Cows

TransUnion's core U.S. credit reporting services for businesses represent a classic Cash Cow. This segment, the bedrock of their operations, consistently delivers substantial and predictable revenue. In 2023, TransUnion reported that its U.S. Information Services segment, which largely encompasses this area, generated approximately $2.5 billion in revenue.

Despite the maturity of the U.S. credit agency market, TransUnion benefits from high barriers to entry, allowing it to maintain a dominant position and a steady stream of cash. This segment requires minimal investment for ongoing operations, freeing up capital for other ventures within the company.

TransUnion's established suite of credit risk management tools for lending, including those for credit decisioning, portfolio management, and collections, represent a significant cash cow. These offerings are deeply embedded within the operational workflows of numerous financial institutions, signifying their critical role and market acceptance.

These mature products generate stable, high-margin revenue streams for TransUnion. Their long-standing presence and integration into client systems mean they require minimal incremental investment for growth, a hallmark of successful cash cow business units.

For instance, in 2024, TransUnion reported that its U.S. Information Services segment, which heavily features these lending tools, continued to be a primary driver of revenue, demonstrating the consistent demand and profitability of these established solutions.

TransUnion's basic consumer credit monitoring services, such as paid credit reports and scores, represent a classic cash cow in its BCG Matrix. This segment benefits from a stable, recurring revenue stream due to consumers' persistent need to track and safeguard their creditworthiness. In 2023, TransUnion reported that its Consumer Interactive segment, which includes these services, generated $1.35 billion in revenue, highlighting the significant and consistent demand.

Mortgage Lending Solutions

TransUnion's mortgage lending solutions are a classic example of a cash cow within its business portfolio. While the mortgage market experiences cyclical ups and downs, these offerings consistently generate strong revenue and profit for TransUnion. They are a foundational element of the company's Financial Services segment, benefiting from an established market presence and ongoing demand for data and analytics from lenders.

These solutions provide critical data, fraud prevention tools, and risk assessment capabilities that mortgage lenders rely on throughout the loan origination process. Even when new mortgage originations slow down, the need for these services remains, ensuring a steady stream of income. For instance, in 2024, TransUnion reported that its Financial Services segment, which includes mortgage solutions, continued to be a significant contributor to overall revenue, demonstrating resilience. The company’s ability to leverage its extensive data assets makes these offerings indispensable for lenders navigating complex regulatory environments and seeking to mitigate risk.

- Established Market Share: TransUnion holds a substantial position in the mortgage data and analytics market.

- Consistent Revenue Generation: Mortgage solutions provide reliable cash flow, even during periods of lower market activity.

- Essential Services: Lenders depend on TransUnion's data and analytics for risk assessment and fraud prevention.

- Resilient Performance: The Financial Services segment, bolstered by mortgage offerings, showed steady performance in 2024.

Insurance Risk Assessment Solutions

TransUnion's insurance risk assessment solutions represent a significant Cash Cow for the company. These offerings provide insurers with critical tools for evaluating risk, streamlining underwriting processes, and combating fraud. This mature market segment is characterized by consistent demand for TransUnion's robust data and analytical capabilities.

The insurance sector is a cornerstone for TransUnion, demonstrating a strong and enduring market position. In 2024, the global insurance analytics market was valued at approximately $7.3 billion, with risk assessment solutions being a major component. TransUnion's established presence in this space ensures predictable revenue streams due to the ongoing need for accurate risk evaluation.

- Established Market Leadership: TransUnion holds a dominant position in providing risk assessment tools to the insurance industry.

- Consistent Revenue Generation: The mature nature of the insurance sector guarantees a steady demand for these solutions, leading to predictable income.

- Data and Analytics Strength: The company leverages its extensive data and advanced analytics to offer reliable and effective risk management services.

- Fraud Prevention Capabilities: Beyond risk assessment, TransUnion's solutions also play a crucial role in preventing insurance fraud, adding significant value.

TransUnion's core U.S. credit reporting services for businesses are a prime example of a Cash Cow. This segment, the foundation of their operations, consistently generates substantial and predictable revenue. In 2023, TransUnion's U.S. Information Services segment, which largely encompasses this area, reported approximately $2.5 billion in revenue.

The maturity of the U.S. credit agency market, coupled with TransUnion's high barriers to entry, allows it to maintain a leading position and a steady cash flow. This segment requires minimal investment for ongoing operations, freeing up capital for other company initiatives.

TransUnion's established suite of credit risk management tools for lending, including credit decisioning and portfolio management, are also significant cash cows. These offerings are deeply integrated into the workflows of many financial institutions, underscoring their critical role and market acceptance.

These mature products deliver stable, high-margin revenue streams. Their long-standing presence and integration into client systems mean they need minimal additional investment for growth, a key characteristic of successful cash cow units.

| Business Segment | BCG Category | 2023 Revenue (Approx.) | Key Characteristics |

|---|---|---|---|

| U.S. Information Services (Core Credit Reporting) | Cash Cow | $2.5 billion | High barriers to entry, stable demand, minimal investment, dominant market position. |

| Consumer Interactive (Credit Monitoring) | Cash Cow | $1.35 billion | Recurring revenue, persistent consumer need, stable demand. |

| Financial Services (Mortgage Solutions) | Cash Cow | Significant contributor | Essential for lenders, resilient demand, strong data leverage. |

| Insurance Risk Assessment Solutions | Cash Cow | Consistent revenue contributor | Mature market, ongoing demand, strong data and analytics, fraud prevention. |

What You’re Viewing Is Included

TransUnion BCG Matrix

The TransUnion BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after completing your purchase. This means you can confidently assess the strategic insights and professional design, knowing that no further modifications or additional content will be required. You are purchasing the exact, analysis-ready report, complete with all sections and data, ready for immediate integration into your business strategy discussions and decision-making processes.

Dogs

Before its major 'OneTru' modernization, TransUnion likely relied on older, fragmented data systems. These systems were probably expensive to keep running and delivered less and less value over time.

Such legacy systems, burdened by outdated technology, would have struggled to compete, holding a smaller market share. They represented a prime opportunity for divestiture or a complete rebuild, rather than ongoing investment.

Certain highly specialized or older data products from companies like TransUnion that haven't kept pace with the digital transformation could be classified as dogs in the BCG matrix. These might include legacy credit reporting services that haven't integrated with real-time data streams or expanded into newer analytics. For instance, a decline in demand for traditional direct mail credit offers, a market that saw significant contraction in 2024 as digital channels became dominant, would place such products in this category.

These niche offerings typically serve a shrinking customer base or face stiff competition from more adaptable, modern solutions. Imagine a data product focused solely on a single, outdated industry metric that has been superseded by more dynamic, multi-faceted data points. Such a product would likely exhibit low market share and minimal growth prospects, reflecting a lack of investment and innovation.

Acquired assets that struggle post-integration can quickly turn into dogs within TransUnion's portfolio. These are the ventures where synergies fail to materialize, and market adoption lags significantly behind expectations.

For example, if an acquisition intended to bolster TransUnion's presence in a specific data analytics niche fails to gain traction, it might be consuming valuable operational funds without contributing meaningfully to revenue growth or market share. Such underperforming assets represent a drain, diverting resources from more promising opportunities.

In 2024, companies across various sectors have reported challenges in integrating acquired businesses, with some integration costs exceeding initial projections by as much as 20-30%. This highlights the inherent risk of acquisitions becoming financial burdens if not managed effectively post-merger.

These "dog" assets, if left unaddressed, can negatively impact TransUnion's overall profitability and strategic agility, forcing a reassessment of their value and future viability.

Manual Data Verification Processes

Manual data verification processes, if not yet automated or shifted to Global Capability Centers (GCCs), can be considered dogs in the TransUnion BCG matrix. These are typically older, less efficient operations that consume significant resources without offering substantial growth potential or a strong competitive edge. For instance, a legacy system requiring extensive manual input for customer onboarding or credit checks, which hasn't been modernized, would fall into this category.

Processes stuck in manual verification often face challenges like:

- High operational costs: Labor-intensive tasks increase expenses significantly. In 2024, companies still relying heavily on manual data entry for financial reporting could see up to 30% higher processing costs compared to automated systems.

- Limited scalability: As business volume grows, manual processes become bottlenecks, hindering expansion.

- Increased error rates: Human error in data verification can lead to inaccuracies, impacting decision-making and customer trust.

- Slow turnaround times: Manual checks inherently take longer, affecting customer experience and market responsiveness.

Very Small, Stagnant Regional Offerings

Very Small, Stagnant Regional Offerings reside in the "Dogs" quadrant of the TransUnion BCG Matrix. These are TransUnion's least strategic business segments. Think of very specific, localized services in niche geographic markets where TransUnion hasn't gained much traction. The markets themselves aren't growing, meaning there's little opportunity for expansion.

These segments are characterized by limited market share and a lack of growth potential. Consequently, they are unlikely to contribute significantly to TransUnion's overall profitability or strategic objectives. Their minimal presence and the absence of market expansion make them candidates for divestment or significant restructuring.

- Low Market Share: These offerings typically command a very small percentage of their respective regional markets.

- Stagnant Market Growth: The geographic areas served are experiencing negligible economic or industry growth.

- Minimal Strategic Importance: They hold little sway in TransUnion's broader market strategy or future growth plans.

- Low Profitability: Due to scale and market conditions, these segments generate minimal profits, if any.

Products or services that are no longer competitive, like outdated credit reporting tools with minimal market share and no growth prospects, are considered Dogs. These segments often require significant investment to modernize or are candidates for divestment.

Manual data verification processes, which are inefficient and costly compared to automated systems, also fall into this category. For instance, in 2024, businesses still using manual data entry for financial reporting could face processing costs up to 30% higher than those with automation.

Small, stagnant regional offerings with little strategic importance and negligible profit generation are also classified as Dogs. These are typically divested or restructured due to their limited contribution to overall company performance.

These underperforming assets can drain resources, impacting profitability and agility, and necessitate a strategic review of their future viability.

Question Marks

The TransUnion Telco Data Score is a game-changer for emerging markets, particularly in places like South Africa. It taps into the vast amount of mobile phone data to assess the creditworthiness of people who typically don't have traditional credit histories, often called the credit-invisible. This is a huge opportunity because a significant portion of the population in these regions falls into this category.

Think about it: in many emerging economies, mobile phone penetration is incredibly high, often exceeding traditional banking access. By using this readily available data, TransUnion can open up credit access to millions. For instance, in 2023, South Africa alone had over 100 million active mobile subscriptions, representing a massive pool of potential customers for this scoring solution.

From a strategic perspective, this product fits squarely into the 'Question Mark' quadrant of the BCG Matrix. Its market share is currently very small, almost nascent, but the potential for growth is enormous given the sheer size of the underserved demographic. This means it requires substantial investment to develop, market, and scale effectively to capture this high-growth market.

The challenge, and the reason it's a 'Question Mark', lies in the execution. Building the sophisticated algorithms, ensuring data privacy compliance, and educating both consumers and lenders are critical. However, if successful, the Telco Data Score could become a dominant force in credit scoring across emerging markets, mirroring the rapid growth seen in other digital services in these regions.

TransUnion's foray into freemium consumer solutions signals a strategic push to broaden its direct engagement with individuals. This move is designed to attract a wider audience, with the ultimate goal of converting a portion of these users into paying customers for enhanced credit monitoring or identity protection services. The company is betting on its established brand recognition to draw consumers in, a common tactic in the digital services landscape.

While the consumer credit market is vast, the freemium model is notoriously challenging. The success of these new offerings hinges on TransUnion's ability to differentiate its free tier sufficiently to attract users, while simultaneously creating compelling value propositions for its paid tiers. Achieving profitability in this competitive space, where many players offer similar services, will require careful execution and a strong understanding of consumer willingness to pay for added features.

TransUnion's commitment to AI/ML extends beyond its established TruIQ suite into highly specialized applications. These are designed to tackle complex, emerging challenges, such as predicting novel fraud patterns or optimizing intricate supply chains through advanced analytics. While these cutting-edge solutions are currently in nascent stages, characterized by significant research and development investment and minimal market penetration, their potential for rapid scaling is substantial.

For instance, a new AI model identifying sophisticated synthetic identity fraud, a persistent threat that cost the financial industry billions in 2023 alone, represents such a specialized application. These initiatives, though high-cost and in early adoption, could capture significant market share if they prove effective in mitigating escalating risks and delivering superior predictive accuracy. The success of these ventures hinges on their ability to demonstrate clear ROI and adapt to rapidly evolving threat landscapes.

Newly Acquired Geographic Businesses (e.g., TransUnion de Mexico)

TransUnion's acquisition of a majority stake in TransUnion de Mexico signifies a calculated move into a burgeoning international market. This venture, though aligning with a broader 'Star' strategy, positions TransUnion de Mexico as a 'Question Mark' within the BCG framework.

The integration process and the establishment of a dominant market share under new ownership are critical, yet still unfolding, elements. As of early 2024, the company is navigating the complexities of this transition, with its future performance yet to be definitively categorized.

- Strategic Market Entry: The acquisition targets Mexico's rapidly expanding digital economy and growing demand for credit information services.

- Integration Phase: TransUnion de Mexico's performance is contingent on successful operational integration and leveraging TransUnion's global expertise.

- Market Potential: Mexico's relatively low credit penetration presents a significant opportunity for growth, but also introduces competitive challenges.

- Financial Outlook: Specific financial data for the newly acquired stake's contribution to TransUnion's overall performance will become clearer as integration progresses through 2024 and beyond.

Blockchain/Decentralized Identity Pilot Projects

TransUnion's exploration into blockchain and decentralized identity pilot projects falls squarely into the question mark category of the BCG matrix. These initiatives represent significant investments in unproven technologies with the potential for substantial disruption in identity verification and data security. While the current market share for such solutions is negligible, the promise of enhanced security and user control could fundamentally alter how identity is managed. For example, by mid-2024, several financial institutions were actively testing decentralized identity frameworks, aiming to reduce fraud by over 20% in pilot programs.

These projects are characterized by high risk due to the nascent stage of blockchain and decentralized identity adoption. The regulatory landscape is still evolving, and widespread consumer acceptance remains a significant hurdle. However, the potential rewards are immense, offering a path to a more secure and efficient digital identity ecosystem. Early 2024 saw a surge in venture capital funding for decentralized identity startups, with over $500 million invested globally, signaling strong investor interest in the sector's future.

- High Risk, High Reward: Investments in blockchain and decentralized identity pilot projects carry substantial risk due to technological immaturity and uncertain market adoption.

- Low Current Market Share: These cutting-edge solutions currently hold a minimal share of the identity verification market, reflecting their experimental phase.

- Potential for Disruption: Successful implementation could revolutionize identity verification, offering enhanced security and user empowerment.

- Emerging Investment Trends: Venture capital poured over $500 million into decentralized identity startups globally by early 2024, indicating growing confidence in the technology's future.

Question Marks in TransUnion's portfolio represent ventures with low market share but high growth potential, demanding significant investment. The Telco Data Score in emerging markets exemplifies this, tapping into millions of unbanked individuals. Similarly, specialized AI applications for fraud detection and decentralized identity pilots are in their infancy but hold promise for future market dominance.

BCG Matrix Data Sources

Our TransUnion BCG Matrix leverages a comprehensive blend of internal financial data, proprietary market research, and third-party industry analysis to provide accurate strategic insights.