TransUnion Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TransUnion Bundle

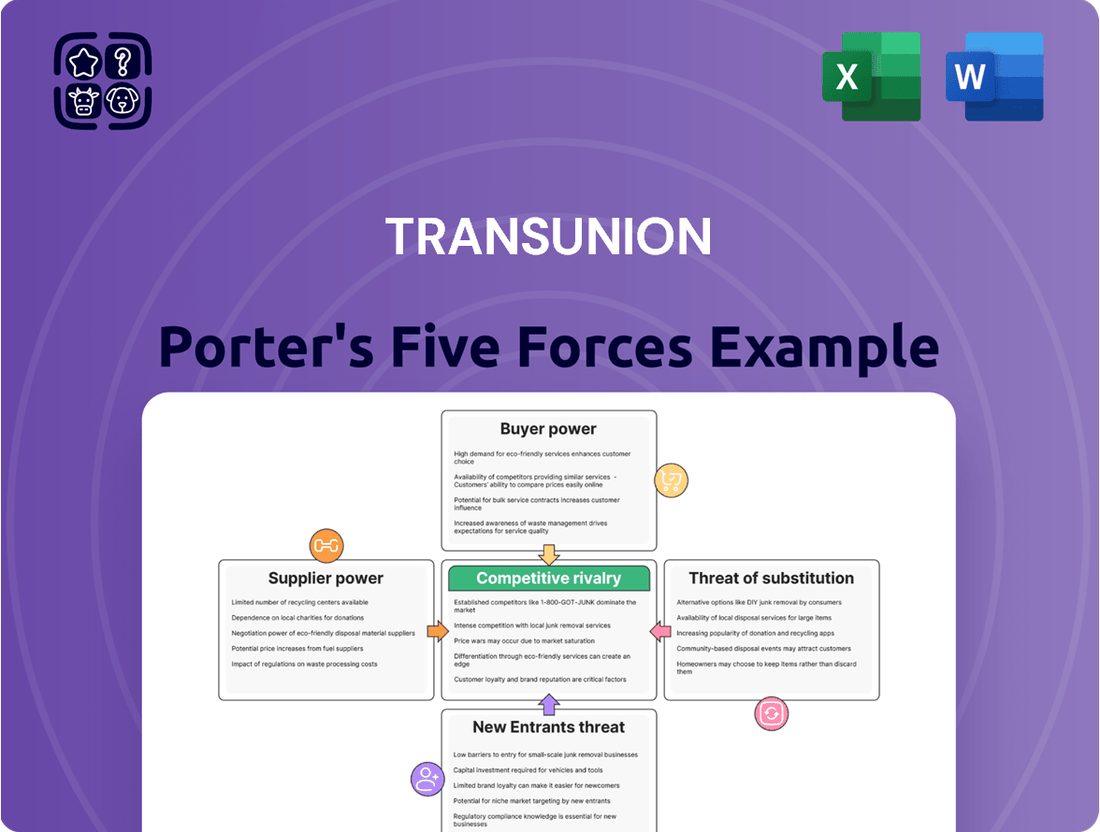

TransUnion operates in a dynamic data and analytics landscape, significantly shaped by powerful market forces. Understanding the intensity of buyer power, the threat of new entrants, and the influence of suppliers is crucial for navigating this competitive arena. The bargaining power of buyers, for instance, can impact pricing and service demands, while the ease of entry for new players dictates market saturation.

The threat of substitute products or services also presents a constant challenge, forcing TransUnion to innovate and differentiate. Furthermore, the intensity of rivalry among existing competitors directly influences profitability and strategic maneuvering. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore TransUnion’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

TransUnion's reliance on external data sources means data providers hold significant bargaining power. These suppliers, ranging from financial institutions to public record aggregators, are essential for TransUnion's operations. The ability to secure unique or hard-to-access data can elevate a supplier's leverage. For instance, specialized fraud detection datasets or proprietary consumer behavior analytics could command higher prices or more favorable terms.

TransUnion's reliance on technology and infrastructure providers is substantial, as these suppliers furnish critical IT infrastructure, software, and cloud services essential for its operations. The bargaining power of these suppliers can be quite high, especially when dealing with highly specialized or proprietary technologies where alternatives are limited.

However, TransUnion is actively working to manage this supplier power. By adopting a hybrid public-private cloud infrastructure, the company is building in redundancy and enhancing its operational resilience. This strategic move not only strengthens its technological backbone but also provides leverage, potentially reducing the dependency on any single supplier and thereby mitigating their individual bargaining power.

TransUnion's growing reliance on specialized analytics and AI tool providers is a significant factor in its operational landscape. As the company increasingly embeds advanced analytics and machine learning into its offerings, the power of these niche suppliers naturally escalates. This trend means that providers of cutting-edge AI and data science platforms hold considerable sway, as their tools are becoming indispensable for maintaining a competitive edge in the data analytics sector.

The increasing criticality of AI and machine learning capabilities for competitive advantage directly amplifies the bargaining power of specialized analytics and AI tool providers. Companies like TransUnion need these sophisticated tools to offer differentiated services and insights. For instance, in 2024, the global AI market size was valued at an estimated USD 200 billion, and it's projected to grow substantially, indicating a robust demand for the very tools TransUnion utilizes.

Strategic collaborations are key to navigating this dynamic. TransUnion's partnership with Omnisient, for example, highlights a proactive approach to managing supplier power by integrating alternative data and advanced analytics capabilities. Such alliances allow TransUnion to leverage specialized expertise while potentially mitigating direct dependency on a single supplier for critical AI functionalities.

Talent Pool

The availability of skilled talent, especially in areas like data science, analytics, cybersecurity, and technology development, significantly influences the bargaining power of suppliers for TransUnion. A scarcity of professionals in these crucial fields can empower employees, driving up labor costs. For instance, in 2024, the U.S. Bureau of Labor Statistics projected faster-than-average growth for software developers, a key talent segment for TransUnion.

TransUnion’s strategic emphasis on Global Capability Centers and robust talent acquisition initiatives are direct responses to managing this supplier dynamic. These efforts aim to secure a consistent and high-quality pool of expertise. By investing in talent development and global recruitment, TransUnion seeks to mitigate the risks associated with a concentrated or highly competitive talent market.

- High Demand for Specialized Skills: In 2024, demand for data scientists and AI specialists continued to outpace supply, leading to competitive compensation packages.

- Impact on Labor Costs: A tight labor market for cybersecurity professionals, for example, can directly increase TransUnion's operational expenses.

- Talent Acquisition as a Strategy: TransUnion's focus on building Global Capability Centers is a move to diversify talent sources and reduce reliance on single geographic markets.

- Employee Bargaining Power: When specialized skills are scarce, employees in those roles gain leverage, potentially demanding higher salaries and better benefits.

Regulatory Data Requirements

Government and regulatory bodies impose stringent data collection, usage, and reporting standards, making them significant suppliers of crucial compliance frameworks. TransUnion, like many in its industry, must adhere to these mandates, which can dictate operational processes and data handling. For instance, TransUnion's subsidiary Argus agreed to a consent order with the Consumer Financial Protection Bureau (CFPB) in 2023, which included a prohibition from seeking government contracts, illustrating the tangible consequences of failing to meet regulatory expectations.

These regulatory requirements directly impact the bargaining power of suppliers by creating high switching costs and potential barriers to entry for new players. Companies must invest heavily in systems and processes to ensure compliance, making it difficult and costly to change providers or adapt to new regulatory regimes. This creates a dependency on entities that can navigate and satisfy these complex rules.

- Regulatory Compliance as a Barrier: Government mandates for data privacy and security, such as GDPR or CCPA, necessitate significant investments in technology and expertise, increasing operational costs and limiting flexibility.

- Supplier Dependence: Companies rely on regulatory bodies to define the 'rules of the game,' influencing how data is managed and reported, thereby empowering these bodies as de facto suppliers of essential operational guidance.

- Enforcement and Penalties: Non-compliance can result in substantial fines and reputational damage. For example, a significant data breach could lead to regulatory investigations and penalties that impact a company's ability to operate, as seen in past cases across the financial services sector.

Suppliers of unique data sets and specialized analytics tools hold considerable bargaining power over TransUnion, especially given the increasing demand for AI and advanced data science capabilities. The scarcity of skilled talent in areas like data science and cybersecurity also amplifies employee leverage, potentially increasing labor costs for TransUnion. Furthermore, government and regulatory bodies act as influential suppliers by dictating compliance frameworks, creating high switching costs and dependencies.

| Supplier Type | Impact on TransUnion | Key Factors | 2024 Data/Trend |

| Data Providers | High Bargaining Power | Access to unique/hard-to-get data | Continued demand for specialized datasets |

| Technology & Infrastructure | Significant Bargaining Power | Proprietary/specialized technologies | Hybrid cloud adoption to mitigate single-supplier dependency |

| Analytics & AI Tool Providers | Escalating Bargaining Power | Criticality for competitive advantage | Global AI market valued at approx. USD 200 billion in 2024 |

| Skilled Talent (Employees) | Increasing Bargaining Power | Scarcity of specialized skills | Faster-than-average growth projected for software developers |

| Regulatory Bodies | De Facto Suppliers of Guidance | Stringent compliance standards | CFPB consent order with Argus (2023) highlights regulatory impact |

What is included in the product

This analysis reveals the competitive intensity and profitability potential for TransUnion by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing firms.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Empower strategic planning by pinpointing areas of vulnerability and opportunity within your market landscape.

Customers Bargaining Power

TransUnion's core clientele consists of large financial institutions like banks and credit unions, alongside insurance providers, all heavily reliant on its credit reporting and risk assessment tools. These significant players, particularly major lenders, wield considerable bargaining influence due to the substantial volume of data and services they procure, coupled with their essential need for precise, up-to-date information.

While these large customers possess significant leverage, the credit bureau industry's structure, characterized by a limited number of major players, somewhat constrains their ability to switch providers easily. For instance, in 2024, the top three credit bureaus in the US, including TransUnion, collectively processed billions of credit inquiries annually, highlighting the scale of these customer relationships and the interdependence involved.

For direct-to-consumer services like credit monitoring and identity protection, individual consumers typically wield low bargaining power. Their ability to negotiate terms or prices on an individual basis is minimal.

However, this shifts when consumers act as a collective. The increasing demand for transparency, financial literacy, and robust data protection significantly influences TransUnion's strategic decisions. For instance, in 2024, TransUnion continued to expand its freemium offerings, providing basic credit education and monitoring services to a broader audience, directly responding to this aggregated consumer pressure.

When financial institutions consolidate or form powerful alliances, customers gain leverage. This can lead to demands for better pricing and bundled services, as the unified entities have more collective power. For example, in 2024, the financial services sector continued to see strategic mergers, enhancing customer options and negotiation strength.

TransUnion actively addresses this by forging strategic partnerships. By collaborating with platforms like MoneyLion, TransUnion expands its service offerings and creates integrated solutions. This approach aims to provide greater value to customers, thereby mitigating the increased bargaining power that arises from industry consolidation.

Regulatory Influence on Customer Demands

Regulatory influence significantly shapes customer demands within the credit reporting industry. Laws like the Fair Credit Reporting Act (FCRA) in the United States, for instance, directly empower consumers. These regulations mandate that credit bureaus like TransUnion provide clear disclosures about how consumer data is used and establish robust dispute resolution processes. This level of transparency and recourse inherently shifts bargaining power towards the customer.

This regulatory framework compels credit bureaus to operate with a heightened awareness of consumer rights. For example, the FCRA requires furnishers of credit information to investigate disputes within a specified timeframe, often 30 days. Failure to comply can lead to penalties, further reinforcing customer leverage by ensuring adherence to data privacy and accuracy standards. In 2024, the ongoing focus on data privacy, amplified by regulations like GDPR and CCPA, continues to push for greater customer control over personal information, thereby increasing their bargaining power.

- Mandated Disclosures: Regulations require credit bureaus to provide consumers with access to their credit reports and information about who has accessed them.

- Dispute Resolution: Consumer protection laws create formal channels for customers to dispute inaccuracies on their credit reports, forcing bureaus to address these issues.

- Data Security Standards: Stricter data security requirements protect customer information, reducing the risk of breaches and increasing consumer confidence and expectations.

- Increased Transparency: The regulatory environment fosters greater transparency in credit reporting practices, enabling customers to better understand and manage their creditworthiness.

Demand for Specialized Solutions

Customers are increasingly seeking highly specialized data and analytics solutions tailored to their unique requirements. This trend is evident across various sectors where TransUnion operates, from advanced fraud detection to nuanced marketing segmentation. For instance, the demand for AI-driven credit decisioning models, which are inherently specialized, has surged as lenders aim to refine risk assessment in evolving economic conditions.

This growing appetite for customized offerings significantly amplifies the bargaining power of customers. When clients require bespoke solutions, they exert greater pressure on providers like TransUnion to adapt and innovate. This can lead to demands for more flexible pricing, dedicated support, or even co-development initiatives, thereby enhancing the customer's leverage in negotiations.

- Specialized Demand: Customers require tailored solutions for fraud prevention, alternative lending, and marketing analytics.

- Innovation Pressure: This demand forces TransUnion to continuously develop and customize its product suite.

- Increased Leverage: Greater customization capabilities empower customers in pricing and contract negotiations.

- Market Responsiveness: TransUnion's ability to meet these specialized needs directly impacts its competitive standing.

The bargaining power of TransUnion's customers is a significant factor, especially with its large institutional clients like banks and credit unions. These entities, by virtue of the sheer volume of data and services they consume, possess considerable sway. For instance, in 2024, major financial institutions continue to rely heavily on TransUnion's credit data for billions of lending decisions annually, reinforcing their negotiation strength.

While individual consumers generally have minimal bargaining power with credit bureaus, collective consumer action and regulatory mandates significantly enhance their leverage. Laws like the FCRA empower consumers with rights to access their reports and dispute inaccuracies. In 2024, ongoing data privacy concerns and regulations like GDPR and CCPA further bolster consumer control, increasing their power.

The demand for specialized, tailored data analytics solutions from TransUnion also amplifies customer bargaining power. As clients require bespoke offerings for fraud detection or marketing, they can negotiate more favorable terms. This trend is highlighted by the increasing demand for AI-driven credit decisioning models, pushing providers to innovate and customize.

| Customer Segment | Bargaining Power | Key Factors |

| Large Financial Institutions | High | Volume of business, interdependence, need for precise data |

| Individual Consumers (Direct-to-Consumer) | Low | Limited individual negotiation capacity |

| Individual Consumers (Collective/Regulated) | Medium to High | Regulatory rights (FCRA, GDPR, CCPA), data privacy concerns |

| Businesses Requiring Specialized Solutions | High | Demand for customization, innovation pressure |

Same Document Delivered

TransUnion Porter's Five Forces Analysis

This preview shows the exact TransUnion Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape impacting TransUnion, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitute products. This professionally written analysis is fully formatted and ready to use, providing actionable insights into TransUnion's strategic positioning and market dynamics.

Rivalry Among Competitors

The U.S. credit reporting landscape is a prime example of an oligopoly, with TransUnion, Experian, and Equifax holding a commanding presence. This trio effectively dictates market dynamics, leading to significant competitive pressures. For instance, in 2023, these three companies collectively processed billions of credit inquiries, underscoring their market dominance and the intense battle for every consumer and business account.

The intense rivalry among these dominant players means competition isn't just about price but also centers on innovation and service. Companies like TransUnion continuously invest in advanced analytics and data security to differentiate themselves. They vie for market share by offering superior data accuracy, faster reporting, and more sophisticated tools for lenders, demonstrating a constant push for technological and service excellence.

Competitive rivalry in the credit reporting industry is intense, fueled by the constant need for innovation in data and analytics. Companies like TransUnion are pouring resources into developing advanced scoring models, robust fraud prevention tools, and sophisticated identity verification services to stay ahead. This relentless pursuit of new solutions directly impacts market share and profitability.

TransUnion's strategic investments highlight this competitive dynamic. The company is actively developing and promoting platforms such as OneTru, alongside newer products like TruIQ and TruValidate. These initiatives are crucial for differentiating its suite of offerings and securing a stronger competitive position in a market where technological advancement is paramount.

While the U.S. credit reporting market is well-established, the competitive landscape is heating up globally, especially in emerging markets. TransUnion, Experian, and Equifax are all aggressively expanding their international footprints, creating more intense rivalry in these new territories. This global push is a key driver of competitive rivalry for TransUnion.

TransUnion’s strategic acquisition of a consumer credit bureau in Mexico in 2023, for instance, signals its commitment to capturing growth in developing economies. This move directly pits TransUnion against its major rivals who are also vying for market share in Latin America and other burgeoning regions.

Pricing Pressures and Cost Management

Even though the credit reporting market is quite concentrated, large clients can still push for lower prices, particularly for services that are pretty standard. This intense competition compels credit bureaus like TransUnion to concentrate heavily on being efficient and cutting costs. For example, TransUnion has been actively involved in its transformation program, aiming to streamline its operations and find ways to save money.

This focus on cost management is crucial for maintaining profitability amidst pricing pressures. It shows how important operational efficiency is when dealing with powerful customers. TransUnion’s efforts in optimizing its operating models reflect this industry-wide challenge.

- Pricing Pressure: Large customers can negotiate better rates, especially for commoditized services.

- Cost Management Focus: Credit bureaus must prioritize operational efficiency and cost reduction.

- TransUnion's Strategy: The company's transformation program highlights a commitment to optimization and cost savings.

- Market Dynamics: Even a concentrated market experiences competitive pricing due to significant buyer power.

Strategic Partnerships and Acquisitions

Major players in the credit reporting industry actively pursue strategic partnerships and acquisitions to bolster their competitive standing. These moves are crucial for expanding data access, advancing technological infrastructure, and broadening their market footprint.

TransUnion, for example, has strategically aligned with companies like MoneyLion and Omnisient. These collaborations aim to enrich its data ecosystem and offer more comprehensive solutions to consumers and businesses. This focus on strategic alliances and bolt-on acquisitions underscores a deliberate effort to enhance its competitive edge.

- Data Enrichment: Partnerships allow for the integration of new and diverse data sets, providing a more holistic view of individuals and businesses.

- Technological Advancement: Acquisitions often bring cutting-edge technologies and AI capabilities into the fold, improving data analytics and service delivery.

- Market Expansion: Strategic deals can open doors to new customer segments or geographical regions, increasing overall market reach.

- Ecosystem Building: These activities contribute to building a robust ecosystem of services around core credit reporting functions, creating greater value for stakeholders.

The competitive rivalry within the credit reporting sector, particularly for companies like TransUnion, is characterized by an intense battle among a few dominant players, primarily Experian and Equifax. This oligopolistic structure means that while customer numbers are vast, the competition for each new account and for retaining existing ones is fierce, driving constant innovation and strategic maneuvering.

The rivalry extends beyond pricing; it's a race for technological superiority and data analytics. TransUnion's ongoing investment in areas like advanced fraud detection and AI-powered insights, exemplified by its development of platforms such as OneTru, demonstrates this commitment. These efforts are crucial for differentiating its services and capturing market share in a landscape where data accuracy and speed are paramount.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Competitive Focus Areas |

|---|---|---|

| TransUnion | 8.4 | Data Analytics, Digital Identity, Fraud Prevention |

| Experian | 6.7 | Data Services, Decision Analytics, Credit Risk Management |

| Equifax | 5.0 | Data & Analytics, AI, Cloud Transformation |

This intense competition forces companies to focus on operational efficiency and cost management. Even with a concentrated market, large clients can exert significant pricing pressure, especially for standardized services. TransUnion's transformation program, aimed at streamlining operations, reflects this industry-wide imperative to reduce costs and maintain profitability in a highly competitive environment.

SSubstitutes Threaten

The growing availability of alternative data sources, like rent and utility payments, coupled with the innovation from FinTech firms, poses a substantial threat to traditional credit bureaus. These alternative datasets allow for credit assessments, especially for individuals lacking traditional credit histories, potentially bypassing established players like TransUnion. For instance, by 2024, the global FinTech market was projected to reach over $2 trillion, highlighting the significant disruption potential.

Large financial institutions are increasingly building robust in-house data analytics capabilities, potentially diminishing their need for external credit bureaus like TransUnion. These institutions can leverage their vast proprietary customer data, augmented by public information, to develop sophisticated, bespoke risk assessment models. For instance, a major bank might use its transaction history and loan performance data to build a more nuanced credit scoring system than a generic bureau model. This internal expertise allows for greater customization and potentially more accurate risk predictions, directly impacting their reliance on third-party data providers.

Emerging technologies like blockchain and decentralized identity solutions pose a potential threat by allowing individuals to control and directly share their verified data. This could disintermediate traditional credit bureaus like TransUnion by offering alternative, peer-to-peer verification and scoring mechanisms. While still in early stages, the growth of decentralized identity platforms, with an estimated market size projected to reach over $30 billion by 2030, signals a significant long-term disruptive force.

Direct Consumer-to-Lender Data Sharing

The rise of direct consumer-to-lender data sharing, often fueled by open banking advancements, presents a significant threat of substitution for traditional credit reporting services like TransUnion. These platforms allow consumers to directly share their financial data with lenders, bypassing intermediaries and potentially reducing reliance on established credit bureaus. This shift empowers consumers to control their financial information and explore alternative lending avenues.

This direct data sharing model offers a compelling alternative by simplifying the lending process and potentially providing more favorable terms for consumers who might have thin credit files or unique financial circumstances. For instance, in the UK, the Open Banking initiative has seen increasing adoption, with millions of consumers granting third-party providers access to their financial data, indicating a growing acceptance of direct data sharing.

- Increased Consumer Control: Open banking frameworks empower individuals to manage and share their financial data directly with lenders, reducing dependence on third-party credit bureaus.

- Alternative Lending Models: Platforms facilitating direct data sharing can foster new lending models that rely on real-time financial activity rather than historical credit scores, potentially serving underserved populations.

- Reduced Intermediary Costs: By cutting out intermediaries, both consumers and lenders may experience lower transaction costs, making direct data sharing an attractive substitute.

- Data Privacy Concerns: While empowering, direct data sharing also raises significant concerns about data security and privacy, which could influence the pace of its adoption as a substitute.

Fraud Prevention and Identity Verification Alternatives

The threat of substitutes for TransUnion's fraud prevention and identity verification services is significant. Many specialized cybersecurity and identity verification firms offer robust solutions, often focusing on niche areas or employing cutting-edge technologies that might appeal to businesses seeking tailored approaches. For instance, companies like LexisNexis Risk Solutions and Experian, while also credit bureaus, have distinct offerings in digital identity and fraud detection that can serve as direct substitutes. In 2024, the cybersecurity market, which heavily encompasses identity verification, was projected to reach hundreds of billions of dollars globally, indicating a crowded and competitive landscape.

Businesses are increasingly looking beyond traditional credit bureaus for their fraud prevention needs. They might choose to integrate multiple smaller, specialized solutions to create a layered defense, or opt for a single, highly effective solution from a dedicated cybersecurity provider. This can be particularly attractive if a business has unique fraud vectors or compliance requirements not fully addressed by a broader credit bureau offering. The rise of decentralized identity solutions and advanced biometrics also presents emerging substitutes that could disintermediate traditional players.

- Specialized Providers: Firms like Onfido, Jumio, and CLEAR offer advanced identity verification and fraud detection, often with a focus on digital channels and user experience.

- Niche Solutions: Businesses might adopt specific fraud detection tools for particular industries or transaction types, such as e-commerce payment fraud or synthetic identity fraud.

- In-House Development: Larger organizations with significant resources may develop their own proprietary fraud prevention systems, leveraging internal data and expertise.

- Emerging Technologies: Biometric authentication, blockchain-based identity solutions, and advanced AI-driven anomaly detection are evolving as potent substitutes for traditional methods.

The threat of substitutes for traditional credit bureaus like TransUnion is amplified by the increasing availability of alternative data sources and the growth of FinTech. These alternatives, such as rent and utility payment data, empower individuals with limited traditional credit history to access financial services, potentially bypassing established players. By 2024, the global FinTech market was projected to exceed $2 trillion, underscoring the significant disruptive potential of these innovations.

Furthermore, large financial institutions are building robust in-house data analytics capabilities, reducing their reliance on external credit bureaus. These institutions can leverage proprietary customer data and advanced analytics to create more nuanced risk assessment models, potentially offering greater accuracy and customization than generic bureau models. This trend highlights a direct substitution path where internal expertise can replace the need for third-party data providers.

Entrants Threaten

The credit reporting industry presents a formidable barrier to entry due to exceptionally high capital and data requirements. New players must commit billions to acquire and integrate vast datasets, build robust technological infrastructure, and develop sophisticated analytical tools. For instance, establishing the necessary data pipelines and processing power for a company like TransUnion or Equifax would necessitate investments in the tens of billions of dollars.

These substantial upfront costs in data acquisition, technology, and analytics create a significant financial hurdle. Aspiring entrants need to amass extensive databases and develop highly complex systems from scratch, a task that is both time-consuming and prohibitively expensive. This financial burden effectively deters most potential competitors.

The credit reporting industry is a minefield of regulations, with laws like the Fair Credit Reporting Act (FCRA) setting strict standards for data privacy, accuracy, and consumer protection. For any new company looking to enter this space, the sheer cost and complexity of achieving and maintaining compliance with these multifaceted legal frameworks represent a significant barrier to entry.

Navigating this intricate web of regulations is not a minor undertaking. New entrants must invest heavily in legal counsel, robust data security infrastructure, and ongoing compliance monitoring. For instance, the cost associated with implementing and maintaining data breach notification protocols alone can be substantial, deterring smaller or less capitalized players.

In 2024, the ongoing evolution of data privacy laws globally, with examples like the California Privacy Rights Act (CPRA) and similar initiatives in Europe, further amplifies these compliance challenges. This constant need to adapt and adhere to evolving legal landscapes necessitates continuous investment, making it difficult for new entrants to compete on a level playing field with established players like TransUnion, which have already absorbed these initial costs.

Established relationships and trust represent a significant barrier to entry for new players in the credit reporting industry. TransUnion, Experian, and Equifax have cultivated deep, long-standing partnerships with thousands of financial institutions and businesses over decades. These relationships are not merely transactional; they are built on a foundation of trust and are deeply integrated into the operational workflows and decision-making processes of these clients, making it incredibly difficult for newcomers to gain traction.

Network Effects and Data Moat

The value of credit bureaus like TransUnion is intrinsically tied to the sheer volume and richness of the data they possess. This creates powerful network effects; as more data is collected, the insights derived become more accurate and valuable, attracting more consumers and businesses. This virtuous cycle, often referred to as a data moat, makes it exceedingly challenging for new entrants to compete.

For instance, TransUnion's extensive data assets, encompassing billions of consumer records, allow for sophisticated risk assessment and fraud detection capabilities that are difficult to replicate. In 2023, credit bureaus processed trillions of data points, a testament to the scale of information required to maintain these network effects.

The difficulty in establishing a comparable data moat presents a significant barrier to entry for potential new competitors in the credit reporting industry.

- The value of credit bureaus escalates with the breadth and depth of their data repositories.

- Strong network effects emerge as more data enhances insights, attracting more users and consequently, more data.

- This self-reinforcing 'data moat' creates a formidable obstacle for new market entrants.

- TransUnion's ability to leverage vast datasets for analytics differentiates it and deters potential new competitors.

Brand Recognition and Consumer Awareness

The established credit bureaus, including TransUnion, benefit from significant brand recognition. This recognition extends to both the businesses that rely on their services and the consumers whose data they manage. For instance, in 2024, major credit reporting agencies consistently ranked high in consumer awareness surveys related to financial services, often cited in articles discussing personal finance and credit scores.

Developing a similar level of trust and widespread awareness is a considerable hurdle for any new player entering the credit reporting market. Such an endeavor would necessitate substantial investment in marketing and public relations campaigns, a process that typically takes years to yield comparable results.

Consider the advertising spend in the financial services sector. In 2023, companies heavily involved in credit management and reporting allocated billions globally to build and maintain their brand presence. This demonstrates the scale of resources required for a new entrant to even begin to compete on brand recognition alone.

The threat of new entrants is therefore somewhat mitigated by this entrenched brand loyalty and consumer familiarity, making it difficult for newcomers to quickly gain traction and market share without a very compelling and well-funded strategy.

The threat of new entrants into the credit reporting industry, including for players like TransUnion, is significantly low. This is primarily due to the immense capital requirements for data acquisition, technological infrastructure, and regulatory compliance. New entrants face prohibitive costs in building comparable data repositories and sophisticated analytical tools. For example, in 2024, the ongoing adaptation to evolving data privacy laws like the CPRA necessitates continuous, substantial investment, a barrier that established firms have already overcome.

Porter's Five Forces Analysis Data Sources

Our TransUnion Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from TransUnion's own investor relations reports, public financial filings (e.g., SEC filings), and reputable industry analysis from firms like IBISWorld and S&P Global Market Intelligence.