TransUnion Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TransUnion Bundle

Unlock the strategic blueprint of TransUnion's success with our comprehensive Business Model Canvas. Discover how they leverage data to create value, identify key customer segments, and build robust revenue streams. This detailed analysis is essential for anyone seeking to understand and replicate their market dominance.

Dive deeper into the operational framework that makes TransUnion a leader in data analytics and credit reporting. Our Business Model Canvas breaks down their core activities, key resources, and crucial partnerships, offering a clear roadmap to their achievements.

Want to see exactly how TransUnion operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out TransUnion’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for TransUnion. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

TransUnion's business thrives on deep collaborations with financial institutions like banks and credit unions. These entities are the bedrock of TransUnion's data ecosystem, providing the vast majority of information used to construct credit reports and scores. For instance, in 2024, the volume of data processed from these partnerships continued to be substantial, underpinning millions of credit decisions daily.

These financial partners are not just data providers; they are also TransUnion's primary customers. They rely heavily on TransUnion's credit reporting and sophisticated risk management solutions to assess borrower creditworthiness, manage portfolios, and comply with regulatory requirements. This symbiotic relationship ensures that lenders have access to critical insights while TransUnion maintains its leading position in the credit information industry.

TransUnion collaborates with a vast network of data providers to go beyond traditional financial institutions. This includes integrating alternative data sources, public records, and verified employment history.

This diverse data integration significantly enhances the comprehensiveness of credit assessments. For instance, by Q2 2024, TransUnion reported leveraging data from over 1,000 alternative data sources globally, contributing to more inclusive credit scoring models.

Such partnerships are crucial for expanding financial inclusion, allowing individuals and businesses with limited traditional credit histories to access financial products. This data enrichment is vital for accurate risk assessment and fostering economic growth.

TransUnion partners with technology and analytics companies to build robust data platforms. These collaborations are essential for maintaining security and operational efficiency. For instance, in 2024, TransUnion continued its investment in cloud infrastructure, leveraging partnerships with major cloud providers to enhance data processing capabilities and support advanced analytics.

These partnerships are crucial for developing cutting-edge solutions. By integrating AI and machine learning capabilities, TransUnion can offer more sophisticated insights to its clients. This focus on innovation is vital for staying ahead in a competitive market, enabling the delivery of real-time data and predictive analytics.

Fraud Prevention and Identity Verification Solution Providers

TransUnion's strategic alliances with fraud prevention and identity verification specialists are crucial for its business model. These partnerships allow TransUnion to integrate cutting-edge technologies and data analytics, bolstering its defenses against sophisticated financial fraud. This is particularly vital given the escalating digital threat landscape.

These collaborations are essential for providing robust protection for both businesses and consumers. By leveraging specialized expertise and advanced data, TransUnion can offer more comprehensive solutions to mitigate risks associated with identity theft and fraudulent transactions.

- Enhanced Fraud Detection: Partnerships integrate advanced machine learning algorithms and real-time data analysis to identify and prevent fraudulent activities more effectively.

- Improved Identity Verification: Collaborations enable the use of diverse data sources and biometric technologies to ensure the authenticity of identities, reducing onboarding risks for businesses.

- Combating Evolving Threats: These alliances are vital for staying ahead of new fraud tactics, ensuring continuous updates to protective measures.

- Data Security and Compliance: Working with specialized providers helps TransUnion maintain high standards of data security and adhere to evolving regulatory requirements in the financial sector.

Government Agencies and Regulators

TransUnion actively collaborates with government agencies and regulators to navigate the complex landscape of data privacy and industry standards. This engagement ensures adherence to regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which are critical for maintaining trust and operational integrity. For instance, in 2024, TransUnion continued its focus on responsible data stewardship, aligning its practices with evolving global data protection frameworks.

These partnerships are instrumental in advancing key societal objectives, such as promoting financial inclusion. By working with government bodies, TransUnion supports initiatives that expand access to credit for underserved populations. Furthermore, these collaborations bolster data security protocols for government applications, reinforcing TransUnion's commitment to safeguarding consumer information.

- Regulatory Compliance: Adherence to data privacy laws and industry standards through active engagement with bodies like the CFPB and FTC.

- Financial Inclusion Initiatives: Supporting government programs aimed at expanding credit access for individuals and small businesses.

- Data Security: Collaborating on best practices for securing sensitive data used by government entities.

- Policy Development: Providing industry insights to inform the creation of new data-related regulations and policies.

TransUnion's network of key partnerships is extensive, forming the backbone of its data acquisition, processing, and solution delivery. These collaborations are critical for maintaining the breadth and depth of its credit information services and for developing innovative offerings in fraud detection and identity verification.

Financial institutions are primary partners, supplying vast amounts of data and simultaneously being major customers. In 2024, the continuous flow of data from these institutions supported billions of credit assessments. Strategic alliances with technology firms enhance data platforms and advanced analytics capabilities, with significant investments in cloud infrastructure in 2024 bolstering processing power.

Partnerships with fraud prevention specialists are vital for combating evolving threats, integrating advanced AI for real-time detection. Collaborations with government and regulatory bodies ensure compliance with data privacy laws and support financial inclusion initiatives, reflecting a commitment to responsible data stewardship throughout 2024.

| Partner Type | Role in TransUnion's Model | Key 2024 Focus/Data Point |

|---|---|---|

| Financial Institutions | Data Providers & Primary Customers | Substantial data volume processed daily, underpinning millions of credit decisions. |

| Technology & Analytics Companies | Platform Enhancement & Innovation | Investment in cloud infrastructure for advanced analytics and data processing. |

| Fraud Prevention Specialists | Security & Risk Mitigation | Integration of AI/ML for enhanced real-time fraud detection. |

| Government & Regulators | Compliance & Societal Impact | Alignment with evolving global data protection frameworks and support for financial inclusion programs. |

What is included in the product

A detailed TransUnion Business Model Canvas outlining its core operations, customer relationships, and revenue streams. It highlights how TransUnion leverages data and technology to deliver credit information and analytics to diverse client segments.

The TransUnion Business Model Canvas offers a structured approach to visualizing complex strategies, relieving the pain point of overwhelming business planning by providing a clear, actionable framework.

Activities

TransUnion's core operations revolve around the ceaseless gathering and consolidation of extensive consumer and business information from a multitude of origins. This includes data from credit bureaus, public filings, and diverse alternative sources.

The capacity to swiftly and precisely aggregate this data from financial institutions, government records, and other data vendors is fundamental to the value TransUnion provides. For instance, in 2024, TransUnion continued to expand its data partnerships, aiming to ingest billions of new data points monthly to enhance its analytics capabilities.

TransUnion's core activity is transforming raw data into actionable insights. This includes generating credit scores, conducting risk assessments, and developing predictive analytics that empower businesses. For instance, in 2024, TransUnion's data analytics capabilities are crucial for lenders evaluating loan applications, with credit scores playing a pivotal role in determining approval rates and interest terms.

Sophisticated algorithms and machine learning are central to these operations. These technologies allow TransUnion to process vast datasets and identify patterns, thereby helping businesses make more informed decisions. This is particularly vital in sectors like insurance, where accurate risk scoring can directly impact profitability and customer acquisition strategies throughout 2024.

The insights derived from data analytics directly support businesses in areas such as lending, insurance, and fraud prevention. For example, TransUnion's fraud detection solutions are increasingly relied upon by e-commerce businesses to mitigate losses in the dynamic online marketplace of 2024. This focus on actionable intelligence underscores their value proposition.

TransUnion's core activities revolve around creating and refining a diverse suite of data and analytics solutions. This includes their flagship offerings like TruValidate, designed to combat fraud, TruAudience for targeted marketing efforts, and TruIQ, which provides sophisticated analytical capabilities.

A significant focus is placed on continuous innovation to adapt to changing market demands and broaden their service offerings into new sectors. This proactive approach ensures TransUnion remains a competitive force, consistently adding value for its clients.

For instance, in 2024, TransUnion continued to invest heavily in AI and machine learning to enhance the predictive power of its fraud detection tools, aiming to reduce false positives and improve customer onboarding experiences.

Customer Relationship Management and Support

TransUnion's key activities heavily involve managing relationships with a broad spectrum of clients, from large financial institutions to individual consumers. This requires a multifaceted approach to customer engagement and ongoing support. For instance, in 2024, TransUnion continued to invest in its digital platforms, aiming to provide seamless self-service options for its business clients, which can range from small businesses seeking credit insights to major corporations utilizing fraud prevention tools. The company also focuses on proactive communication and tailored solutions to meet the evolving needs of each customer segment.

Providing robust customer support is paramount. This includes offering various channels for assistance, such as online portals, dedicated account managers, and responsive customer service teams. In 2024, TransUnion reported a significant uptick in the usage of its digital support resources, indicating a growing preference for self-guided solutions. The company’s commitment extends to ensuring data security and providing educational resources to help customers effectively leverage TransUnion's services, thereby fostering long-term partnerships.

- Client Segmentation: Tailoring relationship management strategies for financial institutions, businesses of all sizes, and individual consumers.

- Digital Engagement: Enhancing self-service portals and digital contact channels for efficient customer interaction and support.

- Customer Support Infrastructure: Maintaining dedicated support teams and resources to address client inquiries and issues promptly.

- Value-Added Services: Offering educational content and tools to help customers maximize the benefits of TransUnion's data and analytics solutions.

Sales, Marketing, and Distribution

TransUnion's core activities revolve around promoting and distributing its extensive data and analytics solutions to various customer segments. This involves a multi-pronged approach to ensure broad market reach and accessibility. Direct sales teams engage with larger enterprises, while online platforms and robust API integrations cater to a wider range of businesses, from startups to established corporations. For instance, in 2023, TransUnion reported revenue growth driven by its focus on these key distribution channels, with digital engagement playing an increasingly vital role in acquiring and serving new clients.

- Direct Sales Force: Cultivating relationships with enterprise-level clients requiring tailored data and analytics solutions.

- Digital Platforms: Offering self-service portals and online access for smaller businesses and developers to leverage TransUnion's data.

- API Integrations: Enabling seamless incorporation of TransUnion's data and decisioning tools into clients' existing systems and workflows.

- Channel Partnerships: Collaborating with other technology providers and consultancies to extend market reach and offer bundled solutions.

TransUnion's key activities center on developing and enhancing its data and analytics products. This includes continuous investment in technology like AI and machine learning to improve fraud detection and risk assessment tools. For example, in 2024, the company focused on expanding its TruValidate suite to offer more comprehensive identity verification and fraud prevention capabilities.

The company also actively manages and strengthens its data ecosystem. This involves forging new partnerships and integrating diverse data sources to enrich its datasets, thereby increasing the predictive power of its analytics. In 2024, TransUnion continued to expand its alternative data sources, particularly in areas like utility payments and rental history, to provide a more holistic view of consumer creditworthiness.

Furthermore, TransUnion's operations involve the sophisticated analysis of this data to generate actionable insights. These insights are delivered through various solutions, such as credit scores, risk models, and decisioning tools, helping businesses make informed decisions in lending, marketing, and fraud mitigation. The company's analytical capabilities are crucial for clients navigating the evolving economic landscape of 2024.

Key activities also encompass maintaining and evolving client relationships across various sectors. This involves providing tailored support, educational resources, and digital engagement platforms to ensure clients can effectively leverage TransUnion's offerings. In 2024, TransUnion emphasized enhancing its digital self-service options for business clients, streamlining access to data and analytics.

| Key Activities | Description | 2024 Focus/Examples |

| Data Acquisition & Consolidation | Gathering and integrating consumer and business data from numerous sources. | Expanding alternative data partnerships; ingesting billions of new data points monthly. |

| Data Analytics & Insight Generation | Transforming raw data into actionable insights like credit scores and risk assessments. | Enhancing AI/ML for predictive analytics in lending and insurance; reducing fraud detection false positives. |

| Product Development & Innovation | Creating and refining data and analytics solutions (e.g., TruValidate, TruAudience). | Investing in AI for fraud tools; expanding identity verification capabilities. |

| Client Relationship Management | Managing relationships with financial institutions, businesses, and consumers. | Improving digital self-service platforms for business clients; providing tailored support. |

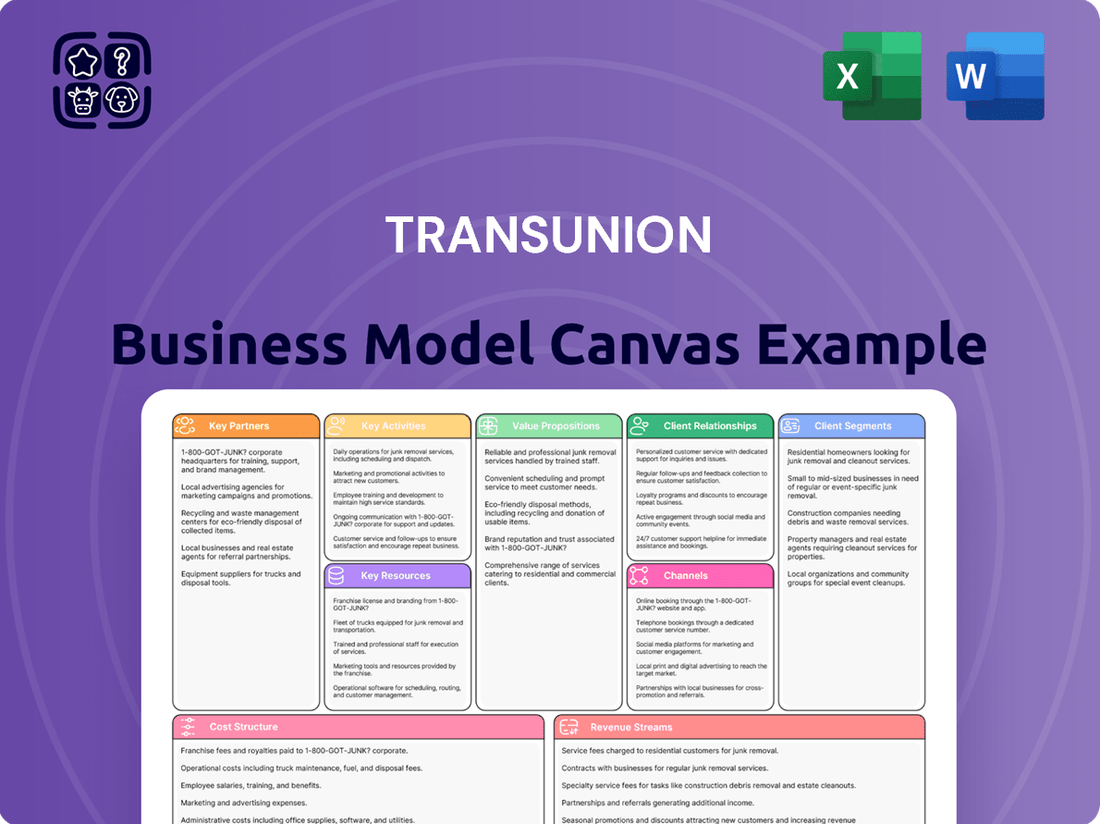

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact replica of the final document you will receive upon purchase. There are no alterations or sample sections; you are seeing the actual deliverable. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, formatted identically to this preview and ready for your immediate use.

Resources

TransUnion's most critical proprietary data asset is its vast and consistently updated repository of consumer and business credit information. This includes historical credit performance, a growing array of alternative data sources like rent and utility payments, and public records, all crucial for accurate risk assessment and identity verification.

In 2024, TransUnion's extensive data assets continue to be a cornerstone of its business, enabling sophisticated analytics and decisioning tools. The sheer volume and depth of this data allow for unparalleled insights into creditworthiness and consumer behavior.

These data assets are not static; they are continuously enriched and refined, making them invaluable for identity resolution services and fraud prevention. This ongoing investment ensures the data remains current and relevant in a dynamic economic landscape.

TransUnion's advanced analytics and AI models are central to its value proposition, converting vast datasets into actionable intelligence. These sophisticated tools, including machine learning algorithms, are crucial for developing predictive scores that inform crucial business decisions.

These intellectual assets empower TransUnion to deliver innovative solutions for critical areas like fraud prevention, where their systems identify and mitigate fraudulent activities, and risk management, assessing creditworthiness and potential financial exposures.

The company's AI capabilities also drive marketing optimization, enabling businesses to target customers more effectively and personalize campaigns. For instance, in 2023, TransUnion reported that its fraud solutions helped businesses prevent over $20 billion in fraud losses globally.

This analytical prowess underpins their ability to offer a competitive edge, as demonstrated by their continuous investment in AI research and development, aiming to further enhance the accuracy and predictive power of their scores and insights for clients.

TransUnion's technology infrastructure is built on robust, secure, cloud-based platforms, enabling efficient management of vast datasets. This foundation is crucial for delivering their credit reporting and information services. In 2024, the company continued to prioritize digital transformation, with significant capital expenditures aimed at enhancing these core capabilities and ensuring scalability to meet growing market demands.

Ongoing investments in modernizing this infrastructure are key to TransUnion's competitive edge. These updates fuel innovation, allowing for faster data processing and the development of new analytical tools. By staying at the forefront of technological advancements, TransUnion can offer more sophisticated solutions to its diverse client base.

Skilled Workforce and Expertise

TransUnion’s success hinges on its highly skilled workforce. This includes data scientists, analysts, software engineers, and seasoned industry experts who are crucial for building, maintaining, and implementing the company’s intricate data solutions.

The collective knowledge and expertise of these professionals directly fuel innovation, enabling TransUnion to stay at the forefront of data analytics and credit reporting. Their insights are fundamental to developing advanced algorithms and predictive models that clients rely on.

In 2024, companies like TransUnion are increasingly investing in talent acquisition and development. For instance, the demand for data scientists continues to surge, with Glassdoor reporting an average base salary of over $120,000 in the US for this role, reflecting the high value placed on these skills.

- Data Scientists: Develop and refine machine learning models for fraud detection and risk assessment.

- Software Engineers: Build and maintain the robust technological infrastructure supporting TransUnion's platforms.

- Industry Experts: Provide domain-specific knowledge in areas like finance, healthcare, and fraud prevention.

- Analysts: Interpret complex data sets to deliver actionable insights for clients.

Brand Reputation and Trust

TransUnion's brand reputation, built over decades, is a cornerstone of its business model. This long-standing image of reliability and accuracy is a critical intangible asset, especially in an industry where data integrity is paramount. For instance, in 2024, TransUnion continued to be a recognized leader in identity verification and fraud prevention, services deeply reliant on consumer trust.

The trust TransUnion cultivates is essential for its operations. It enables the company to maintain robust relationships with a wide array of clients, from financial institutions to small businesses, and also fosters confidence among the consumers whose data it manages. This trust directly translates into continued business engagement and data sharing, which are vital inputs for TransUnion's services.

- Brand Recognition: TransUnion is a household name in credit reporting, signifying established credibility.

- Data Security: A strong track record in protecting sensitive consumer information is crucial for maintaining trust.

- Industry Leadership: Continued innovation and adherence to regulatory standards reinforce its reputation for accuracy.

- Consumer Confidence: Consumers' willingness to engage with TransUnion's services is a direct result of perceived trustworthiness.

TransUnion's key resources are its extensive and continuously updated data sets, sophisticated analytics and AI capabilities, robust technology infrastructure, highly skilled workforce, and strong brand reputation. These elements collectively enable the company to provide crucial services in credit reporting, fraud prevention, and decisioning for businesses.

In 2024, TransUnion's proprietary data remains its most critical asset, encompassing credit history, alternative data, and public records, essential for risk assessment. This vast reservoir of information is continuously enriched, ensuring its relevance for identity verification and fraud mitigation services.

The company's advanced analytics and AI models are vital for transforming raw data into actionable insights, powering predictive scores that guide business decisions. Their fraud solutions alone prevented over $20 billion in global fraud losses in 2023, highlighting the tangible value of these intellectual assets.

TransUnion's technological infrastructure, modernized and cloud-based, supports efficient data management and scalability, critical for its service delivery. The company's brand reputation, built on decades of reliability and data security, fosters trust with clients and consumers alike, underpinning its market leadership.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Proprietary Data Assets | Vast, updated consumer and business credit information, including alternative data. | Enables accurate risk assessment and identity verification; core to all services. |

| Advanced Analytics & AI | Sophisticated models for converting data into actionable intelligence and predictive scores. | Drives innovation in fraud prevention and creditworthiness assessment. |

| Technology Infrastructure | Robust, secure, cloud-based platforms for data management and service delivery. | Supports scalability and efficiency; ongoing modernization critical for competitive edge. |

| Skilled Workforce | Data scientists, engineers, analysts, and industry experts. | Essential for developing and maintaining complex data solutions and driving innovation. |

| Brand Reputation | Long-standing image of reliability, accuracy, and data security. | Fosters trust with clients and consumers, vital for data sharing and continued engagement. |

Value Propositions

TransUnion offers businesses robust solutions for managing credit risk, equipping them with the essential data and tools to assess the creditworthiness of their customers. This capability directly supports minimizing financial exposure and making smarter lending choices.

By providing access to detailed credit reports and scores, TransUnion empowers businesses to understand potential borrowers better. For example, in 2024, the average FICO score in the US remained strong, indicating a generally healthy consumer credit landscape, a key data point for lenders.

Furthermore, TransUnion's advanced analytics offer powerful insights for both acquiring new customers and managing existing portfolios. These analytics help identify high-risk individuals and optimize strategies for customer retention and growth.

This comprehensive approach to credit risk management is vital for businesses aiming to maintain financial stability and make data-driven decisions in today's dynamic market environment.

TransUnion provides businesses and consumers with strong tools to fight financial crime and confirm identities. These solutions are crucial for protecting against identity theft and fraudulent activities, using sophisticated analytics to counter emerging risks.

In 2023, TransUnion reported that its fraud prevention solutions helped businesses avoid an estimated $6 billion in losses globally. This highlights the significant value of their services in an increasingly digital landscape where fraud attempts are on the rise.

For instance, their identity verification services can reduce false positives in application processes by up to 40%, ensuring legitimate customers are onboarded smoothly while deterring fraudsters. This efficiency directly impacts operational costs and customer acquisition.

By offering advanced analytics and data-driven insights, TransUnion empowers organizations to stay ahead of sophisticated fraud schemes, safeguarding their assets and maintaining customer trust.

TransUnion offers consumers direct access to their credit reports, scores, and ongoing monitoring services. This transparency is key to empowering individuals to actively manage and improve their financial well-being. For instance, in 2024, millions of consumers utilized services like TransUnion's credit monitoring to stay informed about their financial standing and potential risks.

Beyond just data, TransUnion provides educational resources and tailored financial product offers. These tools are designed to boost financial literacy and promote greater financial inclusion, helping more people understand and navigate the credit landscape effectively. This approach supports a more informed consumer base ready to make better financial decisions.

Data-Driven Insights for Strategic Decision-Making

Businesses rely on TransUnion's data analytics to refine customer acquisition by identifying high-value prospects, leading to a more efficient allocation of marketing spend. In 2023, companies utilizing advanced data analytics reported an average of 15% higher ROI on marketing campaigns compared to those who did not.

These insights are crucial for enhancing operational efficiency, enabling businesses to streamline processes and reduce costs. For instance, predictive analytics can help forecast demand, thereby optimizing inventory management and supply chain operations.

TransUnion's data empowers informed decision-making across diverse industries, from retail to financial services. This data-driven approach is instrumental in navigating market complexities and identifying new growth opportunities.

- Optimized Customer Acquisition: Identifying and targeting the most valuable customer segments.

- Enhanced Marketing Strategies: Tailoring campaigns for improved engagement and conversion rates.

- Improved Operational Efficiency: Streamlining processes through data-backed predictions and insights.

- Informed Strategic Decisions: Driving growth and performance with a deeper understanding of market dynamics.

Streamlined Tenant and Background Screening

TransUnion's tenant and background screening services provide landlords and property managers with a streamlined process to evaluate potential renters. This includes access to comprehensive credit reports and detailed background checks, crucial for making informed decisions.

By leveraging these tools, property owners can significantly reduce the risks of property damage and tenant non-payment. For instance, in 2024, a significant percentage of landlords reported that thorough background checks helped them avoid problematic tenants, thereby securing their rental income.

- Risk Mitigation: Reduces the likelihood of financial losses due to tenant issues.

- Efficiency Gains: Speeds up the tenant onboarding process for property managers.

- Data-Driven Decisions: Provides objective information to support rental application approvals.

- Income Protection: Helps ensure consistent and reliable rental payments.

TransUnion equips businesses with the data and analytics needed to manage credit risk effectively, enabling them to make smarter lending decisions and minimize financial exposure. This is supported by insights into consumer credit health, with average credit scores remaining robust in 2024, providing a stable backdrop for lending activities.

The company's fraud prevention solutions are critical in safeguarding businesses, having helped clients avoid an estimated $6 billion in global losses in 2023 alone, a testament to their effectiveness against rising digital fraud attempts.

TransUnion empowers consumers with direct access to their credit information and educational resources, fostering financial literacy and enabling better personal financial management, with millions actively using monitoring services in 2024.

Businesses leverage TransUnion's data analytics to optimize customer acquisition, with companies using advanced analytics reporting a 15% higher marketing ROI in 2023, demonstrating the tangible benefits of data-driven strategies.

For the real estate sector, TransUnion's tenant screening services mitigate risk for property owners by providing essential credit and background information, helping to ensure consistent rental income and reduce potential losses from problematic tenants.

Customer Relationships

TransUnion's automated self-service portals, accessible via online platforms and mobile apps, empower consumers to proactively manage their credit. These digital channels offer a convenient and efficient way for individuals to access their credit reports, set up fraud alerts, and dispute any inaccuracies without direct agent interaction. This approach significantly reduces operational costs for TransUnion while enhancing customer satisfaction through immediate access to crucial financial information.

TransUnion understands that large enterprises and financial institutions require a higher level of engagement. That's why they provide dedicated account managers to these business clients. These managers act as a primary point of contact, ensuring a streamlined and efficient experience.

This dedicated approach means clients receive personalized support tailored to their unique operational demands. For instance, a major bank might work with an account manager to integrate TransUnion's fraud detection solutions, receiving expert guidance throughout the process.

Beyond day-to-day support, these account managers offer strategic consultations. They help businesses leverage TransUnion's vast data resources and analytical tools to achieve specific objectives, whether that's improving risk assessment, enhancing customer acquisition, or optimizing fraud prevention strategies.

Furthermore, TransUnion collaborates with these clients on tailored solution development. This might involve customizing data sets or building bespoke analytical models to address emerging market trends or regulatory changes impacting the financial sector.

TransUnion actively champions financial literacy by offering a suite of complimentary credit education services. These resources, including webinars and online articles, equip consumers with the knowledge to navigate their financial journeys effectively. For instance, their credit education hub provides accessible information, aiming to demystify credit scores and reporting.

Interactive tools and personalized insights are also central to TransUnion's strategy, empowering individuals to actively manage their credit health. By providing clear explanations of credit reports and scores, they aim to reduce financial anxiety and foster responsible financial behavior. This focus on empowerment is crucial in today's complex financial landscape.

Proactive Fraud Alerts and Identity Protection Services

TransUnion's proactive fraud alerts and identity protection services are a cornerstone of its customer relationships. These services alert customers to suspicious activity on their credit files, directly addressing concerns about identity theft. This active approach to security builds significant trust.

By providing these vital protections, TransUnion demonstrates a tangible commitment to safeguarding its customers' personal data. This proactive stance is crucial in fostering loyalty and reducing customer churn, especially in an environment where data breaches are a constant concern.

- Proactive Alerts: Customers receive immediate notifications about potential fraud, enabling swift action.

- Identity Protection: Services actively monitor and protect against identity theft, offering peace of mind.

- Trust Building: Demonstrates a commitment to data security, enhancing customer confidence and loyalty.

- Reduced Risk: Empowers customers to mitigate the financial and personal impact of fraud.

Integrated API and Technical Support for Partners

TransUnion Business offers integrated API solutions and robust technical support specifically designed for its technology partners. This focus ensures that businesses integrating TransUnion's data into their own platforms experience a smooth and efficient process.

The comprehensive API documentation provided acts as a vital resource, enabling partners to easily understand and implement TransUnion's data capabilities. This technical backbone is crucial for maximizing the value derived from the data solutions within diverse partner ecosystems.

In 2024, TransUnion continued to invest in its partner support infrastructure, aiming to streamline the integration lifecycle. For instance, their developer portal offers extensive resources, including sandbox environments and code samples, facilitating quicker onboarding and development.

- API Documentation: Detailed and up-to-date guides for seamless integration.

- Technical Support: Dedicated assistance to resolve integration challenges.

- Partner Ecosystem: Enabling businesses to leverage TransUnion data within their own systems.

- Developer Resources: Tools and environments to accelerate development and testing.

TransUnion fosters diverse customer relationships, from self-service portals for consumers to dedicated account managers and tailored solutions for large enterprises. This multi-faceted approach ensures accessibility and specialized support, enhancing engagement across different client segments.

Financial literacy initiatives and proactive fraud alerts are key components, building trust and empowering individuals. For business clients, integrated API solutions and robust technical support facilitate seamless data integration, underscoring a commitment to partnership and technological advancement.

In 2024, TransUnion's focus on digital self-service and partner enablement continued, reflecting a strategy to provide efficient, scalable, and value-added relationships for both individual consumers and complex business ecosystems.

Channels

TransUnion’s direct-to-consumer online platforms, including its websites and mobile apps, serve as a vital touchpoint for individual consumers seeking to manage their financial health. These platforms offer direct access to credit reports, scores, and monitoring services, fostering financial literacy and empowerment. In 2024, TransUnion reported a significant increase in digital engagement, with millions of consumers actively utilizing these self-service tools to understand and improve their credit standing.

This channel is fundamental to TransUnion's strategy, enabling direct interaction and providing valuable data insights that inform product development and service enhancements. The ease of access through these digital channels cultivates a deeper relationship with consumers, driving loyalty and recurring revenue streams.

A dedicated sales force directly targets large businesses, including financial institutions and insurance companies. This approach is crucial for selling complex data and analytics solutions, requiring in-depth understanding of client needs.

These direct interactions foster strong, long-term relationships, essential for the recurring revenue models common in B2B data services. In 2024, companies relying on direct sales for enterprise solutions often see higher average deal sizes, with some B2B software sales averaging over $100,000 annually.

This channel enables a consultative sales process, allowing for customization and integration of services to meet specific business challenges. The success of such a channel is often measured by customer lifetime value and the ability to upsell additional services over time.

TransUnion Business leverages APIs and direct data feeds as crucial channels, enabling clients to embed its comprehensive data and analytics directly into their operational systems. This technological integration is particularly vital for businesses that rely heavily on data-driven decision-making and automated workflows.

For technology-forward companies, these integration channels are paramount. For instance, in 2024, the demand for real-time data access through APIs continued to surge, with many businesses seeking to streamline their customer onboarding and risk assessment processes. TransUnion's offerings facilitate this by providing programmable access to its vast datasets.

The utilization of APIs and data feeds allows for a highly customized and efficient data flow. This means businesses can receive the specific information they need, precisely when they need it, without manual intervention. This efficiency is a key driver for clients looking to optimize their operational costs and enhance customer experiences.

In 2024, TransUnion reported significant growth in its B2B solutions, with API integrations playing a substantial role. This reflects the market's increasing reliance on seamless data connectivity to power sophisticated analytics and business intelligence tools, ultimately supporting more informed strategic planning and execution.

Strategic Partnerships and Affiliates

TransUnion actively cultivates strategic partnerships with fintech innovators, credit management platforms, and other key industry participants. This collaborative approach significantly broadens TransUnion's market penetration and facilitates the seamless integration of complementary services, thereby enhancing its value proposition. For instance, by teaming up with specialized lending platforms, TransUnion can offer its data analytics directly within the borrower onboarding process.

These alliances are crucial for extending TransUnion's distribution channels, allowing it to reach a wider customer base that might not be directly served by its core offerings. By providing integrated solutions, such as bundled fraud detection and credit scoring tools, TransUnion makes its services more accessible and valuable to a diverse range of businesses. In 2024, TransUnion continued to expand its partner ecosystem, aiming to embed its solutions into more workflows across various sectors.

- Fintech Collaborations: Partnerships with companies like Dave and Possible Finance allow for the integration of TransUnion's credit data into their digital lending applications, streamlining applicant approval.

- Credit Management Platforms: Integrations with platforms such as Experian or Equifax's complementary services (where applicable and not competitive) enhance the holistic credit management capabilities offered to businesses.

- Industry-Specific Alliances: Collaborations with vertical-specific technology providers, such as those in the auto finance or insurance sectors, enable tailored data solutions and expanded market reach.

- Extended Distribution Network: These partnerships act as an indirect sales force, driving adoption of TransUnion's services through embedded offerings and co-branded solutions.

Industry Conferences and Events

Industry conferences and events are vital channels for TransUnion to connect with its target audience. By participating in and sponsoring these gatherings, the company can directly engage with potential clients, partners, and influencers. These events provide a platform for marketing efforts, enabling TransUnion to showcase its latest solutions and expertise.

Networking opportunities at these events are invaluable for building relationships and fostering business development. TransUnion can gain insights into market trends and competitor activities, which is crucial for strategic planning. Thought leadership presentations by TransUnion executives can further solidify the company's position as an industry leader.

For example, in 2024, TransUnion actively participated in key financial services and technology conferences. The company reported significant lead generation from these events, with a notable increase in inquiries for its fraud prevention and data analytics solutions. Sponsorships at these events also provided prominent brand visibility to a curated audience of decision-makers.

- Marketing and Brand Exposure: Conferences offer a direct avenue to reach a concentrated audience of industry professionals, enhancing brand awareness and product visibility.

- Networking and Business Development: Events facilitate crucial face-to-face interactions with potential clients, partners, and stakeholders, driving sales and strategic alliances.

- Thought Leadership: Presenting insights and research positions TransUnion as an authority, attracting attention and building trust within the market.

- Lead Generation: Participation often results in direct engagement with interested parties, generating qualified leads for sales teams and new business opportunities.

TransUnion leverages a multi-channel approach to reach its diverse customer base. Direct-to-consumer platforms and a dedicated B2B sales force are complemented by API integrations and strategic partnerships, expanding market reach and embedding solutions into client workflows.

Industry events serve as crucial touchpoints for engagement, lead generation, and thought leadership. These varied channels ensure broad accessibility and tailored engagement for both individual consumers and enterprise clients seeking data-driven insights.

In 2024, TransUnion observed a significant uptick in digital channel engagement for its consumer offerings, while B2B API integrations saw substantial growth, reflecting the increasing demand for real-time data access in business operations.

These channels collectively contribute to TransUnion's revenue streams, from recurring subscriptions for consumers to large-scale data solution contracts for businesses. Strategic alliances, in particular, amplify distribution, driving adoption through embedded offerings.

Customer Segments

Financial institutions, encompassing banks, credit unions, and other lenders, represent a core customer segment for TransUnion. These entities leverage TransUnion's extensive data for critical functions such as assessing credit risk before extending loans, streamlining the loan origination process, and actively managing their existing loan portfolios. For instance, in 2024, the demand for robust credit risk assessment tools remained high as economic conditions fluctuated, directly impacting the need for accurate credit data.

A primary driver for their engagement with TransUnion is the reliance on credit reports and scores to make informed lending decisions. These tools are fundamental in determining borrower creditworthiness, which directly influences a financial institution's profitability and risk exposure. In the first half of 2024, financial institutions processed millions of loan applications, each requiring a thorough credit evaluation, highlighting the continuous need for TransUnion's services.

Beyond credit assessment, these institutions also utilize TransUnion's solutions for fraud prevention and identity verification. This is crucial in safeguarding both the institution and its customers from financial losses due to fraudulent activities. The increasing sophistication of financial fraud in 2024 underscored the value of advanced fraud detection services provided by data analytics firms like TransUnion.

Insurance companies rely heavily on TransUnion's comprehensive data and advanced analytics to refine their risk assessment processes, streamline underwriting, and bolster fraud detection capabilities across a wide array of insurance products. This strategic partnership helps insurers make more informed decisions, leading to better pricing and reduced losses.

The insurance sector has emerged as a significant growth engine for TransUnion, with particular acceleration observed in newer and evolving insurance markets. For instance, TransUnion reported a notable increase in its insurance segment revenue in its 2024 financial updates, underscoring the growing demand for its data solutions in this industry.

TransUnion serves a wide array of businesses, from the fast-paced retail sector to essential service providers like telecommunications and utilities. These companies leverage TransUnion's capabilities for crucial functions such as acquiring new customers, refining marketing efforts, verifying identities to prevent fraud, and managing the recovery of outstanding debts.

This broad customer base, spanning numerous industries, is a significant strength. For instance, in 2024, TransUnion reported that its diverse vertical strategy contributed to its financial stability, with its international segment, which includes many of these businesses, showing robust growth.

The ability to offer tailored solutions for distinct industry needs, whether it's optimizing customer onboarding in telco or reducing chargebacks in retail, allows TransUnion to capture a substantial market share and build recurring revenue streams. This diversification is key to maintaining revenue resilience even when specific sectors face economic headwinds.

Individual Consumers

Individual consumers represent a crucial segment for TransUnion, directly engaging with the company for their credit management needs. They access credit reports, scores, and identity protection services to actively monitor and safeguard their financial well-being.

TransUnion caters to this diverse consumer base through a tiered service model, offering both free access to essential credit information and premium, paid services for enhanced features and protection. This freemium approach allows broad accessibility while incentivizing upgrades for more robust solutions.

- Credit Monitoring: Individuals use TransUnion services to track changes in their credit reports, which is vital for detecting potential fraud.

- Score Access: Consumers can view their credit scores, understanding how lenders perceive their creditworthiness.

- Identity Protection: Services like fraud alerts and credit freezes help consumers protect themselves from identity theft.

- Financial Health Management: By providing these tools, TransUnion empowers individuals to take control of their financial health.

Government and Public Sector

Government agencies and the public sector are significant users of TransUnion's data and solutions. These entities rely on TransUnion for robust identity verification, crucial for onboarding citizens and employees securely. For instance, in 2024, many government initiatives focused on digital identity programs, increasing the demand for advanced authentication services.

Fraud prevention is another key area where government entities leverage TransUnion. This includes protecting against identity theft in social programs, benefits distribution, and procurement processes. The public sector is particularly sensitive to the financial and reputational damage caused by fraud, making TransUnion's fraud detection tools invaluable.

Compliance with various regulations is also a major driver for this segment's engagement with TransUnion. Data security and privacy laws require public sector organizations to have strong measures in place to protect sensitive citizen information. TransUnion's solutions help these agencies meet stringent compliance requirements, ensuring data integrity and lawful data handling.

- Identity Verification: Essential for secure citizen and employee onboarding.

- Fraud Prevention: Safeguarding social programs, benefits, and procurement.

- Compliance: Meeting data security and privacy regulations.

- Data Security: Utilizing authentication solutions to protect sensitive information.

TransUnion's customer segments are diverse, including financial institutions, insurance companies, businesses across various sectors, individual consumers, and government agencies. Each segment utilizes TransUnion's data and analytics for distinct purposes, from credit risk assessment and fraud prevention to identity verification and personal credit management.

Financial institutions and insurance companies are key beneficiaries, relying on TransUnion for accurate credit scoring and risk evaluation to guide lending and underwriting decisions. Businesses leverage these services for customer acquisition, fraud mitigation, and debt recovery, while consumers use them for credit monitoring and identity protection.

Government entities also engage TransUnion for identity verification, fraud prevention in public programs, and ensuring regulatory compliance concerning data privacy.

Cost Structure

TransUnion faces substantial expenses in securing and maintaining access to the immense datasets that form the backbone of its information services. These costs encompass acquiring data from numerous credit bureaus, public records, and other specialized information providers, often involving complex licensing agreements.

In 2024, data acquisition and licensing remain a critical component of TransUnion's operating expenditures. While specific figures for this line item are not publicly detailed, it's understood to be a significant driver of the company's overall cost structure, directly impacting the ability to offer comprehensive credit and identity management solutions.

TransUnion's commitment to innovation and robust operations incurs significant technology development and infrastructure maintenance costs. In 2023, the company reported technology and data costs of approximately $1.3 billion, a substantial portion of which fuels ongoing research and development for new data analytics solutions and fraud prevention tools. This continuous investment is vital for maintaining a competitive edge in the rapidly evolving data and analytics landscape.

Maintaining and modernizing existing platforms, including significant cloud migration initiatives, represents another major expense. These efforts are crucial for ensuring operational efficiency, scalability, and the secure handling of vast amounts of data. For instance, continued investment in cloud infrastructure aims to enhance data processing capabilities and reduce long-term operational overhead, contributing to overall business agility.

TransUnion's cost structure heavily relies on its global workforce, with over 13,000 employees worldwide. Salaries, comprehensive benefits packages, and ongoing training for this diverse team, which includes vital data scientists, skilled engineers, dedicated sales professionals, and essential customer support staff, represent a significant portion of operational expenses.

Sales, Marketing, and Customer Acquisition Expenses

TransUnion’s cost structure is heavily influenced by expenses related to sales, marketing, and customer acquisition across both its business and consumer segments. These costs are substantial, covering a broad range of activities designed to attract and retain clients.

Significant investments are made in advertising, promotional campaigns, and the ongoing management of client relationships. For instance, in 2023, TransUnion reported that its selling, general, and administrative expenses, which include these acquisition costs, amounted to $1.4 billion. This figure highlights the capital-intensive nature of building and maintaining market presence.

- Advertising and Promotions: Direct costs for advertising placements, digital marketing initiatives, and public relations efforts.

- Sales Force Operations: Salaries, commissions, and operational overhead for the teams responsible for direct sales and account management.

- Customer Acquisition: Expenses incurred to acquire new business clients and individual consumers, including onboarding and initial service setup.

- Relationship Management: Costs associated with maintaining and deepening relationships with existing customers through dedicated support and tailored programs.

Compliance, Legal, and Regulatory Costs

TransUnion, operating in the credit reporting and information services sector, faces significant compliance, legal, and regulatory costs due to the sensitive nature of consumer data and the stringent oversight governing its industry. These expenses are crucial for adhering to data privacy laws like GDPR and CCPA, as well as consumer protection statutes and various other governmental mandates. For instance, in 2023, the global regulatory technology market was valued at approximately $13.9 billion, with strong growth projected, reflecting the increasing burden on companies like TransUnion to maintain compliance across diverse legal landscapes.

These costs encompass a wide range of activities, including:

- Legal counsel and advisory services: Engaging experts to interpret and implement complex regulations.

- Compliance officers and staff: Maintaining dedicated teams to oversee adherence to policies and laws.

- Technology and software: Investing in systems for data security, privacy management, and regulatory reporting.

- Audits and certifications: Undergoing regular assessments to ensure compliance and maintain trust.

TransUnion's cost structure is anchored by significant investments in data acquisition, technology infrastructure, and a global workforce. These expenses are vital for maintaining the integrity and breadth of its data assets and analytical capabilities.

In 2023, technology and data costs alone reached approximately $1.3 billion, highlighting the ongoing expenditure necessary to support its operations. Furthermore, selling, general, and administrative expenses, which include sales and marketing efforts, totaled $1.4 billion in the same year, underscoring the investment in market presence and customer engagement.

The company also incurs substantial costs related to compliance and legal requirements, essential for operating within the highly regulated financial data industry. These ongoing investments ensure adherence to data privacy laws and consumer protection statutes, a critical aspect of maintaining trust and operational continuity.

| Cost Category | Key Components | 2023 Estimated Impact (USD Billions) |

|---|---|---|

| Data Acquisition & Licensing | Securing data from credit bureaus, public records | Significant, not precisely detailed |

| Technology & Infrastructure | R&D, cloud migration, platform maintenance | ~$1.3 |

| Sales, Marketing & Admin | Customer acquisition, advertising, personnel | ~$1.4 |

| Compliance & Legal | Regulatory adherence, data privacy, legal counsel | Substantial, driven by industry regulations |

Revenue Streams

TransUnion's subscription-based data services are a cornerstone of its revenue, with businesses regularly paying for access to vital credit information and analytical insights. This recurring revenue model, a key component of their business model, ensures a steady and predictable income stream, making it a reliable foundation for growth. For instance, in 2023, TransUnion reported total revenue of $4.2 billion, with its Solutions segment, which heavily includes these subscription services, demonstrating robust performance.

TransUnion generates revenue through transaction-based fees for data access, charging businesses for each credit report, score, or fraud prevention service they utilize. This model directly links income to the volume of inquiries and usage, meaning the more businesses access and leverage TransUnion's data, the higher the revenue. For instance, in 2024, TransUnion reported that its North America segment, which heavily relies on such transaction-based services, saw significant growth, underscoring the importance of this revenue stream.

TransUnion generates revenue from consumers through its premium credit monitoring and identity protection services. Many consumers start with free services, a freemium approach, which encourages them to upgrade to paid tiers for enhanced features and protection. For example, in the first quarter of 2024, TransUnion reported total revenue of $1.11 billion, with its consumer segment playing a significant role.

Custom Analytics and Consulting Services

TransUnion offers premium custom analytics and consulting services, acting as a value-added revenue stream beyond its core data offerings. These engagements are designed for businesses needing tailored solutions to intricate risk management or marketing hurdles, providing them with deeper, specialized insights.

This segment focuses on bespoke projects where clients require unique analytical approaches or strategic guidance. For instance, a financial institution might engage TransUnion for a custom fraud detection model tailored to its specific transaction patterns.

- Custom Analytics: Developing unique data models and analytical frameworks for specific client needs.

- Consulting Services: Providing expert advice on risk mitigation, customer acquisition, and market segmentation strategies.

- Value-Added: These services complement core data products, offering deeper insights and actionable intelligence.

- Revenue Diversification: This stream contributes to TransUnion's overall financial performance by addressing high-value client requirements.

Fraud and Identity Solution Sales

TransUnion generates dedicated revenue by selling sophisticated fraud prevention and identity verification solutions. These offerings are vital as businesses increasingly operate in the digital realm, facing escalating threats to financial security.

These solutions are designed to safeguard both businesses and consumers from significant financial losses stemming from fraudulent activities and identity theft. The demand for such protective measures continues to grow, reflecting the evolving landscape of cyber threats.

By providing these critical tools, TransUnion addresses a core business need for security and trust. This segment of their revenue stream directly correlates with the increasing complexity and interconnectedness of modern commerce.

- Growing Market Demand: The global fraud detection and prevention market was valued at approximately $31.4 billion in 2023 and is projected to reach $108.9 billion by 2030, growing at a CAGR of 19.4% through 2030.

- Key Product Categories: Revenue is driven by solutions like identity verification services, transaction monitoring, and fraud analytics platforms.

- Impact on Businesses: Companies leverage these solutions to reduce chargebacks, prevent account takeovers, and maintain regulatory compliance.

- Consumer Protection: These tools also help protect individual consumers from identity theft and unauthorized transactions.

TransUnion's revenue is built on a diverse set of offerings, primarily revolving around data services and analytics. These streams cater to both businesses and consumers, providing critical information for decision-making and protection.

| Revenue Stream | Description | Example Data/Context |

|---|---|---|

| Subscription-Based Data Services | Recurring fees for access to credit information and analytical insights. | Key driver for B2B clients, contributing significantly to overall revenue stability. |

| Transaction-Based Fees | Charges per credit report, score, or fraud prevention service utilized. | Directly tied to usage volume; North America segment showed growth in 2024, highlighting its importance. |

| Consumer Services | Premium credit monitoring and identity protection subscriptions. | In Q1 2024, TransUnion reported $1.11 billion in total revenue, with the consumer segment playing a notable role. |

| Custom Analytics & Consulting | Bespoke projects and expert advice on risk, marketing, and strategy. | Addresses high-value client needs for tailored solutions beyond standard offerings. |

| Fraud Prevention & Identity Verification | Sophisticated solutions to combat financial crime and secure digital transactions. | The global fraud detection market was valued at approximately $31.4 billion in 2023, indicating strong demand. |

Business Model Canvas Data Sources

The TransUnion Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic operational insights. This multi-faceted approach ensures each component of the canvas is accurately represented and aligned with current business realities.