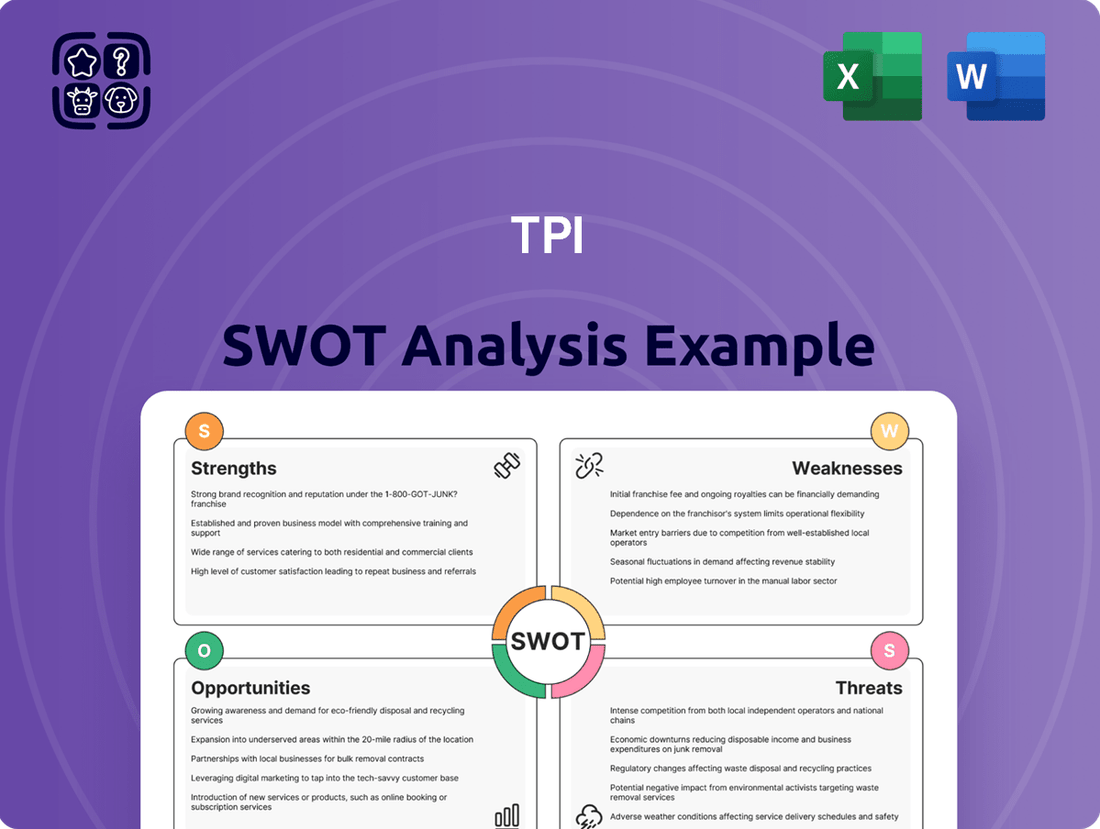

TPI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPI Bundle

The TPI SWOT analysis reveals a company poised for growth, with significant strengths in its innovative product lines and a strong brand reputation. However, it also highlights potential challenges in market penetration and the need to adapt to evolving industry trends.

Want the full story behind TPI's competitive edge and potential roadblocks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

TPI Composites possesses a significant strength as the sole independent global manufacturer of composite wind blades, boasting strategically located factories in the United States, Mexico, Türkiye, and India. This expansive manufacturing footprint enables the company to effectively cater to a wide array of wind energy markets worldwide.

This global reach is not merely about scale; it translates into tangible market share. TPI Composites is estimated to have supplied around 27% of all onshore wind blades sold globally, excluding China, in 2024. Such a substantial portion of the market underscores their operational capacity and competitive positioning.

TPI Composites benefits significantly from its deep-rooted, long-term relationships with major wind turbine Original Equipment Manufacturers (OEMs), including industry giants like Vestas and GE Vernova. These robust partnerships are a cornerstone of TPI's operational stability.

These collaborations often translate into tangible advantages, such as dedicated manufacturing facilities and extended supply agreements, with many contracts secured through 2025. This contractual framework provides TPI with a predictable demand pipeline and clear revenue visibility, crucial for strategic planning and investment.

For instance, in 2023, TPI reported that its order book extended well into 2025, underscoring the long-term nature of these OEM commitments. This stability allows TPI to optimize production and manage its supply chain effectively, reducing uncertainty in a dynamic market.

TPI Composites stands out with its profound engineering and manufacturing know-how in advanced composite structures. This expertise is fundamental to creating wind blades that are not only light and strong but also highly efficient, a key advantage in the renewable energy sector.

The company’s dedication to material innovation and refining manufacturing techniques directly translates into improved blade performance. This commitment fuels the creation of next-generation wind turbine designs, keeping TPI at the forefront of technological advancement in the industry.

As of early 2024, TPI Composites has delivered over 70,000 wind blades, underscoring their extensive production capacity and proven track record. Their ongoing investment in research and development, particularly in areas like resin infusion and automation, aims to further optimize production costs and efficiency, potentially impacting their revenue growth which saw a substantial increase in recent fiscal periods.

Diversification into Other Markets

TPI Composites is actively broadening its market reach beyond its core wind energy sector. This strategic diversification leverages their established expertise in composite materials to serve other promising industries, notably transportation and various industrial applications.

This expansion is crucial for TPI's long-term growth trajectory. By tapping into new markets, the company aims to mitigate the risks associated with being heavily dependent on the cyclical nature of the wind energy industry. For instance, in the transportation sector, TPI is developing lightweight composite solutions that can improve fuel efficiency in trucks and buses.

The company's commitment to diversification is reflected in its ongoing development of new product lines. While specific revenue figures for these newer segments are still emerging, the strategy itself is a key strength. TPI's ability to adapt its advanced composite manufacturing capabilities to meet the demands of different sectors demonstrates significant strategic foresight and operational flexibility.

- Market Expansion: TPI is moving beyond wind energy into transportation and industrial sectors.

- Risk Mitigation: Diversification reduces reliance on the wind energy market's fluctuations.

- Leveraging Expertise: TPI's core composite manufacturing skills are transferable to new applications.

- Growth Potential: Entering new markets opens up significant avenues for future revenue and profitability.

Improved Operational Efficiency and Cost Management

TPI has demonstrated a strong commitment to improving its operational efficiency and managing costs, even amidst a challenging economic landscape. These efforts are directly contributing to enhanced profitability.

Key initiatives include streamlining manufacturing processes and optimizing the company's overall footprint. These strategic moves have led to tangible financial improvements, such as a notable increase in adjusted EBITDA.

For instance, TPI reported positive movement in adjusted EBITDA during Q1 2025 compared to Q1 2024. This improvement is largely attributed to reduced warranty charges and various operational adjustments that have been successfully implemented.

- Streamlined Operations: TPI has actively worked to make its manufacturing and business processes more efficient.

- Cost Reduction: The company has identified and implemented cost-saving measures across its operations.

- Optimized Footprint: Strategic adjustments to its manufacturing and operational locations have been made.

- Improved Profitability: These efforts have translated into better financial performance, including gains in adjusted EBITDA.

TPI Composites holds a commanding position as the world's sole independent global manufacturer of composite wind blades, supported by a robust network of factories across the United States, Mexico, Türkiye, and India. This extensive manufacturing presence allows TPI to effectively serve diverse wind energy markets worldwide, having supplied an estimated 27% of all onshore wind blades sold globally, excluding China, in 2024.

The company's strength is further amplified by its long-standing, deep relationships with major wind turbine Original Equipment Manufacturers (OEMs) like Vestas and GE Vernova. These critical partnerships often include dedicated facilities and supply agreements extending through 2025, providing TPI with significant revenue visibility and a stable demand pipeline, as evidenced by an order book extending well into 2025 reported in 2023.

TPI's profound engineering and manufacturing expertise in advanced composite structures is a core differentiator, enabling the production of efficient, lightweight, and strong wind blades. This technical prowess, coupled with investments in material innovation and production automation, has led to the delivery of over 70,000 wind blades by early 2024, with ongoing R&D focused on cost optimization and efficiency gains.

Furthermore, TPI is strategically expanding beyond its core wind energy business into sectors like transportation and industrial applications, leveraging its composite material expertise to mitigate reliance on the wind market's cyclicality. This diversification, while still developing in terms of revenue contribution, represents a significant growth avenue, with efforts focused on creating lightweight composite solutions for improved fuel efficiency in vehicles, demonstrating strategic foresight.

TPI Composites is actively enhancing its operational efficiency and managing costs, resulting in improved profitability. Initiatives to streamline manufacturing processes and optimize its operational footprint have led to positive financial developments, including an increase in adjusted EBITDA, with Q1 2025 showing improvement over Q1 2024 due to reduced warranty charges and operational adjustments.

| Metric | 2023 (Full Year) | Q1 2024 | Q1 2025 (Estimated/Reported) |

|---|---|---|---|

| Global Market Share (Ex-China Onshore Blades) | N/A | ~27% | N/A |

| Revenue Growth | Significant Increase | N/A | N/A |

| Adjusted EBITDA | Positive Trend | N/A | Improved vs. Q1 2024 |

| Order Book Visibility | Into 2025 | Into 2025 | Into 2025 |

What is included in the product

Analyzes TPI’s competitive position through key internal and external factors, providing a strategic overview of its business environment.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential roadblocks into opportunities.

Weaknesses

TPI Composites' significant reliance on the wind energy sector presents a notable weakness. In 2024, wind blade manufacturing constituted roughly 97% of their total net sales, highlighting a concentrated revenue stream. This deep entanglement with a single industry makes TPI particularly vulnerable to sector-specific downturns.

Any shifts in wind energy policy, such as changes in subsidies or tax credits, could directly and substantially impact TPI's financial performance. Likewise, a slowdown in global wind power deployment, perhaps due to economic factors or supply chain disruptions within the wind sector itself, would disproportionately affect TPI's sales and profitability.

TPI Composites has a history of financial challenges, with a net loss of $49.1 million reported in the fourth quarter of 2024. This trend of unprofitability continued into 2025, as the company announced a net loss of $48.3 million from continuing operations in the first quarter.

The company's financial health is further underscored by its Altman Z-Score, which registered at -0.06 in the first quarter of 2025. This negative score is a significant indicator of potential financial distress, raising serious questions about TPI Composites' ability to sustain its operations in the long term.

TPI's extensive global manufacturing footprint, a key aspect of its operational strategy, also presents a significant vulnerability. This global reach inherently exposes the company to a complex web of geopolitical risks, including potential trade disputes, tariffs, and unpredictable regional instability. For instance, disruptions in the supply of critical raw materials like steel and fiberglass, as seen in recent years, can directly impact production schedules and inflate manufacturing costs.

The company’s reliance on international sourcing and manufacturing means it's susceptible to supply chain bottlenecks, which can cause significant delays and increase expenses. These disruptions, exacerbated by geopolitical tensions, can directly affect TPI's ability to meet production targets and manage costs effectively. Uneven regional economic growth further complicates matters, potentially leading to fluctuating demand and operational challenges across different markets.

Labor Cost Increases and Operational Transitions

TPI has encountered significant headwinds from rising labor costs, particularly in key manufacturing hubs like Mexico and Türkiye. These increases directly translate to higher operating expenses, squeezing profit margins. For instance, reports from early 2024 indicated that average wages in Mexico's manufacturing sector saw an uptick, impacting companies with substantial on-the-ground workforces like TPI.

Furthermore, the company faces substantial costs tied to the initial setup of new production lines and the complex transitions required for next-generation blade technologies. These investments, while crucial for future growth, inevitably place a strain on short-term profitability. Analysts noted in Q4 2023 that TPI's capital expenditures related to these transitions were a notable factor in their earnings reports.

- Rising Labor Expenses: Increased wages in Mexico and Türkiye directly inflate TPI's operating costs.

- New Line Start-up Costs: Initial investments in launching new production lines are a drag on near-term financial performance.

- Technology Transition Expenses: The shift to next-generation blades involves significant upfront costs that affect profitability.

Intense Competition and Pricing Pressures

TPI Composites faces formidable competition from established global players such as Siemens Gamesa, Vestas, and GE Renewable Energy, as well as the rapidly expanding Chinese manufacturers. This crowded market environment inherently leads to significant pricing pressures, as companies vie for contracts and market share.

The intense competition, particularly from lower-cost producers, directly impacts TPI's ability to maintain strong profit margins. For instance, the global wind turbine market is projected to grow, but this growth is accompanied by a fierce battle for dominance, often decided by price. In 2024, reports indicated that the average selling price for wind turbine blades saw a downward trend in certain regions due to oversupply and competitive bidding.

This pricing pressure can erode profitability and necessitate cost-saving measures, potentially affecting investment in research and development or expansion plans. TPI's reliance on large, long-term contracts means that any shift in market pricing dynamics can have a substantial impact on its financial performance.

- Market Share Erosion: Intense competition, especially from Asian manufacturers, can lead to a decline in TPI's global market share if it cannot compete effectively on price.

- Margin Compression: The need to offer competitive pricing to secure orders puts direct pressure on TPI's profit margins, potentially reducing profitability per blade.

- Innovation Challenges: Sustained pricing pressures may divert resources from crucial R&D, hindering the development of next-generation blade technologies needed to stay ahead.

- Customer Leverage: A highly competitive supplier landscape gives wind farm developers more leverage, enabling them to negotiate more favorable terms and prices, further impacting TPI's revenue.

TPI Composites' concentrated revenue stream, with wind blade manufacturing comprising approximately 97% of net sales in 2024, presents a significant weakness. This over-reliance on a single industry makes the company highly susceptible to sector-specific downturns and policy shifts in wind energy. For example, changes in government subsidies or a slowdown in global wind power deployment could disproportionately impact TPI's financial performance.

The company has faced persistent financial challenges, reporting a net loss of $49.1 million in Q4 2024 and $48.3 million in Q1 2025. This ongoing unprofitability is further highlighted by a negative Altman Z-Score of -0.06 in Q1 2025, signaling potential financial distress and raising concerns about long-term operational sustainability.

TPI's global manufacturing presence, while strategic, exposes it to geopolitical risks, trade disputes, and supply chain disruptions. Fluctuations in raw material costs, such as steel and fiberglass, and logistical bottlenecks can directly affect production schedules and inflate manufacturing expenses. This complexity is compounded by uneven regional economic growth, leading to variable demand and operational hurdles across different markets.

Rising labor costs in key manufacturing regions like Mexico and Türkiye are directly increasing TPI's operating expenses, squeezing profit margins. For instance, early 2024 reports indicated wage increases in Mexico's manufacturing sector. Additionally, substantial upfront investments in new production lines and the transition to next-generation blade technologies, noted as a factor in Q4 2023 earnings reports, place a strain on short-term profitability.

| Weakness Category | Specific Issue | Impact on TPI | Data Point |

| Revenue Concentration | Over-reliance on wind energy | Vulnerability to sector-specific downturns | 97% of net sales from wind blades (2024) |

| Financial Performance | Persistent net losses | Concerns about long-term sustainability | $48.3 million net loss (Q1 2025) |

| Financial Health | Negative Altman Z-Score | Indicator of financial distress | -0.06 (Q1 2025) |

| Operational Risks | Global supply chain exposure | Production delays and cost inflation | Raw material cost volatility |

| Cost Structure | Rising labor expenses | Reduced profit margins | Wage increases in Mexico (early 2024) |

| Investment Strain | New production line start-up costs | Pressure on short-term profitability | Capital expenditures for transitions (Q4 2023) |

Full Version Awaits

TPI SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you're investing in the exact professional-quality analysis you're evaluating. No surprises, just the complete, detailed report ready for your strategic planning.

Opportunities

The global wind energy market is set for substantial expansion, with forecasts indicating an 11.1% compound annual growth rate from 2025 through 2034. This robust growth trajectory is expected to propel the market to reach an impressive USD 543.9 billion by 2034. This escalating demand for clean energy solutions, fueled by urgent climate action and a growing emphasis on energy independence, directly translates into a significant opportunity for TPI.

The offshore wind market presents a significant growth avenue, as evidenced by record auction results in 2024 and projections indicating a substantial rise in new capacity by 2030. This expansion directly benefits companies like TPI, which specialize in the composite materials essential for this industry.

The increasing adoption of larger, more powerful wind turbines, coupled with advancements in blade technology, necessitates the use of sophisticated composite materials. TPI's core expertise in producing these advanced materials positions it favorably to capitalize on this evolving demand within the offshore wind sector.

Ongoing innovation in materials science is a significant opportunity for TPI. Lighter, stronger, and more durable composites, such as advanced carbon fiber, can directly translate into enhanced wind turbine blade performance. This means blades can be more aerodynamic and resilient, potentially increasing energy capture efficiency. For instance, the global advanced composites market, including those used in wind energy, was projected to reach over $25 billion in 2024, highlighting the scale of investment and development in this area.

These material advancements also offer avenues for cost reduction and improved manufacturing efficiency. By utilizing next-generation composites, TPI could potentially lower the raw material costs per blade or reduce the amount of material needed while maintaining or improving structural integrity. Furthermore, advancements in manufacturing processes, like automated fiber placement and additive manufacturing techniques for composite parts, could streamline production, reduce waste, and accelerate lead times, giving TPI a competitive edge in a rapidly evolving market.

Government Incentives and Supportive Policies

Supportive government policies and incentives are a significant tailwind for the wind energy sector. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers substantial tax credits for renewable energy projects, including wind power. This legislation is projected to drive billions of dollars in new investment and support the deployment of tens of gigawatts of clean energy capacity through 2030 and beyond. While policy landscapes can evolve, the overarching global commitment to decarbonization continues to bolster the industry.

These supportive measures translate into tangible opportunities for companies like TPI Composites:

- Enhanced Project Viability: Tax credits and subsidies directly improve the financial returns of wind farm projects, making them more attractive to investors and developers.

- Increased Demand for Components: As more wind projects become economically feasible due to policy support, there's a corresponding surge in demand for wind turbine blades and other essential components manufactured by companies like TPI.

- Long-Term Investment Certainty: While short-term policy shifts can create uncertainty, the long-term global trend towards green energy provides a degree of predictability, encouraging sustained investment in manufacturing capacity and technological advancement.

Increased Demand for Field Service and Maintenance

The growing installed base of wind turbines, many of which are aging, is creating a substantial opportunity for increased demand in field service and maintenance. This trend directly translates into a recurring revenue stream for companies like TPI, as these turbines require ongoing inspection, repair, and upkeep to ensure optimal performance and longevity. By 2025, the global wind power installed capacity is projected to reach over 1,200 GW, with a significant portion of this requiring specialized service.

TPI is well-positioned to capitalize on this burgeoning market. The company anticipates a significant increase in its field service revenue, largely fueled by strategic investments in expanding its deployment of skilled technicians. This expansion will enable TPI to effectively address the escalating needs of wind farm operators, ensuring their assets remain operational and efficient.

Key drivers for this opportunity include:

- Aging Turbine Fleets: As wind turbines installed in earlier phases of development reach maturity, their maintenance requirements naturally escalate.

- Recurring Revenue Potential: Field service contracts offer a predictable and stable income source, enhancing financial predictability.

- Technician Deployment: TPI's planned increase in field technicians directly supports its capacity to meet this growing demand.

- Operational Efficiency: Proactive maintenance and timely repairs minimize downtime, maximizing energy generation for clients.

TPI can leverage the expanding global wind energy market, projected to reach $543.9 billion by 2034 with an 11.1% CAGR from 2025. The increasing demand for larger, more advanced wind turbine blades, particularly in the offshore sector, creates significant opportunities for TPI's composite material expertise. Furthermore, supportive government policies like the IRA are enhancing project viability and driving demand for TPI's components.

Threats

The wind turbine sector faces significant headwinds from fluctuating raw material prices, with steel, fiberglass, and critical rare earth elements experiencing considerable volatility. This instability directly impacts manufacturing costs for companies like TPI Composites, which are heavily reliant on these inputs. For instance, steel prices saw significant swings in 2023, influencing overall project economics for wind farm developers.

Supply chain disruptions, often exacerbated by geopolitical factors and trade policies, present another substantial threat. Bottlenecks in the availability of components, particularly those sourced from China, can lead to production delays and increased lead times. Tariffs and anti-dumping measures, such as those previously applied to glass fiber yarns from China, can further inflate the cost of essential materials for blade manufacturing.

Policy instability and shifts in government renewable energy strategies pose a significant threat. For instance, changes in the U.S. federal administration or state-level policies can directly affect the wind sector. A prime example is the potential impact of modifications to the Inflation Reduction Act (IRA), which could alter crucial financial incentives for renewable projects.

Such policy shifts, including potential halts to offshore wind development or reductions in tax credits, could lead to substantial job losses within the industry and a chilling effect on future investment. The U.S. offshore wind sector alone was projected to support thousands of jobs and billions in investment, making policy certainty vital.

The wind energy sector, especially wind blade manufacturing, is experiencing fierce global competition. TPI Composites, a key player, faces significant pressure from both established international companies and emerging manufacturers, particularly those based in China. This intensified competition is directly impacting pricing strategies and TPI's ability to maintain its market share.

New entrants, often backed by aggressive government support, are driving down prices, which directly threatens TPI's profit margins. For instance, reports from 2024 indicated that Chinese manufacturers were increasingly dominating the global market for wind turbine components, including blades, due to lower production costs and expanding capacity. This trend puts TPI under considerable pressure to innovate and optimize its own cost structures to remain competitive.

The influx of lower-cost blades can force TPI to either reduce its own prices, thereby impacting profitability, or risk losing significant contracts. Analysts noted in early 2025 that the global average selling price for wind blades had seen a downward trend, directly attributable to this increased competition. This makes it challenging for TPI to invest in research and development or expand its operations without a corresponding increase in demand or ability to command premium pricing.

Macroeconomic Headwinds and Interest Rate Increases

The wind industry faces significant threats from macroeconomic headwinds, particularly high inflation and rising interest rates. These factors directly translate to increased project costs and a more expensive financing environment. For instance, the U.S. Federal Reserve continued its policy of interest rate hikes through 2024 to combat persistent inflation, impacting borrowing costs for large-scale infrastructure projects like wind farms. This escalation in capital expenditure can make new wind projects less economically viable, potentially slowing down expansion plans and consequently reducing demand for wind blades.

Broader economic challenges, such as potential recessions or supply chain disruptions exacerbated by geopolitical events, further compound these issues. Such uncertainties can lead to project delays or outright cancellations as developers reassess financial feasibility and risk profiles.

- Inflationary Pressures: Global inflation remained a concern throughout 2024, pushing up the cost of raw materials like steel and composites essential for wind blade manufacturing.

- Interest Rate Hikes: Central banks in major economies, including the U.S. and Europe, maintained higher interest rates in 2024, increasing the cost of capital for wind project developers.

- Reduced Investment Appetite: Economic uncertainty can lead to a more cautious approach from investors, potentially reducing the availability of funding for new wind energy projects.

- Project Pipeline Slowdown: Higher costs and financing challenges can result in a backlog or cancellation of planned wind farm developments, directly impacting the order book for wind blade manufacturers.

Technological Obsolescence and Recycling Challenges

TPI's reliance on current wind turbine blade technology presents a threat of obsolescence if the company cannot adapt to the industry's rapid pace of innovation. For instance, while advanced composite materials are emerging, TPI's existing manufacturing processes may struggle to integrate them efficiently. This lag could render their current blade designs less competitive against newer, more efficient models entering the market by 2025.

Furthermore, the environmental and operational hurdles associated with recycling composite wind turbine blades, particularly those made from fiberglass and epoxy resins, pose a significant challenge. As of early 2024, less than 10% of these blades are recycled globally, with landfilling remaining the dominant disposal method. This lack of a scalable and cost-effective recycling solution could lead to increasing regulatory pressure and disposal costs for TPI.

- Technological Obsolescence Risk: Failure to adopt next-generation blade designs or materials by 2025 could impact TPI's market competitiveness.

- Recycling Infrastructure Gap: Limited viable recycling solutions for composite blades present a growing environmental and cost-management challenge.

- Regulatory Scrutiny: Increasing environmental regulations regarding waste disposal could escalate operational costs for TPI.

Intensifying global competition, particularly from Chinese manufacturers with lower production costs, poses a significant threat to TPI Composites, potentially eroding profit margins and market share. Reports in early 2025 indicated that Chinese companies were increasingly dominating the global wind blade market, driving down average selling prices. This pressure necessitates cost optimization and innovation for TPI to remain competitive.

Macroeconomic headwinds, including persistent inflation and elevated interest rates throughout 2024, increase project costs and financing expenses for wind farm developers. This can lead to project delays or cancellations, consequently dampening demand for wind blades. The U.S. Federal Reserve's continued interest rate hikes in 2024 exemplify this challenge.

Policy instability and shifts in government renewable energy strategies represent a substantial risk, as seen with potential modifications to the U.S. Inflation Reduction Act (IRA). Such changes could impact crucial financial incentives, potentially slowing industry growth and investment. The U.S. offshore wind sector’s projected job creation and investment highlight the importance of policy certainty.

Technological obsolescence is a threat if TPI cannot keep pace with advancements in blade design and materials, potentially by 2025. Furthermore, the lack of scalable and cost-effective recycling solutions for composite blades presents a growing environmental and cost-management challenge, with increasing regulatory scrutiny expected.

SWOT Analysis Data Sources

This TPI SWOT analysis is built upon a robust foundation of data, including internal financial reports, comprehensive market intelligence, and expert industry opinions to provide a well-rounded strategic view.