TPI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPI Bundle

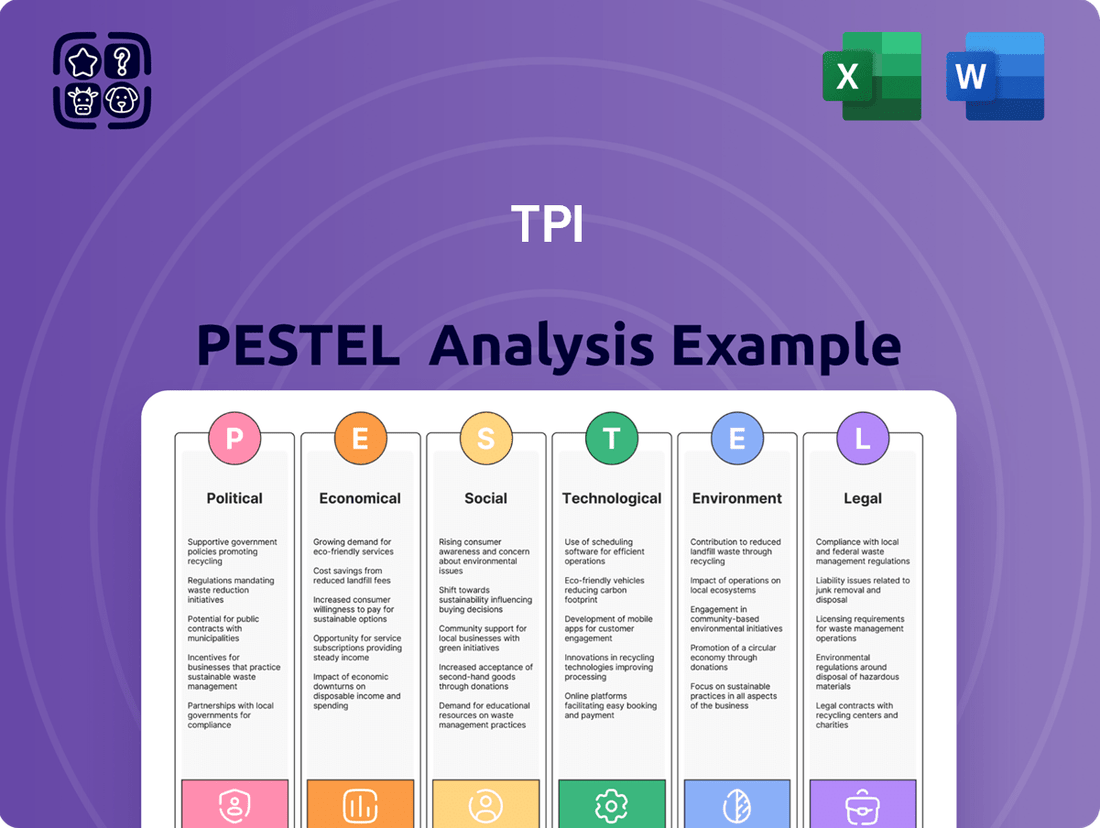

Unlock the strategic advantage by understanding the external forces shaping TPI's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors critical for informed decision-making. Gain a comprehensive overview of the landscape TPI operates within, identifying potential challenges and opportunities. Equip yourself with actionable intelligence to refine your strategies and stay ahead of the curve. Download the full PESTLE analysis now for a complete, expert-driven perspective.

Political factors

Government policies, especially those supporting renewable energy, are critical for TPI Composites. For instance, the Inflation Reduction Act (IRA) in the United States provides significant tax credits for wind energy projects, directly boosting demand for components like wind blades. These incentives, which can extend into 2024 and beyond, create a more predictable and favorable market for TPI.

The stability and longevity of such government support are paramount for TPI Composites' strategic planning and investment decisions. Fluctuations or abrupt changes in subsidy programs can introduce considerable uncertainty, potentially impacting the company's order pipeline and overall financial health. For example, a sudden reduction in wind energy tax credits could lead to a slowdown in new project development, affecting TPI's sales volume.

Beyond tax credits, direct subsidies and grants for manufacturing or research and development in the renewable sector can also play a vital role. These can help TPI Composites offset some of the costs associated with scaling production or developing more advanced blade technologies. As of early 2024, many governments globally continue to explore or enhance these types of support mechanisms to accelerate the energy transition.

International trade policies significantly influence TPI Composites' operations. For instance, trade disputes and tariffs on critical wind turbine components like blades can directly escalate manufacturing expenses and create significant disruptions in global supply chains. The World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.9% in 2023, a notable decrease from previous years, underscoring the sensitivity of manufacturers like TPI to such policy shifts.

The implementation of new tariffs, especially from major manufacturing hubs such as Mexico and China, presents a substantial challenge. These levies can directly erode profitability margins and diminish TPI Composites' competitive standing in the international market. In 2024, various nations continued to review and adjust import duties, with some impacting renewable energy sector components, creating an environment of uncertainty for TPI's cost structures and pricing strategies.

Global climate agreements, like the Paris Agreement, are directly fueling the expansion of renewable energy, including wind power. These international commitments push countries to set aggressive targets for decarbonization and renewable energy adoption. For instance, the European Union aims for at least 42.5% renewable energy by 2030, a significant driver for wind turbine component manufacturers like TPI Composites.

TPI Composites thrives as nations and regions establish ambitious goals for wind energy capacity. These targets create a predictable and sustained demand for their specialized composite solutions. The Inflation Reduction Act in the United States, for example, provides substantial tax credits for renewable energy projects, bolstering the market and TPI’s order books.

Political Stability in Operating Regions

TPI Composites' manufacturing footprint spans diverse political landscapes, including the United States, Mexico, Türkiye, and India. Political stability in these operating regions is paramount, as it directly influences manufacturing efficiency, labor availability, and the overall cost of doing business. For instance, the U.S. generally offers a stable political environment, though policy shifts can impact manufacturing incentives. Mexico's political climate, while generally stable, can experience shifts that affect regulatory frameworks. Türkiye's geopolitical position and domestic political dynamics can introduce volatility. India, with its rapid economic development, presents opportunities but also requires navigating a complex and evolving political and regulatory landscape.

These varying political environments pose distinct challenges and opportunities for TPI Composites. Regulatory consistency is crucial for long-term planning and investment. Geopolitical factors, such as trade relations and regional conflicts, can disrupt supply chains and impact market access. For example, as of early 2024, ongoing geopolitical tensions in Eastern Europe have continued to affect global supply chains and energy prices, indirectly influencing manufacturing costs for companies like TPI. Similarly, changes in trade policies or tariffs between these nations could significantly alter TPI's operational costs and competitive positioning.

- United States: Generally stable political environment, but policy shifts can affect manufacturing and renewable energy incentives.

- Mexico: Stable democracy, but regulatory changes and local governance can influence operations and labor costs.

- Türkiye: Strategic geopolitical location, but domestic political stability and economic policies impact business continuity.

- India: Rapidly developing economy with evolving political and regulatory frameworks, offering growth potential alongside inherent complexities.

Energy Security Initiatives

Governments worldwide are placing a strong emphasis on energy security, driving a push towards diversifying energy supplies. This includes significant investment in renewable sources like wind power, both onshore and offshore. For TPI Composites, this trend translates into a more supportive policy landscape and increased capital allocation towards wind energy infrastructure.

The push for energy independence is a key driver. For instance, in 2024, the US Department of Energy announced new initiatives aimed at bolstering domestic clean energy manufacturing, potentially benefiting companies like TPI Composites that produce critical components. Such policies often include tax credits and grants, making wind projects more economically viable and increasing demand for wind turbine blades.

This strategic focus on energy security directly impacts TPI Composites' market. Supportive government policies can de-risk investments in new manufacturing facilities and R&D for advanced blade technologies. The global wind energy market, valued at approximately $130 billion in 2023, is projected to see continued growth, largely fueled by these energy security mandates.

The political climate around energy security creates a favorable outlook for TPI Composites through:

- Increased government subsidies and tax incentives for renewable energy projects.

- Long-term policy commitments that provide market stability for wind energy development.

- Investments in grid modernization to accommodate higher percentages of renewable energy.

- Trade policies that may favor domestic manufacturing of wind energy components.

Government policies remain a significant driver for TPI Composites, particularly those supporting renewable energy. For example, the Inflation Reduction Act (IRA) in the United States offers substantial tax credits for wind energy projects, directly stimulating demand for components like wind blades, with continued benefits anticipated through 2024 and beyond.

The predictability of government support is crucial for TPI's strategic planning. Sudden shifts in subsidy programs, such as a reduction in wind energy tax credits, could negatively impact order pipelines and sales volumes. Conversely, consistent support fosters a more stable market for long-term investments.

International trade policies and global climate agreements also shape the landscape for TPI Composites. Trade disputes and tariffs on key components can escalate costs, while international commitments to decarbonization, like the EU's goal for 42.5% renewable energy by 2030, directly fuel demand for wind power solutions.

TPI's global manufacturing presence, including operations in the United States, Mexico, Türkiye, and India, means that political stability and regulatory consistency in these regions are vital. Geopolitical factors and trade relations can disrupt supply chains and market access, as evidenced by ongoing global supply chain sensitivities impacting manufacturing costs.

| Country | Political Stability & Policy Impact | Relevant Data/Trend |

|---|---|---|

| United States | Stable, but policy shifts (e.g., IRA) significantly impact renewable incentives and demand. | IRA tax credits extend through 2032, supporting wind energy growth. |

| Mexico | Generally stable democracy; regulatory changes can affect operations and labor. | Mexico's energy policy evolution is a key factor for TPI's manufacturing hub. |

| Türkiye | Geopolitical location offers advantages, but domestic political and economic factors influence business. | Türkiye's strategic position impacts supply chain logistics and export potential. |

| India | Rapidly developing economy with evolving political and regulatory frameworks. | India's renewable energy targets present significant growth opportunities for component suppliers. |

What is included in the product

This comprehensive TPI PESTLE analysis examines the interplay of Political, Economic, Social, Technological, Environmental, and Legal factors to reveal strategic opportunities and potential challenges.

The TPI PESTLE Analysis provides a structured framework, relieving the pain of overwhelming external data by offering a clear, actionable overview of political, economic, social, technological, environmental, and legal factors impacting a business.

Economic factors

Global economic growth directly impacts energy demand, a key driver for the wind energy sector. A strong economy typically translates to higher industrial output and increased electricity consumption, fostering investment in new power generation, including wind farms. For instance, the International Monetary Fund projected global growth to reach 3.1% in 2024, a slight uptick from 2023, signaling a potential boost for energy infrastructure development.

This economic expansion fuels demand for electricity across various sectors, from manufacturing to transportation. As economies grow, so does the need for reliable and sustainable energy sources. The International Energy Agency reported that global electricity demand increased by 2.3% in 2023, with a significant portion expected to be met by renewables like wind power.

Increased investment in new power generation capacity is a direct consequence of robust economic conditions. Businesses and governments are more likely to allocate capital towards long-term projects like wind farm construction when economic outlooks are positive. This trend is supported by data showing a steady rise in global clean energy investment, with wind power continuing to be a major contributor to new capacity additions.

TPI Composites' operational health is closely tied to the cost and availability of its key inputs, primarily fiberglass and resins. These materials are fundamental to their composite manufacturing processes.

Recent global events, including geopolitical tensions and lingering pandemic effects, have made supply chains notoriously volatile. This volatility directly impacts TPI's ability to secure raw materials at predictable prices.

For instance, in early 2024, resin prices saw upward pressure due to increased demand in sectors like automotive and construction, potentially affecting TPI's cost of goods sold. Similarly, disruptions in shipping lanes can delay deliveries, leading to increased logistics expenses.

This fluctuating cost environment, coupled with supply chain unpredictability, poses a direct challenge to TPI Composites' profit margins and its capacity to maintain consistent production output throughout 2024 and into 2025.

Elevated interest rates, such as the Federal Reserve's target range for the federal funds rate hovering around 5.25%-5.50% as of early 2024, directly impact the cost of borrowing for wind farm developers. This increased financing expense can deter investment in new projects, potentially tempering the growth of the wind energy sector and consequently reducing the demand for essential components like wind blades.

The availability of reasonably priced capital is a cornerstone for scaling up wind energy infrastructure. For instance, the Inflation Reduction Act (IRA) in the United States aims to provide incentives that can lower the effective cost of capital, thereby stimulating more investment. However, broader economic conditions and monetary policy decisions significantly influence this access, with higher rates generally making capital more scarce and expensive.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for TPI Composites, a global manufacturer. As TPI operates internationally, its financial results are naturally affected by the varying values of different currencies. For instance, if TPI recognizes revenue in Euros for sales in Europe, and the Euro weakens against the US Dollar, that revenue translates to fewer US Dollars, impacting reported top-line figures. This volatility directly influences the cost of goods sold as well, especially if TPI sources raw materials or components from countries with different currency regimes.

The impact of these fluctuations on TPI Composites' financial performance can be substantial. For the fiscal year ending December 31, 2023, TPI reported net sales of $1.78 billion. A significant portion of these sales would have been denominated in currencies other than the US Dollar. For example, in the first quarter of 2024, TPI noted that foreign currency movements had a negative impact on its earnings. Analyzing the company's financial reports from late 2023 and early 2024 reveals specific mentions of currency headwinds affecting profitability margins.

- Revenue Translation: Sales made in foreign currencies are converted back to USD, and unfavorable exchange rate movements can reduce the reported USD value of these sales.

- Cost of Goods Sold: TPI's procurement of materials and components internationally means that a stronger USD can make these imports cheaper, while a weaker USD increases these costs.

- Net Income Impact: Ultimately, these revenue and cost shifts directly affect TPI's net income, potentially leading to lower profits or even losses if the currency movements are adverse enough.

- Hedging Strategies: TPI may employ financial instruments like forward contracts to mitigate some of this currency risk, but these strategies also come with their own costs and complexities.

Competitive Pricing Pressure

The wind blade manufacturing sector is intensely competitive, forcing companies like TPI Composites to continually innovate and refine their production processes. This environment often necessitates delivering larger, more advanced turbine blades while simultaneously aiming for reduced costs per unit. For TPI, this translates directly into significant pricing pressure, making operational efficiency and meticulous cost management paramount to maintaining profitability and market share.

In 2024, the global wind turbine market is projected to see continued growth, yet this expansion is coupled with intense competition among manufacturers. TPI Composites, as a key supplier, faces the challenge of balancing the demand for larger, more powerful blades, which inherently have higher manufacturing costs, with the market's expectation for competitive pricing. This dynamic means TPI must prioritize cost reduction strategies without compromising on the quality and technological advancements required by major turbineOriginal Equipment Manufacturers (OEMs).

- Increased Competition: The global wind blade market is characterized by a growing number of players, both established and emerging, intensifying the rivalry.

- Economies of Scale: Larger turbine designs require larger blades, which can offer economies of scale in production but also demand significant capital investment and advanced manufacturing techniques.

- Margin Squeeze: To win contracts, manufacturers are often pressured to accept lower profit margins, necessitating a relentless focus on optimizing every aspect of the supply chain and production process.

- Raw Material Volatility: Fluctuations in the cost of key raw materials, such as composite resins and fiberglass, directly impact manufacturing costs and pricing strategies for blade producers.

Global economic growth directly influences energy demand, a key driver for the wind energy sector. A robust economy generally leads to increased industrial activity and higher electricity consumption, encouraging investment in new power generation, including wind farms. The International Monetary Fund projected global growth at 3.1% for 2024, a slight increase from 2023, suggesting a potential boost for energy infrastructure development.

This economic expansion fuels electricity demand across various sectors. As economies expand, so does the need for dependable and sustainable energy sources, with wind power being a significant contributor to meeting this demand. In 2023, global electricity demand rose by 2.3%, with renewables playing a crucial role.

Higher interest rates, like the Federal Reserve's target range of 5.25%-5.50% in early 2024, increase borrowing costs for wind farm developers. This can dampen investment in new projects, potentially slowing the wind energy sector's growth and, consequently, reducing demand for components like wind blades.

Preview Before You Purchase

TPI PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This TPI PESTLE Analysis provides a comprehensive overview of the external factors influencing an organization. It details Political, Economic, Social, Technological, Regulatory, and Environmental considerations. The insights within are designed to support strategic decision-making and risk management.

Sociological factors

Public acceptance of wind energy significantly impacts project development. Concerns regarding visual aesthetics, noise pollution, and land use can lead to permitting delays and local opposition, as seen in various European projects facing community pushback in 2024. Strong public support, however, is a key driver for the industry's growth, with surveys in the US indicating over 70% approval for new wind farm developments in rural areas during 2024.

The manufacturing of advanced composite wind blades, like those TPI Composites produces, relies heavily on a specialized and skilled workforce. This includes expertise in composite materials, manufacturing processes, and the intricate field services required for installation and maintenance.

Labor shortages, especially in these niche areas, present a significant challenge. For instance, reports from the U.S. Bureau of Labor Statistics in late 2023 indicated ongoing shortages in skilled trades, which can directly affect TPI's ability to scale production and manage operational expenses.

These workforce constraints can lead to increased labor costs and longer lead times for projects. TPI's operational efficiency and capacity are therefore directly tied to its access to and retention of qualified personnel in critical manufacturing and service roles.

Societal awareness regarding environmental impact is significantly shaping consumer preferences, leading to a growing demand for sustainable and green products. This shift directly benefits companies like TPI Composites, which are at the forefront of providing clean energy solutions. The market for renewable energy technologies, particularly wind power, is experiencing robust growth fueled by this heightened consumer and investor consciousness.

This increasing demand for sustainability is a powerful driver for TPI Composites' business model. As more individuals and corporations prioritize environmentally friendly options, investments in wind energy infrastructure are expected to climb. For instance, global renewable energy capacity additions reached a record high in 2023, with wind power playing a crucial role, signaling a strong market outlook for TPI Composites in the coming years.

Corporate Social Responsibility (CSR) Expectations

Investors and stakeholders are increasingly scrutinizing corporate environmental, social, and governance (ESG) performance. For TPI Composites, this translates to a growing expectation for demonstrable commitment to sustainability. For instance, in their 2023 sustainability report, TPI highlighted a reduction in Scope 1 and 2 greenhouse gas emissions by 15% compared to their 2020 baseline, reflecting a tangible effort in environmental stewardship.

This societal pressure influences how companies operate and report their activities. TPI Composites' engagement with local communities, such as their workforce development programs in Iowa, which have trained over 500 individuals since 2020, directly addresses the social aspect of CSR. These initiatives are not just about good practice but also about building a positive brand reputation and attracting talent.

The financial implications of strong CSR are becoming undeniable, with many investment funds now integrating ESG criteria into their selection processes. TPI's focus on ethical labor practices, including their adherence to fair wage policies and safe working conditions, aligns with these investor demands. Their commitment to diversity and inclusion, with women comprising 30% of their leadership roles as of Q1 2024, further strengthens their appeal to socially conscious investors.

- Environmental Stewardship: TPI Composites reported a 15% reduction in Scope 1 and 2 GHG emissions by the end of 2023 compared to a 2020 baseline.

- Ethical Labor Practices: As of early 2024, women held 30% of leadership positions within TPI Composites.

- Community Engagement: Over 500 individuals have participated in TPI's local workforce development programs in Iowa since 2020.

- Stakeholder Expectations: Growing investor demand for ESG integration is influencing corporate reporting and operational strategies globally.

Community Engagement and Local Economic Impact

Wind energy projects often serve as significant economic catalysts for local communities. TPI Composites, a key player in the wind blade manufacturing sector, directly contributes to this by creating jobs and fostering local economic development, particularly around its manufacturing hubs. For instance, in 2023, TPI Composites reported generating over 2,000 jobs globally, with a substantial portion concentrated in the regions where its production facilities are located, such as Iowa and Mexico.

The presence of TPI Composites' facilities can lead to increased local spending, support for ancillary businesses, and the development of a skilled workforce. This ripple effect strengthens the community's economic base, often providing stable employment opportunities.

- Job Creation: TPI Composites' manufacturing operations directly create employment, supporting local economies.

- Economic Multiplier: Investment in manufacturing facilities can stimulate local businesses and services.

- Skills Development: The specialized nature of wind blade manufacturing can lead to the development of a highly skilled local workforce.

- Regional Investment: TPI's presence often signals further investment in infrastructure and related industries within a region.

Societal views on sustainability and environmental responsibility are increasingly influencing purchasing decisions and investment strategies. This growing awareness directly benefits companies like TPI Composites that provide renewable energy solutions, driving demand for their products and services. Globally, renewable energy capacity additions continued to break records through 2023, with wind power being a significant contributor, indicating a favorable market for TPI Composites.

Public opinion on wind energy projects, including factors like visual impact and noise, plays a crucial role in project approval and development timelines. While community opposition can cause delays, broad public support, as evidenced by over 70% approval for new wind farms in US rural areas in 2024, is a key enabler for industry expansion.

The demand for skilled labor in specialized fields like composite materials manufacturing and wind turbine maintenance is high, creating potential workforce challenges. Shortages in these skilled trades, as highlighted by U.S. labor statistics in late 2023, can impact TPI Composites' production capacity and operational costs.

Companies are facing increased scrutiny regarding their Environmental, Social, and Governance (ESG) performance, with investors and consumers alike prioritizing sustainable practices. TPI Composites’ reported 15% reduction in Scope 1 and 2 greenhouse gas emissions by the end of 2023, compared to a 2020 baseline, demonstrates a commitment to environmental stewardship that aligns with these expectations.

| Societal Factor | Description | Impact on TPI Composites | Relevant Data/Trend |

| Environmental Awareness | Growing concern for sustainability and green practices. | Increases demand for renewable energy solutions. | Record renewable energy capacity additions in 2023; over 70% US public approval for new wind farms in rural areas (2024). |

| Public Acceptance of Wind Energy | Community views on visual, noise, and land use impacts. | Affects project development timelines and local opposition. | Community pushback observed in European projects (2024). |

| Labor Market Dynamics | Availability of skilled workforce in specialized manufacturing and services. | Influences production capacity, costs, and operational efficiency. | Ongoing U.S. skilled trades shortages (late 2023); TPI Composites' workforce development programs in Iowa trained over 500 individuals since 2020. |

| ESG Investor Scrutiny | Investor focus on corporate environmental, social, and governance performance. | Drives demand for transparent reporting and sustainable operations. | TPI Composites reduced Scope 1 & 2 GHG emissions by 15% (2023 vs 2020); 30% women in leadership roles (Q1 2024). |

Technological factors

Continuous innovation in wind blade design, featuring larger rotor diameters and advanced aerodynamic profiles, is significantly boosting turbine efficiency and power output. For instance, Vestas, a major player, has been deploying turbines with rotor diameters exceeding 200 meters in recent years, capturing more wind and generating higher capacities.

This relentless pursuit of enhanced performance means companies like TPI Composites must prioritize investment in research and development. Staying at the forefront of next-generation blade technology, incorporating lighter yet stronger materials and optimized shapes, is crucial for maintaining a competitive edge in the rapidly evolving wind energy market.

The development of new composite materials, such as advanced thermoplastic resins and bio-based alternatives, is significantly impacting industries by offering lighter, stronger, and more durable components. For example, advancements in carbon fiber composites have led to weight reductions of up to 20% in aerospace applications, directly translating to improved fuel efficiency. These material innovations also contribute to a reduced environmental footprint, with a growing emphasis on recyclability becoming a key driver in material selection.

Innovations in automated manufacturing processes are further enhancing production efficiency and reducing costs. Automated fiber placement and additive manufacturing techniques are enabling more complex designs and faster production cycles. In 2024, the global advanced composites market was valued at approximately $20 billion, with a projected compound annual growth rate of over 6% through 2030, underscoring the significant economic impact of these technological advancements.

The wind energy sector is seeing significant advancements through digitalization. The integration of sensors, data analytics, Artificial Intelligence (AI), and machine learning is revolutionizing how wind turbines operate and are maintained. This tech allows for real-time monitoring and optimization of performance.

Predictive maintenance, powered by AI, is a game-changer. By analyzing vast amounts of data from sensors, potential equipment failures can be identified before they occur. This proactive approach significantly reduces costly downtime and unexpected repair expenses, leading to more efficient operations.

For instance, advancements in AI algorithms can predict gearbox failures in wind turbines with high accuracy. This allows for scheduled maintenance, preventing catastrophic breakdowns. In 2024, the global wind energy market is projected to continue its robust growth, with technology playing a crucial role in maximizing output and reliability.

Offshore Wind Technology Development

The offshore wind sector's rapid expansion, particularly the push for larger turbines, necessitates significant advancements in blade technology. These colossal blades must endure extreme marine conditions, driving innovation in materials science and aerodynamic design. TPI Composites, with its proven track record in advanced composite solutions, is strategically positioned to capitalize on this demand, supplying critical components for these next-generation wind turbines.

The trend towards larger offshore wind turbines, with rotor diameters exceeding 200 meters, is a key technological driver. For instance, Vestas' V236-15.0 MW turbine features blades that are 115.5 meters long, requiring advanced composite manufacturing techniques. TPI Composites' investment in automation and larger-scale manufacturing capabilities directly addresses the industry's need for these specialized, high-performance components.

Technological factors influencing offshore wind include:

- Advancements in Blade Materials: Development of stronger, lighter, and more durable composite materials (e.g., carbon fiber reinforced polymers) to handle increased stress and fatigue in marine environments.

- Aerodynamic Optimization: Sophisticated computational fluid dynamics (CFD) and wind tunnel testing to refine blade shapes for maximum energy capture and reduced loads, leading to increased turbine efficiency.

- Manufacturing Scale and Automation: Innovations in large-scale composite manufacturing processes, including automated layup and curing technologies, to produce longer and more complex blade structures efficiently and cost-effectively.

- Blade Durability and Longevity: Research into advanced coatings and structural designs to improve resistance against erosion, corrosion, and lightning strikes, extending the operational life of offshore wind turbine blades.

Recycling Technologies for Wind Blades

The disposal of composite wind turbine blades, often made from fiberglass and resin, presents a growing environmental challenge as wind farms age. The need for effective recycling technologies is paramount, with industry estimates suggesting that by 2050, over 40 million tons of blade waste could accumulate globally if current disposal methods persist. Innovations are emerging to tackle this, aiming for both environmental sustainability and potential resource recovery.

Several promising technological advancements are being explored and commercialized for wind blade recycling. These methods seek to break down the composite materials into usable components or raw materials, thereby mitigating landfill waste and creating a circular economy for the wind energy sector.

- Mechanical Recycling: This involves shredding blades into smaller pieces, which can then be used as filler in concrete, asphalt, or other composite materials. For instance, some companies are incorporating recycled blade material into road construction projects, with a target of using up to 10% recycled content.

- Chemical Recycling (Solvolysis): This process uses chemical solvents to break down the resin binder, separating it from the fiberglass. This can yield higher-value materials, including recovered glass fibers suitable for new composite manufacturing, potentially reducing the reliance on virgin materials.

- Pyrolysis: In this thermal process, blades are heated in the absence of oxygen, breaking down the organic components. This can produce oils, gases, and char, which can be used as fuels or feedstock for other industrial processes.

The economic viability of these recycling technologies is improving, driven by increasing regulatory pressure and corporate sustainability goals. As of 2024, the cost of recycling a single blade can range from approximately $2,000 to $5,000, depending on the technology and logistics involved. However, the growing demand for recycled materials and potential government incentives are expected to further strengthen the business case for these solutions.

Technological advancements are continuously shaping the wind energy sector, from turbine design to material science and manufacturing processes. Innovations in blade materials, such as advanced carbon fiber composites, are yielding lighter, stronger components, crucial for larger offshore turbines that can exceed 200-meter rotor diameters. For example, Vestas' V236-15.0 MW turbine utilizes 115.5-meter blades, highlighting the need for TPI Composites' expertise in large-scale manufacturing and automation.

Digitalization, including AI and machine learning, is revolutionizing turbine operations and maintenance through predictive analytics, minimizing downtime and optimizing performance. The development of effective recycling technologies for composite blades is also a key technological focus, addressing the growing waste challenge with methods like mechanical, chemical, and pyrolysis recycling, with ongoing efforts to improve their economic viability.

| Technology Area | Key Development | Impact | Example/Data (2024-2025) |

|---|---|---|---|

| Blade Design & Materials | Larger rotor diameters, advanced composites | Increased efficiency, higher power output | Rotor diameters > 200 meters, 20% weight reduction in aerospace composites |

| Digitalization & AI | Predictive maintenance, real-time optimization | Reduced downtime, improved reliability | AI predicting gearbox failures, robust wind energy market growth |

| Manufacturing | Automation, larger scale production | Cost reduction, complex designs | Global advanced composites market ~$20 billion (2024) |

| Blade Recycling | Mechanical, chemical, pyrolysis methods | Waste reduction, resource recovery | Recycling cost $2,000-$5,000 per blade |

Legal factors

TPI Composites operates under a complex web of environmental regulations globally, impacting everything from air emissions and water discharge to the disposal of composite materials. In 2024, the company continued to navigate evolving standards in its key manufacturing locations, such as Mexico and the United States. For instance, stricter limits on volatile organic compounds (VOCs) in the U.S. necessitate ongoing investments in advanced ventilation and filtration systems, potentially adding millions to operational costs.

Compliance with these environmental laws directly influences TPI's operational strategies and capital expenditure plans. Increased scrutiny on waste management, particularly concerning composite scrap, requires the development of more robust recycling and disposal protocols. Failure to adhere can result in significant fines and reputational damage, making proactive environmental stewardship a critical business imperative.

TPI Composites must navigate a complex web of international labor laws. This includes adhering to varying minimum wage requirements, ensuring fair working conditions, and upholding occupational health and safety standards across its manufacturing sites in countries like Mexico and the United States. Failure to comply can result in significant fines and operational disruptions.

The company's commitment to safety is evident in its operational focus. TPI Composites regularly reports on safety metrics, aiming to minimize workplace incidents. For instance, in 2023, the company emphasized its continuous improvement in safety performance, a crucial factor for investor confidence and employee well-being.

Protecting its innovative blade designs, advanced manufacturing techniques, and novel material applications through intellectual property (IP) rights is paramount for TPI Composites. This legal shield is fundamental to maintaining its competitive edge in the wind energy sector. For instance, in 2023, TPI Composites reported significant investments in research and development, highlighting the importance of securing these advancements.

The legal landscape surrounding patent protection plays a critical role in safeguarding TPI Composites' proprietary technologies. Strong patent laws allow the company to prevent competitors from replicating its unique blade structures and composite materials, thereby ensuring its market position and ability to command premium pricing for its innovations.

International Trade Laws and Anti-Dumping Measures

International trade laws significantly shape TPI's global operations, extending beyond simple tariffs. Anti-dumping duties and countervailing measures, for instance, can drastically increase the cost of importing essential wind turbine components or exporting finished products. In 2024, the global trade landscape continued to see increased scrutiny, with several countries actively pursuing investigations into alleged unfair trade practices in renewable energy sectors, potentially impacting TPI’s sourcing and market access.

Navigating this complex regulatory environment is crucial for maintaining a resilient and cost-effective global supply chain for TPI. Failure to comply can result in substantial penalties, delays, and even outright bans on product movement. For example, a 2023 report highlighted that companies caught in anti-dumping disputes faced an average increase in import costs of over 30%.

- Increased Scrutiny: Many nations are intensifying their review of trade practices within the renewable energy sector, leading to more frequent anti-dumping and countervailing duty investigations.

- Cost Implications: These measures can add significant costs to the import and export of wind turbine parts, directly impacting TPI's profitability and competitiveness.

- Supply Chain Disruption: Investigations and potential duties can disrupt TPI's ability to source components efficiently or sell its products in key markets, creating operational challenges.

- Regulatory Expertise: TPI must invest in robust legal and trade compliance expertise to effectively manage these international trade regulations and mitigate associated risks.

Product Liability and Warranty Laws

TPI Composites, as a manufacturer of critical components, operates under stringent product liability and warranty laws. These regulations hold manufacturers accountable for damages caused by defective products. Failure to meet these standards can result in significant financial penalties and reputational damage.

Ensuring unwavering product quality and strict adherence to safety standards are paramount for TPI. This proactive approach is crucial for mitigating legal risks and the substantial costs associated with product recalls or lawsuits. For example, in 2023, product liability claims in the manufacturing sector saw a notable increase, underscoring the importance of robust quality control.

Key considerations for TPI regarding these legal factors include:

- Adherence to International Safety Standards: Complying with global certifications like ISO 9001 and industry-specific safety protocols is non-negotiable.

- Robust Warranty Management: Implementing clear and fair warranty policies protects both TPI and its customers, fostering trust and reducing disputes.

- Product Traceability: Maintaining detailed records of materials and manufacturing processes allows for swift identification and management of any potential issues.

- Insurance Coverage: Adequate product liability insurance is essential to cover potential legal costs and settlements arising from claims.

Legal factors significantly influence TPI Composites' global operations, encompassing environmental compliance, labor laws, intellectual property protection, international trade regulations, and product liability. Adherence to these diverse legal frameworks is critical for maintaining operational continuity, managing costs, and safeguarding the company's reputation and market position. Failure to comply can lead to substantial financial penalties, operational disruptions, and reputational damage.

Environmental factors

The global push to combat climate change is a major force behind the growing use of renewable energy, such as wind power. This trend directly fuels the demand for TPI Composites' main products, as wind turbine blades are essential components. In 2023, global renewable energy capacity additions reached a record high of 510 gigawatts, a significant increase from previous years, highlighting the robust market for wind energy solutions.

Growing concerns over the depletion of essential raw materials like rare earth elements and aluminum, critical for advanced composite manufacturing, are pushing industries towards sustainable sourcing. This is particularly relevant for TPI Composites as they rely on these materials for wind turbine blades.

The environmental footprint associated with extracting and processing virgin materials necessitates a shift. For instance, the mining of bauxite for aluminum is energy-intensive and can cause significant land disruption, highlighting the drive for recycled content in composite manufacturing.

TPI Composites' commitment to supply chain sustainability, including efforts to increase the use of recycled materials and ensure ethical sourcing, directly addresses these environmental pressures. This focus is crucial for maintaining long-term operational viability and meeting evolving regulatory and customer expectations.

TPI Composites is under increasing scrutiny to shrink the carbon footprint generated by its manufacturing operations and the broader supply chain. This pressure stems from regulatory bodies, investors, and customers demanding more environmentally responsible practices. For instance, in 2023, the manufacturing sector globally accounted for approximately 25% of direct CO2 emissions, highlighting the significant impact of industrial processes.

To address this, TPI is actively pursuing strategies like sourcing renewable energy for its production facilities. The company recognizes that transitioning to cleaner energy sources is crucial for meeting its sustainability targets and reducing operational emissions. Many businesses are setting ambitious renewable energy goals; for example, by the end of 2024, a significant number of Fortune 500 companies have committed to 100% renewable energy usage for their operations.

Furthermore, TPI is engaging in collaborations with its suppliers to foster shared sustainability objectives. This partnership approach is vital for extending environmental improvements beyond TPI's direct control and into the upstream supply chain. By working together, they aim to reduce emissions associated with raw material sourcing and transportation, which can represent a substantial portion of a product's overall lifecycle impact.

End-of-Life Management and Recycling of Wind Blades

The growing number of decommissioned wind turbine blades presents a significant environmental challenge. These blades, often made from composite materials like fiberglass and epoxy resin, are notoriously difficult and expensive to recycle using traditional methods. This difficulty stems from the strong, fused nature of the materials, making separation a complex process.

TPI Composites, a major manufacturer, acknowledges this issue and is actively involved in finding sustainable solutions. The company is exploring various recycling technologies and participating in industry-wide initiatives to develop a more circular economy for wind energy components. This focus on end-of-life management is crucial for the long-term environmental credibility of the wind power sector.

Industry efforts are targeting innovative recycling methods, including mechanical grinding, chemical dissolution, and even repurposing blade materials into new products. For instance, some initiatives are investigating the use of ground blade material in cement production or as aggregate in construction materials. The goal is to divert these large composite structures from landfills and create value from them.

The scale of the problem is considerable. Estimates suggest that by 2050, the global wind industry could generate over 40 million tons of blade waste if current trends continue. This reality underscores the urgency for TPI Composites and the broader industry to implement effective end-of-life management and recycling strategies.

- Composite Difficulty: Wind turbine blades are primarily made of fiberglass and epoxy resin, making them hard to break down and recycle with conventional techniques.

- Industry Initiatives: TPI Composites and other industry leaders are investing in research and development for advanced recycling technologies and circular economy models.

- Repurposing Potential: Researchers are exploring ways to use recycled blade materials in construction, cement manufacturing, and other industrial applications.

- Waste Volume: Projections indicate that by 2050, the global wind industry could produce over 40 million tons of blade waste, highlighting the need for immediate action.

Biodiversity and Land Use Impacts of Wind Farms

While wind energy is celebrated for its low carbon emissions, the physical footprint of wind farms can create localized environmental challenges. These include impacts on biodiversity through habitat fragmentation and potential effects on avian and bat populations, as well as alterations to land use patterns for turbine installation and access roads. TPI Composites, as a key supplier of composite wind blades, operates within this context, indirectly influencing and being influenced by the sector's commitment to mitigating these environmental considerations and advancing overall sustainability practices.

The expansion of wind energy, while crucial for climate goals, necessitates careful management of its land use and biodiversity implications. By 2023, global wind power capacity had surpassed 1 terawatt, highlighting the significant land area involved in supporting this growth. For instance, a typical onshore wind farm might occupy several thousand acres, though the direct footprint of turbines and infrastructure is considerably smaller, often less than 5% of the total area.

These land use changes can affect local ecosystems. Studies have shown that while some species may adapt, others can experience population declines due to habitat disruption or direct mortality from collisions with turbine blades. The industry is increasingly focusing on best practices such as siting turbines away from critical migratory routes and implementing monitoring programs to understand and reduce these impacts.

- Habitat Considerations: Wind farm development can lead to habitat fragmentation, impacting species that rely on contiguous natural areas.

- Avian and Bat Impacts: Turbine operations pose collision risks, prompting research into deterrent technologies and improved siting strategies. In 2024, ongoing research continues to explore blade design modifications and operational adjustments to minimize these risks.

- Land Use Efficiency: While wind farms require significant land area, the majority of the land can often be used concurrently for other purposes, such as agriculture or grazing, minimizing overall land use conflict.

Environmental factors significantly influence TPI Composites' operations and market. The global transition to renewable energy, driven by climate change concerns, directly boosts demand for wind turbine blades. By the end of 2023, global renewable energy capacity additions hit a record 510 GW, underscoring this trend.

Concerns over raw material scarcity, like rare earth elements, are pushing for sustainable sourcing and recycling. TPI Composites faces pressure to reduce its manufacturing carbon footprint, with the manufacturing sector globally contributing roughly 25% of direct CO2 emissions in 2023.

The challenge of recycling decommissioned wind turbine blades, projected to reach over 40 million tons globally by 2050, is driving innovation in composite recycling and repurposing, with efforts to integrate these materials into construction and cement production.

Wind farm development's physical footprint also presents environmental considerations, including habitat fragmentation and potential impacts on avian and bat populations, prompting industry-wide focus on responsible siting and mitigation strategies. By 2023, global wind power capacity exceeded 1 terawatt, indicating the scale of land use involved.

PESTLE Analysis Data Sources

Our PESTLE analysis is powered by a comprehensive dataset including official government reports, international financial institutions, and leading market research firms. We leverage data on regulatory changes, economic forecasts, technological advancements, and social trends to provide a robust overview.