TPI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPI Bundle

Uncover the strategic power of the TPI BCG Matrix and understand how your company's products are positioned for growth. This essential tool categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear roadmap for resource allocation.

Get the full BCG Matrix to unlock detailed quadrant placements and gain data-backed insights into your product portfolio's performance. This comprehensive report will equip you with the knowledge to make informed investment decisions and optimize your market strategy.

Don't miss out on the opportunity to transform your business with actionable intelligence. Purchase the complete TPI BCG Matrix today and gain a competitive edge by strategically managing your product lifecycle.

Stars

Large-scale offshore wind blades represent a significant growth opportunity for TPI Composites, positioning them as a potential Star in the BCG matrix. The offshore wind market is booming, with demand for bigger, more powerful turbines driving the need for advanced, longer blades. TPI's proven capabilities in composite manufacturing are well-suited to meet these evolving industry requirements.

In 2024, the global offshore wind capacity is projected to exceed 100 GW, a testament to the sector's rapid expansion. TPI Composites, with its focus on next-generation blades designed for turbines exceeding 15 MW, is strategically positioned to capitalize on this trend. Their ability to produce these large, complex composite structures is a key differentiator.

TPI Composites' dedication to pioneering new wind blade technologies, working hand-in-hand with major original equipment manufacturers (OEMs), firmly establishes these advanced designs as Stars within the TPI BCG Matrix. These next-generation blades, anticipated to be longer and boasting enhanced aerodynamic performance, directly address the wind energy sector's increasing need for greater energy capture and overall efficiency. For instance, TPI's collaboration with GE Renewable Energy on longer blades for their Haliade-X offshore wind turbine, which has a capacity of 12-14 MW, highlights this strategic focus.

TPI is strategically increasing its manufacturing capabilities in rapidly expanding wind energy markets, with Mexico being a prime example. Demand for TPI's wind turbine blades in Mexico is already outstripping its available production capacity for 2025, highlighting a significant growth potential.

This expansion into emerging markets like Mexico, where TPI can secure an early and dominant foothold, leverages its existing global manufacturing network. Such moves are crucial for TPI's growth trajectory, positioning it to capitalize on the increasing global adoption of wind power.

Proprietary Manufacturing Technologies (e.g., BladeAssure™)

Proprietary manufacturing technologies, such as TPI Composites' BladeAssure™, position the company favorably within the wind energy sector. These advanced programs are designed to significantly elevate quality control and streamline production processes for wind turbine blades. By enhancing operational efficiency and product reliability, these innovations provide TPI with a distinct competitive advantage in an expanding global market.

- Enhanced Production Efficiency: BladeAssure™ aims to reduce manufacturing cycle times and material waste, contributing to lower production costs.

- Improved Product Quality: The technology ensures greater consistency and fewer defects in wind turbine blades, leading to improved performance and longevity.

- Competitive Differentiation: TPI's investment in proprietary technology allows it to offer superior products compared to competitors relying on more conventional manufacturing methods.

- Market Growth Alignment: As the demand for renewable energy continues to surge, TPI’s advanced manufacturing capabilities are well-positioned to capitalize on this growth.

Composite Solutions for Select High-Growth Transportation Segments

Despite divesting its general automotive segment, TPI's proficiency in advanced composite materials presents compelling opportunities within select high-growth transportation sectors, particularly those fueled by the electrification trend.

Strategic focus on niche markets such as electric vehicle battery enclosures or specialized aerospace components could position these as strong contenders for future growth, leveraging TPI's core competencies.

For instance, the global electric vehicle battery market was valued at approximately $85.5 billion in 2023 and is projected to reach over $300 billion by 2030, indicating substantial demand for advanced materials in battery enclosures.

TPI's potential to capture significant market share in these specialized areas hinges on its ability to deliver innovative, lightweight, and robust composite solutions that meet the demanding performance requirements of these emerging transportation technologies.

- Electric Vehicle Battery Enclosures: Lightweight composites can improve EV range and safety, a critical factor in a market projected for substantial expansion.

- Aerospace Components: The aerospace industry continues to seek advanced materials for fuel efficiency and structural integrity, areas where TPI's expertise is relevant.

- High-Performance Marine Applications: Opportunities exist in specialized boat construction requiring durable, lightweight, and corrosion-resistant materials.

- Renewable Energy Infrastructure: Composite solutions are also vital for wind turbine blades and other renewable energy components, representing a related growth area.

TPI Composites' advanced offshore wind blades are a clear Star in their portfolio, benefiting from a rapidly expanding global market. The demand for larger, more efficient wind turbines is driving significant growth, and TPI's manufacturing expertise positions them to capitalize on this trend. By 2024, global offshore wind capacity is expected to surpass 100 GW, a strong indicator of the sector's robust expansion and TPI's strategic alignment.

TPI's investment in proprietary technologies like BladeAssure™ further solidifies their Star status by enhancing production efficiency and product quality. This focus on innovation, coupled with expansion into high-growth markets such as Mexico where demand already exceeds 2025 capacity, demonstrates a clear strategy to lead in this segment. These factors collectively position TPI’s offshore wind blade business as a key driver of future growth and market leadership.

What is included in the product

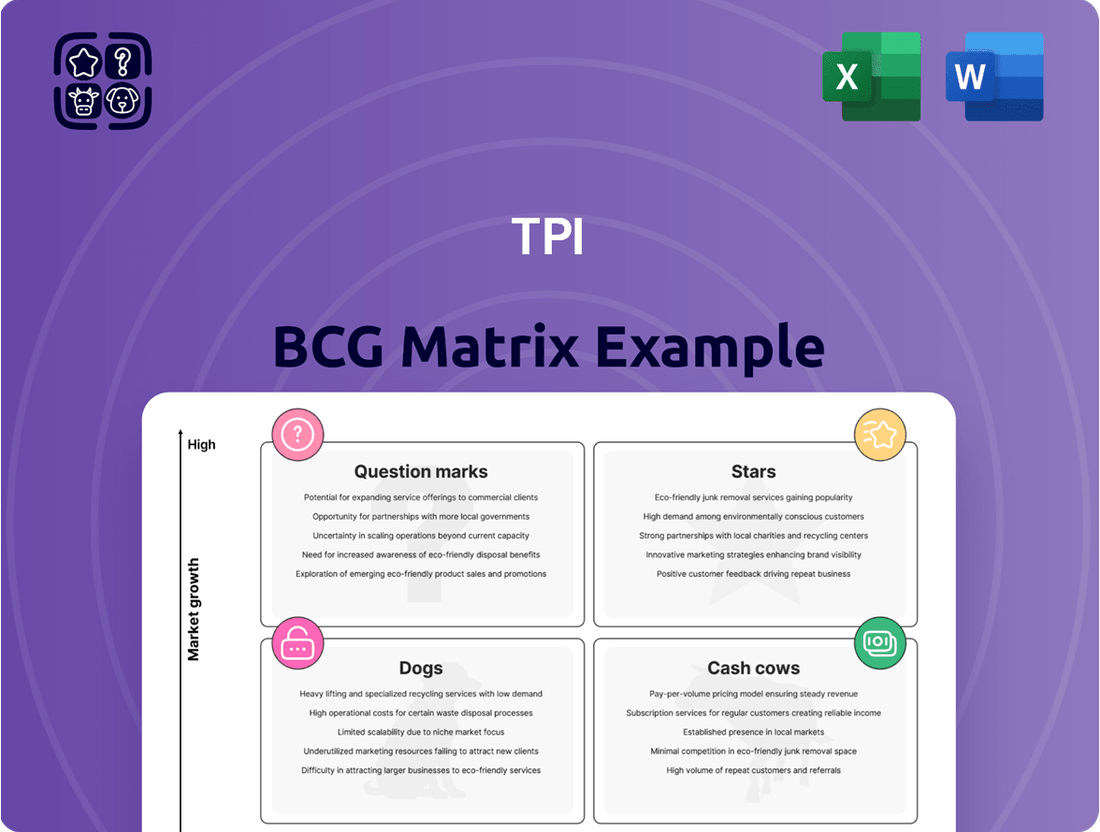

The TPI BCG Matrix provides a strategic framework to analyze product portfolios, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It guides decisions on investment, divestment, and resource allocation for optimal business growth and profitability.

Quickly visualize your portfolio's strengths and weaknesses, reducing the pain of strategic uncertainty.

Cash Cows

TPI's established onshore wind blade manufacturing operations in mature markets like North America and Europe function as a classic Cash Cow within the BCG matrix. These segments, while experiencing less rapid expansion than emerging markets, are characterized by TPI's significant and stable market presence. For instance, TPI held approximately 27% of the global onshore wind market share in 2024, excluding China, a testament to their deep-rooted relationships with major original equipment manufacturers (OEMs).

This strong market position translates into predictable and robust cash flow generation, a hallmark of Cash Cow businesses. The long-standing partnerships with leading OEMs ensure consistent demand for TPI's products in these established regions. Consequently, these operations require minimal investment for maintenance and continue to be a reliable source of earnings for the company.

TPI's field service, inspection, and repair activities represent a classic cash cow within the BCG matrix. This segment consistently generates substantial, high-margin revenue by servicing the existing wind blade fleets TPI has already deployed.

This service-oriented business leverages TPI's established installed base and deep technical knowledge. Consequently, it demands less capital for marketing and market penetration compared to developing and launching new products, ensuring a reliable and steady inflow of cash.

The financial performance in early 2025 reflects this strength, with sales from these essential services experiencing a notable increase in the first quarter of 2025, underscoring its role as a dependable profit generator for TPI.

TPI Composites' long-term supply agreements with major original equipment manufacturers (OEMs) like Vestas and GE Vernova through 2025 are crucial. These agreements solidify TPI's position as a 'Cash Cow' within the BCG matrix.

The extended contracts guarantee stable, contracted volumes, offering significant revenue visibility for TPI. This consistent demand for their core wind blade products in a mature segment of the wind energy supply chain ensures reliable cash generation for the company.

Established Tooling and Other Wind-Related Services

TPI Composites' established tooling and other wind-related services represent a significant cash cow within its portfolio. These mature offerings, crucial for the wind blade manufacturing process, generate consistent revenue streams with lower reinvestment needs. This allows TPI to leverage its foundational expertise to reliably extract cash.

These services are vital for the ongoing operation and expansion of wind energy projects, ensuring TPI's foundational capabilities remain in demand. The company's established presence in this segment means less risk and predictable income, supporting overall financial stability.

- Tooling Services: TPI provides specialized tooling essential for the manufacturing of wind turbine blades, a consistent need for original equipment manufacturers (OEMs).

- Maintenance and Repair: Beyond new manufacturing, TPI offers maintenance and repair services for existing wind turbine components, capitalizing on the large installed base.

- Logistics and Assembly: The company also supports the wind industry through logistics and assembly services, further diversifying its revenue from core competencies.

- Revenue Contribution: While specific figures for this segment are often embedded within broader service revenues, TPI's overall service and aftermarket revenue has shown steady growth, indicating the strength of its cash cow offerings. For instance, in the first quarter of 2024, TPI reported service revenue contributing to their overall financial performance.

Optimized Production Lines in Key Regions (e.g., Mexico)

TPI's optimized production lines in key regions, such as Mexico, are prime examples of a 'Cash Cow.' These facilities are running at peak efficiency, supporting 24/7 operations. This high utilization rate for established blade models directly translates to maximized profitability from their existing infrastructure.

The focus on optimizing these high-volume production lines allows TPI to generate significant cash flow. By maximizing output from their current assets, they solidify their position as a reliable generator of funds. This efficiency is crucial for supporting other areas of the business.

- Increased Utilization: Facilities in Mexico are operating at near-capacity, enhancing output.

- 24/7 Operations: Continuous production cycles ensure maximum throughput and efficiency.

- Established Models: Focus on proven, high-volume blade designs leverages existing demand.

- Profitability Driver: Optimized lines maximize the return on investment for current manufacturing assets.

TPI's established onshore wind blade manufacturing in mature markets like North America and Europe are classic Cash Cows, boasting a significant and stable market presence. In 2024, TPI held approximately 27% of the global onshore wind market share (excluding China), demonstrating deep OEM relationships and translating into predictable, robust cash flow generation with minimal reinvestment needs.

The company's field service, inspection, and repair activities also function as cash cows, leveraging TPI's installed base for high-margin revenue. This segment requires less capital for market penetration, ensuring a steady cash inflow. First quarter 2025 sales from these services showed a notable increase, reinforcing their role as dependable profit generators.

Furthermore, TPI's long-term supply agreements with major OEMs like Vestas and GE Vernova through 2025 solidify its Cash Cow status. These contracts guarantee stable, contracted volumes, providing significant revenue visibility and ensuring reliable cash generation from core wind blade products in mature market segments.

TPI's optimized production lines, particularly in Mexico, operate at peak efficiency, supporting 24/7 production for established blade models. This high utilization maximizes profitability from existing infrastructure, driving significant cash flow and supporting other business areas.

| Business Segment | BCG Matrix Classification | Key Characteristics | Financial Implication |

| Onshore Wind Blade Manufacturing (NA & Europe) | Cash Cow | Stable market share (~27% ex-China in 2024), strong OEM relationships, mature market | Predictable, robust cash flow, low reinvestment |

| Field Service, Inspection & Repair | Cash Cow | Leverages installed base, high-margin revenue, low marketing costs | Steady, reliable cash inflow, increased sales Q1 2025 |

| Long-Term Supply Agreements (Vestas, GE Vernova) | Cash Cow | Guaranteed volumes, revenue visibility, consistent demand | Reliable cash generation |

| Optimized Production Lines (e.g., Mexico) | Cash Cow | Peak efficiency, 24/7 operations, established models | Maximized profitability, significant cash flow generation |

Full Transparency, Always

TPI BCG Matrix

The TPI BCG Matrix document you are currently previewing is the identical, fully finalized report you will receive immediately after completing your purchase. This means you get the complete strategic analysis, meticulously structured and ready for immediate application, without any watermarks or sample data. It's designed to provide actionable insights for your business planning and competitive strategy from the moment you download it.

Dogs

TPI's decision to divest its Automotive Composite Business in June 2024 firmly places this segment in the 'Dog' category of the BCG Matrix. This strategic move signals that the business was underperforming, likely characterized by a low market share and minimal growth opportunities within the broader automotive sector.

The divestiture suggests that the Automotive Composite Business was consuming valuable resources and capital without generating satisfactory returns, hindering TPI's ability to focus on more promising areas of its portfolio.

In 2023, TPI reported that its other segments, such as wind energy, saw significant revenue growth, further highlighting the comparatively stagnant performance of the automotive division.

By shedding this 'Dog' business, TPI aims to streamline operations, improve overall profitability, and reallocate capital towards higher-potential ventures, aligning with a more focused and efficient corporate strategy moving forward.

The closure of manufacturing facilities, such as the Nordex Matamoros site in June 2024, exemplifies the strategic divestiture of 'Dog' business units within the TPI BCG Matrix framework. These actions typically target operations that have low market share and are draining resources, often characterized by underutilization and negative cash flow.

Exiting such underperforming assets, like the Matamoros plant, is a critical step for TPI to reallocate capital and management focus toward more promising ventures. This strategic pruning aims to enhance overall operational efficiency and financial health by eliminating unprofitable segments.

Older, less efficient wind blade models would fall into the Dogs category of the TPI BCG Matrix. These products likely have declining demand and are no longer competitive, contributing minimally to TPI Composites' revenue. For instance, if a particular blade design requires significantly more materials or manufacturing time compared to newer, more aerodynamically advanced options, its profit margin would shrink considerably.

Such models might even become a drag on profitability. As orders for these older designs dwindle, the fixed manufacturing costs are spread over fewer units, increasing the per-unit cost and potentially leading to losses. This situation is common when manufacturers transition to newer, more efficient technologies, leaving older product lines with little market appeal.

Niche Industrial Applications with Stagnant Demand

Within TPI Composites' broader portfolio, certain highly specialized composite solutions for niche industrial applications represent a segment with stagnant or declining demand. These are often custom-engineered components for legacy systems or industries facing significant disruption, leading to flat or decreasing order volumes.

These niche offerings, while contributing to TPI's revenue, typically exhibit low profit margins and require dedicated, albeit limited, resources for manufacturing and support. Their minimal market share in these specific industrial verticals means they don't offer significant growth potential. For instance, consider specialized components for certain types of heavy machinery where technological advancements have rendered older models obsolete, or niche energy infrastructure that is being phased out.

TPI's engagement in these areas, while maintaining operational continuity, aligns with the characteristics of a 'Dog' in the BCG Matrix. These products, while not actively divested, do not represent strategic growth areas. In 2023, TPI's revenue from non-wind and non-transportation segments, which would encompass these niche industrial applications, represented a small percentage of their overall sales, underscoring the limited impact of these offerings on the company's growth trajectory.

- Stagnant Demand: Focus on highly specialized industrial components for sectors experiencing technological obsolescence or market contraction.

- Minimal Market Share: These applications cater to niche segments where TPI holds a small footprint, limiting competitive advantage.

- Low Returns: Profitability on these specialized solutions is typically modest, reflecting the maturity or decline of their respective end markets.

- Resource Allocation: While not a primary focus, these products necessitate ongoing resource commitment for production and customer support, tying up capital and capacity.

Geographic Markets with Persistent Low Utilization and High Costs (e.g., parts of Türkiye and India operations)

TPI's Q1 2025 earnings call highlighted persistent low utilization and high costs in specific geographic markets, notably parts of Türkiye and India. These regions, while potentially offering future growth, currently represent areas of concern due to their struggle to achieve profitability and market share. This situation suggests these operations might be considered Dogs within the TPI BCG Matrix, requiring significant strategic attention for potentially low returns.

For example, the company cited 'underutilization issues in Turkey and India' during the Q1 2025 call. Furthermore, 'higher labor costs in Türkiye and Mexico' were also mentioned, directly impacting operational efficiency. These factors combine to create a challenging environment where investments may not yield adequate returns, placing these operations under scrutiny for their long-term viability.

- Underutilization in Türkiye and India: Specific operational segments within these countries are not operating at optimal capacity, leading to inefficiencies.

- Elevated Labor Costs: Türkiye and Mexico face higher labor expenses, increasing the cost base for TPI's operations in these locales.

- Potential for Divestment or Restructuring: If these markets continue to underperform, TPI may need to consider restructuring or even divesting these assets to reallocate resources more effectively.

- Focus on Cost Optimization: TPI is likely to implement strategies aimed at reducing operational costs and improving utilization rates in these challenged markets.

The Automotive Composite Business, divested in June 2024, clearly fits the 'Dog' category due to its underperformance and low growth prospects in the automotive sector. This move by TPI Composites indicates the business was a drain on resources without delivering sufficient returns, impacting the company's ability to invest in more promising ventures.

The divestiture of the Automotive Composite Business, a 'Dog' in TPI's BCG Matrix, aligns with the closure of facilities like the Nordex Matamoros site in June 2024. These actions target operations with low market share and negative cash flow, freeing up capital and management focus for higher-potential areas.

Certain older, less competitive wind blade models and specialized industrial composite solutions for niche, stagnant markets also fall into the 'Dog' category. These products, representing a small portion of TPI's 2023 revenue, have low profit margins and limited growth potential, often requiring ongoing resource commitment without significant returns.

TPI's Q1 2025 earnings call highlighted underutilization and high costs in Türkiye and India, suggesting these operations may also be considered 'Dogs.' Factors like underutilization and elevated labor costs in Türkiye and Mexico (as noted in Q1 2025) create challenging environments where returns are low, potentially leading to restructuring or divestment.

| Business Segment | BCG Category | Key Characteristics | Strategic Action (as of mid-2025) |

| Automotive Composite Business | Dog | Low market share, minimal growth, divested June 2024 | Divestiture |

| Older Wind Blade Models | Dog | Declining demand, uncompetitive, shrinking profit margins | Phasing out / Limited investment |

| Niche Industrial Composite Solutions | Dog | Stagnant/declining demand, low profit margins, minimal market share | Minimal investment, focus on efficiency |

| Operations in Türkiye & India (specific segments) | Dog (potential) | Underutilization, high costs, low profitability | Under strategic review for restructuring/divestment |

Question Marks

The push for sustainability in the wind energy sector is driving significant innovation, particularly in the development of recyclable composite materials for wind turbine blades. TPI Composites, a key player, is investing heavily in research and development for these advanced materials. This strategic focus positions TPI for high growth in a market that is still emerging, as the technology matures and adoption rates increase.

Entering high-growth transportation sub-segments like aerospace or rail represents a strategic move into potential "Question Marks" for TPI. While the general automotive divestment frees up resources, these new markets demand significant upfront investment to establish a foothold. For example, the global aerospace market was valued at approximately $839.3 billion in 2023 and is projected to grow substantially, offering TPI a chance to capture a nascent market share.

The initial market share in these specialized sectors will likely be low, necessitating substantial capital expenditure for research, development, and specialized manufacturing capabilities. Building brand recognition and securing certifications, particularly in aerospace, are critical, time-consuming, and expensive processes. TPI's success hinges on its ability to leverage its composite expertise effectively in these demanding, technologically advanced environments.

TPI is actively exploring advanced manufacturing processes to drive down costs and enhance scalability. Initiatives include strategic partnerships with universities and research labs. These collaborations aim to shorten product development cycles and reduce tooling expenses by as much as 50%, a significant leap in efficiency.

These manufacturing advancements offer high growth potential by bolstering TPI's competitiveness. While the full impact on market share and profitability is still unfolding, the ability to produce more efficiently at lower costs positions TPI favorably for future expansion and market penetration.

Strategic Review of Business to Optimize Capital Structure

TPI's strategic review of its capital structure, launched in Q1 2025, positions it as a 'Question Mark' within the TPI BCG Matrix. This review is a critical undertaking, aiming to optimize how the company is financed and to explore various strategic avenues. The outcome carries significant potential, either for substantial growth or a strategic divestiture, but the path forward is currently unclear.

The company's market share within a potential new capital structure is, by definition, undefined at this stage, reflecting the exploratory nature of the review. This uncertainty is characteristic of 'Question Mark' entities, which require careful analysis and strategic decision-making to determine their future trajectory.

For instance, TPI's debt-to-equity ratio stood at 0.75 as of Q4 2024, indicating a moderate level of leverage. The review will assess whether this ratio is optimal for future growth or if adjustments are needed to enhance financial flexibility.

- Objective: To optimize TPI's capital structure for enhanced financial flexibility and shareholder value.

- Current Status: Initiated in Q1 2025, with outcomes yet to be determined.

- Market Share Uncertainty: TPI's position in a new capital structure is not yet defined.

- Potential Impact: High, with possibilities for significant growth or strategic divestment.

Investment in Hydrogen Economy Infrastructure Composites

Investing in composites for the hydrogen economy positions TPI within a burgeoning sector. The global hydrogen market is projected to reach $1.4 trillion by 2030, with infrastructure, including storage and transport, being a key driver. Composites are critical for high-pressure hydrogen storage tanks, offering lightweight and durable solutions compared to traditional materials. TPI's involvement here, if in early stages, places it firmly in the Question Mark quadrant of the BCG matrix, signifying high potential growth but currently low market penetration.

This segment represents a significant opportunity for TPI to establish a foothold in a future-oriented industry. By 2050, hydrogen is expected to account for 13% of the global energy mix, driving demand for specialized composite components. For instance, Type IV hydrogen tanks, utilizing polymer liners reinforced with carbon fiber composites, are becoming standard for vehicular applications. TPI's strategic entry into this market would involve substantial R&D and capital investment to compete effectively.

- Market Potential: The hydrogen economy, driven by decarbonization efforts, offers substantial long-term growth prospects for advanced materials.

- Technological Advancement: Composites are essential for enabling safe and efficient hydrogen storage and transportation, particularly for high-pressure applications.

- Competitive Landscape: Early investment is crucial for TPI to build market share and develop a competitive edge against established and emerging players in composite manufacturing for hydrogen applications.

- Investment Rationale: Positioning TPI as a Question Mark highlights the need for careful evaluation of market entry strategies, technological development, and potential partnerships to capitalize on this high-growth opportunity.

The 'Question Mark' in the TPI BCG Matrix represents areas with high growth potential but currently low market share. These are strategic bets that require significant investment to determine if they can become market leaders. TPI's exploration into aerospace and the hydrogen economy, alongside its capital structure review, exemplifies these 'Question Mark' ventures.

TPI's foray into new high-growth transportation sub-segments like aerospace and rail presents classic 'Question Mark' characteristics. These markets, such as the aerospace sector valued at approximately $839.3 billion in 2023, offer substantial upside but demand considerable upfront investment and a long lead time for market penetration. Success here hinges on leveraging composite expertise in technologically demanding environments.

The strategic review of TPI's capital structure, initiated in Q1 2025, also places the company in a 'Question Mark' position. The objective is to optimize financing for shareholder value, but the outcome, and consequently TPI's market share within a new structure, remains undefined. This uncertainty underscores the need for careful strategic decision-making.

Investing in composites for the hydrogen economy is another significant 'Question Mark' for TPI. With the global hydrogen market projected to reach $1.4 trillion by 2030, the demand for composite solutions in storage and transport is immense. TPI's early stage involvement in this burgeoning sector signifies high growth potential but requires substantial R&D and capital to build a competitive edge.

| TPI BCG Matrix: Question Marks | Market Growth Potential | Current Market Share | Strategic Focus | Key Considerations |

|---|---|---|---|---|

| Aerospace & Rail Sub-segments | High (e.g., Global aerospace market ~$839.3B in 2023) | Low (Nascent market penetration) | Leveraging composite expertise, securing certifications | Significant upfront investment, long development cycles, high technical demands |

| Capital Structure Optimization | Uncertain (Dependent on review outcome) | Undefined (Within new capital structure) | Enhancing financial flexibility, shareholder value | Strategic assessment of debt-to-equity ratio (0.75 in Q4 2024), potential for growth or divestment |

| Hydrogen Economy Composites | Very High (Global hydrogen market projected $1.4T by 2030) | Low (Early stage of market development) | Developing solutions for high-pressure storage (e.g., Type IV tanks) | Substantial R&D, capital investment, competition from established players |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of financial statements, industry trend analyses, and competitive benchmarking to provide a robust strategic overview.