TPI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPI Bundle

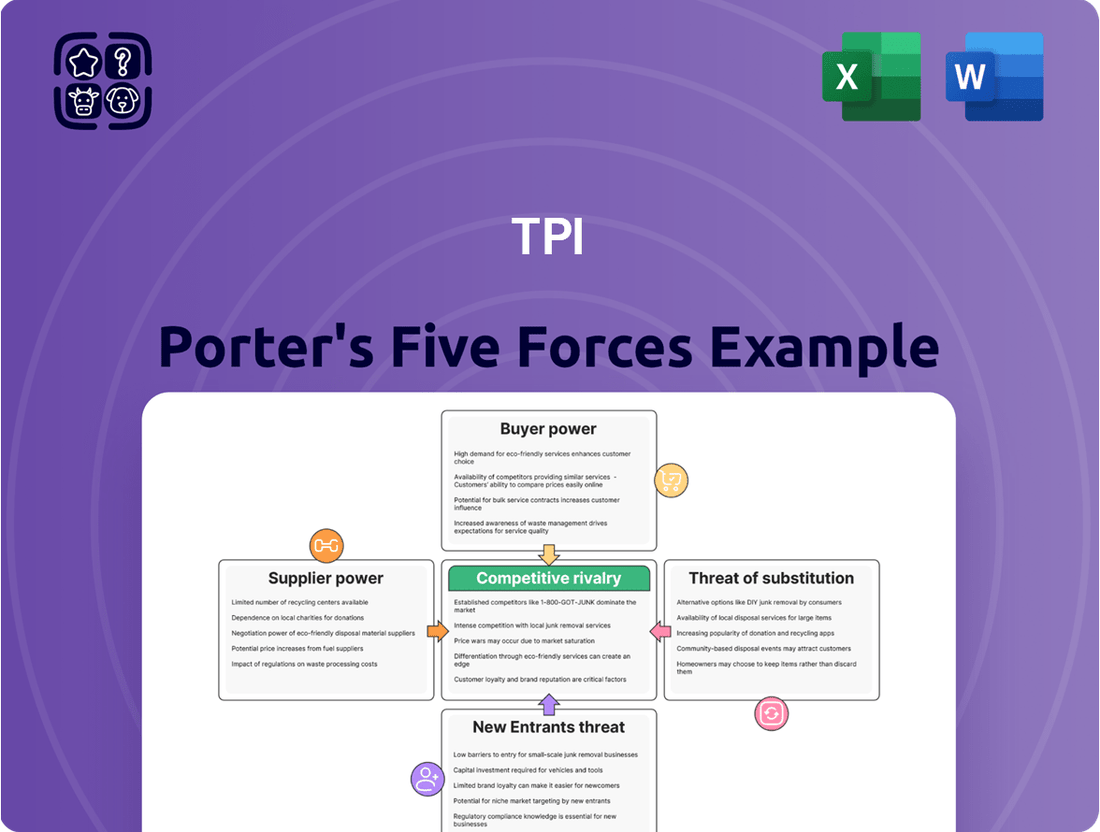

Understanding the competitive landscape is crucial for any business, and TPI is no exception. Porter's Five Forces analysis provides a robust framework to dissect these pressures, revealing the underlying dynamics that shape profitability and strategic positioning. This powerful tool helps identify opportunities and threats within TPI's industry.

The complete report reveals the real forces shaping TPI’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

TPI relies on specialized composite materials such as fiberglass, carbon fiber, and various resins for its wind turbine blades. The sourcing of these critical components often involves a concentrated group of global suppliers. This limited supplier base can enhance their bargaining power, directly impacting TPI's production expenses and profitability.

For instance, in 2024, the price of carbon fiber, a key material for high-performance blades, saw an upward trend due to increased demand from the aerospace sector and ongoing supply chain constraints. This dynamic can translate into higher input costs for TPI, reducing their profit margins if they cannot pass these increases onto their customers.

Disruptions in the supply chain for these advanced materials, whether due to geopolitical issues, natural disasters, or production challenges at supplier facilities, can further embolden suppliers. TPI’s dependence on these specific materials means that any interruption or significant price hike from these few key players can create substantial operational and financial pressure.

The proprietary manufacturing equipment needed for large-scale composite wind blade production is highly specialized, with many pieces custom-built. This means suppliers of this unique machinery can exert significant bargaining power over TPI Composites. The cost and time involved in switching to alternative equipment suppliers are often substantial, giving these specialized providers an advantage. This situation can translate into higher prices for essential machinery and potentially longer delivery times, impacting TPI's operational efficiency and expansion plans.

The availability of highly skilled labor in composite manufacturing, particularly for wind blade production, significantly impacts TPI's operational costs and efficiency. A scarcity of this specialized talent can lead to increased wage demands, directly affecting TPI's bottom line.

For instance, in 2024, the wind energy sector, including TPI, faced a growing challenge in recruiting experienced technicians. Reports indicated a shortage of qualified personnel, with some areas experiencing a 15% to 20% gap between available jobs and skilled applicants.

This situation can force TPI to invest more in training programs, adding to the overall cost of acquiring and retaining this essential 'supply' of expertise, akin to a traditional supplier increasing their prices.

Logistics and Transportation Providers

The bargaining power of logistics and transportation providers for TPI Composites, particularly concerning the transport of massive wind turbine blades, is a significant factor. The sheer scale of these components necessitates specialized equipment and expertise. This reliance on a select group of carriers equipped for oversized loads, especially for global delivery, grants these providers considerable leverage.

This dependence can translate into higher transportation costs and potentially impact delivery schedules. For instance, in 2023, global shipping rates saw fluctuations. The International Monetary Fund (IMF) noted that while some supply chain pressures eased, specialized freight for large-scale industrial goods can still command premium pricing. TPI's need for these specific services means they have fewer alternatives, strengthening the suppliers' position.

- Specialized Equipment: Transporting wind blades requires custom trailers and specialized vessels, limiting the pool of available providers.

- Limited Carrier Options: TPI often deals with a few dominant logistics companies capable of handling such oversized and heavy cargo.

- Cost Impact: The specialized nature of this logistics means higher transportation expenses, directly affecting TPI's cost of goods sold.

- Delivery Timelines: Dependence on a limited number of carriers can lead to less flexibility in delivery schedules, potentially delaying projects.

Limited Supplier Base for Key Components

TPI Composites, Inc. (TPI) may encounter significant bargaining power from suppliers if the market for certain critical components, beyond basic raw materials, is concentrated. When a limited number of specialized manufacturers can produce high-quality, essential parts for wind turbine blades, these suppliers gain leverage. This can translate into TPI facing less favorable pricing and stricter contract terms, impacting its cost structure and production timelines.

- Concentrated Supplier Market: In 2024, the global wind turbine manufacturing supply chain continues to see consolidation, meaning fewer suppliers control specialized component production.

- Component Specificity: For unique or technologically advanced blade elements, TPI might rely on a small pool of suppliers, increasing their influence.

- Impact on TPI: Suppliers' power can lead to higher input costs for TPI, potentially reducing profit margins and requiring adjustments to production schedules if supply is constrained.

- Strategic Sourcing: TPI's ability to mitigate this power hinges on its success in developing alternative suppliers or securing long-term agreements.

The bargaining power of suppliers for TPI Composites, Inc. (TPI) is a key consideration within Porter's Five Forces framework. This power arises when suppliers can dictate terms, influence prices, or restrict availability of essential inputs like specialized materials, equipment, and labor. A concentrated supplier market or unique, proprietary inputs significantly amplifies this influence. For TPI, this means that suppliers of advanced composite materials, specialized manufacturing equipment, and skilled labor can command higher prices or impose more stringent conditions, directly impacting TPI's cost structure and operational efficiency.

| Factor | Impact on TPI | 2024 Data/Trend |

|---|---|---|

| Composite Material Prices (e.g., Carbon Fiber) | Increased input costs, potentially reduced profit margins. | Upward price trend driven by aerospace demand and supply chain constraints. |

| Specialized Manufacturing Equipment | Higher acquisition costs, longer lead times, limited switching options. | Custom-built machinery suppliers hold significant leverage due to high switching costs. |

| Skilled Labor Availability | Increased wage demands, higher training investment. | Reported 15%-20% shortage of qualified wind energy technicians in some regions. |

| Logistics for Oversized Blades | Higher transportation expenses, potential delivery schedule impacts. | Specialized freight commands premium pricing due to limited carrier options. |

What is included in the product

This analysis dissects the competitive forces impacting TPI, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all to illuminate TPI's strategic positioning.

Quickly identify and neutralize competitive threats with a visual breakdown of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

TPI Composites' bargaining power of customers is significantly influenced by its concentrated customer base. The company's primary clients are major global wind turbine original equipment manufacturers (OEMs), including industry giants such as GE Renewable Energy, Vestas, and Siemens Gamesa. This reliance on a few large buyers means that these customers hold considerable sway in negotiations over pricing, contract terms, and product specifications.

The substantial revenue contribution from these key customers grants them significant leverage. For instance, in 2023, TPI Composites reported that its top three customers accounted for approximately 85% of its net sales, highlighting the critical dependence on these relationships. Consequently, any decision by one of these major OEMs to reduce orders or shift production elsewhere could have a material adverse impact on TPI's financial health and operational stability.

TPI's customers, particularly those involved in large-scale wind energy projects, often secure their wind blades through substantial, multi-year orders. This significant purchase volume inherently grants them considerable leverage. They can effectively negotiate for competitive pricing, favorable payment schedules, and enforce stringent quality standards on TPI's output.

These large-volume commitments frequently lead to TPI entering into long-term supply agreements. Such contracts often fix prices, reinforcing the customers' ability to secure predictable costs and further solidifying their bargaining position within the wind energy supply chain.

Some of TPI Composites key customers, including major wind turbine manufacturers like Vestas and Siemens Gamesa, also have the capability to produce wind blades in-house. This internal manufacturing capacity provides them with a powerful alternative to TPI, significantly strengthening their bargaining position.

With the option to manufacture blades themselves, these customers can more aggressively negotiate pricing and delivery terms with TPI. This forces TPI to continually prove its value proposition through competitive pricing, exceptional quality, and ongoing technological advancements to maintain these crucial relationships.

For instance, Vestas, a leading wind turbine manufacturer, has invested in its own blade production facilities, reducing its reliance on external suppliers like TPI for certain components. This strategic move directly impacts TPI's leverage in negotiations.

Standardization and Switching Costs

While wind turbine blades, like those TPI Composites manufactures, are highly engineered, a degree of standardization in design or manufacturing processes can emerge. This standardization might reduce the perceived cost or effort for a wind farm operator to switch to a different blade supplier, thereby increasing customer bargaining power. For instance, if multiple suppliers can meet similar performance specifications, customers have more options.

However, TPI Composites leverages proprietary tooling and unique intellectual property in its blade designs. This can create a degree of customer "stickiness," making it more difficult or expensive for a customer to switch away from TPI's specific solutions. Despite this, customers, particularly large wind farm developers, will consistently seek competitive bids from various manufacturers to ensure they are obtaining the best value.

- Standardization Impact: Common blade dimensions or performance metrics across the industry can reduce switching barriers for customers.

- TPI's IP Advantage: Proprietary designs and manufacturing techniques create differentiation and potential customer loyalty.

- Customer Strategy: Wind farm operators actively solicit bids from multiple suppliers to leverage competition.

- Switching Costs: While TPI's IP can raise costs, the drive for competitive pricing remains a key customer lever.

Demand Fluctuation in Wind Energy Market

The bargaining power of customers in the wind energy market, particularly for components like wind blades supplied by companies like TPI, is significantly shaped by demand fluctuations. Global energy policies, national renewable energy targets, and broader economic conditions all contribute to volatility in the demand for wind power, and consequently, for wind blades.

When demand softens, customers, such as wind turbine manufacturers or project developers, can leverage existing supply chain capacity to negotiate more favorable terms. This often translates into pressure for lower prices and more flexible contract conditions, as suppliers compete for fewer orders.

For instance, in 2023, the global wind power capacity additions saw a notable increase, with approximately 116 GW of new capacity installed. However, this growth can be uneven across regions and project types, leading to periods where customer demand might temporarily outpace or fall short of production capacity, impacting negotiation leverage.

- Demand Volatility: Global renewable energy targets and policy shifts create unpredictable demand for wind energy components.

- Customer Leverage: During downturns, customers can negotiate lower prices and better terms due to potential overcapacity.

- Market Dynamics: The wind energy sector experienced strong growth in 2023, adding around 116 GW globally, but regional variations impact customer power.

- Price Sensitivity: Large-scale projects are highly sensitive to component costs, amplifying customer bargaining power.

The bargaining power of TPI Composites' customers is substantial due to the concentrated nature of its client base, primarily large global wind turbine OEMs. These major players, such as GE Renewable Energy and Vestas, represent a significant portion of TPI's revenue, granting them considerable leverage in negotiations for pricing, terms, and specifications. For example, in 2023, TPI's top three customers constituted roughly 85% of its net sales, underscoring this dependency.

Customers' ability to negotiate favorable terms is also bolstered by their large-volume orders and the potential for in-house manufacturing. For instance, Vestas has its own blade production capabilities, which provides an alternative to TPI and strengthens its negotiating position. Furthermore, industry trends toward standardization in blade design can lower switching costs for customers, increasing their power, though TPI's proprietary technology offers some differentiation.

Demand volatility in the wind energy sector also empowers customers. When demand softens, or if there's excess supply capacity, customers can press for lower prices and more flexible contracts. Despite a strong global growth in wind power capacity additions, reaching approximately 116 GW in 2023, regional and project-specific demand fluctuations create opportunities for customers to leverage their buying power.

Same Document Delivered

TPI Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, a comprehensive Porter's Five Forces analysis of TPI, detailing the competitive landscape and strategic implications. Once you complete your purchase, you’ll get instant access to this exact file, providing you with a thorough examination of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This is the complete, ready-to-use analysis file, professionally formatted and ready for your strategic planning needs.

Rivalry Among Competitors

TPI operates in a highly competitive global landscape. The wind blade manufacturing sector is characterized by numerous independent manufacturers, such as LM Wind Power, a subsidiary of GE, and Aeris Energy, alongside the significant in-house production capacity of major wind turbine original equipment manufacturers (OEMs).

This global presence means TPI contends with rivals across various international markets, each with their own regional strengths and market penetration strategies. For instance, LM Wind Power, with its extensive global footprint, presents a formidable competitor in key wind energy markets worldwide.

The intensity of this rivalry is further amplified by the need for manufacturers to secure contracts with leading turbine OEMs, who often have the option to produce blades internally. This dynamic forces TPI and its competitors to constantly innovate and optimize their cost structures to remain attractive suppliers.

By 2024, the global wind turbine market is projected to see substantial growth, with offshore wind capacity in particular expected to expand significantly. This expansion presents both opportunities and challenges for TPI, as it intensifies the battle for market share among blade manufacturers vying to supply these burgeoning projects.

The industry has seen bouts of overcapacity, especially when demand growth falters or new production sites are established. This situation often intensifies price wars as companies strive to keep their factories running, consequently squeezing TPI’s and its competitors’ profit margins.

For instance, in 2023, global manufacturing capacity utilization rates in several key sectors hovered around 70-75%, a notable dip from pre-pandemic levels, indicating a surplus of production capability relative to immediate demand. This oversupply directly fuels aggressive pricing strategies among industry players.

Effective management of production capacity is therefore paramount for maintaining profitability. Companies that can align their output with market demand, perhaps through flexible manufacturing or strategic capacity adjustments, gain a significant competitive edge.

This dynamic means that TPI must constantly monitor industry capacity and demand trends to avoid being caught in a price-cutting spiral driven by excess supply from rivals.

Competitive rivalry in the wind turbine sector is intensely fueled by relentless technological advancements. Companies are locked in a perpetual race to innovate blade design, explore novel materials, and refine manufacturing techniques. The primary goals are always to boost energy capture efficiency, shave off weight, and enhance overall durability.

This commitment to R&D translates into significant investments, with firms pouring capital into developing blades that can harness more wind energy or, crucially, lower the Levelized Cost of Energy (LCOE) for their clients. For instance, Vestas, a major player, consistently highlights its ongoing blade technology improvements in its financial reports, often citing them as a key differentiator. This creates a dynamic environment where staying ahead technologically is paramount.

Customer Relationships and OEM Integration

Competitive rivalry in the wind turbine blade manufacturing sector, particularly concerning customer relationships and Original Equipment Manufacturer (OEM) integration, is intense. Success for companies like TPI Composites is heavily reliant on fostering strong, enduring partnerships with key wind turbine OEMs. This goes beyond mere transactional exchanges, demanding a deep level of trust and operational synergy.

The competition isn't just about offering the lowest price or the most advanced technology. It's a multifaceted contest that emphasizes unwavering reliability, superior quality, and the crucial capability to integrate seamlessly into an OEM's established manufacturing and supply chain processes. OEMs seek partners who can consistently deliver without disruption.

TPI's strategic advantage is built upon its capacity to be the preferred supplier. This often necessitates securing dedicated supply agreements that lock in business and foster a collaborative approach. For instance, TPI's significant agreements with major players like GE Renewable Energy underscore the importance of these deep-seated OEM integrations. In 2023, TPI reported that its largest customer accounted for 48% of its net sales, highlighting the concentration of its OEM relationships.

- OEM Dependence: TPI's business model is heavily influenced by its relationships with a few large wind turbine manufacturers, making customer retention a paramount competitive factor.

- Integration Value: Beyond product delivery, the ability to align manufacturing processes and quality standards with OEM requirements is a key differentiator.

- Long-Term Commitments: Securing multi-year supply contracts, often involving significant upfront investment and customization, is a common strategy to solidify these competitive advantages.

- Risk of Concentration: While beneficial, a high reliance on a small number of OEMs also presents a competitive risk if those customers shift their sourcing strategies or experience significant downturns.

Pricing Pressures and Cost Efficiency

Competitive rivalry in the wind energy sector is notably high, particularly in mature markets where government incentives are declining. This trend intensifies pricing pressures as wind power increasingly competes on cost with conventional energy sources. TPI Composites, like its rivals, must therefore prioritize relentless cost efficiency across its entire value chain – from manufacturing processes and supply chain management to overall operational expenses – to preserve profit margins and secure its market standing.

The drive for cost reduction is a constant battle. For instance, in 2024, the global average levelized cost of electricity (LCOE) for onshore wind projects continued its downward trajectory, often falling below $0.03 per kilowatt-hour in favorable locations. This economic reality necessitates that manufacturers like TPI innovate to lower production costs for components such as turbine blades.

- Intensified Pricing Pressure: Mature wind energy markets see reduced subsidies, pushing costs down.

- Cost-Competitive Landscape: Renewable energy must now compete directly with fossil fuels on price.

- Focus on Efficiency: TPI and competitors must achieve greater cost efficiencies in manufacturing and operations.

- Profitability Challenge: Maintaining profitability requires constant efforts to lower production and operational expenses.

The wind blade manufacturing market is highly competitive, featuring numerous independent makers and in-house OEM production. TPI faces global rivals like GE's LM Wind Power, all vying for contracts with major turbine manufacturers. This competition is intensified by potential overcapacity, leading to price wars and squeezed profit margins, as seen with global manufacturing capacity utilization rates dipping around 70-75% in 2023.

SSubstitutes Threaten

The primary substitutes for wind energy, and by extension the demand for wind blades, are other renewable sources like solar photovoltaic (PV), hydropower, geothermal, and biomass. In 2024, solar PV continued its strong growth, with global installations projected to reach over 400 GW, according to various industry reports. This expansion, coupled with decreasing solar panel costs, presents a significant alternative for energy generation.

Significant advancements or cost reductions in these competing renewable technologies can directly impact investment flows into wind projects. For instance, if the levelized cost of energy (LCOE) for solar power drops further, it might make solar a more attractive investment compared to wind, potentially diverting capital that would otherwise fund wind turbine manufacturing, including TPI's blades.

Policy support is a critical driver in the adoption of these alternative technologies. Government incentives, tax credits, and renewable energy mandates can significantly alter the competitive landscape. For example, in 2024, many nations continued to offer substantial subsidies for solar installations, potentially influencing the market share away from wind power.

The threat of substitutes for wind blades is evolving, particularly with advancements in energy storage. While not directly replacing wind blades, technologies like utility-scale batteries and pumped hydro storage can alter the demand for consistent power generation. For instance, by 2024, the global energy storage market is projected to reach hundreds of billions of dollars, offering a compelling alternative for grid stability.

These storage solutions could lessen the reliance on wind farms for baseload power. This shift might influence the growth rate of the wind energy sector, as grid operators re-evaluate their energy portfolios. The increasing efficiency and decreasing costs of battery technology, a key substitute, are making it a more viable option for managing intermittent renewable sources.

Traditional energy sources like natural gas, coal, and nuclear power remain viable alternatives, particularly where infrastructure is well-established or energy security is a primary concern. For instance, in 2024, global natural gas consumption continued to be substantial, providing a baseline against which renewable energy growth is measured.

Despite the accelerating global shift towards renewables, any significant policy reversal or a major technological advancement in fossil fuels or nuclear energy could alter the long-term demand for wind energy. This, in turn, would directly influence the market for TPI's components.

The continued reliance on these conventional sources, especially in developing economies or those with specific energy mandates, presents a persistent threat of substitution for wind power. For example, some nations in 2024 continued to prioritize new coal plant construction to meet immediate energy needs.

Decentralized Energy Generation

The growing adoption of decentralized energy generation presents a significant threat of substitutes for TPI's core business. As more consumers and businesses invest in rooftop solar, battery storage, and even small-scale wind turbines, the reliance on large, centralized power plants diminishes. This trend directly impacts the demand for TPI's large composite wind blades, which are designed for utility-scale wind farms. For instance, by the end of 2023, cumulative global solar PV capacity surpassed 1,300 GW, indicating a substantial shift in energy sourcing.

This decentralization means fewer large-scale wind projects might be commissioned, directly affecting TPI's market for its specialized wind blades.

- Rising Rooftop Solar Adoption: In 2024, residential solar installations continue to see strong growth, with some markets experiencing over 20% year-over-year increases in new capacity.

- Growth of Microgrids: The global microgrid market is projected to reach over $60 billion by 2027, signaling a move towards localized and resilient energy solutions.

- Impact on Utility-Scale Projects: Increased distributed generation can lead utilities to re-evaluate the necessity and scale of new large-scale renewable projects, potentially reducing the pipeline for traditional wind farms.

- TPI's Blade Specialization: TPI primarily serves the utility-scale wind turbine market, making it vulnerable to shifts away from this model.

Alternative Materials or Blade Designs

While composite materials like fiberglass and carbon fiber currently dominate wind turbine blade manufacturing, the threat of substitutes is not negligible. Completely new blade designs that are more efficient or cost-effective could emerge, disrupting the market. For example, advances in additive manufacturing might enable novel, optimized blade geometries that reduce material usage and improve aerodynamic performance.

The exploration of alternative materials, although in early stages, presents a potential long-term challenge to the established composite paradigm. Researchers are investigating options such as advanced wood composites, steel alloys, and even fabric-based structures for wind blades. These alternatives could offer advantages in terms of lower production costs or enhanced recyclability, which are increasingly important considerations in the renewable energy sector. For instance, some studies in 2024 are exploring the use of bio-based resins and natural fibers to create more sustainable blades, potentially reducing reliance on petroleum-based composites.

- Emerging Materials: Research into wood, steel, and fabric-based blades indicates a potential shift away from current composite dominance.

- Performance Advantages: New designs or materials could offer superior energy capture or reduced wear and tear.

- Cost and Sustainability: Lower manufacturing costs and improved recyclability are key drivers for exploring substitute materials.

- Technological Advancements: Innovations in areas like additive manufacturing could pave the way for entirely new blade concepts.

The threat of substitutes for wind energy, and thus for wind blades, is multifaceted. Other renewable sources like solar PV, hydropower, and geothermal are key contenders. For instance, global solar PV installations were projected to exceed 400 GW in 2024, a substantial increase that offers a direct alternative for electricity generation.

Advancements and cost reductions in these competing technologies can divert investment from wind projects. Similarly, energy storage solutions, such as utility-scale batteries, are becoming more viable. The global energy storage market was valued in the hundreds of billions of dollars by 2024, impacting the need for wind's consistent output.

Traditional energy sources also persist as substitutes, especially in regions with established infrastructure. In 2024, natural gas consumption remained high globally, providing a baseline comparison for renewable energy growth. Any policy shifts or technological leaps in fossil fuels or nuclear power could also influence wind energy demand.

Decentralized energy generation, like rooftop solar and microgrids, further challenges the utility-scale wind market. By the end of 2023, cumulative global solar PV capacity surpassed 1,300 GW, highlighting a significant shift toward distributed energy.

| Substitute Technology | 2024 Market Indicator | Impact on Wind Blades |

|---|---|---|

| Solar PV | Projected > 400 GW installations globally | Direct competition for new energy capacity investment. |

| Energy Storage (Batteries) | Global market in hundreds of billions USD | Reduces reliance on wind for grid stability, potentially impacting baseload demand. |

| Natural Gas | Substantial global consumption | Continues to serve as a baseline energy source, influencing the pace of renewable adoption. |

| Decentralized Solar | Cumulative > 1,300 GW by end of 2023 | Decreases demand for utility-scale wind projects and their specialized blades. |

Entrants Threaten

Establishing a large-scale composite wind blade manufacturing facility demands a significant capital outlay. This includes specialized machinery, advanced tooling, and robust infrastructure, often running into hundreds of millions of dollars. For instance, setting up a new offshore wind blade factory could easily require an investment exceeding $200 million.

This substantial upfront investment acts as a formidable barrier, deterring smaller or less-established companies from entering the market. Only well-capitalized corporations or existing industrial giants possess the financial muscle to undertake such ventures, thereby limiting the number of potential new competitors.

Furthermore, the ability to rapidly scale production to meet growing demand also entails exceptionally high costs. Companies need to invest in additional production lines, expand facilities, and secure a larger workforce, all of which adds to the already considerable capital burden.

The engineering and manufacturing of advanced composite wind blades are protected by complex, proprietary technologies and require deep technical expertise. This creates a significant barrier for new companies wanting to enter the market.

New entrants would face substantial costs, needing to invest heavily in research and development, secure necessary licenses, or develop their own unique intellectual property. This process is both time-consuming and financially demanding, hindering rapid replication of TPI's established capabilities.

For example, the development of next-generation wind turbine blades, such as those exceeding 100 meters in length, involves intricate aerodynamic design, advanced material science, and sophisticated manufacturing techniques. Companies like TPI Composites have spent years refining these processes, making it challenging for newcomers to match their efficiency and product quality.

The threat of new entrants in the wind energy sector, specifically for companies like TPI Composites (TPI), is significantly mitigated by the deep-seated, long-term customer relationships and supply agreements it has forged. TPI has cultivated trusted partnerships with major global wind turbine original equipment manufacturers (OEMs), a crucial advantage in this capital-intensive industry.

These established relationships are not easily replicated. New entrants would struggle immensely to penetrate these existing supply chains. OEMs prioritize suppliers with a proven history of delivering high-quality components on time, a track record TPI has meticulously built over years of operation.

Securing initial contracts and gaining the trust of these large OEMs represents a formidable barrier. For instance, in 2023, TPI reported that a significant portion of its revenue was derived from long-term agreements with its top customers, underscoring the sticky nature of these relationships. Breaking this cycle of trust and proven performance is a monumental task for any potential competitor.

Economies of Scale in Production

The threat of new entrants is significantly lowered by existing economies of scale in production. Established players like TPI benefit from this through more efficient raw material sourcing, streamlined manufacturing, and extensive distribution networks. For instance, TPI's substantial production volume allows it to negotiate better prices for materials, a significant cost advantage that newer, smaller competitors cannot easily replicate.

New entrants typically face a higher initial cost structure. Their smaller production volumes mean they cannot achieve the same per-unit cost efficiencies as TPI. This cost disadvantage makes it challenging for them to compete on price, a critical factor in the market. By 2024, the renewable energy sector, where TPI operates, saw continued consolidation, further emphasizing the cost benefits of scale.

- Economies of Scale: TPI leverages large-scale operations for cost reductions in procurement and manufacturing.

- Cost Disadvantage for Newcomers: New entrants face higher per-unit costs due to smaller production volumes.

- Price Competition: Established players with scale can offer more competitive pricing, deterring new market entrants.

- Market Entry Barrier: The cost structure associated with achieving comparable scale acts as a significant barrier.

Regulatory Hurdles and Environmental Standards

The wind energy sector faces significant barriers to entry due to stringent regulatory hurdles and evolving environmental standards. New companies must navigate a complex web of permitting processes, safety regulations, and emissions controls that vary considerably by region. For instance, in the European Union, the Renewable Energy Directive sets ambitious targets, requiring thorough environmental impact assessments and adherence to strict land-use and wildlife protection rules. These requirements can add substantial time and expense to project development, acting as a deterrent for potential new players.

Compliance with these regulations is not a one-time event but an ongoing commitment. New entrants must invest in expert personnel and robust systems to ensure continuous adherence to evolving standards, such as those concerning noise pollution, visual impact, and the protection of avian species. The financial burden associated with meeting these requirements, including legal fees and specialized consulting, can be prohibitive, especially for smaller firms attempting to gain a foothold against established, well-resourced competitors.

- Complex Permitting: Obtaining necessary permits for wind farm construction can take years, involving multiple government agencies and public consultations.

- Environmental Standards: Adherence to strict environmental impact assessments, noise limits, and wildlife protection protocols is mandatory.

- Safety Regulations: Compliance with international and national safety standards for turbine operation and maintenance adds to operational costs.

- Certification Costs: Securing certifications for equipment and operational practices involves significant investment in testing and verification.

The threat of new entrants into TPI Composites' market is generally low due to substantial capital requirements, proprietary technology, and established customer relationships. The high cost of setting up manufacturing facilities, often exceeding $200 million for offshore blade production, acts as a significant deterrent.

Furthermore, TPI's deep technical expertise and years of R&D in advanced composite materials create a knowledge barrier. New players must invest heavily to replicate this, making it difficult to compete on quality and efficiency. For example, developing blades over 100 meters long requires specialized engineering and material science that TPI has refined.

Existing long-term supply agreements with major wind turbine OEMs are also a critical barrier. These OEMs value TPI's proven track record, making it challenging for newcomers to secure initial contracts. In 2023, TPI's reliance on these long-term agreements underscored the difficulty of displacing established suppliers.

Economies of scale further solidify TPI's position. Its large production volumes allow for better material sourcing and lower per-unit costs. By 2024, the trend of consolidation in renewables amplified these cost advantages, making it harder for smaller entrants to compete on price.

| Barrier Type | Description | Impact on New Entrants | Example Data |

| Capital Requirements | High cost of manufacturing facilities | Significant financial hurdle | Over $200 million for offshore blade factory |

| Proprietary Technology | Advanced engineering and material science expertise | Requires extensive R&D investment | Development of 100m+ blades |

| Customer Relationships | Long-term supply agreements with OEMs | Difficult to penetrate existing supply chains | Significant revenue from top customers (2023) |

| Economies of Scale | Cost efficiencies from large-scale production | New entrants face higher per-unit costs | Consolidation in renewables (2024) amplifies scale benefits |

Porter's Five Forces Analysis Data Sources

Our TPI Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company financial statements, and regulatory filings. This comprehensive approach ensures an accurate assessment of competitive intensity and strategic positioning.