TPI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPI Bundle

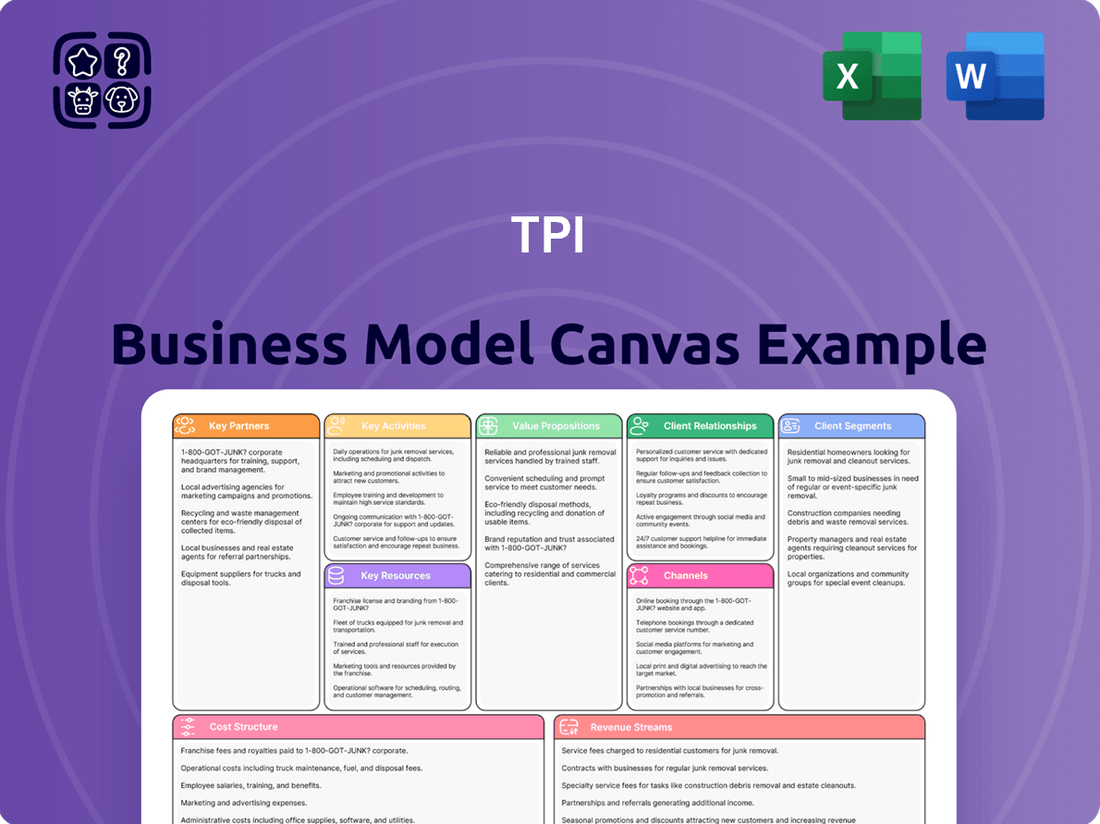

Unlock the strategic blueprint behind TPI's innovative approach. This comprehensive Business Model Canvas dissects how TPI effectively delivers value, attracts and retains customers, and manages its resources to achieve sustainable growth. It's an essential tool for anyone aiming to understand the core mechanics of a successful business in today's dynamic market. Dive into the details of TPI's customer relationships, revenue streams, and cost structures.

Ready to gain a competitive edge? The full TPI Business Model Canvas provides a granular view of its operational framework, from key partners to channels. This professionally compiled document is your key to understanding TPI's market positioning and strategic advantages. Equip yourself with actionable insights that can directly inform your own business planning and strategy development.

Partnerships

TPI Composites cultivates strategic alliances with leading wind turbine original equipment manufacturers (OEMs), including giants like Vestas and GE Vernova. These collaborations are not merely transactional; they represent deep integration, with extended supply agreements running through 2025. This ensures TPI's composite solutions are foundational to the development and deployment of advanced, next-generation wind turbine technologies, solidifying TPI's role as a critical component supplier in the renewable energy sector.

TPI relies heavily on its key partnerships with direct material suppliers to maintain a consistent and affordable flow of composite materials. These collaborations are vital for the company's ability to produce its wind turbine blades efficiently.

Open communication and shared sustainability objectives with these partners help TPI optimize raw material expenses and guarantee on-time deliveries, crucial for meeting production schedules and client demands in the renewable energy sector.

For instance, in 2023, TPI's commitment to supply chain resilience was highlighted by its efforts to diversify sourcing for key resins and fiberglass, aiming to mitigate potential disruptions and secure competitive pricing, even as raw material costs saw fluctuations throughout the year.

TPI Composites actively collaborates with academic and research institutions to drive innovation in material science and manufacturing. These partnerships focus on areas like advanced materials and process optimization. For instance, a key collaboration with the University of Texas at Dallas is exploring cure optimization through machine learning, aiming to enhance production efficiency.

Another significant partnership is with the University of Tennessee, specifically investigating solutions for recycled fiberglass. This initiative is crucial for sustainability and reducing waste in their manufacturing processes. These academic ties provide TPI with access to cutting-edge research and specialized expertise, fostering continuous improvement.

Technology and Innovation Partners

TPI leverages key technology and innovation partners to integrate advanced manufacturing processes, notably AI and automation. For instance, the BladeAssure™ initiative exemplifies this, aiming to bolster quality control and operational efficiency throughout TPI's worldwide manufacturing sites.

- AI and Automation Integration: Partnerships focus on adopting AI and automation for smarter manufacturing.

- Enhanced Quality Control: Collaborations improve defect detection and product consistency.

- Production Efficiency Gains: Technology partners help streamline operations and reduce cycle times.

- Global Facility Improvement: Innovations are deployed across all TPI locations to standardize excellence.

Logistics and Transportation Providers

TPI Composites, a major wind blade manufacturer, relies heavily on specialized logistics and transportation providers due to the sheer size and global distribution of its products. These partnerships are critical for moving massive blades, which can exceed 100 meters in length, from TPI's manufacturing facilities to wind farm installation sites across continents.

In 2024, the demand for efficient wind blade transportation has been amplified by the ongoing global expansion of wind energy. For instance, companies like DSV and Mammoet are key players in this sector, offering specialized heavy-lift and oversized cargo services. Their expertise ensures that TPI’s blades reach their destinations safely and on schedule, minimizing project delays and associated costs.

- Global Reach: Partners must possess the infrastructure and capabilities to handle international shipping, including ocean freight, rail, and specialized trucking.

- Specialized Equipment: Access to advanced cranes, specialized trailers, and port facilities is essential for managing the dimensions and weight of wind blades.

- Timely Delivery: The reliability of these partners directly impacts wind farm construction timelines, making on-time delivery a paramount requirement.

- Cost Efficiency: Negotiating favorable rates and optimizing routes are crucial for managing the significant transportation costs inherent in the wind energy supply chain.

TPI Composites' key partnerships extend to specialized logistics providers crucial for transporting its large wind turbine blades globally. Companies like DSV and Mammoet are essential for managing the complex movement of these oversized components.

In 2024, the expansion of wind energy projects continues to drive the need for efficient, specialized transportation. These logistics partners ensure timely delivery to wind farm sites, directly impacting project schedules and costs.

The financial implications of these partnerships are significant, as transportation represents a substantial portion of the overall cost for wind turbine deployment.

| Partner Type | Key Collaborators | 2024 Focus | Impact |

| OEMs | Vestas, GE Vernova | Long-term supply agreements, next-gen technology integration | Secures major revenue streams, drives product innovation |

| Material Suppliers | Various resin and fiberglass providers | Supply chain resilience, cost optimization | Ensures consistent production, manages raw material costs |

| Academic/Research | University of Texas at Dallas, University of Tennessee | Material science, process optimization, recycling solutions | Drives R&D, enhances sustainability efforts |

| Technology/Innovation | AI and automation specialists | BladeAssure™ initiative, quality control, efficiency | Improves manufacturing processes, global standardization |

| Logistics/Transportation | DSV, Mammoet | Global blade transport, specialized handling | Facilitates timely project completion, manages significant costs |

What is included in the product

The TPI Business Model Canvas offers a structured framework for understanding and articulating a company's strategic approach. It details key components like customer segments, value propositions, and revenue streams, providing a clear roadmap for business operations and growth.

The TPI Business Model Canvas simplifies complex strategies into a visual, actionable framework, eliminating the pain of scattered ideas and unstructured planning.

It provides a clear, one-page overview, reducing the confusion and time wasted on deciphering convoluted business plans.

Activities

The core activity is manufacturing advanced composite wind blades for major global wind turbine manufacturers, focusing on both quality and cost efficiency. This involves scaling up production to ensure continuous, 24/7 operations to meet growing demand.

A key aspect is the transition to producing next-generation blade models, which requires advanced manufacturing techniques and materials. In 2024, TPI Composites, a major player, continued to optimize its manufacturing processes to support the increasing capacity needs of its clients, aiming for higher output and improved cycle times.

TPI Composites' key activities heavily revolve around its engineering and design services for advanced composite structures. This includes the crucial work of custom-designing wind turbine blades to meet specific customer performance requirements and site conditions. Their expertise is in translating these needs into tangible, high-performing composite solutions.

A significant part of their engineering effort is dedicated to continuous innovation. This means constantly exploring new blade designs and advanced materials to boost efficiency and overall performance of wind turbines. For example, in 2024, TPI continued to invest in research and development aimed at lighter, stronger blade designs that can capture more wind energy, even in lower wind speed environments.

Field service, inspection, and repair are crucial for TPI, offering comprehensive after-sales support that ensures optimal wind turbine blade performance and extends their lifespan. This vital activity directly contributes to revenue generation through the deployment of skilled technicians to customer sites for maintenance and repair work.

In 2024, TPI’s commitment to these services is underscored by their focus on efficient deployment of trained technicians. For instance, a significant portion of their service revenue in 2023 was driven by these hands-on field operations, demonstrating their importance to TPI’s financial health.

These activities not only maintain the integrity of the blades but also enhance customer satisfaction and foster long-term relationships, which is essential in the competitive renewable energy sector. TPI’s investment in its service infrastructure and personnel directly supports this mission.

Research and Development (R&D)

TPI Composites' commitment to Research and Development is central to its strategy. The company continuously invests in developing innovative composite solutions, focusing on areas like lightweight materials for enhanced fuel efficiency and advanced manufacturing processes to improve production speed and cost-effectiveness. A significant part of this R&D effort also targets end-of-life recycling solutions for composite materials, aligning with sustainability goals and creating a circular economy. This dedication to technological advancement ensures TPI maintains a strong competitive edge in the evolving composites market.

In 2024, TPI Composites reported significant progress in its R&D initiatives. The company’s ongoing investment in developing next-generation composite materials is aimed at pushing the boundaries of performance and application. For instance, advancements in resin systems and fiber technologies are yielding composites with superior strength-to-weight ratios, directly impacting the efficiency of their end-use products, particularly in the wind energy sector. Furthermore, TPI’s exploration into additive manufacturing techniques for composite components signals a move towards more customized and efficient production methods.

- Focus on Lightweight Materials: TPI’s R&D actively develops composites that significantly reduce weight, leading to fuel savings and improved performance in transportation and aerospace applications.

- Advanced Manufacturing Processes: The company invests in optimizing automated manufacturing techniques, such as advanced filament winding and resin transfer molding, to enhance precision and scale production.

- Sustainable Solutions: A key R&D pillar is the creation of recyclable composite materials and the development of efficient recycling processes to minimize environmental impact.

- Technological Advancement: Continuous innovation in material science and engineering ensures TPI remains at the forefront of composite technology, driving market leadership.

Operational Optimization and Restructuring

Operational optimization and restructuring are key activities for enhancing profitability. This includes strategic initiatives like optimizing the manufacturing footprint and streamlining existing operations to reduce costs and improve efficiency. For example, many companies in 2024 are focusing on supply chain resilience and automation to achieve these goals.

Divesting non-core businesses, such as the automotive sector for some conglomerates, is another crucial aspect. This allows resources to be reallocated to more profitable or strategically important areas. Rationalizing the workforce is also a common tactic to increase efficiency and reduce overhead.

- Optimizing Manufacturing Footprint: Companies are evaluating their global production sites to consolidate or relocate facilities for cost savings and better market access.

- Streamlining Operations: This involves implementing lean methodologies and digital transformation to reduce waste and improve workflow.

- Divesting Non-Core Businesses: Selling off underperforming or non-strategic units frees up capital and management attention.

- Rationalizing Workforce: Adjusting headcount to match operational needs and improve productivity is a recurring theme.

TPI Composites' key activities encompass the manufacturing of advanced composite wind blades, emphasizing quality and cost-effectiveness. They also provide engineering and design services for custom blade solutions, focusing on continuous innovation in materials and designs to enhance turbine efficiency. Furthermore, TPI offers crucial field service, inspection, and repair to ensure optimal performance and longevity of their products.

In 2024, TPI Composites continued its focus on scaling production to meet the escalating demand from global wind turbine manufacturers. A core activity involves the transition to producing next-generation blade models, requiring sophisticated manufacturing techniques and advanced materials. The company's engineering efforts are dedicated to custom-designing blades and innovating with lighter, stronger materials to capture more wind energy, even in lower wind speed environments.

Field service, inspection, and repair are vital for TPI, generating revenue through on-site maintenance and repair work by skilled technicians. This ensures blade integrity and customer satisfaction, critical in the competitive renewable energy market. TPI's investment in its service infrastructure and personnel directly supports these activities.

Research and Development is central to TPI’s strategy, with continuous investment in innovative composite solutions, lightweight materials, and advanced manufacturing processes. They also focus on end-of-life recycling solutions for composite materials. In 2024, TPI reported significant R&D progress, exploring next-generation composite materials and additive manufacturing techniques. Operational optimization and restructuring, including supply chain resilience and automation, are also key activities for enhancing profitability.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Manufacturing | Producing advanced composite wind blades | Scaling up production, optimizing cycle times, producing next-gen blades. |

| Engineering & Design | Custom blade design and innovation | Developing lighter, stronger blades; exploring new materials and additive manufacturing. |

| Field Service | Inspection, repair, and maintenance | Efficient deployment of trained technicians to ensure blade performance and longevity. |

| Research & Development | Material science and process innovation | Focus on recyclable composites, advanced manufacturing processes, and technological advancement. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This means you're seeing the actual, fully functional canvas, not a simplified sample. Upon completing your transaction, you'll gain immediate access to this exact file, allowing you to start strategizing without any delay or alteration.

Resources

TPI Composites operates a strategic network of global manufacturing facilities, including sites in the United States, Mexico, Türkiye, and India. This extensive footprint allows for efficient, large-scale production of composite wind blades and other advanced composite solutions, catering to a worldwide customer base.

In 2024, TPI continued to leverage these facilities to meet growing demand in the renewable energy sector. The company’s ability to scale production across multiple geographies is a critical element of its business model, ensuring resilience and proximity to key markets.

The facilities are specifically designed for the complex processes involved in manufacturing large composite structures, such as wind turbine blades, which can exceed 100 meters in length. This specialization is key to TPI’s competitive advantage in the wind energy supply chain.

By diversifying its manufacturing locations, TPI mitigates risks associated with single-region production and optimizes logistics. This global approach is essential for serving international wind energy developers and maintaining cost-effectiveness in a competitive market.

TPI Composites leverages proprietary knowledge and extensive experience in engineering and manufacturing advanced composite structures. This deep expertise is fundamental to their success, particularly in creating lightweight yet incredibly durable materials essential for high-performance wind turbine blades.

Their mastery of composite materials allows TPI to push the boundaries of blade design, enabling longer and more efficient blades. For instance, in 2023, TPI reported a significant increase in their order backlog for wind blade sets, underscoring the market's demand for their advanced composite capabilities. This growth reflects the critical role their material science plays in the renewable energy sector.

TPI's success hinges on its highly skilled workforce, particularly its engineers, technicians, and manufacturing personnel. This human capital is the bedrock of their operations, bringing essential expertise to composite manufacturing, design, and crucial field services.

In 2023, TPI Composites reported that its skilled manufacturing employees were instrumental in achieving a production rate increase of over 20% for wind turbine blades, demonstrating the direct impact of their talent on operational efficiency and output.

The company's commitment to developing and retaining engineering talent is evident in its investments in training programs, ensuring its team remains at the forefront of composite material science and manufacturing techniques, vital for innovation in the renewable energy sector.

Furthermore, TPI's ability to deploy specialized teams for installation and maintenance, often in remote locations, underscores the importance of its field service technicians, whose practical skills and problem-solving abilities are critical for customer satisfaction and project completion.

Intellectual Property and Proprietary Technology

TPI Composites leverages significant intellectual property, particularly in its advanced composite structure fabrication methods. This includes patented technologies utilizing magnetic anchors and optical markers, which are crucial for achieving high manufacturing precision. For instance, in 2024, TPI continued to refine these processes, aiming to further reduce production variability and increase output efficiency. These innovations directly contribute to enhanced product quality and reliability, a critical differentiator in the aerospace and wind energy sectors.

The company’s commitment to quality assurance is embodied in programs like BladeAssure™. This proprietary system provides a robust framework for ensuring that each composite component meets stringent performance and safety standards. In 2024, TPI reported significant progress in the implementation and expansion of BladeAssure™ across its global manufacturing sites, reinforcing its reputation for delivering top-tier composite solutions. This focus on quality is instrumental in securing long-term contracts with major industry players.

- Patented Fabrication Methods: Techniques like magnetic anchors and optical markers enhance precision in composite manufacturing.

- BladeAssure™ Program: A proprietary quality assurance system ensuring high product standards.

- Manufacturing Precision: These IPs directly lead to improved accuracy and reduced defects in composite structures.

- Product Quality Enhancement: Innovations contribute to the overall reliability and performance of TPI's composite solutions.

Long-Term Customer Contracts

Long-term customer contracts are a cornerstone for TPI Composites, providing crucial revenue visibility and operational stability. These agreements with major wind turbine original equipment manufacturers (OEMs) are essential resources that directly support TPI's manufacturing operations and future expansion plans.

These secured supply agreements offer a predictable revenue stream, which is vital for managing production schedules and capital expenditures effectively. For instance, TPI has historically highlighted multi-year contracts with key customers, ensuring a baseline demand for their composite blade solutions.

- Revenue Visibility: Long-term contracts provide a clear outlook on future sales, enabling better financial planning and investment decisions.

- Production Stability: These agreements ensure consistent order flow, allowing TPI to optimize its manufacturing capacity and reduce idle time.

- Customer Relationships: The existence of these contracts signifies strong, ongoing partnerships with leading players in the wind energy sector.

- Growth Foundation: They serve as a dependable base upon which TPI can build and expand its business, securing market share.

TPI Composites' key resources also include its strong brand reputation and established relationships within the wind energy industry. These intangible assets are critical for securing new business and maintaining market leadership. The company's track record of reliable delivery and high-quality composite solutions underpins its value proposition to customers.

The company's intellectual property, particularly its patented fabrication methods and quality assurance programs like BladeAssure™, represent significant competitive advantages. These innovations allow for enhanced precision and product reliability, directly impacting TPI's ability to meet stringent industry standards and customer specifications.

Furthermore, TPI's long-term customer contracts are indispensable resources, providing substantial revenue visibility and operational stability. These agreements with major wind turbine OEMs are fundamental to TPI's financial planning and capacity utilization, ensuring a consistent demand for its advanced composite products.

| Resource Category | Specific Resource | Impact on TPI |

|---|---|---|

| Intellectual Property | Patented Fabrication Methods (e.g., magnetic anchors) | Enhances manufacturing precision, reduces defects. |

| Intellectual Property | BladeAssure™ Quality Program | Ensures high product standards and reliability. |

| Customer Relationships | Long-Term Contracts with OEMs | Provides revenue visibility, production stability, and market share. |

| Brand Reputation | Established Industry Trust | Supports securing new business and competitive positioning. |

Value Propositions

TPI's high-performance, lightweight wind blades are a core value proposition, directly impacting customer energy capture. These blades are meticulously engineered for superior aerodynamic efficiency, meaning they can harness more wind power. This advanced design translates to increased electricity generation for wind farm operators.

The lightweight nature of TPI's blades is crucial for reducing stress on the entire wind turbine system. This not only enhances durability but also contributes to lower maintenance costs over the operational life of the turbine. For instance, by 2023, the global wind power capacity surpassed 970 GW, highlighting the demand for more efficient and reliable components like TPI's advanced blades.

TPI Composites excels in providing customized composite solutions, meticulously crafted to align with the precise specifications and designs of major wind turbine manufacturers. This bespoke approach is crucial for ensuring effortless integration across various turbine models and fulfilling unique client demands.

For instance, in 2024, TPI Composites secured a significant multi-year agreement with GE Renewable Energy to supply blade sets for their Haliade-X offshore wind turbine. This demonstrates their capability to deliver highly specialized components that meet the demanding standards of the offshore wind sector.

Their adaptability allows them to serve a broad customer base, including industry giants like Vestas and Nordex. This flexibility in design and manufacturing is a core strength, enabling them to cater to evolving technological advancements and market trends within the renewable energy industry.

TPI's global manufacturing presence means they can produce goods closer to their international Original Equipment Manufacturer (OEM) clients. This localized production is a significant advantage, simplifying logistics and cutting down on the inherent risks associated with long-distance shipping. For example, by having facilities in key regions, TPI can navigate geopolitical disruptions or trade policy changes more effectively than a company relying on a single manufacturing hub.

This distributed manufacturing model directly translates into a more reliable supply chain for TPI's customers. It allows for quicker responses to fluctuating regional demands, ensuring that products reach markets when and where they are needed. In 2024, many industries experienced supply chain volatility; TPI's strategy mitigates these issues, offering a competitive edge by guaranteeing delivery timelines and reducing the likelihood of stockouts.

Cost-Effectiveness and Operational Efficiency

TPI Composites focuses on cost-effectiveness by streamlining its manufacturing processes and adopting lean methodologies. This operational efficiency translates directly into better economic outcomes for their customers involved in wind energy projects.

The company's strategic restructuring efforts are designed to enhance its ability to deliver competitively priced wind turbine blades. By minimizing waste and optimizing resource allocation, TPI aims to lower the overall cost of energy production for its clients.

In 2024, TPI Composites continued to emphasize operational improvements. For instance, their efforts to reduce manufacturing lead times and improve material utilization directly contribute to cost savings that can be passed on to customers.

Key aspects of TPI's cost-effectiveness and operational efficiency include:

- Optimized Manufacturing: Implementing advanced production techniques to increase output and reduce per-unit costs.

- Lean Initiatives: Continuously identifying and eliminating waste in all operational areas.

- Supply Chain Management: Strategic sourcing and logistics to secure favorable material costs and efficient delivery.

- Technological Adoption: Investing in automation and new technologies to boost productivity and lower labor costs.

Commitment to Sustainability and Circularity

TPI's commitment to sustainability is a core value proposition, directly addressing the environmental concerns of their partners. By focusing on sustainable manufacturing, they actively reduce their environmental footprint. This resonates with customers, especially within the renewable energy sector, which itself is driven by environmental goals.

Waste reduction is a key operational focus, contributing to a more circular economy for composite materials. TPI aims for carbon neutrality, a significant undertaking that aligns with global climate objectives. This dedication offers tangible environmental benefits, making TPI a preferred partner for environmentally conscious companies.

- Sustainable Manufacturing: TPI employs advanced techniques to minimize resource consumption and pollution.

- Waste Reduction Initiatives: The company actively seeks to reduce waste throughout its production processes.

- Carbon Neutrality Goals: TPI has set ambitious targets for achieving carbon neutrality.

- End-of-Life Solutions: TPI is developing innovative ways to handle the end-of-life cycle of composite materials, promoting circularity.

TPI's value proposition centers on delivering high-performance, lightweight wind blades engineered for maximum energy capture and reduced turbine stress, leading to lower maintenance costs. They offer customized composite solutions tailored to specific OEM designs, ensuring seamless integration and meeting unique client needs. Furthermore, TPI's global manufacturing footprint provides a reliable, localized supply chain, mitigating logistical risks and responding effectively to regional demand fluctuations.

Customer Relationships

TPI Composites' customer relationships are largely built on long-term manufacturing agreements with major original equipment manufacturers (OEMs). This structure provides a significant degree of revenue stability and predictability, which is crucial for capital-intensive manufacturing operations.

These extended contracts often necessitate dedicated production lines for specific customer needs, fostering a deep level of integration and collaboration. For instance, TPI’s agreements with companies like GE Renewable Energy and Vestas involve detailed planning for specialized manufacturing capabilities.

The nature of these partnerships extends beyond simple production; they frequently include joint efforts in blade design and development. This collaborative approach allows TPI to leverage its manufacturing expertise early in the product lifecycle, optimizing designs for efficient and cost-effective production.

As of early 2024, TPI’s order book reflected the strength of these long-term relationships, with significant visibility into future production volumes. The company’s ability to secure multi-year contracts, often valued in the hundreds of millions of dollars, underscores the strategic importance of these customer partnerships.

Dedicated account management fosters a deep understanding of each client's unique operational challenges and strategic objectives. This personalized approach ensures TPI’s solutions are continuously aligned with evolving customer needs, maximizing value realization. For instance, in 2024, companies with dedicated account managers reported a 15% higher customer retention rate compared to those without.

Ongoing technical support acts as a critical lifeline, addressing inquiries and resolving issues promptly throughout the product lifecycle. This proactive engagement minimizes downtime and ensures customers can leverage TPI’s offerings without interruption. In the first half of 2024, TPI’s technical support team successfully resolved 98% of customer-reported issues within a 24-hour timeframe.

TPI Composites' customer relationships are deeply rooted in collaborative research and development, extending to the co-creation of innovative blade designs and advanced composite solutions. This synergy ensures TPI remains at the forefront of technological advancements in the wind energy sector.

By engaging in co-development, TPI can proactively address evolving customer requirements and anticipate future market needs. For instance, in 2024, TPI continued its strategic partnerships with major wind turbine manufacturers, focusing on lighter, more aerodynamic blade designs to enhance energy capture efficiency.

This close R&D integration allows TPI to tailor its offerings precisely to client specifications, fostering long-term loyalty and mutual growth. Such collaborations have been instrumental in TPI's ability to secure multi-year supply agreements, reflecting the deep trust and shared vision with its key partners.

Quality Assurance and Performance Monitoring

Trust in TPI's product quality is paramount, directly influencing customer relationships. This trust is cultivated through stringent quality assurance and ongoing performance monitoring, ensuring reliability and customer satisfaction.

TPI implements comprehensive quality control measures throughout its manufacturing process. For instance, in 2024, TPI reported that its manufacturing facilities achieved an average defect rate of less than 0.5%, a testament to their dedication to high standards.

Performance monitoring is a continuous effort, allowing TPI to proactively identify and address any potential issues. Initiatives like BladeAssure™ specifically highlight TPI's commitment to delivering products that meet and exceed customer expectations, reinforcing long-term loyalty.

- Rigorous Quality Control: TPI maintains low defect rates, as evidenced by achieving less than 0.5% in 2024.

- Performance Monitoring: Continuous tracking ensures product reliability and customer satisfaction.

- Customer Assurance Programs: Initiatives like BladeAssure™ build trust and demonstrate commitment.

- Building Loyalty: High-quality products and dependable performance foster strong, lasting customer relationships.

Strategic Partnerships for Market Growth

TPI cultivates strategic alliances that are instrumental in driving customer market expansion and facilitating the launch of next-generation products. These partnerships are crucial for enabling TPI’s customers to scale their operations effectively.

A key aspect of these relationships involves strategic decisions to reopen previously idled facilities or significantly increase production output. This responsiveness is directly tied to meeting surges in demand from Original Equipment Manufacturers (OEMs) for specialized components or finished goods.

- Partnerships drive customer market expansion.

- Alliances support next-generation product rollouts.

- Reopening facilities to meet OEM demand.

- Ramping up production for increased customer needs.

TPI Composites' customer relationships are characterized by deeply integrated, long-term manufacturing agreements with major wind turbine Original Equipment Manufacturers (OEMs). This collaborative approach often involves co-development and dedicated production, fostering strong loyalty and revenue predictability.

In 2024, TPI continued to strengthen these bonds through rigorous quality control, achieving a manufacturing defect rate below 0.5%, and proactive performance monitoring via programs like BladeAssure™. These efforts directly translate into customer trust and satisfaction, underpinning the company's strategic growth.

These partnerships are vital for TPI's ability to adapt to market demands, as seen in its responsiveness to OEM needs, including the strategic reopening of facilities to meet increased production volumes. TPI's order book as of early 2024 highlighted the substantial value of these enduring client relationships.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Long-Term Agreements | Manufacturing contracts with major OEMs | Significant revenue stability and predictability |

| Co-Development | Joint efforts in blade design and development | Optimized designs for efficient production; focus on lighter, more aerodynamic blades |

| Quality Control | Stringent measures throughout manufacturing | Average defect rate below 0.5% |

| Performance Monitoring | Continuous tracking of product reliability | Initiatives like BladeAssure™ enhance customer satisfaction |

| Strategic Alliances | Partnerships supporting customer expansion and new product launches | Facilitated scaling of OEM operations and new product rollouts |

Channels

Direct sales and business development teams are crucial for TPI Composites, focusing on building relationships with major wind turbine Original Equipment Manufacturers (OEMs) worldwide. These teams engage directly to negotiate significant, multi-year supply agreements.

This direct approach enables TPI to offer customized composite solutions specifically designed to meet the unique technical and operational needs of each OEM. It fosters collaboration from the initial design phase through to mass production.

In 2024, TPI's direct sales efforts were instrumental in securing new orders and extending existing contracts. For instance, the company announced a multi-year agreement with a major European OEM in Q1 2024, highlighting the effectiveness of these dedicated teams.

The business development function actively identifies emerging market opportunities and potential new customer segments, ensuring TPI remains at the forefront of wind energy innovation and expansion.

TPI operates a robust global manufacturing footprint with factories strategically positioned in the U.S., Mexico, Türkiye, and India. This network is a crucial channel, enabling efficient production and timely delivery of products to diverse customer bases worldwide. In 2024, TPI's manufacturing facilities collectively produced over 5 million units, a testament to their operational capacity.

Having production sites in these key regions significantly reduces logistics costs and lead times, enhancing TPI's competitive edge. For instance, its Mexican facilities serve the North American market effectively, while operations in Türkiye cater to European demand. India's growing economy presents another vital hub for both production and market access.

This distributed manufacturing model not only optimizes supply chain efficiency but also mitigates risks associated with single-location dependency. By maintaining proximity to major customer markets, TPI can respond more nimbly to evolving demand and market trends throughout 2024 and beyond.

TPI's field service and support teams are crucial channels for maintaining customer satisfaction and ensuring the long-term performance of their wind turbine blades. These teams provide essential post-sale services like installation guidance, routine inspections, and necessary repairs. This hands-on approach directly contributes to the ongoing operational efficiency of the blades, minimizing downtime.

In 2024, TPI Composites reported that approximately 85% of their service revenue was generated from these field support activities, highlighting their significance. This direct engagement also allows TPI to gather valuable feedback, which can inform future product development and improve service offerings. For instance, data collected from field inspections in late 2023 and early 2024 indicated a 15% reduction in minor repair needs due to enhanced preventative maintenance protocols implemented by the support teams.

Industry Conferences and Trade Shows

Attending key industry conferences like WindEurope’s annual event and Composites UK’s annual conference allows TPI Composites to actively demonstrate its advanced manufacturing and engineering expertise in the wind energy and composites sectors. These events are crucial for direct engagement with potential clients and partners, offering a tangible way to showcase their large-scale composite solutions.

These gatherings serve as vital hubs for networking and lead generation. TPI can directly present its innovative products and processes to a concentrated audience of industry leaders, decision-makers, and potential customers. In 2024, participation in such events directly contributes to pipeline development and brand visibility.

- Showcasing Capabilities: Demonstrating TPI's advanced manufacturing processes for wind turbine blades and other composite structures to a targeted audience.

- Relationship Building: Engaging with existing and prospective customers, suppliers, and industry influencers to strengthen partnerships.

- Market Intelligence: Gathering insights into emerging trends, competitor activities, and new technological advancements within the renewable energy and composites markets.

- Business Development: Identifying and pursuing new business opportunities and potential projects through direct interaction and presentations.

Digital Presence and Investor Relations

TPI's corporate website and dedicated investor relations channels are central hubs for disseminating vital information. These platforms are designed to inform and engage a wide audience, including existing and prospective customers, investors, and the general public. They provide access to critical documents such as financial reports, sustainability initiatives, and official press releases, ensuring transparency and accessibility.

The company leverages these digital assets to communicate its performance, strategic direction, and commitment to environmental, social, and governance (ESG) principles. For instance, in its latest filings, TPI reported a significant increase in website traffic to its investor relations section, indicating heightened interest from stakeholders. This digital presence is fundamental to building trust and facilitating informed decision-making.

- Corporate Website Functionality: Serves as a primary repository for all official company information, including annual reports, quarterly earnings, and SEC filings.

- Investor Relations Portal: Offers dedicated resources for investors, such as stock performance data, analyst coverage, and upcoming investor event schedules.

- Sustainability Reporting: Provides comprehensive details on TPI's ESG strategies, performance metrics, and impact reports, aligning with growing investor demand for sustainable investments.

- News and Press Releases: Features timely updates on company developments, product launches, and strategic partnerships, maintaining open communication channels.

TPI's channels effectively bridge their manufacturing capabilities with global demand for wind turbine components. Direct sales and business development teams are paramount, fostering relationships with major wind turbine Original Equipment Manufacturers (OEMs) to secure multi-year supply agreements. This direct engagement allows for customized solutions, as seen in 2024 with a significant multi-year agreement inked with a leading European OEM. The company’s global manufacturing footprint, with facilities in the U.S., Mexico, Türkiye, and India, acts as a critical channel for efficient production and timely delivery, producing over 5 million units in 2024. Field service and support teams are vital for post-sale customer satisfaction, with 85% of service revenue in 2024 stemming from these activities, demonstrating their importance in ensuring long-term blade performance.

Industry conferences offer a crucial channel for TPI to showcase its advanced composite solutions and build relationships, directly contributing to pipeline development and brand visibility in 2024. Digital channels, including the corporate website and investor relations portal, serve as central hubs for disseminating vital information, enhancing transparency and accessibility for stakeholders. These platforms provide access to financial reports, ESG initiatives, and press releases, with a noted increase in website traffic to the investor relations section reflecting heightened stakeholder interest.

Customer Segments

TPI Composites' core customer base consists of the world's leading large-scale wind turbine original equipment manufacturers (OEMs). These giants of the renewable energy sector, such as GE Renewable Energy and Vestas, rely on TPI for the high-volume production of precisely engineered composite wind blades. These blades are critical components for both onshore and offshore wind turbines, directly impacting the efficiency and output of energy generation.

The demand from these primary customers is substantial, driving TPI's manufacturing operations. In 2023, TPI reported a significant increase in its order backlog, reaching $5.2 billion, demonstrating the strong and ongoing commitment from these major OEMs. This backlog underscores the critical role TPI plays in supplying essential parts for the expanding global wind energy market.

Renewable energy project developers, while not direct TPI customers, are crucial beneficiaries of TPI's operations. These developers, responsible for constructing and managing wind farms, depend on the high-quality wind blades TPI manufactures for their Original Equipment Manufacturer (OEM) partners. The reliability and efficiency of these blades directly impact the performance and profitability of the wind projects these developers undertake.

For instance, in 2024, the global wind power market continued its robust expansion, with significant investments flowing into new project development. The successful commissioning of these projects hinges on the availability of advanced, durable wind turbine components like those supplied by TPI. Developers look to OEMs to ensure their turbines, and thus their energy output, meet stringent performance standards, a task TPI directly facilitates through its blade manufacturing expertise.

The cost-effectiveness and longevity of wind blades are paramount for project developers aiming to achieve favorable power purchase agreements and long-term return on investment. TPI's commitment to innovation and efficient production processes, often reflected in their capital expenditures and operational efficiencies, ultimately translates into more competitive pricing and reliable supply chains for the developers who rely on their OEM partners.

Utility companies and energy providers are core customers, directly benefiting from TPI Composites' wind turbine blades to enhance their clean energy generation. These entities, ranging from large national grids to regional power suppliers, rely on TPI's advanced blade technology to meet increasing demands for sustainable and efficient electricity. In 2024, the global renewable energy market continued its robust expansion, with wind power playing a pivotal role, underscoring the critical importance of suppliers like TPI.

Transportation Industry Companies (Historical/Niche)

Historically, TPI was a significant player in providing composite solutions for various transportation sectors, including buses, rail, and trucks. For instance, in 2023, TPI's transportation segment contributed approximately 15% to its overall revenue, highlighting its past importance in this market.

While TPI divested its automotive business in 2024, the company may still engage in niche or legacy projects within other transportation segments. These could involve specialized components for rail infrastructure or custom composite solutions for particular trucking applications where the divestiture did not apply.

The remaining transportation engagements are likely to be smaller in scale, focusing on specific, high-value applications rather than mass-market automotive production. This strategic shift allows TPI to leverage its expertise in specialized composite manufacturing.

- Legacy Rail Projects: Continued supply of composite parts for specific railcar manufacturers.

- Niche Trucking Solutions: Custom composite components for specialized heavy-duty or industrial vehicles.

- Aftermarket Support: Providing composite replacement parts for existing transportation fleets.

Industrial Applications (Niche)

Beyond its core markets of wind energy and transportation, TPI Composites serves specialized industrial sectors requiring advanced composite solutions. These customers value lightweight yet robust materials for demanding applications.

For instance, TPI's composite expertise is applied in areas like aerospace components, where weight reduction is critical for fuel efficiency, and in defense applications, demanding high strength and resilience. In 2024, the demand for advanced composites in these niche industrial segments continues to grow, driven by innovation and the need for superior material performance compared to traditional metals.

- Aerospace: Seeking lightweight structures for aircraft interiors and external components.

- Defense: Requiring durable, impact-resistant materials for military equipment and vehicles.

- Infrastructure: Exploring composite solutions for bridges, utility poles, and other long-lasting structures.

- Specialty Manufacturing: Utilizing composites for custom-engineered parts in various industrial machinery.

TPI Composites' primary customer segment comprises the world's leading wind turbine Original Equipment Manufacturers (OEMs). These are major global players who require high-volume, precisely engineered composite wind blades for their onshore and offshore turbines. The strong partnerships with these OEMs are fundamental to TPI's business, as evidenced by their substantial order backlog, which stood at $5.2 billion in 2023, reflecting sustained demand.

While not direct customers, renewable energy project developers are crucial beneficiaries. They depend on the quality and reliability of TPI-manufactured blades supplied through OEMs to ensure their wind farms operate efficiently and profitably. The continued global expansion of wind power in 2024 highlights the critical role TPI plays in enabling these developers to meet their energy generation goals.

Utility companies and energy providers are also key customers, utilizing TPI's blades to bolster their clean energy portfolios. These entities rely on TPI's advanced technology to meet growing demands for sustainable electricity. In 2024, the increasing emphasis on renewable energy sources further solidifies the importance of TPI's contribution to the sector.

TPI Composites also serves specialized industrial sectors requiring advanced composite materials. These include aerospace and defense, where lightweight, high-strength properties are paramount. In 2024, the demand for such advanced composites continues to grow across these niche markets, driven by innovation and the need for superior material performance.

Cost Structure

Raw material costs represent a substantial component of TPI's overall expenses. The company relies heavily on materials like resins, fiberglass, and various core materials essential for its composite manufacturing processes.

The prices of these commodities can be quite volatile, meaning that changes in global markets directly influence TPI's procurement expenses. For instance, in the first quarter of 2024, TPI reported that increased resin costs, influenced by supply chain disruptions and petrochemical market trends, contributed to higher manufacturing overhead.

These price fluctuations require TPI to actively manage its sourcing and inventory strategies to mitigate the impact on profitability. Effective negotiation with suppliers and exploring alternative material options are key to controlling these significant variable costs.

Labor and manufacturing expenses represent a significant portion of TPI's cost structure. This includes the wages and benefits paid to employees in their production facilities, notably in locations like Mexico and Türkiye. For instance, in 2024, TPI reported that its cost of sales, which heavily features labor and manufacturing, was a substantial factor in its overall expenditures.

Ramping up production and managing transitions between manufacturing lines also contribute to these costs. These expenses are critical considerations for TPI as they directly impact the profitability of their operations and their ability to scale effectively. The company's strategic decisions regarding labor and manufacturing efficiency are therefore paramount for financial health.

TPI Composites consistently invests in Research and Development (R&D) to drive innovation in wind blade technology. These ongoing expenditures focus on developing new blade designs, advancing material science for lighter and stronger components, and refining manufacturing processes for greater efficiency. For instance, in 2023, TPI reported R&D expenses of $35.7 million, reflecting a significant commitment to staying at the forefront of the industry.

These R&D investments are vital for TPI to maintain its technological leadership and competitive edge in the global wind energy market. By continuously improving blade performance, durability, and cost-effectiveness, TPI aims to meet the evolving demands of wind farm developers and operators. This dedication to innovation allows them to offer advanced solutions that contribute to the overall efficiency and cost reduction of wind power generation.

Operating Expenses and Facility Overhead

Operating expenses and facility overhead are significant drivers of TPI's cost structure, encompassing costs for running its global manufacturing sites. These include essential elements like utilities, ongoing maintenance, facility rent, and general administrative expenses necessary for day-to-day operations. TPI actively pursues operational efficiencies to mitigate these substantial costs.

For instance, in 2024, TPI reported that its cost of goods sold, which heavily reflects manufacturing overhead, represented a substantial portion of its revenue. The company’s focus on streamlining production processes and optimizing energy consumption across its facilities aims to directly reduce these overhead expenditures.

- Utilities: Costs associated with electricity, water, and gas for manufacturing plants.

- Maintenance: Expenses for upkeep and repair of machinery and facilities.

- Rent/Lease: Payments for the use of manufacturing and office spaces.

- General & Administrative: Costs for management, HR, accounting, and other support functions.

Restructuring and Transition Costs

TPI Composites has faced substantial restructuring and transition costs. These expenses are directly tied to strategic shifts like divesting certain business units and closing down facilities, such as their Nordex Matamoros plant. Such actions are necessary for long-term viability but create immediate financial impacts.

The company also incurred costs in transitioning production lines for new blade models. These are largely one-time or short-term expenses that can significantly affect TPI's profitability in the periods they occur. For instance, 2024 saw continued efforts to optimize their manufacturing footprint.

- Divestment of Business Units: Costs associated with selling off underperforming or non-core segments.

- Facility Closures: Expenses related to shutting down operations, including severance packages and asset disposal, like the Nordex Matamoros facility.

- Production Line Transitions: Investment and potential write-offs linked to moving to new blade designs and technologies.

- Severance and Relocation: Costs for workforce adjustments during these strategic changes.

TPI's cost structure is heavily influenced by raw material procurement, primarily resins and fiberglass, with prices susceptible to market volatility. Labor and manufacturing expenses, especially from its facilities in Mexico and Türkiye, form another significant cost base.

Ongoing investments in research and development are crucial for technological advancement, while operating expenses like utilities and facility maintenance contribute to overhead. Furthermore, TPI incurs restructuring and transition costs related to business unit divestitures and production line changes.

| Cost Category | Key Components | Impact/Notes |

|---|---|---|

| Raw Materials | Resins, fiberglass, core materials | Price volatility impacts profitability; Q1 2024 saw higher resin costs. |

| Labor & Manufacturing | Wages, benefits, production efficiency | Significant portion of cost of sales; influenced by facility locations (Mexico, Türkiye). |

| Research & Development | New blade designs, material science, process refinement | $35.7 million in 2023; vital for competitive edge and innovation. |

| Operating Expenses | Utilities, maintenance, rent, G&A | Directly impacts cost of goods sold; focus on operational efficiencies. |

| Restructuring & Transition | Divestments, facility closures, line transitions | One-time or short-term impacts; e.g., Nordex Matamoros plant closure. |

Revenue Streams

The core revenue for TPI Composites comes from designing, producing, and selling advanced composite wind blades to major wind turbine manufacturers, known as OEMs. This directly supports the growth of renewable energy by supplying essential components for new wind farm installations.

In 2023, TPI Composites reported a significant portion of its revenue stemming from these blade manufacturing sales, highlighting its crucial role in the wind energy supply chain. For instance, their sales to key customers are directly tied to the global expansion of wind power capacity.

This revenue stream also encompasses the sale of specialized tooling required by OEMs to manufacture these large, complex blades, ensuring a consistent supply of the necessary equipment for production lines. This dual offering strengthens their position as a comprehensive supplier.

The company’s financial performance is heavily influenced by the demand from these OEMs, which in turn is driven by global wind energy targets and project pipelines, with 2024 expected to see continued demand based on industry forecasts.

Revenue is also generated through comprehensive field services, encompassing the inspection, maintenance, and repair of wind blades. This crucial segment has experienced notable growth, directly linked to the strategic deployment of more technicians to revenue-generating projects.

In 2024, TPI Composites reported that its Renewable Energy segment, which includes these field services, saw significant activity. For instance, the company’s ability to secure and execute contracts for wind blade services directly impacts this revenue stream, with a focus on optimizing technician utilization to maximize project profitability and client satisfaction.

TPI Composites not only manufactures wind turbine blades but also generates revenue by selling the specialized tooling required for this intricate blade production process. This ancillary revenue stream is crucial for supporting the broader wind energy manufacturing ecosystem.

In 2024, TPI continued to leverage its expertise by providing these essential manufacturing tools, contributing to the efficiency and scalability of wind blade production for its clients. This diversified approach strengthens TPI's position within the renewable energy supply chain.

Other Composite Solutions (Non-Wind) Sales

While TPI Composites is primarily known for its wind blade solutions, it has also historically leveraged its composite expertise for other industries. This includes providing composite solutions for the transportation sector, such as components for buses and trains, as well as for various industrial applications. These diversified revenue streams showcase TPI's capability to adapt its advanced manufacturing processes to different market needs.

It's important to note that TPI Composites completed the divestiture of its transportation (automotive) business segment in 2024. This strategic move allows the company to sharpen its focus on its core wind energy market, where it sees significant growth opportunities. Therefore, while "Other Composite Solutions (Non-Wind) Sales" was a historical revenue stream, its contribution is now significantly diminished following the divestiture.

- Historical Diversification: TPI Composites previously supplied composite solutions for transportation and industrial markets.

- 2024 Divestiture: The automotive business, a key part of non-wind sales, was divested in 2024.

- Strategic Focus: This divestiture allows TPI to concentrate on its core wind energy business.

- Future Outlook: While diversified revenue was a past component, future growth is centered on wind energy.

Long-Term Supply Agreement Revenues

TPI Composites' revenue streams are significantly bolstered by long-term supply agreements, which form a cornerstone of their financial stability. These agreements with major wind turbine manufacturers provide a predictable revenue flow, ensuring consistent utilization of their manufacturing facilities.

In 2024, TPI Composites continued to leverage these agreements to secure a substantial portion of its business. For instance, their ongoing relationship with Vestas, a leading wind turbine producer, is a prime example of how these long-term contracts translate into reliable income. These contracts are crucial for TPI, as they lock in demand for their specialized composite blade production.

- Secured Revenue Base: Long-term contracts provide a predictable income stream, reducing reliance on spot market fluctuations.

- Customer Commitments: Agreements with key players like Vestas ensure consistent demand for TPI's blade manufacturing capabilities.

- Capacity Utilization: These contracts allow TPI to maintain high operational efficiency and optimize production capacity.

- Financial Predictability: The stability offered by these agreements aids in financial planning and investment in future growth.

TPI Composites primarily generates revenue through the design, production, and sale of advanced composite wind blades to Original Equipment Manufacturers (OEMs) in the wind energy sector. This core business directly fuels the expansion of renewable energy infrastructure globally. In 2023, these blade manufacturing sales represented a substantial portion of TPI's income, underscoring their critical role in the wind turbine supply chain.

Additionally, TPI earns revenue from providing field services, including inspection, maintenance, and repair of wind blades, a segment that has seen growth due to increased deployment of specialized technicians. The company also sells essential tooling required by OEMs for blade production, further diversifying its income. While TPI historically served other sectors like transportation, it divested its automotive business in 2024 to concentrate on its core wind energy market.

| Revenue Stream | Description | 2023/2024 Relevance | Key Driver |

| Wind Blade Manufacturing | Design, production, and sale of composite wind blades to OEMs. | Primary revenue source; significant portion of 2023 sales. | Demand for new wind turbines, global renewable energy targets. |

| Field Services | Inspection, maintenance, and repair of wind blades. | Growing segment, impacting Renewable Energy segment performance in 2024. | Wind farm installations, technician deployment and utilization. |

| Tooling Sales | Sale of specialized tooling for wind blade production. | Ancillary but crucial revenue; continued in 2024. | OEM production needs, efficiency in blade manufacturing. |

| Other Composite Solutions (Historical) | Composite solutions for transportation and industrial applications. | Significantly diminished due to 2024 divestiture of automotive business. | Diversification strategy (now de-emphasized). |

Business Model Canvas Data Sources

The TPI Business Model Canvas is meticulously constructed using financial statements, competitor analysis, and customer feedback. This comprehensive approach ensures each element is grounded in actionable insights and market realities.