Tom Tailor Holding AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tom Tailor Holding AG Bundle

Navigate the complex external landscape impacting Tom Tailor Holding AG with our comprehensive PESTEL analysis. Uncover how political shifts, economic volatility, and evolving social trends are shaping the fashion retail giant's operations and strategic direction. From technological advancements to environmental regulations and legal frameworks, understand the critical forces at play. Gain the foresight needed to anticipate challenges and seize opportunities in this dynamic market. Download the full version now to unlock actionable intelligence and solidify your strategic advantage.

Political factors

Governmental policies and trade relations are crucial for Tom Tailor. Shifts in international trade agreements or the introduction of new tariffs, especially those potentially emerging from a new US administration in 2025, could directly impact sourcing costs and necessitate adjustments to their global supply chain. For example, changes in import duties on textiles from key manufacturing regions could increase production expenses.

As an international fashion retailer, Tom Tailor's ability to maintain competitive pricing and operational efficiency hinges on navigating these evolving geopolitical dynamics. The company's reliance on a diverse supplier base means that trade policies in countries like Bangladesh or Vietnam, major textile exporters, have a significant bearing on their cost of goods sold. A disruption in these trade flows, perhaps due to protectionist measures, could force price increases or require a costly restructuring of sourcing operations.

Global legislation like the Uyghur Forced Labor Prevention Act (UFLPA), which came into full effect in June 2022, and upcoming EU directives such as the Corporate Sustainability Due Diligence Directive (CSDDD) and Corporate Sustainability Reporting Directive (CSRD) are significantly reshaping supply chain management for companies like Tom Tailor. These regulations demand enhanced transparency and ethical sourcing practices, placing direct pressure on businesses to meticulously vet their entire supplier network.

Tom Tailor must ensure its vast network of international suppliers, particularly those in regions with potential labor or environmental concerns, strictly adhere to evolving international labor and environmental standards. Failure to comply can result in substantial penalties, including fines and import bans, alongside severe reputational damage that can erode consumer trust and market share.

The company's response necessitates robust due diligence processes, including supplier audits and certifications, to verify compliance. In 2023, for instance, several major apparel brands faced scrutiny and product seizures under the UFLPA, highlighting the real-world consequences of inadequate supply chain oversight.

Consequently, Tom Tailor may need to actively re-evaluate and diversify its sourcing locations, potentially shifting production away from high-risk areas to mitigate regulatory exposure and maintain a reliable, ethically sound supply chain. This strategic adjustment is critical for long-term operational resilience and market standing.

The political stability of countries where Tom Tailor sources its production, especially in key manufacturing hubs across Asia, directly influences its operational efficiency. For instance, geopolitical shifts or internal unrest in nations like Bangladesh or Vietnam can trigger unexpected supply chain disruptions, impacting lead times and potentially increasing raw material or labor costs.

Tom Tailor's proactive strategy to mitigate these risks involves diversifying its sourcing network. By not relying on a single region, the company can better absorb shocks from political instability in one area. This adaptability is paramount for maintaining consistent production flow and meeting consumer demand, particularly as global trade dynamics evolve.

Consumer Protection and Product Safety Regulations

Governments worldwide are intensifying their focus on consumer protection and product safety, particularly within the apparel sector. This trend is evidenced by the growing number of regulations targeting harmful substances in textiles. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, with ongoing discussions and potential restrictions on substances like per- and polyfluoroalkyl substances (PFAS), often used for water and stain resistance in outdoor wear. Tom Tailor must diligently track these regulatory shifts to ensure its product offerings remain compliant in all operating regions.

Tom Tailor's ability to adapt to these stringent consumer protection and product safety regulations is crucial for its long-term success. Failure to comply could result in costly product recalls, significant fines, and damage to brand reputation. For example, in 2023, several major retailers faced scrutiny and potential penalties due to non-compliance with chemical restrictions in children's clothing, highlighting the financial and reputational risks involved. The company needs robust systems for monitoring chemical usage throughout its complex global supply chain, from raw material sourcing to finished product manufacturing. This includes rigorous testing protocols and close collaboration with suppliers to ensure adherence to the latest safety standards.

Key considerations for Tom Tailor in navigating these evolving regulations include:

- Monitoring PFAS restrictions: Keeping abreast of proposed and enacted bans or limitations on PFAS in textiles across key markets like the EU and North America.

- Supply chain transparency: Enhancing visibility into chemical inputs and manufacturing processes employed by all suppliers.

- Product reformulation: Investing in research and development to identify and implement safer, compliant alternatives for chemicals currently in use.

- Compliance audits: Conducting regular, thorough audits of suppliers to verify adherence to product safety and chemical usage standards.

State Aid and Financial Support

Government financial support, like state guarantees on loans, can be a crucial lifeline for companies like Tom Tailor, especially during economic downturns. For instance, in 2020, Tom Tailor secured a significant loan backed by a state guarantee from the German government. This political backing acts as a safety net, enabling strategic development and operational continuity. This support, however, often comes with the expectation of adherence to certain governmental guidelines or conditions impacting business operations.

The availability and terms of state aid are directly influenced by political decisions and economic priorities. Governments may offer financial assistance to sectors deemed strategically important or to companies facing temporary liquidity issues. This can include direct subsidies, loan guarantees, or tax relief. For example, the German government's support package for businesses during the COVID-19 pandemic, which included loan guarantees, was a direct response to the political imperative to stabilize the economy.

- State Guarantees: The German government provided state guarantees for loans to companies like Tom Tailor, bolstering their financial stability during challenging times.

- Economic Stabilization: Such support is often a political response aimed at preventing widespread bankruptcies and maintaining employment levels within key industries.

- Conditional Support: While beneficial, government financial aid can impose certain operational restrictions or reporting requirements on the recipient company.

- Sectoral Focus: Political decisions may prioritize aid for specific sectors, influencing which industries and companies are most likely to receive support.

Governmental policies on trade and international relations significantly influence Tom Tailor's global operations, particularly concerning sourcing costs and supply chain stability. The potential for new tariffs or trade restrictions from major economies, especially in 2025, could directly impact the company's cost of goods sold and necessitate strategic sourcing adjustments.

New regulations, such as the EU's Corporate Sustainability Due Diligence Directive (CSDDD) and the ongoing implementation of the Uyghur Forced Labor Prevention Act (UFLPA), demand greater supply chain transparency and ethical sourcing. Tom Tailor must ensure its extensive supplier network adheres to evolving international labor and environmental standards to avoid penalties and reputational damage, as evidenced by past product seizures under UFLPA in 2023.

Stricter consumer protection laws, particularly regarding chemical content in textiles, are also a key political factor. The evolving REACH regulation in the EU, with potential restrictions on substances like PFAS, requires Tom Tailor to continuously monitor and adapt its product formulations and sourcing practices to remain compliant across all markets, avoiding costly recalls and brand damage.

Government financial support, like state guarantees on loans, played a vital role in Tom Tailor's financial stability, as seen with a German government-backed loan in 2020. While such support offers a crucial safety net, it often comes with conditions that can influence operational decisions and strategic direction, reflecting the political imperative to stabilize economies and support key industries.

What is included in the product

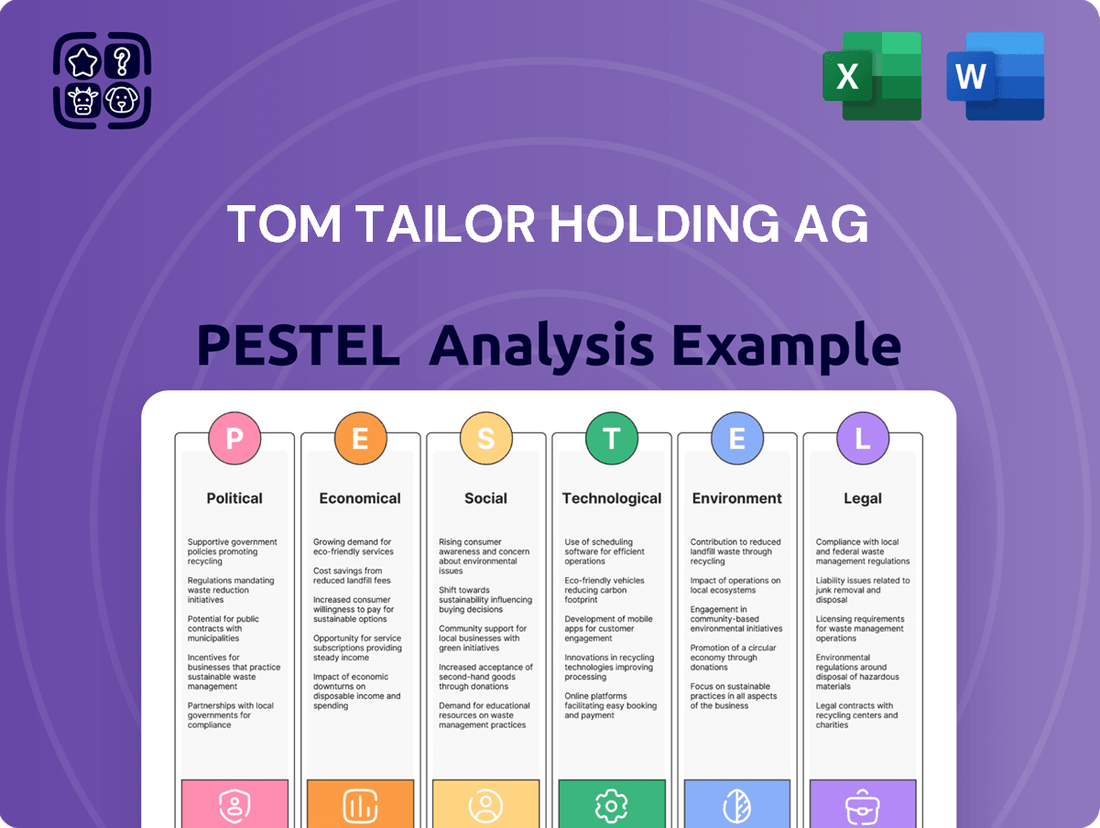

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping Tom Tailor Holding AG, providing a comprehensive understanding of its external operating landscape.

It offers actionable insights into how these macro-environmental factors present both risks and strategic advantages for Tom Tailor Holding AG in the current global market.

Tom Tailor Holding AG's PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic discussions.

This analysis helps alleviate concerns by highlighting potential risks and opportunities within political, economic, social, technological, environmental, and legal landscapes.

Economic factors

Persistent inflation, with global consumer prices rising significantly in 2024, directly squeezes household budgets, making consumers more cautious with their spending. This means individuals are more likely to prioritize essential goods over discretionary purchases like apparel.

For Tom Tailor, operating in the mid-price casual wear market, this heightened price sensitivity is a major concern. Customers are actively seeking out better deals and may switch to cheaper brands or delay purchases altogether, impacting Tom Tailor's sales volumes.

The economic slowdown in key European markets, where Tom Tailor has a strong presence, further exacerbates this trend. Reduced disposable income forces consumers to become more value-conscious, making it challenging for brands like Tom Tailor to maintain pricing power without risking customer attrition.

This economic environment directly impacts profit margins. If Tom Tailor cannot pass on rising costs due to fear of losing price-sensitive customers, their profitability will likely be squeezed, requiring careful cost management and a focus on value proposition.

The global economic outlook for 2025 points to continued uncertainty, with the IMF forecasting a modest 2.7% GDP growth worldwide, a slight dip from 2024. Persistent inflation remains a concern, impacting consumer spending power and increasing operational costs for retailers like Tom Tailor.

This subdued economic climate necessitates a strong focus on operational efficiency and supply chain adaptability for fashion companies. Tom Tailor, operating in the non-luxury segment, faces a market where consumers are increasingly price-sensitive, demanding value for money.

While luxury markets might see slower growth, the non-luxury fashion sector could benefit from increased demand for affordable, quality products. Tom Tailor’s ability to navigate these shifts, offering compelling value propositions, will be crucial for maintaining and improving its market position in 2025.

As an international fashion retailer, Tom Tailor Holding AG is significantly exposed to exchange rate fluctuations. For instance, if the Euro strengthens against currencies like the US Dollar or Chinese Yuan, the cost of materials sourced from these regions increases, directly impacting Tom Tailor's cost of goods sold. Conversely, a weaker Euro can make its products more attractive to international buyers, boosting sales revenue when converted back into Euros.

In 2024, the Euro experienced volatility, with its value fluctuating against major trading partners. For example, the EUR/USD rate saw periods of both appreciation and depreciation, creating uncertainty for companies like Tom Tailor. These shifts can directly influence the profitability of its overseas operations and the expense of its global supply chain, necessitating robust currency risk management strategies.

Tom Tailor's pricing strategies are also indirectly affected by these currency movements. To maintain competitive pricing in international markets, the company might need to absorb some of the currency-related cost increases or adjust its pricing, which could impact sales volume. Effective hedging techniques and careful financial planning are therefore crucial to mitigate these risks and ensure consistent financial performance.

Supply Chain Costs and Efficiency

Rising operating costs, including wages and overall supply chain expenses, are a significant challenge for Tom Tailor. For instance, global shipping costs saw substantial increases in 2024, impacting the cost of goods for many apparel retailers. This puts pressure on Tom Tailor's profitability, making efficient operations paramount.

The company's focus on supply chain efficiencies and efforts to reduce excess inventory are crucial for mitigating these cost pressures. By streamlining logistics and improving inventory management, Tom Tailor aims to minimize waste and maximize the value of its stock. This proactive approach is vital in a volatile market environment.

Strategic initiatives like nearshoring are being explored to enhance agility and reduce risks associated with long, complex supply chains. This move could help Tom Tailor respond more quickly to changing consumer demands and mitigate disruptions, potentially improving delivery times and reducing transportation costs.

- Rising Operating Costs: Global logistics and labor costs continue to be a significant factor affecting Tom Tailor's bottom line.

- Inventory Management: Enhancing supply chain efficiency and reducing excess inventory are key strategies to counter cost pressures.

- Nearshoring Exploration: The company is investigating nearshoring as a means to boost supply chain agility and mitigate risk.

- Impact on Profitability: Effective management of these supply chain factors is directly linked to maintaining and improving Tom Tailor's profitability.

E-commerce Growth and Digital Sales Contribution

The ongoing surge in e-commerce significantly impacts the retail landscape, with online sales becoming a dominant force. For Tom Tailor, this presents a dual opportunity for expansion and a challenge due to the associated variable costs. In 2023, global e-commerce sales were projected to reach over $6 trillion, underscoring the immense market size.

This digital shift necessitates strategic investment in online infrastructure and marketing. While e-commerce offers wider reach and potential for increased revenue, it also entails higher expenses related to digital advertising, sophisticated packaging for online orders, and managing product returns. These costs can impact profit margins if not carefully managed.

- E-commerce Share of Global Retail: Expected to continue its upward trajectory, potentially exceeding 20% of total retail sales in many developed markets by 2025.

- Digital Marketing Spend: A critical investment area, with fashion brands increasingly allocating substantial budgets to social media advertising, influencer collaborations, and search engine optimization (SEO).

- Logistics and Returns Costs: These variable costs are a significant consideration for online retailers, with return rates in fashion e-commerce often ranging from 20% to 40%.

- Platform Investment: Tom Tailor's commitment to enhancing its website user experience, mobile optimization, and efficient order fulfillment systems is crucial for capturing and retaining online customers.

Persistent inflation in 2024 and 2025 continues to pressure consumer spending, particularly for non-essential items like apparel. This economic climate amplifies price sensitivity among shoppers, forcing retailers like Tom Tailor to balance competitive pricing with maintaining profit margins, especially in key European markets experiencing economic slowdown.

Exchange rate volatility in 2024, for instance with the EUR/USD, directly impacts Tom Tailor's sourcing costs and international sales revenue. Effective currency risk management is therefore essential for stable financial performance, influencing both profitability and the competitiveness of its global product pricing.

Rising operational costs, including global shipping and labor, pose a significant challenge, with logistics expenses seeing notable increases in 2024. Tom Tailor's focus on supply chain efficiency, inventory reduction, and exploring nearshoring are strategic responses to mitigate these cost pressures and enhance market responsiveness.

The accelerating shift to e-commerce, projected to exceed 20% of retail sales in developed markets by 2025, requires substantial investment in digital infrastructure and marketing. However, the associated variable costs for digital advertising, packaging, and managing high fashion return rates (20%-40%) necessitate careful management to protect profit margins.

What You See Is What You Get

Tom Tailor Holding AG PESTLE Analysis

The preview you see here is the exact Tom Tailor Holding AG PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the insights and structure presented in this preview are precisely what you will gain immediate access to. No surprises, just the complete PESTLE breakdown for informed strategic planning.

Sociological factors

Consumers are increasingly making purchasing decisions based on sustainability, transparency, and ethical considerations. This evolving preference is fueling demand for products made with eco-friendly materials and a growing interest in circular fashion. Brands that clearly demonstrate a commitment to social and environmental responsibility are resonating more with shoppers.

Tom Tailor's strategic initiatives, such as their 'BE PART' program, directly respond to these shifting consumer values. Their focus on sustainable sourcing and transparent supply chains aims to meet the expectations of a more conscientious customer base, which is a significant trend observed throughout 2024 and into 2025.

Modern consumers, particularly Millennials and Gen Z, are increasingly demanding personalized experiences and products that align with their unique identities and ethical beliefs. Tom Tailor must deliver tailored offerings, from customized product suggestions to inclusive sizing and styles, to foster stronger customer relationships. This focus on individuality is crucial for building brand loyalty in a crowded market.

The brand's engagement strategy on social media and digital channels must also reflect this demand for personalization and inclusivity. For example, by mid-2024, fashion retailers reporting higher levels of customer personalization saw an average of a 10-15% increase in repeat purchase rates. Tom Tailor's ability to connect authentically and offer relevant content will be key to capturing this demographic.

Social media platforms are powerful drivers of fashion trends and consumer decisions. In 2024, it’s estimated that over 60% of online shoppers discover new fashion items through social media channels, making it a critical touchpoint for brands like Tom Tailor.

Tom Tailor needs to actively engage in social commerce and leverage influencer marketing to resonate with its audience. Creating compelling digital content that fosters interaction is key to building brand loyalty and driving sales in this environment.

The company should explore innovative digital experiences, such as virtual try-on technologies. These immersive solutions can significantly enhance the online shopping journey, boosting conversion rates and customer satisfaction, as evidenced by a reported 20% increase in online sales for brands adopting such features in early 2025.

Aging Population and 'Silver Generation' Spending

The aging population, often referred to as the 'Silver Generation', is a significant and growing demographic with considerable influence in the fashion market. Consumers aged 50 and over are increasingly prioritizing quality, comfort, and practical functionality in their clothing choices. This trend is particularly relevant for brands like Tom Tailor Holding AG, which specializes in casual wear, as it presents an opportunity to align its product offerings with the evolving needs and preferences of this affluent segment.

The economic clout of older consumers is substantial. In 2024, it's estimated that individuals over 50 will account for a significant portion of consumer spending. For instance, in Europe, this demographic is expected to drive a large share of discretionary spending, making them a key target market for fashion retailers. Tom Tailor's established presence in casual wear, emphasizing relaxed fits and durable materials, naturally positions it to appeal to the Silver Generation's desire for comfortable yet stylish apparel.

- Growing Demographic: The proportion of the population aged 50 and above is steadily increasing across key Tom Tailor markets, particularly in Europe.

- Spending Power: This demographic possesses significant disposable income, with a notable portion allocated to lifestyle and fashion purchases. In 2023, for example, the 55-64 age group in Germany showed a propensity to spend on clothing and footwear that exceeded younger demographics in certain categories.

- Preference Shift: Key purchasing drivers for this group include durability, ease of care, and a classic aesthetic over fast fashion trends.

- Market Opportunity: Tom Tailor can leverage its casual wear expertise to develop collections that specifically cater to these preferences, potentially through expanded sizing, more accessible fabric choices, and timeless designs, thereby capturing a larger share of this lucrative market.

Rise of Value Shopping and Secondhand Market

Economic shifts, including persistent inflation and concerns about disposable income, are significantly driving consumer behavior towards value-oriented purchasing. This trend is particularly evident in the burgeoning secondhand and off-price retail sectors, which offer significant cost savings compared to new items. For instance, the global secondhand apparel market was projected to reach $350 billion by 2027, demonstrating substantial consumer adoption.

Consumer mindsets are also evolving, with a growing emphasis on sustainability and conscious consumption. This has led many shoppers to actively seek out pre-owned items or products that offer better longevity and quality for their price. A 2024 survey indicated that over 60% of consumers consider sustainability when making fashion purchases, often equating it with value.

Tom Tailor's strategy in the mid-price segment must therefore highlight durability and cost-effectiveness to resonate with these changing preferences.

- Growing Secondhand Market: The global secondhand apparel market is experiencing rapid expansion, with projections indicating significant growth in the coming years.

- Consumer Shift to Value: Economic pressures are pushing consumers to prioritize affordability and long-term value in their purchasing decisions.

- Sustainability Influence: A rising awareness of environmental impact is making secondhand and durable goods more attractive to a wider consumer base.

- Tom Tailor's Positioning: The brand needs to emphasize the enduring quality and reasonable cost of its offerings to align with these dominant consumer trends.

Sociological factors significantly influence consumer choices, with a growing demand for sustainability and ethical production. Tom Tailor's 'BE PART' initiative addresses this by focusing on eco-friendly materials and supply chain transparency, aligning with consumer values observed throughout 2024 and into 2025.

Personalization is key, especially for younger demographics like Millennials and Gen Z, who seek products reflecting their identity and beliefs. In mid-2024, fashion retailers offering personalization saw a 10-15% increase in repeat purchases, highlighting the importance of tailored experiences for brands like Tom Tailor.

The increasing purchasing power of the 'Silver Generation' (50+) presents a significant market opportunity. This demographic prioritizes quality and comfort, with European consumers aged 55-64 showing a strong propensity to spend on clothing and footwear in 2023, often exceeding younger age groups in certain categories.

Economic pressures are driving a shift towards value, boosting the secondhand market and consumer interest in durable goods. By 2024, over 60% of consumers consider sustainability when purchasing fashion, often equating it with value, making Tom Tailor's emphasis on enduring quality and reasonable cost crucial for market resonance.

| Sociological Factor | Description | Impact on Tom Tailor | Relevant Data (2024/2025) |

|---|---|---|---|

| Ethical Consumerism | Demand for sustainable and transparent practices. | Necessitates responsible sourcing and production. | 60% of consumers consider sustainability in fashion purchases (2024). |

| Personalization Demand | Consumers seek unique and tailored experiences. | Requires personalized product offerings and marketing. | 10-15% increase in repeat purchases for personalized retail experiences (mid-2024). |

| Aging Population (Silver Generation) | Growing demographic with significant spending power and specific preferences. | Opportunity for casual wear catering to comfort, quality, and classic style. | 55-64 age group in Germany exceeded younger demographics in clothing spend (2023). |

| Value Consciousness | Economic shifts drive demand for affordability and durability. | Emphasis on cost-effectiveness and long-lasting products. | Global secondhand apparel market projected to reach $350 billion by 2027. |

Technological factors

Digital transformation is reshaping fashion, demanding brands like Tom Tailor to innovate across design, production, and customer interaction. This evolution accelerates the need for seamless integration of online, mobile, and physical retail channels. For example, in 2024, a significant portion of fashion sales are expected to occur online, pushing brands to prioritize robust e-commerce platforms and digital marketing efforts.

Tom Tailor must strengthen its omnichannel strategy to meet modern consumer expectations for a unified shopping journey. This involves ensuring smooth transitions between online browsing, mobile app engagement, and in-store experiences. Features like buy online, pick up in-store (BOPIS) are becoming standard, with many retailers reporting substantial increases in sales from such integrated services, often seeing a 10-15% uplift in customer spending.

Artificial intelligence and machine learning are revolutionizing retail by improving demand forecasting, inventory management, and customer personalization. Tom Tailor can harness AI for trend spotting, creating new designs, and offering real-time tailored shopping experiences, thereby boosting efficiency and cutting down on waste.

Tom Tailor is actively embracing supply chain digitalization to boost transparency and efficiency. By incorporating technologies such as QR codes and platforms like Retraced, the company is establishing robust tracking for its products, from the initial raw materials to the finished apparel. This move is essential for meeting upcoming regulatory demands, including the Digital Product Passport, and significantly improves traceability while bolstering sustainability efforts.

E-commerce Platform Advancements

Tom Tailor's commitment to enhancing its e-commerce platforms is crucial for connecting with today's digitally native shoppers. This means constantly refining the user journey, incorporating innovative features, and staying ahead of digital trends.

The company's strategic investments in its online presence are directly tied to its ability to adapt to evolving consumer preferences and maintain a strong market position. For instance, by early 2024, e-commerce sales represented a significant portion of many fashion retailers' revenue, with projections showing continued growth.

- User Experience Optimization: Ensuring a seamless and intuitive online shopping process is paramount.

- Virtual Try-On Technologies: Integrating augmented reality for virtual fittings can reduce returns and boost conversion rates.

- Shoppertainment and Live Commerce: Engaging customers through interactive content and real-time sales events is becoming increasingly important.

- Mobile-First Approach: Prioritizing the mobile experience as a majority of online traffic originates from smartphones.

Innovative Materials and Manufacturing Technologies

Technological advancements in materials science are significantly reshaping the fashion industry. Innovations like bio-based materials, recycled fabrics, and sophisticated manufacturing techniques such as 3D printing are paving the way for more sustainable fashion. For Tom Tailor, integrating these eco-friendly materials into its product lines presents a prime opportunity to reduce its environmental impact and appeal to a growing segment of environmentally conscious consumers.

The adoption of these new materials goes hand-in-hand with advancements in manufacturing processes. Efficient waste management technologies are also becoming crucial. For example, by 2024, the global textile recycling market was projected to reach USD 9.1 billion, indicating a strong demand for sustainable practices. Tom Tailor could leverage these technologies to minimize production waste and enhance its circular economy initiatives.

Key technological factors influencing Tom Tailor include:

- Advancements in sustainable materials: Development and availability of bio-based, recycled, and biodegradable textiles.

- 3D printing and digital manufacturing: Potential for on-demand production, reduced waste, and customized designs.

- Efficient waste management technologies: Innovations in textile recycling, upcycling, and waste reduction during production.

- Digitalization of supply chains: Enhanced traceability and transparency in material sourcing and manufacturing processes.

Tom Tailor's technological focus is on enhancing its digital presence and supply chain efficiency. By investing in e-commerce platforms and data analytics, the company aims to improve customer engagement and personalize offerings, responding to the 2024 trend of a significant portion of fashion sales occurring online.

The brand is also integrating technologies like QR codes for supply chain transparency, aligning with upcoming regulations such as the Digital Product Passport, and exploring AI for design and forecasting. This digital push is crucial as the global fashion e-commerce market continues its upward trajectory.

| Technology Area | Impact on Tom Tailor | Key Data/Trend (2024/2025) |

|---|---|---|

| E-commerce & Digital Marketing | Improved customer reach and sales conversion. | Online fashion sales projected to grow significantly, with mobile dominating traffic. |

| Supply Chain Digitalization | Enhanced transparency, traceability, and compliance. | Increased demand for product passports and sustainable sourcing verification. |

| AI & Machine Learning | Personalized customer experiences and efficient operations. | AI adoption in retail for trend prediction and inventory management is rapidly expanding. |

| Sustainable Materials & Manufacturing | Reduced environmental impact and appeal to conscious consumers. | Growth in the textile recycling market, with innovation in bio-based and recycled fabrics. |

Legal factors

The growing adoption of Extended Producer Responsibility (EPR) laws, such as those being implemented in California for textiles, is a significant legal factor. These regulations place the onus of product end-of-life management, including disposal and recycling, directly onto manufacturers like Tom Tailor. This trend is a key driver towards a circular economy, aiming to minimize waste and promote sustainable practices throughout the product lifecycle.

Tom Tailor must proactively adapt its operational strategies and potentially rethink its product design to align with these evolving EPR mandates. Non-compliance can lead to substantial penalties, making adherence crucial for maintaining market access and a positive brand image. For instance, California's recent textile EPR law, the first of its kind in the US, sets a precedent for other regions, underscoring the increasing regulatory pressure on apparel companies.

New and evolving due diligence laws are significantly impacting the fashion industry. For instance, the German Supply Chain Due Diligence Act (LkSG), which came into full effect in 2024, mandates that companies establish effective risk management systems to address human rights and environmental violations within their supply chains, extending to indirect suppliers. This is further reinforced by the proposed EU Corporate Sustainability Due Diligence Directive (CSDDD), which aims to harmonize these requirements across member states, potentially impacting companies with significant EU operations.

Tom Tailor must implement robust systems for monitoring and reporting. This includes going beyond direct (Tier 1) suppliers to assess risks at deeper tiers, such as textile factories or raw material producers. Failure to do so could lead to substantial fines; under the LkSG, penalties can reach up to 2% of average annual global revenue for companies exceeding 400 million euros in annual revenue. This regulatory landscape necessitates a proactive approach to ethical sourcing and supply chain transparency to avoid legal repercussions.

The increasing number of stringent data privacy laws, such as the GDPR in Europe and evolving state-level regulations in the US, directly affects how Tom Tailor handles customer information. Compliance is paramount; failure to adhere to these rules, which govern data collection, storage, and utilization, can result in substantial penalties. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

These regulations significantly impact Tom Tailor's e-commerce platforms and its customer relationship management (CRM) strategies. Ensuring data is collected with explicit consent and used only for specified purposes is critical for maintaining consumer trust and avoiding legal repercussions. The company must invest in robust data security measures and transparent privacy policies to navigate this complex legal landscape effectively.

Intellectual Property Rights and Counterfeiting

Protecting intellectual property, including brand names, designs, and trademarks, is paramount for fashion retailers like Tom Tailor Holding AG. This involves safeguarding its core brands, Tom Tailor and Bonita, from unauthorized use and imitation.

Tom Tailor faces continuous legal battles concerning intellectual property infringement and the persistent issue of counterfeiting. These activities directly threaten the brand’s equity and can significantly erode sales, as counterfeit goods often compete unfairly on price and availability.

In 2023, the global fashion industry continued to grapple with the economic impact of counterfeiting, with estimates suggesting billions in lost revenue annually. For Tom Tailor, this translates to a need for robust legal strategies and vigilant market monitoring.

- Brand Protection: Safeguarding the Tom Tailor and Bonita trademarks and unique designs is essential for maintaining brand integrity and consumer trust.

- Counterfeit Deterrence: Implementing proactive measures to identify and combat counterfeit products in the market is crucial for revenue protection.

- Legal Recourse: Pursuing legal action against infringers is necessary to enforce intellectual property rights and deter future violations.

- Market Monitoring: Continuous surveillance of online and offline marketplaces is required to detect and address instances of intellectual property theft.

Labor Laws and Ethical Employment Practices

Tom Tailor Holding AG must diligently comply with labor laws, ensuring fair wages, safe working conditions, and the absolute prevention of forced labor throughout its operations. This commitment is critical, particularly given ongoing investigations and reports of labor abuses within the garment industry, especially in key sourcing regions. The company's adherence to ethical employment practices across its entire supply chain is paramount.

Recent regulatory shifts, such as the Uyghur Forced Labor Prevention Act (UFLPA) in the United States, are increasing scrutiny and enforcement, directly impacting global supply chains. This legislation, enacted in June 2022, presumes that goods manufactured in the Xinjiang Uyghur Autonomous Region of China are made with forced labor, making their importation prohibited. Tom Tailor, like many apparel companies, must demonstrate robust due diligence to ensure its products are free from such practices. For instance, in 2023, several major apparel brands faced increased pressure and scrutiny regarding their supply chain transparency and labor practices in light of UFLPA enforcement. The expectation is for companies to map their supply chains extensively, identifying and mitigating any risks of forced labor. This involves rigorous auditing and supplier engagement to uphold international labor standards.

- UFLPA Enforcement: The U.S. Customs and Border Protection's active enforcement of the UFLPA creates a direct legal imperative for companies like Tom Tailor to ensure their supply chains are free of forced labor originating from specific regions.

- Supply Chain Transparency: Increased demand from consumers and regulators for transparency means Tom Tailor must provide clear visibility into its sourcing and manufacturing processes to prove compliance with labor laws.

- Ethical Sourcing Audits: Regular and thorough audits of suppliers' facilities are essential to verify compliance with fair wage, working hour, and safety regulations, as well as to prevent child labor and forced labor.

- International Labor Standards: Adherence to International Labour Organization (ILO) conventions, covering fundamental principles and rights at work, is a benchmark for responsible business conduct.

The fashion industry faces increasing legal scrutiny regarding environmental impact and waste management, with Extended Producer Responsibility (EPR) laws gaining traction globally. For instance, California's textile EPR law, enacted in 2022, places responsibility for end-of-life product management on manufacturers, setting a precedent for similar legislation. This necessitates proactive adaptation in product design and operational strategies to minimize waste and comply with regulations, as non-compliance can lead to significant penalties.

Environmental factors

Consumers and regulators are increasingly pushing the fashion industry towards circular economy models. This means a greater emphasis on making clothes last longer, using fewer resources, and finding ways to reuse or recycle garments. Tom Tailor is responding to this by collaborating with repair services and aiming to incorporate more recycled materials into its collections, a move that directly addresses the growing demand for sustainability.

This shift towards circularity is not just an environmental concern; it's a market opportunity. For instance, the global market for sustainable fashion is projected to reach $15.1 billion by 2030, highlighting a significant consumer base willing to support brands that adopt these practices. Tom Tailor’s efforts to minimize textile waste and offer more sustainable products are therefore strategically aligned with evolving consumer preferences and regulatory landscapes.

The fashion industry faces increasing pressure to adopt sustainable material sourcing. Tom Tailor is responding by aiming to boost its use of recycled materials, aligning with a broader market shift towards eco-friendly alternatives like organic cotton and hemp. This focus is critical as consumers increasingly demand transparency and environmental responsibility in their purchases.

Tom Tailor has set a clear goal to source 100% of its cotton from sustainable origins, a significant commitment reflecting the growing imperative to reduce reliance on resource-intensive conventional cotton. This strategic move not only addresses environmental concerns but also positions the company to meet evolving regulatory landscapes and consumer preferences for ethical production.

Tom Tailor is actively working to reduce its environmental footprint by setting ambitious carbon emission reduction targets. The company has committed to a 50% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, with a long-term goal of achieving net-zero by 2050. These targets are in line with recognized science-based initiatives, signifying a serious commitment to combating climate change.

Achieving these goals involves a multi-pronged approach, focusing on critical areas like optimizing energy consumption within its operations and improving the efficiency of its extensive supply chain logistics. For instance, in 2023, Tom Tailor reported a 15% decrease in energy intensity across its retail stores through LED lighting upgrades and smarter HVAC systems.

Waste Management and Pollution Control

The fashion industry, including companies like Tom Tailor Holding AG, faces significant environmental scrutiny regarding waste management and pollution control. The sheer volume of textile production and consumption contributes heavily to landfill waste and environmental degradation. According to recent industry reports, the fashion sector is responsible for a substantial portion of global carbon emissions and water pollution.

Tom Tailor is addressing these concerns by focusing on reducing its environmental footprint. This involves implementing more robust waste management systems across its supply chain and retail operations. A key area of focus is minimizing packaging waste, a common issue in retail, by exploring more sustainable materials and designs.

The company is actively working to reduce pollution, particularly concerning water usage and chemical discharge in manufacturing processes. For instance, initiatives such as transitioning to 100% recycled and recyclable polybags for product packaging are concrete steps toward a more circular economy.

- Textile waste is a major global issue, with the fashion industry contributing significantly to landfill burden.

- Tom Tailor is committed to reducing its environmental impact through improved waste management and pollution control strategies.

- Minimizing packaging waste, such as the use of 100% recycled and recyclable polybags, is a key initiative.

- Efforts are also directed at reducing water consumption and chemical pollution in the production lifecycle.

Water Scarcity and Sustainable Water Usage

Water scarcity presents a significant challenge for the fashion industry, which is a major consumer of water, especially during cotton farming and fabric dyeing. Tom Tailor's commitment to sourcing sustainable cotton and investigating water-saving manufacturing techniques, like those used in less water-intensive denim production, is vital for responsible environmental practice. For instance, by 2024, the global textile dyeing industry was estimated to consume over 7 trillion liters of water annually, highlighting the urgent need for innovation.

Tom Tailor's strategic approach to water management is becoming increasingly important given global trends. The company's efforts in 2024 and projected for 2025 to enhance water efficiency in its supply chain directly address this environmental factor.

- Growing Global Water Stress: Over 2 billion people globally live in countries experiencing high water stress, impacting resource availability for industries like fashion.

- Fashion Industry Water Footprint: Cotton cultivation alone accounts for a substantial portion of the fashion industry's water consumption, with estimates suggesting that producing a single kilogram of cotton can require up to 20,000 liters of water.

- Tom Tailor's Sustainable Sourcing: The company's focus on materials like organic cotton, which often requires less water than conventional cotton, contributes to mitigating this impact.

- Innovation in Production: Exploring and implementing water-saving technologies in dyeing and finishing processes is critical for reducing the environmental impact of apparel manufacturing.

Environmental factors are increasingly shaping the fashion industry, with a strong push towards sustainability and circular economy models. Tom Tailor is actively responding by aiming to use more recycled materials and reduce waste, aligning with growing consumer demand for eco-friendly practices.

The company has set ambitious targets to cut carbon emissions, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030. This includes improving energy efficiency in retail operations, such as upgrading to LED lighting, which contributed to a 15% decrease in energy intensity in 2023.

Water scarcity is another critical environmental concern, given the fashion industry's high water consumption. Tom Tailor is addressing this by prioritizing sustainable cotton sourcing and exploring water-saving production techniques, vital for mitigating its environmental footprint.

The global market for sustainable fashion is expanding, projected to reach $15.1 billion by 2030, underscoring the financial incentive for brands to adopt environmentally responsible strategies. Tom Tailor's commitment to 100% sustainable cotton sourcing by 2024 is a key step in this direction.

PESTLE Analysis Data Sources

Our PESTLE analysis for Tom Tailor Holding AG is built upon a comprehensive review of data from reputable sources including government economic reports, international financial institutions like the IMF and World Bank, and leading market research firms. We also incorporate insights from industry-specific publications and sustainability reports to ensure a well-rounded perspective on the macro-environmental factors affecting the company.