Tom Tailor Holding AG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tom Tailor Holding AG Bundle

Unlock the full strategic blueprint behind Tom Tailor Holding AG's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Tom Tailor AG relies on a broad international network of suppliers and manufacturers to create its fashion collections. This partnership is crucial for the timely production and quality of its apparel and accessories. A key focus for Tom Tailor is ensuring ethical practices within this supply chain, including fair labor standards. By 2025, the company is committed to increasing its use of recycled materials and sourcing 100% of its cotton sustainably.

Strategic licensing agreements are vital for Tom Tailor Holding AG to extend its brand's presence into new product categories and markets. These partnerships allow for diversification beyond core apparel offerings, leveraging the expertise of specialist partners.

Recent and upcoming collaborations highlight this strategy. For instance, the partnership with Mäurer & Wirtz for Tom Tailor Fragrances, effective January 2025, signifies a push into the beauty sector. Similarly, the TOM TAILOR Eyewear collection with Eschenbach Optik, launching in Fall/Winter 2025, expands the brand into the accessories market.

These licensing deals are expected to generate new revenue streams and enhance brand visibility. By partnering with established players in their respective fields, Tom Tailor can ensure product quality and effective market penetration without significant upfront investment in new production capabilities.

Tom Tailor AG actively partners with leading e-commerce platforms like Zalando and About You, significantly expanding its reach and customer base. These collaborations are crucial for driving online sales and maintaining a strong presence in the competitive fashion retail landscape.

In late 2024, Tom Tailor also integrated with SCAYLE, a technology partner specializing in e-commerce solutions. This move aims to streamline online operations and improve the overall digital customer experience, further bolstering their direct-to-consumer strategy.

Furthermore, the company is leveraging technology from partners like 7Learnings for advanced predictive pricing optimization. This data-driven approach helps Tom Tailor to dynamically adjust prices, maximizing revenue and improving inventory management, a key strategy for fashion retailers in 2024.

Wholesale Partners and Franchisees

Tom Tailor leverages a robust network of wholesale partners and franchisees to achieve significant market penetration throughout Europe and internationally. This collaborative approach is fundamental to their distribution strategy.

As of 2024, the company’s expansive reach is evident in its operational footprint. Tom Tailor’s products are available through more than 10,100 multi-brand points of sale, complemented by 577 directly operated retail stores and an additional 170 franchise locations. This multi-channel strategy ensures widespread accessibility for their fashion offerings.

- Wholesale Partnerships: Over 10,100 multi-brand points of sale as of 2024.

- Retail Stores: 577 directly operated retail stores.

- Franchise Network: 170 franchise stores contributing to market expansion.

Sustainability and Non-Profit Organizations

Tom Tailor Holding AG actively partners with non-profit organizations to bolster its sustainability efforts. A prime example is the collaboration with MBRC the ocean, which saw the launch of a loyalty program in April 2024. This initiative directly supports ocean conservation, aligning with Tom Tailor's broader commitment to reducing its environmental footprint.

The company's 'BE PART' strategy is intrinsically linked to these partnerships, showcasing a dedication to ethical practices and environmental responsibility. These collaborations are not merely symbolic; they are integral to achieving tangible progress in areas like waste reduction and promoting circular economy principles within the fashion industry.

- MBRC the ocean partnership: Launched April 2024, focusing on ocean conservation through a loyalty program.

- 'BE PART' strategy: Demonstrates commitment to sustainability and ethical sourcing.

- Environmental impact reduction: Aiming to minimize ecological footprint across operations.

- Ocean conservation initiatives: Directly contributing to the health of marine ecosystems.

Tom Tailor's key partnerships extend to a vast network of suppliers and manufacturers, essential for their production cycles and quality control. Strategic licensing agreements, such as the one with Mäurer & Wirtz for fragrances (effective January 2025) and Eschenbach Optik for eyewear (Fall/Winter 2025), are crucial for brand diversification and market expansion.

Collaborations with e-commerce giants like Zalando and About You, alongside technology partners like SCAYLE and 7Learnings, are vital for enhancing online sales and operational efficiency. The company also relies on a widespread network of over 10,100 multi-brand points of sale and 170 franchise stores as of 2024 to maximize market penetration.

| Partnership Type | Key Partners | Scope/Impact | Data Point (2024/2025) |

| Suppliers & Manufacturers | International Network | Production & Quality | Commitment to 100% sustainable cotton by 2025 |

| Licensing | Mäurer & Wirtz, Eschenbach Optik | Brand Extension, New Categories | Fragrance launch Jan 2025, Eyewear launch F/W 2025 |

| E-commerce Platforms | Zalando, About You | Online Sales, Market Reach | Streamlined operations via SCAYLE integration |

| Wholesale & Franchise | Multi-brand POS, Franchisees | Market Penetration | 10,100+ multi-brand POS, 170 franchise stores |

| Sustainability | MBRC the ocean | Environmental Initiatives | Loyalty program launched April 2024 |

What is included in the product

Tom Tailor Holding AG's Business Model Canvas focuses on a multi-brand strategy, targeting fashion-conscious consumers across various age groups and lifestyles through a mix of owned retail stores, wholesale partners, and online channels. The company's core value proposition lies in offering trendy, affordable, and high-quality casual wear with a strong emphasis on brand identity and customer experience.

Tom Tailor Holding AG's Business Model Canvas helps alleviate the pain of fragmented market understanding by providing a clear, one-page snapshot of their customer segments, value propositions, and key activities.

This visual tool simplifies complex strategies, allowing stakeholders to quickly grasp how Tom Tailor addresses market needs and delivers its fashion offerings.

Activities

Tom Tailor's key activity in product design and development centers on crafting fresh clothing and accessory lines for men, women, and children. This process is deeply attuned to seasonal trends, with a consistent emphasis on casual wear that resonates with their core customer base.

A significant driver is the company's commitment to delivering quality items at accessible price points. This strategy is supported by their agility in adapting to evolving international fashion movements, a capability crucial for staying relevant in the fast-paced apparel market.

The rapid pace of adaptation is further exemplified by their practice of introducing new collections monthly. For instance, in 2024, Tom Tailor continued to launch a steady stream of new products, aiming to capture consumer interest with timely and on-trend offerings.

Tom Tailor Holding AG's key activities heavily involve managing a complex global supply chain. This encompasses the efficient and ethical sourcing of raw materials and the production of a wide range of garments, ensuring both quality and responsible practices.

A significant aspect of their operations is the implementation of advanced traceability platforms. For instance, their use of RETRACED allows for detailed tracking of products, extending all the way back to the origin of raw materials. This technology is crucial for verifying compliance with increasingly stringent sustainability goals.

In 2023, Tom Tailor continued its focus on supply chain optimization. While specific production volume figures are proprietary, the company emphasized its commitment to increasing the proportion of sustainably sourced materials. For example, their goal was to reach 50% certified sustainable cotton by 2025, with significant progress made in 2023 towards this target.

Tom Tailor AG actively develops and executes marketing campaigns across various channels, including digital and traditional media. They leverage social media marketing and influencer collaborations to boost brand awareness and connect with their target audience.

A significant element of their brand messaging is the 'BE PART' sustainability initiative. This focus on responsible practices aims to resonate with increasingly eco-conscious consumers.

In 2023, Tom Tailor saw a continued emphasis on digital marketing efforts, contributing to their overall brand presence and customer engagement strategies.

Multi-channel Sales and Distribution

Tom Tailor AG operates a robust multi-channel sales strategy to maximize market penetration and customer accessibility. This includes managing its own retail outlets, which offer a direct brand experience, alongside a network of franchise stores that extend its geographical reach. The company also leverages shop-in-shop concepts within department stores and a significant wholesale distribution arm that supplies numerous independent retailers.

Crucially, Tom Tailor AG places a strong emphasis on its e-commerce platforms, recognizing the growing importance of online sales. This integrated approach ensures customers can engage with the brand and make purchases through their preferred channels.

For the fiscal year 2023, Tom Tailor Group reported a significant increase in online sales, contributing substantially to overall revenue. The company's digital transformation efforts have been a key driver of growth, enabling it to reach a broader customer base and adapt to evolving consumer purchasing habits.

- Own Retail Stores: Direct customer interaction and brand control.

- Franchise Stores: Expanded market presence with lower capital investment.

- Shop-in-Shops: Increased visibility within established retail environments.

- Wholesale Distribution: Reaching a wider customer segment through third-party retailers.

- E-commerce Platforms: Driving online sales and providing convenient purchasing options.

Customer Relationship Management

Tom Tailor AG focuses on building lasting customer connections through several key activities. They actively implement loyalty programs designed to reward repeat business and foster a sense of belonging among their clientele. Personalized communication is a cornerstone, ensuring customers feel recognized and valued.

A crucial element is their commitment to actively gathering and responding to customer feedback. This data-driven approach allows them to continuously refine their offerings and service. For instance, in 2024, the company continued to invest in digital channels for customer interaction, aiming to enhance engagement and understand evolving preferences.

- Loyalty Programs: Implementing tiered rewards and exclusive offers to encourage repeat purchases.

- Personalized Communication: Utilizing customer data for targeted marketing campaigns and tailored product recommendations.

- Feedback Mechanisms: Actively soliciting and analyzing customer reviews and surveys to identify areas for improvement.

- Customer Service Excellence: Providing responsive and helpful support across all touchpoints to enhance overall satisfaction.

Tom Tailor's key activities encompass product design, sourcing, marketing, sales, and customer relationship management. They focus on creating trendy casual wear, managing a global supply chain for quality and sustainability, and employing multi-channel sales strategies including e-commerce. Building customer loyalty through programs and feedback is also central.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Product Design & Development | Creating seasonal casual wear for men, women, and children, adapting to fashion trends. | Continuous introduction of new collections monthly in 2024. |

| Supply Chain Management | Ethical sourcing of materials and production, with a focus on traceability and sustainability. | Progress towards 50% certified sustainable cotton by 2025, with significant 2023 strides. |

| Marketing & Brand Building | Executing multi-channel campaigns, including digital and influencer marketing, and promoting sustainability initiatives like 'BE PART'. | Continued emphasis on digital marketing in 2023 to enhance brand presence. |

| Sales & Distribution | Operating own retail, franchise, shop-in-shops, wholesale, and e-commerce channels. | Significant increase in online sales in fiscal year 2023, driving overall revenue. |

| Customer Relationship Management | Implementing loyalty programs, personalized communication, and feedback mechanisms. | Investment in digital channels for customer interaction in 2024 to improve engagement. |

Preview Before You Purchase

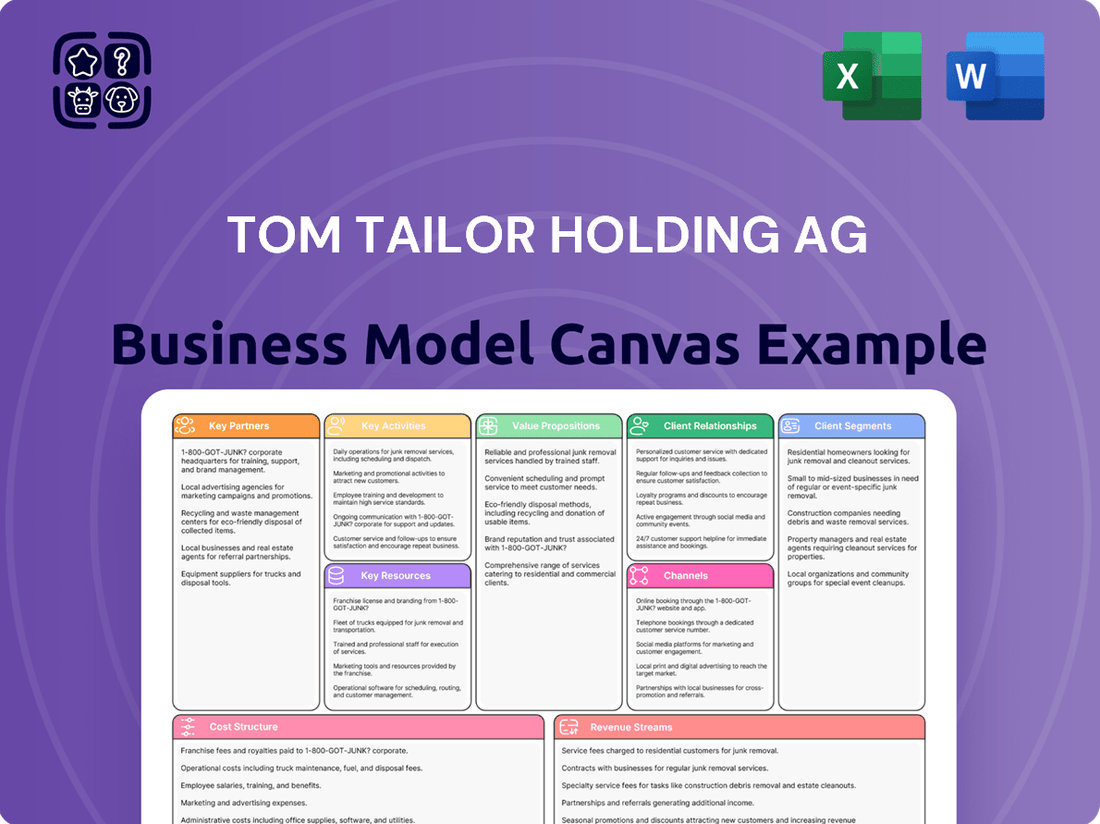

Business Model Canvas

The Business Model Canvas for Tom Tailor Holding AG that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are seeing a direct snapshot of the final, ready-to-use deliverable, ensuring complete transparency and no surprises.

Resources

The Tom Tailor and Bonita brands are cornerstone assets for Tom Tailor Holding AG, appealing to a wide range of consumers in the mid-price fashion market. These established brands represent significant intangible value, fostering customer loyalty through their distinct offerings.

Tom Tailor primarily focuses on casual wear and lifestyle products, catering to a younger, trend-conscious demographic. In contrast, Bonita targets a slightly older customer base with its range of comfortable and stylish apparel.

As of 2024, the strength of these brands is crucial for driving sales volume and maintaining market share in a competitive retail landscape. The brand portfolio’s recognition directly translates into customer acquisition and retention, underpinning the company's revenue streams.

Tom Tailor Holding AG relies heavily on its skilled workforce, a diverse group encompassing creative designers, efficient supply chain managers, savvy marketing professionals, customer-focused retail staff, and adept e-commerce specialists. These individuals are the backbone of the company's day-to-day operations and its ability to adapt to evolving market trends.

The company actively promotes a balanced human resources policy, recognizing that employee well-being and development are crucial for sustained success. This approach aims to create a positive and productive work environment where talent can thrive.

Fostering trust-based relationships within the organization is a key element of Tom Tailor's human capital strategy. This builds a foundation of mutual respect and collaboration, essential for navigating the complexities of the fashion retail industry.

In 2024, Tom Tailor Holding AG continued to invest in its people, with employee development programs focusing on digital skills and sustainability, reflecting the company's strategic priorities.

Tom Tailor maintains a robust physical footprint across Europe through its extensive retail store network. This network comprises entirely owned retail stores, strategically located franchise outlets, and integrated shop-in-shops within partner retailers.

As of 2024, the company's physical presence is substantial, boasting 577 directly operated retail stores. This is further augmented by 170 franchise stores, extending the brand's reach into new markets and demographics.

Complementing these dedicated stores, Tom Tailor operates an impressive 2,300 shop-in-shops. These embedded retail spaces within larger department stores or fashion retailers are crucial for brand visibility and accessibility across various European countries.

E-commerce Infrastructure and Digital Platforms

Tom Tailor Holding AG leverages a dual e-commerce strategy, operating its own dedicated e-shop alongside strategic collaborations with prominent online marketplaces. This multi-channel approach is underpinned by a sophisticated IT infrastructure, enabling efficient sales, targeted marketing campaigns, and streamlined supply chain operations. For instance, in 2023, the company reported significant online sales contributions, highlighting the growing importance of its digital channels.

Recent strategic enhancements to its digital infrastructure include new partnerships. The collaboration with SCAYLE aims to bolster its headless commerce capabilities, providing greater flexibility and customization for the online customer experience. Additionally, the partnership with 7Learnings focuses on optimizing pricing and promotion strategies through advanced data analytics, directly impacting sales performance and customer engagement.

- Own E-Shop: Direct-to-consumer sales channel driving brand engagement and margin.

- Platform Partnerships: Expanded reach and customer acquisition through collaborations with major online retailers.

- IT Infrastructure: Robust systems supporting sales, marketing, and supply chain for seamless operations.

- Digital Tools: Application of technology for data-driven decision-making in marketing and operations.

Financial Capital and Investor Backing

Tom Tailor Holding AG requires significant financial capital to fund its daily operations, invest in crucial areas like technology upgrades and sustainable initiatives, and pursue market expansion strategies. This financial backing is essential for maintaining competitiveness and driving growth in the dynamic fashion retail sector.

The company’s primary source of financial strength and strategic direction comes from its majority shareholder, Fosun International. This substantial backing provides a critical layer of financial stability, enabling Tom Tailor to undertake long-term investments and navigate economic fluctuations with greater resilience.

- Financial Resources: Operations require consistent capital for inventory, marketing, and personnel.

- Investment Areas: Funds are allocated to technology for e-commerce and supply chain, and to sustainable practices in sourcing and production.

- Market Expansion: Capital is deployed for entering new geographic markets and enhancing brand presence.

- Fosun International's Role: As the majority shareholder, Fosun provides essential financial stability and strategic guidance, evidenced by Fosun’s significant ownership stake.

Tom Tailor Holding AG's key resources are its strong brand portfolio, particularly the Tom Tailor and Bonita labels, which resonate with distinct customer segments in the mid-price fashion market. These brands are supported by a dedicated and skilled workforce, crucial for design, operations, and customer engagement. The company also maintains a substantial physical retail network across Europe, complemented by a growing e-commerce presence and strategic online marketplace partnerships.

| Resource Category | Key Components | 2024 Significance |

|---|---|---|

| Brand Portfolio | Tom Tailor, Bonita | Drives customer loyalty and sales in the competitive mid-price fashion segment. |

| Human Capital | Designers, supply chain, marketing, retail staff, e-commerce specialists | Essential for operational execution, innovation, and adapting to market trends; ongoing investment in digital and sustainability skills. |

| Physical Retail Network | 577 directly operated stores, 170 franchise stores, 2,300 shop-in-shops | Ensures broad market reach and customer accessibility across Europe. |

| Digital Channels | Own E-Shop, platform partnerships (e.g., SCAYLE, 7Learnings) | Crucial for expanding reach, customer engagement, and optimizing sales strategies through advanced IT infrastructure and data analytics. |

Value Propositions

Tom Tailor Holding AG's Fashionable Casual Wear value proposition centers on providing a diverse selection of clothing and accessories for the entire family. These items are designed to reflect a confident, authentic, and stylish casual aesthetic. This approach appeals to a broad customer base seeking everyday wear that is both on-trend and comfortable.

The brand's agility in responding to global fashion movements is a key differentiator. By quickly adapting to international trends and introducing new collections on a monthly basis, Tom Tailor ensures its offerings remain fresh and relevant. This rapid product cycle is crucial in the fast-paced fashion industry, enabling them to capture consumer interest effectively throughout the year.

Tom Tailor Holding AG's mid-price segment accessibility is a cornerstone of its business model, offering consumers good quality fashion at competitive prices. This strategy makes stylish apparel attainable for a wide audience within the mid-income bracket, effectively bridging the gap between high-end fashion and budget options. In 2023, the company reported a revenue of €763.7 million, demonstrating the significant market reach of its accessible pricing strategy.

Tom Tailor Holding AG's broad product range and diverse brand portfolio are cornerstones of its business model, effectively capturing a wide customer base. The company strategically leverages its core brands, Tom Tailor and Bonita, to cater to distinct demographic segments and fashion preferences. This allows for targeted marketing and product development, ensuring relevance across various consumer needs.

Further diversifying its appeal, Tom Tailor Holding AG offers specialized lines such as Tom Tailor Denim, Lifestyle, and Kids. This multi-brand strategy, encompassing everything from casual wear to more specific collections, allows the company to address a spectrum of tastes and age groups. For instance, in 2024, the Tom Tailor brand continued to focus on its core demographic of 20-45 year olds, while Bonita maintained its appeal to the 40+ age segment.

Commitment to Sustainability

Tom Tailor's commitment to sustainability is a core value proposition, evident in its 'BE PART' initiative. This program champions the use of environmentally friendly materials and ensures fair working conditions across its entire supply chain. This focus not only appeals to a growing segment of eco-conscious consumers but also significantly bolsters the brand's reputation.

The company's dedication to sustainability translates into tangible actions that benefit both the planet and its stakeholders. By prioritizing eco-friendly sourcing and ethical manufacturing, Tom Tailor aims to reduce its environmental footprint and foster a more responsible fashion industry.

In 2024, Tom Tailor continued to expand its range of sustainable products. For instance, they reported that over 50% of their cotton purchases were from more sustainable sources, a significant increase from previous years. This commitment is reflected in their product labeling, making it easier for consumers to identify and choose more environmentally responsible options.

- Sustainable Materials: Offering products made from recycled polyester, organic cotton, and other eco-friendly alternatives.

- Ethical Supply Chain: Partnering with suppliers who adhere to fair labor practices and safe working conditions.

- Consumer Engagement: Educating customers about sustainability through transparent product information and marketing campaigns.

- Environmental Impact Reduction: Implementing measures to decrease water consumption, energy usage, and waste generation in production.

Omnichannel Shopping Experience

Tom Tailor Holding AG focuses on delivering an integrated omnichannel shopping experience, making it easy for customers to connect with the brand and buy products wherever they are. This approach ensures convenience by allowing engagement through physical stores, a robust online platform, and collaborations with wholesale partners.

This strategy bridges the gap between online browsing and in-store purchasing, offering flexibility. For instance, customers can check stock availability online before visiting a physical store, or vice versa. This seamless integration is crucial in today's retail landscape. In 2024, the apparel market continued to see a strong demand for such integrated experiences, with many consumers expecting to switch between channels effortlessly. Tom Tailor’s efforts in this area aim to capture a broader customer base and increase overall sales by meeting diverse shopping preferences.

- Seamless Integration: Customers can browse online, purchase in-store, or collect online orders at a physical location, enhancing convenience.

- Multi-Channel Reach: The brand maintains a strong presence across its own e-commerce site, physical retail stores, and through various wholesale partners, broadening accessibility.

- Customer Engagement: This approach fosters consistent brand interaction, allowing customers to engage with Tom Tailor through their preferred channel, whether digital or physical.

- Adaptability to Market Trends: By investing in omnichannel capabilities, Tom Tailor positions itself to capitalize on evolving consumer shopping habits, which heavily favor integrated retail experiences.

Tom Tailor Holding AG offers fashionable casual wear for the entire family, emphasizing an authentic and stylish aesthetic that appeals to a broad customer base seeking on-trend, comfortable everyday clothing. The brand's agility in adapting to global fashion trends, with monthly collection updates, ensures its offerings remain fresh and relevant. This commitment to timely fashion, combined with accessibility in the mid-price segment, allows Tom Tailor to capture significant market share, as evidenced by its €763.7 million revenue in 2023.

The company strategically leverages its diverse brand portfolio, including core brands Tom Tailor and Bonita, alongside specialized lines like Tom Tailor Denim, to cater to distinct demographic segments and fashion preferences. This multi-brand approach, targeting age groups from 20-45 with Tom Tailor and 40+ with Bonita in 2024, ensures broad market penetration and relevance across various consumer needs.

Tom Tailor's commitment to sustainability is a key value proposition, driven by its 'BE PART' initiative, which prioritizes eco-friendly materials and ethical supply chains. In 2024, over 50% of their cotton purchases were from more sustainable sources, reflecting a tangible effort to reduce environmental impact and appeal to eco-conscious consumers.

An integrated omnichannel shopping experience is central to Tom Tailor's customer engagement strategy, allowing seamless interaction across physical stores, its online platform, and wholesale partners. This adaptability to evolving consumer habits, with a strong demand for integrated retail experiences in 2024, enhances accessibility and aims to increase overall sales.

Customer Relationships

Tom Tailor AG focuses on fostering customer loyalty through engaging programs. A key initiative is their partnership with MBRC the ocean, launched in April 2024. This collaboration allows customers to contribute to ocean conservation efforts with their purchases, deepening brand connection and encouraging repeat business.

Tom Tailor Holding AG leverages data-driven strategies to segment its customer base, enabling highly personalized communication. For instance, in 2024, the company continued to refine its approach to targeted email campaigns, analyzing purchase history and browsing behavior to offer relevant product recommendations and promotions. This data-informed approach allows for tailored content, ensuring that each customer receives communications that resonate with their individual style and needs, thereby enhancing engagement and loyalty.

Tom Tailor Holding AG actively manages customer relationships by systematically gathering feedback. They collect insights at crucial moments, such as post-purchase and after delivery, to gauge customer satisfaction levels.

This collected feedback isn't just stored; it's analyzed to pinpoint areas of both satisfaction and dissatisfaction. For instance, during 2024, a significant portion of customer comments focused on delivery times and product quality.

The insights derived from this feedback loop directly inform improvements. Tom Tailor uses this data to refine its product offerings and enhance the overall customer journey, aiming to address recurring concerns and capitalize on positive trends.

By prioritizing active feedback management, Tom Tailor fosters loyalty and ensures its business model remains responsive to evolving customer expectations in the dynamic fashion retail landscape.

Social Media Engagement

Tom Tailor actively uses social media platforms like Instagram and Facebook to engage with its customer base, fostering a direct line of communication. These campaigns are designed to be responsive to current fashion trends and build a loyal community that identifies with the brand's values. This approach strengthens the customer connection by facilitating immediate dialogue and feedback.

In 2024, Tom Tailor continued to invest in its digital presence, aiming to increase social media engagement rates. For instance, campaigns often feature user-generated content and interactive polls, encouraging participation and making customers feel more involved. The company’s strategy focuses on creating relatable content that resonates with its target demographic.

- Brand Community Building: Social media efforts are geared towards creating a sense of belonging and shared interest among customers, turning followers into brand advocates.

- Trend Responsiveness: Platforms allow for real-time adaptation to emerging fashion trends, ensuring Tom Tailor remains relevant and appealing to consumers.

- Direct Customer Interaction: This channel provides a space for direct dialogue, enabling the brand to answer queries, gather feedback, and address concerns promptly, thereby enhancing customer satisfaction.

- Data-Driven Insights: Engagement metrics from social media are analyzed to understand customer preferences and inform future product development and marketing strategies.

In-store Experience

Tom Tailor Holding AG focuses on creating an appealing and service-oriented in-store experience across its own retail and franchise locations. This commitment extends to developing innovative store concepts designed to enhance the real-life brand interaction and guide customers through effective product presentation.

A key initiative in 2024 was the launch of the Denim shop-in-shop concept. This strategic move aims to deepen customer engagement by offering a more curated and immersive experience within the brand's denim offerings, thereby strengthening the physical retail presence.

- Enhanced In-Store Experience: Tom Tailor prioritizes creating inviting and service-focused environments in both directly operated and franchised stores.

- New Store Concepts: The introduction of innovative store designs, such as the 2024 Denim shop-in-shop, aims to elevate the physical brand encounter.

- Customer Guidance: These new concepts are designed to assist customers with product discovery and selection through improved visual merchandising and layout.

- Brand Immersion: The goal is to foster a stronger connection with the brand by offering a richer, more engaging real-world shopping journey.

Tom Tailor Holding AG cultivates strong customer relationships through a multi-faceted approach, emphasizing personalized communication and community building. Their 2024 initiatives, including partnerships like MBRC the ocean and refined digital engagement strategies, aim to foster loyalty and create deeper brand connections.

Channels

Tom Tailor leverages its own retail stores as crucial direct-to-consumer touchpoints, fostering brand immersion and driving sales. As of 2024, the company actively manages a significant footprint of 577 retail stores strategically positioned across 23 European countries.

These company-owned outlets are more than just sales channels; they are designed to be vibrant brand experience centers, allowing customers to directly engage with Tom Tailor's collections and brand identity.

Tom Tailor Holding AG leverages a robust wholesale strategy, acting as a key driver for product distribution and revenue. This channel focuses on reaching customers through an extensive network of multi-brand retail locations and independent resellers.

This widespread presence is a significant contributor to the company's sales. In 2024, Tom Tailor's products were available across more than 10,100 multi-brand points of sale, demonstrating the breadth of its wholesale partnerships.

Tom Tailor Holding AG leverages its own e-shop alongside strategic partnerships with major e-commerce platforms such as Zalando and About You to maintain a robust online presence. This multi-channel approach is fundamental to driving digital sales growth and effectively responding to evolving consumer shopping habits.

In 2024, the fashion industry continued to see a significant shift towards online retail. For Tom Tailor, this means that platforms like Zalando, which reported strong revenue growth in early 2024, and About You, a key player in the German-speaking market, are vital for reaching a broad customer base and capitalizing on the digital commerce trend.

These e-commerce channels are not just sales outlets but also crucial touchpoints for brand engagement and customer acquisition. By offering a seamless online shopping experience and utilizing the reach of these established marketplaces, Tom Tailor aims to capture a larger share of the growing online fashion market, enhancing its overall revenue streams.

Franchise Stores and Shop-in-shops

Tom Tailor Holding AG significantly expands its market reach through a robust network of 170 franchise stores and an impressive 2,300 shop-in-shops. This strategy allows the company to place its brands, Tom Tailor and Bonita, within existing retail environments, effectively creating dedicated selling spaces without the full overhead of standalone stores.

These partnerships are crucial for reaching a wider customer base and increasing brand visibility. For instance, as of the first half of 2024, the franchise and shop-in-shop segments contributed to the company's overall sales performance, demonstrating their importance in the omnichannel strategy.

- Franchise Stores: 170 locations, offering dedicated Tom Tailor and Bonita retail experiences.

- Shop-in-Shops: 2,300 locations, integrating brand presence within larger retail partners.

- Market Penetration: These channels are key to extending geographical reach and accessing new customer demographics.

- Sales Contribution: In early 2024, these combined channels played a vital role in the company's revenue generation.

Licensed Product Distribution

Tom Tailor leverages strategic partnerships to expand its brand reach through licensed product distribution. This includes collaborations for categories like fragrances and eyewear, which are then channeled through specialized retail environments.

These specialized channels, such as perfumeries and opticians, offer targeted access to consumers actively seeking these product types. This complements Tom Tailor's existing sales avenues, which include its own brick-and-mortar stores and e-commerce platforms.

For example, in 2024, Tom Tailor continued to emphasize its licensing business as a key growth driver. While specific revenue figures for licensed product distribution aren't always broken out individually, the overall licensing segment has historically contributed significantly to brand visibility and revenue diversification for fashion retailers.

The strategy allows Tom Tailor to tap into the expertise and established customer bases of specialized distributors. This approach amplifies the brand's presence without requiring direct investment in niche retail infrastructure for every product category.

- Partnership Expansion: Tom Tailor actively seeks and maintains partnerships for product licensing, focusing on categories like fragrances and eyewear.

- Dual Distribution Channels: Licensed products are distributed through both specialized retail partners (perfumeries, opticians) and Tom Tailor's own sales channels (retail stores, online).

- Market Penetration: This strategy enhances market penetration by reaching specific consumer segments through expert third-party retailers.

- Brand Diversification: It allows the brand to extend its lifestyle offerings into new product categories, increasing overall brand appeal and revenue streams.

Tom Tailor's channel strategy is a multi-pronged approach designed for maximum market penetration and customer engagement. The company operates a significant network of 577 directly managed retail stores across 23 European countries as of 2024, serving as key brand experience hubs. Complementing this, a robust wholesale operation distributes products through over 10,100 multi-brand points of sale, significantly broadening its reach.

The digital realm is equally vital, with Tom Tailor's own e-shop and partnerships with major platforms like Zalando and About You catering to evolving online shopping habits. Furthermore, 170 franchise stores and 2,300 shop-in-shops in 2024 extend brand presence within existing retail environments, effectively expanding market access without the full investment of standalone outlets. Licensing agreements for products like fragrances and eyewear through specialized retailers also contribute to brand diversification and revenue.

| Channel Type | 2024 Presence (Approx.) | Key Role |

|---|---|---|

| Retail Stores (Owned) | 577 stores in 23 countries | Direct sales, brand experience |

| Wholesale | >10,100 points of sale | Broad distribution, market reach |

| E-commerce (Own + Partners) | Active presence on Zalando, About You | Digital sales growth, customer acquisition |

| Franchise Stores | 170 locations | Brand expansion, market penetration |

| Shop-in-Shops | 2,300 locations | Increased brand visibility, strategic placement |

| Licensed Products | Via specialized retailers (e.g., opticians) | Product category diversification, targeted reach |

Customer Segments

Tom Tailor AG designs fashion for everyone, from the youngest to the oldest. Their product lines cater specifically to men, women, and children, ensuring a comprehensive offering for the entire family. This broad demographic appeal is a cornerstone of their business strategy.

The company’s commitment to serving all age groups is evident in their dedicated collections. They provide fashion for men and women, alongside specialized lines like Tom Tailor Denim for younger demographics and distinct ranges for kids, minis, and babies. This segmentation allows them to meet diverse style preferences across different life stages.

In 2023, Tom Tailor’s wholesale business, which significantly influences their customer reach, saw a positive development. While specific customer numbers by segment aren't publicly detailed, the overall strategy aims to capture a substantial share of the fashion market by appealing to a wide age and gender spectrum.

Tom Tailor AG's mid-income consumers are individuals who value a blend of quality, style, and affordability. They are actively looking for fashionable casual wear that doesn't break the bank, making them a core demographic for the brand's accessible pricing strategy.

In 2024, this segment continues to be a significant driver of sales for fashion retailers. Consumers in this bracket are often budget-conscious but still desire to stay current with trends, seeking out brands that offer good value for their money.

Tom Tailor's focus on the mid-price segment means they cater to a broad base of shoppers who appreciate well-made garments at competitive price points. This approach positions the company to capture a substantial portion of the market seeking everyday stylish apparel.

The company's commitment to offering fashionable casual wear at competitive prices directly addresses the needs of these mid-income consumers. This strategy ensures they remain a relevant choice for a large and discerning customer group.

Casual Wear Enthusiasts are the heart of Tom Tailor's customer base. These are individuals who value a relaxed yet stylish approach to their daily attire, seeking comfort without compromising on fashion. They want to feel good and look put-together whether they're running errands or meeting friends.

Tom Tailor's core strategy directly addresses this segment by offering versatile pieces that embody a confident, authentic, and fashionable casual lifestyle. The brand aims to be the go-to for everyday wear that supports this self-expression. In 2023, the casual wear segment continued to be a significant driver for the apparel industry, with consumers increasingly prioritizing comfort and durability in their purchasing decisions, a trend that Tom Tailor is well-positioned to capitalize on.

Environmentally and Socially Conscious Consumers

Environmentally and socially conscious consumers represent a significant and expanding demographic for fashion retailers. These individuals prioritize brands that demonstrate a commitment to sustainability, ethical labor practices, and open communication regarding their supply chains. Tom Tailor actively engages this segment through its 'BE PART' initiative, which highlights efforts in responsible sourcing and production.

This growing customer base is increasingly influential, impacting purchasing decisions and brand loyalty. For instance, a 2024 study indicated that over 60% of consumers consider sustainability when buying clothing. Tom Tailor's transparency in its operations, from material sourcing to manufacturing, directly addresses the core values of this consumer group.

- Growing Market Share: This segment's purchasing power is on the rise, demanding more responsible business practices.

- Brand Loyalty Drivers: Transparency and demonstrable sustainability efforts foster stronger customer relationships.

- Impact of Initiatives: Tom Tailor's 'BE PART' initiative aims to resonate with these values, potentially increasing market penetration within this segment.

- Information Demands: Consumers in this segment actively seek detailed information about product origins and ethical production standards.

European Markets Focus

Tom Tailor Holding AG's customer segmentation heavily emphasizes its European core markets. This includes a strong presence in Germany, Austria, Switzerland, the Benelux region, and France. The company is also strategically expanding its reach into Southeastern European markets, indicating a clear geographical focus.

This European concentration allows Tom Tailor to leverage established brand recognition and tailor its product offerings to specific regional preferences and economic conditions. The company's commitment to these key territories underpins its sales and marketing strategies.

- Primary European Markets: Germany, Austria, Switzerland, Benelux, France.

- Expansion Focus: Ongoing development in Southeastern Europe.

- Geographical Segmentation: Tailoring strategies to regional market nuances.

- Brand Leverage: Utilizing established presence in core European countries.

Tom Tailor AG targets a broad demographic, focusing on men, women, and children with distinct product lines. Their core customer base comprises mid-income individuals who prioritize fashionable casual wear that is both stylish and affordable. This segment values quality and seeks to stay current with trends without overspending.

A significant portion of their customers are casual wear enthusiasts who appreciate comfort and style for everyday life. The company also appeals to environmentally and socially conscious consumers by highlighting its sustainability initiatives, such as the 'BE PART' program. This growing segment prioritizes brands with ethical practices and transparent supply chains.

Geographically, Tom Tailor's primary focus remains on its core European markets, including Germany, Austria, Switzerland, the Benelux countries, and France. They are also strategically expanding into Southeastern Europe, leveraging established brand recognition while adapting to regional preferences.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Mid-Income Consumers | Value style, quality, and affordability in casual wear. | Continue to drive sales for fashion retailers, seeking good value. |

| Casual Wear Enthusiasts | Seek comfortable, stylish, and versatile everyday apparel. | Prioritize comfort and durability, a trend Tom Tailor is positioned for. |

| Environmentally/Socially Conscious | Value sustainability, ethical practices, and transparency. | Over 60% of consumers consider sustainability in clothing purchases (2024 estimate). |

| European Core Markets | Germany, Austria, Switzerland, Benelux, France. | Established brand recognition supports sales and marketing strategies. |

Cost Structure

The Cost of Goods Sold (COGS) for Tom Tailor Holding AG encompasses expenses directly tied to creating their apparel and accessories. This includes the cost of fabrics, buttons, zippers, and other components, as well as the wages paid to factory workers involved in the production process. For instance, in 2023, Tom Tailor's COGS amounted to €602.8 million, representing a significant portion of their overall operational expenses.

Sustainable sourcing and material choices, while aligning with modern consumer values, can influence these direct costs. Opting for higher-quality, ethically produced materials or investing in environmentally friendly manufacturing processes might initially lead to higher per-unit costs. However, these choices can also mitigate long-term risks and enhance brand reputation, a factor increasingly valued by their target demographic.

Operating expenses for Tom Tailor Holding AG are significant, encompassing the costs of running its extensive retail and wholesale operations. These include essential expenditures like rent for its 577 retail stores, utilities to keep them operational, salaries for a large retail workforce, and ongoing maintenance to ensure a positive customer experience.

Beyond the direct costs of physical stores, managing a vast wholesale network also contributes substantially to operating expenses. This involves costs associated with sales teams, marketing efforts targeting wholesale partners, and the administrative overhead required to support these relationships.

Logistics and distribution are another major component of the cost structure. Efficiently moving goods from suppliers to warehouses and then to the 577 retail locations and numerous wholesale clients requires significant investment in transportation, warehousing, and inventory management systems.

For instance, in 2023, Tom Tailor Holding AG reported a notable portion of its revenue dedicated to cost of sales and operational expenses, reflecting the scale of its physical retail footprint and wholesale distribution network. These expenses are crucial for maintaining brand presence and ensuring product availability across diverse sales channels.

Marketing and sales expenses are a significant investment for Tom Tailor Holding AG, encompassing activities like brand building, advertising, and digital marketing. In 2024, the company continued to allocate substantial resources to these areas to maintain its market presence. These costs are essential for driving sales across their diverse retail and online channels.

Specific initiatives include targeted advertising campaigns and collaborations with influencers to reach a broader audience. Sales promotions are also a key component, designed to boost immediate sales and attract new customers. These expenditures are vital for supporting the company's growth objectives and ensuring continued brand visibility in a competitive fashion market.

E-commerce and IT Infrastructure Costs

Tom Tailor Holding AG's e-commerce and IT infrastructure represent a significant portion of its cost structure. These expenses are crucial for maintaining and evolving its digital presence, which is vital in today's retail landscape. The company invests heavily in its online platforms, encompassing website hosting, e-commerce software, and robust cybersecurity measures to protect customer data and ensure seamless transactions.

Beyond day-to-day operations, Tom Tailor is committed to digital transformation, which includes implementing advanced technologies. Initiatives like supply chain traceability platforms, such as RETRACED, and predictive pricing tools, like 7Learnings, are key investments. These technologies aim to optimize operations, enhance customer experience, and drive profitability.

In 2024, the company's focus on digital capabilities underscores the importance of IT in its business model. While specific figures for this segment are part of broader operational expenses, the strategic emphasis on these digital tools highlights their substantial financial commitment. This investment is geared towards future growth and competitive advantage in the evolving fashion retail market.

- Website Hosting and E-commerce Software: Ongoing costs for maintaining the online store's functionality and user experience.

- Cybersecurity: Investments in protecting customer data and preventing online threats.

- Digital Transformation Initiatives: Funding for projects like RETRACED for supply chain visibility and 7Learnings for dynamic pricing.

- IT Maintenance and Upgrades: Costs associated with keeping the entire technological infrastructure up-to-date and efficient.

Administrative and General Expenses

Administrative and General Expenses represent the essential overhead required to keep Tom Tailor Holding AG functioning. These costs encompass salaries for corporate leadership and administrative staff, alongside expenditures for legal counsel, accounting services, and the general management of the business. A significant portion of these expenses is tied to the operations of their headquarters located in Hamburg, Germany.

For Tom Tailor Holding AG, these administrative costs are a crucial element of their overall cost structure. In 2024, managing these overheads efficiently is key to maintaining profitability and supporting strategic initiatives across the group. The company's ability to control these expenses directly impacts its bottom line.

- Corporate Salaries: Compensation for executive and administrative teams.

- Professional Services: Costs associated with legal, accounting, and consulting engagements.

- Headquarters Operations: Expenses related to the main administrative hub in Hamburg.

- General Management: Outlays for the overall oversight and direction of the company.

Tom Tailor Holding AG's cost structure is multifaceted, with significant outlays in Cost of Goods Sold (COGS), operating expenses, marketing, IT, and administration. In 2023, COGS stood at €602.8 million, highlighting the direct costs of materials and production. Operating expenses, covering the vast retail and wholesale networks, are substantial, as are investments in marketing and digital transformation, including e-commerce and IT infrastructure.

| Cost Category | 2023 (€ million) | Key Components |

|---|---|---|

| Cost of Goods Sold (COGS) | 602.8 | Fabrics, production labor, components |

| Operating Expenses | - | Retail store rent, utilities, staff salaries, wholesale support |

| Marketing & Sales | - | Advertising, digital marketing, sales promotions |

| IT & E-commerce | - | Platform maintenance, cybersecurity, digital transformation initiatives |

| Administrative & General | - | Corporate salaries, legal, accounting, HQ operations |

Revenue Streams

Revenue streams for Tom Tailor Holding AG are significantly driven by retail sales. This includes income generated directly from their 577 own retail stores and also from the 170 franchise stores they operate as of 2024. These physical locations are crucial for direct customer engagement and brand presence, contributing substantially to overall sales figures.

Wholesale sales represent a core revenue stream for Tom Tailor Holding AG, generated by selling their apparel and accessories to a diverse network of multi-brand retailers and other wholesale partners. This channel is crucial for reaching a broader customer base and extending the brand's presence across various markets.

In 2024, the wholesale segment continued to be a significant contributor to the company's overall financial performance. While specific figures for 2024 wholesale revenue are still being finalized, the company has historically relied on this channel to drive substantial income, showcasing its enduring importance in their business strategy.

Tom Tailor's e-commerce sales are a vital revenue stream, generated through its proprietary online shop and partnerships with various third-party e-commerce platforms. The company is strategically prioritizing and investing in its digital presence to amplify these online sales.

In 2024, Tom Tailor continued to focus on enhancing its online capabilities. While specific consolidated e-commerce revenue figures for 2024 aren't yet fully detailed, the group's overall performance highlights a growing importance of digital channels in its sales mix. The company's commitment to strengthening its online business reflects a broader industry trend and a key element of its strategy to reach a wider customer base and drive revenue growth.

Licensing Royalties

Tom Tailor Holding AG generates revenue through licensing royalties, primarily from agreements where external partners produce and sell products under the Tom Tailor brand in categories such as fragrances and eyewear. These partnerships allow the company to expand its brand reach without the direct costs of manufacturing and distribution.

For instance, in 2023, licensing agreements contributed to the overall financial performance of Tom Tailor, although specific figures for this segment are often embedded within broader revenue reporting. These royalties represent a crucial component of the company's strategy to leverage its established brand name across a wider array of consumer goods.

- Brand Extension: Licensing allows Tom Tailor to offer products in categories like accessories and personal care, enhancing brand visibility and consumer touchpoints.

- Reduced Capital Expenditure: The company avoids significant investment in manufacturing facilities and inventory for licensed products.

- Partnership Leverage: External partners handle production, marketing, and sales, sharing the operational burden and risk.

- Royalty Income: Tom Tailor receives a percentage of sales revenue or a fixed fee from its licensing partners, providing a steady income stream.

Sale of Accessories and Footwear

Tom Tailor Holding AG generates revenue from the sale of accessories and footwear, which are crucial complementary products to their core apparel offerings. These items, including shoes, bags, belts, and scarves, enhance the lifestyle appeal and provide customers with complete outfit solutions.

This segment caters to a broader customer base by offering fashion-forward yet practical accessories that align with their clothing collections. The strategy aims to increase the average transaction value by encouraging add-on purchases.

For instance, in 2023, the accessories and footwear segment contributed significantly to the overall sales performance of the company. While specific segment breakdowns can fluctuate, accessory and footwear sales often represent a notable portion of a fashion retailer's revenue, with industry reports indicating this category can account for 10-20% of total apparel sales for similar brands.

- Revenue Diversification: Accessories and footwear broaden the product portfolio beyond clothing, capturing a wider market segment and increasing sales opportunities.

- Customer Lifestyle Offering: These items complete the fashion look, allowing customers to purchase a full ensemble, thereby enhancing customer loyalty and spending.

- Profitability Potential: Often, accessories and footwear can carry higher profit margins compared to core apparel, contributing positively to overall profitability.

- Brand Enhancement: Well-curated accessory lines reinforce the brand's image and lifestyle positioning, making the brand more attractive to consumers.

Tom Tailor Holding AG's revenue streams are multifaceted, encompassing both direct-to-consumer sales and wholesale activities. The company leverages its physical retail footprint, with 577 own stores and 170 franchise locations as of 2024, to drive significant revenue. Alongside this, a robust wholesale channel serves a broad network of retailers, extending the brand's reach across diverse markets.

Digital commerce is a critical and growing revenue contributor for Tom Tailor. The company actively invests in its e-commerce platform and collaborates with third-party online retailers to capture a wider customer base. This strategic focus on digital channels reflects the evolving retail landscape and the company's commitment to expanding its online sales presence.

In addition to direct sales, Tom Tailor generates income through licensing agreements, allowing third parties to produce and market products under the brand name in categories such as fragrances and eyewear. This strategy capitalizes on brand recognition while minimizing capital expenditure for the company.

| Revenue Stream | Description | Key Aspects |

|---|---|---|

| Retail Sales | Income from owned and franchise stores. | Direct customer interaction, brand visibility. |

| Wholesale Sales | Sales to multi-brand retailers and partners. | Broad market reach, extended brand presence. |

| E-commerce Sales | Revenue from proprietary online shop and third-party platforms. | Digital presence enhancement, wider customer access. |

| Licensing Royalties | Income from brand usage agreements for categories like fragrances and eyewear. | Brand extension, reduced capital expenditure. |

| Accessories & Footwear | Sales of complementary fashion items. | Revenue diversification, increased transaction value. |

Business Model Canvas Data Sources

The Tom Tailor Holding AG Business Model Canvas is informed by a robust combination of financial disclosures, internal sales data, and comprehensive market research reports. These sources provide a solid foundation for understanding customer segments, value propositions, and revenue streams.