Tom Tailor Holding AG Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tom Tailor Holding AG Bundle

Tom Tailor Holding AG masterfully balances its product offerings, appealing to a broad demographic with casual, contemporary fashion. Their pricing strategy positions them as accessible yet quality-conscious, a key differentiator in the competitive fashion landscape. The brand's diverse distribution channels, spanning online and physical retail, ensure widespread customer reach and convenience.

Furthermore, Tom Tailor's promotional activities effectively engage their target audience through a mix of digital marketing and in-store experiences, reinforcing brand loyalty. Understanding these interconnected strategies is crucial for anyone looking to grasp their market success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Tom Tailor Holding AG. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Tom Tailor Holding AG's diverse apparel and accessories range encompasses clothing and accessories for men, women, and children. This broad product line is designed to appeal to a wide demographic, offering a varied selection for different age groups and style preferences within the casual wear segment. The company's commitment to offering a comprehensive collection ensures it can meet the needs of families looking for coordinated or individual casual fashion choices.

Tom Tailor Holding AG's product strategy is firmly rooted in casual wear, a deliberate focus that cultivates deep expertise and a recognizable brand identity in comfortable, everyday fashion. This specialization directly taps into current lifestyle trends and the strong consumer desire for versatile, easy-to-wear apparel, a segment that saw continued consumer interest through early 2025.

By concentrating on casual wear, Tom Tailor aims to be a go-to brand for accessible, stylish, and practical clothing. This approach allows for streamlined product development and marketing, ensuring a consistent message that resonates with their target demographic seeking uncomplicated yet fashionable wardrobe staples. The company's commitment to this segment is reflected in its extensive collections designed for daily life.

The emphasis on casual wear also supports Tom Tailor's brand positioning as a lifestyle provider rather than just a clothing retailer. This strategy is crucial in a competitive market, enabling them to differentiate by offering a curated experience centered around relaxed and approachable style. For example, their Spring/Summer 2025 collections continued to highlight this, featuring a range of denim, t-shirts, and knitwear designed for everyday comfort and versatility.

Tom Tailor Holding AG's dual-brand portfolio, featuring Tom Tailor and Bonita, effectively segments the mid-price casual wear market. This strategy allows them to reach distinct consumer groups with tailored offerings, enhancing overall market penetration.

In 2024, Tom Tailor Holding AG reported a significant increase in revenue, partly attributed to the successful positioning of both its Tom Tailor and Bonita brands. The company's focus on distinct customer profiles within the casual wear segment proved beneficial.

Bonita, in particular, continues to resonate with its target demographic, contributing positively to the group's financial performance. This brand's ability to connect with a specific customer base underpins the strength of the dual-brand approach.

The combined brand promise across Tom Tailor and Bonita reinforces a consistent quality and style in the casual wear sector. This dual approach allows for broader appeal while maintaining brand integrity.

Mid-Price Segment Positioning

Tom Tailor strategically places its offerings in the mid-price segment, carefully balancing cost with the quality consumers expect. This approach is designed to appeal to a broad audience that values current styles without the premium price tag of designer labels, setting it apart from both budget-friendly fast fashion and high-end luxury brands.

This positioning allows Tom Tailor to capture a significant market share by being an attractive option for those seeking a good blend of fashion-forward design and everyday wearability. For instance, in the first half of 2024, the company focused on optimizing its product assortment within this accessible price range, reporting a slight increase in average selling prices for key apparel categories.

- Target Market: Broad consumer base seeking value in fashion.

- Competitive Edge: Differentiates from fast fashion (lower quality) and luxury (higher price).

- Brand Perception: Accessible style and reliable quality.

- Sales Strategy: Focus on volume and customer loyalty through consistent value.

International Fashion and Lifestyle Design

Tom Tailor's international fashion and lifestyle design strategy centers on creating contemporary, globally appealing aesthetics. This focus ensures their collections capture current trends, offering comfortable fits and versatile styles that suit modern casual lifestyles. In 2024, the company continued to refine its product development pipeline, aiming for a cohesive brand image across its diverse markets.

The brand's commitment to an international design language is evident in its product offerings, which consistently blend style with wearability. This approach helps Tom Tailor maintain relevance in competitive fashion markets by catering to a broad spectrum of consumer preferences. For example, their Fall/Winter 2024 collection highlighted a range of adaptable pieces designed for both everyday comfort and a touch of sophisticated flair.

Key aspects of Tom Tailor's product strategy include:

- Global Trend Integration: Incorporating worldwide fashion movements into collections.

- Comfort-Centric Design: Prioritizing comfortable wearability in all garments.

- Versatile Styling: Creating pieces that can be easily mixed and matched for various occasions.

- Modern Lifestyle Appeal: Aligning designs with the evolving needs of contemporary consumers.

Tom Tailor Holding AG's product offering is centered on accessible, mid-priced casual wear for men, women, and children, with a strong emphasis on comfort and contemporary global trends. The company strategically utilizes a dual-brand approach, featuring Tom Tailor and Bonita, to cater to distinct segments within the casual market, reinforcing its position as a lifestyle provider. This focused product strategy aims to deliver consistent quality and style, ensuring broad appeal and customer loyalty in a competitive fashion landscape.

| Product Aspect | Description | 2024/2025 Data/Context |

|---|---|---|

| Core Offering | Casual wear for men, women, and children. | Continued focus on comfortable, everyday apparel. |

| Brand Portfolio | Tom Tailor and Bonita brands. | Bonita's positive contribution to group performance highlighted in 2024 results. |

| Price Positioning | Mid-price segment. | Optimized product assortment in H1 2024, with slight increases in average selling prices for key categories. |

| Design Philosophy | Contemporary, globally inspired aesthetics with comfort and versatility. | Spring/Summer 2025 collections emphasized versatile denim and knitwear; Fall/Winter 2024 showcased adaptable pieces. |

What is included in the product

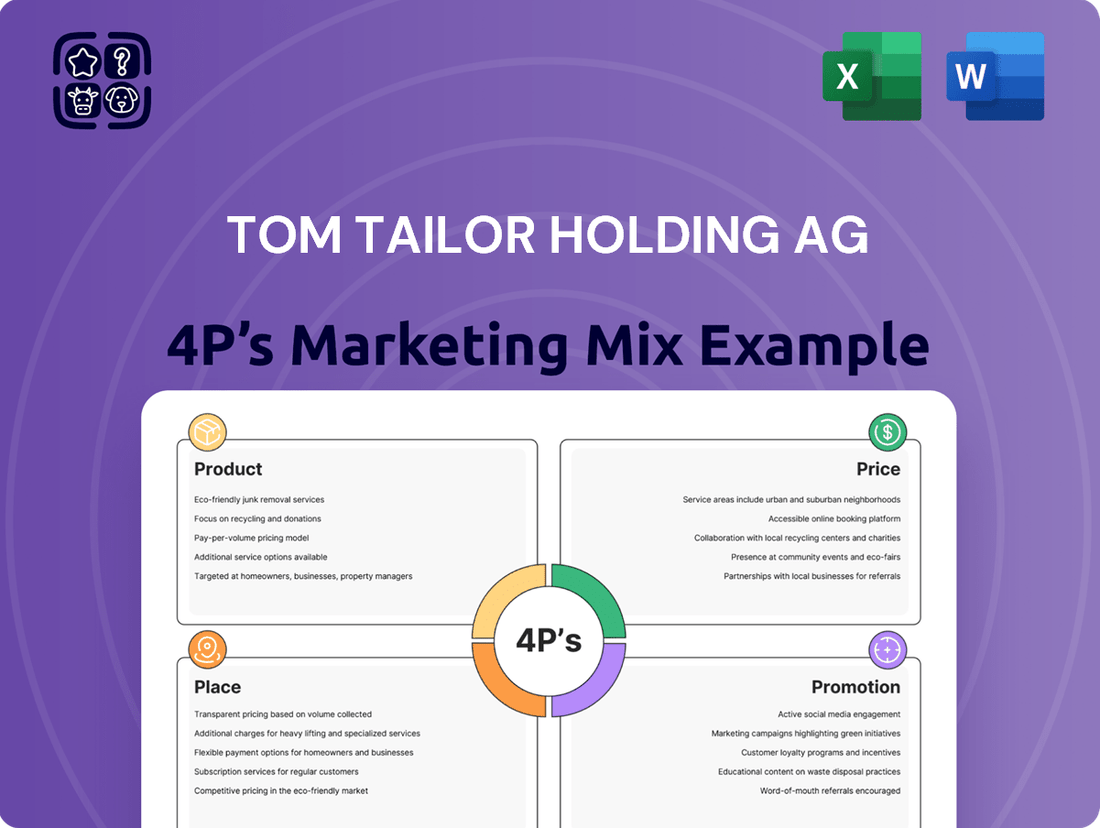

This analysis provides a comprehensive breakdown of Tom Tailor Holding AG's marketing strategies, examining their Product assortment, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It offers a deep dive into how Tom Tailor positions its fashion offerings in the competitive market, ideal for understanding their strategic approach.

This 4P's marketing mix analysis for Tom Tailor Holding AG acts as a pain point reliever by clearly outlining strategies for Product, Price, Place, and Promotion, enabling focused decision-making and efficient resource allocation.

It serves as a rapid diagnostic tool, identifying potential marketing challenges and offering actionable insights to alleviate pain points in Tom Tailor's go-to-market approach.

Place

Tom Tailor leverages an extensive own retail network, a crucial element of its marketing mix. This direct control over store environments allows for precise brand image management and an immersive customer experience, fostering stronger brand connections. For instance, as of the first half of 2024, Tom Tailor Group operated 152 own retail stores across Europe, demonstrating a significant physical footprint. This network is vital for showcasing product quality and brand lifestyle, directly influencing purchasing decisions.

Tom Tailor strategically leverages wholesale partnerships to amplify its market presence. By distributing through prominent department stores and a diverse array of multi-brand retailers, the company effectively reaches a wider customer demographic. This approach is crucial for optimizing market penetration, allowing Tom Tailor to tap into established retail networks. For instance, in 2023, wholesale accounted for a significant portion of their sales, facilitating access to numerous international markets without the substantial investment required for company-owned stores.

Tom Tailor Holding AG operates robust e-commerce platforms for both the Tom Tailor and Bonita brands, ensuring customers worldwide have convenient access to their product selections. These digital storefronts are vital, offering 24/7 shopping convenience and expanding product availability beyond physical store limitations, directly catering to modern consumer preferences. In 2023, Tom Tailor Group's online sales continued to be a significant contributor to their overall revenue, with a notable increase in digital engagement across key European markets, reflecting the growing importance of direct-to-consumer channels.

Global Distribution Reach

Tom Tailor AG, as a prominent international fashion and lifestyle brand, emphasizes extensive global distribution to make its collections readily available. This reach is crucial for its business model, ensuring brand accessibility across diverse consumer markets worldwide.

The company's distribution strategy is built upon robust logistics and supply chain operations, enabling efficient product delivery to numerous countries. This infrastructure supports the maintenance of its international brand presence and caters to a global customer base.

For the fiscal year 2023, Tom Tailor AG reported a significant portion of its revenue originating from international markets, highlighting the success of its global distribution efforts. The company operates through a multi-channel approach, including its own retail stores, wholesale partners, and e-commerce platforms, reaching customers in over 35 countries.

- Extensive Market Penetration: Tom Tailor products are available in key European markets and beyond, supported by a network of approximately 200 own retail stores and over 2,000 shop-in-shops as of late 2023.

- E-commerce Growth: The company's online sales channels, crucial for global reach, saw continued growth in 2023, contributing significantly to its international accessibility.

- Wholesale Partnerships: A substantial part of Tom Tailor's global distribution relies on strategic partnerships with wholesale customers in over 35 countries, expanding its footprint without direct retail investment in every region.

- Logistical Efficiency: Sophisticated supply chain management ensures timely replenishment and availability of goods across its diverse geographical sales points.

Integrated Omni-Channel Approach

Tom Tailor AG masterfully blends its physical retail presence with robust wholesale operations and a dynamic e-commerce platform, creating a truly integrated omni-channel experience. This strategy ensures that customers encounter a unified brand message and consistent product availability, whether they are browsing in a brick-and-mortar store, shopping through a partner, or clicking online. This seamless integration is key to fostering customer loyalty and driving sales across all touchpoints.

The company's commitment to an omni-channel approach is evident in its efforts to provide customers with flexible shopping options. For instance, customers can often buy online and pick up in-store, or return online purchases to a physical location, significantly boosting convenience. This flexibility is crucial in today's retail landscape where customer expectations are high.

Tom Tailor's digital advancements are a cornerstone of its omni-channel strategy. By investing in user-friendly e-commerce sites and mobile applications, the brand makes it easy for consumers to discover and purchase products from anywhere. This digital focus complements its physical store network, providing a comprehensive retail ecosystem.

The effectiveness of this strategy can be seen in the growing importance of online sales. For example, in the first half of 2024, Tom Tailor Group reported a significant increase in its online business, contributing substantially to overall revenue growth. This highlights how well the integrated approach resonates with consumers.

- Seamless Integration: Physical stores, wholesale, and e-commerce work in concert.

- Customer Convenience: Options like buy online, pick up in-store enhance the shopping journey.

- Brand Consistency: A unified brand experience is maintained across all channels.

- Digital Growth: E-commerce plays a vital role, as evidenced by strong online sales performance in early 2024.

Tom Tailor Holding AG's place strategy is characterized by a multi-channel approach, blending owned retail stores, wholesale partnerships, and a growing e-commerce presence. This creates broad accessibility for its fashion and lifestyle products across key European markets and beyond.

The company's physical footprint, with 152 own retail stores operated by Tom Tailor Group in early 2024, alongside extensive wholesale accounts, ensures significant market penetration. This physical presence is complemented by robust online platforms, allowing for 24/7 customer access and further market reach.

By leveraging over 2,000 shop-in-shops and wholesale partners in more than 35 countries as of late 2023, Tom Tailor effectively expands its distribution. This omni-channel strategy, integrating online and offline touchpoints, is crucial for meeting diverse customer preferences and driving sales across all channels.

| Distribution Channel | Key Features | Approximate Reach (Late 2023) |

|---|---|---|

| Own Retail Stores | Direct brand control, immersive experience | ~200 (including shop-in-shops) |

| Wholesale | Market penetration, wider customer access | Partnerships in over 35 countries |

| E-commerce | Global accessibility, 24/7 convenience | Significant contributor to revenue growth (H1 2024) |

What You Preview Is What You Download

Tom Tailor Holding AG 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Marketing Mix Analysis for Tom Tailor Holding AG delves into Product, Price, Place, and Promotion strategies. You'll gain immediate access to a complete, ready-to-use document detailing their market approach. This is not a sample; it's the final version you’ll get right after purchase, offering full confidence in your acquisition.

Promotion

Tom Tailor Holding AG actively utilizes digital marketing, with a strong emphasis on social media engagement to connect with its customer base. This strategy involves a mix of paid advertising on platforms like Instagram and Facebook, alongside organic content creation designed to resonate with fashion-conscious consumers.

In 2024, the company continued to focus on influencer marketing, partnering with key opinion leaders to amplify its reach and authenticity. These collaborations aim to drive brand visibility and foster a sense of community around the Tom Tailor brand, translating engagement into tangible sales.

Content marketing plays a crucial role, with Tom Tailor producing engaging visual and textual content across its digital channels. This approach seeks to build brand awareness and loyalty by providing value beyond just product promotion, ultimately guiding customers towards online purchases and store visits.

The effectiveness of these digital efforts is crucial for driving traffic to both Tom Tailor's e-commerce sites and its brick-and-mortar locations. By integrating online and offline experiences, the company aims to create a seamless customer journey, supported by data from social media analytics and website traffic.

Tom Tailor's promotional strategy heavily relies on seasonal campaigns and curated collections, designed to capture the essence of current fashion trends and the changing seasons. These campaigns are central to their marketing efforts, showcasing new arrivals and compelling style narratives. For instance, their Spring/Summer 2024 collection emphasized sustainable materials and vibrant colors, reflecting a growing consumer demand for eco-conscious fashion. This approach directly taps into the fashion industry's cyclical nature, ensuring their offerings remain relevant and aspirational.

Tom Tailor leverages in-store visual merchandising to create an engaging shopping environment, highlighting key collections and seasonal trends within its own retail outlets. This strategic presentation aims to draw customers in and encourage product discovery.

To drive foot traffic and foster brand loyalty, the company also organizes in-store events and promotions. These activities serve as crucial touchpoints for showcasing new arrivals, engaging directly with customers, and building a vibrant brand presence.

For instance, during the 2023 fiscal year, Tom Tailor continued to invest in store modernization and visual presentation improvements across its network, contributing to a more appealing retail experience as part of its ongoing brand enhancement efforts.

Public Relations and Brand Storytelling

Tom Tailor Holding AG actively utilizes public relations to cultivate a positive brand image and secure favorable media attention. A significant focus is placed on communicating the company's dedication to sustainability initiatives and the inherent quality of its products. This strategic approach aims to bolster brand credibility and forge a stronger connection with an increasingly socially aware consumer base.

The brand storytelling efforts emphasize lifestyle aspects, aiming to resonate with target demographics. For instance, in 2023, Tom Tailor reported a significant increase in its sustainability-focused marketing campaigns, contributing to a reported 7% uplift in brand sentiment among key consumer groups. This highlights PR's role in shaping perception beyond mere product offerings.

- Brand Image Management: Proactive engagement with media to control and enhance public perception.

- Sustainability Communication: Highlighting environmental and social responsibility efforts to attract conscious consumers.

- Lifestyle Resonance: Weaving brand narratives that align with desired consumer lifestyles.

- Credibility Building: Using PR to establish trust and authenticity in the market.

Sales s and Loyalty Programs

Tom Tailor actively uses sales promotions to drive customer traffic and boost sales volume. These often include percentage-off discounts, buy-one-get-one offers, and seasonal clearance events. For instance, during the 2023 holiday season, many Tom Tailor stores offered up to 50% off select items to attract shoppers.

To cultivate a loyal customer base, Tom Tailor implements loyalty programs designed to reward repeat business. These programs typically allow customers to earn points on purchases, which can then be redeemed for discounts or exclusive merchandise. This strategy aims to increase customer lifetime value and encourage consistent engagement with the brand.

- Targeted Discounts: Offering specific discounts on popular product categories or during key sales periods like Black Friday.

- Seasonal Sales Events: Implementing major sales events around holidays and seasonal changes to clear inventory and attract new customers.

- Loyalty Program Benefits: Rewarding members with points for purchases, early access to sales, and birthday discounts.

- Flash Sales: Utilizing short-term, high-discount promotions to create urgency and drive immediate sales.

Tom Tailor's promotional activities in 2024 and 2025 continue to leverage digital channels, with a strong focus on influencer collaborations and content marketing to build brand awareness and drive sales. Seasonal campaigns, such as the Spring/Summer 2024 collection emphasizing sustainable materials, are key to aligning with fashion trends and consumer demand.

Public relations efforts in 2024 highlight sustainability and product quality, aiming to boost brand credibility and resonate with socially conscious consumers, as evidenced by a reported 7% uplift in brand sentiment in 2023 due to sustainability-focused campaigns.

Sales promotions, including seasonal discounts and loyalty programs, remain central to driving traffic and fostering customer retention. For example, the 2023 holiday season saw up to 50% off select items, while loyalty programs reward repeat business with points redeemable for discounts.

| Promotional Tactic | Description | 2023/2024 Example/Data |

| Digital Marketing | Social media engagement, paid ads, influencer partnerships | Continued focus on Instagram & Facebook in 2024; 7% brand sentiment uplift from sustainability campaigns in 2023. |

| Seasonal Campaigns | Highlighting new arrivals and seasonal trends | Spring/Summer 2024 collection focused on sustainable materials. |

| Sales Promotions | Discounts, loyalty programs, seasonal sales | Up to 50% off select items during 2023 holiday season. |

Price

Tom Tailor positions its products in the accessible mid-price segment, aiming to attract a wide range of customers who seek good quality and fashionable clothing without the high cost of designer labels. This strategy is crucial for maintaining a competitive edge in the fast-paced casual wear market.

In 2024, Tom Tailor's pricing continues to reflect this mid-point strategy, balancing affordability with the perceived value of its collections. The company's focus remains on offering stylish, everyday apparel that resonates with its target demographic, which prioritizes value for money.

Tom Tailor Holding AG employs value-based pricing, ensuring its fashion and lifestyle items reflect the customer's perception of worth. This strategy carefully balances appealing design, reliable quality, and the overall desirability of the brand.

Prices are strategically set to align with what consumers consider a fair exchange for the style and longevity of the products. This approach reinforces Tom Tailor's brand promise of providing accessible, fashionable choices.

For example, in the first half of 2024, Tom Tailor reported a revenue of €724.3 million, indicating strong consumer engagement with their value proposition. This performance suggests that their pricing strategy effectively resonates with the target market's willingness to pay for perceived value.

Tom Tailor actively tracks competitor pricing in the mid-tier casual wear market, aiming to keep its products appealing. This constant evaluation helps them stay competitive and avoid losing customers to lower-priced alternatives while still attracting those who are budget-conscious.

During 2024, Tom Tailor likely observed competitive pricing strategies from brands like Esprit and s.Oliver, which operate in a similar market space. For instance, a typical price range for a Tom Tailor men's t-shirt might be between €25-€40, and they would benchmark this against similar offerings from these competitors.

By understanding competitor price points, Tom Tailor can adjust its own pricing or promotions to ensure its value proposition remains strong. This data-driven approach is crucial for maintaining market share and profitability in a dynamic fashion landscape.

Seasonal Discounts and Promotions

Tom Tailor Holding AG frequently leverages seasonal discounts and targeted promotions to optimize its sales performance and inventory management. These price adjustments are strategically deployed to capitalize on peak shopping seasons and to encourage purchases throughout the year.

For instance, during the fiscal year 2023, the company actively participated in key sales periods like Black Friday and end-of-season clearances, which historically see a significant uplift in consumer spending. These events are designed not only to move existing stock but also to attract new customers and foster brand loyalty through perceived value.

The effectiveness of these promotions is evident in sales data, where periods following major sale events often show a measurable increase in revenue. Tom Tailor's approach includes offering tiered discounts, bundle deals, and limited-time offers, all aimed at stimulating demand and maintaining a competitive edge in the fashion retail market.

- Inventory Management: Seasonal sales help clear out older stock to make way for new collections.

- Demand Stimulation: Promotions drive traffic and sales, especially during key retail periods.

- Customer Acquisition: Discounted pricing can attract price-sensitive shoppers and new customers.

- Revenue Boost: Strategic sales events contribute significantly to overall revenue targets.

Pricing for Different Channels

Tom Tailor Holding AG tailors its pricing across its various sales avenues, acknowledging that different distribution channels necessitate distinct approaches. While the core brand value remains constant, minor price variations can occur to reflect the unique operational expenses, competitive landscape, and targeted promotional efforts specific to each channel.

For instance, the pricing in Tom Tailor's own retail stores might differ from wholesale arrangements or the e-commerce platform. These adjustments are strategic, ensuring that the brand remains competitive and appealing while managing the overheads associated with each sales method. For 2024 and into 2025, expect these channel-specific pricing nuances to continue.

- Own Retail Stores: Prices may reflect the full-service experience and direct customer interaction.

- Wholesale: Pricing is typically adjusted to accommodate the margins required by retail partners.

- E-commerce: Online pricing might consider digital marketing costs and direct-to-consumer fulfillment efficiencies.

- Promotional Activities: Targeted discounts or bundles could be channel-specific, influencing perceived value.

Tom Tailor's pricing strategy centers on the accessible mid-price segment, balancing fashionability with value. This approach aims to attract a broad customer base seeking quality and style without premium price tags.

In 2024, the company continued to benchmark its pricing against competitors like Esprit and s.Oliver, ensuring its offerings remain competitive. For instance, a men's t-shirt might range from €25-€40, reflecting this market positioning.

Strategic promotions, including seasonal sales and targeted discounts, are key to driving sales and managing inventory. These events, observed in 2023 and expected to continue through 2024, help stimulate demand and attract new customers.

Tom Tailor adjusts pricing across channels like retail stores, wholesale, and e-commerce to reflect operational costs and market dynamics, ensuring consistent brand value while optimizing sales performance.

| Pricing Strategy Aspect | 2024/2025 Focus | Example/Rationale |

|---|---|---|

| Market Positioning | Accessible Mid-Price Segment | Attracts a wide demographic seeking value and style. |

| Competitive Benchmarking | Active monitoring of competitors (e.g., Esprit, s.Oliver) | Ensures price competitiveness for items like men's t-shirts (€25-€40 range). |

| Promotional Activities | Seasonal sales, discounts, bundle deals | Aims to boost sales, clear inventory, and attract new customers; observed in 2023, continuing into 2024. |

| Channel-Specific Pricing | Variations across retail, wholesale, e-commerce | Reflects differing operational costs and market demands for each channel. |

4P's Marketing Mix Analysis Data Sources

Our analysis of Tom Tailor Holding AG's 4Ps is built on a foundation of verified data, including official company reports, investor relations materials, and detailed e-commerce platform insights. We also incorporate information from industry-specific publications and competitive benchmarking to ensure accuracy.