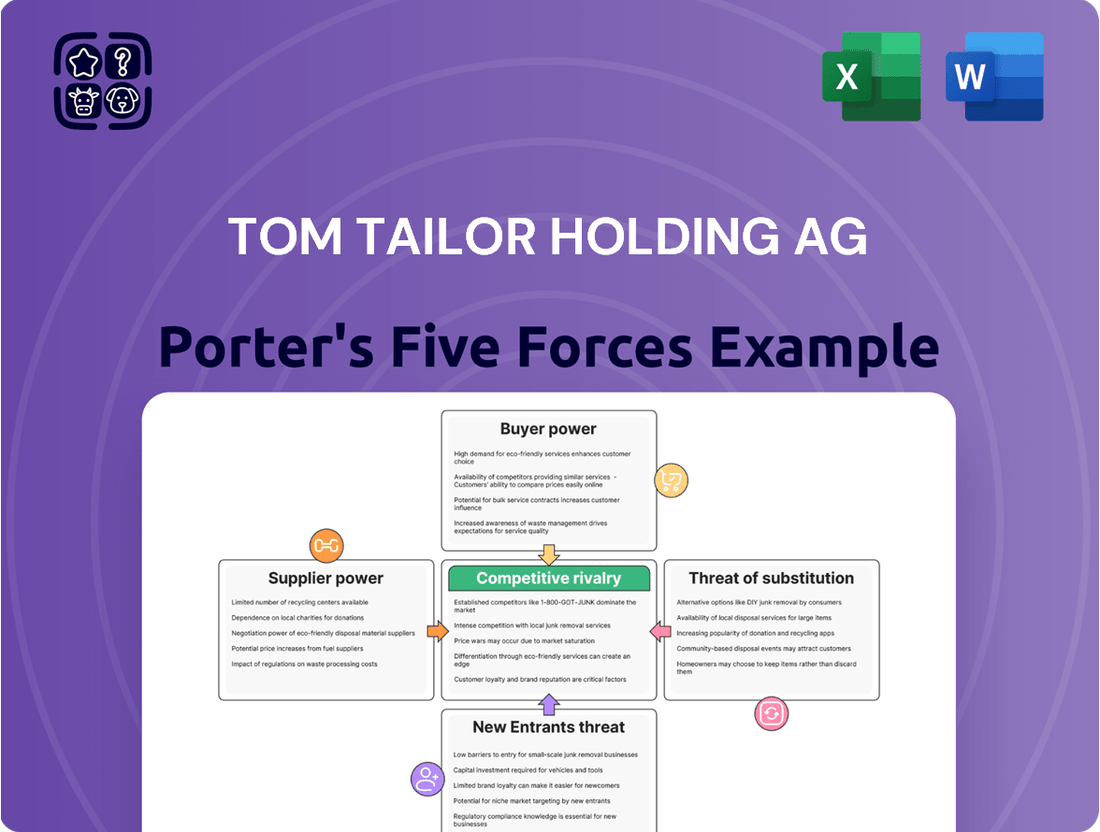

Tom Tailor Holding AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tom Tailor Holding AG Bundle

Tom Tailor Holding AG navigates a competitive fashion landscape where buyer power is significant due to readily available alternatives and price sensitivity. The threat of new entrants, while moderate, exists in the accessible fashion market, requiring continuous innovation and brand loyalty. Supplier power is generally low, with numerous textile producers, yet can increase for specialized or sustainable materials.

The threat of substitutes is a constant concern, with online retailers and fast-fashion brands offering diverse and often cheaper options to consumers. However, Tom Tailor's established brand presence and focus on specific customer segments can mitigate this. Intense rivalry among existing players, including numerous apparel brands, further shapes the industry dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tom Tailor Holding AG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The fashion industry, particularly in the mid-price casual wear segment where Tom Tailor operates, typically features a fragmented supplier base. This fragmentation means there are many textile and apparel manufacturers worldwide, which generally dilutes the bargaining power of any single supplier. For instance, in 2024, the global apparel manufacturing market continued to be characterized by a vast number of small to medium-sized enterprises, offering ample sourcing options for companies like Tom Tailor.

However, this dynamic can shift if Tom Tailor requires specialized materials or commitments to sustainable sourcing. In such niche areas, the number of qualified suppliers is often limited. If a significant portion of Tom Tailor's production relies on a few specialized suppliers for unique fabrics or ethically certified production, these suppliers gain considerable leverage. This leverage could manifest in demands for higher prices or more favorable payment terms, impacting Tom Tailor's cost structure.

Switching suppliers for Tom Tailor Holding AG involves moderate costs. These include expenses related to re-establishing new vendor relationships, implementing rigorous quality control checks for unfamiliar suppliers, and the potential for production delays during the transition. While these costs are not insurmountable, they do present a barrier to frequent supplier changes, thereby granting existing suppliers a degree of bargaining power.

For the majority of casual wear, the inputs Tom Tailor AG uses are readily available and standardized, which means suppliers have very little leverage. Think of basic cotton or polyester – many companies can supply these, keeping prices competitive. This commoditization inherently limits supplier power.

However, things change when Tom Tailor looks for something special. If they decide to use unique fabrics, perhaps with a particular weave or texture, or opt for eco-friendly materials that aren't widely produced, the suppliers of these niche items gain more influence. The fewer suppliers can provide these specialized inputs, the stronger their bargaining position becomes.

The increasing consumer focus on sustainability is a prime example. As demand for ethically sourced and environmentally friendly materials grows, the suppliers who can offer these specialized inputs are in a stronger position. For instance, a supplier of certified organic cotton or recycled polyester might command higher prices due to this rising demand and potentially limited production capacity.

In 2023, the global market for sustainable textiles was valued at approximately $10.9 billion and is projected to grow, indicating a tangible shift. This trend empowers those suppliers who can meet these specific, often higher-cost, material requirements, directly impacting Tom Tailor’s sourcing costs and strategies if they choose to prioritize these materials.

Threat of Forward Integration

The threat of Tom Tailor's suppliers integrating forward into apparel manufacturing and brand ownership is generally low. This is particularly true in the mid-price fashion segment where Tom Tailor operates. The significant capital investment needed for brand development, marketing, and establishing a robust retail distribution network presents a substantial barrier for most textile manufacturers.

Suppliers in this industry tend to concentrate on their core competencies, which lie in material sourcing, production, and efficient manufacturing processes. Venturing into the complex and highly competitive fashion retail landscape requires a different set of skills and resources, making forward integration an unattractive proposition for many.

For instance, while some large textile conglomerates might have the financial capacity, the operational shift and market understanding required to successfully launch and manage a fashion brand are considerable. This strategic focus on manufacturing rather than retail limits a key avenue through which supplier power could be amplified.

- Low Barrier to Entry for Suppliers: While capital requirements are high for fashion brands, the primary focus of textile suppliers is on production, not retail.

- Focus on Core Competencies: Textile manufacturers typically excel in material production and manufacturing, not brand building or retail distribution.

- Limited Forward Integration: The complexity and cost associated with establishing a brand and distribution network deter most suppliers from integrating forward.

Supplier Importance to Tom Tailor

Tom Tailor's substantial operational scale, encompassing a wide array of retail outlets, wholesale collaborations, and online sales channels, positions it as a considerable purchaser for its suppliers. This significant demand volume grants Tom Tailor considerable negotiating power, allowing for more favorable pricing and contractual conditions, particularly when dealing with smaller or medium-sized suppliers.

In 2023, Tom Tailor's consolidated revenue reached €631.4 million, underscoring its purchasing volume and its importance as a client for its supply chain partners. This financial weight translates directly into leverage during supplier negotiations.

- Significant Customer Volume: Tom Tailor's extensive sales network ensures it is a major buyer for many suppliers.

- Negotiating Leverage: Large order volumes allow Tom Tailor to secure better pricing and terms.

- Supplier Dependence: Smaller and medium-sized suppliers may be more reliant on Tom Tailor's business, increasing the company's bargaining power.

- Impact on Cost of Goods Sold: Favorable supplier terms directly contribute to managing Tom Tailor's cost of goods sold, impacting overall profitability.

For many of Tom Tailor's core products, the vast and fragmented supplier base for standard textiles like cotton and polyester significantly limits supplier bargaining power. This means suppliers have little leverage to dictate terms or prices for these common materials. However, this changes when Tom Tailor seeks specialized or sustainably sourced materials, where a limited number of suppliers can meet demand, thereby increasing their leverage.

The bargaining power of suppliers for Tom Tailor Holding AG is generally considered low to moderate. This is primarily due to the availability of numerous suppliers for standard materials and Tom Tailor's substantial purchasing volume, which provides significant leverage. While switching costs exist, they are manageable, and the threat of supplier forward integration is minimal.

Tom Tailor's robust sales, evidenced by its €631.4 million revenue in 2023, makes it a critical client for many suppliers, especially smaller ones. This scale grants Tom Tailor considerable negotiating power, enabling it to secure favorable pricing and terms, which directly impacts its cost of goods sold and overall profitability.

| Factor | Assessment | Impact on Tom Tailor |

|---|---|---|

| Supplier Concentration | Generally fragmented for standard materials; concentrated for specialized/sustainable materials. | Low leverage for common inputs; moderate leverage for niche inputs. |

| Switching Costs | Moderate due to relationship building, quality checks, and potential transition delays. | Slightly favors existing suppliers, but not prohibitive. |

| Availability of Substitutes | High for standard materials; low for specialized or certified materials. | Limits supplier power for commoditized inputs. |

| Supplier Forward Integration Threat | Low due to high barriers in brand building and retail. | Suppliers remain focused on manufacturing, not competing as brands. |

| Tom Tailor's Purchasing Volume | High, supported by €631.4 million revenue in 2023. | Significant leverage in negotiations, especially with smaller suppliers. |

What is included in the product

This analysis of Tom Tailor Holding AG's competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all crucial for understanding its strategic positioning.

A comprehensive Tom Tailor Holding AG Porter's Five Forces Analysis that pinpoints key industry pressures, enabling targeted strategies to mitigate competitive threats and enhance profitability.

Customers Bargaining Power

Customers in Tom Tailor's mid-price casual wear segment exhibit significant price sensitivity, a trend amplified by economic headwinds and inflationary pressures experienced throughout 2024. They actively seek the best value, scrutinizing pricing strategies and promotional offers.

The digital landscape, particularly e-commerce, has dramatically empowered these consumers. Easy access to price comparison tools, user reviews, and detailed product information across numerous online platforms means customers can readily assess alternatives and negotiate better deals, directly increasing their bargaining power against retailers like Tom Tailor.

The availability of numerous substitutes significantly weakens customer bargaining power for Tom Tailor. Consumers can readily find comparable casual wear from a wide range of competing brands, including fast fashion giants and established denim labels. This broad selection empowers customers to easily switch if Tom Tailor’s pricing, product quality, or fashion offerings don't meet their expectations.

The burgeoning second-hand and resale market further amplifies this pressure. For instance, platforms like Vinted and Zalando's pre-owned section offer customers access to a vast inventory of used clothing at lower price points. This trend, gaining considerable traction in 2024, provides an even more accessible alternative, forcing Tom Tailor to remain highly competitive on value to retain its customer base.

Tom Tailor AG's broad consumer base limits the bargaining power of individual customers. However, significant wholesale partners and large e-commerce platforms, by consolidating substantial order volumes, can indeed exert considerable influence. For instance, major department stores or online marketplaces often negotiate terms based on the sheer quantity of goods they procure, potentially impacting Tom Tailor's pricing and inventory management strategies.

Low Switching Costs for Customers

Customers of apparel brands like Tom Tailor Holding AG typically face very low switching costs. This means that a consumer can easily decide to purchase from a different brand without facing significant financial penalties, time investment, or the need to learn new processes. For instance, in 2024, the global apparel market is highly competitive, with numerous brands offering similar products, reinforcing this low switching cost dynamic.

This ease of transition directly enhances the bargaining power of customers. When switching is effortless, buyers can readily shift their spending to competitors if they perceive better value, quality, or price from another retailer. This situation puts pressure on Tom Tailor to remain competitive in its offerings and pricing strategies.

- Low Switching Costs: Consumers can easily switch between apparel brands without incurring financial or psychological barriers.

- Increased Buyer Power: This low switching cost empowers customers to demand better prices and quality from retailers.

- Competitive Landscape: The highly competitive nature of the apparel industry, with many brands offering similar products, amplifies customer choice and bargaining power.

- Impact on Loyalty: Maintaining customer loyalty becomes more challenging for companies like Tom Tailor when switching is so straightforward.

Product Differentiation

Tom Tailor operates in the casual wear market, which generally features less product differentiation compared to high fashion. This can inherently give customers more leverage. However, Tom Tailor's established brand identity and its design aesthetic can foster a degree of customer loyalty, somewhat counteracting this bargaining power.

In a highly competitive apparel landscape, Tom Tailor's ability to differentiate its products is paramount in reducing customer power. This differentiation can stem from unique design elements, consistent quality, or increasingly, a focus on sustainability practices. For instance, as of late 2023, many apparel brands, including those in the casual segment, were increasingly highlighting their use of recycled materials or ethical sourcing to attract environmentally conscious consumers.

- Brand Loyalty: While casual wear is a broad category, a strong brand image can cultivate repeat customers, lessening their inclination to switch based solely on price.

- Design Innovation: Unique and trend-aware designs can make Tom Tailor's offerings stand out, giving customers less readily available alternatives.

- Quality Perception: Consistent product quality builds trust and reduces the perceived risk for customers, making them less sensitive to price competition.

- Sustainability Initiatives: For a growing segment of consumers, a brand's commitment to sustainable practices can be a significant differentiator, influencing purchasing decisions.

The bargaining power of Tom Tailor's customers is substantial, driven by low switching costs and the availability of numerous substitutes in the casual wear market. In 2024, economic pressures further heightened customer price sensitivity, compelling them to seek value across a wide array of brands. The digital environment, with its price comparison tools and readily available reviews, amplifies this influence, making it easier for consumers to find competitive offers.

| Factor | Impact on Tom Tailor | 2024 Relevance |

|---|---|---|

| Switching Costs | Very Low | Consumers can easily shift to competitors with minimal effort. |

| Availability of Substitutes | High | Numerous brands offer similar casual wear, increasing customer choice. |

| Price Sensitivity | High | Economic conditions in 2024 increased focus on value for money. |

| Information Availability | High | Online platforms provide easy access to price comparisons and reviews. |

Preview the Actual Deliverable

Tom Tailor Holding AG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of Tom Tailor Holding AG through Porter's Five Forces, including the threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive analysis equips you with a deep understanding of the industry dynamics affecting Tom Tailor.

Rivalry Among Competitors

The mid-price casual wear market where Tom Tailor operates is intensely competitive. It's a crowded space with many domestic and international brands, from fast fashion behemoths to established high street names and a growing number of online-only retailers. This saturation means Tom Tailor faces constant pressure.

This fierce rivalry translates into aggressive pricing strategies and frequent promotional activities across the board. Brands are continually vying for customer attention through sales and discounts. For instance, in 2024, many retailers were observed to offer significant markdowns, especially during peak seasons, to clear inventory and attract price-sensitive consumers.

The need for continuous innovation is paramount. Companies like Tom Tailor must constantly refresh their collections, adapt to changing fashion trends, and improve their supply chains to remain relevant. This includes investing in new designs, sustainable materials, and efficient e-commerce platforms to keep pace with evolving consumer demands and competitor offerings.

While the global casual wear segment is anticipated to see some expansion, the broader fashion industry faced a period of slower growth leading into 2025. Revenue growth in the fashion sector was expected to hover in the low single digits. This environment of subdued market expansion naturally fuels more intense rivalry among existing players.

When the overall market isn't growing rapidly, companies must actively vie for existing customer bases and market share. This means that brands like Tom Tailor Holding AG are likely to encounter heightened competition as rivals focus on attracting customers through pricing, product differentiation, and marketing efforts, rather than simply benefiting from a booming market.

Tom Tailor, like many fashion retailers, faces intense rivalry driven by high fixed costs. These costs, encompassing everything from design and manufacturing to marketing campaigns and maintaining a physical store presence, create a significant barrier to exit and pressure companies to maintain sales volume. For instance, in 2023, Tom Tailor’s cost of sales was €647.9 million, highlighting the substantial operational expenses involved in the fashion industry.

The dynamic nature of fashion trends necessitates sophisticated inventory management. Companies must constantly balance the risk of overstocking obsolete items with the potential loss of sales from understocking popular products. This delicate act is amplified by the need to respond quickly to shifting consumer preferences. In 2023, Tom Tailor reported inventory levels of €252.1 million, underscoring the capital tied up in managing stock.

The pressure to move inventory, especially as seasonal collections change or trends evolve, often leads to aggressive discounting and promotional activities. This can trigger price wars among competitors, eroding profit margins for all players. Companies that fail to manage their inventory effectively are particularly vulnerable to these price pressures, as they may be forced to sell at steep discounts to clear excess stock.

Brand Identity and Differentiation

Tom Tailor’s competitive rivalry is intense, with a strong brand identity being essential for survival in the German fashion market. Differentiation hinges on consistent style, perceived quality, and effective marketing campaigns. The company faces significant pressure from fast-fashion giants like Zara and the rapidly growing ultra-fast fashion player Shein, both known for their agile supply chains and attractive price points.

- Brand Loyalty: Tom Tailor aims to build brand loyalty through its established presence and consistent product offering, contrasting with the trend-driven nature of some competitors.

- Market Saturation: The German apparel market is highly saturated, intensifying the need for clear differentiation and compelling value propositions to attract and retain customers.

- Price Sensitivity: Competitors like Shein, which reported significant revenue growth in its European operations, often leverage lower price points, putting pressure on mid-market brands like Tom Tailor to justify their pricing.

- Innovation Pace: The speed at which competitors like Zara and Shein introduce new collections forces Tom Tailor to be more agile in its product development and marketing strategies.

Exit Barriers

Tom Tailor Holding AG, like many in the fashion retail sector, faces significant exit barriers. These barriers can trap even struggling companies in the market, intensifying rivalry. Think about the substantial investments in physical retail spaces; closing these stores often involves penalties and unrecovered leasehold improvements, effectively locking companies into existing operations.

The fashion industry relies on established supply chains and supplier relationships. Terminating these contracts prematurely can incur significant costs and damage future sourcing capabilities. Furthermore, a brand's reputation, built over years, is difficult to divest or abandon without substantial loss, making it challenging for unprofitable entities to simply walk away.

These high exit barriers mean that even companies performing poorly may continue to operate, contributing to market overcapacity. This situation prolongs competitive pressure, as these firms fight to survive, impacting pricing and profitability for all players in the sector. For instance, while specific 2024 data for Tom Tailor's exit barriers isn't publicly detailed, the general industry trend shows many retailers struggling with lease obligations and inventory write-downs as they attempt to downsize or exit less profitable segments.

- Specialized Assets: Retail leases and store infrastructure represent substantial sunk costs, making closure financially punitive.

- Supply Chain Commitments: Long-term agreements with manufacturers and logistics providers create ongoing obligations.

- Brand Reputation: The effort and investment in building brand equity are difficult to recover upon exit.

- Labor Costs: Severance packages and contractual obligations to employees can be a significant exit expense.

Competitive rivalry in the casual wear market is a major force impacting Tom Tailor Holding AG. The sector is crowded with numerous domestic and international brands, including fast fashion giants and online-only retailers, creating intense pressure. This saturation leads to aggressive pricing, frequent promotions, and a constant need for innovation to stay relevant amidst evolving consumer demands. For example, many retailers in 2024 were observed offering significant discounts, especially during peak selling periods, to manage inventory and attract price-conscious shoppers.

The German apparel market, where Tom Tailor primarily operates, is highly saturated, demanding clear differentiation and strong value propositions. Competitors like Shein, known for its aggressive pricing, put considerable pressure on mid-market brands. This dynamic forces companies like Tom Tailor to be agile in product development and marketing, mirroring the pace set by players like Zara and Shein in introducing new collections.

High fixed costs associated with retail operations, marketing, and manufacturing create a significant pressure to maintain sales volume for brands like Tom Tailor. In 2023, Tom Tailor's cost of sales stood at €647.9 million, illustrating the substantial operational expenses involved. Furthermore, the challenge of managing inventory, with €252.1 million tied up in stock as of 2023, forces a delicate balance between avoiding obsolescence and meeting demand, often leading to price wars.

Tom Tailor faces formidable competition from fast-fashion giants like Zara and ultra-fast fashion players such as Shein, both of which boast agile supply chains and competitive price points. Building and maintaining brand loyalty through consistent style and perceived quality is crucial for Tom Tailor to stand out against the trend-driven strategies of its rivals. The rapid pace of new collection releases by competitors necessitates a more responsive approach to product development and marketing for Tom Tailor to remain competitive.

SSubstitutes Threaten

The burgeoning second-hand and resale market presents a substantial threat to Tom Tailor Holding AG. Driven by increasing consumer focus on sustainability and affordability, shoppers are increasingly turning to pre-owned apparel. This trend directly impacts the demand for new casual wear, as consumers can secure similar styles at a fraction of the original cost.

This shift is not a minor blip; the global secondhand apparel market is projected to reach $350 billion by 2027, according to ThredUp’s 2023 Resale Report. For a company like Tom Tailor, which operates in the casual wear segment, this means consumers may opt for a pre-owned jacket or pair of jeans instead of purchasing a new item, directly impacting sales volume and potentially forcing price reductions.

The rise of clothing rental services, while still developing, introduces a potential substitute, especially for items needed for specific events or those driven by rapidly changing fashion trends. This model offers consumers access to a wider variety of styles without the commitment of ownership, a concept gaining traction. For instance, services like Rent the Runway have seen significant growth, demonstrating consumer interest in this alternative consumption pattern. While not yet a major threat to Tom Tailor's core casual wear market, it highlights a broader shift in how consumers approach fashion consumption, potentially impacting long-term purchasing habits.

The rise of DIY and customization trends in fashion presents a significant threat of substitutes for companies like Tom Tailor. Consumers are increasingly engaging in modifying existing garments or creating entirely new pieces, which directly diminishes the demand for new, ready-made casual wear. This movement, fueled by a desire for individuality and sustainability, allows customers to extend the lifespan of their current clothing, potentially reducing their reliance on purchasing new items from established brands.

Non-Apparel Spending

The threat of substitutes for Tom Tailor Holding AG is significant, primarily stemming from non-apparel spending. Consumers possess discretionary income that can be directed towards a wide array of goods and services beyond clothing. This includes items like electronics, travel and leisure experiences, home furnishings, and even investments.

In periods of economic uncertainty or slowdown, consumers often become more cautious with their spending. This can lead to a prioritization of essential purchases or a shift towards lower-cost alternatives in discretionary categories. For instance, during 2024, inflationary pressures and concerns about global economic stability influenced consumer behavior across many sectors.

Data from early 2024 indicated that while consumer confidence saw some fluctuations, spending on experiences and technology remained robust, potentially at the expense of traditional retail categories like apparel. For example, reports showed continued strong consumer spending in areas such as digital entertainment and travel, diverting funds that might otherwise have been allocated to fashion purchases.

- Diversion of Discretionary Income: Consumers can allocate their disposable income to non-apparel categories like consumer electronics, travel, or home goods, directly competing for consumer spending.

- Economic Sensitivity: During economic downturns or periods of high inflation, as seen in various global markets through 2024, consumers may cut back on apparel spending to prioritize essentials or other discretionary items perceived as more valuable or necessary.

- Shifting Consumer Preferences: Evolving lifestyle choices and the rise of the experience economy mean consumers might opt for services or activities over physical goods, including clothing.

- Availability of Alternatives: The vast array of available goods and services outside the apparel sector means consumers always have choices for how to spend their money, making apparel a non-essential purchase for many.

Durability and Longevity of Existing Clothing

The growing emphasis on sustainability is a significant threat to casual wear brands like Tom Tailor. Consumers are increasingly looking for durable, timeless clothing that lasts longer, which directly reduces the demand for frequent new purchases. This shift means fewer sales for brands relying on regular replenishment of wardrobes.

This trend is amplified by a desire for value, encouraging shoppers to invest in fewer, higher-quality items. For instance, reports indicate a rise in the resale market for clothing, suggesting consumers are extending the life of their garments rather than buying new. This directly impacts the sales volumes for brands focused on more frequent, trend-driven purchases.

- Consumer shift towards sustainable fashion

- Increased demand for durable, long-lasting apparel

- Extended lifespan of existing wardrobes reducing purchase frequency

- Growth in the second-hand clothing market impacting new sales volumes

The threat of substitutes for Tom Tailor Holding AG is considerable, primarily stemming from non-apparel spending and evolving consumer values. The burgeoning second-hand market, projected to reach $350 billion by 2027, directly competes by offering similar styles at lower price points, fueled by sustainability concerns. Furthermore, the rise of clothing rental services and DIY fashion trends presents alternative consumption models that reduce the need for new purchases.

Consumers are increasingly prioritizing experiences and durable goods over frequent apparel purchases, especially during economic uncertainty, as observed throughout 2024. Inflationary pressures in 2024 also prompted consumers to re-evaluate discretionary spending, potentially diverting funds away from fashion towards essentials or perceived better value alternatives.

| Substitute Category | Key Driver | Impact on Tom Tailor | 2024 Data/Trend |

| Second-hand Market | Sustainability, Affordability | Reduced demand for new apparel, potential price pressure | Global resale market growth continues, ThredUp reported significant volume increases. |

| Rental Services | Variety, Event-specific needs | Potential shift from ownership to access for certain fashion segments | Emerging trend, consumer adoption varies by demographic and usage. |

| DIY & Customization | Individuality, Sustainability | Decreased reliance on ready-made garments | Growing online communities and platforms supporting DIY fashion. |

| Non-Apparel Spending | Discretionary Income Allocation | Competition for consumer wallet share | Strong spending in electronics and travel observed in 2024 despite economic headwinds. |

Entrants Threaten

Establishing a fashion brand with a physical retail presence, wholesale operations, and extensive marketing, much like Tom Tailor, demands significant upfront capital. This includes costs for inventory, store leases and fit-outs, supply chain development, and brand building. For instance, in 2023, Tom Tailor Holding AG’s capital expenditure was €15.1 million, illustrating the ongoing investment required to maintain and grow its infrastructure. This high capital requirement acts as a considerable deterrent for potential new competitors aiming to enter the market at a comparable scale and scope.

Established brands like Tom Tailor benefit from significant brand recognition and deep-seated customer loyalty, advantages that new market entrants simply do not possess. This existing trust acts as a substantial barrier, making it challenging for newcomers to attract and retain customers.

For any new company to gain traction, it must invest heavily in marketing and advertising campaigns to build brand awareness and establish trust in a saturated retail landscape. This considerable financial outlay and time commitment are significant hurdles for emerging competitors.

In 2023, the global apparel market was valued at approximately $1.7 trillion, highlighting the immense scale and competitiveness Tom Tailor operates within. Successfully carving out market share against established players requires more than just a competitive product; it demands a compelling brand narrative and consistent customer engagement.

New players face significant hurdles in securing access to established distribution channels. This includes the difficulty of obtaining prime retail locations, which are often already occupied by established brands. Furthermore, building crucial wholesale partnerships and integrating with major e-commerce platforms presents a considerable barrier to entry.

Tom Tailor Holding AG benefits from its well-established omnichannel presence, which includes a strong network of physical stores and a robust online platform. This existing infrastructure provides a significant advantage, making it harder for new entrants to compete for customer reach and sales volume. In 2023, Tom Tailor reported a significant portion of its sales coming through its own retail and online channels, underscoring the importance of this established distribution.

Supply Chain Complexity and Economies of Scale

The fashion industry, particularly for a company like Tom Tailor Holding AG, presents a significant barrier to new entrants due to the inherent complexity of developing and managing a global supply chain. This involves intricate sourcing of raw materials, overseeing diverse manufacturing processes, and coordinating logistics across multiple regions, all of which demand substantial expertise and capital investment.

Established players benefit from considerable economies of scale, allowing them to negotiate better prices for materials and production, and optimize shipping costs. For instance, in 2023, Tom Tailor's robust logistics network likely enabled them to absorb fluctuations in shipping rates more effectively than a smaller, newer competitor could. This scale advantage makes it challenging for newcomers to match the cost efficiencies of established brands.

- Supply Chain Investment: Building a comparable global supply chain infrastructure requires multi-million euro investments in technology, partnerships, and inventory management systems.

- Sourcing Power: Large volumes allow established companies to secure preferential terms with suppliers, a key differentiator in cost competitiveness.

- Logistical Efficiency: Optimized distribution networks reduce lead times and shipping expenses, creating a significant cost advantage over less experienced entrants.

- Risk Mitigation: Established firms have experience in managing supply chain risks, such as geopolitical disruptions or material shortages, which newer companies may not anticipate or handle effectively.

Regulatory and Sustainability Compliance

The fashion industry's increasing regulatory landscape presents a significant hurdle for new entrants, particularly concerning labor practices and environmental impact. Navigating complex compliance requirements, such as detailed sustainability reporting and ethical sourcing mandates, demands substantial upfront investment in systems and expertise. For instance, the EU's proposed Ecodesign for Sustainable Products Regulation, expected to be fully implemented by 2024-2025, will impose stringent requirements on material traceability and circularity, adding considerable cost and complexity for newcomers.

These compliance burdens can act as a strong deterrent, effectively raising the barrier to entry. New players must allocate significant resources to understand and implement these evolving standards, from supply chain transparency to chemical usage restrictions. Failure to comply can result in substantial fines and reputational damage, making it a critical consideration for any aspiring fashion brand.

- Increased compliance costs for new fashion brands.

- Stringent sustainability reporting and ethical sourcing mandates.

- EU's Ecodesign for Sustainable Products Regulation impacting material traceability by 2024-2025.

- Resource-intensive navigation of evolving environmental and labor standards.

The threat of new entrants for Tom Tailor Holding AG is moderate, primarily due to the substantial capital requirements for establishing a brand, securing prime retail locations, and building a global supply chain. While the fashion market is large, the cost of entry, coupled with the need for extensive marketing and navigating complex regulations like the EU's Ecodesign for Sustainable Products Regulation, deters many potential competitors. Existing brand loyalty and established distribution networks also present significant hurdles for newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tom Tailor Holding AG is built on a foundation of publicly available information, including the company's annual reports and financial statements. We also incorporate data from reputable industry analysis firms and relevant trade publications to provide a comprehensive view of the competitive landscape.