Tiger Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tiger Brands Bundle

Tiger Brands boasts strong brand recognition and a diversified product portfolio, key strengths in a competitive FMCG landscape. However, navigating economic volatility and evolving consumer preferences presents significant challenges.

Understanding the nuances of Tiger Brands' market position requires a deeper dive. Our comprehensive SWOT analysis reveals the intricate interplay of their internal capabilities and external market forces.

Want the full story behind Tiger Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Tiger Brands possesses a powerful stable of iconic brands deeply embedded in South African households, covering essential food, home, and personal care segments. Several of these brands, including Albany, Koo, Tastic, All Gold, and Purity, were highlighted in the 2024 Kantar Most Valued Brands report, underscoring their enduring consumer trust and significant market penetration.

This robust brand equity translates into a substantial competitive edge, fostering strong customer loyalty and establishing Tiger Brands as a go-to choice for consumers. The market leadership demonstrated by these brands provides a solid foundation for continued sales and revenue generation.

Tiger Brands demonstrated strong financial results for the year ending September 30, 2024. Revenue grew by 1% to R37.7 billion, and headline earnings per share (HEPS) saw a 4% increase. This positive trend signals that the company's revitalized strategy and ongoing improvement efforts are gaining traction.

The second half of 2024 was particularly strong, with performance surpassing earlier projections. This resilience highlights Tiger Brands' capacity to adapt to difficult economic environments and successfully boost its profitability.

Tiger Brands is sharpening its focus on cost optimization and efficiency as a core strength. This strategic turnaround plan is designed to streamline operations and unlock significant savings.

A key initiative involves reducing stock-keeping units by a targeted 20% over the next three years, aiming to simplify the product portfolio and reduce complexity. The company is also working to identify R500 million in cost savings across its entire value chain, demonstrating a commitment to financial discipline.

Further enhancing efficiency, Tiger Brands has restructured its operating model into six distinct business units. This decentralization of decision-making is intended to foster greater agility and responsiveness, contributing to substantial annual cost savings.

Expanding Reach in Informal Trade and Export Markets

Tiger Brands is significantly broadening its market presence by focusing on South Africa's informal trade sector. The company aims to reach 130,000 informal stores, such as spaza shops, by 2029, with a substantial 90,000 of these targeted for completion by the close of 2024. This strategic move into townships and rural areas, which are frequented by over 70% of South African households, unlocks considerable growth potential and improves product availability where it's most needed.

The company's export business is also showing robust expansion, particularly within key African markets. Tiger Brands is experiencing strong volume increases in countries like Mozambique, Zambia, and Zimbabwe, demonstrating its growing influence and product demand across the continent. This international growth complements its domestic expansion efforts.

- Informal Sector Expansion: Targeting 130,000 stores by 2029, with 90,000 expected by end-2024.

- Market Penetration: Reaching over 70% of South African households in townships and rural areas.

- Export Growth: Demonstrating strong volume growth in Mozambique, Zambia, and Zimbabwe.

Commitment to Innovation and Sustainability

Tiger Brands' commitment to innovation and sustainability is a significant strength, as demonstrated by their 2024 product launches. They are focusing on health and nutrition, introducing items like KOO Dry Pulses and Ace Baby in spoutless pouches, directly responding to consumer desires for healthier, more affordable, and convenient options. This strategic pivot is crucial in the current market environment.

The company's investment in product quality, food safety, and environmental stewardship further solidifies this strength. Initiatives like renewable energy adoption and waste reduction efforts are not only good for the planet but also align with increasing consumer demand for ethically sourced and sustainable products. This proactive approach positions Tiger Brands favorably for future growth.

Key initiatives supporting this strength include:

- Prioritizing Health and Nutrition: Launching new products like KOO Dry Pulses and Ace Baby in spoutless pouches in 2024.

- Addressing Consumer Trends: Catering to demand for health, affordability, and convenience in product development.

- Investing in Sustainability: Allocating resources to renewable energy and waste reduction programs.

- Strengthening Core Values: Enhancing product quality and food safety standards across the portfolio.

Tiger Brands boasts a portfolio of highly recognized and trusted brands, consistently appearing on Kantar’s Most Valued Brands list. This strong brand equity drives consumer loyalty and market leadership, ensuring consistent sales and revenue.

The company's financial performance in the year ending September 30, 2024, showcased resilience with a 1% revenue increase to R37.7 billion and a 4% rise in headline earnings per share. This growth, particularly strong in the second half of 2024, indicates successful strategic execution.

A key strength lies in Tiger Brands' aggressive cost optimization and efficiency drive, aiming for R500 million in savings. This includes simplifying the product range by reducing stock-keeping units by 20% and restructuring operations into six business units for greater agility.

Tiger Brands is expanding its reach significantly into the informal trade sector, targeting 130,000 stores by 2029, with 90,000 planned for completion by the end of 2024. This focus on townships and rural areas taps into over 70% of South African households, alongside robust export growth in markets like Mozambique, Zambia, and Zimbabwe.

Innovation and sustainability are central to Tiger Brands' strategy, evident in 2024 product launches like KOO Dry Pulses and Ace Baby pouches, catering to health and convenience demands. Investments in quality, safety, and environmental initiatives further bolster its market position.

| Strength Area | Key Initiative/Metric | Impact/Target |

|---|---|---|

| Brand Equity | Iconic Brands (Albany, Koo, Tastic, etc.) | High consumer trust, market leadership |

| Financial Performance (FY2024) | Revenue Growth | 1% increase to R37.7 billion |

| Financial Performance (FY2024) | HEPS Growth | 4% increase |

| Cost Optimization | SKU Reduction | Target of 20% over 3 years |

| Cost Optimization | Cost Savings Target | R500 million |

| Market Expansion (Informal Sector) | Store Target | 130,000 by 2029 (90,000 by end-2024) |

| Market Expansion (Informal Sector) | Household Reach | Over 70% in townships/rural areas |

| Export Growth | Key Markets | Strong volume increases in Mozambique, Zambia, Zimbabwe |

| Innovation & Sustainability | 2024 Product Launches | KOO Dry Pulses, Ace Baby pouches |

What is included in the product

Delivers a strategic overview of Tiger Brands’s internal and external business factors, highlighting its strong brand portfolio and market leadership while identifying operational challenges and competitive pressures.

Unpacks Tiger Brands' internal and external factors, highlighting threats and opportunities to inform strategic adjustments.

Identifies weaknesses and leverages strengths, offering a roadmap to mitigate risks and capitalize on market positions.

Weaknesses

Tiger Brands faced a significant challenge in its domestic operations, with volumes dropping by 8% for the fiscal year ending September 2024. This decline occurred even as revenue saw growth, primarily fueled by price increases. Essentially, the company sold fewer items despite charging more per item, pointing to consumers struggling with affordability and opting for more budget-friendly options.

The company itself admitted that its higher prices, particularly when compared to rivals, have resulted in a loss of market share. This is evident in key categories such as bread, maize, and cereals. Consumers are clearly making choices based on price, and Tiger Brands' premium pricing strategy has made it less competitive in these essential product segments.

Tiger Brands grapples with fluctuating commodity prices, a persistent vulnerability. The cost of key ingredients like cocoa beans, oranges, wheat, and maize can swing wildly, directly squeezing their profit margins even when they try to control expenses.

Global supply chain snags, amplified by things like extreme weather, political unrest, and logistical bottlenecks in South Africa, also pose a significant threat. These disruptions make it harder and more expensive to get the raw materials they need, sometimes forcing them to pay premium prices just to ensure supply.

For instance, the year-to-year volatility in global wheat prices, which saw significant spikes in late 2023 and early 2024 due to Black Sea disruptions, directly impacts Tiger Brands' baking and cereal divisions. This increased input cost pressure can erode gross margins, making it a constant challenge to maintain profitability.

While the company implements cost-saving measures, the underlying issue of securing essential raw materials at stable, predictable costs remains a concern for the long-term health of their operations and their ability to offer competitive pricing to consumers.

Tiger Brands faces formidable competition in the fast-moving consumer goods (FMCG) sector, both from global giants like Nestlé and Unilever, and established local players such as AVI and Premier Foods. This crowded marketplace means Tiger Brands constantly battles for consumer attention and loyalty.

The pressure intensifies as consumers increasingly opt for more affordable private label brands or cheaper alternatives, directly impacting Tiger Brands' market share and profit margins. This trend is particularly challenging when Tiger Brands' product portfolio is perceived as less budget-friendly.

For instance, in the fiscal year ending September 2023, Tiger Brands reported a 3% decline in its revenue for the Home and Personal Care segment, partly attributed to the competitive landscape and shifting consumer spending habits towards value offerings.

Navigating this intense rivalry requires continuous innovation and cost management to maintain competitiveness and market positioning against both international powerhouses and agile local competitors.

Operational Challenges and Past Missteps

Tiger Brands has historically grappled with significant operational hurdles, including past strategic missteps that led to investor disappointment and necessitated substantial restructuring efforts. For instance, the company has been actively working on reducing its complex product portfolio, aiming to streamline operations by cutting down on Stock Keeping Units (SKUs) to improve efficiency.

These ongoing restructuring initiatives highlight past inefficiencies that demanded a considerable overhaul. The implementation of a new federated operating model is a key part of addressing these legacy issues, and while early signs are positive, the company is still navigating the complexities of consolidating its manufacturing footprint.

- Historical operational challenges: Past missteps have impacted investor confidence and required significant organizational adjustments.

- SKU rationalization: Efforts are underway to simplify the product portfolio by reducing the number of Stock Keeping Units (SKUs).

- Manufacturing consolidation: The company continues to work on consolidating its manufacturing facilities to enhance operational efficiency.

Exposure to Socio-Economic Pressures in South Africa

South Africa's persistent socio-economic challenges significantly weigh on Tiger Brands' domestic operations. Weak economic growth, coupled with high unemployment, which stood at approximately 33.5% in the second quarter of 2024, severely curtails consumer purchasing power. This environment, characterized by widespread poverty and inequality, directly pressures consumer spending, making it difficult for Tiger Brands to achieve robust organic volume growth.

Even with a moderation in food price inflation, consumers continue to feel the pinch, impacting their demand for everyday packaged goods. This strained consumer sentiment directly translates into a more challenging market for Tiger Brands' product portfolio. The company's reliance on the South African market makes it particularly vulnerable to these localized economic pressures.

- Economic Slowdown: South Africa's GDP growth forecasts for 2024 and 2025 remain subdued, limiting overall market expansion.

- Unemployment Impact: High unemployment rates, around 33.5% in Q2 2024, reduce the disposable income available for consumer goods.

- Consumer Strain: Persistent poverty and inequality continue to pressure household budgets, dampening demand for packaged foods and beverages.

- Limited Volume Growth: The challenging socio-economic landscape directly constrains Tiger Brands' ability to drive organic volume increases within its core South African market.

Tiger Brands' domestic volumes dropped 8% in the fiscal year ending September 2024, despite revenue growth driven by price hikes. This indicates a loss of market share as consumers, squeezed by affordability issues, switch to cheaper alternatives. The company acknowledges that its higher pricing, particularly in staple categories like bread and cereals, has made it less competitive against rivals and private label brands.

Persistent vulnerability to fluctuating commodity prices, such as cocoa and wheat, directly impacts Tiger Brands' profit margins. Supply chain disruptions further exacerbate this, increasing input costs and making stable pricing a challenge. Intense competition from global and local players, coupled with a consumer shift towards value offerings, also pressures market share and profitability, as seen in the 3% revenue decline in the Home and Personal Care segment for FY2023.

The company continues to address historical operational inefficiencies and past strategic missteps, including ongoing SKU rationalization and manufacturing footprint consolidation. These efforts, while aimed at improving efficiency, highlight legacy challenges that require significant management attention and investment to overcome.

South Africa's challenging socio-economic environment, marked by a high unemployment rate (around 33.5% in Q2 2024) and subdued economic growth, significantly limits consumer purchasing power. This directly constrains Tiger Brands' ability to achieve robust organic volume growth in its primary market, as consumers remain under financial strain despite some moderation in food price inflation.

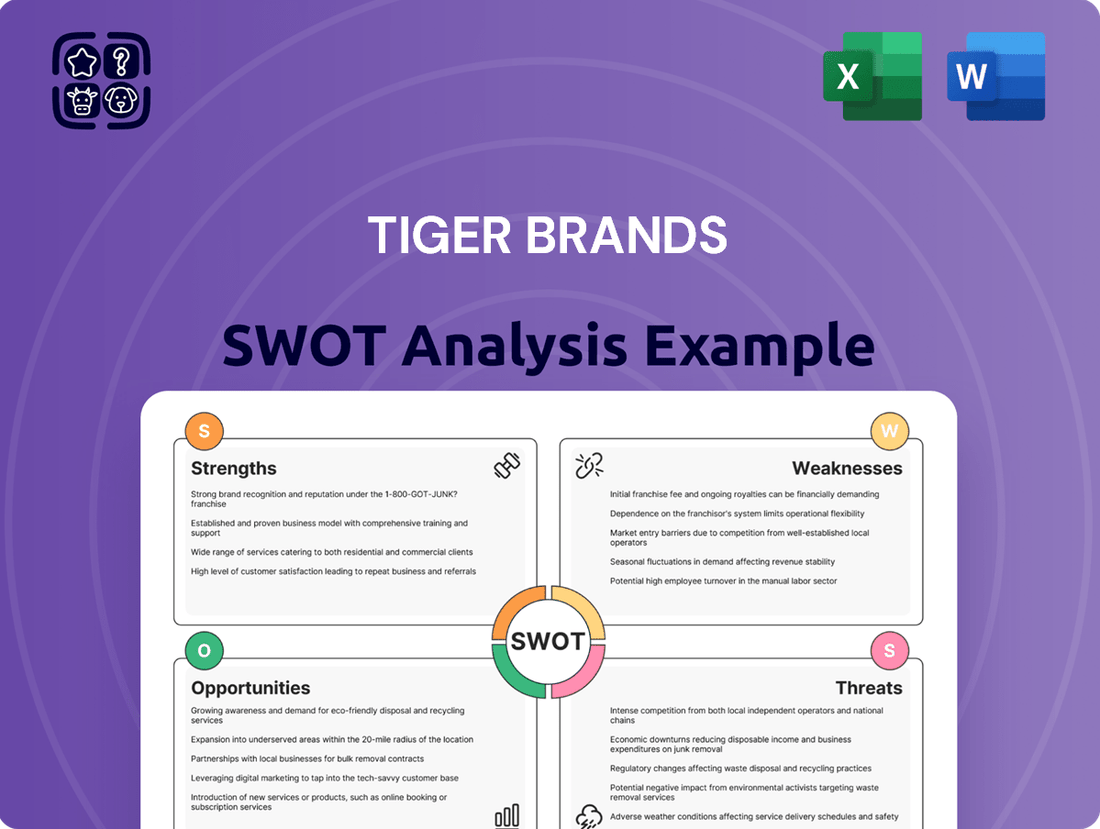

What You See Is What You Get

Tiger Brands SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Tiger Brands SWOT analysis you see here is an accurate representation of the comprehensive report you will download after purchasing. It details the company's Strengths, Weaknesses, Opportunities, and Threats with insightful analysis. You can trust that the content is complete and directly from the final document.

Opportunities

South African consumers are increasingly seeking healthier, organic, and plant-based food and beverage choices, reflecting a broader awareness of sustainability and ethical sourcing. This shift presents a significant opportunity for Tiger Brands. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow substantially, with South Africa showing a rising interest in these categories.

Tiger Brands can effectively leverage these trends by expanding its existing portfolio of health-conscious products and by fortifying popular items with added nutritional benefits. Investing in research and development for innovative products that align with these evolving consumer preferences will be key.

This strategic direction allows Tiger Brands to tap into a segment of the market that is often willing to pay a premium for products perceived to offer enhanced health and sustainability attributes. This can translate into increased market share and improved brand perception.

Tiger Brands sees significant opportunities in expanding its reach beyond South Africa. Many sub-Saharan African markets are expected to see modest economic growth, presenting a fertile ground for consumer goods. The company already has a presence, exporting to 29 African markets.

To capitalize on this, Tiger Brands is strategically planning to establish teams in key growth areas such as Kenya, Nigeria, Ghana, and the Democratic Republic of Congo. This direct presence will facilitate a deeper understanding of local consumer preferences and market dynamics.

By strengthening its distribution networks within these countries and developing product offerings specifically tailored to regional tastes and needs, Tiger Brands aims to unlock substantial new revenue streams. This approach is crucial for navigating diverse consumer landscapes across the continent.

The accelerating shift to e-commerce, particularly in South Africa's grocery sector, presents a significant opportunity for Tiger Brands. Online sales in the country surged by 29% in 2024, contrasting with a decline in traditional retail, highlighting a clear consumer preference shift. This trend underscores the need for robust digital infrastructure.

Tiger Brands can capitalize on this by increasing investment in digital systems. Automating supply and demand planning, along with digitizing its freight desk, can streamline operations and improve responsiveness to market changes. Enhancing e-commerce capabilities will be crucial to effectively reach and serve the growing segment of digitally active consumers.

Optimizing Portfolio and Strategic Disposals

Tiger Brands' strategic review and divestment of non-core assets, like the Baby Wellbeing business and specific cereal lines, is a key opportunity to refine its operational focus. This streamlining allows the company to concentrate on areas where it holds a competitive advantage and can achieve superior returns. For instance, in their financial year ending September 2023, Tiger Brands reported a notable improvement in their operating margin, partly due to these strategic adjustments, reaching 12.2% compared to 10.8% in the prior year.

By divesting underperforming or non-strategic units, Tiger Brands can reallocate capital and management attention to its core, high-growth segments. This strategic pruning is crucial for enhancing overall profitability and operational efficiency. The company's focus on categories like home care and snacks, which have shown resilient demand, is expected to drive future growth and margin expansion.

- Portfolio Optimization: Divesting non-core brands and units simplifies operations and enhances focus.

- Improved Profitability: Concentrating on 'right to win' categories can lead to higher margins.

- Resource Allocation: Freed-up capital can be reinvested into high-potential, core business segments.

- Operational Efficiency: Streamlining operations reduces complexity and improves overall performance.

Enhancing Affordability and Value Offerings

In South Africa's current economic climate, where consumers are highly sensitive to prices, Tiger Brands has a significant opportunity to boost affordability. This can be achieved through smart value engineering and ongoing improvement efforts across its product lines. For instance, by focusing on popular, basic nutritional needs, the company can cater to a wider segment of the population.

The company can strategically position itself by narrowing its price index relative to competitors. This approach is crucial for winning back market share, especially in categories where price is a primary driver.

Key strategies to enhance affordability and value include:

- Value Engineering: Redesigning products to maintain quality while reducing costs, making them more accessible.

- Promotional Strategies: Implementing targeted promotions and bundle deals to offer perceived value to price-conscious consumers.

- Product Portfolio Optimization: Focusing on core, high-demand products that meet basic nutritional needs, ensuring competitive pricing in these segments.

- Competitor Price Monitoring: Actively tracking and responding to competitor pricing to maintain a favorable price index.

For example, in 2023, the South African consumer price index (CPI) averaged 5.9%, indicating persistent inflation. Tiger Brands' ability to offer value-driven options becomes even more critical in such an environment. By focusing on affordability, Tiger Brands can tap into a larger consumer base, potentially reversing market share declines observed in certain categories.

Tiger Brands can capitalize on the growing demand for healthier, plant-based options by expanding its product offerings in this segment. The global plant-based food market, valued at approximately USD 29.7 billion in 2023, presents a substantial growth opportunity, with South Africa showing increasing interest.

Expanding its footprint in sub-Saharan Africa, where modest economic growth is expected, offers significant potential for consumer goods. The company's strategic plan to establish a presence in key growth markets like Kenya and Nigeria aims to deepen market understanding and tailor offerings to local tastes.

The accelerating e-commerce trend in South Africa, with online grocery sales surging by 29% in 2024, necessitates increased investment in digital infrastructure and online sales capabilities.

Divesting non-core assets, such as the Baby Wellbeing business, allows Tiger Brands to streamline operations and reallocate capital to core, high-growth segments, potentially improving operating margins which stood at 12.2% in FY23.

Threats

Despite some positive shifts like moderating inflation, South African consumers continue to grapple with the effects of sluggish economic growth and high unemployment. This economic backdrop means that household budgets are still tight, forcing many to make more budget-conscious purchasing decisions.

This sustained consumer pressure often translates into a shift towards more affordable options, including private label brands and lower-priced alternatives. For Tiger Brands, this trend directly impacts sales volumes and can put downward pressure on the profit margins of their premium and branded products.

Data from late 2024 indicated that while inflation eased, the real disposable income for many South Africans had not significantly recovered, maintaining the pressure on spending habits. For instance, the unemployment rate remained stubbornly high, hovering around 32.9% in the first quarter of 2024, further restricting consumer spending power.

This ongoing environment of economic strain presents a significant threat, as it limits consumers' willingness and ability to spend on higher-priced goods, a core segment for many of Tiger Brands' offerings.

The rise of private label products presents a significant challenge, as they now account for roughly 25% of the local food and beverage market's value. These own-brand offerings are expanding at an accelerated pace, with an estimated 12% growth in 2024, far outpacing the 6% growth seen in established branded products.

Consumers are increasingly prioritizing affordability, especially within a strained economic climate. This trend is driving a noticeable shift towards private labels and generic alternatives, directly impacting the market share of brands like Tiger Brands.

This heightened consumer preference for value-driven options intensifies price-based competition across the sector. It forces established brands to re-evaluate their pricing strategies and marketing efforts to remain competitive against these growing private label segments.

Increasingly frequent and severe extreme weather events, such as droughts and floods, pose significant threats to Tiger Brands' agricultural supply chains. These disruptions directly impact the availability and price volatility of key commodities. For instance, in 2024, persistent drought conditions in West Africa led to a sharp decline in cocoa yields, with futures prices reaching record highs, directly affecting confectionary production costs.

Global supply chain disruptions, exacerbated by climate change, further compound these risks. This forces Tiger Brands to invest more in securing raw materials, potentially at inflated prices, impacting profit margins. For example, the 2023-2024 citrus season saw reduced orange harvests in key growing regions due to unseasonal weather, leading to higher input costs for juice production.

These climate-related challenges threaten the consistency of Tiger Brands' product output and increase operational expenses. The company must navigate these uncertainties to maintain its production schedules and manage rising input costs. This also raises questions about the long-term viability of sourcing certain agricultural products without significant adaptation strategies.

Regulatory and Geopolitical Instability

Tiger Brands faces increasing regulatory hurdles, particularly with stricter food safety and labeling mandates in South Africa. Compliance with these evolving standards necessitates ongoing investment and potential adjustments to product formulations and packaging, impacting operational agility.

Geopolitical instability worldwide, including ongoing conflicts, poses a significant threat by disrupting global supply chains. This can lead to increased freight costs and unpredictable delays in the movement of raw materials and finished goods, directly affecting Tiger Brands' logistics and profitability. For instance, maritime shipping costs saw significant spikes in late 2023 and early 2024 due to regional conflicts impacting key shipping lanes.

Internal operational challenges within South Africa exacerbate these external pressures. Poorly managed port operations are causing substantial logistics delays, adding significant complexity and cost to Tiger Brands' distribution network. These delays can lead to stock shortages and increased inventory holding costs.

These combined threats can be summarized:

- Evolving Food Safety Regulations: Increased compliance costs and potential product reformulation needs due to stricter South African mandates.

- Global Geopolitical Disruptions: Higher shipping costs and supply chain volatility stemming from international conflicts impacting freight movement.

- South African Port Inefficiencies: Significant logistics delays and increased operational costs due to challenges in domestic port operations.

Operational Disruptions from Infrastructure Challenges

South Africa's persistent infrastructure challenges, notably electricity outages, are a significant threat to Tiger Brands' operations. These loadshedding events directly impede manufacturing processes, forcing reliance on expensive backup power solutions, which escalates operational costs. For instance, in 2023, South Africa experienced over 3,000 hours of loadshedding, significantly impacting industrial output across sectors.

Water scarcity and unreliable supply further compound these operational risks, particularly for a business with substantial water needs in its production. Beyond production, these infrastructure failures extend to distribution networks, potentially affecting delivery schedules and product availability to retailers. This can lead to reduced store operating hours for some partners, directly limiting Tiger Brands' market reach and sales opportunities.

- Increased energy costs due to reliance on generators.

- Production slowdowns and potential spoilage of goods.

- Logistical challenges impacting timely product delivery.

- Reduced sales volume from disrupted retail environments.

Tiger Brands faces intense competition from the rapidly growing private label sector, which saw an estimated 12% growth in 2024 compared to 6% for established brands, directly impacting market share and margins. Extreme weather events, such as droughts in 2024 impacting cocoa yields, and unseasonal weather affecting citrus harvests in 2023-2024, disrupt agricultural supply chains, leading to increased commodity prices and production costs. Ongoing geopolitical instability, exemplified by rising maritime shipping costs in late 2023 and early 2024 due to regional conflicts, further strains global supply chains and increases freight expenses.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of Tiger Brands' official financial statements, recent market intelligence reports, and expert commentary from industry analysts to provide a robust and well-informed strategic overview.