Tiger Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tiger Brands Bundle

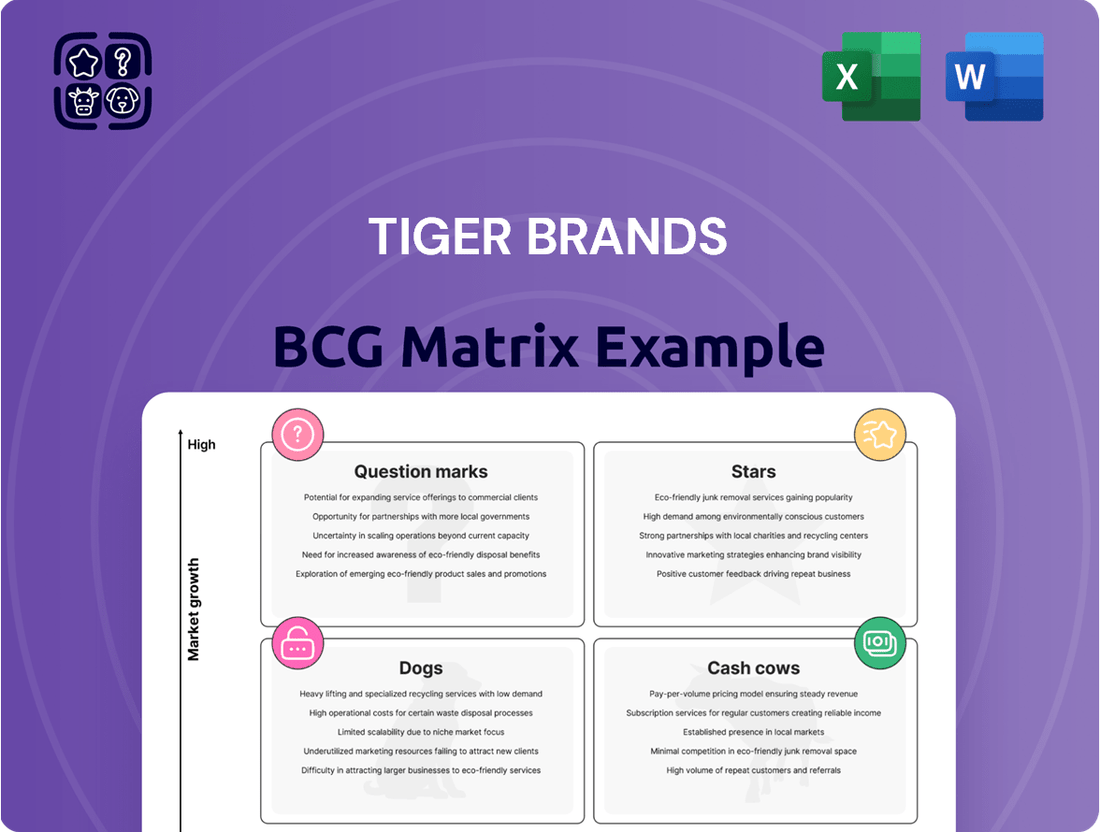

Tiger Brands, a giant in the African consumer goods sector, presents a fascinating case study for the BCG Matrix. Understanding their product portfolio's placement – whether Stars, Cash Cows, Dogs, or Question Marks – is crucial for investors and strategists alike. This preview offers a glimpse into how their diverse brands are performing in their respective markets.

Uncover the strategic implications of Tiger Brands' portfolio by diving into the full BCG Matrix. Gain a clear view of where each product stands, allowing you to make informed decisions about resource allocation and future investments.

This report goes beyond theory. The full version includes strategic moves tailored to Tiger Brands' actual market position—helping you plan smarter, faster, and more effectively.

Purchase the full BCG Matrix for a complete breakdown and strategic insights you can act on, empowering you to navigate the complexities of the consumer goods market with confidence.

Stars

The Snacks, Treats & Beverages Division stood out as Tiger Brands' top performer in the first half of the 2025 financial year, concluding March 31, 2025. This segment achieved a robust growth rate of 6.1%.

Key brands within this division, such as Oros and Jungle health bars, experienced significant double-digit sales growth. This performance suggests a strong market share in a rapidly expanding sector of South Africa's food and beverage market, driven by increasing consumer demand for convenience and snack-oriented products.

The Culinary Business Unit, encompassing brands like All Gold and Crosse & Blackwell, experienced a robust 5.0% revenue uplift in the first half of 2025. This growth was largely fueled by effective promotional activities and successful market share expansion.

These well-established brands operate within a market segment that is currently seeing increased consumer focus on value and tailored offerings. This strategic advantage, combined with their strong market standing, positions the Culinary Business Unit for sustained growth and continued market leadership.

Black Cat Peanut Butter is a standout star within Tiger Brands' portfolio, holding the coveted 'Icon Brand' status in South Africa. This recognition speaks volumes about its strong consumer loyalty and dominant market share in the peanut butter category.

Tiger Brands' strategic commitment to Black Cat is further evidenced by a substantial R300 million investment in a new manufacturing facility, operational in 2024. This move is designed to significantly boost production capacity and reinforce Black Cat's leading position in a market segment that continues to resonate with consumers' everyday needs.

KOO (Tinned Fruit, Beans, Vegetables)

KOO, a prominent brand within Tiger Brands' portfolio, is a classic example of a 'Star' in the BCG Matrix. Its consistent performance in the Ask Afrika Icon Brands 2024 survey, securing top spots across various categories, highlights its significant market share and consumer recognition. This strong brand equity translates into robust sales and a leading position in the tinned fruit, beans, and vegetables market.

Tiger Brands is actively nurturing KOO's 'Star' status by driving innovation. The introduction of products like KOO Dry Pulses demonstrates a strategic move to tap into evolving consumer preferences for healthier options and to ensure long-term growth. This focus on innovation is crucial for maintaining KOO's competitive edge in a dynamic market.

- Market Dominance: KOO's repeated success in the Ask Afrika Icon Brands 2024 survey underscores its substantial market share in the canned goods sector.

- Brand Loyalty: Consumers consistently recognize KOO as a top-tier brand, indicating strong brand loyalty and preference.

- Innovation Focus: Tiger Brands is investing in product development, such as KOO Dry Pulses, to capitalize on health-conscious trends and sustain growth.

- Growth Potential: While a staple, KOO's adaptability through innovation positions it to capture future growth opportunities in the food industry.

Tastic Rice

Tastic Rice stands out as an 'Icon Brand' and holds a dominant market leadership position in South Africa's rice category, a crucial staple. Despite economic pressures impacting consumers, Tastic achieved a slight increase in its market share between 2020 and 2024. This resilience, combined with Tiger Brands' strategic emphasis on affordable grain options, signals Tastic as a strong contender with the capacity for future volume growth.

Tiger Brands' overall performance in the food sector, particularly within grains, highlights Tastic's role as a high-market-share product. The company’s focus on affordability is a key driver for Tastic, positioning it to capitalize on consumer demand for value. This strategic alignment supports Tastic’s potential for volume recovery, even in a demanding economic climate.

- Market Leader: Tastic is the leading brand in the South African rice market.

- Resilient Growth: Achieved marginal market share growth from 2020-2024.

- Strategic Focus: Benefits from Tiger Brands' emphasis on affordability within grains.

- Volume Potential: Positioned for volume recovery due to its high market share and strategic support.

Black Cat Peanut Butter is a clear 'Star' within Tiger Brands' portfolio, enjoying 'Icon Brand' status and dominant market share. The significant R300 million investment in a new manufacturing facility, operational in 2024, underscores its importance and is set to boost production capacity. This strategic move solidifies Black Cat's leading position in a consistently popular market segment.

KOO exemplifies a 'Star' in the BCG Matrix, consistently recognized in the Ask Afrika Icon Brands 2024 survey. Its strong brand equity translates to robust sales in the tinned fruit, beans, and vegetables market. Tiger Brands is actively investing in innovation, such as KOO Dry Pulses, to meet evolving consumer preferences for healthier options and maintain long-term growth.

Tastic Rice, a market leader in South Africa, also fits the 'Star' category. It demonstrated resilient market share growth between 2020 and 2024 despite economic pressures. Tiger Brands' focus on affordable grain options, including Tastic, positions it for future volume recovery and continued success in this essential category.

What is included in the product

Tiger Brands' BCG Matrix provides a clear breakdown of its product portfolio, identifying which units to invest in, hold, or divest.

The Tiger Brands BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex portfolio performance.

Cash Cows

Albany Bread, a cornerstone of Tiger Brands' portfolio, operates as a Cash Cow within the BCG Matrix. It commands a leading position in the South African bread market, securing a substantial portion of national sales across most provinces.

While Albany experienced a dip in market share between 2020 and 2024, it continues to be a high-volume product. This sustained demand translates into significant and reliable cash flow generation for Tiger Brands, underscoring its Cash Cow status.

Given its mature market position, the focus for Albany is on maintaining efficiency rather than pursuing aggressive expansion. Tiger Brands aims to optimize its operations to maximize the consistent cash flow this segment provides.

Jungle Oats stands as a quintessential Cash Cow for Tiger Brands, firmly anchored as an 'Icon Brand' and a dominant force within the traditional breakfast cereals segment. Its enduring popularity as a household staple ensures consistent and predictable revenue generation, a hallmark of a mature, high-market-share product.

Despite facing increased competition in the broader cereals market, the core Jungle Oats product demonstrates remarkable resilience, maintaining its entrenched position. This stability translates directly into reliable cash flow, providing Tiger Brands with a crucial financial foundation to support other ventures.

In 2024, the breakfast cereal market in South Africa continued to be robust, with traditional oats like Jungle Oats showing sustained demand. While specific financial figures for Jungle Oats as a standalone entity within Tiger Brands are proprietary, the company's overall performance in the consumer staples division, where Jungle Oats resides, consistently reflects the strength of its established brands.

Fattis and Monis stands as an 'Icon Brand' within Tiger Brands' portfolio, commanding a significant market share in the mature pasta sector. This strong consumer loyalty is a testament to its enduring appeal as a staple food.

Tiger Brands has strategically focused on value engineering for Fattis and Monis, a key tactic for maximizing profitability from this established cash generator. This approach ensures the brand continues to contribute positively to the company’s financial health.

In 2024, the South African pasta market, where Fattis and Monis operates, experienced steady demand, with consumers prioritizing value and consistent quality. This environment is ideal for a cash cow, allowing for consistent revenue generation.

Golden Cloud Wheat Flour

Golden Cloud Wheat Flour is a cornerstone of Tiger Brands' grain division, commanding a significant market share in the essential wheat flour category. This brand acts as a reliable source of income for the company, even amidst broader industry headwinds. Tiger Brands' strategic focus on vertical integration is aimed at bolstering Golden Cloud's profitability and securing its supply chain.

In 2024, the South African wheat market experienced fluctuating prices, with local production facing challenges from weather patterns. Despite these pressures, Golden Cloud's established brand recognition and extensive distribution network continue to ensure consistent sales volumes. The company's investments in controlling more of the value chain, from grain sourcing to milling, are designed to mitigate cost volatility and enhance margins for this mature product.

- Golden Cloud holds a dominant position in the South African wheat flour market.

- Tiger Brands is actively pursuing vertical integration to improve Golden Cloud's profitability.

- The brand represents a stable revenue generator within the company's portfolio.

- Market conditions in 2024 presented challenges but did not significantly impact Golden Cloud's sales stability.

Doom Insecticides

Doom Insecticides stands as a prime example of a cash cow within Tiger Brands' portfolio, fitting perfectly into the mature insecticide market. Its status as an 'Icon Brand' underscores its dominant market position and deep-rooted consumer loyalty, ensuring consistent sales.

The insecticide sector, characterized by stable and predictable demand, allows Doom to generate substantial and reliable profits. This stability means that the investment required to maintain Doom's market share is relatively low, freeing up capital for other ventures.

- Icon Brand Status: Doom is a leading, trusted name in the insecticide market.

- Mature Market: The insecticide industry offers predictable revenue streams.

- Consistent Profit Generation: Doom reliably produces profits with minimal reinvestment needs.

- Low Growth, High Share: It holds a significant market share in a slow-growing category.

Albany Bread, Fattis and Monis, Jungle Oats, Golden Cloud Wheat Flour, and Doom Insecticides exemplify Tiger Brands' Cash Cows. These brands possess high market share in mature, slow-growing categories, generating consistent and predictable profits with minimal investment required for maintenance. Their 'Icon Brand' status ensures strong consumer loyalty and sustained demand, providing a stable financial foundation for the company.

| Brand | Category | Market Position | Cash Flow Contribution | 2024 Market Context |

|---|---|---|---|---|

| Albany Bread | Bread | Leading, High Share | High, Reliable | Sustained demand despite competitive pressures. |

| Jungle Oats | Breakfast Cereals | Dominant, Icon Brand | Consistent, Predictable | Resilient demand in traditional oats segment. |

| Fattis and Monis | Pasta | Significant Share, Icon Brand | Stable, Strong | Steady demand with focus on value and quality. |

| Golden Cloud Wheat Flour | Wheat Flour | Dominant, Essential | Reliable Revenue | Consistent sales despite commodity price fluctuations. |

| Doom Insecticides | Insecticides | Leading, Icon Brand | Substantial, Low Reinvestment | Predictable demand in a mature market. |

Preview = Final Product

Tiger Brands BCG Matrix

The Tiger Brands BCG Matrix you are currently previewing is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted for strategic clarity, will be delivered directly to you, ready for immediate application in your business planning.

Dogs

Tiger Brands divested its Baby Wellbeing division, including brands like Purity & Elizabeth Anne's, in November 2024. This strategic move signals that the business was classified as a 'Dog' within the BCG matrix. Such a classification typically means the division had low market share in a slow-growing industry.

The disposal suggests the Baby Wellbeing division was not contributing significantly to Tiger Brands' overall growth or profitability. Companies often divest 'Dogs' to reallocate capital towards more promising business units. This action aligns with Tiger Brands' strategy to streamline its portfolio and focus on core, higher-potential brands.

The divestment of Langeberg and Ashton Foods’ canned fruit operations in the first half of 2025 underscores Tiger Brands’ strategic move to streamline its business. This unit, historically a significant player, likely faced a mature, low-growth canned fruit market, diminishing its relevance within Tiger Brands’ evolving portfolio.

Positioned as a 'Dog' in the BCG matrix, the canned fruit unit was a prime candidate for divestment due to its limited growth prospects and potential drain on resources. This aligns with Tiger Brands’ broader objective of focusing on its more robust and high-potential domestic brands.

Tiger Brands reported a 16% decline in its value-added sugar confectionery segment in its 2023 results, partly due to challenges in categories like canned fruit, indicating the unit's underperformance contributing to its 'Dog' status.

Tiger Brands strategically divested several non-core Home and Personal Care (HPC) brands, including Bio Classic and Crystal, during the latter half of 2024. This move aimed to streamline the company's portfolio and focus on more profitable segments.

The HPC division saw a 4.8% revenue decrease in the first half of 2025. This downturn was attributed to significant pricing pressures across the market and a general lack of substantial innovation within the sector.

The divestment of brands like Bio Classic and Crystal suggests they held a low market share and were not contributing significantly to the division's overall performance. Their underperformance likely played a role in Tiger Brands' decision to exit these specific product lines.

Ace Maize Meal

Ace Maize Meal is positioned as a 'Dog' within Tiger Brands' BCG Matrix. This classification stems from the company's decision to divest from the maize milling sector, citing its oversaturation and lack of viability for major corporations due to fierce competition from regional businesses.

The brand's market share experienced a notable decline, shrinking by 4 percentage points between 2020 and 2024. This downward trend solidifies its 'Dog' status, indicating a product with low market share in a low-growth industry, prompting Tiger Brands' strategic exit.

- Market Share Decline: Ace Maize Meal's market share fell by 4% from 2020 to 2024.

- Sector Viability Concerns: Tiger Brands deems the maize milling sector unviable for large corporates.

- Competitive Landscape: Intense competition from regional players is a key factor in the sector's challenges.

- Strategic Exit: The brand is slated for sale as part of Tiger Brands' portfolio adjustments.

King Korn Sorghum

King Korn Sorghum, much like Ace Maize Meal, is earmarked for divestiture as Tiger Brands streamlines its operations. This strategic move positions King Korn Sorghum within the 'Dog' quadrant of the BCG matrix, signifying its status as a non-core and underperforming asset in a demanding grains market.

Its inclusion in the divestiture plan underscores a challenging market environment for sorghum products. For instance, in the fiscal year ending September 2023, Tiger Brands reported a decline in its Grains division's revenue, reflecting broader market pressures that impact products like King Korn.

- Divestiture Plan: King Korn Sorghum is slated for divestment as part of Tiger Brands' portfolio optimization.

- Market Position: Classified as a 'Dog' due to underperformance in a challenging grains market.

- Financial Context: The Grains division, which includes sorghum products, faced revenue pressures in recent fiscal periods.

Tiger Brands has strategically divested several brands classified as 'Dogs' in its BCG Matrix. This includes the Baby Wellbeing division, canned fruit operations, and certain Home and Personal Care brands like Bio Classic and Crystal, all divested in 2024 and early 2025. These moves reflect a focus on streamlining the portfolio and reallocating resources to more promising areas, as these units likely experienced low market share in slow-growing sectors.

The divestment of Ace Maize Meal and King Korn Sorghum further exemplifies this strategy. Ace Maize Meal's market share declined by 4 percentage points between 2020 and 2024, and Tiger Brands views the maize milling sector as oversaturated and unviable for large corporations. Similarly, King Korn Sorghum faces a challenging grains market, contributing to its 'Dog' classification and planned divestiture.

| Brand/Division | BCG Classification | Reason for Classification | Divestment/Exit Period | Impacted Segment |

|---|---|---|---|---|

| Baby Wellbeing Division | Dog | Low market share in a slow-growing industry | November 2024 | Babycare |

| Canned Fruit Operations (Langeberg & Ashton Foods) | Dog | Mature, low-growth market | H1 2025 | Canned Goods |

| Bio Classic & Crystal | Dog | Low market share, underperformance | H2 2024 | Home & Personal Care (HPC) |

| Ace Maize Meal | Dog | Declining market share (-4% from 2020-2024), sector unviability | Slated for sale | Grains/Maize |

| King Korn Sorghum | Dog | Underperformance in challenging grains market | Slated for divestment | Grains/Sorghum |

Question Marks

Tiger Brands is strategically focusing on health and nutrition, evidenced by new product launches like KOO Dry Pulses and Ace Baby in convenient formats. The South African market is experiencing a surge in demand for healthy, plant-based, and functional foods, creating a fertile ground for these innovations.

Despite the promising market trends, these new health and nutrition offerings, such as KOO Dry Pulses, currently hold a low market share. Significant investment will be necessary to build brand awareness and distribution channels to compete effectively in this growing segment.

Tiger Brands is strategically leveraging the 'snackification' trend to drive growth, particularly by expanding its Jungle brand into new formats like Jungle Flakes. This initiative aims to tap into a high-growth consumer behavior, where consumers increasingly opt for smaller, more frequent meals and snacks throughout the day.

While Jungle health bars are already performing well, the move into flakes represents a significant opportunity. However, these new formats currently hold a low market share. To avoid them becoming 'Dogs' in the BCG matrix, substantial investment in marketing and distribution is critical to gain traction and build brand awareness.

The success of these 'snackification' initiatives hinges on effectively reaching consumers within this evolving snacking landscape. For instance, by late 2024, the global snack market was projected to continue its upward trajectory, with South Africa showing strong consumer adoption of convenience-oriented food products.

Tiger Brands is making a significant push into general and informal trade channels, with a goal to reach 130,000 stores. This expansion is a strategic move to tap into high-growth areas that often serve a large portion of the population. It's a recognition that these channels are crucial for broad market penetration.

While the potential is vast, capturing market share in these fragmented channels demands substantial investment. The company's current penetration within these specific segments may be modest, meaning they need to allocate considerable resources to build brand awareness and distribution networks. For instance, in 2024, the informal sector represented a significant portion of consumer spending in many emerging markets, underscoring the importance of this strategy.

Food Service Innovation Offerings

Tiger Brands is actively innovating within the South African foodservice sector, a market anticipated to expand robustly. Projections indicate a compound annual growth rate (CAGR) of 6.6% for this sector between 2024 and 2029, highlighting its significant potential.

Products tailored for this expanding channel, particularly those in their early market stages, can be categorized as Question Marks within the BCG Matrix. These offerings require strategic investment to cultivate market presence and achieve desired market share.

- Foodservice Innovation: Tiger Brands is developing specific product lines for the growing foodservice industry.

- Market Growth: The South African foodservice sector is forecast to grow at a 6.6% CAGR from 2024-2029.

- BCG Matrix Classification: Nascent foodservice products represent Question Marks, needing investment.

- Strategic Focus: Investment is crucial for these offerings to gain traction and capture market share.

E-commerce Focused Product Lines

E-commerce is rapidly reshaping the South African food and beverage landscape, and Tiger Brands is actively expanding its digital footprint to meet this evolving consumer demand. Products or brands specifically developed for online sales, particularly those where the company's market share is still developing, represent potential Stars. These require strategic investment to fully leverage the significant growth potential of the e-commerce channel.

In 2024, the South African e-commerce market for FMCG (Fast-Moving Consumer Goods) continued its upward trajectory. Reports indicated that online grocery sales in South Africa experienced substantial year-on-year growth, driven by convenience and increasing digital penetration. Tiger Brands' investment in its digital infrastructure and direct-to-consumer capabilities is crucial for capturing a larger share of this expanding market.

- E-commerce Growth: South Africa's online grocery market saw significant expansion in 2024, mirroring global trends.

- Investment Need: New product lines tailored for online sales, especially in areas with lower market penetration, necessitate capital infusion.

- Digital Presence: Tiger Brands' focus on enhancing its digital channels is key to capitalizing on the high-growth e-commerce segment.

- Market Share Development: Products entering this space where Tiger Brands lacks dominance are prime candidates for Star classification, requiring support to become market leaders.

Tiger Brands' ventures into the foodservice sector, particularly new product lines designed for this expanding market, are currently classified as Question Marks. This segment is projected to grow, with a 6.6% CAGR anticipated between 2024 and 2029, indicating substantial future potential.

These emerging foodservice offerings, like specialized ingredients or ready-to-eat meals for restaurants and caterers, have a low current market share. Significant investment is therefore essential to build brand recognition, establish distribution networks, and gain a competitive foothold in this dynamic industry.

By strategically investing in these nascent foodservice products, Tiger Brands aims to cultivate them into future Stars. This requires a focused approach to marketing and sales tailored to the unique demands of the foodservice channel.

The company's commitment to innovation in this area reflects a broader trend of seeking growth in less saturated, high-potential markets.

| Business Unit | Market Growth | Relative Market Share | BCG Classification | Strategic Implication |

| Foodservice Innovations | High (6.6% CAGR 2024-2029) | Low | Question Mark | Requires significant investment to gain market share. |

BCG Matrix Data Sources

Our Tiger Brands BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research, and industry growth projections. This ensures a robust and accurate representation of each business unit's market position and potential.