Tiger Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tiger Brands Bundle

Tiger Brands operates in a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves into these critical factors, offering a clear roadmap for navigating the complexities of the South African and broader African markets.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Tiger Brands. Discover how political, economic, social, technological, legal, and environmental forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The formation of a Government of National Unity (GNU) in South Africa in June 2024 has generally been seen as a positive step towards greater political stability. This improved environment, coupled with a more predictable policy landscape, is welcomed by business leaders, including those at Tiger Brands. For instance, a Deloitte survey in early 2024 indicated that improved governance was a key expectation from businesses looking to invest in South Africa.

This enhanced stability is expected to foster a more constructive economic outlook and boost investor confidence. Businesses often thrive when they can anticipate government policies and reforms, reducing uncertainty. Early indications from the GNU suggest a focus on economic growth and job creation, which could directly benefit companies like Tiger Brands through increased consumer spending.

However, the ongoing political dynamics within the GNU present a potential risk. Internal disagreements or coalition challenges could slow down or halt critical economic reforms. Such infighting might deter foreign and domestic investment, creating an unstable environment that could negatively impact Tiger Brands' operational planning and market growth strategies.

Globally, a noticeable shift towards protectionism and economic fragmentation is underway, influencing how trade and investment move across geopolitical boundaries. For Tiger Brands, which operates extensively across diverse African markets, this trend presents significant challenges. It could directly affect the costs associated with importing raw materials and exporting finished goods, potentially impacting profit margins.

This increasing protectionism can also restrict market access in certain regions, making it harder for Tiger Brands to expand or even maintain its presence. Consequently, the efficiency of its supply chains, already complex given the diverse operational landscape, faces potential disruption. Navigating these shifting trade policies is crucial for Tiger Brands to retain its competitive advantage and ensure uninterrupted operations throughout its African footprint.

Tiger Brands navigates a complex web of South African government regulations, with evolving legislative requirements posing continuous compliance risks. New taxes and increasingly stringent environmental and health standards necessitate ongoing adaptation of operations and product development to avoid penalties and maintain its license to operate. For instance, the company's commitment to food safety protocols and environmental impact mitigation, critical for consumer trust and regulatory adherence, remains a key focus.

Public Health Policies and Food Safety Oversight

Government and regulatory bodies in South Africa maintain rigorous oversight of food safety, a direct response to past public health crises such as the devastating 2017-2018 Listeria outbreak. This heightened scrutiny means companies like Tiger Brands must adhere to stringent standards to protect public health and maintain consumer confidence. The ongoing legal proceedings related to this outbreak underscore the profound impact of public health policies on business operations and reputation.

Tiger Brands' involvement in the Listeria class action settlement, which saw the company agree to pay approximately R400 million in compensation to affected consumers, vividly illustrates the financial and reputational costs associated with non-compliance or perceived failures in food safety oversight. This settlement, finalized in 2024, emphasizes the critical need for robust internal food safety protocols and continuous improvement to meet evolving regulatory expectations and safeguard brand integrity.

- Listeria Outbreak Impact: The 2017-2018 Listeria outbreak, linked to Tiger Brands' Enterprise Foods facility, resulted in over 1,000 confirmed cases and 200 deaths, leading to significant regulatory and public backlash.

- Class Action Settlement: In 2024, Tiger Brands agreed to a settlement of approximately R400 million in a class action lawsuit brought by victims of the Listeria outbreak, highlighting the substantial financial implications of food safety failures.

- Regulatory Compliance: Adherence to food safety regulations is paramount for maintaining consumer trust and avoiding severe legal penalties, which can include fines, product recalls, and reputational damage.

- Ongoing Scrutiny: Following the Listeria incident, food manufacturers face increased scrutiny from regulatory bodies like the Department of Health and the National Consumer Commission, requiring proactive risk management and transparent communication.

Economic Transformation and Empowerment Initiatives

The South African government's strong emphasis on social redress and economic transformation, particularly through Black Economic Empowerment (B-BBEE) policies, significantly shapes Tiger Brands' strategic direction. These policies necessitate a commitment to fair and inclusive employment practices, alongside preferential procurement strategies, to ensure alignment with national developmental aims.

Tiger Brands actively participates in socio-economic development initiatives, fostering support for local enterprises as a means to contribute to overarching economic transformation objectives within South Africa. For instance, in the 2023 financial year, Tiger Brands reported that 83% of its procurement spend was with Black-owned businesses, demonstrating a tangible commitment to B-BBEE.

The company's approach to transformation is also reflected in its workforce demographics. As of its latest reporting, Tiger Brands maintained a board composition that exceeded the B-BBEE requirements for gender and racial diversity. This focus extends to community upliftment projects, with significant investment in education and skills development programs in underserved areas.

These political factors require continuous adaptation and integration into Tiger Brands' core business operations. The company's ongoing efforts to meet and exceed transformation targets are crucial for maintaining its social license to operate and for fostering sustainable growth in the South African market.

The formation of South Africa's Government of National Unity (GNU) in June 2024 is anticipated to bring enhanced political stability, fostering a more predictable policy environment welcomed by businesses like Tiger Brands. This stability could bolster investor confidence and stimulate economic growth, potentially leading to increased consumer spending, which directly benefits companies in the consumer goods sector.

However, the internal political dynamics within the GNU present a risk, as potential disagreements could impede crucial economic reforms and deter investment, impacting Tiger Brands' strategic planning. Globally, rising protectionism and economic fragmentation pose challenges for Tiger Brands' extensive African operations, potentially increasing import costs and restricting market access.

Tiger Brands faces ongoing regulatory compliance risks in South Africa, with evolving food safety and environmental standards requiring continuous operational adaptation. The company's 2024 settlement of approximately R400 million in a class action lawsuit related to the 2017-2018 Listeria outbreak underscores the significant financial and reputational consequences of food safety failures and the heightened scrutiny from regulatory bodies.

The company's commitment to Black Economic Empowerment (B-BBEE) is demonstrated by its procurement practices, with 83% of its spend in the 2023 financial year directed towards Black-owned businesses, and its board composition exceeding diversity requirements, reflecting adaptation to political and social redress policies.

What is included in the product

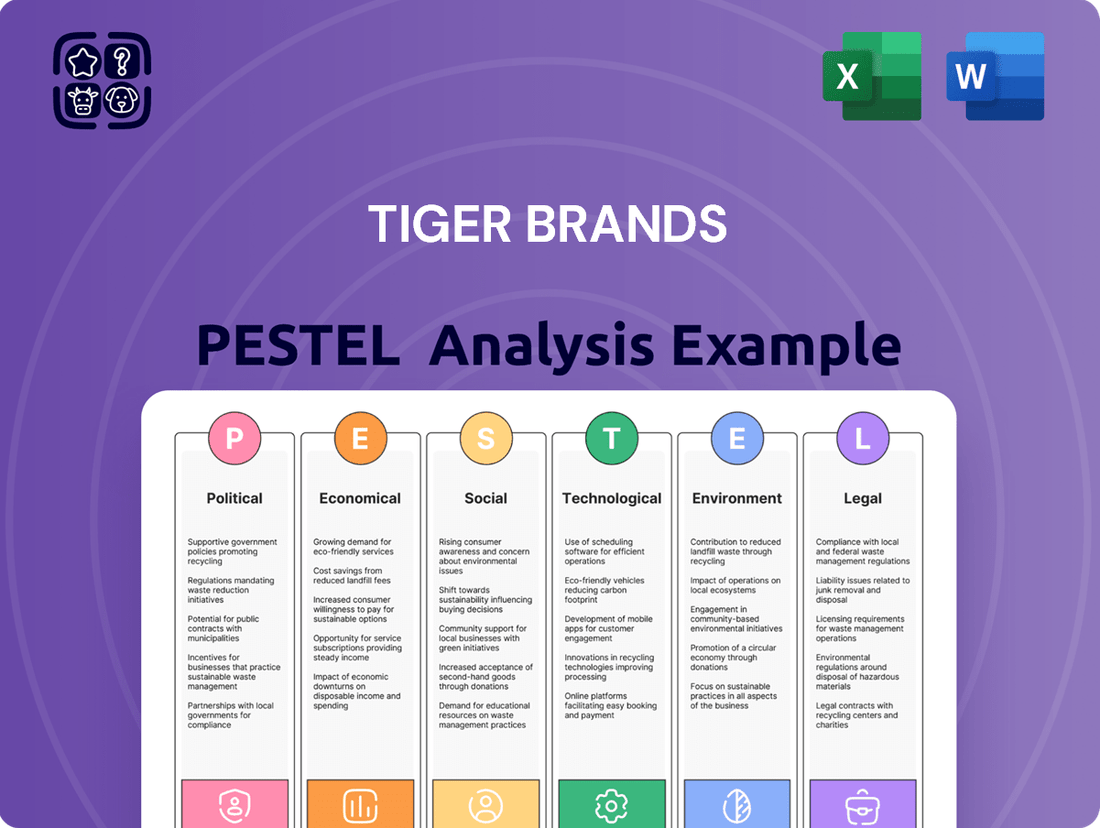

This Tiger Brands PESTLE analysis comprehensively examines how Political, Economic, Social, Technological, Environmental, and Legal forces shape the company's strategic landscape.

It offers actionable insights for navigating external challenges and capitalizing on emerging opportunities within the food and beverage industry.

Offers a streamlined PESTLE analysis of Tiger Brands, acting as a pain point reliever by providing clear, actionable insights for strategic decision-making.

This analysis serves as a pain point reliever by offering a concisely summarized version of Tiger Brands' PESTLE factors, perfect for quick integration into presentations and team planning sessions.

Economic factors

Consumer disposable income in South Africa faced considerable strain throughout 2024, with inflation impacting purchasing power. For instance, the Consumer Price Index (CPI) remained elevated, averaging around 5.5% for the first half of 2024, eroding the real value of household earnings. This economic environment directly influences consumer spending habits, pushing them towards more budget-friendly options.

The persistent economic pressures, including job market uncertainties and existing high household debt levels which averaged over 70% of disposable income in early 2024, compel South African consumers to prioritize value. Consequently, there's a noticeable shift in preference, with a growing demand for private label or store-brand products as consumers seek to stretch their budgets further.

Tiger Brands is actively responding to this trend by emphasizing affordability across its product portfolio. The company's strategy includes a focus on optimizing pricing and introducing more accessible product tiers. This approach aims to capture market share by catering effectively to consumers who are increasingly price-sensitive and actively seeking cost-effective solutions.

While headline inflation in South Africa has shown signs of cooling, food price inflation remains a concern. For instance, the Consumer Price Index (CPI) for food and non-alcoholic beverages stood at 5.1% year-on-year in April 2024, a slight decrease from 5.4% in March 2024, yet still above the South African Reserve Bank’s target range of 3-6%.

Tiger Brands continues to grapple with volatile input costs, particularly for key commodities like cocoa, which saw significant price surges in late 2023 and early 2024, impacting profitability in its chocolate categories. Citrus prices have also been elevated due to supply constraints stemming from adverse weather conditions in key growing regions.

The company’s ability to pass on these rising costs to consumers is constrained by competitive market dynamics and consumer affordability. Therefore, managing margins requires a dual approach of strategic price adjustments and operational efficiencies.

To counter these pressures, Tiger Brands is focusing on robust cost recovery strategies and implementing continuous improvement programs across its value chain. This includes optimizing procurement, enhancing manufacturing productivity, and streamlining distribution to mitigate the impact of input cost volatility on overall profitability.

South Africa's economic outlook for 2024 and 2025 points towards a modest GDP growth, with projections around 1.2% for 2024 and nearing 2% for 2025. This expected uptick in economic activity, supported by improvements in energy reliability and a downward trend in inflation, is fostering a more optimistic consumer sentiment.

Tiger Brands has observed positive momentum, with its recent financial reports reflecting revenue growth and enhanced trading performance across both its retail and wholesale segments. This suggests the company is beginning to capitalize on the nascent signs of market recovery, aligning with the broader economic improvements.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant challenge for Tiger Brands. The strengthening of the South African rand (ZAR) against major currencies, such as the US dollar, can negatively impact the company's international earnings when translated back into rand. For instance, in its 2023 financial results, Tiger Brands noted that the appreciation of the rand affected the reported revenues from its Cameroon subsidiary, Chococam, when compared to the prior year. This currency volatility requires careful management to ensure consistent profitability across its diverse operations in various African markets.

Managing currency volatility is crucial for maintaining profitability in Tiger Brands' diverse African markets.

- Rand Appreciation Impact: A stronger rand reduces the rand-equivalent value of revenues earned in foreign currencies, impacting international subsidiaries' reported performance.

- Chococam Example: The appreciation of the rand was cited as a factor affecting the revenue performance of Tiger Brands' Cameroon subsidiary, Chococam, in its 2023 reporting period.

- Profitability Management: Tiger Brands must employ strategies to mitigate the effects of currency fluctuations to protect its overall profitability.

Competition and Private Label Growth

The South African food and beverage landscape is marked by intense competition, with retailers increasingly leveraging private label offerings. This shift is evident in market share dynamics, where private labels are not only capturing a substantial portion of sales value but also demonstrating a growth trajectory that outpaces traditional branded products. For instance, by the end of 2024, private label penetration in key grocery categories in South Africa reached an average of 25%, with some retailers seeing this figure climb above 30%.

This heightened private label presence directly challenges incumbent brands like those of Tiger Brands. The aggressive pricing strategies associated with private label products exert significant downward pressure on the sales volumes and profit margins of established brands. As retailers invest more in the quality and marketing of their own brands, consumers are often presented with more affordable alternatives, forcing branded manufacturers to re-evaluate their market positioning.

- Private Label Market Share: Private label products accounted for approximately 25% of total grocery sales value in South Africa by late 2024, with a notable upward trend.

- Growth Differential: Private label sales in the South African food sector grew by an estimated 7% year-on-year in 2024, compared to a 3% growth rate for branded goods.

- Impact on Margins: The increased competition from private labels is estimated to have compressed gross margins for branded food manufacturers by an average of 1-2 percentage points in 2024.

- Strategic Imperative: Tiger Brands faces the critical need to implement robust brand rejuvenation initiatives and develop effective strategies to regain market share in response to this evolving competitive environment.

South Africa's economic landscape in 2024 and 2025 is characterized by modest GDP growth projections, anticipated to reach around 1.2% in 2024 and nearing 2% in 2025, signaling a gradual recovery. This improved economic outlook, coupled with moderating inflation and enhanced energy reliability, is contributing to a more positive consumer sentiment, which Tiger Brands is beginning to leverage for revenue growth across its segments.

However, persistent food price inflation, which stood at 5.1% year-on-year in April 2024, continues to challenge consumer affordability, even as headline inflation shows signs of cooling. This environment necessitates strategic pricing and operational efficiencies for companies like Tiger Brands to manage margins effectively amidst volatile input costs, such as surges in cocoa prices experienced in late 2023 and early 2024.

Exchange rate volatility remains a significant factor, with rand appreciation impacting the translation of foreign earnings. For instance, Tiger Brands noted this effect on its Cameroon subsidiary, Chococam, in its 2023 reporting, highlighting the need for careful currency management to protect international profitability.

The competitive environment is intensified by the growing prevalence of private label products, which captured approximately 25% of South African grocery sales value by late 2024. This trend, with private labels growing at an estimated 7% year-on-year in 2024 compared to 3% for branded goods, puts pressure on established brands and necessitates strategic responses from manufacturers like Tiger Brands.

What You See Is What You Get

Tiger Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Tiger Brands. Understand the market dynamics and strategic considerations influencing this major consumer goods company. Gain actionable insights for your business planning.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a strong demand for nutritious and convenient food choices. This shift is a significant driver for the food industry, pushing companies to innovate and adapt their product portfolios. Tiger Brands is actively addressing this trend by aiming to make healthier options more accessible and affordable, a strategy they term 'democratising nutrition'.

The company's strategic focus on growth platforms like health and nutrition, alongside 'snackification', directly reflects these evolving consumer preferences. For instance, in their 2023 integrated report, Tiger Brands highlighted a commitment to expanding their range of healthier products, aligning with the growing market for functional foods and convenient, wholesome snacks. This focus is crucial for maintaining market relevance and capturing a larger share of the health-conscious consumer base.

Urbanization continues to fuel the expansion of the informal market, with spaza shops and similar outlets becoming crucial for consumers facing tighter budgets due to ongoing economic pressures. Tiger Brands recognizes this shift, actively refining its distribution strategies to bolster its reach and visibility within these general trade channels.

The company's commitment extends to nurturing emerging black-owned businesses within township economies. This strategic focus aims to deepen Tiger Brands' footprint in these vital, growing market segments.

South Africa's informal retail sector is significant; for instance, spaza shops are estimated to account for approximately 20% of total FMCG sales in the country, a figure expected to grow. Tiger Brands’ investment in this area reflects an understanding of evolving consumer purchasing habits and economic realities.

Tiger Brands actively addresses South Africa's significant poverty levels through robust socio-economic development (SED) programs. These efforts are crucial given that approximately 30.3% of South African households experienced food insecurity in 2024, according to Stats SA.

The company's initiatives, such as providing meals through in-school feeding programs and distributing food hampers, directly combat hunger and improve nutritional outcomes for vulnerable populations. These programs are designed to uplift communities and foster sustainable livelihoods.

Furthermore, Tiger Brands' establishment of community trusts demonstrates a commitment to long-term social impact, aiming to create shared value and enhance the company's social license to operate. This approach is vital for maintaining stakeholder trust and operational stability.

Brand Loyalty and Consumer Trust

Brand loyalty is shifting, with consumers increasingly focused on price and the growing appeal of private label goods. This trend directly impacts established players like Tiger Brands, as seen in the competitive landscape where value propositions are paramount. For instance, in the 2023 financial year, Tiger Brands noted that while overall sales volume saw a slight increase, a significant portion was driven by promotions aimed at mitigating price sensitivity.

Tiger Brands is actively working to counteract this by investing in its core brands. This includes significant marketing spend, with a reported R847 million allocated to brand building and advertising in the 2023 fiscal year, aiming to reconnect with consumers and reinforce the value and quality of their offerings. The goal is to foster a stronger emotional connection and habitual purchasing, thereby rebuilding and maximizing brand loyalty.

Consumer trust is a critical element, and recent events highlight its fragility. The Listeria outbreak and subsequent class action lawsuit, while being managed and resolved, have underscored the absolute necessity of unwavering commitment to product safety and quality. Maintaining trust is paramount for long-term brand health, and Tiger Brands continues to emphasize rigorous quality control measures across its operations to ensure consumer confidence.

Key initiatives and observations regarding brand loyalty and trust include:

- Price Sensitivity: Increased consumer focus on affordability and promotional activities impacting purchasing decisions.

- Private Label Growth: Rise in the popularity and market share of store-brand products, offering a competitive challenge.

- Brand Rejuvenation: Strategic investments in marketing and product innovation to revitalize core brands.

- Trust and Safety: Ongoing emphasis on product integrity and transparency to rebuild and maintain consumer confidence following past incidents.

Demographic Shifts and Diverse Product Needs

South Africa's demographic landscape is characterized by significant diversity, with a growing middle class across the African continent presenting a substantial opportunity for Tiger Brands. This expansion means more consumers can afford branded goods, increasing the demand for the company's offerings.

Tiger Brands' broad product portfolio is a key strength in addressing these diverse needs. From essential food items and home care products to personal care and baby essentials, the company is well-positioned to serve various consumer segments and income levels.

For instance, by 2024, it's estimated that the African middle class will represent a significant consumer base, driving demand for packaged goods. Tiger Brands' ability to adapt its product lines and marketing strategies to resonate with different cultural preferences and economic realities will be crucial for its sustained market presence and future growth.

- Growing African Middle Class: Projections indicate continued expansion, creating new consumer segments.

- Diverse Portfolio: Tiger Brands offers products across food, home care, and personal care, catering to a wide demographic.

- Market Segmentation: Understanding and responding to the varied needs of different income groups and cultural preferences is vital for market penetration.

- Consumer Spending Power: The increasing disposable income among emerging middle-class populations directly benefits companies with strong brand recognition and product availability.

Consumer purchasing habits are increasingly influenced by health and wellness trends, pushing demand for nutritious and convenient food options. Tiger Brands is addressing this by making healthier choices more accessible and affordable, a strategy termed 'democratising nutrition'. This focus aligns with their growth platforms in health, nutrition, and 'snackification', reflecting a commitment to meeting evolving consumer desires for wholesome snacks and functional foods, as seen in their 2023 report.

Urbanization is expanding the informal market, with spaza shops becoming vital for budget-conscious consumers. Tiger Brands is adapting its distribution to strengthen its presence in these general trade channels, recognizing their growing importance. This strategy also supports emerging black-owned businesses within township economies, deepening the company's reach in these key growth areas. The informal retail sector, including spaza shops, accounts for an estimated 20% of total FMCG sales in South Africa, a share expected to rise.

South Africa's significant poverty levels are being addressed by Tiger Brands through robust socio-economic development programs, particularly given that approximately 30.3% of households experienced food insecurity in 2024. Initiatives like in-school feeding programs and food hamper distributions directly combat hunger and improve nutrition for vulnerable groups, aiming to uplift communities. The company's community trusts further demonstrate a commitment to long-term social impact and shared value creation.

Brand loyalty is shifting towards price and private labels, impacting established brands like Tiger Brands. In response, the company invested R847 million in brand building and advertising in the 2023 fiscal year to reinforce value and quality, aiming to foster stronger consumer connections and habitual purchasing. Maintaining consumer trust is paramount, especially after past incidents, leading to an intensified focus on rigorous quality control measures across all operations to ensure product integrity and rebuild consumer confidence.

Technological factors

Tiger Brands is making substantial investments to bolster its research and development (R&D) and innovation efforts. A prime example is the recent launch of its cutting-edge Sensorium facility. This advanced innovation hub represents a significant multi-year commitment, designed to cultivate a robust innovation pipeline and expedite the creation of new products for the market.

The company's strategic focus within the Fast-Moving Consumer Goods (FMCG) sector centers on consumer-driven innovations, leveraging advancements in science and technology. Key areas of emphasis include developing more affordable food solutions, improving health and nutrition offerings, and capitalizing on the growing trend of snackification.

Tiger Brands is actively investing in automation to bolster food safety and product quality, enhancing the monitoring of supplier non-compliance. This technological push is designed to streamline operations and ensure higher standards across its product lines.

The company is also digitizing its procurement processes, implementing new systems for digital sourcing, contract management, and purchase-to-pay workflows. These advancements are crucial for modernizing how Tiger Brands engages with its suppliers and manages its purchasing operations.

These strategic technology implementations are projected to significantly boost operational efficiency and drive down costs. By optimizing these core functions, Tiger Brands aims for a more robust and responsive supply chain, ultimately improving its competitive edge.

Tiger Brands is making significant strides in supply chain digitization, integrating automated systems for planning both supply and demand. This digital transformation is crucial for enhancing operational efficiency and optimizing logistics across the company. For instance, the company is digitizing its freight desk to manage import and export goods more effectively.

Further demonstrating this commitment, Tiger Brands is implementing route management software within its bakery operations. This technological adoption is designed to streamline delivery routes, reducing transit times and fuel consumption, a key aspect of logistics optimization. By leveraging these digital tools, Tiger Brands aims to achieve substantial improvements in its supply chain performance, potentially leading to cost savings and faster product delivery.

E-commerce and Digital Sales Channels

The retail landscape is undeniably shifting, with e-commerce and digital sales channels becoming increasingly vital. Consumers, especially the younger, tech-savvy demographics, now expect to be able to shop for groceries and other goods online just as easily as they do in physical stores, often demanding a smooth transition between online and offline experiences. This trend is accelerating, with online retail sales projected to continue their upward trajectory. For instance, global e-commerce sales are estimated to reach over $7 trillion by 2025, underscoring the massive potential in this space.

Tiger Brands recognizes this fundamental change and is actively working to enhance its digital footprint. The company is making strides in digitizing its business-to-business (B2B) operations, focusing on creating self-service ordering platforms for its trade partners. This move is crucial for streamlining transactions and improving efficiency in its supply chain.

Developing a robust B2B customer self-service portal is a key strategic initiative for Tiger Brands. Such a portal allows business clients to manage their orders, track deliveries, and access product information conveniently, thereby fostering stronger relationships and improving customer satisfaction. This digital engagement is paramount for staying competitive.

Expanding its e-commerce presence is not just a matter of keeping pace; it’s essential for capturing future growth. As more consumers embrace online shopping, companies that fail to establish a strong digital presence risk being left behind. Tiger Brands' investment in these digital channels positions it to capitalize on the evolving consumer behavior and the expanding online retail market.

- E-commerce Growth: Global e-commerce sales are anticipated to surpass $7 trillion by 2025, highlighting a significant consumer shift.

- Omnichannel Expectations: Consumers increasingly demand seamless integration between online and physical retail experiences.

- Tiger Brands' Digitalization: The company is actively digitizing B2B self-service ordering and developing customer portals.

- Strategic Imperative: Expanding e-commerce presence is critical for Tiger Brands to capture growth in the evolving retail environment.

Data Analytics and Consumer Insights

Tiger Brands is increasingly leveraging data analytics to gain deeper consumer insights, which is crucial for developing more targeted products and refining marketing strategies. This technological advancement allows them to understand evolving consumer preferences more effectively.

While specific 2024/2025 data on Tiger Brands' data analytics investment isn't publicly detailed in recent reports, the broader industry trend and the company's stated focus on digital transformation and consumer-centric innovation underscore a growing reliance on these capabilities. For instance, the company has spoken about enhancing its digital presence and e-commerce capabilities, which inherently rely on robust data analysis to drive growth.

The ability to analyze vast amounts of consumer data allows Tiger Brands to be more agile in responding to changing market trends and consumer needs. This data-driven approach can lead to more successful product launches and marketing campaigns.

- Enhanced Consumer Understanding: Data analytics provides granular insights into consumer behavior, preferences, and purchasing patterns, enabling more personalized marketing and product development.

- Agile Market Response: By analyzing real-time data, Tiger Brands can quickly adapt its strategies to emerging trends and shifting consumer demands.

- Optimized Marketing Spend: Data-driven insights help in allocating marketing resources more efficiently, targeting the right consumer segments with the most effective messages.

- Informed Product Innovation: Understanding consumer needs through data analysis supports the development of innovative products that are more likely to succeed in the market.

Tiger Brands is enhancing its technological capabilities through significant R&D investments, exemplified by its Sensorium facility, which drives innovation and product development. The company is also automating processes to improve food safety and quality, while digitizing procurement for greater efficiency.

The company is embracing supply chain digitization, incorporating automated planning systems and digitizing its freight desk. Furthermore, route management software is being implemented in bakery operations to optimize deliveries and reduce costs.

Tiger Brands is actively expanding its e-commerce presence and digitizing B2B operations, including developing self-service portals for trade partners to meet evolving consumer demands for online shopping convenience.

Leveraging data analytics is a key focus for gaining deeper consumer insights, enabling more targeted product development and refined marketing strategies, crucial for agile market response and optimized marketing spend.

Legal factors

Tiger Brands operates under strict food safety regulations, a critical area underscored by the severe Listeria outbreak in 2017-2018. Recent reports from mid-2024 indicate that the company has been finalizing agreements for interim compensation to claimants affected by that incident, demonstrating ongoing legal and financial engagement with the consequences.

Compliance with these rigorous food safety standards is not merely a legal obligation but a fundamental requirement for maintaining consumer trust and avoiding further legal repercussions. Failure to adhere to these regulations can result in substantial fines, product recalls, and significant reputational damage, impacting market position and profitability.

Consumer protection laws are paramount for Tiger Brands, dictating stringent standards for product quality, accurate labeling, and overall safety. This legal framework makes product liability a critical concern, directly impacting operational costs and brand reputation. For instance, the significant financial repercussions stemming from the 2017-2018 Listeria outbreak, which saw Tiger Brands face a substantial class action lawsuit, underscore the immense potential liabilities in the packaged goods sector and highlight the absolute necessity of robust product liability insurance coverage.

Maintaining transparency and providing truthful product information is not merely good practice but a legal imperative. Failure to do so can lead to regulatory penalties and further legal challenges, as seen with past recalls in the industry. Ensuring all marketing materials and product packaging adhere strictly to consumer protection regulations is vital for ongoing legal compliance and mitigating risk for Tiger Brands.

Tiger Brands operates within South Africa's stringent competition law framework, overseen by the Competition Commission. As a dominant player in various packaged goods segments, the company faces potential scrutiny regarding its market share and pricing. For instance, in 2023, Tiger Brands continued its portfolio optimization strategy, which included the disposal of certain non-core assets, partly to refine its competitive standing and focus on core growth areas, demonstrating an awareness of regulatory oversight concerning market dominance.

Labor Laws and Employment Equity

Tiger Brands operates under stringent South African labor laws, necessitating strict adherence to regulations governing employment equity and fair labor practices. The company's proactive approach to Broad-Based Black Economic Empowerment (B-BBEE) and its investment in talent development programs demonstrate compliance with these legal frameworks. For instance, in 2024, Tiger Brands continued its focus on skills development, with a significant portion of its training budget allocated to upskilling its diverse workforce, aligning with B-BBEE objectives.

Maintaining ethical employment standards and ensuring a safe, healthy working environment are continuous legal and ethical mandates for Tiger Brands. These obligations are crucial for fostering positive employee relations and mitigating legal risks. The company's safety record and employee grievance procedures are subject to regular review, with reported workplace incidents in 2024 showing a downward trend, reflecting ongoing efforts in this area.

- Employment Equity Compliance: Tiger Brands actively works to achieve equitable representation across all levels of its workforce, aligning with the Employment Equity Act.

- B-BBEE Contribution: The company's commitment to B-BBEE extends to procurement, ownership, and skills development, contributing to economic transformation in South Africa. In 2024, Tiger Brands reported progress in increasing its B-BBEE scorecard points.

- Fair Labor Practices: Adherence to the Basic Conditions of Employment Act ensures fair wages, working hours, and leave entitlements for all employees.

- Health and Safety: Tiger Brands prioritizes a safe working environment, implementing robust occupational health and safety management systems to comply with the Occupational Health and Safety Act.

Environmental Regulations and Carbon Tax

New legislative mandates, particularly concerning stricter environmental regulations and carbon tax liabilities, directly shape Tiger Brands' operational landscape. The company's financial planning for 2024-2025, for instance, includes provisions for these carbon tax obligations, reflecting a proactive approach to managing these new costs.

Tiger Brands is making significant capital investments, such as upgrading effluent treatment facilities, to ensure full compliance with evolving environmental standards. These investments are critical for meeting regulatory benchmarks and maintaining operational licenses.

Adherence to the National Environmental Management: Air Quality Act (AQA) presents a core legal imperative for Tiger Brands. This act governs air emissions, requiring the company to monitor and control pollutants from its manufacturing processes. Failing to comply could result in penalties and operational disruptions.

- Carbon Tax Budgeting: Tiger Brands is allocating resources in its 2024-2025 budgets to cover anticipated carbon tax liabilities, a direct response to South Africa's carbon tax policy.

- Effluent Treatment Upgrades: Investments in upgrading effluent treatment plants are underway to meet stricter wastewater discharge standards, reflecting a commitment to environmental stewardship and regulatory compliance.

- AQA Compliance: The company is focused on maintaining compliance with the Air Quality Act, which impacts its manufacturing operations through emission control and monitoring requirements.

Tiger Brands faces ongoing legal scrutiny stemming from the 2017-2018 Listeria outbreak, with compensation agreements being finalized in mid-2024. Strict adherence to food safety regulations is paramount to avoid substantial fines and reputational damage, as highlighted by the significant liabilities incurred from past incidents and the necessity of robust product liability insurance.

Consumer protection laws mandate product quality and accurate labeling, making product liability a critical cost factor. The company's continued focus on ethical employment standards and compliance with labor laws, including B-BBEE initiatives and skills development, is evident in its 2024 training budget allocations.

Navigating South Africa's competition law framework requires careful attention to market share and pricing, especially as Tiger Brands engages in portfolio optimization. Furthermore, new environmental mandates, including carbon tax liabilities, are being integrated into financial planning, with capital investments in effluent treatment facilities demonstrating a commitment to compliance with evolving air and water quality acts.

Environmental factors

Water scarcity poses a significant challenge for Tiger Brands in South Africa, a nation grappling with severe water stress. The company's operations, particularly in food and beverage manufacturing, are inherently water-intensive. This reality underscores the critical need for robust water management strategies.

In 2024, Tiger Brands undertook a detailed water risk assessment, identifying critical vulnerabilities such as inconsistent water supply and reduced pressure at its facilities. This proactive step is crucial for understanding the direct impact on production capabilities and supply chain reliability.

Looking ahead to 2025, Tiger Brands is prioritizing initiatives to bolster its operational water security. Investments in upgrading effluent treatment plants and exploring water recovery technologies are key components of this strategy to mitigate the effects of scarcity.

Energy security remains a critical environmental factor for Tiger Brands, especially given South Africa's ongoing challenges with electricity supply. This directly affects manufacturing costs and ensures consistent operations.

Tiger Brands is actively working to improve its energy efficiency and lower its carbon footprint. In 2024, the company achieved a notable 9.1% reduction in carbon emissions, though this was partly influenced by reduced production volumes.

Looking ahead, the company is developing a more comprehensive climate change strategy. This includes exploring various alternative fuel sources to support its ambitious emission reduction targets set for 2030.

Climate change is increasingly disrupting agricultural supply chains, leading to unpredictable availability and price volatility for key raw materials used by Tiger Brands. Extreme weather events, such as droughts and floods, directly impact crop yields and the quality of agricultural inputs, creating significant operational challenges.

Tiger Brands' sustainability strategy directly addresses these environmental pressures by focusing on enhancing the livelihoods of small-scale farmers and promoting environmental stewardship. This approach is crucial as these farmers are particularly vulnerable to climate-related disruptions, and their resilience directly affects the company's long-term supply security.

For instance, South Africa, a key market for Tiger Brands, has experienced significant weather pattern shifts. Between 2023 and early 2024, severe drought conditions in some regions impacted maize production, a staple ingredient for many food products, while unseasonal heavy rains in other areas affected fruit harvests, highlighting the direct link between climate events and raw material costs.

Waste Management and Circular Economy Initiatives

Tiger Brands is actively pursuing a circular economy model, prioritizing waste reduction across food, packaging, and operational processes. The company is investing in innovations to lessen its environmental impact, a crucial aspect of its sustainability strategy.

While waste management performance showed variability in 2024, Tiger Brands remains committed to ongoing investments in this area. A key focus includes developing advanced packaging solutions that support its broader environmental objectives.

- Circular Economy Focus: Tiger Brands aims to minimize waste through initiatives targeting food, packaging, and process waste.

- 2024 Performance: Waste management results in 2024 were mixed, indicating areas for continued improvement.

- Investment in Sustainability: The company continues to allocate resources towards reducing its overall environmental footprint.

- Packaging Innovation: New packaging solutions are being developed as part of the strategy to meet sustainability targets.

Sustainable Sourcing and Biodiversity Protection

Tiger Brands is deeply invested in responsible sourcing, particularly for its agricultural inputs, understanding that thriving ecosystems are crucial for a stable food supply. The company acknowledges the global challenge of declining food systems and actively supports smallholder farmers to build resilience. This commitment is a cornerstone of their environmental stewardship, aiming to reduce ecological footprints and champion biodiversity.

Their strategy directly addresses the interconnectedness of environmental health and business continuity. For instance, a significant portion of Tiger Brands' raw materials comes from agriculture, making them particularly sensitive to environmental degradation and climate change impacts. In 2023, the company continued to refine its sustainable sourcing policies, with a focus on key commodities like maize and wheat, where biodiversity loss and water scarcity pose increasing risks. Efforts include promoting climate-smart agricultural practices among their supplier base, which in turn can enhance crop yields and reduce environmental strain.

- Responsible Sourcing Commitment: Tiger Brands prioritizes sourcing ingredients responsibly, especially from agricultural value chains.

- Ecosystem Health: The company recognizes that healthy ecosystems are foundational for securing a reliable food supply.

- Addressing Food System Decline: Initiatives focus on counteracting the decline in food systems and providing support to small-scale farmers.

- Environmental Stewardship Alignment: This effort is integral to Tiger Brands' broader sustainability strategy, emphasizing minimal environmental impact and biodiversity promotion.

Environmental factors significantly impact Tiger Brands' operations, particularly water scarcity and energy security in South Africa. The company is actively implementing strategies to address these challenges, including investing in water management technologies and improving energy efficiency to reduce its carbon footprint.

Climate change presents a substantial risk to Tiger Brands' agricultural supply chains, leading to price volatility and unpredictable raw material availability. In response, the company is enhancing farmer livelihoods and promoting sustainable agricultural practices to build resilience against extreme weather events.

Tiger Brands is committed to a circular economy model, focusing on waste reduction across its value chain and investing in innovative packaging solutions. This commitment extends to responsible sourcing, ensuring ecological health and biodiversity to support a stable food supply chain.

| Environmental Factor | 2024 Impact/Action | 2025 Outlook/Strategy |

| Water Scarcity | Water risk assessment completed; identified vulnerabilities in supply and pressure. | Prioritizing operational water security; investing in effluent treatment and water recovery. |

| Energy Security & Emissions | Achieved 9.1% carbon emission reduction; affected by reduced production. | Developing comprehensive climate change strategy; exploring alternative fuel sources for 2030 targets. |

| Climate Change Impacts on Agriculture | Observed weather pattern shifts affecting crop yields (e.g., maize, fruit) and raw material costs. | Focusing on smallholder farmer resilience and climate-smart agriculture for supply chain stability. |

| Waste Management & Circularity | Mixed waste management performance; ongoing investment in reducing environmental impact. | Investing in advanced packaging solutions; driving circular economy initiatives. |

PESTLE Analysis Data Sources

Our Tiger Brands PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.