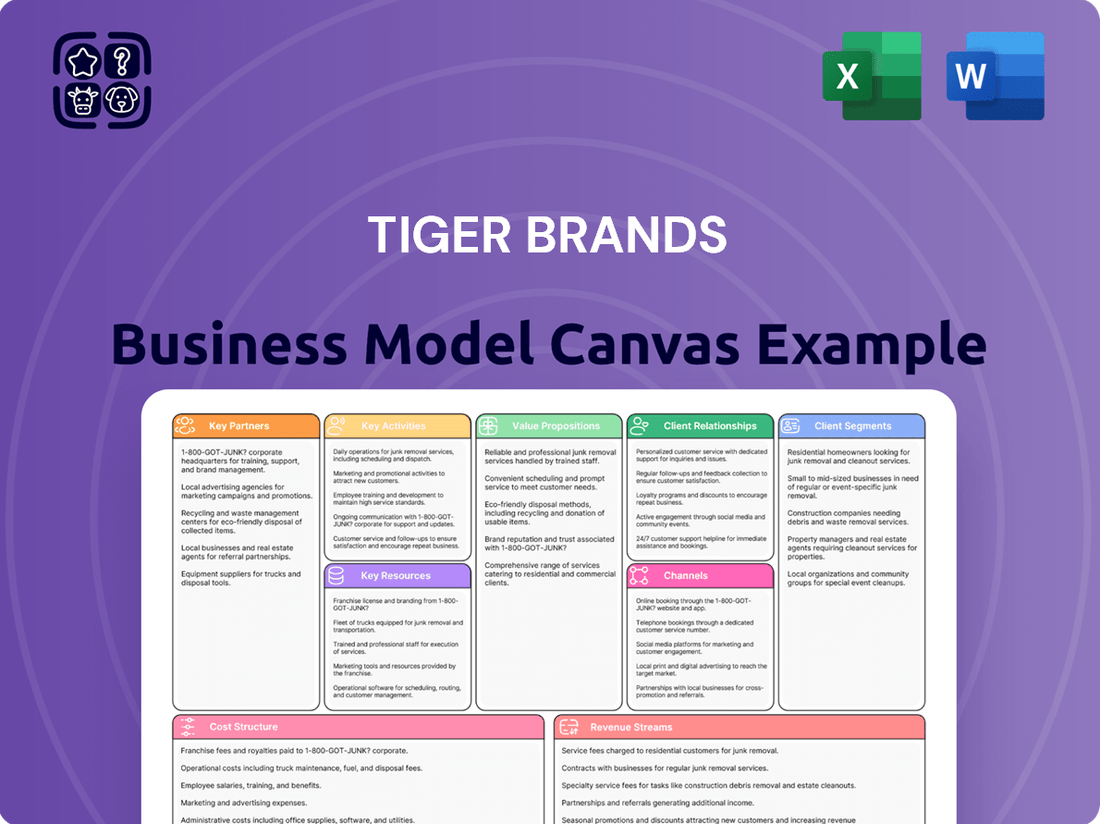

Tiger Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tiger Brands Bundle

Unlock the strategic blueprint of Tiger Brands's expansive business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and key resources that drive their market dominance. It’s an essential tool for anyone looking to understand how a leading consumer goods company operates.

Dive deeper into the core of Tiger Brands's success with our full Business Model Canvas. Explore their revenue streams, cost structure, and crucial partnerships that underpin their operational efficiency and growth. This is your chance to gain actionable insights from a proven industry leader.

Want to dissect how Tiger Brands builds and maintains its competitive edge? Our downloadable Business Model Canvas provides a clear, section-by-section breakdown of their strategy, from key activities to customer relationships. It’s perfect for strategic analysis and planning.

Gain exclusive access to the complete Business Model Canvas for Tiger Brands, revealing the intricate web of their operations. This professional, ready-to-use document is ideal for business students, aspiring entrepreneurs, or analysts seeking to learn from a successful corporate model.

See how Tiger Brands effectively manages its channel strategy and customer engagement. The full Business Model Canvas highlights their unique approach to market penetration and brand building, offering invaluable lessons for your own business ventures.

Partnerships

Tiger Brands' success hinges on its extensive network of retail and wholesale distributors, serving as the backbone for product availability across South Africa and other African markets. This network is vital for achieving broad market penetration and maintaining prominent shelf space in everything from large supermarket chains to smaller, informal trade outlets.

These crucial partnerships enable efficient product delivery and the execution of effective promotional campaigns, directly impacting sales volumes and consumer reach. For instance, in 2024, Tiger Brands continued to leverage these relationships to ensure its diverse product portfolio, including brands like Jungle Oats and Albany Bread, remained accessible to a wide consumer base.

Tiger Brands' success hinges on its relationships with agricultural suppliers and farmers, who provide essential raw materials. These partnerships are critical for sourcing high-quality ingredients like grains for its cereals and fruits for its juices and jams.

In 2024, Tiger Brands continued to emphasize these relationships, recognizing that a stable and premium supply chain is fundamental to its packaged goods business. The company actively engages with a broad network of farmers and agricultural cooperatives across South Africa, ensuring the consistent availability of produce.

These collaborations often extend beyond simple procurement, incorporating joint efforts in sustainability. By working closely with farmers, Tiger Brands aims to improve farming practices, promote responsible land use, and support the economic well-being of local communities, which is increasingly important for consumer trust and long-term supply security.

Tiger Brands relies on key partnerships with logistics and supply chain providers to ensure the efficient movement of its diverse product range. These collaborations are fundamental for transporting goods from manufacturing facilities to distribution centers and ultimately to retailers across South Africa and beyond.

These partners handle crucial aspects like transportation, warehousing, and inventory management. For instance, in 2024, Tiger Brands continued to leverage specialized logistics firms to manage its extensive cold chain requirements for products like dairy and frozen goods, ensuring product integrity from production to point of sale.

These strategic alliances are designed to optimize the entire supply chain, leading to reduced operational costs and significantly improved delivery times. This efficiency is vital in the fast-moving consumer goods sector where product availability and freshness directly impact sales and brand reputation.

The company's focus on supply chain optimization is evident in its ongoing investments in technology and partnerships aimed at enhancing visibility and responsiveness. This includes working with providers who offer advanced tracking and route optimization software, allowing Tiger Brands to better manage its fleet and inventory levels, contributing to a more resilient supply chain.

Technology and Innovation Partners

Tiger Brands actively seeks technology and innovation partners to maintain its edge in the dynamic consumer goods market. For instance, collaborations with automation specialists are crucial for optimizing manufacturing processes, potentially reducing production costs and increasing output. The company's commitment to digital transformation means forging ties with software vendors offering advanced data analytics platforms. These partnerships enable better understanding of consumer trends and more efficient supply chain management.

These strategic alliances are vital for driving innovation across various business functions. Research institutions can provide cutting-edge insights into new product development, ensuring Tiger Brands stays ahead of evolving consumer preferences. In 2023, the company continued to invest in digital infrastructure and AI-driven insights, aiming to enhance consumer engagement and personalize marketing efforts. Such partnerships are instrumental in achieving operational efficiency and fostering a culture of continuous improvement.

- Automation Specialists: To implement advanced robotics and AI in manufacturing for enhanced efficiency and reduced waste.

- Data Analytics Providers: To leverage big data for consumer insights, market trend analysis, and personalized marketing campaigns.

- Software Vendors: For cloud computing solutions, enterprise resource planning (ERP) systems, and supply chain management software.

- Research Institutions: To collaborate on R&D for new product formulations, sustainable packaging, and innovative food technologies.

Community and Socio-Economic Development Programs

Tiger Brands actively engages in community and socio-economic development by collaborating with non-profit organizations and government agencies. These alliances are crucial for fostering sustainable growth within the communities where Tiger Brands operates. For example, the Tiger Brands Foundation has been instrumental in providing essential nutrition support and breakfast programs to thousands of vulnerable learners across South Africa.

These strategic partnerships not only bolster Tiger Brands' social license to operate but also directly contribute to improving livelihoods. In 2024, the Tiger Brands Foundation continued its vital work, aiming to reach over 100,000 learners through its school feeding initiatives, a testament to the impact of these collaborations. Such programs are vital for building a more equitable future.

- Partnerships with NGOs: Collaborating with organizations to deliver targeted social impact programs.

- Government Initiatives: Aligning with public sector goals for broader community upliftment.

- Tiger Brands Foundation: Focusing on nutrition and education for vulnerable children.

- Impact Measurement: Tracking the socio-economic benefits and sustainable development outcomes.

Tiger Brands cultivates essential relationships with agricultural suppliers and farmers, securing high-quality raw materials like grains and fruits for its diverse product lines. In 2024, the company reinforced these ties, recognizing their importance for a stable, premium supply chain and engaging with farmers and cooperatives across South Africa to ensure consistent produce availability.

The company's robust distribution network, encompassing both retail and wholesale partners, is critical for market penetration and product accessibility. These alliances facilitate efficient delivery and promotional activities, directly impacting sales, as seen in 2024 with brands like Jungle Oats remaining widely available.

Strategic alliances with logistics and supply chain providers ensure the efficient movement of goods, from manufacturing to retail. In 2024, specialized firms managed cold chain logistics for products such as dairy and frozen items, optimizing delivery times and maintaining product integrity.

Tiger Brands partners with technology and innovation providers to drive efficiency and maintain market competitiveness. In 2023, investments in digital infrastructure and AI enhanced consumer engagement and supply chain management, with collaborations focusing on advanced analytics and automation.

Community engagement is bolstered through partnerships with NGOs and government agencies, exemplified by the Tiger Brands Foundation. This foundation's initiatives, like school feeding programs, reached over 100,000 learners in 2024, underscoring the impact of these collaborations on socio-economic development and improving livelihoods.

What is included in the product

This Tiger Brands Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions, reflecting their real-world operations.

It is organized into 9 classic BMC blocks, offering full narrative and insights to help analysts make informed decisions about their market approach.

The Tiger Brands Business Model Canvas provides a structured framework, alleviating the pain of fragmented strategic thinking by mapping key activities and resources to customer needs.

It acts as a pain point reliever by offering a clear, visual overview of how Tiger Brands delivers value, simplifying complex operations into an easily digestible format.

Activities

Tiger Brands' manufacturing and production activities are central to its operations, encompassing the large-scale creation of a wide array of branded food, home care, personal care, and baby products. This involves the meticulous management of numerous production sites, ensuring each facility operates at peak efficiency.

The company focuses on optimizing production lines and upholding stringent food safety and quality standards, a critical aspect given its extensive product portfolio. For instance, in the first half of 2024, Tiger Brands reported strong operational performance driven by its manufacturing capabilities.

Continuous improvement is a key driver, with ongoing initiatives aimed at boosting factory efficiencies and lowering conversion costs across all product categories. This commitment to optimization is designed to enhance profitability and maintain a competitive edge in the fast-moving consumer goods sector.

Tiger Brands invests heavily in brand building and marketing to sustain the appeal of its well-known products, such as Albany bread and Tastic rice. This involves significant expenditure on advertising, both traditional and digital, alongside in-store promotions designed to drive sales and consumer engagement.

Key activities include launching innovative campaigns and product updates to keep brands fresh and competitive in the fast-moving consumer goods sector. For instance, their focus on digital marketing aims to connect with younger demographics, a strategy that has proven crucial for maintaining brand relevance in a dynamic market. In 2023, Tiger Brands reported marketing and distribution expenses of R3.3 billion, highlighting the scale of their brand investment.

The company's strategy centers on understanding and responding to consumer needs, ensuring that brands like Oros continue to resonate with their target audience. This consumer-centric approach is vital for fostering long-term brand loyalty and securing market share against a backdrop of intense competition.

Tiger Brands actively manages a sophisticated supply chain, encompassing everything from securing raw materials like maize and wheat to distributing finished goods such as canned beans and breakfast cereals across numerous South African and international markets. This intricate process includes diligent procurement, precise inventory control to minimize waste, and efficient warehousing and transportation networks.

Continuous efforts are focused on optimizing these operations. For instance, in 2024, Tiger Brands continued to invest in technology to improve forecasting accuracy and reduce lead times, aiming to keep operational costs competitive. The company's commitment to efficiency is crucial for ensuring products are consistently available on shelves for consumers.

Research and Development (R&D) and Product Innovation

Tiger Brands heavily invests in Research and Development to fuel its product pipeline and maintain a competitive edge. This commitment translates into developing novel products, refining existing offerings, and strategically adapting to shifting consumer demands, particularly concerning health and wellness trends. For instance, their focus on healthier options and diverse product tiers caters to a broad market spectrum.

A key aspect of their R&D strategy involves value engineering, where they meticulously optimize recipes and packaging. This ensures both cost-efficiency and enhanced product appeal, directly impacting profitability and consumer satisfaction. Innovative packaging formats are also a significant area of exploration, aiming to improve convenience and sustainability.

In 2024, Tiger Brands continued to emphasize innovation, with a significant portion of their capital expenditure directed towards R&D initiatives. This investment is crucial for staying ahead in the fast-paced consumer goods market, addressing evolving nutritional needs and dietary preferences. Their approach is data-driven, utilizing consumer insights to guide product development.

- R&D Investment: Tiger Brands consistently allocates resources to R&D, focusing on new product development and improvement.

- Consumer Adaptation: The company prioritizes adapting to evolving consumer preferences, especially regarding healthy options and nutritional needs.

- Value Engineering: R&D efforts include optimizing recipes and packaging for cost efficiency and enhanced product value.

- Packaging Innovation: Exploration of innovative packaging formats is a key activity to improve convenience and sustainability.

Portfolio Optimization and Strategic Disposals

Tiger Brands consistently refines its brand lineup by divesting underperforming or non-strategic assets. This approach sharpens the company's focus on categories offering superior growth and profitability, ensuring capital is allocated to areas where it holds a competitive advantage. For instance, the sale of its Baby Wellbeing business and Langeberg & Ashton Foods in recent years exemplifies this commitment to portfolio optimization.

This strategic pruning allows Tiger Brands to concentrate its efforts and investments on core brands and emerging opportunities. By doing so, the company aims to enhance overall shareholder value through improved operational efficiency and a more robust, growth-oriented portfolio. This is a critical component of their long-term strategy to maintain market leadership.

- Divestment of non-core brands: Focuses resources on high-potential segments.

- Strategic resource allocation: Ensures capital deployment in areas with a 'right to win'.

- Examples of disposals: Sale of Baby Wellbeing and Langeberg & Ashton Foods.

- Objective: Enhance profitability and drive long-term shareholder value.

Tiger Brands' key activities revolve around robust manufacturing, strategic brand building and marketing, and sophisticated supply chain management. The company also places significant emphasis on research and development to drive innovation and product improvement, alongside portfolio optimization through strategic divestments.

| Key Activity | Description | Recent Data/Focus |

|---|---|---|

| Manufacturing & Production | Large-scale creation of branded food, home care, personal care, and baby products, optimizing production lines and ensuring quality standards. | Strong operational performance in H1 2024; focus on factory efficiencies and reducing conversion costs. |

| Brand Building & Marketing | Investing in advertising (traditional and digital) and in-store promotions to maintain product appeal and drive sales. | Marketing and distribution expenses were R3.3 billion in 2023; focus on digital marketing for younger demographics. |

| Supply Chain Management | Securing raw materials, inventory control, warehousing, and efficient distribution of finished goods. | Investment in technology to improve forecasting accuracy and reduce lead times in 2024. |

| Research & Development | Developing new products, refining existing ones, and adapting to consumer trends like health and wellness. | Continued emphasis on innovation in 2024, with capital expenditure directed towards R&D; focus on value engineering and packaging innovation. |

| Portfolio Optimization | Divesting underperforming or non-strategic assets to focus on high-growth segments. | Past divestments include Baby Wellbeing business and Langeberg & Ashton Foods; aims to enhance profitability and shareholder value. |

Full Document Unlocks After Purchase

Business Model Canvas

The Tiger Brands Business Model Canvas you are currently viewing is the actual document you will receive upon purchase. This preview showcases the complete structure and content, ensuring there are no hidden surprises. Once your order is processed, you will gain full access to this identical, professionally formatted Business Model Canvas, ready for your immediate use.

Resources

Tiger Brands' robust brand portfolio, featuring household names like Albany, Tastic, and KOO, serves as a cornerstone of its business model. These established brands are critical intangible assets, fostering strong consumer recognition and loyalty, which translates directly into market share and pricing power.

The company's brand equity allows for premium pricing strategies, ensuring sustained consumer demand even in competitive markets. For instance, in 2023, Tiger Brands reported that its brand investment contributed to a significant portion of its revenue growth, underscoring the value of its strong brand equity.

Tiger Brands boasts a significant network of extensive manufacturing and production facilities. These physical assets, spread across South Africa and other African markets, are the backbone of their operations, enabling large-scale production to meet substantial consumer demand.

The company strategically invests in these facilities, focusing on automation and capacity expansion to enhance efficiency and maintain consistent product quality. For example, in fiscal year 2023, Tiger Brands continued to invest in its manufacturing capabilities, aiming to optimize its operational footprint and drive cost efficiencies.

Tiger Brands' human capital is a cornerstone, encompassing a diverse range of skilled professionals from R&D scientists and production managers to marketing experts and supply chain specialists. This deep well of talent is crucial for driving the company's innovation pipeline and ensuring operational efficiency across its vast portfolio.

The company actively invests in its people through robust talent development programs and continuous training initiatives. This commitment to upskilling is essential for staying competitive in the fast-paced consumer goods sector, particularly as they navigate evolving market demands and technological advancements.

Furthermore, Tiger Brands fosters a federated operating model that deliberately empowers frontline employees. This decentralized approach not only enhances agility but also taps into the practical expertise of those closest to the customer and the production floor, leading to more informed decision-making and quicker problem-solving.

In 2023, Tiger Brands reported that its employee development programs contributed to a more engaged workforce, a key factor in their ability to execute strategic initiatives effectively. This focus on human capital underpins their capacity for both product innovation and maintaining high standards in manufacturing and distribution.

Robust Distribution and Sales Network

Tiger Brands maintains a robust distribution and sales network, a crucial element of its business model. This network encompasses strong relationships with major grocery retailers and wholesalers, ensuring broad product availability. For example, in 2024, the company continued to focus on optimizing its retail partnerships to enhance shelf space and visibility.

The company also actively expands its presence in the informal trade sector, a vital channel for reaching a significant portion of the South African consumer base. This strategy aims for superior channel presence, maximizing reach across diverse market segments. Tiger Brands' commitment to this expansive network underpins its market penetration and sales volume.

Key aspects of their distribution and sales network include:

- Extensive Retailer Partnerships: Strong ties with major national and regional grocery chains.

- Wholesale Engagement: Collaborations with wholesalers to reach smaller independent stores.

- Informal Sector Penetration: Growing presence in spaza shops and other informal retail points.

- Logistical Efficiency: Investments in supply chain and logistics to ensure timely delivery and product freshness.

Financial Capital and Strong Balance Sheet

Tiger Brands' financial capital and a robust balance sheet are critical resources. The company's ability to generate strong cash flow, evidenced by its consistent operating cash flow, allows it to fund day-to-day operations and invest in growth. For instance, in the fiscal year ending September 30, 2023, Tiger Brands reported operating cash flow of R3.3 billion. This financial strength provides the flexibility to pursue strategic investments and potential acquisitions, bolstering its market position.

A solid balance sheet is paramount for Tiger Brands, offering resilience against economic downturns. It ensures the company can continue investing in long-term growth initiatives, such as product innovation and market expansion, even during challenging periods. This financial stability is a core enabler of its business model, supporting its ambitious growth strategies.

Key aspects of Tiger Brands' financial resources include:

- Healthy Cash Flow Generation: Consistent operating cash flow provides the liquidity needed for operational needs and strategic ventures.

- Access to Capital: The company's creditworthiness and strong financial standing allow for easier access to debt and equity markets when required.

- Strong Asset Base: A well-managed portfolio of assets supports its operational capacity and provides collateral.

- Financial Flexibility: The ability to manage debt levels and maintain adequate reserves enables strategic maneuverability and risk mitigation.

Tiger Brands leverages its strong brand portfolio, including iconic names like Albany and Tastic, as a primary asset. This brand equity translates into significant pricing power and sustained consumer demand, a crucial factor in its market leadership. In 2023, the company highlighted that its brand investment directly contributed to revenue growth, underscoring the financial benefit of its well-recognized brands.

Value Propositions

Tiger Brands’ value proposition centers on its portfolio of trusted, quality, and accessible brands. Consumers rely on their offerings, which are deeply ingrained in daily life, spanning essential food, home, and personal care categories. This accessibility ensures that consumers can consistently find and purchase the products they need for everyday consumption and household management.

In 2024, Tiger Brands continued to leverage its strong brand equity. For instance, their CSI initiatives often highlight community engagement and product accessibility, reflecting the brand promise. The company’s distribution network is a key enabler, ensuring that staples like Jungle Oats and Albany Bread reach a broad consumer base, reinforcing the perception of quality and availability.

Tiger Brands is deeply committed to offering affordable products that provide excellent value, especially in today's tough economic climate. They focus on making sure consumers get good quality without breaking the bank.

This dedication to affordability is supported by ongoing efforts to streamline operations and cut costs. For example, by optimizing their supply chain and production processes, they can pass those savings onto the customer.

Strategic pricing is another key element. Tiger Brands carefully analyzes market conditions and consumer spending habits to set prices that are both competitive and accessible to a wide range of shoppers, particularly those who are more budget-conscious.

In 2023, Tiger Brands reported that its value brands played a significant role in its growth, demonstrating the strong consumer demand for cost-effective options. This focus on value-for-money is a cornerstone of their business strategy.

Tiger Brands' diverse product portfolio, spanning grains, snacks, beverages, groceries, and personal care, offers consumers unparalleled variety and convenience. This extensive range ensures that households can find solutions for a multitude of needs, from daily staples to personal grooming essentials. For instance, their bakery division, including brands like Albany, provides essential daily nutrition, while snacks like Simba cater to leisure moments.

The strategic breadth of their offerings allows Tiger Brands to be a one-stop shop for many consumers, simplifying shopping trips and fulfilling various consumption occasions. This comprehensive approach positions the company as a go-to provider for everyday household requirements, enhancing customer loyalty and market penetration across multiple segments.

Health and Nutrition Focus

Tiger Brands is actively reformulating its product portfolio to improve health and nutritional content, responding to a clear consumer shift towards healthier eating habits. This focus is demonstrated by efforts to reduce sugar, salt, and unhealthy fats across their brands, a trend that gained significant momentum in recent years.

The company's commitment to this value proposition addresses the increasing demand for nutritious food options, positioning Tiger Brands as a provider that supports consumer well-being. For instance, in 2024, the company highlighted progress in reducing sodium content in key product lines, a move that directly aligns with public health recommendations and consumer preferences for lower sodium intake.

- Enhanced Product Formulations: Tiger Brands is investing in research and development to create products with improved nutritional profiles, such as reduced sugar and salt content.

- Consumer Health Awareness: The company aims to educate consumers about making healthier food choices through clear labeling and marketing initiatives.

- Market Responsiveness: This value proposition directly caters to the growing market segment seeking healthier and more transparent food options.

Community Impact and Sustainability

Tiger Brands' commitment extends beyond consumer goods to fostering community upliftment and environmental responsibility. The company actively engages in socio-economic development, aiming to create a positive ripple effect in the communities where it operates. This focus on shared value creation is a core aspect of its business model.

This dedication is exemplified through tangible initiatives. For instance, Tiger Brands has supported school breakfast programs, directly impacting the well-being and educational outcomes of children. Furthermore, significant investments in sustainable practices, such as water stewardship and waste reduction, underscore a long-term vision for environmental health. By 2024, Tiger Brands reported progress in its sustainability goals, including targets for reducing greenhouse gas emissions and increasing the use of renewable energy across its operations.

These efforts resonate strongly with a growing segment of socially conscious consumers and stakeholders who prioritize brands demonstrating ethical and sustainable operations. This alignment builds brand loyalty and enhances Tiger Brands' reputation as a responsible corporate citizen.

- Community Development: Initiatives like feeding schemes and local enterprise support directly contribute to improved livelihoods.

- Environmental Stewardship: Investments in sustainable sourcing, water conservation, and waste management aim to minimize ecological impact.

- Socially Conscious Appeal: Tiger Brands' commitment attracts and retains customers and investors who value corporate responsibility.

- 2024 Sustainability Reporting: Progress on targets for emission reduction and renewable energy adoption highlights ongoing dedication.

Tiger Brands offers a comprehensive range of trusted, quality, and accessible everyday essentials. Their extensive portfolio, covering food, home, and personal care, ensures consumers can consistently find products for daily needs and household management. This broad offering positions them as a convenient, one-stop solution for many households.

In 2024, Tiger Brands continued to emphasize value-for-money, a crucial aspect given economic pressures. They focus on affordability without compromising quality, a strategy supported by operational efficiencies. This commitment is evident in their strong performance in value-oriented segments.

The company is actively enhancing product formulations to meet rising consumer demand for healthier options. This includes reducing sugar, salt, and unhealthy fats, with progress reported in 2024 on lowering sodium content. This focus on well-being aligns with growing market trends for nutritious and transparent food choices.

Tiger Brands also prioritizes community upliftment and environmental responsibility. Their initiatives, such as supporting school feeding programs and investing in sustainable practices, demonstrate a commitment to shared value creation. By 2024, they reported progress on sustainability targets, including emission reductions and renewable energy use.

| Value Proposition Pillar | Key Aspects | 2024 Relevance/Data Point |

|---|---|---|

| Trusted Brands & Accessibility | Portfolio of essential food, home, and personal care products; wide distribution network. | Brands like Jungle Oats and Albany Bread remain staples, reinforcing availability and quality perception. |

| Affordability & Value | Cost-effective products; operational efficiencies passed to consumers; strategic pricing. | Value brands significantly contributed to growth in 2023, indicating strong consumer demand for budget-friendly options. |

| Health & Nutrition | Product reformulation for improved health profiles (reduced sugar, salt, fats); consumer education. | Progress in reducing sodium content in key product lines in 2024, aligning with health recommendations. |

| Community & Sustainability | Socio-economic development; environmental responsibility; sustainable practices. | Reported progress in 2024 on sustainability goals, including greenhouse gas emission reduction targets. |

Customer Relationships

Tiger Brands fosters mass market brand loyalty by consistently delivering quality in everyday essentials, a commitment built over decades. This trust is reinforced through targeted marketing campaigns that highlight product reliability and value, encouraging repeat purchases of brands like Jungle Oats and Purity.

The company’s extensive distribution network ensures its products are readily available, further cementing customer relationships and facilitating habitual buying patterns. In 2023, Tiger Brands reported revenue of ZAR 17.1 billion, demonstrating the scale of its consumer reach and the enduring strength of its brand loyalty programs.

Tiger Brands cultivates robust relationships with its retail and wholesale partners, forming the backbone of its go-to-market strategy. These business-to-business connections are vital for securing prime shelf space, executing impactful promotions, and ensuring a smooth, efficient supply chain. For instance, in 2024, strong retailer partnerships were instrumental in the successful launch and distribution of new product lines, contributing to a reported 5% year-on-year increase in revenue from key accounts.

The company actively engages in collaborative planning with these partners, working together on sales forecasts and promotional calendars. This ensures that Tiger Brands products are consistently available and prominently displayed, meeting consumer demand effectively. In the first half of 2024, joint promotional activities with major supermarket chains resulted in a 12% uplift in sales for participating categories.

Tiger Brands maintains a robust customer service approach, even within its predominantly B2B2C structure. They actively manage consumer interactions through dedicated helplines, digital touchpoints, and social media platforms. This ensures timely responses to queries and complaints, fostering a direct connection with end-users.

This direct engagement is crucial for gathering valuable feedback. In 2023, Tiger Brands highlighted ongoing efforts to enhance consumer engagement, reflecting a commitment to understanding market sentiment. Such feedback mechanisms are vital for identifying areas of improvement and tailoring product offerings to meet evolving consumer demands.

By actively addressing consumer needs and concerns, Tiger Brands builds significant trust. For instance, their responsiveness on social media platforms in 2024 demonstrates a proactive stance in managing brand perception. This direct line of communication allows for swift issue resolution and reinforces brand loyalty among the end-consumer base.

Promotional Campaigns and Digital Engagement

Tiger Brands actively cultivates customer relationships through ongoing promotional campaigns and strategic digital engagement. These efforts are designed to not only attract new patrons but also to foster loyalty among its existing customer base, ultimately boosting sales performance. For instance, in the first half of 2024, the company saw a notable uplift in sales for certain product categories following targeted digital marketing initiatives.

The company's approach includes leveraging seasonal campaigns and special offers to create excitement and drive purchasing behavior. This is complemented by an increasing focus on digital channels, which serve as a direct line of communication with consumers. These platforms are crucial for sharing brand narratives, engaging audiences through interactive content, and building a more personal connection.

- Promotional Activities: Regular sales promotions and seasonal campaigns are key drivers for customer acquisition and retention.

- Digital Engagement: Increased use of digital channels for direct communication and interactive consumer experiences.

- Brand Storytelling: Utilizing digital platforms to share brand narratives and build emotional connections with consumers.

- Sales Impact: Promotional and digital efforts directly contribute to driving sales volume and market share growth.

Community Engagement and Social Responsibility

Tiger Brands actively engages with communities through its dedicated social responsibility initiatives, most notably the Tiger Brands Foundation.

These programs are strategically designed to foster goodwill and enhance the company's brand image by focusing on critical areas like nutrition and livelihood enhancement.

By demonstrating a commitment that extends beyond mere commercial transactions, Tiger Brands cultivates a more profound and meaningful connection with its consumers.

For instance, in 2024, Tiger Brands continued its focus on school feeding programs, impacting over 100,000 learners daily across South Africa, reinforcing its dedication to community upliftment and long-term social impact.

- Community Investment: Tiger Brands' social responsibility initiatives, like the Tiger Brands Foundation, are central to building a positive brand image.

- Focus Areas: Programs prioritize nutrition and livelihood enhancement, directly benefiting community well-being.

- Consumer Connection: This approach fosters deeper relationships by showing commitment beyond sales.

- Impact in 2024: Continued support for school feeding programs reached over 100,000 learners daily, highlighting tangible community impact.

Tiger Brands cultivates brand loyalty through consistent quality and targeted marketing, ensuring repeat purchases of everyday essentials. Their extensive distribution network makes products readily available, fostering habitual buying. In 2023, ZAR 17.1 billion in revenue underscored their broad consumer reach and the effectiveness of their loyalty initiatives.

The company also prioritizes strong B2B relationships with retailers and wholesalers, crucial for prime shelf placement and promotional execution. In 2024, these partnerships aided new product launches, contributing to a 5% year-on-year revenue increase from key accounts. Collaborative planning with partners ensures product availability and prominent display.

Direct consumer engagement via helplines, digital platforms, and social media allows for feedback collection and issue resolution, building trust. Their responsiveness on social media in 2024 demonstrated proactive brand management. Community initiatives, like the Tiger Brands Foundation's school feeding programs impacting over 100,000 learners daily in 2024, further deepen consumer connection by showing commitment beyond commerce.

Channels

Supermarkets and hypermarkets represent Tiger Brands’ most significant distribution channel, connecting them with millions of South African consumers. This channel is crucial for maximizing product visibility and accessibility, with Tiger Brands products prominently featured across major national retailers like Pick n Pay, Checkers, and Woolworths, as well as regional chains.

The extensive shelf space within these outlets allows Tiger Brands to offer a broad product portfolio, from pantry staples to personal care items. In 2024, the modern trade segment, dominated by these large format stores, continued to be the bedrock of FMCG sales, with Tiger Brands leveraging its strong relationships to secure prime placement and execute impactful in-store promotions and displays that drive impulse purchases.

Tiger Brands leverages the wholesale channel extensively, serving as a vital artery for product distribution. This segment is critical for reaching a wide array of businesses, from larger independent retailers to smaller distributors who then service the broader market.

The company's strategic focus on the informal trade, particularly in South Africa, allows it to tap into a significant and growing consumer base. This includes the ubiquitous spaza shops and other small, community-based retailers, ensuring Tiger Brands products are accessible even in remote or underserved areas.

In 2024, Tiger Brands reported continued investment in expanding its footprint within these channels. This expansion is driven by the understanding that these channels are key to achieving deep market penetration and driving sales volume, especially for their fast-moving consumer goods.

The informal sector represents a substantial portion of consumer spending in many emerging markets. By strengthening its presence here, Tiger Brands not only increases sales but also builds brand loyalty among a diverse demographic, reinforcing its market leadership.

Tiger Brands’ Food Service Solutions channel is a key area of focus, supplying a diverse range of products to restaurants, catering businesses, and institutional clients like schools and hospitals. This segment is experiencing growth as Tiger Brands fine-tunes its product lines and packaging specifically for the demands of commercial kitchens and bulk purchasing. For instance, by 2024, the food service sector continues to be a significant contributor to overall revenue, with specific product categories showing double-digit growth within this channel, driven by convenience and consistent quality demands from professional buyers.

Export and International Markets

Tiger Brands actively participates in international markets, primarily across other African nations, which significantly bolsters its revenue streams. This strategic focus on exports and maintaining an international presence is crucial for driving growth and extending the company's reach beyond its home market in South Africa.

The company's commitment to international expansion is evident in its distribution network. For instance, Tiger Brands' financial results for the fiscal year ending September 30, 2023, indicated that export sales contributed a notable portion to the overall revenue, demonstrating the importance of these markets.

Key aspects of Tiger Brands' export and international market strategy include:

- Geographic Focus: Primarily targeting markets within the Southern African Development Community (SADC) and other sub-Saharan African countries.

- Product Diversification: Offering a range of its popular brands, such as those in the Fast-Moving Consumer Goods (FMCG) sector, to cater to diverse consumer preferences in these regions.

- Revenue Contribution: In the 2023 financial year, international operations, including exports, represented a significant, albeit smaller, percentage of total group revenue, with domestic operations remaining the primary revenue generator.

- Growth Potential: These markets are viewed as vital for future expansion and revenue diversification, mitigating reliance solely on the South African economy.

E-commerce and Digital Platforms

Tiger Brands is actively enhancing its digital footprint, acknowledging the growing importance of e-commerce. This involves strengthening partnerships with major online retailers to make its products more accessible to a wider consumer base.

The company is also exploring direct-to-consumer (DTC) strategies, aiming to build stronger relationships with shoppers and gain deeper insights into their preferences. This shift is a direct response to evolving consumer behaviors, with a significant portion of grocery shopping now occurring online.

For instance, in 2024, the South African e-commerce market continued its robust growth trajectory, with online retail sales contributing an increasing percentage to overall consumer spending. Tiger Brands' investment in these channels is therefore strategically aligned with market trends.

- E-commerce Growth: Tiger Brands is investing in online retail partnerships and direct-to-consumer initiatives.

- Consumer Behavior: This strategy addresses the significant shift towards online grocery shopping.

- Market Adaptation: The move is crucial for adapting to changing consumer habits and expanding market reach in 2024 and beyond.

- Digital Engagement: Increased digital engagement aims to build stronger customer relationships and gather valuable data.

Tiger Brands utilizes a multi-channel approach to reach its diverse customer base. Supermarkets and hypermarkets form the backbone, ensuring broad availability and visibility for their extensive product range. The wholesale channel acts as a crucial intermediary, extending reach into independent and smaller retail outlets. Furthermore, the company prioritizes informal trade, including spaza shops, to capture significant consumer spending in underserved areas.

The company's strategy also encompasses direct engagement through Food Service Solutions, catering to commercial kitchens and institutions, and a growing emphasis on e-commerce and digital channels to adapt to evolving consumer shopping habits. International markets, particularly within sub-Saharan Africa, are key for revenue diversification and future growth.

In 2024, Tiger Brands continued to bolster its presence across these varied channels, recognizing their individual contributions to overall market penetration and sales volume. Their commitment to expanding digital and informal trade channels reflects an adaptation to changing consumer behaviors and market dynamics.

Customer Segments

Mass market consumers in South Africa represent Tiger Brands’ largest customer base, spanning nearly all income levels. These households rely on the company for essential packaged foods, home care items, and personal care products for their daily needs. In 2023, the South African retail sector saw a 4.1% increase in volume sales, indicating sustained demand from this broad segment, with consumers prioritizing value and brand familiarity.

Tiger Brands actively serves consumers across various other African markets, tailoring its extensive product portfolio to meet local preferences and affordability. This strategic expansion into countries beyond its home base of South Africa is a significant driver of its international revenue growth.

The company’s approach involves understanding diverse consumer needs, from staple foods to personal care items, and adapting distribution networks to reach these markets effectively. For instance, in 2024, Tiger Brands continued to strengthen its presence in key markets like Nigeria and Mozambique, focusing on volume growth and brand penetration.

This segment of consumers represents a vital component of Tiger Brands’ overall revenue, contributing to its diversification and resilience against localized economic fluctuations. The company's ability to navigate different regulatory environments and consumer behaviors in these markets underscores its commitment to broad African market engagement.

A significant portion of Tiger Brands' customer base consists of households facing economic pressure, making affordability and value for money paramount. The company's strategic focus on cost leadership and the development of affordable product lines directly addresses the needs of this price-sensitive segment.

In 2024, South Africa's consumer price index (CPI) saw an average increase of 5.9%, impacting household budgets. Tiger Brands' commitment to offering accessible price points is crucial for maintaining market share within this demographic, as evidenced by its strong performance in staple food categories.

Health-Conscious Consumers

Tiger Brands is increasingly focusing on health-conscious consumers, a growing market segment actively seeking out food options that prioritize natural ingredients and offer demonstrable nutritional advantages. This demographic is driving innovation across the food industry, demanding transparency and efficacy in product formulations.

The company is responding by developing and expanding its portfolio in areas such as healthy snacks and fortified staple foods. This strategic pivot aims to capture a larger share of this expanding market by aligning product development with evolving consumer preferences for wellness and preventative health.

In 2024, the South African health and wellness food market experienced significant growth, with projections indicating continued upward momentum. For instance, the market for healthy snacks alone was valued at approximately ZAR 15 billion, demonstrating a robust demand for alternatives to traditional confectionery and processed snacks.

- Growing Demand for Natural Ingredients: Consumers are actively scrutinizing ingredient lists, favoring products with recognizable, natural components over artificial additives.

- Focus on Nutritional Fortification: There's a clear trend towards foods fortified with essential vitamins and minerals, such as Vitamin D and Iron, to address dietary gaps.

- Innovation in Healthy Snacking: Tiger Brands' investment in healthy snack lines, including fruit-based snacks and nut mixes, caters directly to consumers looking for convenient yet nutritious options.

- Fortified Staples: The company's efforts to enhance staple foods like maize meal and flour with vital nutrients address a broader public health need while appealing to the health-conscious segment.

Food Service and Institutional Clients

Tiger Brands serves a significant Food Service and Institutional (FSI) client base, encompassing a wide array of businesses from quick-service restaurants and hotels to universities and hospitals. These clients require bulk purchasing power and often specialized product formulations to meet their operational needs. For instance, in 2024, Tiger Brands continued to leverage its extensive portfolio to supply essential ingredients and finished goods to these vital sectors, contributing to their daily operations and menu offerings.

The company's strategy for this segment involves providing larger, more economical pack sizes and tailored solutions designed for commercial use. This approach directly addresses the cost-efficiency and volume demands characteristic of institutional procurement. Data from 2024 indicates that the FSI sector remains a crucial revenue stream, with Tiger Brands actively participating in tender processes and establishing long-term supply agreements with key players in hospitality and public institutions.

- Target Clients: Restaurants, hotels, catering companies, schools, hospitals, and other large-scale food service providers.

- Value Proposition: Bulk packaging, cost-effective solutions, and product consistency suitable for high-volume operations.

- 2024 Focus: Strengthening relationships with major hotel chains and catering groups through dedicated account management and supply chain reliability.

- Market Contribution: FSI sales represent a substantial portion of Tiger Brands' revenue, underpinning its role as a key supplier to South Africa's hospitality and institutional sectors.

Tiger Brands' customer base is predominantly the mass market in South Africa, covering diverse income levels and relying on its packaged foods and home care products. In 2023, South African retail volume sales grew by 4.1%, reflecting strong demand from these broad consumer groups who prioritize value and familiar brands.

The company also actively serves consumers in other African nations, adapting its offerings to local tastes and affordability, which is a key driver of its international revenue. By 2024, Tiger Brands continued to enhance its presence in markets like Nigeria and Mozambique, aiming for increased volume and brand penetration.

A substantial segment includes economically pressured households where affordability is paramount. Tiger Brands addresses this through cost leadership and developing accessible product lines, crucial for retaining market share amidst rising inflation. In 2024, South Africa's CPI averaged 5.9%, making value offerings vital.

Furthermore, Tiger Brands caters to a growing health-conscious demographic seeking natural ingredients and nutritional benefits, a trend evident in the 2024 healthy snack market valued at approximately ZAR 15 billion in South Africa.

The company also serves a significant Food Service and Institutional (FSI) sector, providing bulk items and tailored solutions to businesses like restaurants and hospitals. FSI sales remained a crucial revenue stream in 2024, with Tiger Brands securing supply agreements with major players.

| Customer Segment | Key Characteristics | 2023/2024 Data/Focus |

| Mass Market (South Africa) | Broad income levels, daily essential needs, value-driven | 4.1% retail volume sales growth (2023); Focus on affordability. |

| African Markets | Diverse preferences, affordability focus, international revenue driver | Continued expansion in Nigeria & Mozambique (2024); Volume & penetration goals. |

| Price-Sensitive Households | Economic pressure, prioritize value for money | 5.9% average CPI (2024); Emphasis on cost leadership & accessible pricing. |

| Health-Conscious Consumers | Seek natural ingredients, nutritional benefits, wellness-oriented | Healthy snack market ~ZAR 15 billion (2024); Product innovation in fortified foods. |

| Food Service & Institutional (FSI) | Bulk purchasing, operational needs, cost-efficiency | Key revenue stream (2024); Strengthening relationships with hospitality sector. |

Cost Structure

Tiger Brands' cost structure is heavily influenced by raw material and ingredient expenses, a significant portion stemming from agricultural products like grains, fruits, and sugar. For instance, in their 2023 financial year, the company reported that input cost inflation, particularly for commodities, presented a notable challenge.

Fluctuations in global commodity markets and local agricultural yields directly impact these procurement costs. This volatility means that the price Tiger Brands pays for essential ingredients can change considerably, affecting their overall profitability.

The company's reliance on a diverse range of agricultural inputs means that disruptions in supply chains or adverse weather conditions in key sourcing regions can lead to increased raw material prices, as observed in several periods throughout 2023 and early 2024.

Tiger Brands' manufacturing and production costs are a significant component, encompassing the operational expenses of its diverse factory network. These costs include direct labor for production teams, essential utilities like electricity and water, ongoing machinery upkeep, and the depreciation of manufacturing assets. For instance, in its fiscal year 2023, Tiger Brands reported that its cost of sales, which largely reflects manufacturing expenses, stood at R29.1 billion, highlighting the scale of these outlays.

The company actively pursues strategies to optimize these conversion costs and boost factory productivity. This focus on efficiency aims to mitigate rising input costs and maintain competitive pricing in the market. Initiatives often involve technological upgrades and process improvements to reduce waste and energy consumption, thereby streamlining the production cycle.

Tiger Brands incurs significant logistics and distribution costs, covering the movement of raw materials to its manufacturing facilities and the delivery of finished products to a wide network of retailers. These expenses encompass fuel for its fleet, ongoing vehicle maintenance, warehousing and storage charges, and fees paid to third-party logistics providers.

In 2024, the company continued to focus on optimizing its distribution network to mitigate these substantial costs. For instance, efficient route planning and load consolidation are crucial for reducing fuel consumption and delivery times, directly impacting profitability.

Warehousing expenses, including rental, utilities, and staff, form another major component. Tiger Brands manages numerous distribution centers across South Africa to ensure timely product availability for consumers, necessitating careful inventory management to avoid excess holding costs.

External logistics service provider fees can fluctuate based on market rates and service agreements. By strategically managing these relationships and leveraging economies of scale, Tiger Brands aims to control a significant portion of its operating expenses related to getting its products to market efficiently.

Marketing and Sales Expenses

Tiger Brands invests heavily in marketing and sales to stay competitive in the fast-moving consumer goods (FMCG) sector. This includes significant spending on advertising, promotional activities, and brand building initiatives. These expenditures are crucial for maintaining brand awareness and driving consumer demand.

The company's sales force remuneration also forms a key part of these costs, incentivizing them to achieve sales targets. In the fiscal year ending September 30, 2023, Tiger Brands reported marketing and distribution expenses of R3.8 billion. This figure highlights the substantial resources allocated to reaching and persuading customers.

- Advertising and Promotions: Costs associated with TV, radio, print, and digital advertising campaigns, as well as in-store promotions and sampling events.

- Brand Building: Investments in activities designed to enhance brand equity and consumer loyalty over the long term.

- Sales Force Costs: Salaries, commissions, bonuses, and other incentives paid to the sales teams responsible for distribution and retail relationships.

- Distribution Costs: Expenses related to getting products from manufacturing facilities to retailers, including logistics and warehousing.

Administrative and Overhead Costs

Administrative and overhead costs represent the essential, ongoing expenses required to run Tiger Brands as a corporate entity. These include salaries for crucial administrative personnel, the cost of maintaining office spaces, investments in IT infrastructure to support operations, and expenditures on research and development to foster innovation. Furthermore, significant resources are allocated to ensure adherence to all regulatory compliance requirements, which is vital for a company of Tiger Brands' scale.

In 2024, Tiger Brands continued its focus on optimizing these costs. Recent restructuring initiatives have been implemented with the specific goal of reducing headcount and streamlining operational processes. These measures are designed to achieve substantial cost savings, thereby enhancing the company's overall financial efficiency and profitability.

- Salaries for administrative staff

- Office rent and utilities

- IT infrastructure and software

- Research and Development (R&D) expenditure

- Regulatory compliance and legal fees

Tiger Brands' cost structure is dominated by raw material and ingredient expenses, with agricultural products forming a significant portion. These costs are susceptible to global commodity market fluctuations and local agricultural yields, as evidenced by input cost inflation challenges noted in their 2023 financial year. Manufacturing and production costs, encompassing labor, utilities, and machinery upkeep, also represent a substantial outlay, with the cost of sales in FY2023 reaching R29.1 billion.

| Cost Category | Key Components | 2023 Data (Illustrative) |

|---|---|---|

| Raw Materials & Ingredients | Grains, fruits, sugar, agricultural products | Significant portion of Cost of Sales impacted by input cost inflation |

| Manufacturing & Production | Direct labor, utilities, machinery, depreciation | Cost of Sales: R29.1 billion |

| Logistics & Distribution | Fuel, vehicle maintenance, warehousing, third-party fees | Marketing & Distribution Expenses: R3.8 billion (includes distribution) |

| Marketing & Sales | Advertising, promotions, brand building, sales force | Marketing & Distribution Expenses: R3.8 billion (includes marketing) |

| Administrative & Overhead | Staff salaries, IT, R&D, compliance | Ongoing focus on optimization and cost reduction initiatives in 2024 |

Revenue Streams

Tiger Brands' primary revenue stream stems from the sale of its diverse portfolio of packaged food products. This includes staples like grains, maize meal, pasta, as well as popular snacks and beverages. In the first half of 2024, the company reported a 15.1% increase in revenue, largely driven by strong performance in its consumer brands segment.

Tiger Brands generates significant revenue from its home and personal care product lines, complementing its dominant food business. This diversification strategy helps spread risk and capture a broader consumer market. For instance, in 2024, the company's home care segment includes popular brands like Domestos and Sunlight, while personal care features items such as Lux and Lifebuoy. These categories, while smaller than food, are crucial for overall sales volume and market presence.

Historically, Tiger Brands generated revenue through the sales of baby food and personal care items. For instance, in their 2023 financial year, while the Baby Wellbeing business was divested, the company's strategic focus shifted. The integration of Baby Nutrition into the Culinary business unit signifies a reallocation of resources towards their primary growth areas.

International and Export Sales

Tiger Brands generates revenue from selling its products in various African markets beyond its home base in South Africa, as well as through exports. This international and export sales segment is crucial for the company's growth strategy, allowing it to tap into new customer bases and reduce reliance on any single market. For instance, in their 2024 fiscal year, international sales, primarily within Africa, played a significant role in their overall performance, contributing to a diversified geographic revenue stream.

This strategy not only broadens Tiger Brands' market reach but also helps to mitigate risks associated with economic fluctuations in its domestic market. The company actively seeks to expand its presence in key African regions, leveraging its established brands and product offerings. While specific export figures outside of Africa are often integrated into broader international sales reporting, the focus remains on strengthening its footprint across the continent.

Key aspects of their international revenue streams include:

- Geographic Diversification: Revenue from sales in countries like Nigeria, Kenya, and Mozambique, among others, reduces dependence on the South African market.

- Brand Expansion: Leveraging well-known brands such as Jungle Oats and Purity into new African territories.

- Export Growth: Targeting opportunities to sell products to markets outside of Africa, although the primary focus remains on intra-African trade.

- Contribution to Overall Revenue: International and export sales are a vital component, supporting the company's financial resilience and expansion ambitions.

Food Service Channel Sales

Tiger Brands generates income by supplying its diverse range of food and beverage products to commercial clients within the food service sector. This includes establishments such as restaurants, hotels, catering companies, and institutional buyers like schools and hospitals.

This segment represents a significant and growing revenue stream, distinct from direct-to-consumer sales. The company leverages its brand recognition and distribution network to cater to the specific needs of these business customers.

For instance, during the fiscal year ending September 30, 2023, Tiger Brands reported that its broader "Grains" segment, which includes products often supplied to food service, contributed significantly to overall revenue. While specific figures for the food service channel alone are not always broken out, the strategic importance of this channel is evident in the company's ongoing efforts to expand its B2B offerings.

- Target Customers: Restaurants, hotels, catering services, institutional kitchens.

- Product Focus: Bulk ingredients, ready-to-use food items, beverages suitable for commercial preparation.

- Revenue Generation: Wholesale pricing and contract agreements with food service businesses.

- Growth Driver: Increasing demand for convenient and consistent food solutions in the hospitality and institutional sectors.

Tiger Brands' revenue streams are primarily driven by the sale of its extensive portfolio of fast-moving consumer goods, encompassing both food and home and personal care categories. The company also generates income through its operations in various African markets and by supplying its products to the food service sector.

In the first half of 2024, Tiger Brands reported a notable revenue increase of 15.1%, with its consumer brands, particularly in the food segment, showing strong performance. The company's strategic focus on expanding its African footprint and catering to the food service industry further diversifies its income generation capabilities.

The company's diverse revenue streams include:

| Revenue Stream | Key Product Categories | 2024 Performance Indicator |

|---|---|---|

| Packaged Food Sales | Grains, maize meal, pasta, snacks, beverages | 15.1% revenue increase (H1 2024) |

| Home & Personal Care | Detergents, soaps, personal hygiene items | Significant contributor to overall sales volume |

| International & Export Sales | Products sold across Africa and other export markets | Crucial for geographic diversification and growth |

| Food Service Sector Supply | Bulk ingredients and ready-to-use items for hospitality | Growing segment targeting B2B clients |

Business Model Canvas Data Sources

The Tiger Brands Business Model Canvas is informed by a combination of internal financial reports, extensive market research on consumer behavior and competitor analysis, and strategic insights derived from industry trends. These diverse data streams ensure a comprehensive and accurate representation of the company's operational framework and market positioning.