Tiger Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tiger Brands Bundle

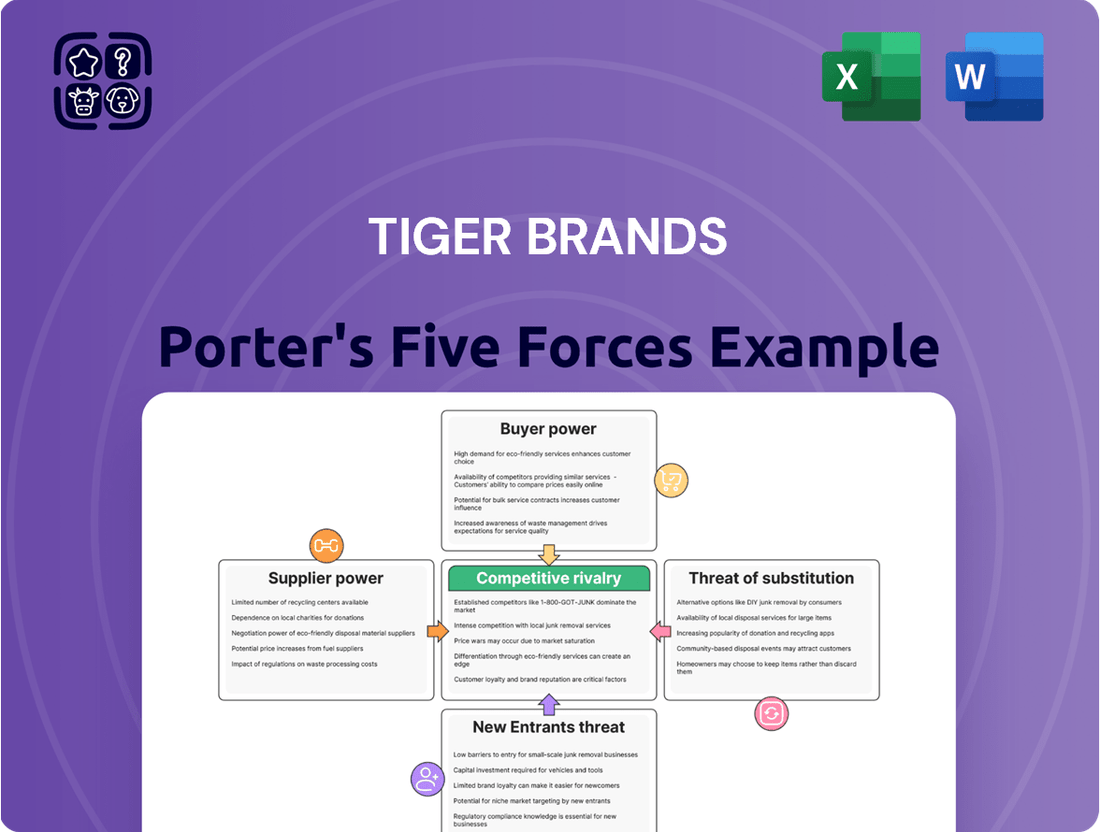

Tiger Brands navigates a complex food and beverage landscape, facing significant competitive rivalry and the constant threat of new entrants eager to capture market share. The bargaining power of buyers, particularly large retailers, exerts considerable pressure on pricing and margins. Furthermore, the availability of substitutes and the influence of suppliers on input costs are crucial factors shaping their strategic decisions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tiger Brands’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of Tiger Brands' suppliers is influenced by their concentration and the uniqueness of the inputs they provide. If only a few suppliers offer critical raw materials or specialized packaging, they gain leverage. For instance, a unique flavor extract or a proprietary food-grade plastic for packaging could significantly empower a supplier. Assessing the ease of switching to alternatives is crucial; high switching costs or a lack of viable substitutes strengthen supplier positions.

The availability of substitutes for Tiger Brands' key inputs significantly influences supplier bargaining power. If readily available alternatives exist for agricultural commodities like maize or wheat, or for manufacturing components such as packaging materials, Tiger Brands can switch suppliers or inputs to counter price hikes. For instance, in 2024, global corn prices saw volatility, but the existence of alternative grains or the ability to adjust product formulations could mitigate the impact of any single corn supplier's increased pricing.

Tiger Brands' significance to its suppliers varies greatly depending on the specific input. For commodity suppliers like grain farmers, Tiger Brands is one of many buyers, meaning these suppliers have considerable leverage. In 2024, Tiger Brands' procurement of agricultural inputs likely represented a fractional portion of the total market demand, underscoring the limited power Tiger Brands holds over these broad-based suppliers.

However, for suppliers of specialized ingredients or packaging materials, Tiger Brands' substantial order volumes can create a degree of dependence. If a particular supplier's output is largely tailored for Tiger Brands' product lines, and they lack alternative major clients, their bargaining power against Tiger Brands would be diminished. This reliance might compel them to accept less favorable terms to secure the continued business.

Switching Costs for Tiger Brands

Tiger Brands faces significant switching costs when considering a change in suppliers for its key raw materials and packaging. These costs can be substantial, impacting production efficiency and product consistency.

For example, altering ingredient sourcing might necessitate extensive re-validation of product formulations and quality control processes to ensure they meet Tiger Brands’ stringent standards. In 2024, the company's extensive portfolio, spanning various food and beverage categories, means that each product line could require unique supplier changeover protocols.

Consider the potential need for retooling manufacturing equipment to accommodate new ingredient specifications or packaging designs. This could involve significant capital expenditure. Furthermore, the process of re-certifying new suppliers and their materials adds layers of complexity and time, directly bolstering the bargaining power of incumbent suppliers who can demonstrate reliability and proven integration into Tiger Brands’ operations.

- Supplier Qualification and Testing: The rigorous testing and approval process for new ingredients or packaging materials can take months, involving R&D and quality assurance teams.

- Manufacturing Process Adjustments: Modifying production lines, including recalibrating machinery and retraining staff, represents a direct operational cost.

- Packaging Redesign and Recertification: Changes to packaging often require new regulatory approvals and can involve significant upfront design and tooling expenses.

- Inventory Management Disruption: Transitioning suppliers can lead to temporary stockouts or the need to manage dual inventory streams, increasing logistical costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the packaged goods sector poses a significant concern for Tiger Brands. This means that a supplier could potentially bypass Tiger Brands and start producing and selling their own branded products directly to consumers, effectively becoming a competitor. This is especially potent if these suppliers have established brand recognition or robust distribution networks that can be leveraged.

For instance, a major ingredient supplier who also has a well-known consumer brand could decide to launch their own line of finished goods, directly competing with Tiger Brands' offerings. This would not only reduce Tiger Brands' customer base but also potentially increase the bargaining power of other suppliers who might be more willing to collaborate with a new market entrant. Such a strategic move by a supplier could drastically reshape the competitive dynamics within the industry.

Consider the implications for Tiger Brands if a key supplier of, for example, dairy products decided to launch their own branded yogurt or milk products. If this supplier has a strong existing relationship with retailers and a recognized brand name, they could quickly capture market share. This would directly challenge Tiger Brands' existing product lines and necessitate a strategic response to maintain its market position.

This forward integration threat is amplified when suppliers possess unique capabilities or proprietary technologies. If a supplier holds a patent on a key processing method or has exclusive access to a specialized raw material, they might see an opportunity to capture more value by moving further down the supply chain. This would allow them to control the entire product lifecycle, from raw material to finished good, thereby increasing their overall influence and profitability.

The bargaining power of Tiger Brands' suppliers is moderated by the availability of substitutes and the concentration of suppliers. For commodity inputs like grains, where numerous suppliers exist, Tiger Brands has more options. However, for specialized ingredients or packaging, fewer suppliers mean greater leverage for them.

Switching costs for Tiger Brands are substantial, encompassing R&D, quality assurance, and potential manufacturing adjustments. These costs reinforce the position of incumbent suppliers, as demonstrated by the months-long qualification processes for new materials. The threat of forward integration by suppliers, especially those with unique technologies or consumer brands, also looms, potentially turning suppliers into direct competitors.

| Factor | Impact on Tiger Brands | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | A few dominant suppliers of specialized food preservatives could dictate terms. |

| Input Uniqueness | Unique inputs grant suppliers significant leverage. | Proprietary flavor extracts or specific vitamin blends might be difficult to substitute. |

| Availability of Substitutes | Abundant substitutes reduce supplier power. | Multiple sources for common packaging materials like PET bottles offer Tiger Brands flexibility. |

| Switching Costs | High switching costs empower existing suppliers. | Re-validating a new sugar supplier for a major beverage line involves significant time and testing. |

| Threat of Forward Integration | Suppliers becoming competitors reduces Tiger Brands' market position. | A large dairy supplier launching its own branded milk could directly challenge Tiger Brands' dairy products. |

What is included in the product

This analysis delves into the competitive landscape for Tiger Brands, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the FMCG sector.

Easily identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Tiger Brands.

Customers Bargaining Power

Tiger Brands faces significant bargaining power from large retail chains, which often represent a substantial portion of its sales volume. For instance, major retailers like Pick n Pay and Shoprite in South Africa are dominant players, giving them leverage to negotiate favorable pricing and terms. The sheer volume of goods these key customers purchase amplifies their influence.

The availability of substitute products significantly impacts Tiger Brands' bargaining power with its customers. When consumers and retailers have many readily available alternatives, whether from competing brands or private labels, their power to negotiate better prices or terms increases. This is particularly true in the food, home, and personal care sectors where product differentiation can be challenging.

In 2024, the South African grocery retail landscape continued to see robust growth in private label offerings, with some major retailers reporting private label sales exceeding 20% of their total revenue. This trend directly provides consumers with more affordable alternatives to Tiger Brands' products, thereby amplifying customer bargaining power.

The ease of switching is also influenced by the perceived quality and value proposition of these substitutes. If alternative products are seen as offering comparable quality at a lower price point, customers are more likely to make the switch, further strengthening their negotiating position against Tiger Brands.

Tiger Brands faces this pressure across its diverse product portfolio, from canned goods to detergents. For instance, the availability of numerous generic or store-brand cereals means customers can easily opt out of premium branded options if price becomes a primary consideration.

Tiger Brands' customers exhibit significant price sensitivity, particularly in the current economic climate of South Africa. With consumers facing financial pressures, the demand for everyday staple products, a core segment for Tiger Brands, becomes highly responsive to price fluctuations. For instance, as of early 2024, inflation in South Africa remained a concern, impacting household disposable income.

This heightened sensitivity means that if Tiger Brands increases prices, consumers are more likely to seek out cheaper alternatives, either from competitors or by switching to private label brands. This directly enhances the bargaining power of customers, as they can readily exert pressure on brands to maintain competitive pricing. The company's extensive portfolio of essential goods means this dynamic affects a broad customer base.

Customer Information and Brand Loyalty

Tiger Brands benefits from strong brand equity built over years, which generally tempers customer power. For instance, brands like Jungle Oats and Albany Bread hold significant consumer recognition and trust. However, this power is increasingly challenged. Customers today have access to more product information and price comparisons than ever before, often through online channels. This heightened awareness can lead them to seek out alternatives, even for established brands.

The growing acceptance and availability of private label brands, often priced lower, also directly impacts Tiger Brands' customer loyalty. Consumers are more willing to switch to these store-brand options if the price difference is substantial and perceived quality is acceptable. While Tiger Brands' brand loyalty is a mitigating factor, the informed consumer and the rise of private labels represent a tangible increase in customer bargaining power, potentially pressuring Tiger Brands on pricing and product innovation.

- Informed Consumers: Widespread internet access allows consumers to easily compare prices and product features across numerous brands, including Tiger Brands' offerings and competitors.

- Private Label Growth: Retailers' own brands, often stocked alongside Tiger Brands' products, continue to gain market share, offering a lower-cost alternative that appeals to price-sensitive consumers.

- Brand Loyalty as a Buffer: Tiger Brands' established brands like Koo and Purity have strong historical loyalty, which provides some insulation against customer power, particularly in staple food categories.

- Shifting Preferences: Evolving consumer preferences towards health and wellness, or specific dietary needs, can also empower customers to seek out niche brands or private label alternatives that better meet their requirements.

Threat of Backward Integration by Customers

Large retail customers possess a significant threat of backward integration, meaning they could start manufacturing their own packaged goods, directly challenging Tiger Brands.

Many major retailers, such as Pick n Pay and Shoprite in South Africa, already have robust private label programs. For instance, in 2024, private label sales across the South African grocery sector continued to grow, with some categories seeing private label penetration exceeding 20%.

- Threat of Backward Integration: Large retailers can leverage their existing infrastructure and market access to produce their own brands.

- Private Label Expansion: The increasing prevalence and sophistication of retailer private labels directly erode Tiger Brands' market share.

- Impact on Bargaining Power: As retailers become manufacturers, their bargaining power over Tiger Brands intensifies, potentially forcing price concessions.

- Competitive Landscape Shift: This integration shifts the competitive landscape, with retailers becoming both distributors and direct competitors.

The bargaining power of customers is a significant force for Tiger Brands, driven by informed consumer choices and the growing strength of private labels. As of 2024, South African retailers continued to expand their private label offerings, with some reporting over 20% of their revenue coming from these own-brand products. This trend provides consumers with more affordable alternatives, directly increasing their leverage to demand competitive pricing from brands like Tiger Brands.

Furthermore, the threat of backward integration by major retailers, such as Pick n Pay and Shoprite, adds another layer to customer bargaining power. These large entities possess the infrastructure to produce their own packaged goods, intensifying pressure on Tiger Brands to offer favorable terms. This dynamic is reshaping the competitive landscape, with retailers increasingly acting as both distributors and direct competitors.

Price sensitivity among South African consumers, exacerbated by economic pressures in early 2024, means that even established brands face considerable pressure to maintain competitive pricing. The ease with which consumers can now compare products and prices online, coupled with the increasing availability of value-driven alternatives, empowers them to exert greater influence over brands.

| Factor | Impact on Tiger Brands' Customer Bargaining Power | Supporting Data (2024 Context) |

|---|---|---|

| Private Label Growth | Increases customer options, driving price competition | Private label sales in SA grocery sector exceeded 20% of revenue for some retailers. |

| Consumer Price Sensitivity | Heightens demand for value, pressuring pricing | Continued inflation concerns impacting South African household disposable income. |

| Information Accessibility | Enables easier comparison and switching | Widespread internet access facilitates real-time price and feature comparisons. |

| Backward Integration Threat | Retailers become potential direct competitors | Major retailers possess infrastructure to develop and market own-brand manufactured goods. |

What You See Is What You Get

Tiger Brands Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Tiger Brands, detailing the competitive landscape and strategic considerations within the FMCG sector. The document you are viewing is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights without any alterations or placeholders. This analysis meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, providing a robust understanding of Tiger Brands' market positioning. Rest assured, what you see is precisely what you will download and utilize for your strategic planning needs.

Rivalry Among Competitors

The South African packaged goods market is a crowded space, featuring a substantial number of both local and international companies vying for market share. This sheer volume of participants inherently fuels intense competition.

The diversity among these competitors is a key driver of rivalry. You have large multinational corporations with vast resources and established brands, alongside smaller, agile local players who can be quick to adapt to market trends. This mix creates a dynamic competitive landscape.

For instance, in 2024, Tiger Brands competes directly with global giants like Unilever and Nestlé, as well as significant regional players such as RCL Foods and AVI Limited. Each of these entities brings a different scale of operation and strategic focus to the market, from broad portfolios to niche specializations.

This fragmentation means that no single competitor holds a dominant position across all segments. Consequently, companies are constantly pressured to innovate, optimize costs, and engage in aggressive marketing to retain and grow their customer base.

The South African Fast-Moving Consumer Goods (FMCG) market, which includes packaged goods, experienced a moderate growth rate in recent years. For instance, NielsenIQ reported that the FMCG market in South Africa saw a volume growth of around 1.2% in the first half of 2023, with value growth being higher due to inflation.

In a market with a relatively modest growth rate like South Africa's FMCG sector, competitive rivalry can indeed be quite intense. Companies like Tiger Brands often find themselves vying for market share as the overall pie isn't expanding at a breakneck pace, forcing them to innovate and compete on price, quality, and distribution.

When growth is slower, each percentage point of market share becomes more valuable. This dynamic encourages aggressive marketing campaigns, product line extensions, and efficiency drives to capture consumer spending. For Tiger Brands, this means constantly evaluating its product portfolio and operational costs to stay ahead of competitors.

Conversely, a rapidly expanding market can sometimes ease competitive pressures, as companies can grow their revenues by simply tapping into new demand without necessarily stealing customers from rivals. However, the South African FMCG landscape typically presents a more mature, slower-growth environment, necessitating a sharp focus on competitive strategy.

Tiger Brands benefits from significant product differentiation in key categories, particularly with brands like Jungle Oats and Koo canned goods, which enjoy strong consumer recognition and loyalty. This allows them to command premium pricing and reduces direct price wars. For instance, in 2024, Tiger Brands reported that its brand equity remained a significant asset, contributing to sustained market share in its core segments despite economic pressures.

While many of Tiger Brands' food and beverage products are not easily substitutable due to established recipes and perceived quality, the broader FMCG market, especially in staples, can see intense rivalry when differentiation is less pronounced. Competitors often focus on price promotions and wider distribution networks to challenge Tiger Brands' market position in these instances.

Exit Barriers for Competitors

Tiger Brands, like many established players in South Africa, faces competitors who may find it difficult to leave the market. This is often due to significant investments in specialized assets and infrastructure, such as large-scale manufacturing plants and extensive distribution networks. For example, the capital expenditure required to build and maintain these facilities represents a substantial sunk cost, making a complete exit financially unviable for many.

High fixed costs associated with these operations further contribute to elevated exit barriers. Even if a competitor is experiencing low profitability, the need to cover these ongoing costs can compel them to remain active in the market, potentially intensifying competitive pressure.

Strategic interdependencies also play a role. Competitors might be integrated with other business units or have long-term supply agreements that tie them to the South African market. Severing these relationships could incur significant penalties or disrupt broader corporate strategies, thus acting as a deterrent to departure.

These factors collectively mean that competitors might continue to operate and compete, even in challenging economic conditions, contributing to sustained rivalry within the sector.

- High Capital Investments: Competitors have sunk capital into specialized manufacturing plants and distribution networks, representing significant unrecoverable costs.

- Operational Fixed Costs: Ongoing expenses for maintaining these assets, even during periods of low profitability, pressure companies to stay operational.

- Strategic Alliances and Agreements: Existing contracts and interdependencies with suppliers or other business divisions can make exiting the market costly or strategically detrimental.

- Brand Reputation and Market Share: Significant investment in building brand equity and market share can be lost upon exiting, acting as an implicit barrier to departure.

Competitive Strategies and Market Share

Competitive rivalry in the South African packaged goods sector is intense, with major players like Tiger Brands, AVI, and RCL Foods frequently engaging in strategies such as price competition and extensive marketing campaigns to capture market share. Innovation in product development and packaging also plays a crucial role in differentiating offerings. For example, in 2023, the fast-moving consumer goods (FMCG) market in South Africa saw continued focus on value offerings and private label growth, indicating a strong sensitivity to price among consumers.

Tiger Brands, as a dominant player, often sets the pace for competitive actions within the industry. Its willingness to invest heavily in advertising and promotions, alongside strategic pricing adjustments, directly influences the intensity of rivalry. In the fiscal year ending September 30, 2023, Tiger Brands reported revenue of R17.1 billion, underscoring its significant market presence and its capacity to absorb and respond to competitive pressures.

- Price Wars: Competitors often engage in promotional pricing and discounts to attract price-sensitive consumers.

- Aggressive Marketing: Significant advertising spend and promotional activities are common to build brand loyalty and awareness.

- Innovation: New product launches and improvements in existing lines are used to gain a competitive edge.

- Market Share Dynamics: The relative market shares of key players dictate their ability and willingness to engage in aggressive tactics.

Competitive rivalry is a significant force for Tiger Brands, stemming from a crowded South African packaged goods market with numerous local and international players. This intense competition is amplified by a diverse competitor landscape, ranging from global giants to agile local firms, all vying for market share in a sector characterized by moderate growth.

In 2024, Tiger Brands faces direct competition from major entities like Unilever, Nestlé, AVI Limited, and RCL Foods, each employing distinct strategies to capture consumer spending. This environment necessitates continuous innovation, cost optimization, and aggressive marketing to maintain and expand market presence, especially as overall market growth is not exceptionally rapid.

The intensity is further fueled by high exit barriers, as competitors have made substantial capital investments in manufacturing and distribution, making market departure costly. Companies often remain operational even with low profitability due to these sunk costs and strategic interdependencies, thus sustaining a highly competitive landscape for Tiger Brands.

| Competitor | Market Presence | Key Product Categories |

|---|---|---|

| Unilever | Global Giant | Home Care, Personal Care, Foods |

| Nestlé | Global Giant | Confectionery, Dairy, Beverages, Pet Care |

| AVI Limited | Significant Regional Player | Snacks, Beverages, Personal Care |

| RCL Foods | Significant Regional Player | Consumer Foods, Sugar, Animal Feed |

SSubstitutes Threaten

The threat of substitutes for Tiger Brands' diverse product portfolio is significantly influenced by the price-performance trade-off. Consumers constantly evaluate whether alternative products offer comparable or superior benefits at a more attractive price point. For instance, private label brands, often stocked by major retailers, frequently present a compelling value proposition, directly challenging Tiger Brands' market share in categories like canned goods, cereals, and personal care items.

In 2023, the South African grocery sector saw continued growth in private label penetration, with some categories reporting over 20% market share. This trend indicates that consumers are actively seeking out lower-cost alternatives that deliver acceptable quality, thereby increasing the pressure on Tiger Brands to justify its pricing through brand equity, innovation, and perceived product superiority.

The availability of generic and private label brands presents a substantial threat to Tiger Brands, particularly in the South African market. As retailers enhance the quality and marketing of their own-brand offerings, especially in staple categories like food and household essentials, consumers increasingly opt for these more affordable alternatives. For instance, during 2024, major South African retailers reported significant growth in their private label sales, capturing a larger share of the grocery market as consumers focused on value.

Shifting consumer tastes present a significant threat of substitution for Tiger Brands. For instance, a growing movement towards fresh, unpackaged produce and artisanal goods, as evidenced by the increasing popularity of farmers' markets and specialty food stores, directly challenges the demand for traditional packaged food items. This trend is further amplified by a desire for healthier, often home-prepared meals, which bypasses the need for many convenience-oriented packaged products. In 2024, reports indicated a notable increase in consumer spending on fresh food categories, outperforming processed goods in several key markets.

Switching Costs for Buyers to Substitutes

The threat of substitutes for Tiger Brands' diverse product portfolio is influenced by how easily and expensively consumers can switch to alternative offerings. For many of Tiger Brands' staple food and beverage products, switching costs for consumers are generally low. For example, a shopper deciding between a Tiger Brands cereal and a competitor's cereal often faces no significant financial or practical barriers to making that choice, simply picking a different item off the shelf.

While brand loyalty can serve as a barrier to switching, its impact is not uniform across all product categories. In segments like canned goods or basic cleaning supplies, where product differentiation might be minimal and price is a primary driver, brand loyalty might be less entrenched. This allows for a higher threat of substitution if competitors offer comparable quality at a more attractive price point. For instance, in 2024, the South African grocery market saw intense price competition, with promotional activities from rival brands directly impacting sales volumes for established players.

- Low Switching Costs: For many everyday consumer goods, consumers can easily switch between Tiger Brands' products and those of competitors with minimal effort or expense.

- Brand Loyalty Variation: The effectiveness of brand loyalty as a deterrent to switching varies significantly by product category, being less impactful in commoditized markets.

- Price Sensitivity: In categories where products are perceived as similar, price becomes a key factor, increasing the threat of substitution from lower-priced alternatives.

- Competitive Landscape: Intense competition in the South African consumer goods sector, especially in 2024, means that rivals frequently leverage price and promotions to attract customers away from established brands.

Innovation in Substitute Products/Services

The threat of substitutes for Tiger Brands is significantly influenced by the pace of innovation in alternative consumption methods. For instance, the burgeoning meal kit delivery sector, which saw substantial growth in 2024, offers consumers a convenient way to prepare meals, directly competing with Tiger Brands' packaged food offerings. Similarly, the expansion of fresh food delivery services provides an alternative to processed and pre-packaged goods.

New technologies and evolving business models are constantly creating more options for consumers to meet their dietary needs. The rise of specialized dietary products, catering to specific health trends or allergies, further fragments the market. For example, the plant-based food market, which has been a key area of innovation and investment throughout 2024, presents a direct substitute for traditional meat and dairy products often found in Tiger Brands' portfolio.

- Meal Kit Market Growth: The global meal kit delivery market size was valued at approximately USD 15 billion in 2023 and is projected to grow significantly, indicating a strong substitute for traditional grocery purchases.

- Plant-Based Food Innovation: Investment in the plant-based food sector continued to surge in early 2024, with numerous new product launches and company expansions, directly challenging established players in the protein and dairy categories.

- Direct-to-Consumer (DTC) Trends: The increasing adoption of DTC models by food producers and retailers offers consumers direct access to fresh and niche products, bypassing traditional retail channels where Tiger Brands products are prevalent.

The threat of substitutes for Tiger Brands is amplified by the increasing prevalence of private label brands, particularly in staple categories. In 2024, major South African retailers reported substantial gains in their private label sales, driven by consumer focus on value, directly challenging Tiger Brands' market share as these offerings become more sophisticated.

Shifting consumer preferences towards healthier, fresh, and minimally processed foods also pose a significant threat. The growing popularity of farmers' markets and specialty food stores, alongside increased spending on fresh produce in 2024, indicates a move away from traditional packaged goods, impacting demand for many of Tiger Brands' core products.

The low switching costs associated with most of Tiger Brands' product categories mean consumers can easily opt for alternatives. In 2024, intense price competition and promotional activities in the South African grocery market further facilitated this substitution, especially in categories where product differentiation is minimal.

| Factor | Impact on Tiger Brands | 2024 Data/Trend |

|---|---|---|

| Private Label Growth | Direct competition, pressure on pricing | Retailers reported significant private label sales growth capturing larger market share. |

| Consumer Shift to Fresh/Healthy | Reduced demand for packaged goods | Increased consumer spending on fresh food categories, outperforming processed goods. |

| Low Switching Costs | Ease of consumer choice for alternatives | Minimal financial or practical barriers for consumers switching between similar products. |

| Intense Price Competition | Encourages substitution towards cheaper options | Promotional activities from rivals directly impacted sales volumes for established brands. |

Entrants Threaten

Entering South Africa's packaged goods sector, where Tiger Brands operates, demands substantial financial investment. This includes setting up modern manufacturing plants, establishing extensive distribution networks across the country, and funding significant marketing campaigns to build brand recognition. For instance, the capital expenditure for a new, large-scale food processing facility can easily run into hundreds of millions of South African Rand.

Achieving economies of scale is crucial for competitiveness, allowing established players like Tiger Brands to lower their per-unit production costs. This means new entrants must commit to high production volumes from the outset to compete on price, a challenging feat given the market's maturity.

Tiger Brands' vast operational scale, with a diverse portfolio spanning categories like breakfast cereals, snacks, and beverages, creates a significant cost advantage. This established scale makes it exceptionally difficult for smaller, new players to match their pricing and profitability, acting as a formidable barrier to entry.

New entrants face a formidable hurdle in overcoming the deeply ingrained brand loyalty enjoyed by established players like Tiger Brands. Consumers often develop strong emotional connections and trust with brands they’ve used for years, making them less inclined to switch to unfamiliar offerings. For instance, Tiger Brands’ portfolio includes household names like Jungle Oats and Albany, brands that have been staples in South African kitchens for decades, fostering a significant competitive advantage through sheer familiarity and perceived reliability.

New companies entering the fast-moving consumer goods (FMCG) sector face significant hurdles in gaining access to vital distribution channels. Major retail chains, such as Shoprite and Pick n Pay, are often saturated with established brands, making it exceptionally difficult for newcomers to secure prime shelf space. For instance, in 2024, Tiger Brands maintained strong relationships with these key retailers, leveraging decades of presence to ensure prominent product placement.

The cost and complexity of establishing an efficient logistics network across South Africa present another formidable barrier. New entrants must invest heavily in warehousing, transportation, and supply chain management to compete. This logistical capability is crucial for ensuring product availability and freshness, areas where established players like Tiger Brands have a distinct advantage due to their scale and experience.

Government Policy and Regulations

The South African food and packaged goods industry is heavily influenced by government policy and stringent regulations, acting as a significant barrier to entry. These include rigorous food safety standards, detailed labeling requirements, and complex import/export regulations. For instance, the Foodstuffs, Cosmetics and Disinfectants Act mandates strict adherence to safety protocols, increasing operational costs for new entrants. Compliance with these regulations can demand substantial investment in infrastructure, testing, and specialized personnel, making it difficult for smaller or less capitalized companies to compete effectively with established players like Tiger Brands.

Compliance with these regulatory frameworks presents a substantial hurdle for potential new entrants. For example, the South African Bureau of Standards (SABS) sets quality marks and standards that require significant investment to meet. In 2024, the cost of obtaining and maintaining various food certifications can run into hundreds of thousands of South African Rand. Furthermore, evolving legislation, such as proposed changes to sugar tax regulations impacting beverage products, adds another layer of complexity and uncertainty, deterring new market participants.

The threat of new entrants is therefore moderated by the significant compliance burden imposed by government policy. Key regulatory areas impacting entry include:

- Food Safety Standards: Adherence to standards set by the Department of Health and local municipalities is mandatory.

- Labeling Requirements: Compliance with the Consumer Protection Act and specific food labeling regulations is essential, adding complexity and cost.

- Import/Export Regulations: Navigating customs duties, phytosanitary certificates, and trade agreements can be challenging for new international players.

Expected Retaliation from Incumbents

Established players like Tiger Brands possess significant resources and market share, making them likely to retaliate against new entrants. This retaliation can manifest as aggressive price cuts, aiming to squeeze out new competitors who may not have the same cost efficiencies. For instance, in the competitive South African consumer goods sector, incumbents have historically engaged in price wars to defend their market positions.

Increased marketing and promotional activities are another common retaliatory tactic. New entrants might face a surge in advertising spend from established brands, making it more difficult and expensive for them to gain brand recognition and customer loyalty. Tiger Brands, with its extensive brand portfolio, can easily ramp up marketing budgets for key product categories.

Furthermore, incumbents may introduce new or improved products rapidly to counter the appeal of a new entrant's offering. This could involve product line extensions or significant R&D investments to maintain a competitive edge. The threat of such aggressive product innovation can significantly deter potential new companies from entering the market.

The prospect of strong retaliation from companies like Tiger Brands, which has a long history of market leadership and substantial financial reserves, acts as a potent deterrent. Potential entrants must carefully weigh the significant costs and risks associated with facing such formidable opposition before committing to market entry.

The threat of new entrants into South Africa's packaged goods sector, where Tiger Brands operates, is significantly mitigated by high capital requirements. Establishing modern manufacturing facilities and extensive distribution networks demands hundreds of millions of South African Rand in capital expenditure. Furthermore, achieving economies of scale to match established players' pricing is a considerable challenge for newcomers in this mature market.

Porter's Five Forces Analysis Data Sources

Our analysis of Tiger Brands' competitive landscape is built upon a robust foundation of data, drawing from the company's annual reports, investor presentations, and official press releases. We supplement this with insights from reputable industry analysis firms and market research reports to gain a comprehensive understanding of the food and beverage sector.